Forbes cover: Hao Gambling Bitcoin

Reprinted from panewslab

01/31/2025·3MAuthor/Source: Nina Bambysheva Forbes

Compilation: liam

MicroStrategy is not only a huge Bitcoin bet, but also a corporate financing revolution.

Most people think that Microslategy, a listed company of Billionaire Michael Saylor, is a huge and adventure betting on Bitcoin. But if you observe it carefully, you will find that this is a masterpiece that manipulates traditional finance to use the magic dust that uses cryptocurrency fanatics.

The New Year's Eve of Vicia Villa is a gorgeous scene of orange and golden. This scene is directly taken from the most gorgeous fantasy of Fitz Jerald. More than 500 people are crowded on this century -old house trimming lawn. Its Versailles -style banquet hall has received Margaret Satcher, Henry Kissinger and Mikhail Gorbachev Wait for celebrities.

Bitcoin has recently exceeded $ 100,000 (not from 2025) is the real reason for this feast. The waiter walked around with champagne on the silver tray. The appetizer was printed with the ubiquitous B of B. The dancer wearing a golden tights wielded the glittering orange sphere and paid tribute to the iconic tone of Bitcoin. A huge poker card is visible in the center of the garden, and the king's face is replaced by a shameless B.

Water parties continue to be carried out on the USHER number. The 154 -foot -long super yacht appeared in the 2015 movie "Star Partner" and shined in Miami's skyline. The shuttle bus is endless, carrying Bitcoin executives and opinion leaders. The most important thing is institutional investors. They are dressed in "Bitcoin Fashion" (orange suit, B logo accessories). The two giant projectors played a clip that predicts that Bitcoin would rise to millions, and a DJ wearing a space helmet conducted heavy bass songs between swaying palm trees.

"I feel a little tired of victory," a carnival wearing a black hat printed with Nakamoto. Those who attended the party have the reputation of cryptocurrencies: the person wearing Satoshi Nakamoto is David Belle. He is the 34 -year -old CEO of BTC Inc. and the publisher of Bitcoin Magazine. He hosted in July. At the Bitcoin meeting, Donald Trump vowed to make the United States a "cryptocurrency capital of the earth" and established a national Bitcoin reserve.

The owner and host of Villa Vecchia, Michael Saylor, is 59 years old. He wore a iconic black suit jacket, blue jeans and T -shirts (B. words printed on the front) through the carnival. In the crowd. He intimidated people's handshake and selfie requests. Here, Bitcoin is God, and Seller is its prophet.

Cryptocurrencies are the second rebirth to Seller, because during the initial Internet bubble period, he earned more than $ 100 billion. At that time, after graduating from the Massachusetts Institute of Technology in 1989, he co -founded MicroStrategy, a software company in Tystes, Virginia. The company was initially engaged in data mining and commercial intelligent software business, and later clashed with the Securities and Exchange Commission due to accounting behavior. In 2000, the company paid a fine, reached a settlement with the federal government, and re -announced the results of previous years.

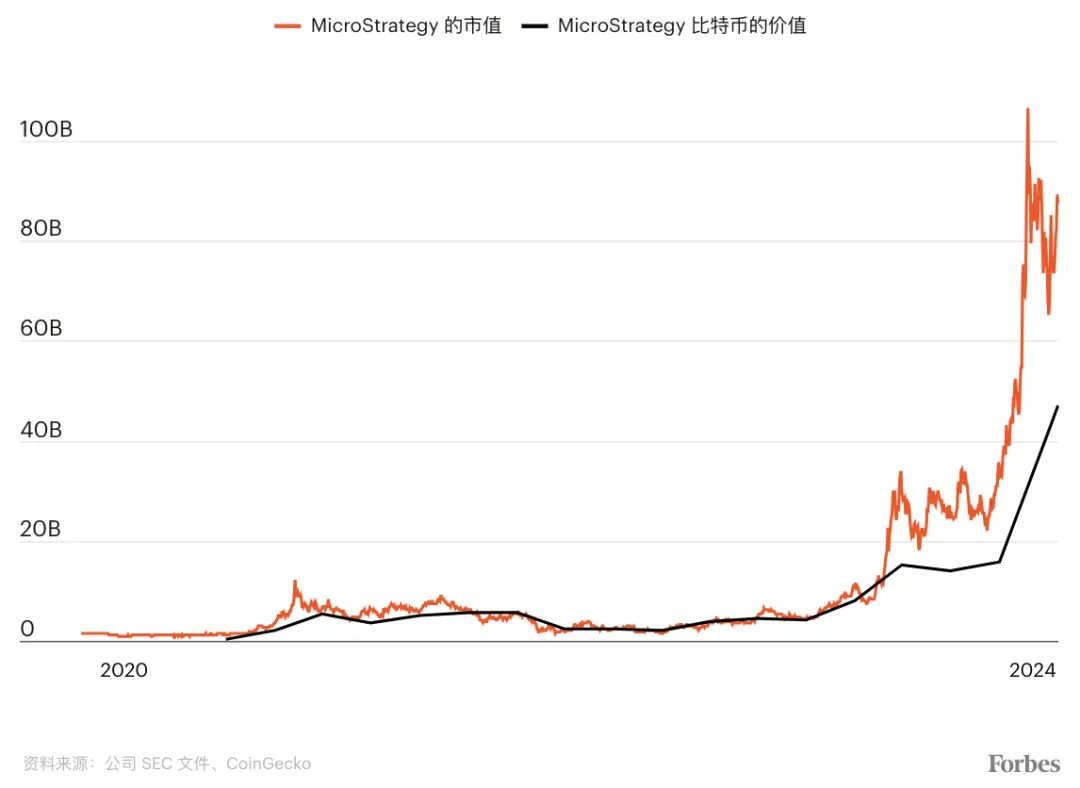

In the next two decades, MicroStrategy's sales performance was mediocre, and the market value hovered around $ 1 billion. All this changed in 2020, when Seller decided to use Bitcoin as the core strategy of Microslategy.

Last year, after the SEC approved the Bitcoin ETFs such as Berlaide and Fidelity, the prices of cryptocurrencies soared, over 12 months, and exceeded $ 100,000 in early December. Before Christmas, MicroslateGy joined the Nasdaq 100 index, which stimulated more demand for its stock. Its stock price rose by more than 700%last year because it issued bonds and accumulated more Bitcoin (it now owns 471107 indivual). Seller's company is now the biggest holder of digital assets, second only to elusive Nakamoto Satoshi, and it is said that Satoshi held 1 million bitcoin. During 2024, Seller's net assets jumped from $ 1.9 billion to $ 7.6 billion. After entering the new year, his value reached $ 9.4 billion.

The amazing income of MicroStrategy has stirred up a large number of critics and short -selling dissatisfaction. They cannot understand why a small software company holding only $ 48 billion in Bitcoin, why the market value is as high as 84 billion US dollars. But what Cale's critics do not understand is that Microslategy cleverly spans two areas: one is constrained by traditional financial rules, the company issues debt and stocks, and is bought and sold by hedge funds, traders and other institutions; The determination of the firm believers believes that Bitcoin will bring you a better world.

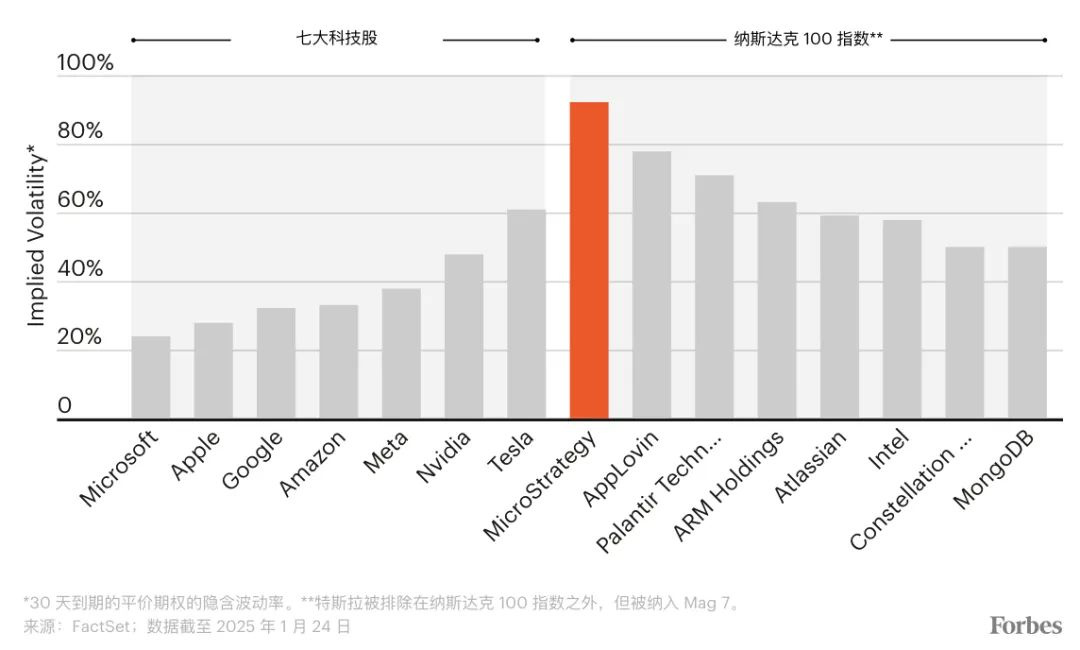

The motivation to promote the success of MicroStrategy is to embrace and cultivate volatility, which is a significant feature of its core assets. Violations is the natural enemy of traditional investors, but it is a close friend of option traders, hedge funds and retail speculators, which makes MicroslateGy one of the most active stocks in the market. Although its annual income is relatively small, it is only $ 496 million, the daily transaction volume is comparable to the seven major technology giants (META, Apple, Alphabet, Microsoft, Amazon, Tesla and Nvidia).

"People think this is too crazy," Sailler said, "How could such a small company have such a high liquidity? This is because we placed an encrypted reactor in the middle of the company to attract capital and then rotate it. Increased stock volatility makes our options and convertible bonds the most interesting and best product in the market. "

Michael Saylor's popularity of US $ 7.3 billion in convertible bonds issued since 2021, he is 100 % correct. Every minute on the trading day, Micros''s stock price will be magnified in real time due to the continuous fluctuations of Bitcoin, thereby increasing the implicit volatility of the inherently bullish options in convertible bonds. This is because unlike ordinary bonds, convertible bonds provide security for debt holders. They can choose to convert their bonds into MicroslateGy shares at the predetermined price before maturity. Every trader who has received BLACK-SCHOLES option pricing formulas knows that high hidden volatility will increase the value of options. Therefore, Seller can issue convertible bonds without paying the cost of interest.

So far, the expiration date of 6 convertible bonds issued by Microslategy was from 2027 to 2032, and interest rates ranged from 0%to 2.25%. In the open bond market, liquidity has been shrinking due to the prosperity of private credit, and institutional investors are eager to get excess returns. MicroStrategy's bonds are not only one of the only ways for large investors such as German Insurance Corporation and Daofu Bank to invest digital assets, but also one of the best bonds in the market. The return rate has exceeded 250%since issuance. Even Microslategy issued a $ 3 billion five -year bond issued in November with a ticket interest rate of 0%and a license price of $ 672 (80%higher than the current stock price of MicroslateGy), and also rose 89%in just a few months.

Elasticity is vitality

This is the three words released on Twitter in March last March, the founder of MicroStrategy co -founder of Microslategy, revealing the axbos of Lingdan in promoting its excellent performance of their stocks and bonds: the implicit volatility of the company 's options, and the volatility rate It was driven by Bitcoin that he accumulated. Many traders are eager to volatility. They expect that Microslategy's stock price will fluctuate more than 90%in the next month, while Tesla and Amazon's volatility will be 60%and 30%, respectively.

In order to improve the return on investment portfolios, they will continue to buy his high -risk stocks in order to improve the return on investment portfolios. Like MicroStrategy, a large number of convertible bonds are issued, but in this case, convertible bonds have a bullish effect, because these bonds represent the demand for stocks that are getting higher and higher in the future. Through secondary issuance and convertible bond issuance, MicroStrategy's circulation shares have increased from 97 million shares to 246 million shares since 2020. During the same period, its stock price rose 2666%. At the end of January, its shareholders voted to increase the company's authorized shares to 10.3 billion shares. This cycle is self -operated: issuing billions of low cost or cost -free debt and stocks, pushing a large amount of Bitcoin prices by buying a large amount, and promoting the significant fluctuations of MicroslateGy's stocks. Repeatedly.

"They found that there was currency vulnerabilities in the financial market and used this vulnerability," Richard Wede Bywood, a management partner of Syz Capital, a transliterated bond trader in Nomura Securities and Syz Capital.

This is understandable without concealing the admiration of Bitcoin. In August last year, he invented a new financial indicator called Bitcoin Yield or BTC Yield. This "yield" has nothing to do with any income generated, but only measures the percentage of the stock ratio that the Bitcoin held by the company and the company that is completely diluted with the company over time. His initial goal was to increase 4%to 8%each year, but data released by MicroslateGy in January showed that the Bitcoin yield yield in the fourth quarter was 48%, and the whole year in 2024 was 74.3% -although these numbers were large, although these numbers were large, although these numbers were very large. But it is meaningless, he provides these numbers to followers who worships him like a bait.

Former commercial bankers, consultants, and the company's Bitcoin strategy, Ben Werkman, said that trying to use the old method for the MicroStrategy valuation, it will only make you lose your mind. Seller "closed the profit and loss table thinking, saying 'We must start with the company's net assets and focus on the use of our advantages on the balance sheet'. In this case, this means acquiring more bitcoin. "

This is exactly what MicroStrategy is doing. In October, Seller announced a plan called "21/21". It raised up to $ 42 billion in funds in the next three years (half passed equity financing and half passed debt financing) to purchase more Bitcoin. In November and December alone, the company acquired nearly 200,000 Bitcoin worth about $ 18 billion.

As long as the price of Bitcoin continues to rise, it will be very smooth, but what if Bitcoin collapses like before?

" The scale is everything, because liquidity is everything. Microslategy is the most single source of liquidity in the risk of trading Bitcoin, including the spot market and the option market. The latter is more important."

Unless the end of the world is really coming, Microsterategy should not have a problem. Bitcoin needs to fall by more than 80%from the current level of more than 100,000 US dollars, and for at least two years, Microsterategy can unable to repay the current debt. Sales once again showed his talent in using the capital market and bond investors.

The $ 7 billion debt issued by Microslategy is unpaid. Technically, any bitcoin in its fund library cannot be used as a guarantee. In addition, based on the company's current stock price of 373 US dollars, its debt of more than $ 4 billion is already "valuable", or it is actually an equity.

"In fact, there are few debts on the Microslategy's balance sheet," said Jeff Park, the strategy director of the Alpha Strategy Director of the Crypto Asset Management Company of San Francisco. Some people have a high degree of tolerance for re -financing, even if they go bankrupt in the worst case.

What prevents Bitcoin financial engineering from the rematch of other companies? Nothing. Many companies have begun to follow suit. According to Park, Bitwise has counted about 90 listed companies, including well -known companies such as Tesla and Block, which have included Bitcoin into their balance sheets. In March of this year, his company will launch the Bitwise Bitcoin Standard ETF, which will include 35 listed companies holding at least 1,000 Bitcoin (about $ 100 million) Bitcoin holding index. Microslategy will dominate the index.

The imitator is providing ammunition for the opponent of Microslategy. KerrisDale Capital, an investment company headquartered in Miami, released a short report on the stock in March. The company stated that MicroStrategy's stock represents a rare and unique way to obtain Bitcoin, but this situation no longer exists. But Park believes that, just like Netflix in the field of streaming media, MicroslateGy's first -mover advantage and scale make it different.

"The scale is everything, because liquidity is everything. Whether it is the spot market or the option market, they are the most liquid sources of trading Bitcoin -related risks," Park said. A single name option market. The annual funding rate of the fund was 106%, which has accumulated $ 1.9 billion assets.

Sitting by the swimming pool in Visia, his three parrots HODL, Satoshi, and Max chatted behind him, and Seller dismissed the critics. "Traditional business intelligence in the past 40 years believes that capital is a liability and volatility is not good. Bitcoin standard stipulates that capital is asset and volatility is a good thing -this is its characteristic," he insisted, "they live in life," they live in. In a flat world, a before Copernicus. Can't move "

This is not the first time that Michael Seller has been near the sun.

He was born in a Air Force base in Lincoln, Nebraska in 1965, and was immersed in military discipline in his early years. His father was a chief sergeant. The family touched between the Air Force bases around the world and finally settled in the location of the Leeter Brothers Air School near Leter Patterson, Ohio.

He entered the Massachusetts Institute of Technology to study aviation and aerospace with the full scholarships of the Air Force Reserve Officer Training Team, and wrote a computer simulation paper on the city -state in the Italian Renaissance. In his spare time, he likes to play guitar in the rock band and drive gliding machine. He graduated with the highest honor in 1987 and was appointed as the air force.

When 1 + 1 = 3, by investing in Bitcoin, even if the price of Bitcoin is sluggish, the market value of Microslategy has increased 60 times within 4 years.

At the age of 24, he and Sanju Bansal, a member of the Massachusetts Institute of Technology, founded MicroslateGy. At that time, few people understood the potential of data analysis, but the company took the lead in enoplane in this field. With the help of the Internet, the company was listed in 1998. By 2000, its market value soared to more than $ 24 billion. Seller's net assets reached a peak of nearly $ 14 billion. He became a technical evangelist, and the prediction data will flow like water. "We will use our technology to destroy the entire supply chain," Sailler told the Magazine of "Forbes" in the end of 1998. "We strive to win the permanent victory of the entire industry in the world."

The company then collapsed. On March 10, 2000, Microslategy's stock price reached a peak of $ 313 per share, more than 60 times higher than the first public offering. Two weeks later, the company announced that its financial performance was required, and the stock price plunged to $ 72. The US Securities and Exchange Commission accused Seller and others offending account fraud, and Microslategy later reconciled these allegations with 11 million US dollars. Within two years, the company's stock price fell below $ 1. Seller's $ 13 billion of wealth evaporated.

"This is the darkest moment in my life. It is really bad when people lose money because they trust you," he said.

In 2020, after the government implemented a quantitative easing policy for many years and invested trillions of dollars for the new crown epidemic -related stimulus measures, Seller believed that the remaining 530 million US dollars cash and short -term investment on the MicroStrategy's balance sheet was best used to invest in Bit bit currency. The US government can print the US dollar at will -and it is trying to do this -but the design of Bitcoin has a hard upper limit: the number of Bitcoin will never exceed 21 million.

If the price of Bitcoin plummets, the decline in Microslategy's stock price will be more serious and faster than the Bitcoin itself. But don't ignore him because Seller is too smart. Many other companies also imitate Microslate — the company now claims to be "the first and largest Bitcoin Financial Department in the world."

Some listed companies, such as Metaplanet, even rely on Bitcoin to maintain survival. The chain of the headquarters in Tokyo faced a crisis of survival during the epidemic epidemic, when Japan closed the border with tourists at the time. This small hotel provider sells 9 of its 10 hotels, and issues stocks and bonds to buy hotels for $ 70 million in Bitcoin. Metaplanet's stocks traded on the Tokyo Stock Exchange and the off -site trading market, which rose 2600%in 2024. Although the value of Bitcoin held is only 183 million US dollars, its market value is currently US $ 1 billion. The company's homepage is now written "to protect the future with Bitcoin", and the hotel almost does not mention the hotel. "We are very grateful to Michael Sail to make a business plan for us to follow the world for follow -up," said Simon Gerovich, chief executive of Metaplanet, said that he was a guest of the Saile New Year's party.

" I invented 20 things and worked hard to make them success, but none of them changed the world. Nakamoto Cong created a thing, gave it to the world, and then disappeared. It made me more successful than every idea of me."

Although many companies are unlikely to go extreme like Metaplanet, the holders of Bitcoin will definitely be more and more. In January of this year, the US Financial Accounting Standard Committee amended a rule that the rule had previously allowed the company to record the value of cryptocurrencies in the quarterly report as a loss. Now holding cryptocurrencies will be priced at a market value, allowing profit or loss hedging at the same time. For Microslategy, which lobbying the rules, this may mean that in the future, it is possible to be included in the S & P 500 index.

According to YCharts data, the cash held by hundreds of large listed companies worldwide in the world is more than twice the current operations and liabilities. The most famous of which is Berkshire Hathaway, which currently holds $ 320 billion in cash.

In view of the US $ 35 trillion (and still growing) national debt, the Calem medmles have always been "cash is garbage." "Financial suppression is an eternal phenomenon," Bitwise's Park insisted that this is an inevitable result of the government's reduction in interest rates. We live in a highly developed world, and the real economy is basically disconnected from the financial economy. If you do not print more money, you cannot actually repay the debt. If you think you must continue to print more money, then you better believe that the yield curve will be suppressed.

In Seller's view, Vicia is the best example. The 18,000 square feet luxury mansion on Miami "Millionaire Street" was built in 1928 and was built for the president of Fw Woolworth. Seller bought the house at a price of $ 13 million in 2012. In a 2023 podcast interview, Seller said: "The house was worth $ 100,000 in 1930. Its valuation a few years ago was $ 46 million," Sailler said in an interview with 2023 podcasts. " It is moving towards a road worth 100 million US dollars, which means that the dollar will depreciate by 99.9%in 100 years.

Trump may be a good thing for MicroStrategy and Bitcoin in the next few years. Although Trump promoted "government efficiency", he was a big squander during his first president: According to the data of the Federal Budget Committee, in the four -year term of Trump 1.0, Treasury bonds increased by 84 trillion yuan Dollar. Although he once publicly called Bitcoin as a "scam, he would compete with the US dollar in 2021, Trump is now devoting himself to cryptocurrencies. In fact, his son Eric recently released a photo with Seller in Haihu Manor, and wrote "Two Friends, One Passion: Bitcoin".

The value of not only the value of the dollar may further depreciate in the next four years, and Seller's unremitting publicity is fully consistent with the Maga worldview of the anti -Utopia. "Human conditions have always been plagued by dirt: toxic foods, toxic liquids, and human economic conditions have been plagued by toxic capital. My mission is to publicize non -toxic capital to the world," he preached.

But even Michael Seller will occasionally come down from his podium to reflect on his business trip. He said: "We used Bitcoin out of helplessness and despair. Later, it became an opportunity, then turned into a strategy, a identity, and finally became a mission. I invented 20 things and tried to make them success, but I really did not use any of them to change the world. It means that this makes me more successful than those who try to commercialize everyone.

This also reminds us that lightning can indeed hit the same place twice, especially when there is a smart manager who is good at seizing the opportunity.