Ethereum announces a new framework, Open Intents Framework. Why do L2 still talk about expansion?

Reprinted from chaincatcher

02/20/2025·3MAuthor: 0xFacai, BlockBeats

On February 20, the Ethereum Foundation announced the launch of the Open Intents Framework, which is promoted by more than 30 teams in various fields of the Ethereum ecosystem to achieve accelerated development of full-ecological interoperability. According to EF official, this is a modular and open framework designed to allow any chain to seamlessly deliver intent to users and improve the cross-chain user experience.

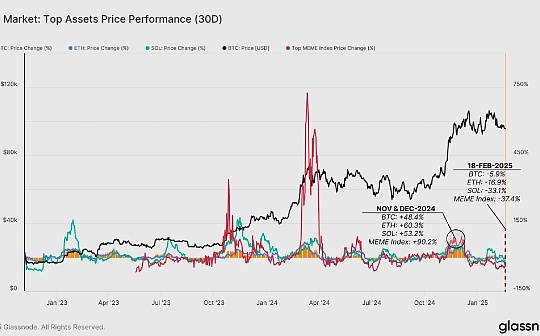

Obviously, this new framework of EF is aimed at promoting further liquidity integration and cost reduction between its L2 ecosystem. In recent months, discussions on "L2 feed back L1 capabilities" have been very frequent. Due to the continued weak performance of ETH prices, the market's dissatisfaction with the Ethereum ecological economic structure has become increasingly strong. Many people believe that L2, as an important part of the ecosystem, does not and cannot capture the value of ETH itself.

The L2 crisis is not just about "feedback"

L2 feeds back to L1, helping ETH achieve value capture, which is the dominant imagination of the Ethereum ecosystem in the past few years. However, the "rental collection situation" of Ethereum L1 in the past year is far from everyone's original vision.

Taking Arbitrum as an example, it charges a 10% handling fee to the Layer 3 platform within the ecosystem, while itself, as the Layer 2 platform, only pays 2% to Ethereum. After the Blob mechanism was launched, the average operating expenses of L2 plummeted.

At the same time, due to the strong impact of the Solana ecosystem, the weak performance of the entire Ethereum ecosystem is directly reflected in the entire L2 sector. According to L2BEAT data, the total L2 TVL has continued to decline since the end of last year. In just one week in early February, the top L2 TVLs such as OP, ZKsync and Starknet fell by about 5%, and the face activity of the L2 sector was in full swing. Consumption with Gas also fell to freezing point.

However, under this circumstance, EF still insists on implementing the expansion route and upgrade of L2 in recent months. In a recent official blog , EF announced that the Ethereum Pectra network hard fork upgrade plan will be launched on the Ethereum test network Holesky at 05:55 Beijing time on February 25. Pectra is also another major upgrade after Dencun last year, and its main goal is to improve the expansion capacity of the L2 ecosystem.

Why is this?

In fact, even with the help of blob, L2 still faces the problem of cost competition. In October last year, Scroll started SCR short claims, and the Ethereum network blob fee was instantly pushed to $4.52, reaching a month-old high, and as L2 activity slowed down, blob fee quickly fell back to near zero costs.

Previously, the sharp increase in blob fees has occurred twice, one during the surge in L2 activity in July last year and another in earlier March, during the tide of Blobscriptions inscriptions.

Some researchers have analyzed that the increase in blob fees is a double-edged sword for Ethereum. More expensive blobs will lead to more blob gas payments to the network, but at the same time they are pushing users to perform transactions and transfers on L2. cost. From the actual situation, whenever the Ethereum ecosystem is high, the blob expansion mechanism is almost useless.

On the other hand, the battle for blob space has also made Base, the leader of L2 and "Ethereum's only hope", feel tremendous pressure.

In January this year, Base Jesse said in a tweet that the growth of L2 has been severely affected by blob fee restrictions, and some pressures driven by daily demand have caused network fees to soar in cyclical prices. It is worth noting that since mid-9 last year, Jesse has been emphasizing that solving the expansion problem is Base's current work focus, and the way to solve the problem is not to rely on the native mechanism of the Ethereum network.

In January this year, polynomialfi co-founder gauthamzzz mentioned in his blog post that Ethereum L2 is facing a serious bottleneck, and 55% of the blob space is completely consumed by a few L2s. According to the current growth trend of L2, the Ethereum L2 ecosystem The maximum capacity will be reached in May 2025, when the problem is not resolved, the Ethereum ecosystem will face collapse.

Currently, Ethereum has only 3 blobs per block, and the reality is that dozens of L2s are competing for these 3 valuable storage locations. This is like dozens of growing cities competing for a single three lane. highway.

Currently, the average usage rate of blobs is close to 100%, and the usage of these blob storage is highly concentrated in very few head L2s such as Base. More L2s are either useless or show super high transaction costs when they are popular. Many community members believe that even after Pectra upgrades, the number of blobs per block increases from 3 to 6, it will be difficult to save the current L2 dilemma.

Can "L2 Interoperability" solve the problem?

In this context, "L2 interoperability" has become an important way to resolve the crisis. On the one hand, this can solve the reality of the separation of Ethereum's ecological liquidity. On the other hand, it can also spread the storage requirements of the head L2 and distribute them to other L2s in demand.

Last May, Vitalik said: "We need an open decentralized (no operator, no management) protocol to quickly transfer assets from one L2 to another and integrate them into the default sending of the wallet. In the interface. But before you are too obsessed with any fancy toys, do the basic work first. "Vitalik said that the biggest user experience problem at present is that L2-verse doesn't feel "like a unified Ethereum."

In January this year, Vitalik once again emphasized the need for enhanced interoperability between L2s. He said that L2 faces two main challenges: scale and heterogeneity challenges. In addition to improving the hardware expansion capabilities of L1 and L2, the Layer2 and wallets also need to accelerate improvement and standardize interoperability to make Ethereum more like "Single ecosystem, not 34 different blockchains."

However, the reality may not be that simple. Among the many L2s that have been launched, most of them have issued their own native tokens, which means that this part of L2 has been indirectly decoupled from ETH and the Ethereum ecosystem at the economic level. In other words, most of the current L2 profit model is still mainly "selling coins", rather than relying solely on sorter fees to create profits like Base.

This makes most L2 prefer to consider the value capture of its own tokens in the future "economic interest alignment" issue, and is closer to maintaining competition with other L2s rather than sharing relationships, and the "tributary" to ETH itself is even more important It is a tendency to superficial article. On the road to achieving a "great unification regime", Ethereum, the banishing dynasty, does not seem to have many strong bargaining chips, and the actual results of "L2 Interoperability" still need to be verified by time.

panewslab

panewslab

jinse

jinse