Dissect how crypto protocols handle revenue and cash flow?

Reprinted from panewslab

03/30/2025·1MWritten by: Saurabh Deshpande

Compiled by: Luffy, Foresight News

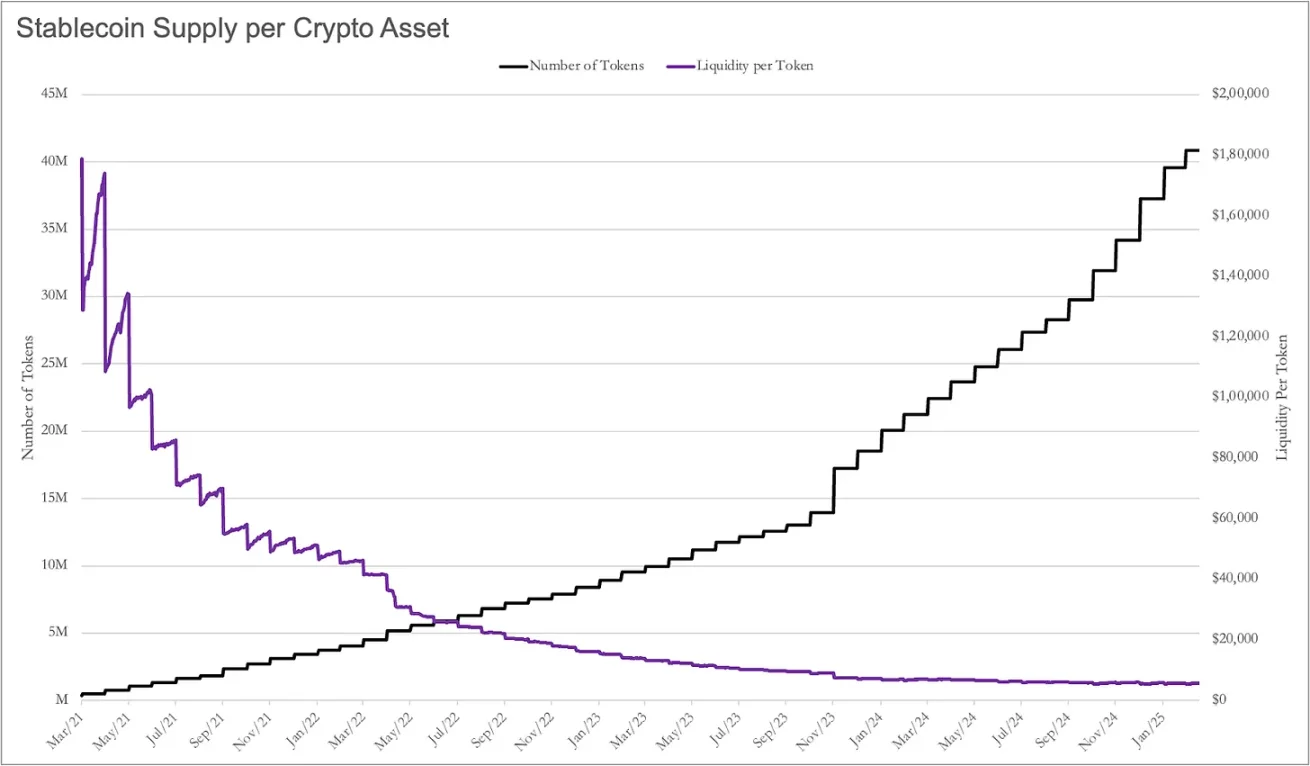

Recently, I used the supply of stablecoin as an indicator to measure liquidity, and then comprehensively considered the number of tokens in the market, hoping to calculate the liquidity of each asset. As expected, liquidity eventually approached zero, and the chart drawn based on the analysis results can be called a "work of art".

In March 2021, each cryptocurrency could enjoy about $1.8 million in stablecoin liquidity, while in March 2025, this figure was only $5,500.

As a project, you have to compete with other 40 million tokens for users and investors' attention, which was only 5 million three years ago. So, how to retain token holders? You can try to build a community, let members say "GM" on Discord, and then do some airdrop activities.

But then what? Once they get the tokens, they will switch to the next Discord group to talk about "GM".

Community members will not stay for no reason, you have to give them a reason. In my opinion, a high-quality product with actual cash flow is the reason, or to make the project data look good.

Russ Hanneman Syndrome

In the American TV series "Silicon Valley", Russ Hanneman once boasted that he would become a billionaire by "moving the radio station to the Internet." In the crypto field, everyone wants to be Russ, chasing the pursuit of getting rich overnight, but not worrying about the "boring" but practical problems of business fundamentals, building moats and obtaining sustainable income.

Joel’s recent articles Death to Stagnation and Make Revenue Great Again highlight the urgent need for crypto projects to focus on sustainable value creation. Like the impressive scenes in the show, Russ Hanneman dismisses Richard Hendricks’ concerns about building a sustainable revenue model, many crypto projects relied on speculative narratives and investor enthusiasm. Now it seems that this strategy is obviously unsustainable.

But unlike Russ, the founder cannot make the project successful by shouting "Tres Comas" (the term Russ shows off his wealth in the play). Most projects require sustainable income, and to achieve this, we must first understand how those current income-related projects are done.

https://youtu.be/BzAdXyPYKQo

Zero-sum game of attention

In traditional markets, regulators maintain liquidity of tradable stocks by setting high thresholds for listed companies. There are 359 million companies worldwide, and only about 55,000 are listed publicly, accounting for only about 0.01%. The benefit of this is that most of the available funds are concentrated within a limited range. But this also means that investors have fewer opportunities to bet on companies in the early stage and pursue high returns.

Dispersed attention and liquidity are the price for all tokens to be easily traded publicly. I am not judging which model is better here, but just showing the differences between the two worlds.

The question is, how to stand out in the seemingly endless ocean of tokens? One way is to show that the project you are building is in demand and token holders are involved in project growth. Don't get me wrong, not every project must be equally obsessed with maximizing revenue and profits.

Revenue is not the goal, but a means to achieve long-term vitality.

For example, an L1 that carries enough applications can simply earn enough fees to offset token inflation. Ethereum's validator yield is about 3.5%, which means its annual token supply will increase by 3.5%. Any holder who pledges ETH to obtain income will be diluted. But if Ethereum destroys an equal amount of tokens through a fee burning mechanism, the ETH of ordinary holders will not be diluted.

As a project, Ethereum does not need to be profitable, because it already has a prosperous ecosystem. As long as the validator can get enough profits to keep the nodes running, Ethereum has no additional revenue and is OK. But this is not the case for projects with a token circulation rate (the proportion of circulating tokens) of about 20%. These projects are more like traditional companies and may take time to achieve a state where enough volunteers can maintain the project operation.

Founders must face up to the reality that Russ Hanneman ignores, and it is crucial to generate tangible, sustained income. It should be noted that in this article, whenever "revenue" is mentioned, I actually refer to free cash flow (FCF), because for most crypto projects, the data behind revenue is difficult to obtain.

Understanding how to allocate FCF, how to reinvest it to boost growth, when to share it with token holders, and the best way to allocate (such as buybacks or dividends), these decisions are likely to determine the success or failure of founders who aim to create lasting value.

Referring to the equity market is helpful for making these decisions effectively. Traditional companies often distribute FCF through dividends and repurchases. Factors such as company maturity, industry, profitability, growth potential, market conditions and shareholder expectations will affect these decisions.

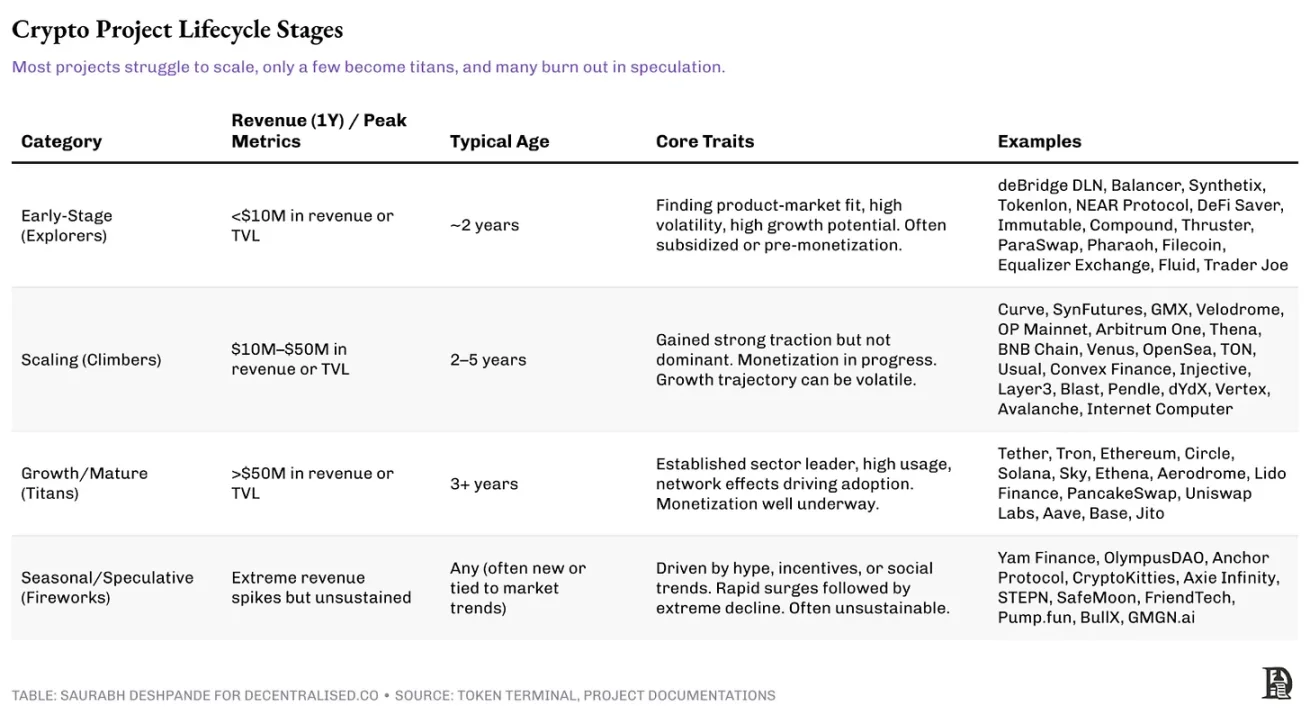

Different crypto projects are based on the life cycle stages they are in, and there are naturally different opportunities and limitations in value redistribution. I will describe it in detail below.

Encryption project life cycle

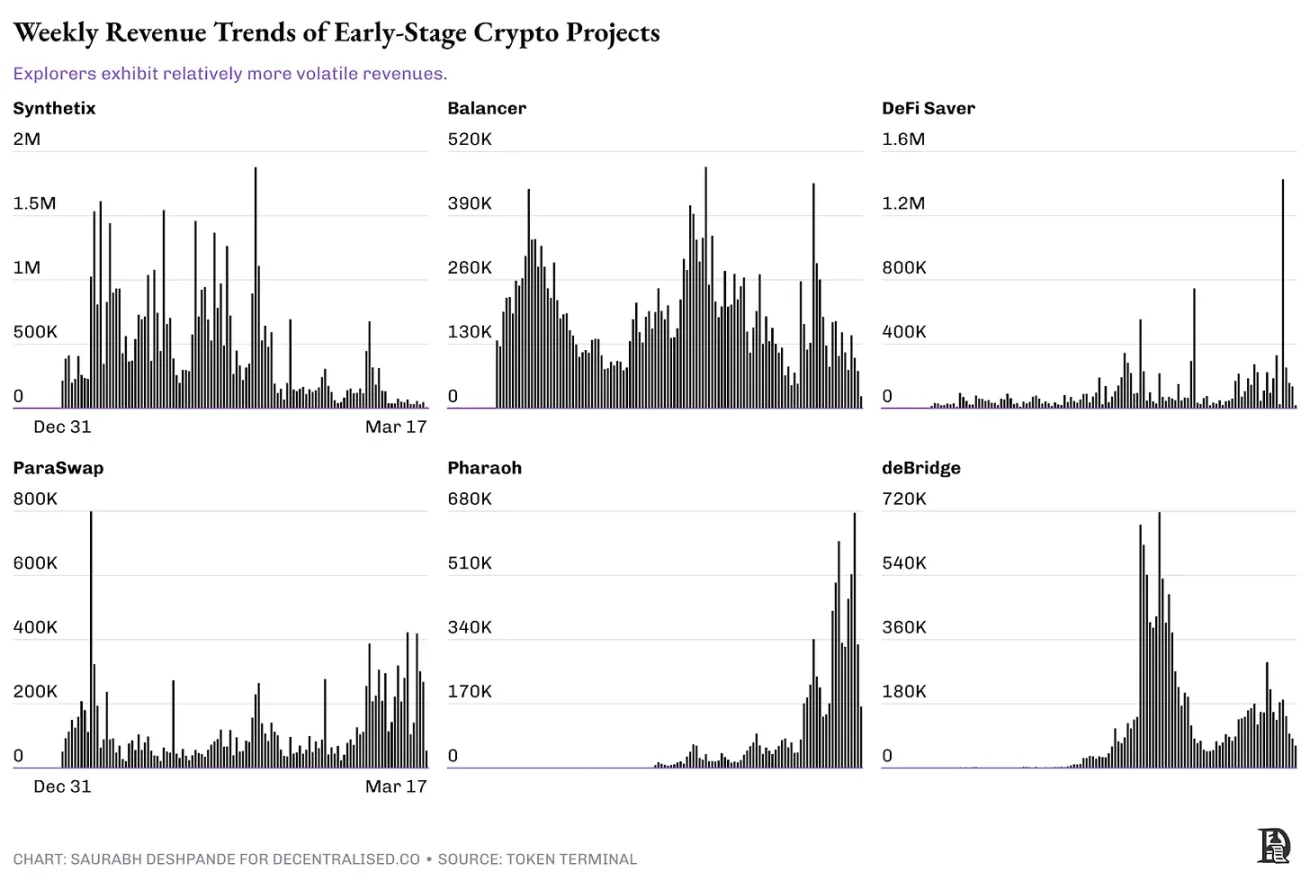

(I) Explorer stage

Early crypto projects are often in the experimental stage, focusing on attracting users and polishing core products rather than radically pursuing profitability. The product-market fit is unclear, and ideally, these projects prioritize reinvestment to maximize long-term growth rather than earnings sharing plans.

The governance of such projects is usually more centralized, with the founding team controlling upgrades and strategic decisions. The ecosystem is still budding, the network effect is weak, and user retention is a major challenge. Many of these projects rely on token incentives, venture capital or grants to maintain initial user guidance rather than stemming from natural demand.

While some projects may have early success in the niche market, it still needs to be proven whether their models can be sustainable. Most crypto startups are in this category, with only a small number of them being able to break through and move forward.

These projects are still looking for product-market fits, and revenue models highlight their dilemma of difficulty in maintaining sustained growth. Projects such as Synthetix and Balancer have seen a sharp surge in revenue and then decline significantly, indicating that they have a period of speculative activity rather than being steadily accepted by the market.

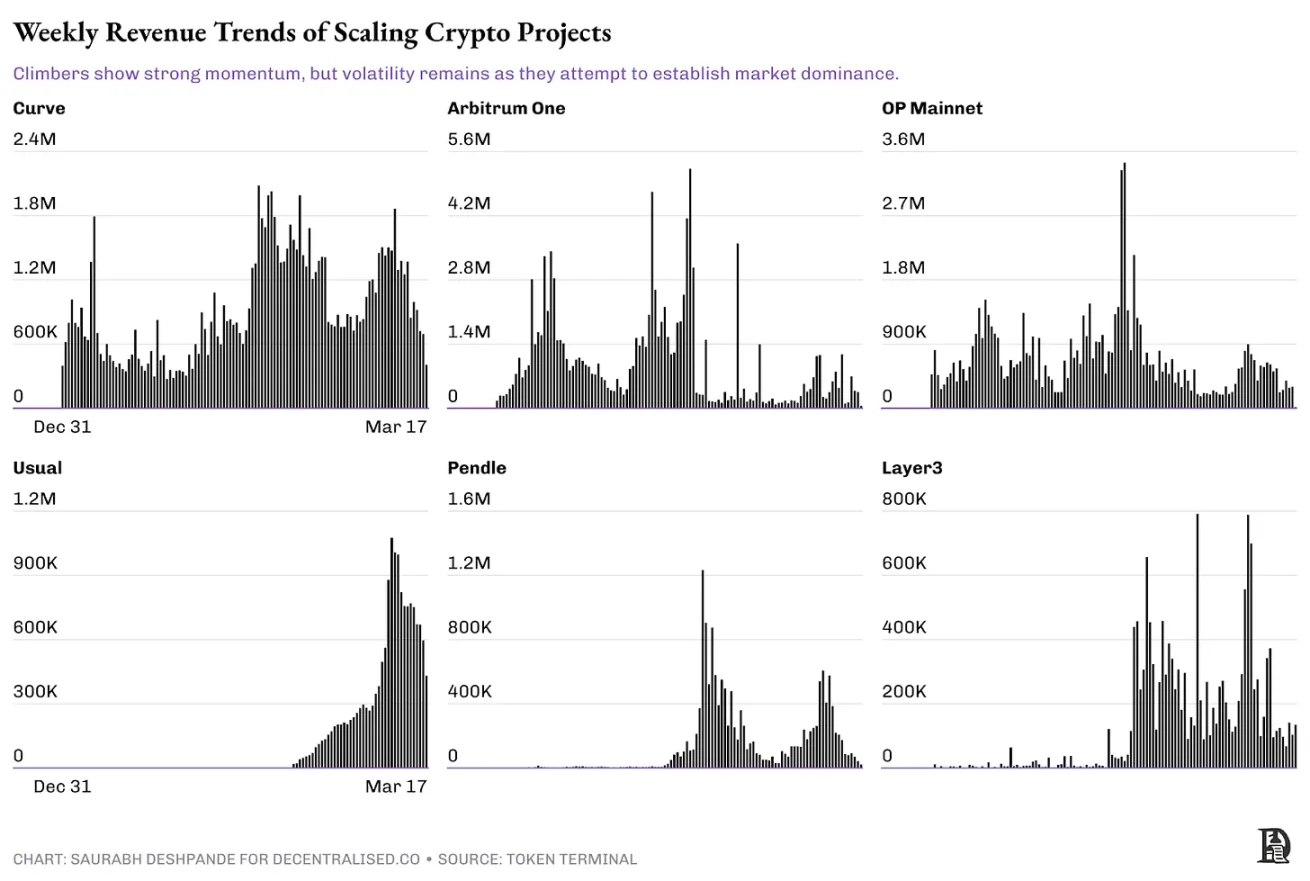

(II) Climber stage

Projects that have passed the early stages but have not yet dominated the field are in the growth category. These agreements generate substantial revenues, ranging from $10 million to $50 million a year. However, they are still in the growth stage, the governance structure is evolving, and reinvestment remains a priority. Although some projects consider profit sharing mechanisms, a balance must be found between profit distribution and continuous expansion.

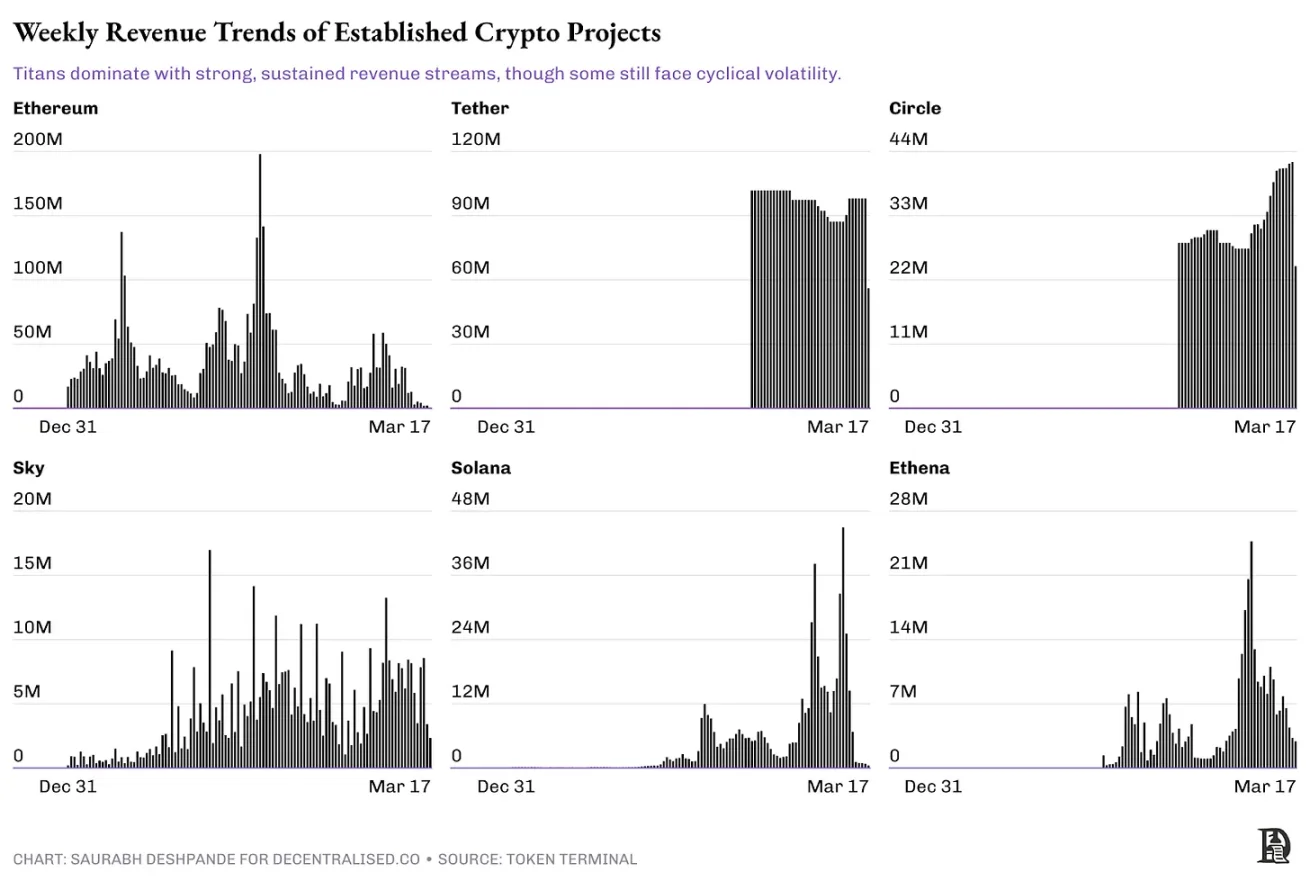

The above chart records weekly revenue for crypto projects in the Climber stage. These agreements have some appeal, but are still in the process of consolidating their long-term status. Unlike the early Explorer stage, these projects have significant revenue, but the growth trajectory remains unstable.

Projects such as Curve and Arbitrum One have relatively stable revenue flows with obvious peaks and troughs, indicating fluctuations due to market cycles and incentives. OP Mainnet also showed a similar trend, with a surge indicating a period of high demand that would slow down later. Meanwhile, Usual's revenue has increased exponentially, indicating it has been adopted quickly, but lacks historical data to confirm whether this growth is sustainable. Pendle and Layer3's activity surged sharply, indicating that it is a time for high user engagement, but also reveals the challenges of maintaining momentum in the long run.

Many L2 expansion solutions (such as Optimism, Arbitrum), decentralized financial platforms (such as GMX, Lido), and emerging L1s (such as Avalanche, Sui) all fall into this category. According to Token Terminal, only 29 projects currently have annual revenues of more than $10 million, but the actual figures may be slightly higher. These projects are at a turning point, with projects that consolidate network effects and user retention going to the next stage, while others may stagnate or go downhill.

For climbers, the path forward is to reduce reliance on incentives, strengthen network effects, and prove that revenue growth can be sustained without a sudden reversal.

(III) Giant Stage

Mature protocols like Uniswap, Aave and Hyperliquid are in the growth and maturity stages, and they have achieved product-market fit and can generate large amounts of cash flow. These projects have the conditions to implement structured repurchases or dividends to enhance the trust of token holders and ensure long-term sustainability. Their governance is relatively decentralized, and the community actively participates in upgrading and vault decision-making.

The network effect forms a competitive moat, making it difficult to replace. Currently, only dozens of projects can reach this revenue level, which means very few protocols have truly matured. Unlike early or growth-stage projects, these protocols do not rely on inflationary token incentives, but earn sustainable income through transaction fees, lending interest or pledge commissions. Their ability to resist market cycles further distinguishes it from speculative projects.

Unlike early-stage projects or growth stage projects, these protocols show strong network effects, a solid user base and a deeper market foundation.

Ethereum is leading the way in decentralized revenue generation, showing a periodic peak that is consistent with the high activity period of the network. The revenue situation of the two stablecoin giants, Tether and Circle, is different, with revenue streams more stable and structured rather than large fluctuations. Solana and Ethena, although revenue is considerable, still have significant growth and decline cycles, reflecting their changing adoption.

At the same time, Sky's revenue is relatively unstable, indicating that demand is volatile rather than continuing to dominate.

Although the giants stand out in scale, they are not immune to volatility. The difference is their ability to cope with downturns and maintain revenue for a long time.

(IV) Seasonal Project

Some projects experience rapid but unsustainable growth due to hype, incentives or social trends. Like FriendTech and memecoin, they may generate huge revenue during peak cycles, but it is difficult to retain users for a long time. Premature earnings sharing plans may exacerbate volatility because once incentives dry up, speculative capital will quickly withdraw. Their governance is often weak or centralized, the ecosystem is thin, the adoption rate of decentralized applications is limited, or the long-term practicality is insufficient.

Although these projects may temporarily obtain extremely high valuations, once market sentiment changes, it is easy to collapse, which disappoints investors. Many speculative platforms rely on unsustainable token issuances, false trading or inflated yields to create artificial demand. Although some projects can get rid of this stage, most cannot establish a lasting business model, which is essentially high-risk investment.

Profit sharing model of listed companies

Observing how listed companies deal with surplus profits can help us learn more.

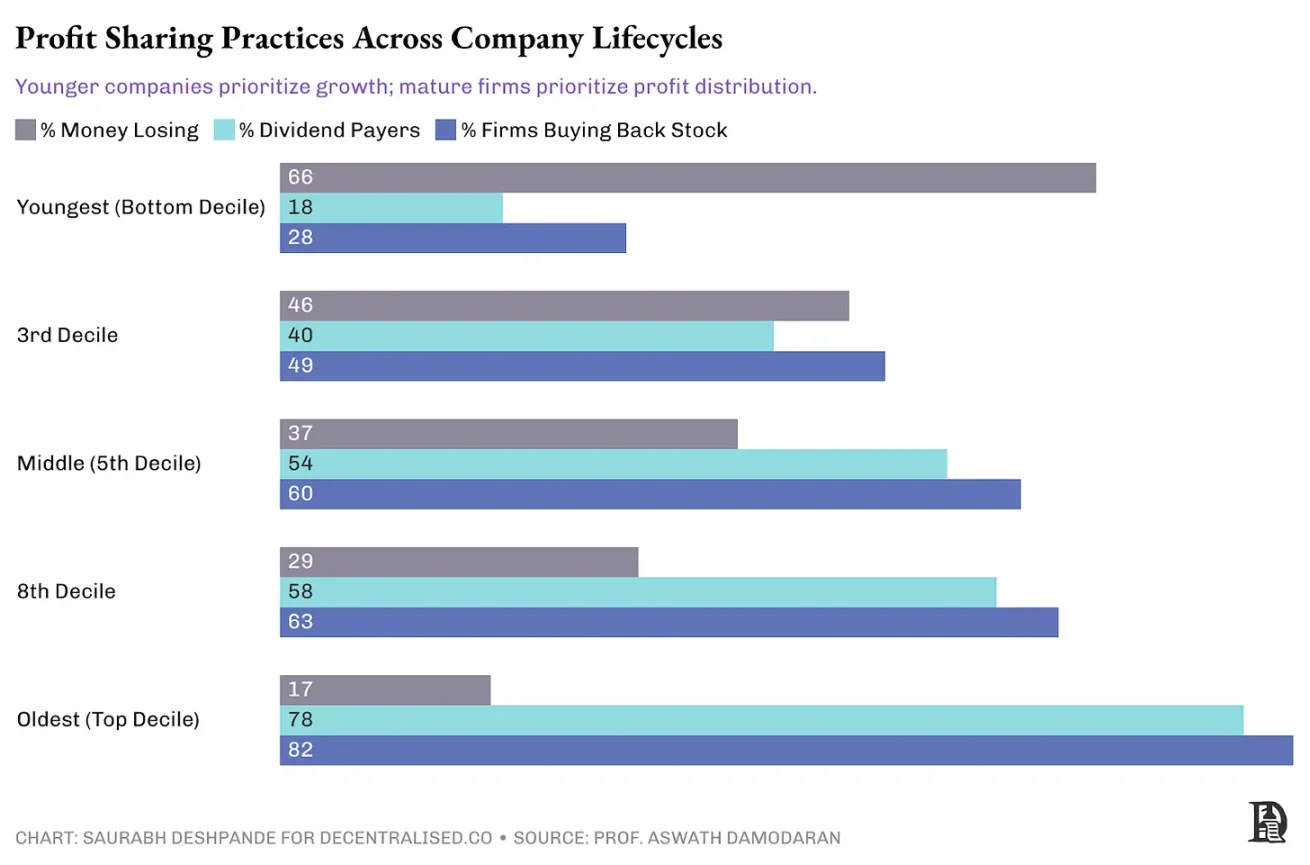

This chart shows how profit sharing behavior evolves as traditional companies grow maturity. Young companies face high financial losses (66%) and therefore tend to retain profits for reinvestment rather than distributing dividends (18%) or conducting stock buybacks (28%). As companies mature, profitability usually stabilizes, and dividend payments and buybacks increase accordingly. Mature companies often distribute profits, dividends (78%) and buybacks (82%) become common.

These trends echo the life cycle of crypto projects. Like young traditional companies, early crypto “explorers” often focus on reinvestment to find a fit between products and markets. On the contrary, mature crypto “giants”, like old and stable traditional companies, have the ability to distribute revenue through token repurchases or dividends, enhancing investor confidence and long-term feasibility of the project.

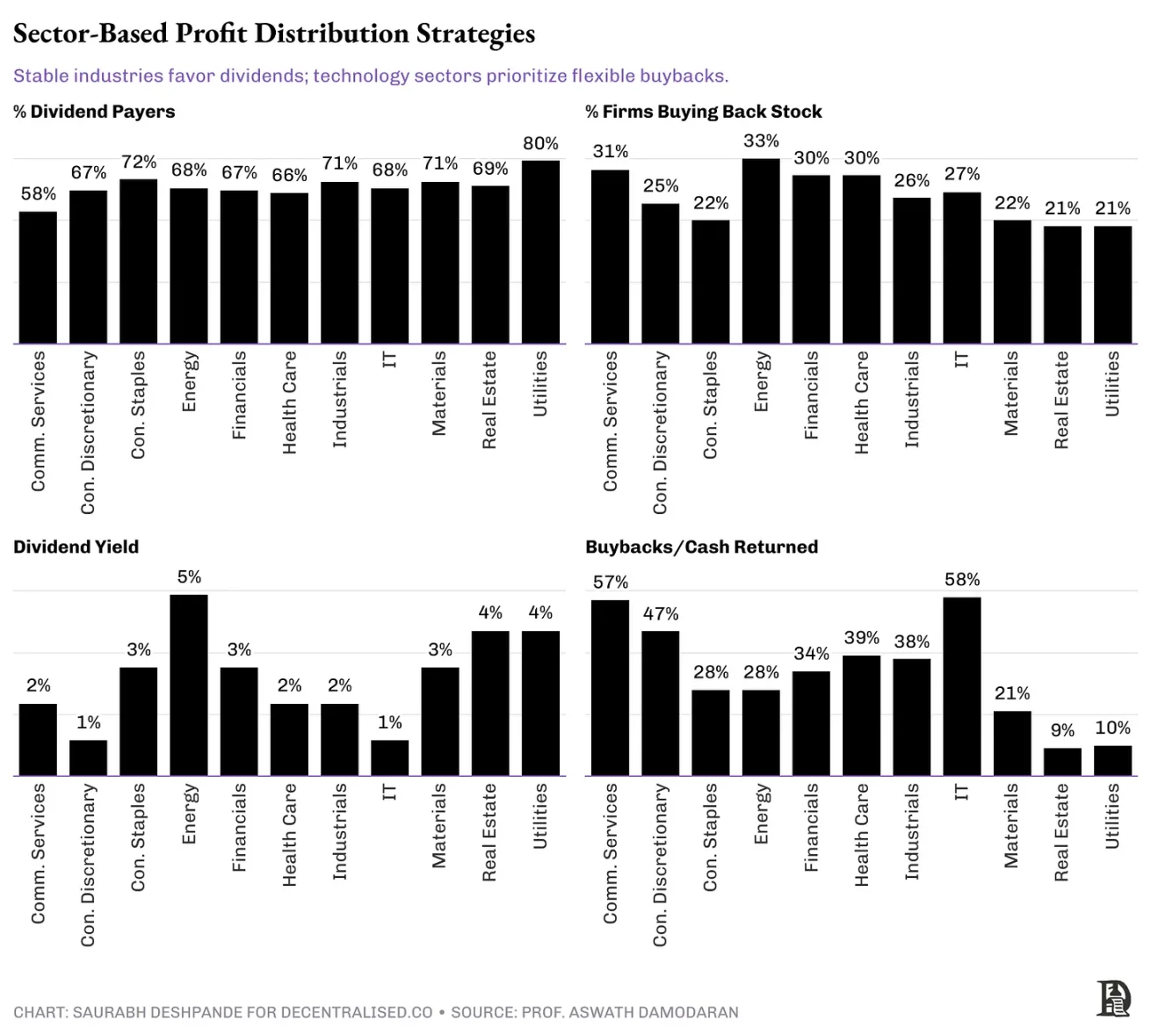

The relationship between company age and profit sharing strategy naturally extends to the practice of specific industries. Although young companies usually give priority to reinvestment, mature companies adjust their strategies according to the characteristics of their industry. Cash flow-stable, rich industries tend to predictable dividends, while industries characterized by innovation and volatility prefer the flexibility brought by stock buybacks. Understanding these nuances helps crypto project founders to effectively adjust their income distribution strategies to match the life cycle phase and industry characteristics of the project with investor expectations.

The chart below highlights the unique profit distribution strategies for different industries. Traditional, stable industries like utilities (80% of companies pay dividends, 21% buybacks) and consumer essentials (72% pay dividends, 22% buybacks), they are strongly inclined toward dividends due to predictable revenue streams. In contrast, technology-focused industries such as information technology (27% repurchase, with the highest percentage of cash back through repurchase, up to 58%) tend to repurchase to provide flexibility when revenue fluctuates.

These have a direct impact on crypto projects. Protocols with stable, predictable income, such as stablecoin providers or mature DeFi platforms, may be the best suited to adopt a dividend-like ongoing payment method. On the contrary, high-growth, innovative crypto projects, especially at the DeFi and infrastructure levels, can adopt flexible token repurchase methods, emulating the strategies of traditional technology industries to adapt to volatile and rapidly changing market conditions.

Dividends and buybacks

Both methods have their own advantages and disadvantages, but recently repurchases are more popular than dividend payments. Buybacks are more flexible, while dividends are sticky. Once an X% dividend is announced, investors expect you to do it every quarter. Therefore, the repurchase leaves strategic space for the company: not only how much profit is returned, but also when to return it, so that it can adapt to the market cycle without being limited to rigid dividend payment plans. A buyback does not set fixed expectations like dividends, it is considered a one-time attempt.

But repurchase is a way to transfer wealth, a zero-sum game. Dividends create value for each shareholder, so the two have room for existence.

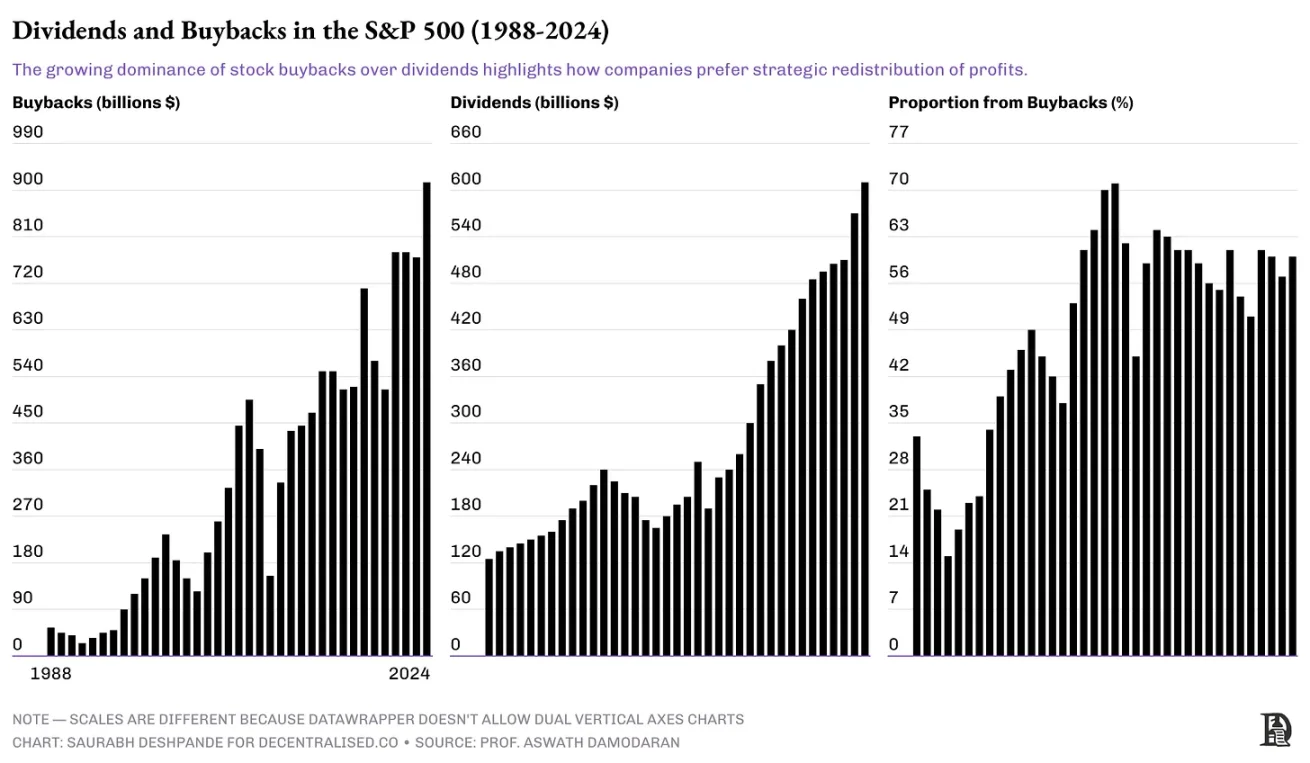

Recent trends show that repurchases are becoming more and more popular due to the above reasons.

In the early 1990s, only about 20% of profits were distributed through repurchase. By 2024, about 60% of profit distribution is distributed through repurchases. In USD, buybacks exceeded dividend payments in 1999 and have remained ahead of the curve ever since.

From a governance perspective, buybacks require careful valuation assessments to avoid unintentional transfer of wealth from long-term shareholders to those who sell their stocks at high valuations. When a company buys back shares, (ideally) it thinks the stock is undervalued. Investors who choose to sell their stocks believe that the stock price is overvalued. These two views cannot be correct at the same time. It is often believed that companies know their plans better than shareholders, so those who sell their shares during buybacks may miss out on opportunities for higher profits.

According to a Harvard Law School paper, current disclosure practices tend to lack timeliness, making it difficult for shareholders to assess the progress of repurchases and maintain their shareholding ratios. Additionally, when compensation is tied to indicators such as EPS, buybacks may affect executive compensation, which may prompt executives to prioritize short-term stock performance over long-term growth of the company.

Despite these governance challenges, buybacks are attractive to many companies, especially U.S. technology companies, due to the operational flexibility of buybacks, autonomy in investment decision making, and a lower future expectation compared to dividends.

Income generation and distribution of cryptocurrencies

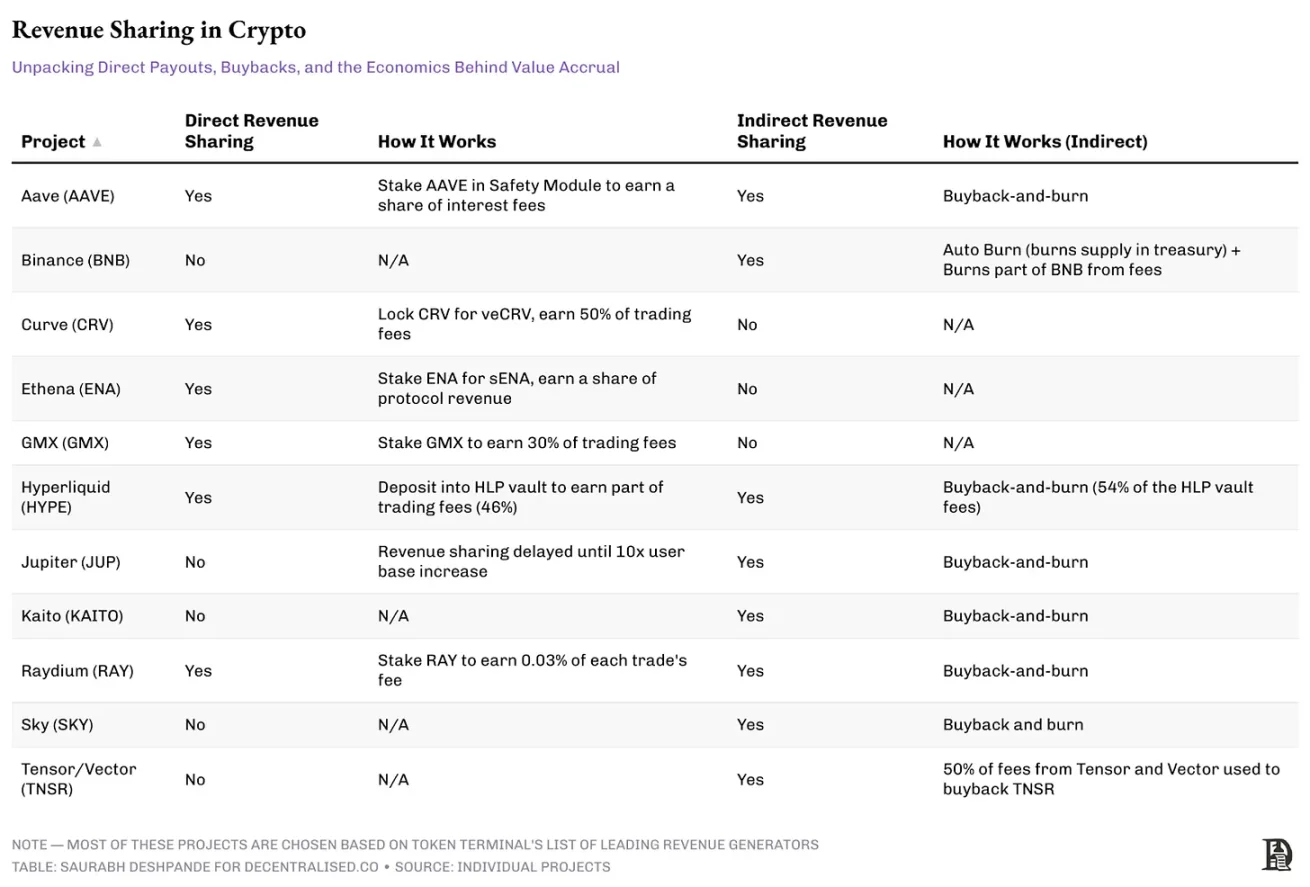

According to Token Terminal, 27 projects in the encryption field generate $1 million in revenue per month. This is not comprehensive, because it misses like PumpFun, BullX, etc. But I think it's not far from that. I looked at 10 of these projects and observed how they handle revenue. The key is that most crypto projects should not even consider distributing revenue or profits to token holders. In this regard, I appreciate Jupiter. When announcing the token, they made it clear that they had no intention of sharing direct earnings (such as dividends) at that stage. Only after the number of users has increased by more than ten times will Jupiter launch a repo mechanism to allocate value to token holders.

Profit sharing in crypto projects

Crypto projects must rethink how to share value with token holders, both drawing inspiration from traditional corporate practices and adopting unique approaches to circumvent regulatory scrutiny. Unlike stocks, tokens provide innovative opportunities to directly integrate into the product ecosystem. Instead of simply distributing benefits to token holders, projects actively incentivize key ecosystem activities.

For example, Aave rewards token stakers who provide key liquidity before launching a repo. Similarly, Hyperliquid strategically shares 46% of revenue with liquidity providers, similar to the traditional consumer loyalty model in mature businesses.

In addition to these strategies for integrating with tokens, some projects adopt a more direct revenue sharing approach, reminiscent of traditional public equity practices. However, even the direct income sharing model must be operated with caution to avoid being classified as a security, maintaining a balance between rewarding token holders and compliance with regulatory regulations. Projects like Hyperliquid outside the United States often have greater room for operation when adopting the revenue sharing practice.

Jupiter is an example of a more creative value sharing. Instead of doing traditional repurchases, they utilize the third-party entity Litterbox Trust, which receives JUP tokens through encoding, which amounts to half the revenue of the Jupiter protocol. As of March 26, it had accumulated about 18 million JUPs, worth approximately $9.7 million. This mechanism allows token holders to be directly linked to the success of the project, while avoiding regulatory issues related to traditional repos.

Remember, Jupiter has embarked on the path of giving back value to token holders after having a strong stablecoin vault that can support the project for many years.

The reason for distributing 50% of income to this accumulation plan is simple. Jupiter follows a guiding principle that balance ownership between teams and communities, promoting clear consistency and co-motivation. This approach also encourages token holders to actively promote the agreement, allowing their financial interests to be directly linked to product growth and success.

Aave also recently launched a token repurchase after a structured governance process. The agreement, which has over $95 million in health vaults (excluding its own token holdings), launched a repo program after detailed governance proposals in early 2025. The program, called Purchase and Distribution, allocates $1 million per week for buybacks, after extensive community discussions on token economics, vault management and token price stability. Aave’s vault growth and financial strength enables it to initiate this move without compromising its operational capabilities.

Hyperliquid repurchases HYPE tokens using 54% of revenue, while the remaining 46% is used to incentivize exchange liquidity. Repurchases are conducted through the Hyperliquid Aid Fund. Since the launch of the program, the aid fund has purchased more than 18 million HYPEs. As of March 26, it was worth more than $250 million.

Hyperliquid stands out as an exception, with its team eschewing venture capital, likely self-funded for development, and now spending 100% of its revenue on rewarding liquidity providers or buying back tokens. It may not be easy for other teams to replicate this. But both Jupiter and Aave exemplify a key aspect: their financially sound state is sufficient to repurchase tokens without compromising core operations, reflecting a rigorous financial management and strategic vision. This is something that every project can follow. There must be sufficient financial reserves before starting a repurchase or dividend.

Tokens as a product

Kyle makes a great point that crypto projects require an investor relations (IR) position. It is ironic for an industry built on transparency, but crypto projects are underperforming in operational transparency. Most external communication is done through sporadic Discord announcements or Twitter posts, with financial metrics selectively shared, and expenses mostly opaque.

When the token price continues to fall, users will soon lose interest in the underlying product unless it has built a strong moat. This creates a vicious cycle: falling prices lead to a decline in interest, which further lowers prices. Projects need to give token holders sufficient reasons to stick to them and give non-holders reasons to purchase.

With clear and continuous communication on development progress and fund use, it can itself create a competitive advantage in today's market.

In traditional markets, the Investor Relations (IR) department builds a bridge of communication between companies and investors by regularly publishing financial reports, holding analyst conference calls and providing performance guidance. The crypto industry can learn from this model while leveraging its own unique technological advantages. Regular reporting of revenue, operating costs and development milestones on a quarterly basis, combined with the verification of on-chain cash flows and repurchase situations, will greatly enhance stakeholders' confidence.

The biggest transparency gap lies in spending. Disclosing team compensation, fee details and grant allocations can answer questions that only arise when the project crashes: "Where is the money spent on the ICO?" and "How much salary does the founder pay himself?"

The strategic advantages of strong IR practices come from more than just transparency. They reduce volatility by reducing information asymmetry, expand the investor base by making it easier for institutional capital to enter, cultivate long-term holders who fully understand operations, can stick to their positions during market cycle volatility, and build community trust that can help projects get through the difficulties.

Forward-thinking projects like Kaito, Uniswap Labs and Sky (formerly MakerDAO) have moved in this direction, publishing transparent reports regularly. As Joel points out in his article, the crypto industry must get rid of the speculative cycle. By adopting professional IR practices, the project can get rid of the reputation of "casino" and become the "compound interest creator" envisioned by Kyle, that is, an asset that can continuously create value for the long term.

In a market with increasingly sharp capital vision, transparent communication will become a necessary condition for survival.