Delphi Digital: In-depth analysis of Sui Q1 ecological development

Reprinted from panewslab

04/30/2025·1MAuthor: Delphi Digital

Compiled by: Glendon, Techub News

Since Delphi Digital last delved into Sui’s architecture, ecosystem and token economics, the network has completed a series of key upgrades in its infrastructure and application stack areas. In this follow-up report, we will analyze key progress in its ecosystem, including the construction of Bitcoin Finance (BTCfi) infrastructure, the growth trajectory of the lending protocol Suilend, and the expansion of Aftermath Finance.

In terms of infrastructure, the launch of Mysticeti v2 introduces a “fast path” for low-competitive transactions, significantly reducing latency and rebalancing validator workloads. Meanwhile, Move VM 2.0 achieves significant execution improvements through advanced composability, region-based memory management, modular architecture, and enhanced capabilities designed to support more complex and dynamic on-chain logic.

At the same time, Sui's expansion roadmap is constantly improving as Pilotfish performs sharding to achieve true horizontal scalability and elastic validator configuration. These improvements by Sui are strengthened again by implementing localized object-based fee markets and MEV-aware optimizations, including priority transaction submissions and consensus block flows.

Ecosystem update

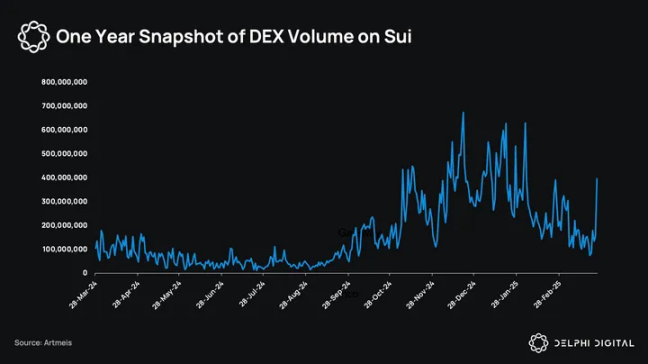

DEX trading volume on Sui has fallen from its previous quarter highs, but it can be seen that trading volume has risen after the WAL token of decentralized storage protocol Walrus went live on March 27.

BTCfi on Sui

BTCfi has recently become an emerging niche on Sui, bringing the basic elements of borrowing, pledging and earnings to Bitcoin, which is traditionally regarded as passive collateral. According to DeFiLlama, the total locked value of the BTCfi sector (TVL) has grown from less than US$100 million to more than US$4.5 billion, covering a variety of assets such as re-staking, anchoring and decentralized BTC.

At the end of 2024, Sui announced a partnership with Babylon Labs and Lombard Protocol to introduce native BTC staking through LBTC. LBTC is a liquid staking token directly minted by Lombard on Sui and Cubist platforms, aiming to help users manage deposits, minting, cross-chain and staking. A few weeks later, in December 2024, Sailayer entered into a partnership with LBTC and WBTC to launch a restaking opportunity for BTC for LBTC and WBTC. Prior to this, the Lorenzo protocol launched stBTC on Sui, a liquid staking token powered by Babylon, designed to aggregate BTC earnings and integrate with DeFi protocols such as Cetus and Navi. In early February 2025, Sui Bridge added support for packaged BTC assets such as WBTC and LBTC, and since then, more than 587 BTC has flowed into the Sui DeFi platform.

So far, more than $111 million in packaged BTC has been deposited into Suilend, Navi and Cetus.

DeFi protocol on Sui

Suilend

Suilend is the Sui Eco-Lending Agreement. In less than one year of operation, its annualized revenue reached US$15 million in February 2024, with 70% of which flowing into SEND's vaults. The vault initially obtained 1.2 million SUI from "mdrop".

Suilend also launched the Automatic Market Maker (AMM) Steamm, with integrated money market components designed to maximize capital efficiency by depositing idle liquidity into the lending market. The protocol has a composable architecture that supports a variety of quotation systems including constant product quotations, stablecoin professional quotations and dynamic paid quotations based on market volatility. By allowing idle funds to generate returns in the lending market while still being available for trading, Steamm improves capital efficiency and provides additional benefits to liquidity providers through its bToken mechanism.

Aftermath

MetaStables is incubated on Sui by Aftermath, as a vault system that allows users to deposit cross-chain assets or native assets to mint stablecoins such as mUSD (pegged to USD) and mETH (pegged to ETH), and plans to launch meta-tokens such as mBTC in the future. It uses oracle-based exchange rates (such as Python) to conduct slip-free transactions between vault assets, avoiding the inefficiency brought by AMM slip-free and enabling lending of deposited assets to boost returns. The philosophy of MetaStables is to respond to liquidity fragmentation problems by promoting meta tokens and allow users to earn mPOINTS.

In addition to MetaStables, Aftermath also launched Perp DEX on the Test Network, a fully Sui-based on-chain perpetual contract order book.

Walrus is online

Decentralized storage protocol Walrus launched the main network on March 27, 2025 and completed a US$140 million financing led by Standardcrypto.

Walrus is a decentralized storage network built on Sui, designed to store a variety of data, from NFT assets, AI model weights to blockchain archives and website content. It can also act as a data availability layer for rollups, similar to Celestia or EigenDA. While Walrus uses Sui for metadata and governance, it transfers storage tasks to a separate set of nodes, avoiding the overhead of Sui validator.

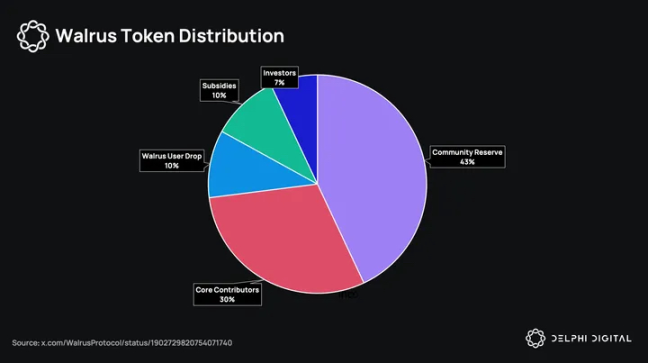

At the heart of Walrus is Red Stuff, a two-dimensional encoding protocol that enables efficient single-time file encoding and has powerful data recovery capabilities. The system is protected by a staking-based WAL token incentive model where nodes are rewarded for uptime and correct processing of data and are penalized for failure or malicious behavior. The breakdown of WAL token economics is as follows:

- Community reserve: 43%

- Core Contributors: 30%

- Walrus User Airdrop: 10%

- Subsidy: 10%

- Investors: 7%

Technical updates

Sui Core Development Project

Mysticeti V2 update

Delphi Digital details Mysticeti v1 in its previous report Sui Network: Unveiling the Mystery of Single Contenders. It eliminates the need for block authentication by embedding commit rules directly into the DAG structure. This allows the submission time of each block to theoretically be the shortest delay of only three rounds of messages, thus reducing Sui's consensus delay from about 1900 milliseconds (Bullshark testnet) to about 390 milliseconds. Furthermore, since only one signature is required per block, it reduces the CPU load of the verifier, thereby increasing execution throughput and response speed.

Mysticeti-FPC (v2) is extended based on Mysticeti-C (v1), introducing a "fast path" for transactions that do not require full consensus, especially for common situations such as token transfers or NFT minting, which only involve assets owned by a single address. Instead of running a separate protocol (such as FastPay or Sui Lutris), Mysticeti-FPC embeds fast path logic into the same DAG, avoiding additional messaging, redundant encryption operations, and post-consensus checkpoints.

Move VM 2.0 Enhancements

Sui's Move VM v2 is a fundamental optimization focused on execution efficiency and system composability. Core improvements include memory area allocation, package caching, and low lock contention, aiming to reduce latency under load. With pointer references across packages (including system-level access), internal call speeds are currently significantly improved.

In addition, the virtual machine also introduces a multi-stage abstract syntax tree (AST) for validation, optimization, and execution, as well as link logic for parsing and updating across package virtual tables, simplifying modular development. Early benchmarks showed that individual execution paths were 30% to 65%. This will enable Sui to scale to more complex, high-throughput use cases with Move VM v2.

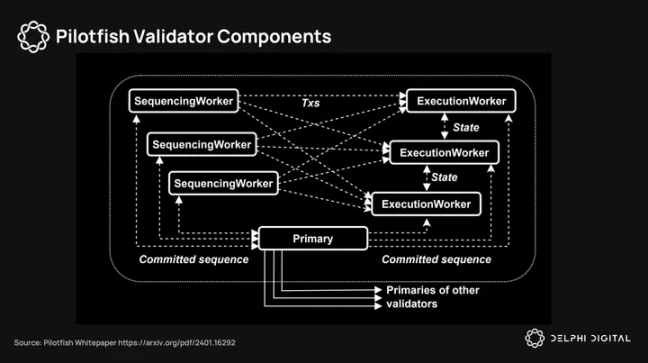

Execute sharding using PilotFish

Pilotfish is a horizontally scalable execution engine that breaks the bottleneck of Sui's original stand-alone execution model. Traditionally, Sui validators are monolithic, handling consensus, data acquisition, and state execution on a single machine, limited by vertical scaling in terms of computing, memory, and storage.

Pilotfish breaks this whole into three different layers:

- Primary: Central coordinator who handles transaction sorting and consensus;

- SequencingWorkers (SWs): Scalable nodes responsible for extracting and routing transactions;

- ExecutionWorkers (EWs): horizontally distributed machines, storing fragments of state on the chain and performing actual execution.

Pilotfish's sharded workload distribution:

- Each transaction is routed to a specific sequencing worker.

- Each on-chain object (i.e., state) is mapped to a specific executor.

Transactions that require access to objects across multiple shards are solved by coordinated data exchange, a pull-based model in which the executor requests remote state on demand. This maintains consistency without sacrificing parallel execution and is closely linked to Sui’s lazy consensus design that is based on batch metadata rather than full transaction data.

This enables parallelism without shared memory, allowing compute-intensive workloads to scale linearly with the increase in available hardware. Benchmarks show that Pilotfish can achieve up to 10x throughput improvements using 8 EWs compared to the benchmark execution engine.

Horizontal scaling can pave the way for the true resilience of validator infrastructure. Unlike vertical scaling, vertical scaling is strictly limited by hardware cost and configuration latency, while horizontal scaling allows validators to resiliently launch common servers, such as 32-core servers on AWS or GCP, to cope with peak demand. If traffic persists, validators can migrate to more cost-effective bare metal servers.

Its impact is three aspects:

- Verifier operations become hardware-independent: no special high-end configuration is required;

- Infrastructure configuration becomes resilient and programmatic: automatically scales according to requirements;

- Design spaces open up spaces for Sui native innovations, such as the "package"-specific fee markets or priority queues, implemented by Sui's object-centric state model.

This will make Sui one of the few execution environments that can absorb consumer-level transaction throughput without increasing concentration or affecting latency.

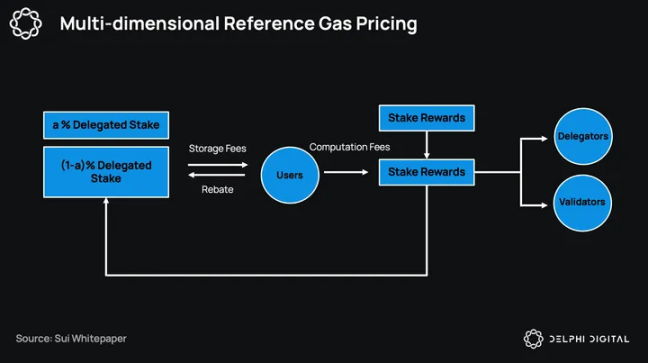

Implement a local fee market based on Object-Based

Sui uses a multi-dimensional reference Gas pricing mechanism to divide costs into two main parts: calculation costs and storage costs. So, how does Sui’s local expense market operate in Sui object environment?

Sui implements an object-based local fee market mechanism, which is different from Ethereum and is more similar to Solana's fee structure. Sui sets expenses based on specific needs associated with a single object or asset. Each asset or application on Sui has an independent expense market, enabling local adjustments without impacting the entire network.

By contrast, Ethereum operates a unified global expense market where each transaction leads to overall network congestion, resulting in increased expenses across the chain during the increasing demand. Similarly, Solana uses a localized fee market system to adjust fees around specific disputed state objects or accounts.

Sui further expands the concept of localization by directly associating expenses with "objects" rather than "states". By associating expenses with specific objects, Sui can process transactions involving different assets in parallel, avoiding fee interactions or congestion overflows. This isolation means that even if other applications on Sui are already very active, the activity of new applications can reach a high level of activity. For example, popular trading pairs on DEX can adjust fees independently according to their own needs. In this way, Sui's local fee market with object-level granularity is more fair to its user base and more efficient to its developer base.

Standard balance accumulator

Sui's "Canonical Balance Accumulators" adopt an object-based design, and the balance is an on-chain Move object. These objects are not abstract concepts within the contract, but independent, verifiable state objects. This setting enables transaction-level parallelism, because execution only relies on access to specific objects, not shared global storage.

Ethereum uses centralized mapping in ERC-20 contracts to track balances. Each transfer triggers a shared state, which hinders parallelism and binds composability to contract-specific logic. Each token has its own implementation, and there is usually an integration edge case.

And Solana processes balances through token accounts, which helps with parallel execution. But developers need to specify all accounts for each transaction in advance. This puts resistance to building modular systems and limits flexibility under dynamic conditions.

Sui simplifies this process. Standardized balance objects and a "BalanceManager"-like manager provide a clear way for the protocol to track and modify balances without having to own state. Execution is horizontally scalable by default, and balanced logic can be ported across modules without having to wrap it in a custom interface. Without coordination overhead, it is clearer to build and unlock using object-level expense markets, isolation and composability.

Multi-signature account implementation

Sui's multi-signature implementation is a weighted k-of-n signature model. Each signer is assigned a weight, and the transaction is executed when the sum of all weights reaches or exceeds the preset threshold. This allows for flexible signature strategies, such as requiring 2 of 3 signers, or forcing one key to always sign with the other keys to achieve a setup similar to two-factor authentication (2FA).

The unique feature of the Sui method is that it supports the use of heterogeneous key schemes in the same multi-signature. Users can mix Ed25519, secp256 k1, and secp256 r1 keys in a single authentication object, enabling more composable wallet and hosting designs without the need for specialized tools.

Unlike threshold signatures that compress approvals into a single opaque signature, Sui's multi-signature exposes which keys sign and which approvals are signed. This improves auditability and cross-side coordination without the need for complex multi-party computing (MPC) setups. Therefore, it is easier to reason, rotate participants more easily, and is natively compatible with the Sui trading model.

Sui on MEV development

Priority transaction submission

At the execution level, Sui resolves conflicts on shared objects through a Gas-based priority mechanism. Priority Gas Auctions (PGAs) act as the main coordination layer. Because Sui's execution is object-centric and transactions that modify the same object must be serialized, PGAs act as a congestion pricing mechanism, which is especially useful in case of object hotspots or DEX fluctuations.

SIP-19 introduces a soft bundling mechanism to submit off-chain assembled transaction groups as one unit. This makes reverse auctions (for example through Shio) possible, where searchers can bid to attach their transactions to bundles with high execution probability.

SIP-45 adds consensus amplification. Transactions with Gas prices exceeding kx RGP will be submitted multiple times by different validators, effectively amplifying their presence in consensus. This reduces volatility caused by validator outages or leader rotations and ensures that Gas prices accurately reflect inclusion in priority, thus curbing spam and increasing fairness.

Mysticeti Block Streaming

One of the most interesting upgrades Sui is Block Streaming. The full node will be able to directly subscribe to the consensus block, thereby accessing pending transactions with a delay of less than 200 milliseconds before the transaction is finalized. This reduces the advantages of the same-local searchers and further democratizes the acquisition of MEV opportunities.

Unlike off-chain relay, it is license-free and open. It also provides a deterministic view of transaction sorting for third-party nodes, allowing speculative execution, arbitrage, and repo logic to run in near real-time.

Time lock encryption is being planned to help Sui deal with harmful MEVs, and the MEV income distribution model is also being explored. Incentives will benefit validators, applications and users, not just searchers.

DevX Update

Sui has some DevX improvements. Move Registry eliminates address-based fragile links by supporting on-chain package naming and versioning imports, thus formalizing dependency management. Critical frameworks and libraries are being open sourced and provide registry support, enabling developers to safely write and upgrade applications. In addition, Sui also provides programmable transaction block (PTB) replay and Move tracking to provide deep debugging support, enabling developers to perform transaction execution step by step and accurately locate fault states in multi-call processes.

in conclusion

Sui had a lot of highlights last quarter. Mysticeti v2 and Pilotfish are not just regular upgrades, they will change how Sui handles transactions under load and how validators run their infrastructure. Move VM 2.0 also brings many improvements to developers building modular applications. Together, these improvements drive Sui towards a direction that can truly support high-frequency use cases without increasing coordination overhead.

In terms of ecosystems, BTCfi is clearly becoming a wedge and may be favored by institutions. Protocols such as Suilend and Aftermath are trying new primitives that are natively compatible with Sui architecture, such as object-based stablecoins, AMM lending hybrids, meta-tokens, etc. The interesting part now is watching how the expense market performs when demand surges, whether MEV tools such as soft bundling or block streaming will be adopted by searchers, and how infrastructure like Pilotfish can change validator economics in practice.

In addition, Delphi Digital noted an increase in institutional interest and Canary Capital submitted an application for the Canary SUI ETF in the first quarter. Previously, there were reports that financial institutions such as Grayscale, Franklin Templeton, VanEck, Libre and Ant Financial were also involved, and they all launched related investment products on the Sui network, from tokenized funds to exchange-traded notes (ETNs).