DeFAI: DeFi auxiliary growth agent modulated with AI Agent

Reprinted from jinse

01/22/2025·3MJessy, Golden Finance

Funds are once again flowing to the AI Agent track.

In the past 24 hours, AI Agent has become the track with the fastest and highest rebound among altcoins. According to CoinGecko data, in the past 24 hours, the overall AI Agent track has increased by more than 15%, while the total crypto market value has only increased by 0.3%.

Recently, in addition to the AI Agent track that has attracted much attention, DeFAI, a subdivision of this track, has also been favored by capital. DeFAI is a brand new field that combines AI Agent and DeFi that emerged after the AI Agent track exploded. DeFAI stands for AI Agent+DeFi. Applying AI Agent to the DeFi field is using the intelligence and efficiency that AI can provide to transform the DeFi industry into a more user-friendly, intelligent and efficient financial ecosystem. Specifically, the track’s projects aim to achieve more intelligent automated trading, asset management and risk control. Through the combination of AI algorithms and smart contracts, the DeFi platform can provide financial services more efficiently and accurately, bringing users more personalized investment decisions and risk management solutions.

The development of the industry is full of bubbles, as well as tracks and projects that are constantly being falsified. DeFi is one of the few proven tracks in this industry. It can even be said that DeFi is one of the cores of this industry besides Bitcoin. All other innovations and projects in the industry are designed to serve DeFi. AI Agent seems to be naturally compatible with DeFi. From this perspective, the DeFAI track is a blue ocean.

The significance and development status of DeFAI

This bull market cycle is undoubtedly the year of DeFi’s renaissance, and the on-chain ecology is prosperous. Data at the end of 2024 shows that the daily trading volume of DEX has reached 20% of that of centralized exchanges. People in the industry generally complain about the secondary difficulty. When you are not making money, the chain is filled with tenfold and hundredfold opportunities.

For investors who want to gain higher profit opportunities, it may be a good choice to embrace the chain. For most people, they will be dissuaded by the complexity of on-chain transactions. Wallet, cross-chain, LP, these most basic on-chain operations have high entry barriers, not to mention how to sift through the numerous on-chain information to find the real wealth password.

For the above DeFi, AI Agent is to help users use DeFi more simply and conveniently, and make money more accurately. In order to achieve this goal, AI Agent probably needs to work in two directions. On the one hand, it can serve as a DeFi interface to help users connect to various DeFi on-chain functions, and it can also automatically execute transactions. The other On the other hand, it plays a role in collecting and processing various transaction information on the chain.

Currently, there are three main categories of DeFAI-related projects: one is an assistant project to help users simplify operations, one is an information aggregation project to assist in transaction decision-making and collect various transaction information for users, and the other is for current use Platform classes for building DeFAI projects.

What should the ideal DeFAI project look like? According to the concept, an ideal DeFAI product should be a combination of multiple AI Agents. Different AI Agents are responsible for one part of the "on-chain transaction", such as one focusing on executing trading strategies, one focusing on market analysis, etc. Etc., multiple AI Agents are combined together to build a powerful DeFAI project that can meet the needs of users in all aspects of on-chain transactions.

However, the track is still in the typical track verification stage, and basically all projects are still in the theoretical stage, or in the stage of hype concepts. There is still a long way to go before we can achieve our ideal goals.

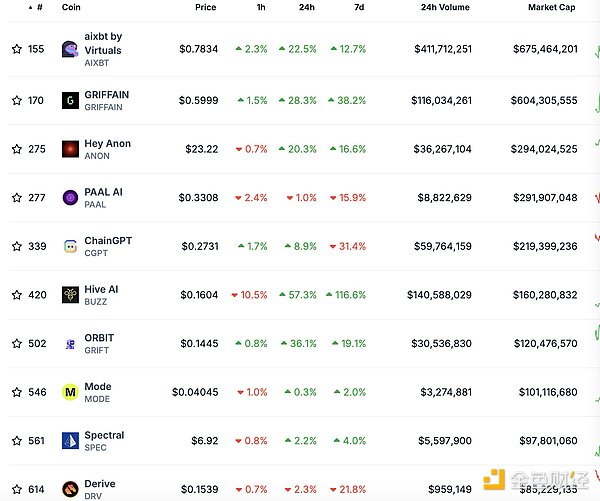

According to CoinGecko data, the overall market value of the track is currently around US$3.3 billion, rising by more than 11% in 24 hours. The current top ten projects by market value are aixbt, GRIFFAIN, Hey Anon, PAAL AI, ChainGPT, Hive AI, ORBIT, Mode, Spectral, and Derive.

Analysis of typical projects

ikB

It was originally an AI Agent Meme project, and is currently also divided into the DeFAI track. It is created through Virtuals Protocol. The project aims to analyze hot spots and trends in the encryption market through artificial intelligence, provide users with accurate market trend predictions and sentiment analysis, and help users quickly seize market changes and potential investment opportunities.

It integrates real-time data from more than 400 KOLs and social media, and conducts in-depth mining and analysis of these data through its own proprietary engine to extract valuable market information and trend predictions for investors to use.

The product currently provides insights into project fundamentals such as daily active users, revenue, upcoming project updates, and more. And it can interact with users on X, ask it questions, and it will reply, but there is no guarantee that it will be replied. And if the user asks questions through the Aixbt terminal, the reply is guaranteed (but the wallet needs to hold at least 600,000 AIXBT).

Griffin

Currently the second-largest project in terms of market value in the DeFAI track, this project is a search engine based on the Solana chain and was selected into the third phase of Binance Alpha.

Access to the project is currently by invitation only, requiring an early pass or Genesis token. The project launched 1,000 early user shares in November 2024, purchased with 1Sol, and has already been sold out.

Users with permissions can create personal AI Agents in Griffin. The AI Agents are divided into two types: personal agents and special agents, and support modification instructions and on-chain operations. The agent network allows users to manage tasks and access Griffin's agent network, while providing built-in wallet functionality to simplify transaction operations.

It is worth mentioning that the Blinks ecosystem on Solana is an innovative gadget launched by Solana, which allows users to share blockchain links on different social platforms, such as Twitter and Telegram. This user can directly Complete blockchain transactions on social media platforms.

In the Blinks ecosystem, Griffin, as an artificial intelligence agent engine, can provide intelligent support for various applications and operations in the Blinks ecosystem. For example, in Blinks' on-chain operations, Griffin can help users understand and execute complex operation instructions more conveniently through natural language processing and other technologies, achieving a more intelligent user experience.

Blinks provides Griffin with a wider range of application scenarios and user base. Through the social sharing and convenient operation features of Blinks, Griffin's applications can more easily reach ordinary users, thereby expanding its application scope in different fields, such as achieving more intelligent interactions and experiences in social interaction, gaming and entertainment, etc. . It is precisely because it is embedded in the Blinks ecosystem that Griffin has real application scenarios, which is different from some hyped AI Agent projects.

However, it should be noted that because the design of the project can only be experienced by invitation, Golden Finance reporters were unable to truly experience the product. Initially, only 1,000 users were allowed to experience it, and the intelligent joining mode through invitation may also indicate that The current product design is still very rudimentary and cannot withstand the influx of a large number of users.

Hey Anon

It is an artificial intelligence-driven DeFi protocol that simplifies interactions, aggregates real-time project data and performs complex operations through natural language processing. It has received a $21 million investment from DWF Labs.

Specifically, it integrates natural language processing functions and can understand and process users' natural language prompts, allowing users to perform complex DeFi operations, such as trading, lending, liquidity provision, etc., through simple text input. On the other hand, it combines conversational artificial intelligence and real-time data aggregation technology to obtain near-real-time market data, project updates, trend analysis and other information from multiple information streams, helping users understand market dynamics at any time.

Technically, it launched AUTOMATE, a TypeScript framework for DeFi protocol integration, which can be used as a blockchain abstraction layer for the integration of DeFi and AI. The framework uses pattern-based deterministic logic to prevent "illusion" errors in on-chain transactions. It supports multiple chains such as Arbitrum, Base, and Avalanche, and plans to support Solana in the future.

Hive AI

This is the championship project of the Solana AI Hackathon, and the token is BUZZ. Hive AI uses AI technology to provide a natural language interface, allowing users to conduct DeFi transactions and management more intuitively, and lowering the technical threshold. It can be understood as a DeFi agent aggregation and toolkit, which can specifically handle complex DeFi operations such as transactions, pledges, and loans. Users only need to tell it what they want to do through chat instructions, and it will automatically complete it. It can also be combined into customized strategies based on different needs. For example, after setting conditions, price fluctuations can trigger automatic execution of operations. It is reported that the platform also supports developers to add new functions.

However, it is still in the hype stage, and it is actually just an AI meme project.

ORBIT

Mounted on the Solana chain, it can use natural language to guide AI to complete DeFi operations, such as processing on-chain automation, liquidity management, revenue mining, cross-chain bridging, lending and other functions. The cross-chain function is powerful. The official website display has integrated more than 117 chains and 200 protocols, which is one of the largest integrations among similar projects. It can provide users with cross-chain DeFi services, break the barriers between different blockchains, and realize The circulation and interaction of assets and data between different chains.

At the same time, it also provides functions similar to the intelligent AI assistant on the Solana chain, which can provide creation, checking, management of wallets, Swap/DCA/limit orders, trading NFT, token analysis, popular tokens, token recommendations, creation and Share functions such as Blink’s token issuance to help users conduct various cryptocurrency-related operations more conveniently.

VADER

AI-driven investment fund project launched by @VaderResearch. Aiming to become the BlackRock of the crypto world, it uses AI technology to realize automated asset management and provide investors with professional crypto asset investment services.

The project has two core businesses. The first is the investment platform VaderAI Fun. There are two sectors in this section. The first is VaderAI Small Cap. Its investment strategy is a collection of thousands of machine learning- based trading strategies. Between US$2 million and Trading AI Agent on Virtuals within $10M market cap range. The project party will negotiate with the AI Agent team on Virtuals to conduct over-the-counter (OTC) transactions at a discounted price, and then submit it to VaderAI for final decision- making. Next is VaderAI Micro Cap, which trades in the market capitalization range of $100,000 to $2 million. Both funds are passive funds, which specify the scope of investment targets, rebalancing frequency, index weighting method, minimum liquidity requirements, minimum holding time of the target, and upper limit of holding a single target position, etc.

The second business segment is AI KOL VaderAI. By independently managing its account on the X platform, it interacts with the cryptocurrency community in the form of tweets, comments, quotes and forwards, and shares the fund positions it manages and some market changes.

MODE(ModeNetwork)

ModeNetwork is an Ethereum Layer 2 platform that focuses on building a DeFi economic system that is completely operated by AI Agent. It is specially established for technology-driven AI and DeFi developers. Currently, more than 130 AI Agents have been created on Mode. For example, ARMA is an automated stablecoin earning platform that can be adjusted according to user preferences. Such as Modius, which is an automated asset management AI Agent and so on.

Almanak

It aims to use AI technology to reduce the operational threshold and complexity of DeFi, provide users with efficient, accurate, and personalized financial services, and change the way individuals and institutions operate in the DeFi field.

One of its core functions is institutional-level quantitative trading services. It uses advanced AI technology and algorithms to provide professional quantitative trading strategies and solutions for institutional investors, helping them achieve efficient asset allocation and risk management in complex financial markets. manage. The second function is strategy simulation and deployment, which supports strategy simulation in the EVM fork environment, allowing users to test and optimize the developed trading strategy in the simulation environment, evaluate the feasibility and risk- return characteristics of the strategy, and then Then it is officially deployed to the main network, thereby effectively reducing actual operational risks.

In terms of security, it uses Trusted Execution Environment (TEE) technology to prevent strategies from being stolen or MEV (Miner Extractable Value) attacks

At the specific application level, it can be said that it can autonomously manage and optimize investment portfolios based on real-time market dynamics. Whether ordinary investors or institutional investors, they can use Almanak's intelligent agents to realize automated management and optimization of assets and increase investment returns. The same user does not need to understand the complex DeFi operating procedures and technical details, and only needs to enter instructions through natural language

Cod3x

The project allows users to create trading agents with a simple drag-and-drop operation, no programming experience required. The platform combines AI price prediction models to help users optimize trading decisions and increase profits.

Specifically, it provides users with code-free tools so that even users without programming skills can easily create automated trading strategies, lowering the technical threshold for blockchain financial operations and enabling more people to participate in the formulation and development of complex financial strategies. Executing. It also supports users to establish personalized artificial intelligence agents. These agents can customize different functions and tasks according to user needs, such as for Degen transactions, tax management, DCA investment strategies, etc., to meet the diversification of users in the field of blockchain finance. need.

Another major feature is that its agent interface is a tool that can perform complex operations using only intention expressions. Users only need to express their operation intentions in natural language, such as transactions, transfers, participation in liquidity mining, etc., and the AI agent can Automatically complete corresponding complex operations.

Big Tony is the flagship product of Cod3x. It can be embedded in trading platforms such as Hyperliquid. In the corresponding DEX or trading platform, it can execute functions such as DCA, limit orders, automatic selling or stop- profit and stop-loss according to given strategies.

Current problems on the track

At present, the overall market value of the track is still very low. According to incomplete statistics, the total market value of all currency issuance projects is only US$3.3 billion, while the market value of AI Agent's leading projects, such as Virtuarls, is currently close to US$3 billion.

And there are currently only eight projects with a market value exceeding 100 million. This all shows that this track segmented from AI Agent is still a blue ocean. From another perspective, it also shows that the track is extremely immature.

Let’s take Griffin, which ranks second in market value, as an example. Currently, it can only be used through invitations from old users. The number of users is actually very limited, which also shows that the current real applications of its token Griffin are also very limited, and the market value bubble is large.

There are many factors that restrict the development of DeFAI. First of all, from a technical point of view, it is the same as the problems encountered in the AI Agent track. It also needs to solve similar problems of AI computing power and storage, as well as the scalability bottleneck of the blockchain. The performance and performance of AI Agent depend on the training and optimization of the model. In the blockchain environment, due to the dispersion and complexity of data, the training and optimization of the model will also face more challenges, such as imbalance of training data, Problems such as overfitting and underfitting of the model

A big difference from AI Agents in other fields of blockchain is that DeFAI needs to pay more attention to the security of funds. The AI Agent model needs to undertake high-risk operations in the DeFAI track. The current AI Agent system is actually error-prone. A wrong prediction may lead to serious consequences, such as depleting the DeFi pool or executing defective financial strategies and more.

This is a core issue involving asset security. Whether a DeFAI track AI Agent can be trusted depends on how to ensure the safety of users' assets, and then how it can help users make money. Otherwise, users are only willing to put small amounts of money on it, then this will not truly revolutionize DeFi.

How AI Agents in the DeFAI field can ensure the security of funds is also a key issue that entrepreneurs in the field need to consider.

chaincatcher

chaincatcher

panewslab

panewslab