Data Interpretation MUBARAK is so popular: Is the BNB chain ecosystem the biggest beneficiary?

Reprinted from panewslab

03/18/2025·3MMUBARAK has just reached 150M (it has reached 200M when it was published), and many communities have special Fomo, and there are even single coins A7/A8. Many users are late for this "event-oriented" pull-up. What does this indicate? Let’s use three indicators to take you back to the previous data today and see what impact this wave of operations has on the BNB ecology.

Important timeline

- On March 13, Binance announced that it had received an investment of up to US$2 billion in the UAE sovereign fund MGX; the official tweet was posted on X, with the image of a "rich" wearing a Middle Eastern turban. CZ forwarded the tweet with the caption "Mubarak"

- On March 14, CZ then forwarded a related tweet from a member of the "0x5c...46f6" community; CZ posted on Binance Plaza saying "Go to meet a friend on the weekend."

- On March 15, Binance Alpha launched Mubarak; CZ spent 1 BNB to buy TST and mubarak the next day, and posted a message on Binance Plaza to "do some tests on weekends." This series of operations pushed Mubarak's hype to a climax

- On March 16, CZ tweeted that "consider changing a new avatar; Mubarak won the $4.4 million permanent liquidity pool support provided by Binance

The following is officially entered the analysis stage:

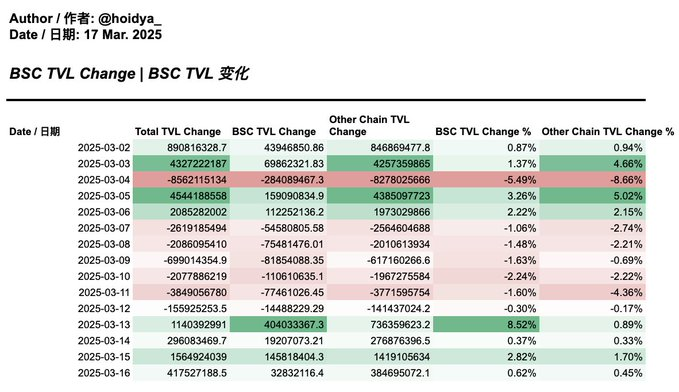

1/TVL

From the TVL perspective, BNB Chain's main liquidity flowed from March 13, which may be mainly affected by MGX investment information.

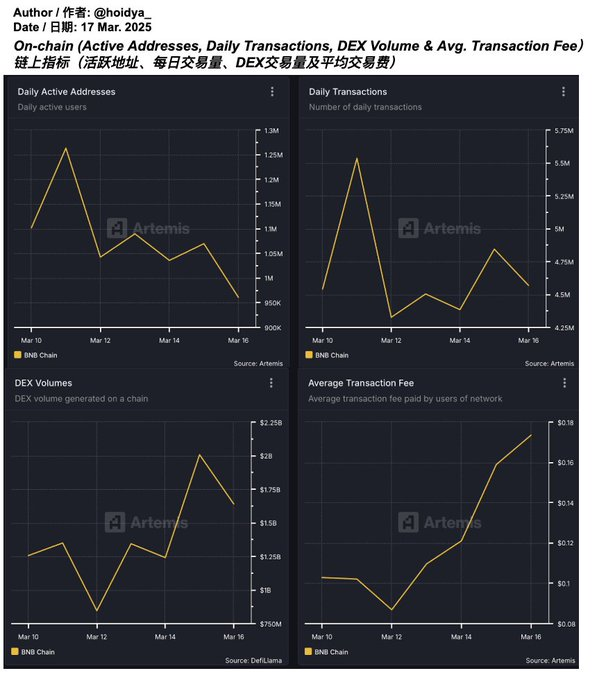

2/on-chain indicators

- Daily active address: There is no increase in users due to MGX investment information, and 500k addresses were added on the 13th and 15th respectively.

- Daily trading volume: After experiencing a plunge on the 11th, the trading volume slightly rose to 4.8 m on the 15th.

- DEX transaction volume: The transaction volume increased by ~500m & ~750m respectively on No. 13 and 15 respectively.

- Transaction fee: The transaction fee continues to climb after the 12th, from 0.1 to 0.18

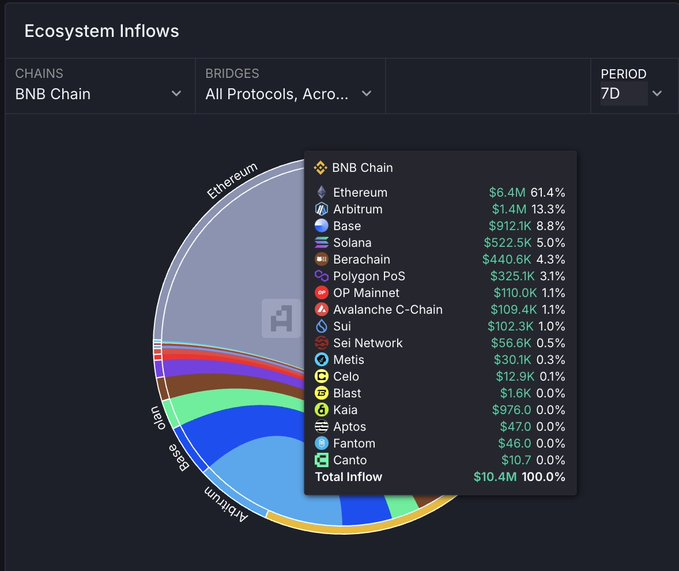

Source of cross-chain liquidity in 3/7d

In the past 7 days, liquidity mainly comes from Ethereum, accounting for 61%. Solana is only 5%.

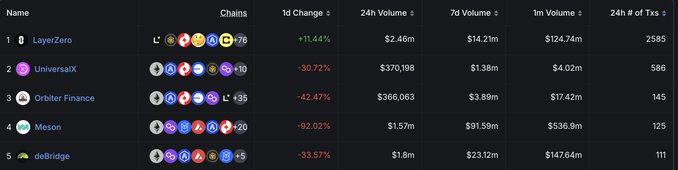

4/Cross-chain transaction volume

Cross-chain transaction volume in the past 24 hours:

- LayerZero 2585 tx Large transaction

- UniversalX 586 tx Small transactions

- Orbiter Finance 145 tx Small transactions

- Meson 125 tx Large transaction

- deBridge 111 tx large transactions

可以看得出LayerZero、 meson 、 deBridge主要解决的是大额交易。 And Orbiter Finance&UniversalX focuses on small transactions. But UniversalX's trading volume is higher than Orbiter Finance.

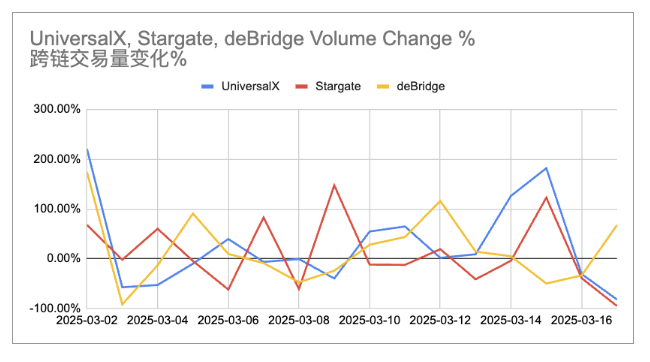

5/Cross-chain transaction volume change %

It can be seen that UniversalX obviously increased transaction volume due to the BSC Meme wave last weekend, while Stargate and deBridge have relatively low incremental changes.

6/Summary

The Fomo caused by MUBARAK's pullback has increased the BNB Chain ecosystem a lot of liquidity. DEX trading volume and average trading fees have also hit a new high in a week. However, the core user group did not surge, and even showed a downward trend 7 days ago. This may mean that on-chain DEX ecological transactions have become more active, but this still has not allowed BSC to gain more users.

From the perspective of liquidity sources, the main source is the EVM ecosystem, and there is not much liquidity from Solana, which may also explain why BSC has no incremental users - the liquidity of a large number of meme users is still in Solana.

From the perspective of cross-chain sources, this kind of "event-oriented" outbreak opportunity may not be able to efficiently solve the need for instant currency buying by just mainstream cross-chain bridges, so it is not surprising that users use cross-chain bridge + aggregation trading platforms like UniversalX. In fact, the transaction volume increment is indeed higher than other cross-chain bridges that do not have "coin buying application scenarios".

The data should be updated in a few days to verify my ideas. The main reason is that I think there will be other event opportunities in BSC.