dappOS launches intentEX, an intent exchange, to create a CEX-level trading experience

Reprinted from panewslab

12/19/2024·6M

introduction

dappOS is committed to building a complete Web3 intent layer to help users simplify operations and gain institutional-level execution efficiency. The three core elements of the Web3 intent layer are: operations, assets, and transactions. Previously, dappOS has launched the intent operating system (intentOS) and intent assets (Intent Asset), realizing the intent of operations and assets. Based on the accumulation of these product technologies, dappOS has now launched the intent exchange IntentEX to further help users achieve transaction intent and improve the key components of the dappOS intent layer ecosystem.

The core advantage of intentEX is that it allows ordinary users to directly enjoy institutional-level liquidity resources, with faster transaction execution speed, lower fees, and an experience close to CEX level.

1. Background

The current market is in the midst of an upsurge of new assets and MEME, and users have strong demand for on-chain transactions. However, many existing on-chain exchanges struggle to provide users with sufficient liquidity, have slow execution speeds, and have high handling fees. These problems seriously affect the user experience. The core reason for these problems is that the trading liquidity of an asset is often dispersed across various exchanges, and users cannot enjoy the liquidity of the entire market for that asset in one exchange.

The emergence of intentEX , the dappOS intent exchange, solves these problems of liquidity, transaction costs, and transaction efficiency, and truly helps users realize transaction intentions.

2. The principle of intentEX

The core design innovation of intentEX is based on the traditional order book exchange. It additionally entrusts the user's limit order as an intent task to the nodes in the dappOS intent execution network for execution, and allows the nodes to execute at any time. Complete the transaction on the chain. This design not only gives full play to the trading liquidity advantages of professional institutions, allowing the tokens in intentEX to have substantially better liquidity than all CEX and DEX, but also gives users faster transaction speeds and lower execution Handling fee.

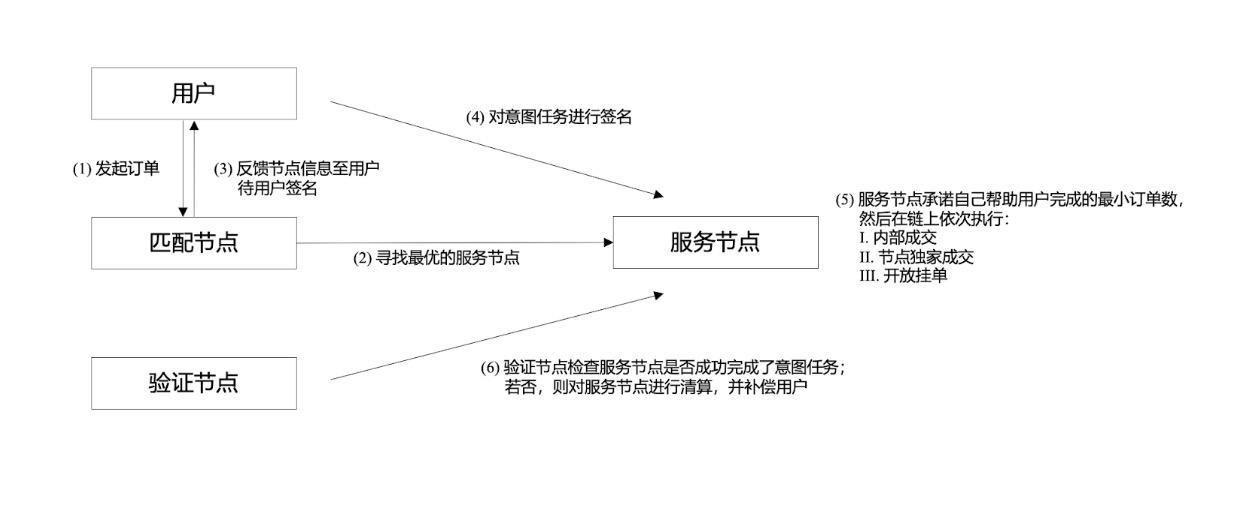

2.1 Publish intent tasks

When a user places a limit order on intentEX, it is equivalent to publishing an intent task in the dappOS intent execution network. The matching nodes in the network will match the intent task to the service node with the strongest comprehensive competitiveness. When selecting a service node, the matching node will comprehensively consider various factors, such as the node's margin, execution cost, execution speed, how many orders the node is willing to accept at a certain price per deviation from the market opening, etc.

After the user completes the signature, the service node that confirms receiving the intent task will, according to its own situation, promise an order amount that it guarantees the user can successfully complete. Since dappOS intends to enforce the OMS mechanism constraints of the network, once the service node completes the signature and confirms the exclusive transaction amount, if the node is not fulfilled in the end, it will be liquidated. Therefore, usually at this stage, users can consider that the order part promised by the service node has been completed. No need to wait for final on-chain confirmation. When the user's quotation is near the market price, since the service node will tend to promise to complete all orders, the speed of user order completion can be higher than the block speed of the public chain itself.

2.2 On-chain order processing

After completing the commitment, the service node will complete the order processing on the chain in the following three steps under system constraints:

-

Internal Fill: If there is a matching pending order in the intentEX order book, the system will directly match the transaction. Some orders that cannot be completed at this stage will enter the next stage.

-

Node Exclusive Fill: For the remaining orders, this service node will have the exclusive right to fill them within a certain period of time. If the order quantity promised by the service node to the user is not completed during the internal transaction stage, the service node needs to complete the transaction on its own, otherwise it will face the liquidation of the dappOS network. The service node can also process more orders than promised during this stage.

-

Open Order: The remaining orders will be listed on intentEX for other users to trade.

If the execution speed of a service node is too slow, or the number of orders promised to help users close is small, its competitiveness weight in the matching node will be reduced, making it difficult to receive more orders. This mechanism is conducive to the fact that service nodes tend to promise to help users complete more orders and complete transactions faster.

2.3 A specific case

In order to facilitate readers' understanding, here is a specific scenario as an example - Assume that the current selling price of $A token in intentEX has a total selling price of 990U, and the price is 9.9U; the total selling price of $A token is 9.9U; the total selling price of $A token is 1010U, and the price is 10.1U .

At this time, the user initiates 300 10U limit purchase orders, then this purchase order will be published to the dappOS intent execution network as an intent task, and the matching nodes in the network will assign this task to the current optimal service node.

Assuming that a service node successfully competes for this intent task, it needs to commit to a minimum number of orders that it can help users complete (for example, 250 $A buy orders). The specific amount of this commitment is generally related to the node's strategy and the current handicap depth of $A tokens in all other trading markets. For example, if this node is willing to promise to help users trade at least 250 buy orders, it may be because: the intentEX handicap is currently itself There are 100 sell orders that can be executed immediately; and after observing all other DEX and CEX, it found 150 $A tokens whose cost is less than 10U after including relevant handling fees.

From the user's perspective, 250 of its 300 limit buy orders have been completed when the service node submits its commitment to the network. This transaction speed is faster than the block production speed of the public chain itself. In this example, the handicap depth of $A is not large, but in more cases, when the handicap depth is sufficient, the node will promise to help the user close all orders near the handicap, so that the user can find himself All orders can be filled immediately.

Next, the service node will execute the transaction according to the following process:

- Internal Fill

100 of the user's 300 10U limit buy orders will be matched with 100 9.9U sell orders in intentEX's existing market, and will be directly executed at a price of 9.9U.

- Node Exclusive Fill

Since the node has made a commitment to help users trade at least 250 orders, at this stage it needs to help users trade at least the remaining 150 orders, otherwise it will face liquidation.

Herein lies the advantage of intentEX: Rather than letting users’ remaining unexecuted orders hang on the market and wait for other market makers to carry out arbitrage, the professional service nodes in the intent execution network directly assume this role. On the one hand, this allows users to essentially have the liquidity of $A tokens in the entire market, and on the other hand, it also allows users to have faster transaction speeds for their orders.

3. Open Order

If the matched service node is unwilling to complete the transaction for the last 50 10U limit buy orders, they will appear in the buy order of intentEX's $A token.

Generally speaking, this situation will only occur when the user's pending order price is far from the market price, or the liquidity of the relevant tokens in all trading markets is relatively insufficient.

3. Core advantages of intentEX

1. Institutional-level market-wide liquidity

dappOS's professional service nodes can observe and match user orders in real time in CEX and DEX across the market. Therefore, token transactions within intentEX have market-level liquidity.

Compared with pure on-chain inquiry designs such as routers, intentEX combines high-quality liquidity on and off the chain, bringing institutional-level liquidity capture capabilities. In this way, each user's order can quickly access the optimal price source, achieve higher transaction rates and faster transaction execution, and enjoy the liquidity of the entire market.

Compared with the design of other intent architectures, dappOS's unique OMS mechanism allows nodes to accept tasks without consuming capital costs (as long as the intent tasks can be completed, the funds can be used simultaneously by multiple businesses, and there is no need to specifically pledge funds like acting as an LP) As well as dealing with the cost of order grabbing, this reduces the overall operating cost of the node and makes the entire system more efficient.

2. Fast execution

intentEX utilizes the liquidity of its entire platform to provide users with faster transaction speeds than conventional on-chain transactions through rapid matching of market prices. The execution efficiency of intentEX benefits from the professional service nodes of the dappOS intent execution network. Under normal circumstances, signature confirmation can be completed within 500 milliseconds from the completion of the user's signature, which is even higher than the speed of public chain block generation. This significantly reduces transaction wait times, allowing users to complete transactions faster.

Compared with other intentional architecture designs, this transaction speed and smooth experience are superior to those of public chains, bringing users a convenient experience closer to centralized exchanges.

3. Low transaction fees

intentEX relies on dappOS's professional service node network to greatly optimize transaction fees, with costs as low as 0.1%, which is far lower than the rates of most on-chain exchanges. This makes intentEX a more economical choice for users to trade on the chain.

4. Decentralization and transparency

All intentEX transactions are publicly recorded on the chain, ensuring the transparency and credibility of the system. The decentralized mechanism in the dappOS intent execution network ensures reliable execution of orders. Even if a service node fails, other nodes can seamlessly connect and continue to ensure successful transactions. Through this decentralized structure, intentEX provides users with a more stable trading experience that does not rely on the stability of a single point server.

4. intentEX and dappOS ecosystem

Intention exchange intentEX is an important part of the dappOS ecosystem. It is a product launched by dappOS to help users achieve transaction intent after realizing operation intention and asset intention.

The detailed implementation of intentEX based on the dappOS intent execution network has been explained in detail in the previous article. For the detailed principles of the dappOS intent execution network, please refer to: https://dappos.gitbook.io/docs/dappos/how-dappos-works

In addition, the USDT, BTC, and ETH used in exchanges in intentEX are actually the intended assets of dappOS, namely intentUSD, intentBTC, and intentETH. In this way, users can enjoy interest income even when they hold these mainstream assets without trading, and it does not affect users' immediate use of these mainstream assets for transactions. For the detailed principles of dappOS intent assets, please refer to:https://dappos.gitbook.io/docs/dappos/intent-task-frameworks/intent-assets

chaincatcher

chaincatcher