Daily | Binance Alpha launches BMT; Solana's online transaction fee hits a 6-month low, and its activity drops by 85% compared with the TRUMP issuance period

Reprinted from chaincatcher

03/11/2025·2MCompiled by: Jerry, ChainCatcher

Important information:

- El Salvador signs cryptocurrency regulation agreement with Paraguay

- Trump may sign cryptocurrency-related executive orders this week to repeal bank restrictions on cryptocurrency companies

- Solana's online transaction fee hits a 6-month low, with activity dropping 85% from TRUMP issuance period

- Arthur Hayes: Don't rush to buy at the bottom, wait until the Fed "releases" before adding positions

- Crypto market evaporated by $1.3 trillion in three months, hitting its biggest quarterly decline

- Upbit will launch ARKM Korean won trading pair

- The first inflation report during Trump's term is about to be released, and slowing inflation may boost crypto markets

- Binance Alpha launches BMT

- Zhao Changpeng: Prepare to test and invest in one of three BNB/BSC-based payment projects

“What important events have happened in the past 24 hours”

El Salvador signs cryptocurrency regulation agreement with Paraguay

Paraguay's Secretariat for Asset Money Laundering Prevention (SEPRELAD) and El Salvador's National Digital Assets Commission (CNAD) signed a memorandum of understanding last Friday. This is the second such agreement signed in nearly three months after El Salvador reached a similar regulatory cooperation with the Argentina National Securities Commission (CNV) in December.

According to SEPRELAD's statement, the two sides will jointly crack down on unlicensed cryptocurrencies and strengthen anti-money laundering measures.

Sources revealed that Trump plans to sign an executive order as early as this week to overturn the Biden administration's policy to restrict crypto-business banking services, especially "Operation Chokepoint 2.0". Sources said the order may involve the Federal Reserve's "main account" policy, relaxing access to crypto banks. However, as an independent institution, the Federal Reserve's policies are usually not directly affected by the White House.

In addition, the executive order may cover stablecoin regulation, which makes it clear that stablecoins should not be considered as securities. Senior White House officials plan to meet Thursday to assess potential legal obstacles to the executive order before submitting it to President Trump for a signature.

The total transaction fees generated by Solana network last week were only 53,800 SOL, the lowest weekly figure since September 2024.

Data shows that the total transaction fees in the past week fell 10% from the previous week, an improvement over the average weekly decline of 25% in the past six weeks. It is worth noting that Solana's weekly transaction fees have fallen 85% from its all-time high of 361,000 SOL in the fourth week of January (during the $TRUMP and $MELANIA meme coin issuance).

Jito validator tips have also dropped sharply since the release of $TRUMP, averaged just $11,300 last Sunday, compared to $62,000 on Sunday during the release of $TRUMP. Similarly, the 7-day moving average of the number of active addresses on the Solana network also fell by 35% during this period. The decline in these fundamental indicators has affected the SOL token price, down about 50% since January 20.

As Solana's main revenue and token generation platform, Pump.fun has also experienced a similar decline. Last week, on average, only 0.89% of Pump.fun created tokens "graduate" to Raydium, compared with 1.6% per day in the third week of January. This 0.71% drop is relatively significant given the hundreds of thousands of tokens created by Pump.fun every day.

BitMEX co-founder Arthur Hayes posted a statement, "The plan is as follows: Be patient and don't worry. Bitcoin may bottom out around $70,000, pulling back 36% from an all-time high of $110,000, which is very normal in a bull market. Then, we need the U.S. stocks to plummet freely, and then the big players in traditional finance go bankrupt.

Then, the Federal Reserve and central banks of various countries began to let the market go, and then it was time to all in. Traders will try to buy at the bottom. If you are a risk-averse player, you can wait until major central banks start to release money before increasing their positions. You may not be able to accurately buy to the bottom, but you don’t have to suffer from the long consolidation period and potential floating losses. ”

Crypto market evaporated by $1.3 trillion in three months, hitting its biggest quarterly decline

According to The Kobeissi Letter, since hitting a record high on December 16, 2024, the cryptocurrency market has evaporated its market value of US$1.3 trillion, a drop of 33%, equivalent to an average daily loss of US$15.5 billion for 84 consecutive days.

The Kobeissi Letter noted that this marks the largest three-month market cap pullback in cryptocurrency history, with the current total crypto market value falling to its lowest level since November 6, 2024.

Upbit will launch ARKM Korean won trading pair

According to official news, Upbit will launch Arkham (ARKM) in the Korean won market at 16:00 on March 11 (Korea time).

The Bureau of Labor Statistics will release its Consumer Price Index (CPI) report on Wednesday, which will be the first inflation report during Trump's presidency. If inflation shows signs of cooling, it could increase the likelihood of the Fed's interest rate cut and boost confidence among risk-asset investors that have suffered hard-hit recently.

The market predicts that the overall inflation rate (CPI) will drop from 3% to 2.9%, while the core inflation rate is expected to drop from 3.3% to 3.2% after excluding large volatility factors such as food and energy.

A slowdown in inflation often increases the likelihood of interest rate cuts, thereby increasing investors' interest in risky assets such as stocks and cryptocurrencies. CPI has been rising continuously in the past four months. Recently, the S&P 500 index (S&P 500) has fallen nearly 10% from its all-time highs, while Bitcoin (BTC) has fallen about 30% from its highs to about $80,000.

Both Trump and Treasury Secretary Scott Bessent stressed the need to lower the 10-year Treasury yield to push for a lower federal funds rate. At present, the strategy seems to have begun to show results.

Binance Alpha launches BMT.

According to Web3 asset data platform RootData, Bubblemaps aims to replace traditional block browsers with cutting-edge visual effects, allowing users to easily analyze complex patterns and connections, bringing basic data to millions of DeFi users.

Zhao Changpeng: Prepare to test and invest in one of three BNB/BSC-based payment projects

YZi Labs says on X platform that if developers are building a minimal viable product (MVP) that uses Binance Smart Chain (BSC) as the main payment option,

Zhao Changpeng said that there are already three, and one will be selected for testing and investment.

“What are some great articles worth reading in the past 24 hours”

What kind of potential does this project with big shots hide?

Finally, Shenyu looks forward to the combination of AI and Crypto, believing that in the future, AI Agent may play an important role in blockchain networks and promote industry innovation.

Is the crypto market really turning bearish? What is the opinion of institutions and traders.

TON Ebb and flow: A folding narrative of VC, trading platform and traffic carnival

When the TON ecosystem started, the author bought 32 TONs and hoped to fully experience the rise of telegram through these 32 TONs, becoming a super app like web3 WeChat, so that the wallet balance of TON network will continue to appreciate like gold.

What exactly is driving the market value of stablecoins to rise against the market?

Meme Popular List

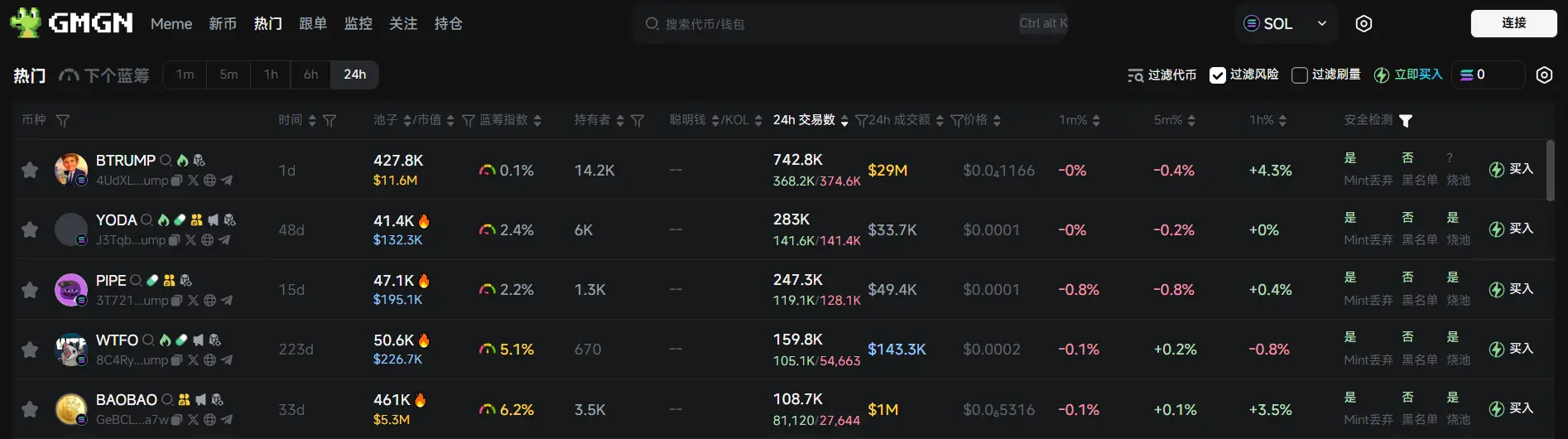

According to the market data of Meme token tracking and analysis platform GMGN , as of March 11, 19:50:

The top five popular Ethereum tokens in the past 24 hours are: COCORO, SPX, RAD, LINK, UNO

The top five popular tokens in the past 24h Solana are: B TRUMP, YODA, PIPE, WTFO, BAOBAO

The top five popular tokens in the past 24h Base are: SKITTEN , VIRTUAL, USDT, EURC, DRB

panewslab

panewslab