CZ tests the MEME perpetual contract on-chain derivatives track ushering in spring breeze?

Reprinted from jinse

03/24/2025·1MAuthor: Spirit, Golden Finance

Preface

On-chain perpetual contracts, as an important part of the decentralized finance (DeFi) ecosystem, allow traders to invest in the price of the underlying asset without maturity. This type of contract not only provides traders with high leverage and hedging opportunities, but also gradually becomes the focus of market attention. In 2025, with the leadership of leading projects such as Hyperiquid, dYdX, GMX, Drift and SynFutures, the on-chain perpetual contract market has shown an explosive growth trend. CZ tested the Mubarak perpetual contract on the APX Finance platform, which once again sparked heated discussions in the market and provided us with a new perspective to observe the changes in the entire track and industry.

Perpetual contract market status and data performance (CEX)

The perpetual contract market is driven by the transformation of CEX's currency listing strategy, and trading volume and position value are showing a strong growth trend. This has opened up market space for the on-chain perpetual contract market and provided early education for users. Data shows:

-

After VINE launched Binance Futures in January 2025, its 24-hour trading volume exceeded US$1.6 billion.

-

Coinbase Internationala's report shows that the transaction volume of Turbo and GOAT two AI meme coins accounted for 60%, indicating a strong market demand for high volatility products.

-

In terms of leverage, the MEXC platform provides up to 200 times leverage, while Binance Futures supports 125 times leverage, fully meeting the market's demand for extremely high-risk and high-return products.

-

Risks follow: For example, GOAT coins once plummeted 50% in one day, highlighting the risk of liquidation under high leverage.

Data shows that against the backdrop of active adjustment of CEX's currency listing strategy and increasingly diversified user needs, the on-chain perpetual contract track is ushering in a new development window.

CZ Test Mubarak Perpetual Contract

On March 24, 2025, CZ opened a position with 0.04 BNB on the APX Finance platform and tested the Mubarak perpetual contract with 24.7 times leverage, mainly focusing on the MEV (miners can extract value). During the test period, APX tokens rose 26%, while Mubarak tokens rose 5.5%. This operation has attracted widespread attention from the market:

-

This test of CZ not only demonstrates the application potential of perpetual contracts in the meme currency field, but also sends a signal to the market: in a highly volatile market, innovative perpetual contract design is expected to become a new trading tool.

-

The market 's positive reaction to this test reflects investors' demand and concern for on-chain perpetual contract tools, especially on meme coins, as meme tokens usually begin to explode during the on-chain trading stage.

APX Finance Overview

APX Finance is a decentralized exchange that provides on-chain perpetual contracts. The V2 version supports meme coins such as Mubarak. The CZ test brings market attention to it.

Product mechanism:

-

V1: Order book model, off-chain matching + on-chain settlement, supports 100 times leverage, cost Maker 0.02% and Taker 0.07%.

-

V2: Perpetual contracts on the whole chain, AP pool provides liquidity, supports 250 times leverage (classic mode), Degen mode 1001 times, no slippage. Dual oracles (Binance Oracle and Chainink) ensure accurate prices. .

-

AP Pool: The initial price is USD 1, the user earns Fee APY, and the value is affected by the transaction.

-

DEX engine: allows third parties to build DEX based on technical frameworks, and the transaction fee income is divided into 10% to APX DAO, 40% to AP pool, and partners can obtain 10%-30% monthly income.

On-chain perpetual contract track analysis

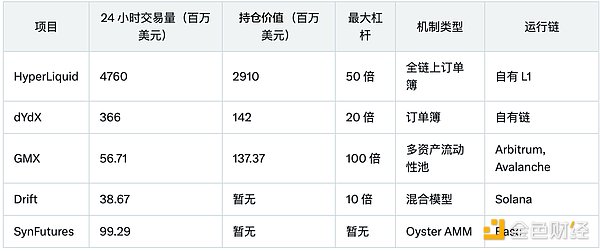

At present, the on-chain perpetual contract track is led by many leading projects, each project has its own focus.

-

Hyperiquid: With the high throughput of full-chain order book, zero Gas fees and own 1 chain (initial launch stage), Hyperiquid achieved a trading volume of US$4.6 billion and a holding value of US$2.91 billion in 24 hours, showing the support advantages of institutional infrastructure for large transactions.

-

dYdX: As a pioneer of perpetual contracts, its order book model and its own chain based on Cosmos SDK provide professional traders with a stable trading experience, with a 24-hour trading volume of US$366 million.

-

GMX: Relying on multi-asset liquidity pool and high leverage mechanism, it runs on Arbitrum and Avaanche. Although the trading volume is low, it attracts some high-risk investors with up to 100 times of leverage.

-

Drift and SynFutures: Use hybrid models and full-chain order matching engines on Soana and Base respectively to provide diversified services for different market positioning.

Overall, the on-chain perpetual contract track is in a stage of rapid development. Each project meets the market's demand for high leverage, low fees, and transparent and efficient transactions through different mechanisms and technical advantages.

Track Outlook

The on-chain perpetual contract market is expected to continue to grow rapidly, mainly driven by the following factors:

Improvement of blockchain scalability: With the continuous optimization of infrastructure, such as enhanced cross-chain interoperability and upgrade of oracle technology, the execution efficiency and stability of on-chain perpetual contracts will be further improved.

-

User experience optimization: Lower transaction fees, higher transaction speeds and continuously improved trading interface will attract more professional and retail investors to participate.

-

Improvement of regulatory environment: Although regulatory risks still exist, market participants and project parties are actively seeking communication with regulators, striving to achieve innovation within the compliance framework, which is expected to bring a stable growth environment to the industry in the long run.

At the same time, investors need to pay attention to market risks, especially potential liquidation risks in high-leverage trading and high volatility environments. Investors should implement effective risk management strategies and pay attention to macroeconomic volatility and changes in regulatory policies.

summary

CZ's testing has attracted new attention to the on-chain perpetual contract track and further confirmed the market's demand for innovative trading tools. As leading projects such as Hyperiquid, dYdX, GMX, Drift and SynFutures continue to promote technological progress, the on-chain perpetual contract market will usher in broader development prospects. In the future, the crypto asset field will continue to use DeFi innovation and high-leverage trading tools to build a more efficient, transparent and secure financial ecosystem, providing global traders with a wider range of trading opportunities while continuing to evolve in challenges.

panewslab

panewslab

chaincatcher

chaincatcher