Culfur market conclusion: Practice whether berachain can be the end of DEFI

Reprinted from panewslab

02/05/2025·3MAuthor: Andy ; Eureka Partners

Tl; DR

- What is the end of Defi, and why are some projects heading to a dead end?

The ending essence of Defi is the beginning of the next Defi. The ending of most projects towards a dead end is only in line with the natural life cycle of the plate, achieving their respective main factors of collapse, and other projects undertake their liquidity. From a high-dimensional perspective, the entire Web3 industry is still "permanent", which shows that the relationship between disks and disks built by the Web3 ecosystem is in line with a healthy ecosystem. By observing various ecology, projects, and protocols with this logic, we can find that their life cycle will become shorter and shorter as the dimension is lower, which is a reasonable phenomenon. Therefore, the "turnover rate" of the plate represents the health of the project, and the "turnover rate" of the project represents the health of the ecosystem. Next time, don't say "no one picks up", you should look at the inverted cards of each project more carefully, and abstract the business logic of the business abstract, and will not be bluffed by those seemingly tall concepts.

- Can Berachain achieve "never end"?

Berachain's main collapse point is: BGT pledge income <BGT's profit to Bera. This also defaults that the ecology on the chain can no longer support more foam, which also means that as long as there is no systemic risk, BERACHAIN's native assets (BGT, BERA, Honey) all have ecological corpses. But from the actual situation, this matter will be more complicated, because not all participants have sufficiently clear global information, and make absolute rational judgments. Some project parties may buy BGT for voting to obtain BGT release income to obtain potential liquidity, so this crash should be modified: under the rational market, the project party 's bribery revenue <purchase liquidity cost (bribe selection, directly buy BGT) / BGT pledge income <BGT is exchanged into Bera's income.

- Defi Liquidity Game: Has Berachain essentially changed anything?

Is Berachain an essentially breaking through the liquidity market? The answer is obvious, nothing, just part of the improvement. But BERACHAIN chose the right application scenario -public chain. If we just pay attention to the mechanism, we will misjudge this potential only at the level of the agreement, but the actual BGT bribery reward can be the ecological other projects. Revitalization can even be regarded as a big narrative of the same level as Restaking.

- What is happening with Berachain and what is the best way for users to participate?

The author observed 103 projects and summarized the following characteristics of Berachain:

- The original project is strong, and the GTM strategy is different: most of the projects deployed in BERA are not multi -chain compatibility, but natively in Berachain. The proportion of native projects to non -native projects is about 10: 1 (Note: It is not ruled out that certain products are certain products Born in the same team). Contrary to intuition, not all non -NFT native project parties tend to start NFT as cold starts, most of which are still halal.

- Economic flywheels are mixed, and they will never leave their roots: most of the projects deployed in Berachain realize economic flywheels through Infrared, and at the same time, projects further build multi-layer VE (3, 3) based on the original BEX, such as Berodrome. However, the core ideas remain unchanged. Any incentive is the monetary. Therefore, the user only needs to clarify the fundamental aspect of the project party behind the token. The flywheel between projects should be coupled, but it does not mean that the flywheel effect of the project will collapse due to the collapse of a single project. As long as the ceased tokens can be exchanged for excess returns, the user is willing to continue to protect the market and allow others to The project fills the gap in the flywheel.

- Most high-financing projects issue NFT: 7 of the top 10 financing projects are Community/NFT/Gamefi, and all issue NFTs.

- The community is hot, but it is hot for each other to divert traffic: the average number of viewers of the native Berachain ecological project is 1,000-2,000+, and some project parties are underestimated in the number of readers (number of followers/number of readings of draws < ecological average). For example, Infrared has 7,000+ followers, and the average number of post viewers is 10,000+; many native ecological projects will cooperate with each other, and the cooperation forms are relatively diverse, such as participating in economic flywheels, ceding tokens, etc.

- Projects are still innovating, but they are not subversive narratives: In the NFT track, some project parties choose to use BD capabilities in exchange for user attention rather than just brag about the effectiveness, such as HoneyComb and Booga Beras. In the Defi track, some project parties continue to study liquidity solutions, such as Aori, and some project parties try to optimize past VE(3,3) models, such as Beradrome. In the Social track, some project parties tried to review the quality of ecological projects through Peer to Peer, such as Standard & PAWS. In the Launchpad track, some project parties try to implement Fair Launch in the form of token equity cutting and LP allocation, such as Ramen and Honeypot. In the Ponzi/Meme track, some projects tried to achieve a "sustainable economy" by Floor price pool, such as Goldilocks.

- Where should Berachain 's explosion point be? What ecosystem is potential stocks?

The author believes that LSDFI and Tuco assets are the explosion points of Berachain. The former builds more diverse economic flywheels, creating a larger economic bubble & seat belt for Berachain. The latter splits more liquidity for the project party and gains more users by participating in the ecological flywheel.

Foreword

After experiencing Berachain's products some time ago, I communicated with a few friends about product experience and project development judgments. Here are a few core points I heard:

- Strictly speaking, the Berachain POL mechanism is not innovative, and it will also raise the threshold for user participation, but will not affect the early user Fomo sentiment.

- The rise and fall of Berachain is reflected in single currency, not the "three currency model".

- Berachain's NFT is the shovel, not the currency.

- Berachain is the end of Defi.

The views of the first three are not painful, but the fourth point I reserved, and I hope to leave more imagination space for Defi, not to be bound by an ecological prosperous Tang Dynasty. The author does not want to be groundless, so he wrote this article and left it to the readers to decide.

What is the end of Defi, and why are some projects heading to a dead end?

First of all, we need to reach a consensus on the nature of Defi, that is, Defi is a plate - a plate that repeats itself over and over again. If the plate is only roughly understood as "new money is covered with old money", some of the hubs that Defi has really started will be ignored. The author believes that the understanding of the plate @thecryptoskanda 's three-plate theory has good reference value.

https://x.com/thecryptoskanda/status/1702031541302706539

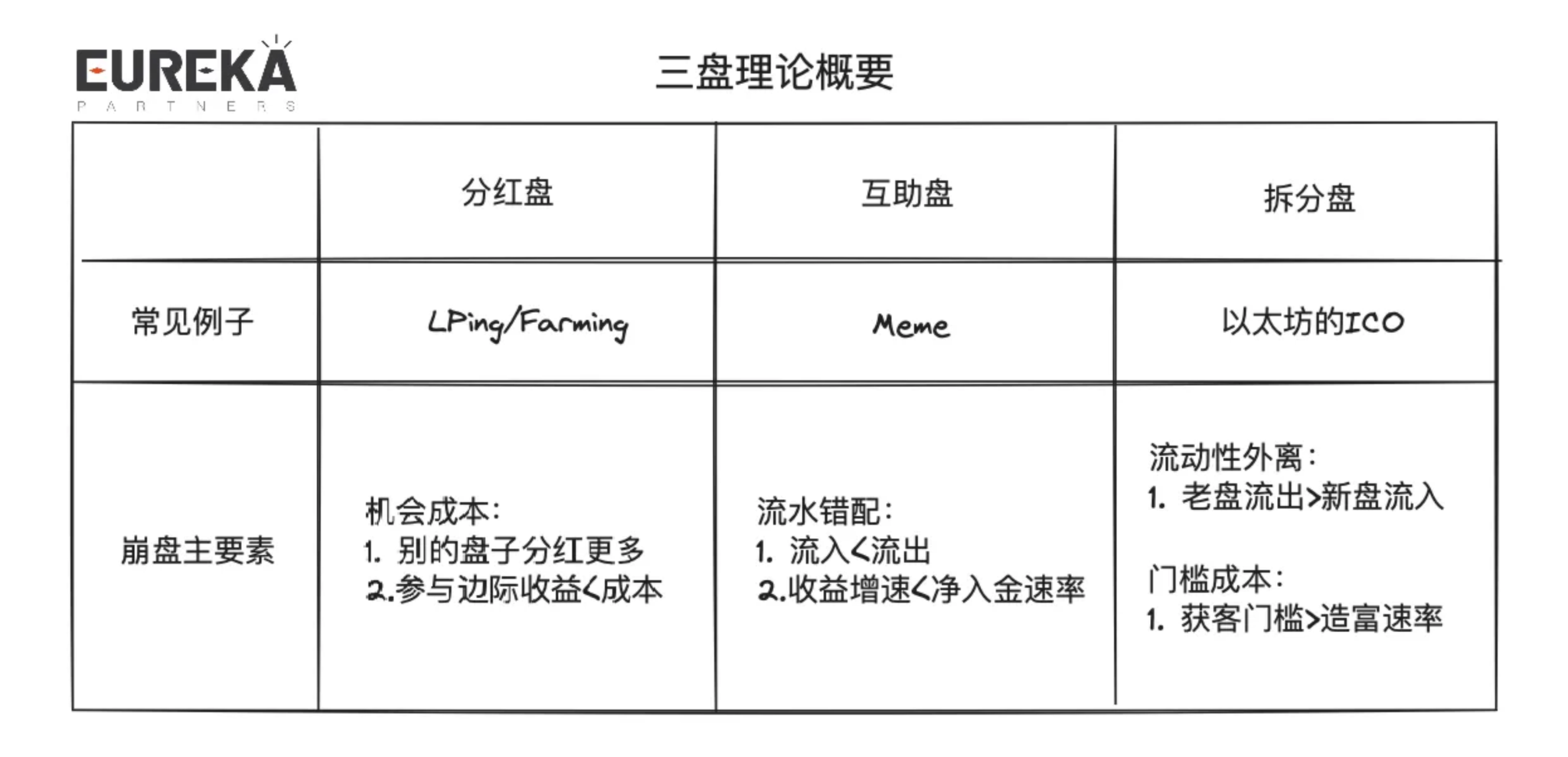

The three plates refer to:

- Dividend plate: Get interest after depositing, such as Bitcoin mining, Ethereum POS, and LP income.

- Mutual aid disk: P2P model, the focus is on flow mismatch, such as meme.

- Split plate: By splitting principal chips, reduce entry costs and double market value, such as Ethereum ICO.

The following are the main factors of the collapse of different plates:

The life cycle of an ordinary plate is inevitably a death spiral and does not take over, but the life cycle of a good plate is repeated, and may be combined and serialized by different plates, like an Ouroboros. Therefore, understanding a project should be a "modular" understanding and disassembled according to the category of the plate. Otherwise, after the narrative period Fomo ends, the future trend of the project may be misunderstood.

The so-called one produces two, two produces three, and three produces all things. The three -set theory is not limited to the "three sets", but the coupling relationship between the plate and the plate truly achieves endless life.

The author briefly explains what cases will be found in different combination disks:

- Dividend first - Dividend later: LRT. The user's ETH will be pledged to POS (get the first layer dividend income), and then authorized to AVS (get the second layer dividend income).

- Dividends first-and then mutual assistance: point-to-pool lending agreement. Users first pledge tokens to obtain initial collateral income, and then other Borrowers lend out collateral to increase the user's collateral income.

- Dividends first - then split: ICO on the POS chain. Participate in the P2P network with native tokens, receive block rewards, and deploy non-native/copy token contracts on the network to capture the liquidity of other users.

- Mutual assistance first - then dividends: OHM/Reserve Currency. The OHM theory is anchored at $1, and after purchasing at a premium, the remaining pledgers can obtain more dividend benefits.

- Mutual assistance first-and then mutual assistance: mixed lending. Borrowers can prioritize point-to-point Lenders, such as insufficient liquidity and then match point-to-pool Lenders.

- Mutual assistance first-and then split: Runestone. Users first hype Runestone, and then Runestone holders can get airdrops for each project.

- Split first - then dividends: non-native interest-generating assets on the chain. Non-native assets are generated from ICOs and dividends are paid in other tokens/native tokens.

- Split first - then mutual assistance: frend.tech. Users can set up new targets with low thresholds, and then they will still meet the requirements of new money to cover old money.

- Split first - then split: Bong Bears. Bong Bears is an NFT that continues to regenerate multiple rounds. Bong Bears is born Bond Bears, Boon Bears is born Boo Bears… and then Baby Bears and Band Bears.

It can be clearly seen that the above combinations and judgments for different plates are actually relatively subjective. From the actual situation, the possible combinations of plates that a project may contain are not limited to 1-2 types, but may be as many as 4-5 types. But is it certainly better if there is too much? This is related to the allocation resources of a project, or to be straightforward - trading ability. The allocable resources also determine how the relationship between disks can be handled, that is, parallel or serial (referring to the concept of computer thread processing here).

Parallel: The relationship between different disks in a project's business is not conflicting, and multiple logics can be implemented separately. For example, there are no necessary business coupling between the protocols in which the public chain ecosystem is flourishing.

Serial: There may be conflicts between different disks in a project's business, and the business logic needs to be sequenced. For example, the LRT protocol logic is used in serial processing, and the user's ETH will be pledged to POS first, and then authorized to AVS to obtain two layers of profits.

After understanding the essence of DEFI, let's return to the question: What is the end of Defi, and why do some projects go to dead end?

The end of DEFI is the beginning of the next Defi. The ending of most projects towards a dead end is only in line with the natural life cycle of the plate, achieving their respective main factors of collapse, and other projects undertake their liquidity. From the perspective of high -dimensional perspective, the entire Web3 industry is still "enduring", which shows that the relationship between the disk and disk built by the web3 ecology conforms to a healthy ecology. By observing various ecology, projects, and protocols with this logic, we can find that their life cycle will become shorter and shorter as the dimension is lower, which is a reasonable phenomenon. Therefore, the "replacement rate" of the plate represents the health of the project, and the project's "change rate" represents the health of the ecology. Next time, don’t say “no one takes over” hastily. You should take a closer look at every project’s reverse card, and abstractly decouple business logic, and no longer be fooled by those seemingly high-end concepts.

Does this mean that Meme is the healthiest? After all, the starting cost is low and the project turnover rate is also high. From this understanding, technological breakthroughs are not important. As long as someone recognizes this narrative, they can continue. Is this really the case?

If the dimension is only placed in the Meme track, then the continuous stream of new and old plates can be understood as a healthy operation. But if we mention the dimension to the entire public chain ecosystem, only the Meme track can be born Best, can this really represent the public chain is healthy? I believe you also find it a little weird. Although in a practical sense, we often see the popularity of a certain track, and we jokingly say that the xx chain is about to rise and regard its popularity as a sufficient and unnecessary condition, but with a little thought, This kind of explosion may usher in a sudden drop in other ecological liquidity of a chain, and even strongly bound the fate of the native chain coin price to a certain track. This is not what most chain-making projects hope to see一 (Appchain is not considered here), so in most cases, the popularity of a certain track should be a necessary and insufficient condition, that is, the traffic of a certain track cannot infer the development of the entire chain, and the trend of the chain should be reversed. Push its ecological flow.

Can Berachain achieve "never end"?

After reading the above article, I believe that many readers have begun to have a preliminary interpretation of Berachain. Let’s not rush to interpret the project first. Let’s take a step back and think about what is the core as a chain?

Yes, liquidity. Mobility, as the nutrient for all things, determines the subsequent development of the ecology and also represents the degree of heat of the chain. In the past, the public chains of the halal factions ignored this focus and just engaged in marketing, trying to "take away liquidity" from other chains. What about? Without it, they are not prepared to consider how to better manage users' funds.

"Retaining liquidity isn't this the job of the project party? What should the public chain party do? We can only provide the best three-piece development set, and the others must be created by the public."

Under the ideal state, public chains can also create some narratives to allow the ecology to undertake these liquidity, but the magnitude is never the public chain level. At present, the most ideal narrative that can carry the public chain level is LRT+AVS. However, other chains have always been difficult to get out of track-level narratives, and will only be limited by the development of a certain target, such as BTCL2 is limited by the outbreak of inscriptions and runes.

From this moment, we can reposition Berachain. The author believes that the best understanding of Berachain should be the "navigator of liquidity". Readers who are not familiar with Berachain can find many three-coin models + POL interpretations written by many colleagues on the Internet. The author will not bother to let me introduce Berachain's token model:

- Three coins: BGT (governance), Bera (Gas), Honey (calculated)

- Key process: BGT can be obtained in Berachain native applications (the main network may be released on more protocols in the future), BGT can be used to "boot" the BGT release amount of different LP pools; BGT is not transferable, but can be redeemed 1:1 Bera. Friends who are familiar with Defi can basically understand it as a variant of ve(3,3).

- Note: BGT can only be obtained from the officially deployed protocols (BEX, BERPS, BEND), but after the main network is online, it will be open to all protocols deployed on Berachain.

The author believes that Berachain's token model should be viewed in conjunction with the ecology, rather than hasty viewing it as a product. Here, the author explains the process of positive ecological development with BERACHAIN: three -set theory:

- Dividend plate: User/ecological project party mortgages assets as LP and obtains BGT release income.

- Split disk: BGT can be used to pledge it to become a governor, or authorize it to other governors; BGT governors can determine the amount of BGT releases in different LP pools.

- Mutual Aid Pan: Ecological project parties provide bribery rewards to attract BGT managers, and Ecological project parties gain potential liquidity from higher BGT releases.

- Split disk: Users purchase tokens from different project parties from LP pools.

- Dividend plate/split plate/mutual aid plate: User assets flow in and out of different ecological projects.

Therefore, Berachain's main collapse point is: BGT pledge income <BGT's profit to Bera. This also defaults that the on-chain ecosystem can no longer support more bubbles, and it also means that as long as there is no systemic risk, Berachain's native assets (BGT, Bera, Honey) have ecological corpses. But from the actual situation, this matter will be more complicated, because not all participants have clear enough global information and make absolutely rational judgments, and not all participants are investors. Some project parties may purchase BGT to vote to obtain BGT to release returns to obtain potential liquidity, so this collapse point should be modified to: In a rational market, project parties ' bribery benefits < purchase liquidity costs (bribery, purchase BGT directly) / BGT pledge income <BGT is exchanged into Bera's income.

It is not difficult to find that this is a seesaw mechanism. When Bera/BGT is highly implicit, the potential anti-refuge pressure of BGT will be very high. Once there are fewer BGT pledges, the absolute return on BGT pledge should become higher at this time, which will push up BGT pledge. Willingly, the implicit value of Bera/BGT becomes lower, but the profit space will be reduced when the pledgers are more likely, and the implicit value of Bera/BGT becomes higher again... After repeated cycles, the healthy Berachain ecosystem should maintain Bera/BGT for a long time The premium means that the ecology has more trading volume, and "deserved" is willing to pay more bribery rewards for BGT pledges. However, considering the actual situation, the amount of bribery reward for purchasing liquidity is not "dark forest". Rational project parties can refer to the bids of friendly competitors to set prices, or conspire to set prices to re-determine the attractiveness of liquidity by the free market. Finally, It will only return to a "market equilibrium" return average.

In addition, another hidden collapse point of Berachain is that the LP staking income is lower than that of other DEX self-organized LPs in the ecosystem, which means that users will be lost due to "vampire attacks". If you look at the actual situation, this problem is not big, and there are two reasons:

- Berachain native DEX should have the most trading pairs, and small projects should choose cold start/IDO DEX. Therefore, in terms of user experience, it can provide the widest trading routes without huge liquidity outflows.

- Berachain has the strongest brand power in native DEX, which is difficult to match with other DEXs. You can refer to Uniswap's rapid rebound after being attacked by Sushiswap's vampire, which shows the important impact of brand power on users' trading minds.

Defi Liquidity Game: Has Berachain essentially changed anything?

For Defi, even though the shapes are different, the core elements are still liquidity. Therefore, how to attract and distribute liquidity in product structure has become a measure of sustainable development, especially for public chains. Below, the author will briefly review some liquidity solutions that have appeared in the past few years and compare whether Berachain's solution has essentially solved the liquidity problem.

Option 1: Liquidity mining

Only LPs with handling fees are subsidized with the original currency of the project. Suitable for early Defi, users have not been affected by the dazzling product model, this simple and effective subsidy helps quickly capture liquidity. The most classic case is Sushiswap's vampire attack on Uniswap, using LP mining subsidies $SUSHI tokens to capture $1.4 Billion liquidity in the short term. But the problem is also obvious. This dividend is not U-based, and the more liquidity, the less dividends it pays. Therefore, the tokens mined by early users will only quickly exit at the secondary level, which accelerates the possibility of the project collapse. Nansen's 2021 report has long pointed out that 42% of the LPs entered on the day of liquidity mining start-up withdrawal within 24 hours. About 16% of LPs exit within 48 hours, and by the third day, 70% of users will exit. If it were today, this data would not be surprising. If it weren’t for a diamond player or a believer in the project party, who would be willing to run away?

Solution 2: CLMM/Other AMM variants

Liquidity aggregation is carried out by changing the normal AMM (i.e. CPMM, constant product market maker) model. The most famous algorithm is CLMM, which is actually more like countless independent liquidity pools with different price ranges, and is seamless in terms of user experience. This approach is to achieve a balance between the order book and the CPMM, and to improve capital efficiency while ensuring sufficient liquidity to take over. For further explanation, readers can just look at Uniswap V3 or the V3 fork on the market. I won’t explain too much here. This kind of solution iteration will not harm the platform tokens, so basically everyone has one set.

Solution 3: Dynamic distribution AMM

The liquidity range adjustment is carried out through passive/active methods, but its core idea is to ensure that liquidity reaches the highest capital efficiency. For more detailed contents of the plan, please refer to Maverick Protocol. It is similar to manually re-deployment of CLMM intervals. This approach allows users to experience lower slippage transactions, but the trade-off is to establish a "price buffer zone", and the potential cost of the project party in market value management will be higher (for example, it is more difficult to pull the market), so this Token pairs using dynamically distributed AMMs have high correlation, such as LST/ETH.

Solution 4: VE Model

The classic VE model was proposed by Curve. After the user pledged the governance token, he can obtain some credentials, the masterpiece VE token, which can be used to determine the proportion of liquidity mining in different LP pools, that is, the dividend income of the governance token. . In short, governance tokens can be used to determine the distribution of governance token releases in the LP pool . Because governance tokens can determine the allocation amount of liquidity mining, it has extended a project-guided liquidity, aiming to provide a deeper transaction depth to ensure sufficient liquidity to undertake it. Therefore, the project party is willing to provide more rewards for "election bribery". Most of the governors related to the project are rewarded with the project's native tokens. Early projects will choose to outsource bribery platforms, but more new solutions will now adopt built-in bribery modules.

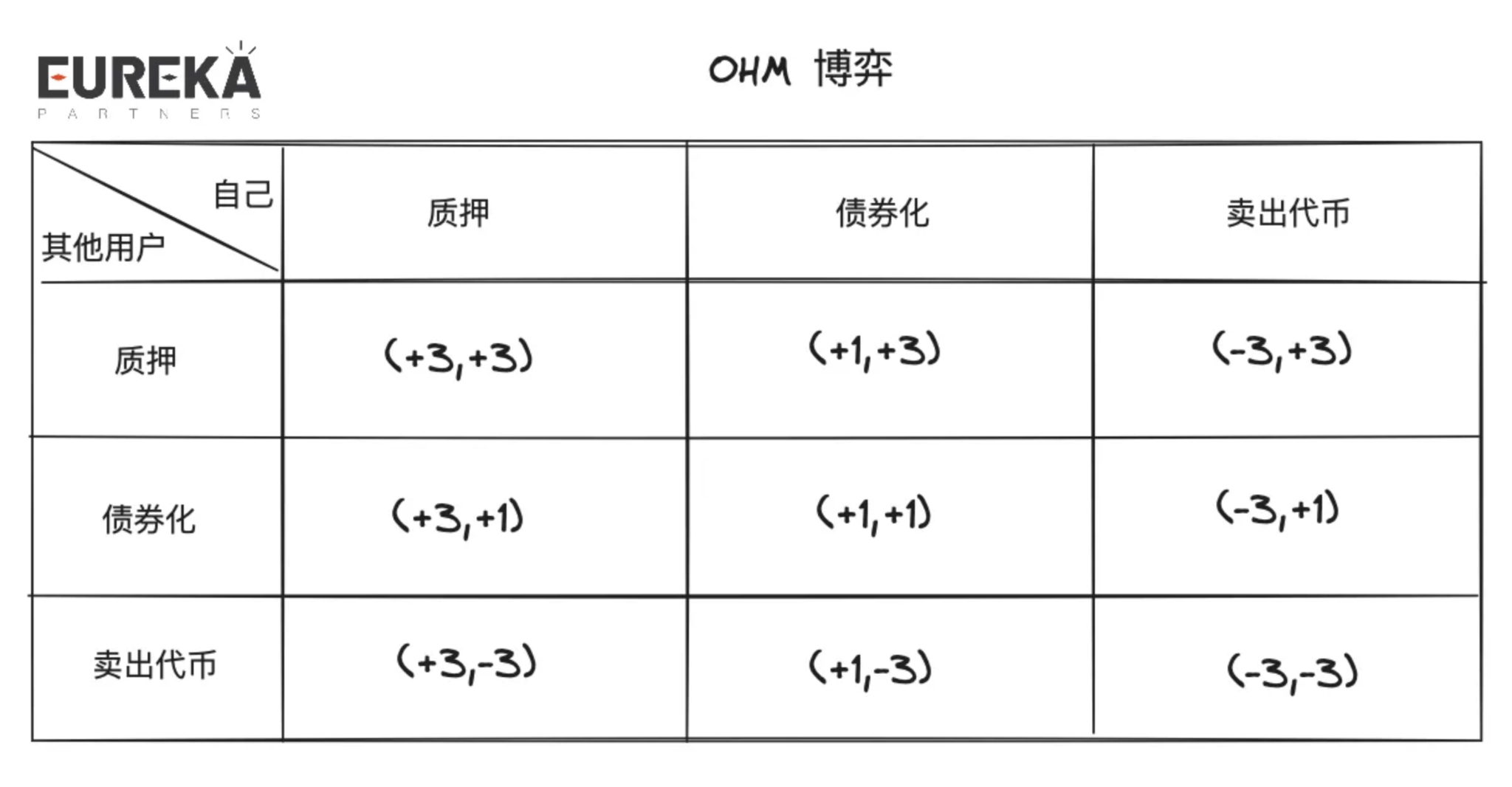

Solution 5: Reserve Currency/OHM imitation disk

Selling bonds at a discount to collect liquidity and issuing stablecoins with this liquidity, because stablecoins should be anchored to US$1. Once there is an over-purchase, the remaining liquidity is regarded as profit and allocated to the stablecoin Purer. In theory, this method can operate sustainably, but the actual user does not consider these tokens to be stablecoins, but chooses to over-purchase the stablecoin and pledge it to obtain the treasury surplus income. Under the combination of pledge, bondization, and secondary market purchases, the value of the stable currency will be pushed to a level that should not be achieved far. If there is a huge amount of profitable positions, there will only be a further squeeze, and finally return to the water level below $ 1. OHM's game situation is also called (3,3) model. From the above, users can choose to choose pledge, so it is expressed in a 3x3 matrix, which is (3,3).

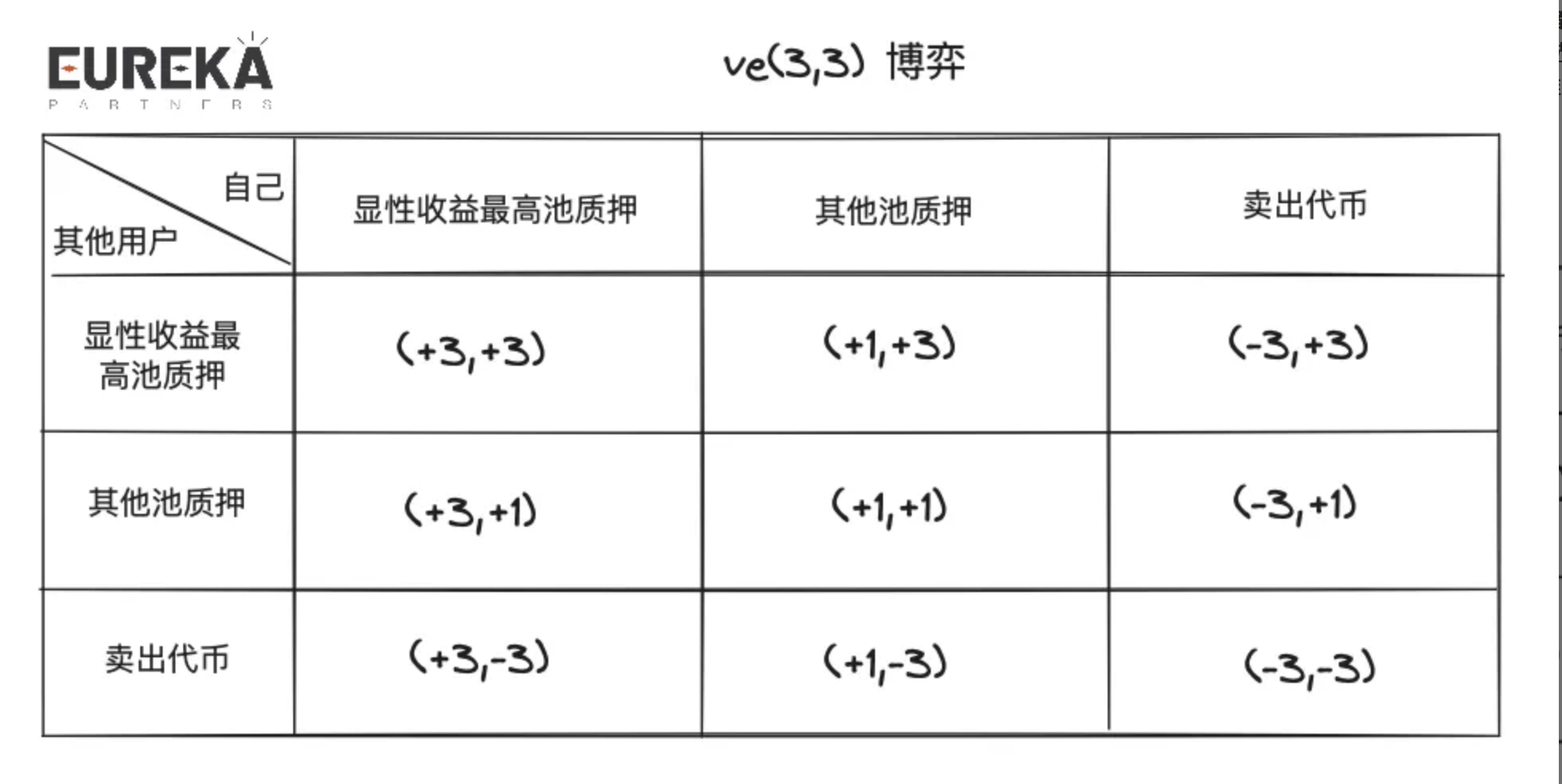

Option 6: VE (3,3) model

Different from ordinary VE models, VE (3,3) pays more attention to local optimal consensus. Therefore, the project party will create an environment to guide the currency holders of the governance to the token. The LP handling fee of the VE model mentioned above is actually a global dividend, that is, all the pledges of the governance token have benefits. However, most of the LP fees of VE (3,3) only appear in the governor who voted in the pool. The pledgers need to choose the estimation of the subsequent divided by different LP fees, and then choose to vote. Therefore, in a sense, the bribery platform also provides a local consensus to allow users to take the initiative to obtain the most income. Therefore, whether it is the LP handling fee isolation or the bribery market, it further allows the liquidity market to have internal competition, and try to attract liquidity under the condition of "single -blindness", that is, how much liquidity will the liquidity provider provide for the liquidity provider will provide. This part is always opaque. In addition, the biggest difference between the bribery market and the LP handling fee is the method of revenue dependency. The former is denominated by the project party token, and the latter is more commonly priced in the U (so the former can be used as a buffer belt for the entire DEX. Maintain the price of tokens.

Option 7: Reverse VE (3,3) model

Positive (3,3) attaches great importance to the global optimal solution, and reverse (3,3) improves the cost of pledge/holding currency by the loss mechanism. Readers may understand that traders hold token risks, but such projects are common in group friends. It is called Native Deflation Mechanism. The practice of conventional projects on the market is slightly conservative. For example, GMX does not mean that not pledge leads to the depreciation of the principal. Instead, the pledge may cause some dividend damage. Readers can read the GMX interpretation online. The use of this model requires the project party to fully understand his business and understand that the life cycle & design logic will only allow the project to speed up the death. Whether it is tokens too high or rapid depreciation, it will not be a long -term development project hope. Seeing.

Option 8: Lobricity guidance

Lobricity guidance generally exists with two characters LP & LD (liquidity diary). LP still provides liquidity, and LD is responsible for determining where the liquidity will go. Tokemak is one of the few liquidity solutions that use this solution on the market. V2 also iterates to use the internal algorithm to obtain the optimal liquidity guidance route to allow LP to obtain the optimal mortgage income, and liquidity purchase Those who can know how much money can be "leased". The liquidity Marketplace has not yet been opened, but it has accumulated more than 8m liquidity. From the perspective of the past currency price performance, this narrative only received attention in the last round of Defi Summer. In the bear market & this round of bull markets, there is not much performance. Whether the liquidity market requires the market to be transparent is still a follow -up verification. The author believes that in the liquidity market, it takes a certain degree of "clear price", because the blind zone occurs, the bidding will not be efficient, and there are many potential idle rewards. It acts as a terminator during gameplay, just like MEV-boost in MEV dark forest.

Plan 9: VE-LP / Proof of Bond (POB)

Finally coming to the highlight of this chapter is also why the author thinks Berachain POL is not the core reason for innovation.

The core idea of VE-LP/POB is to introduce liquidity to the project’s tickets & defense line. The former can be seen in Balancer, and the latter can be seen in THORchain. Balancer allows users to LP in BPL/WETH, and the LP credentials they obtain can be further pledged to obtain veBAL for handling fee sharing and governance. The ThorChain Pob requires node operation to pledge its native token as an insured fund, and deducts 1.5 times the mortgage assets for LP after lp loss. The liquid HARD CAP carried by the entire network will be 1/3 of the governance of the token. When the network becomes unsafe/not efficient, it will seek a balance point through liquidity mining <> node operators' income distribution. For example, when the mortgage assets of network nodes are not enough to repay liquidity loss on the chain, the next one will increase the next one Release of period node income (governance tokens). No matter how the details change, the core issues will have the threshold for entry. Therefore, how to set a reasonable admission difficulty to maintain sufficient liquidity is the key.

So when we look back at Berachain's POL+Three Coin model, it is essentially a variant of the VE(3,3)+VE-LP model. According to the above introduction, the market for BGT bribery is an application of VE(3,3) model, while POL is an application of VE-LP. The core of the former lies in the management of the market value of the governance token, while the core of the latter lies in the entry threshold. Generally, the governance of the VE model on the market is randomly traded in the secondary market, so for the ecological project party, it can be purchased casually. , But the method of POL slows down the acquisition of the governance tokens (BGT). To a certain extent, it gives more time control time and space. At the same time, POL allows multiple types of tokens to mortgage, which reduces some entry threshold in exchange for more than more. More potential liquidity.

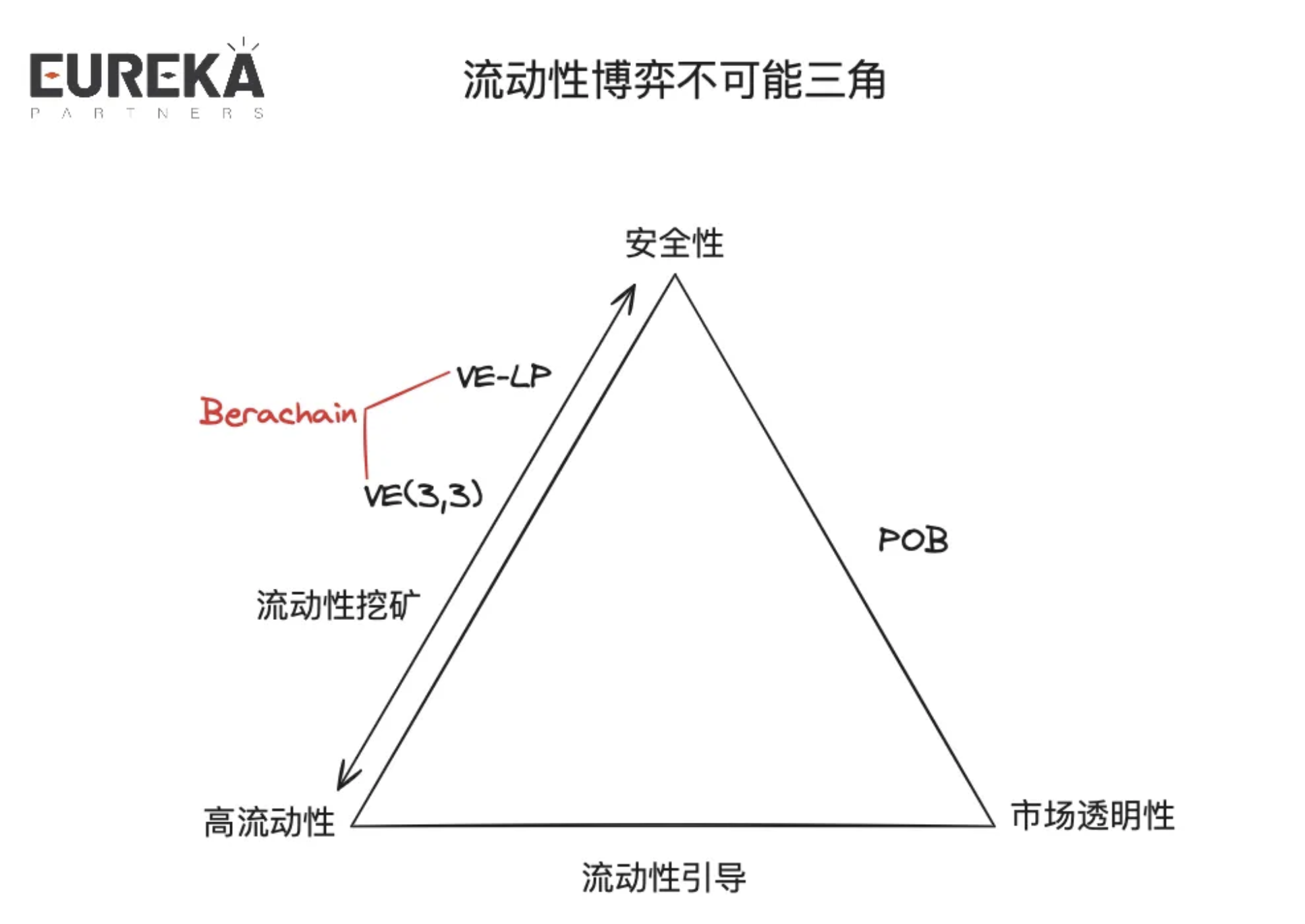

From the above series of liquidity solutions, we can summarize the impossible triangle of liquidity game: security, high liquidity, and market transparency.

Safety: refers to whether the plan can provide a back-end defense line for the project party's liquidity. For example, the bribery income of the VE(3,3) model bursts, which will cause the VE project party to collapse.

High liquidity: refers to whether the plan can attract absolutely high-value liquidity. For example, if the project party is willing to cede most of the governance tokens, then this income will attract a batch of short-term liquidity.

Market transparency: refers to whether the plan can transparentize the market demand for liquidity. For example, the liquidity that the POB project can carry determines the total amount of node assets.

Back to the question itself: Is BERAChain's technical bottleneck that essentially breaks through the liquidity market? The answer is obvious, but only a part of the improvement. But Berachain chose the right application scenario - public chain. If we only focus on the mechanism, we will misjudgment that this potential is only at the protocol level. However, the actual bribery reward of BGT token can also be used to promote other ecological projects. Verifying can even be regarded as a big narrative at the same level of RESTAKING. Imagine that you are the project party now. You do not have enough capital reserves as an early reward for liquidity mining, but you still have a transaction pair in the BEX (BERAChain Native Dex). It is convenient to obtain BGT income from the liquidity of these pledge, and BGT can determine the subsequent release of the pool. Because the pool is small, even if it is a small amount of BGT release, compared to other blue chip token LP income, it is necessary High, indirectly attracting liquidity. Thinking from this logic, in fact, the POL mechanism of Berachain is a bit like the RESTAKING track. Because of the security of the AVS integrated part of the RestAKING track, and the small project of Berachain is also the "security" of the integrated part of BGT, which provides more sufficient liquidity for the subsequent development of the project.

What is happening with Berachain and what is the best way for users to

participate?

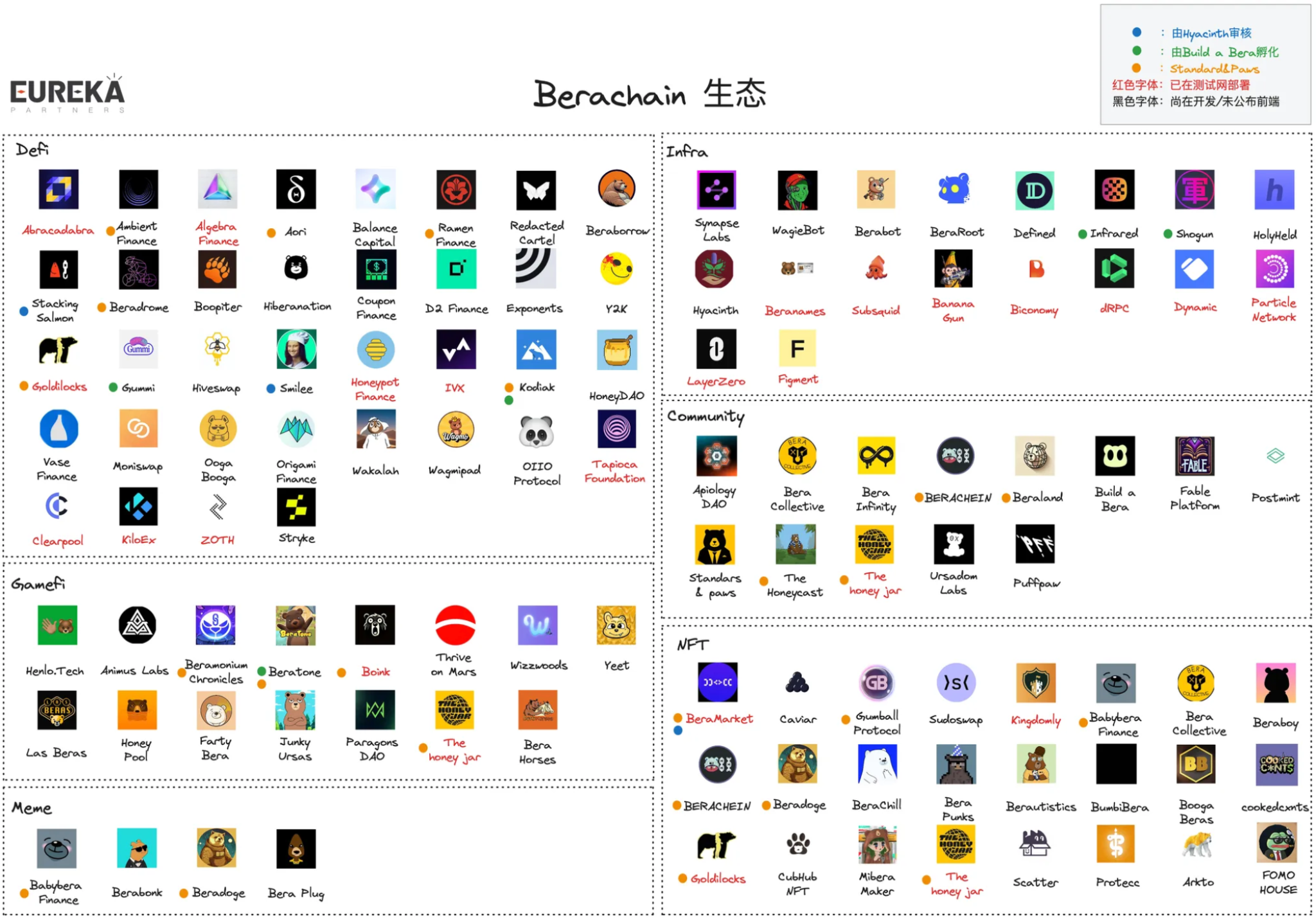

As of May 3, 2024, according to Beraland and the author, there are currently about 103 projects, of which Defi and NFT account for the majority. Since the project may have multiple businesses, the author also divides such projects into the categories of business. The specific ecological distribution is as follows:

- Defi: 36

- Gamefi: 15

- Meme: 4

- Infra: 18

- Community: 13

- NFT: 24

Currently, most of the projects are Defi and NFT products. Berachain 's ecology is relatively complicated, and I only choose some key project introduction (relatively subjective).

- The Honey Jar (THJ)

“The Honey Jar is an unofficial community NFT project, situationed at the heart of the Berachain ecosystem, which hosts a number of games.”

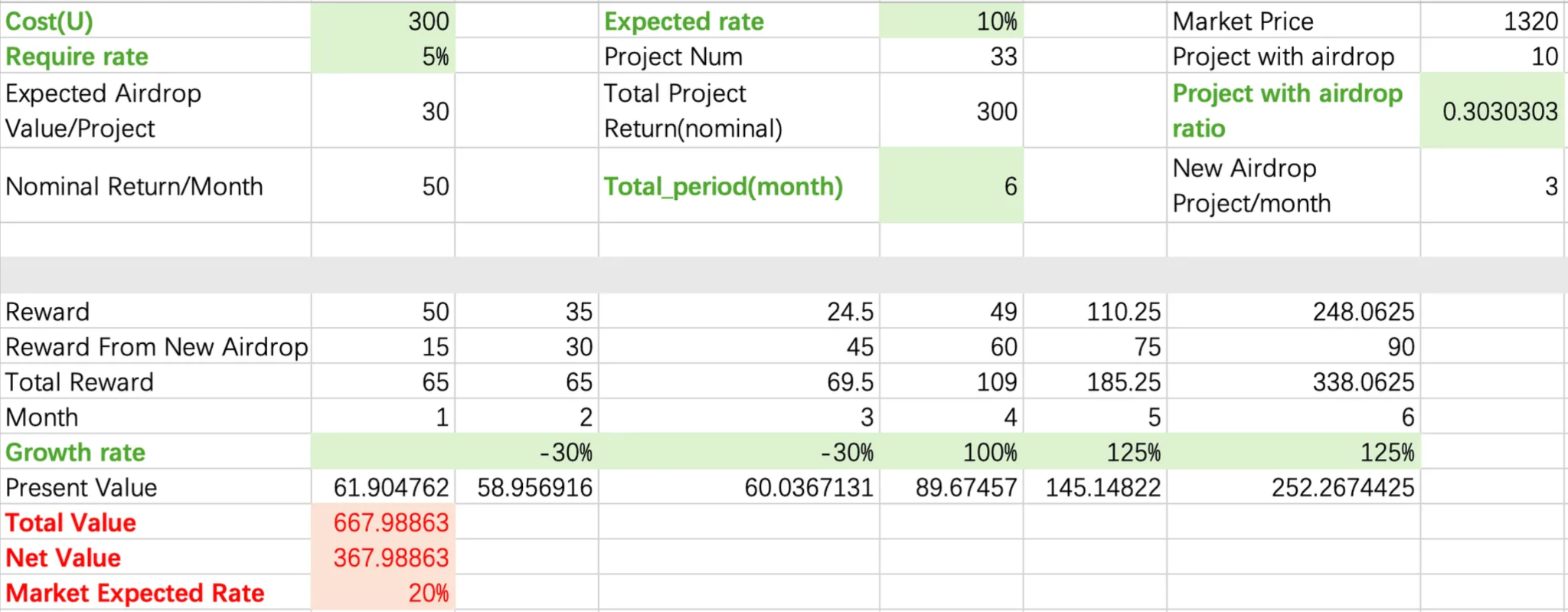

The above is the official positioning, which can basically be understood as a hodgepodge project of NFT+Gamefi+Community+Gateway+Incubator. Its NFT is called Honeycomb and can be used for governance within projects. Currently all Honeycombs have been cast, with a floor price of 0.446ETH and an initial cast price of 0.099ETH. The holders of NFT can participate in the platform of the platform and get some mysterious rewards of the ecosystem of the potential BERACHAIN projects (as of February 22, 2024, HJ has accumulated 33 projects in cooperation , and about 10 projects provide airdropping rewards). BERAChain's ecology can locate "valuable high net worth users through these NFT holders" and potentially improve the future participation of the project (high net worth users may be willing to invest). In short, this is an NFT that requires "the project party is doing things".

In addition, each quarter, The Honey Jar will release new mini -games, and allows users to perform a new round of NFT casting, with a total of 6 rounds. These NFTs are different from Honeycomb, called Honey Jar (Gen 1-6), and the Gen serial number of this round is determined by the order. Users who purchase these NFTs can participate in the game. The game can be understood as an NFT lottery game, and a lottery will be held after all the current NFTs are minted. The winners can receive the rewards in the prize pool (NFT+ bonus). There are currently two rounds of games, and the remaining four rounds will be announced in 2024Q2 and deployed on 4 different EVM chains.

THJ incubated 6 tissues:

First, Standard and PAWS. The project is a rating system designed to avoid ecological waste projects.

Second, Berainfinity, which can be understood as Berachain's Gitcoin, helps developers/projects develop sustainably.

Third, ApiologyDAO. Positioning is the investment DAO of the Berachain ecosystem.

Fourth, Mibera Maker. Positioned as Milady of Berachain ecosystem.

Fifth, The Apiculture Jar. Positioned is the Meme/Artist department of THJ.

Sixth, Bera Baddies. Positioning is the female community on Berachain.

Evaluation: The author believes that the early participation value of this project is relatively high, and no one will dislike the "shovel". However, this narrative generally has the opportunity to price in early, so we must know other core collapse/risk points other than the systemic risk (subsequent performance of the Berachain main network):

First, the project party has sufficient bargaining power and BD capabilities, and can "use OG to make the project party". If this narrative is proven that Honeycomb cannot truly capture high-net-worth users, then there will be no subsequent project party willing to be an NFT holder. Provide high value benefits.

Second, the total value of potential rewards provided by other project parties to NFT holders needs to be greater than or equal to NFT. Let 's conservatively estimate the price of Honeycomb:

-

Honeycomb cost price: 0.099ETH is approximately equal to 300U

-

Forecast return: The risk-free return on the chain is about 5% (POS); currently 10 projects are willing to pay for airdrops, and each project airdrop is distributed in about 6 months, with an initial value of 30U (10% Expected rate). The total theoretical value is 300U (30U*10), which means 50U is issued every month; assuming there are 3 new projects willing to airdrop to NFT holders every month.

-

Growth rate of income: Assuming the first three months, the project party is washing the disk, waiting for low suction and then pulling the disk. The price point is returned, and the release period is 12 months, which means that the project party needs to pull 2.5-5 times within 6 months (about 1 times, 1.25 times, and 1.25 times in the next three months).

The final result estimated NFT net value was 367U. If estimated at the current floor price (0.446ETH), the market forecasts the return value of a single project needs to be maintained at 20%. The above estimate is for fun, but the actual reference value is not high.

- Build a bera

"Build-a-bera is a Results-Driven Partner with the Berachain Foundation Designed to PROVIDE BERA-Oriented Founders with The Tools, and Resources N eeded to thrive in a competitive market.”

According to the official definition, Build-a-Bera is a partner of the foundation and helps the project parties of the ecosystem develop, in layman's terms, it is an incubator. Each period will recruit 5 project parties for a period of 12 months. Currently, the five projects on the official website are: Infrared, Gummi, Kodiak, Shogun, and Beratone.

Evaluation: The author believes that these selected project parties have a high probability that it can get more Berachain support, and various projects in the incubator are more likely to form cooperation (the same is true in terms of in terms of perspective).因此后续笔者会介绍上文提到的各个入选项目。

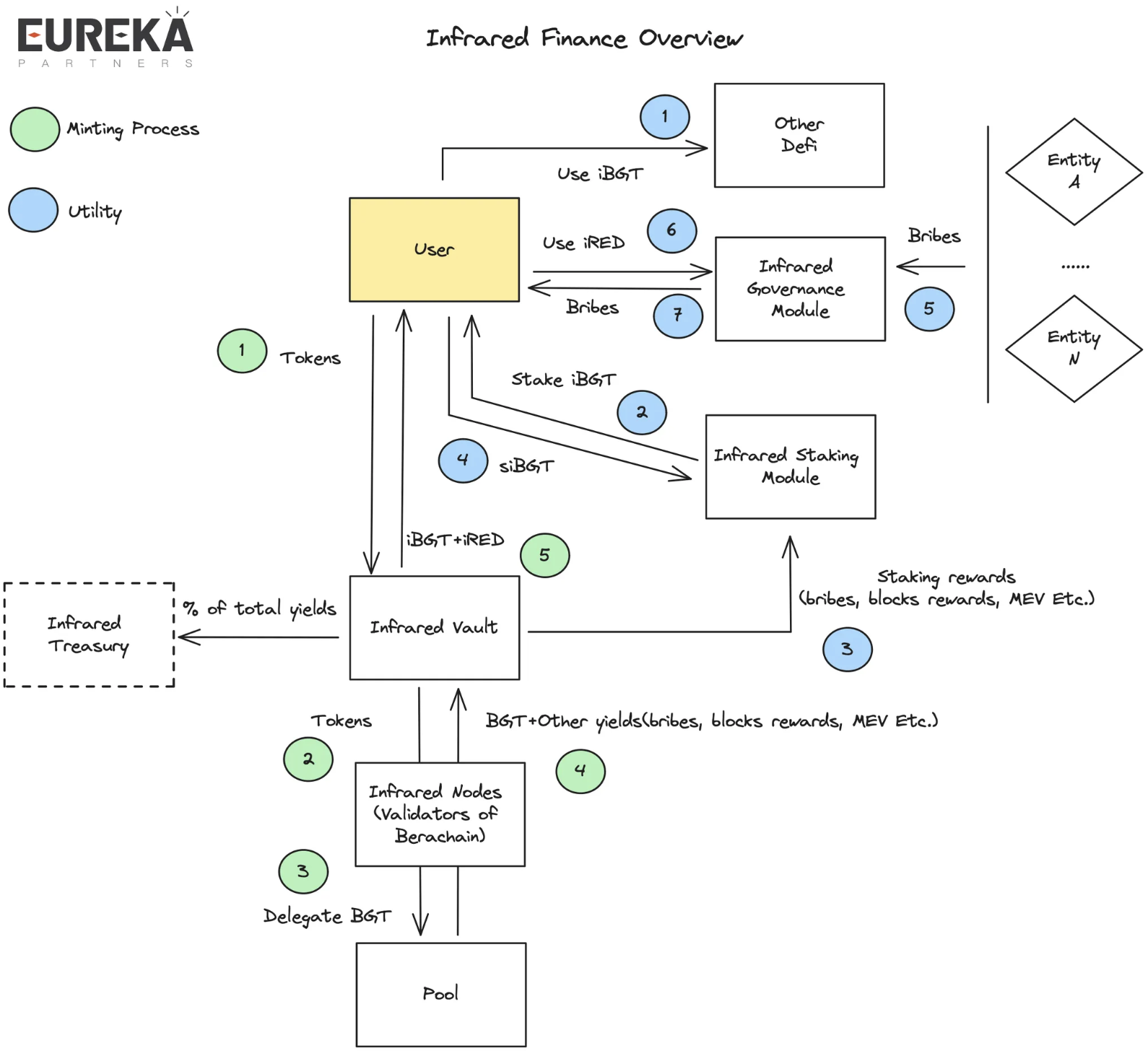

- Infrared Finance

熟悉Defi的朋友可以视作为Frax(frxeth+sfrxeth)和Convex的结合。简而言之,Infrared Finance是一个LSD项目,意在解决BGT流动性问题。

大致流程:用户将代币质押在Infrared Finance,这些代币会进而被Infrared Finance质押在BEX流动性池里,同时收到的BGT收益将授权给Infrared的验证器。Infrared 验证器将之后的BGT释放收益+其他收益(区块奖励、贿赂、MEV等)一并返回给Infrared Vault。Infrared将部分其他收益当作国库收益,并将池里累计的BGT收益铸造为iBGT+ iRED返回用户。

代币模型:iBGT是由BGT 1:1质押;用户可以用iBGT在其他Berachain上的产品中使用;用户可以质押iBGT以获得siBGT,siBGT可以获得Infrared 验证器的BGT收益,比如贿赂、出块收益等;iRED可用于平台治理,比如引导Infrared验证器向某LP增加BGT的释放量。

评价 : 又一“挟天子以令天下”的项目 。 表面上是解决了BGT流动性的问题,但实际上是让贿选争夺战从BGT转移到了iRED 。比如,Infrared Finance占据了51%的LP,意味着对BGT释放分布占据了绝对话语权,自然iRED是令天下的“传国玉玺“。在此基础下,如果项目方的流动性需求不变,Infrared收到的贿选收益理论上比其他验证器高,进一步加剧Infrared对Berachain的掌控程度。实际情况下,这个可能更像是一种事实,以过去Convex 对Curve的话语权一度逼近50%为例,加上Berachain目前还没有其他具备Build-a-Bera扶持的LSD项目,且目前生态合作也比较多,如果用户的需求是较为稳定的BGT收益+部分超额收益,可以预计上线后,用户质押代币的优先门户是Infrared。另外项目采用的双代币“跷跷板”机制也进一步放大了siBGT持有人的收益,因为不是所有用户都是希望牺牲流动性,所以这个质押的收益理应会比一般的BGT LSD产品要更高,且来源都是“真实收益”。看似一个多方共赢的产品,我们也需要明白他的一些崩盘点/核心风险:

第一,iRED的贬值风险。每一次的iRED释放都将让总流通量提高,进而间接降低iRED价值。iRED的隐含价值代表着贿选收益,如果潜在项目因为某些原因(比如:去中心化的追求)更愿意在Berachain BGT Station直接提供高额贿选,那么对于iRED的隐含价值就变低,进而加速iRED贬值。如果Infrared能够掌握多数流动性,那么本质上还是回归到Berachain的POL机制,严格意义来看这个算是系统性风险。

第二,Infrared的中心化风险。虽然Infrared目前有多方支持,包括基金会合作的孵化器,但仍不能忽视他们潜在的作恶风险。 目前Infrared 没有明示他们验证器参与门槛,如果是完全自家人运行,那么将会比Lido更具备单点故障的风险。

- Kodiak

“an innovative DEX that brings concentrated liquidity and automated liquidity management to Berachain.”

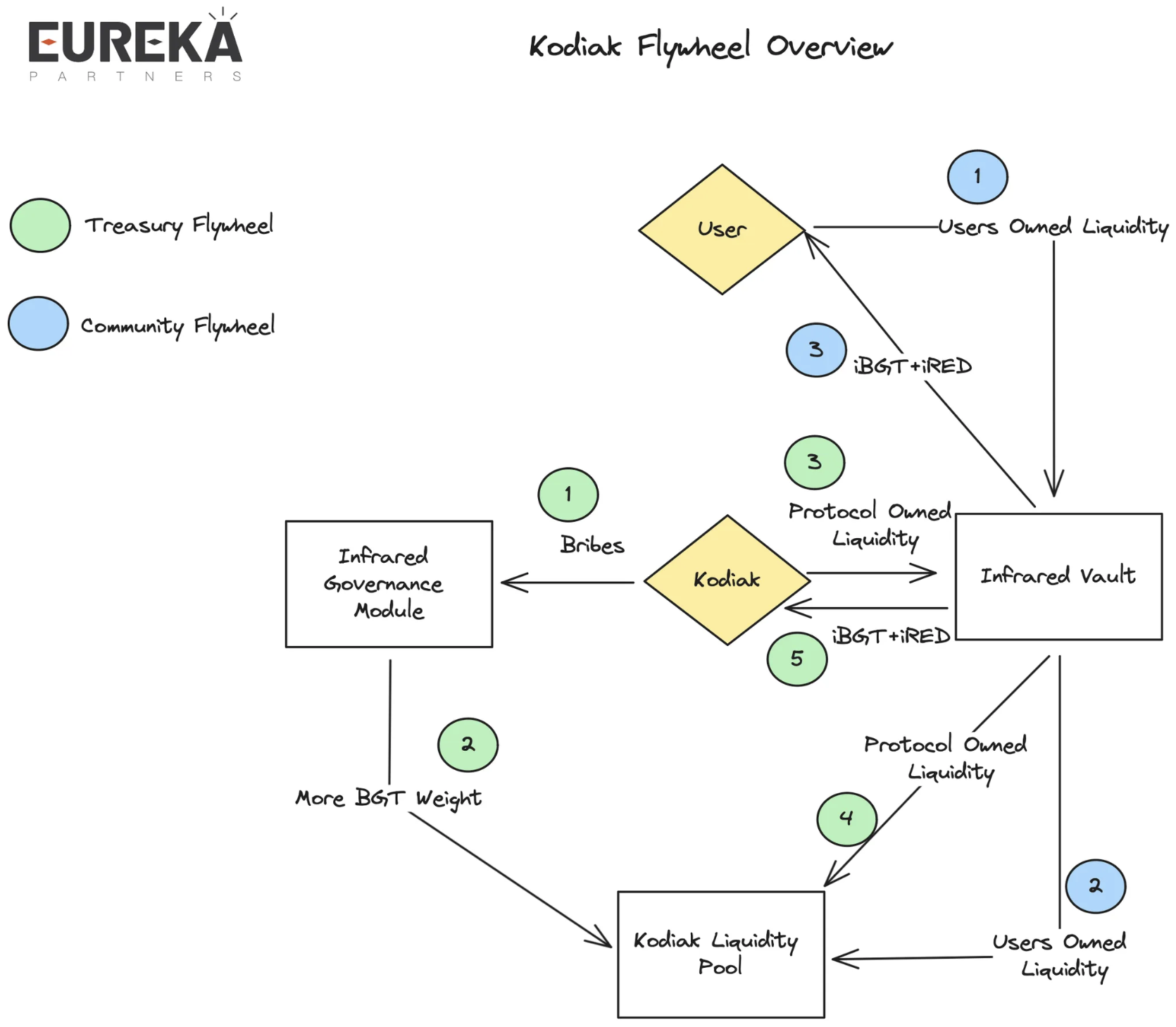

Kodiak 定位是一个DEX并且提供自动化管理流动性的服务(参考上文流动性解决方案中的动态AMM一览),此外也提供一键发币功能。据官方称,Kodiak并不是BEX的直接竞争对手,而是生态位的补给,原因是BEX并不提供聚集流动性的功能。另外,值得注意的是,Kodiak与Infrared合作,并提出了两种经济飞轮:

第一,国库飞轮。Kodiak会首先贿赂Infrared,进而提高Kodiak LP的BGT释放量。随后Kodiak 将国库的流动性质押在Kodiak LP池,并将LP代币抵押给Infrared,Infrared因而获得该LP的控制权,随后在Kodiak LP池中进行质押以获得Infrared的iBGT+iRED收益。

第二,社区飞轮。用户可以用质押他们的Kodiak LP代币并且获得Kodiak返回的iRED+iBGT的收益。

评价:适用于生息资产与原生资产交易对,但未必适用于siBGT&iBGT场景,同时该飞轮对项目的中后期控盘能力要求很高。上文也提到动态分布AMM适用于相关性较高的代币对。比如LST/ETH,LST(non-rebasing token)会累计验证器的收益,理应比iBGT的价格更高,但因为收益属于稳定性收益,并不会出现极具的波动性,所以动态AMM会更容易形成价格缓冲带,让两者之间并不会出现。但是siBGT原生收益有别于POS,来源比较多元,且波动性不低,所以价格缓冲带反而让价格发现的效率变低,潜在低估了siBGT的市场真正收益价值。另外项目的核心崩盘点在于: 贿赂收益(iBGT+iRED+流动性稳定性)低于贿赂成本(大概率为Kodiak原生代币) ,这点基本上是所有贿选项目的通病,这也隐含意味着Kodiak代币隐含价值应当低于或等于贿赂收益,否则项目方则出现赤字(类似lido的现状),但反过来看,若是Kodiak原生代币价值不够高,无法吸引足够流动性,即没有足够BGT释放quantity.

-

早期来看,大部分LP思维应当是币本位的,也就是一个看涨信号 ,*处于贿选成本大于或等于贿选收益,但中后期,生态乏力,LP自然需要以U本位思考,届时Kodiak将只剩下两个选择:以U本位维持贿赂量,或者以币本位继续贿赂。前者加速市场的潜在抛压,后者减少平台流动性吸引力,都是处于崩盘的临界点,若没有其他叙事,则是来到了生命周期的结局。

- Gummi

“A sweet treat for those sers interested in something a little stronger than honey.”

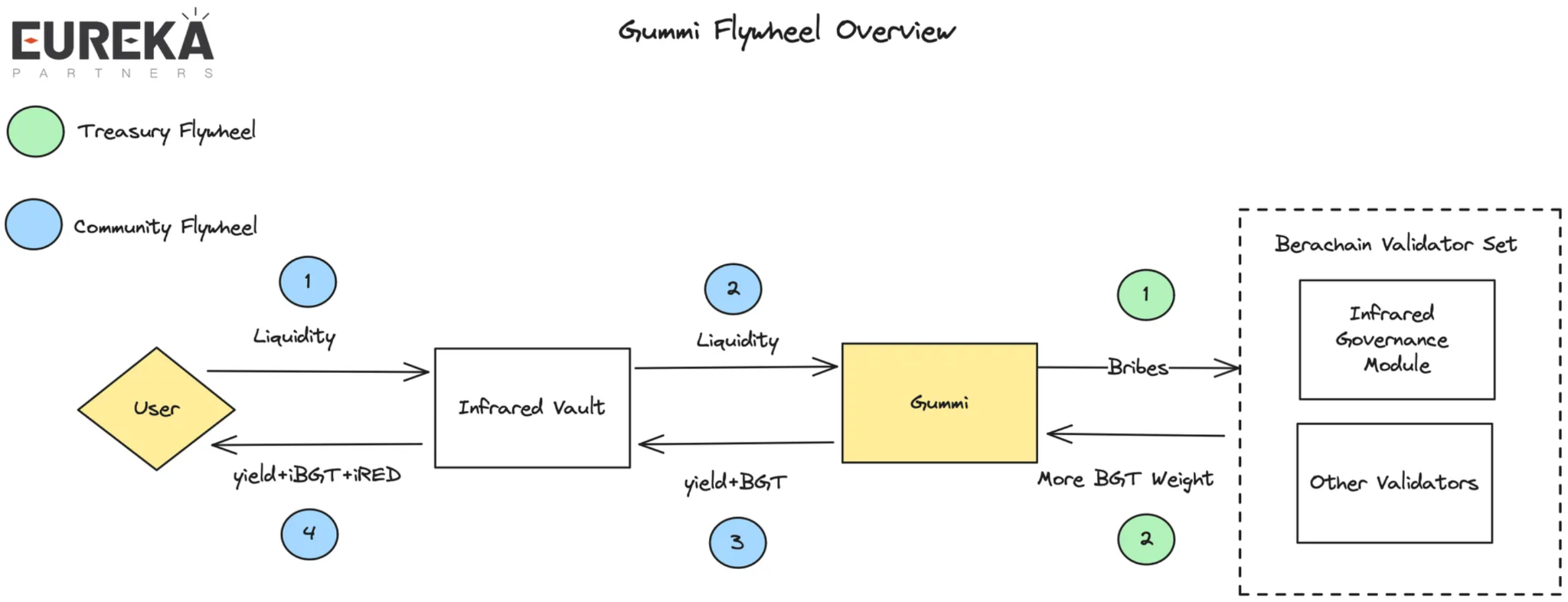

根据官方描述,Gummi定位是一个money market为主。目前资料不多,但大概率是一个借贷协议,并且支持杠杆借贷。

他们与Infrared的合作形式与Kodiak相似,虽然Gummi没有明说会去贿赂Infrared验证器还是所有验证器,但大概率是前者。

评价:此项目目前没有很多讨论空间,因为产品细节仍不清晰。但因为属于Build-a-bera孵化产品+Infrared 生态合作伙伴,所以在此提及。

- BeraBorrow

“Beraborrow is a decentralised protocol at the forefront of the Berachain ecosystem, providing interest-free loans using the iBGT token as collateral. ”

熟悉Defi的朋友可以理解为Liquity的仿盘。根据官方描述,BeraBorrow是一个抵押债务协议(CDP),允许用户用iBGT以0利息+110%抵押率的方式借出NECT稳定币,该稳定币理论锚定在1美金。

为何免息:不可能存在真正“免息”的协议。所以我们的关注点应该是协议从何处抽水。BeraBorrow会在用户每次借出NECT和赎回时收取费用,赎回费用根据12小时内的赎回频率动态调整,赎回的越多(意味着NECT价值被高估),收费越多。

锚定机制:分为硬锚定、软锚定。前者提供了iBGT与NECT的1:1赎回机制,当NECT被高估(大于1.1美金),则可以在平台以110%抵押率换出价值1 BGTi的NECT,随后卖出NECT以获得差价作为收益;当被低估(低于0.9美金),则可以在二级市场购买,并且在平台1:1赎回iBGT,中间的差价则是收益。后者指的是NECT理论锚定价值,即等于1美金,平台通过动态赎回费用调节被高估的NECT。

最大杠杆 :11倍。因为平台抵押率是110%,所以理论能够开设11倍杠杆(1+1/0.1=11)。

其他风控:后续会推出稳定池用作平台清算,清算的收益将会给该稳定池的LP。

评价:稳定币项目本质上还是债券,用户在意的是APY,而不是稳定币的使用场景(更多交易对)。如果真要用稳定币,为何不去用Honey呢?从目前产品的收益来源来看,只有稳定池是潜在的收益来源,但不排除 抵押在平台的iBGT可能后续可以进一步抵押在Infrared vault以获得潜在收益。那么对于用户而言,如果短期看空iBGT,则可以放大杠杆等待底仓被清算以获得潜在的清算利差。

Liquity的清算最高价值=债务价值-(抵押资产数量 当前价格 <10%*用户在稳定池占比)。

简单以例子估算一下,假设一个仓位有500iBGT,10000的NECT债务,当前抵押率在109%,即iBGT价格在21.8 U (109% 10000/500) 。如果稳定池里该用户占50%,意味着用户可以获得利润450U(500 50% 21.8-10000 50%)。按照上述例子,用户的关键盈利点在于当前 稳定池的占比+清算频次 。

另外,如过用户中长期看多iBGT,则可能通过放大杠杆以获得最高11倍的siBGT收益,不过当前业务并未在BeraBorrow官方文件中指出。 对此类用户而言,关键风险点在于BGT的向下波动风险。

- Beratone

“BeraTone offers an intricate life-sim and farming system, reminiscent of beloved classics like Stardew Valley, allowing players to cultivate and manage their dream farmstead.”

根据官方介绍,Beratone属于MMORPG,玩家将扮演小熊在模拟世界里与各个熊熊一起种田,熟悉游戏的朋友可以参考星露谷物语。Beratone的创作者之一是PixelBera,也是Bit Bears(Bong Bears NFT的第五代变基衍生NFT)的美术。得益于Bit Bears的爆火,PixelBera希望给Bit Bears推出一些“效用“,Beratone由此诞生。预计游戏Demo在24年Q2推出,并在2025Q1推出正式版游戏。而NFT售卖在24Q3进行,目前已经售卖了Founder's Sailcloth NFT,将给游戏内提供多种buff,比如增多背包空间。 值得注意的是,游戏将会是所有人都可以游玩,并没有门槛限制,所以Q3售卖的NFT并不是入场券,可能也是类似Founder 's Sailcloth NFT。

评价:美术风格紧贴Web2游戏,但TBH,Web3用户追求的还是APY,游戏本质上还是一个巨大的Defi。但作为Gamefi项目方,其中一个不可多得优势是经济模型可以设计为单盲模式,即用户对收益是不清楚的,配以适当长周期的经济系统,外加内购系统,一款游戏的生命周期将比我们想象的还要长。另外Gamefi的收益以NFT本位计算,那么也可以通过较低的换手率塑造出虚高的市值进而吸引用户参与打金刷量,但相比起U/币本位要更难去控盘。 简而言之,如果你是Bera的爱好者,可以考虑陪跑,游戏的赔率比较高,同时需要估算二级市场的换手率,必要时通过盘前交易、OTC避险。

上述多个项目介绍较为入门,并不足以给各位读者带来生态级别的insight,因此笔者将上述生态版图的所有项目皆做了些许研究,多则1小时,短则5-10分钟。以下是我的一些总结:

项目原生性强,GTM策略不一:大多在Bera部署的项目,都并非多链兼容,而是原生在Berachain,原生项目与非原生项目比例大概是10:1(注:不排除是某些产品是同一团队出身)。与直觉相反,并不是所有非NFT原生项目方都倾向通过发行NFT作为冷启动,大部分还是走清真派。

经济飞轮杂,万变不离其宗:在Berachain部署的项目大多通过Infrared实现经济飞轮,同时有项目进一步在BEX原本基础上再搭建多层VE(3,3),比如Berodrome。但核心思想不变,任何激励都是币本位,因此用户只要明晰该代币背后项目方基本面+做市能力即可。项目与项目之间的飞轮理应是耦合的,但不代表项目的飞轮效应会因为单一项目的崩盘而崩盘,只要确保割让的代币能换取超额收益,那么用户就愿意继续护盘,并让其他项目补上飞轮的缺口。

高融资项目大多发行NFT:TOP10融资额的项目方里面有7个都是Community/NFT/Gamefi,皆发行NFT。

社区热度断层,但热于彼此导流:原生Berachain生态项目方平均推特观看人数是1000-2000+人,部分项目方呈阅读人数低估状态(关注人数/平局阅读数< 生态平均值)。比如Infrared 关注人数7000+,帖子观看人数平均为10000+;许多原生生态项目方会彼此合作,合作形式比较多元,比如参与经济飞轮、割让代币等。

项目仍在创新,但不属于颠覆性叙事:NFT赛道里,有项目方选择以BD能力以换取用户注意,而不是一昧吹嘘效用,比如HoneyComb, Booga Beras。Defi赛道里,有项目方继续深研流动性解决方案,比如Aori,也有项目方尝试优化过往VE(3,3)模型,比如Beradrome。 Social 赛道里,有项目方尝试通过Peer to peer 的方式审核生态项目的品质,比如Standard & Paws。Launchpad赛道里,有项目方尝试代币权益切割、LP分让的形式实现Fair Launch,比如Ramen、Honeypot。而Ponzi/Meme赛道里,有项目方尝试Floor price pool实现“可持续经济”,比如Goldilocks。

Berachain的爆发点应当在哪,什么生态是潜力股?

我相信各位读者读到这,也大概对Berachain有了比较全面的认知,因此不难想象得到有两个潜在的发展路径:LSDFI、图币资产。

第一,LSDFI指的是与Infrared 有关的所有经济飞轮,本质上属于是Berachain的经济护城河。从上文大概可以看见,目前很多项目已经建立对Infrared Finance生态的合作,并将该LP委托在Infrared以获得超额收益,因此之后的生态大概率复刻以太坊的老路,比如以siBGT作为抵押资产的稳定币、利率互换协议等。但有别于以太坊质押门槛,Berachain的门槛在于流动性大小,因此puffer finance等降低质押者参与门槛的LSD 协议也可能够以另一种形态在Berachain上复刻——放大流动性,比如杠杆借贷等方式。

第二,图币资产指的不一定是某一种协议,比如ERC404,而是所有潜在的NFT资产与NFT碎片化解决方案。图币资产适合的原因是Berachain 原生提供了流动性贿赂,即是所有要发币的生态项目的命门,也是Berachain的自己的后防线。NFT项目方可以通过图转币的方式吸引一波新的买量,也是一种rebasing的思维(拆分盘),同时间参与到生态其他项目方经济飞轮,比如上文提到的Infrared finance。

上述两个方向,其实读者可以自行探索一下,笔者在研究的过程时已经发现个别案例,但因为本文仅作为研究分析,不作为投资建议,所以不在此提及。

postscript

笔者后跟友人聊起Berachain,又谈起了项目是否能成功?

有人说:“Berachain的社区支持力很高,现在的数据也还不错,不少NFT都卖出去,应该是能跑出来。”

另一人说:“Berachain只是一个巨大的Defi,这轮叙事结束后,很快就会跑不下去,没有根本性的生态级别叙事是不可能跑出来的。”

笔者一直认为”成功项目“的定义很复杂,有别于”Defi/项目的终局是什么“,他并不是单一度量的。

如果社区反响好,但VC不赚钱,这是好项目吗?

如果VC都赚钱,社区哭声一片,这是好项目吗?

如果普天同乐,个别人士成了炮灰,这是好项目吗?

如果你是地主,众人成了你的庄稼,这是好项目吗?

项目跟你谈未来,你跟他谈现在,这是好项目吗?

项目跟你谈技术,你跟他谈叙事,这是好项目吗?

致谢:本文所引用的“三盘理论”源自@thecryptoskanda,特此表示感谢。同时,感谢Eureka Partners的合伙人Arthur对本文的宝贵指导与建议。

Source:

https://www.youtube.com/watch?v=LDS2Baz0RQM

https://www.youtube.com/watch?v=aawQAF6YzlI

https://twitter.com/thecryptoskanda/status/1760118631869096160?s=20

https://0xhoneyjar.mirror.xyz/soVN56Jla_Y9x2USB9UO2Pw3T0ALiHwAbI0oxC5AA0M

https://medium.com/@KodiakFi/introducing-kodiak-berachains-native-liquidity-hub-63c3e7749b30

https://medium.com/@beratonegame/the-evolution-of-beratone-b7aacae86e9f

jinse

jinse