Crypto Market March Report: Break through the fog of tariff war, BTC may usher in a reversal in Q2

Reprinted from panewslab

04/03/2025·1MWritten by: 0xWeilan

The chaos and concerns caused by Trump's tariff war, coupled with the rebound in US inflation expectations, have strengthened the market's expectations that the US economy may "stagflation" or even "recession". This is a huge negative and high-risk asset.

This expectation hit the valuation of US stocks, which had risen for two consecutive years and was then transmitted to the crypto market through BTC ETFs.

BTC short-term investors locked in the maximum loss in this cycle and initially completed the latest pricing of BTC. The long-term hands once again changed from "reducing holdings" to "increasing holdings" to taking over some selling, making the price reach a new balance around US$82,000. However, the market is still fragile, and short-hand floating losses are still at a high level. If the US stock market is in chaos and BTC ETF funds are sold, short-handers will inevitably participate in the selling, and the price will inevitably be revised down.

At present, the medium-level adjustment of US stocks has been basically completed, but the further trend still depends on the degree of explosion of the tariff war triggered on April 2 and whether the employment data will decline sharply in March. If both worse than expected, prices will still be downward.

The opposite is the movement of Tao. As the chaos fell out, both US stocks and BTC achieved sharp downward revisions, and the sell-off and panic were also released to a considerable extent.

We believe that as the tariff war is gradually over, the Fed restarts and interest rate cuts are gradually coming, and it is highly likely that BTC will reversal in the second quarter.

**Macro finance: Economic and employment data drives "stagflation" and

even "recession" expectations, while US stocks break down**

After the "Trump 2.0 transaction" was shut down, US stocks basically returned to the starting point of November 6, 2024, which is the day when Trump's victory was launched. The new transaction judgment framework was initially established at the end of February, and throughout March it revolved around the output of various economic, employment and interest rate data that were continuously released.

This judgment framework is the game between the possibility of "economic stagflation" and even "recession" caused by Trump's tariff policy and whether the Federal Reserve's monetary policy should give priority to employment protection or inflation reduction.

On Friday, March 7, the U.S. Bureau of Labor Statistics first released February employment data: non-farm employment increased by 151,000 in February, lower than the market expectations of 170,000, indicating a slowdown in employment growth, but remains relatively stable. The unemployment rate rose to 4.1% from 4.0% in January, indicating a slight loosening of the labor market. The average hourly wage increased by 0.3% month-on-month and 4.0% year-on-year, which is higher than the inflation rate, indicating that real wages have improved, but may put pressure on inflation.

This "fair" employment data partially dispelled concerns that the economy had begun to decline, and US stocks fell first and then rose. But the hidden worries remain, the employment data is lower than expected, and the unemployment rate is also rebounding.

On March 12, the U.S. Department of Labor released CPI data: the overall consumer price index in February increased by 0.2% month-on-month and 2.8% year-on-year, a slight decrease from 3.0% in January. The core CPI (excluding food and energy) grew by 0.2% month-on-month and 3.1% year-on-year, indicating that inflation has eased, but core inflation is still higher than the Fed's 2% target.

The PCE data that the Federal Reserve is more concerned about was released on the 28th. The overall personal consumption expenditure price index in February increased by 0.3% month-on-month and 2.5% year-on-year; the core PCE increased by 0.4% month-on-month and 2.8% year-on-year, reflecting that the downward path of inflation is blocked and the core indicators are strongly sticky.

PCE data shows that the overall personal consumption expenditure price index in February increased by 0.3% month-on-month, 2.5% year-on-year, higher than 2.5% in January; core PCE increased by 0.4% month-on-month, 2.79% year-on-year, higher than 2.66% in January.

Although the amplitude is small, both CPI and PCE indicate that price growth has begun to rebound, which means that the Fed's insistence on reducing inflation target is severely challenged.

From the 18th to the 19th, after the two-day interest rate meeting, the Federal Reserve announced that it would keep the federal funds rate unchanged between 4.25 and 4.50%, and suspend interest rate cuts for the second consecutive time. The statement pointed out that economic activity has steadily expanded and the labor market has been solid, but inflation is still slightly higher, especially under the influence of Trump's policy, with uncertainty in the economic outlook increasing. This is the first time the Federal Reserve has made it clear that tariff policies may affect the economic downturn, but the risk of an economic recession "has risen, but not high."

Perhaps out of care for the panic U.S. stock market, Federal Reserve Chairman Powell said inflation may delay returning to the 2% target due to tariffs and other policies, and hinted that interest rate cuts will be taken if the job market deteriorates. As a first move to cope with the impact of tariffs, the Federal Reserve slowed the cap on U.S. Treasury bond reduction from $25 billion per month to $5 billion per month.

The Fed's relatively "double" statement boosted the market and pushed the three major stock indexes to rebound sharply. By the end of the month, the CME Fed Watch board showed that the market raised its 2025 interest rate cut expectations to three times for the first time. Goldman Sachs also expects to cut interest rates three times this year.

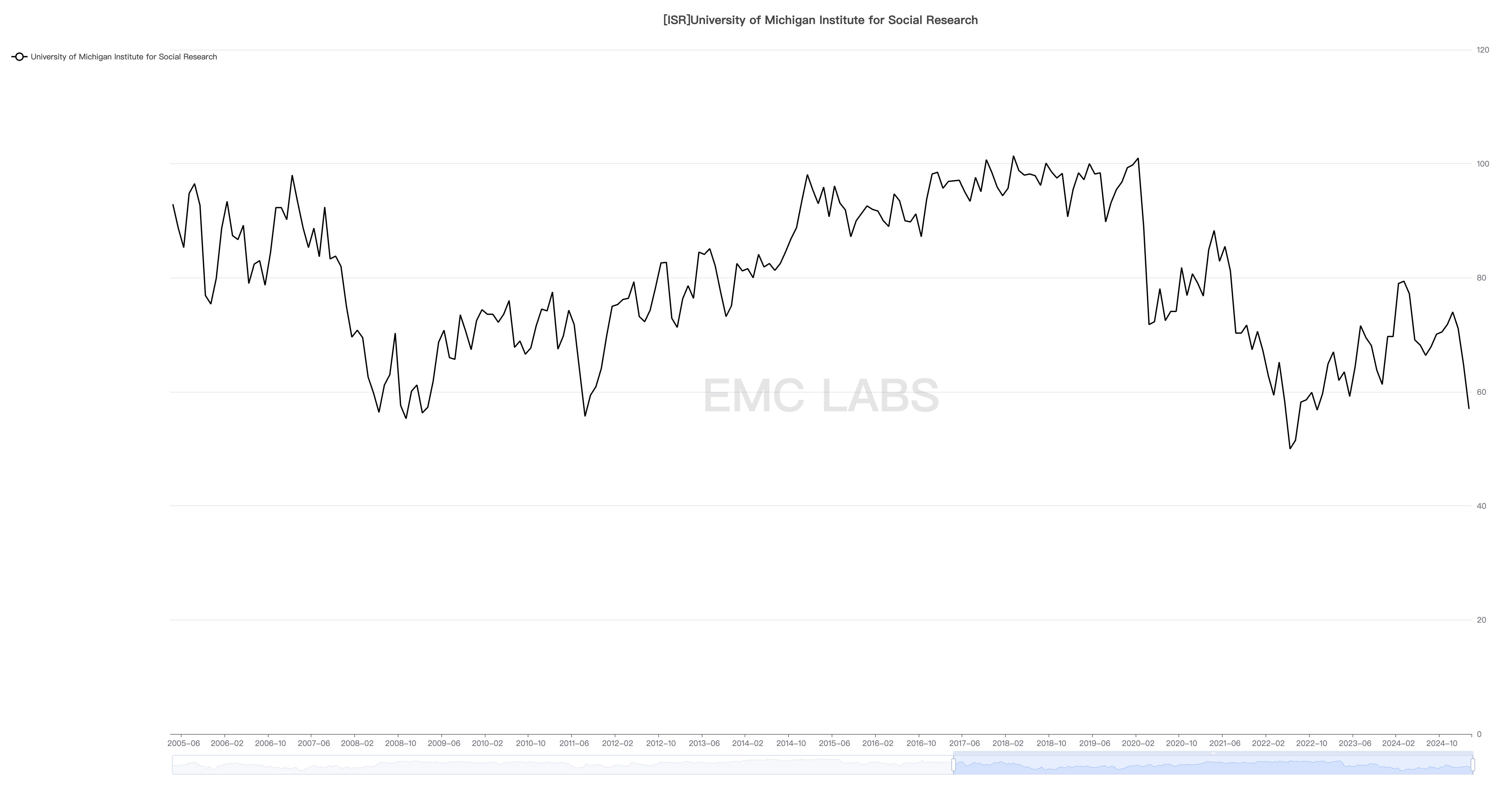

On Friday, the University of Michigan released the final value of the consumer confidence index in March, falling from 64.7 in February to 57, a decline from the initial value of 57.9, and lower than the median estimated value of economists surveyed. Consumers expect annual inflation to be 4.1% in the next five to ten years, the highest since February 1993, up from the initial value of 3.9%. The expectation for inflation in the next year is 5%, the highest level since 2022.

The University of Michigan Consumer Confidence Index is subjective data, but it fully reflects the decline in confidence of end consumers. On the same day, the Atlanta Federal Reserve Bank GDPNow model showed that the forecast value of the real GDP growth rate in the first quarter ended on the 28th was -2.8%. This figure resonates with the University of Michigan Consumer Confidence Index. As in February, the three major stock indexes responded with a sharp decline, with the VIX index rising 11.9% in a single day.

****University of Michigan Consumer Confidence Index

Trump's tariff policy has also been repeated many times this month. As of the end of March, tax increases for Canadian, ink, and Zhonghe for steel and aluminum products have been implemented.

Starting from April 2, the United States will impose a 25% tariff on all imported cars, covering vehicle types such as passenger cars and light trucks. A 25% tariff will also be imposed on core automotive parts (such as engines, gearboxes, electrical systems), with the effective date no later than May 3.

What is pending is that "reciprocal tariffs" will be imposed on major trade deficit countries, and the specific list will be released on April 2. On April 2, it is currently regarded as the most concerned day by the market for tariff wars.

Concerned about tariff uncertainty, "economic stagflation" and even "recession", funds continued to withdraw from the equity market in March, causing the Nasdaq, S&P 500 and Dow Jones to fall 8.21%, 5.75% and 4.20%, respectively, falling below or close to falling below the 250-day moving average, achieving a moderate technical adjustment.

Safe-haven funds poured into US Treasury bonds, pushing the yield on two-year US Treasury bonds to fall by 1.15% in a single month. The 10-year U.S. Treasury yield fell 0.45%, but combined with inflation expectations, long-term funds' expectations for long-term economic growth have fallen to negative growth levels.

Gold, another safe-haven target of mainstream funds, has been favored by key players. This month, London gold officially broke through the 3,000 yuan mark, with a sharp rise of 8.51% in a single month, rising to $3,123.97 per ounce.

Consumption confidence is sluggish and inflation expectations are rising. We are underestimating the growth of the US economy and even worrying about the uncontrolled and volatile tariff war that drives the US economy into "stagflation" and "recession". EMC Labs judges that Trump's tariff uncertainty is the biggest variable, which is driving the deterioration of US economy and consumer confidence, thereby driving the market to conduct "stagflation" and "recession" transactions. With Powell's relatively "dove" speech, the market began to play a game with the Federal Reserve's intervention in interest rate cuts in June, and the number of interest rate cuts as the US stock market fell has also risen from two to three. The inflation problem may be temporarily put on hold, but it has not disappeared instead as the tariff war will intensify. The impact of the tariff war will not be seen until it is settled.

**Crypto Assets: Running in a downward channel, extreme market conditions

may fall to $73,000**

Traders' worries and fears dominated the turmoil in capital markets in March, with BTC remaining relatively stable in March due to a sharp decline in late February, but the rebound was weak, eventually recording a monthly decline of 2.09%.

In February, BTC opened at

US$84,297.74 and closed at US$82,534.32, with a high of 95,128.88 and a low of

76,555.00, with an amplitude of 22.03%, and a trading volume slightly

increased compared with last month.

In February, BTC opened at

US$84,297.74 and closed at US$82,534.32, with a high of 95,128.88 and a low of

76,555.00, with an amplitude of 22.03%, and a trading volume slightly

increased compared with last month.

In terms of time, after a sharp drop at the end of February, BTC launched a technical rebound in the second and third week of March, but the rebound strength was weaker and the highest from the low point was only 16%. In the following week, as US tariff policies frequently appeared, inflation data, especially consumer confidence data, fell, BTC fluctuated downward with US stocks, and eventually recorded a monthly decline.

Technically speaking, the whole month was within the downward channel since February, and below the first upward trend line of this cycle. Moreover, since the sell-off at the beginning of the month, trading enthusiasm has dropped sharply, and trading volume has dropped week by week. Most of the time it runs below the 200-day line, and the tiers briefly touched the 365-day line on March 11.

Although BTC, a centralized exchange, was inflowing out of the state throughout the month, and there was a small amount of capital inflow in the BTC ETF channel, BTC, as a high-risk asset, still finds it difficult to attract buying power in the face of the panic of US stocks.

At the policy level, there are many positive news this month.

On March 6, US President Trump signed an executive order to formally establish the "Strategic Bitcoin Reserve" (SBR), including the approximately 200,000 BTC previously confiscated by the federal government into the reserves, and made it clear that these assets will not be sold within the next four years. At the same time, the order also proposed to establish a reserve of digital assets other than Bitcoin, aiming to enhance the United States' position in the global financial system through diversified assets. This is the first time that Bitcoin has been managed as a permanent national asset by the US government, marking the establishment of its "digital gold" status. Although the executive order is not legislative, it lays the foundation for subsequent policies.

On March 7, Trump held a White House crypto summit the next day after signing the executive order, inviting many industry and capitalists to participate to discuss the regulation, reserve policies and future development direction of the crypto industry. The summit further sent a signal that the U.S. government supports crypto innovation.

On March 29, the Federal Deposit Insurance Corporation (FDIC) issued guidelines to clarify the compliance process for banks to participate in cryptocurrency-related activities. It provides a clear path for traditional financial institutions to integrate into the crypto market, which helps banks intervene in crypto asset services.

On the same day, Trump pardoned three co-founders of cryptocurrency exchange BitMEX.

At the state level, on March 6, Texas proposed to establish a state-level Bitcoin strategic reserve, which has entered the "notification of intention" stage of the legislative process. Usually this step indicates that the bill is likely to pass. On March 31, the California Legislature formally submitted the Bitcoin Equity Act, aiming to clarify the legitimate rights and usage regulations of Bitcoin in the state.

All of the above shows that BTC and crypto assets are being implemented in the United States. These policies, regulations, etc. take time to truly take effect, but they are undoubtedly clearing the bottlenecks for the United States to build a "crypto-capital" in succession.

However, concerns and expectations of "stagflation" and "inflation" dominate the market, and traders who avoid risks and valuations choose to ignore these long-term positives and dominate the short-term decline in BTC prices.

Perhaps out of long-term positive support, BTC is still in a strong trend compared with US stocks that have returned to the November 6th point. The closing price of this month is $82,378.98, still higher than the $70,553 on November 5.

Considering the lack of liquidity, if tariffs exceed expectations or worse employment and economic data are released, BTC does not rule out that it will give up the entire increase in "Trump transactions" and fall to $70,000 to $73,000. But this will only happen when tariffs or employment data worsen far beyond expectations. If US stocks can gradually stabilize after the "Liberation Day" tariff negative news on April 2, the previous $76,000 may become the low point for this round of sell-offs.

**Funds: BTC Spot ETF outflow slows down, stablecoins continue to flow

in**

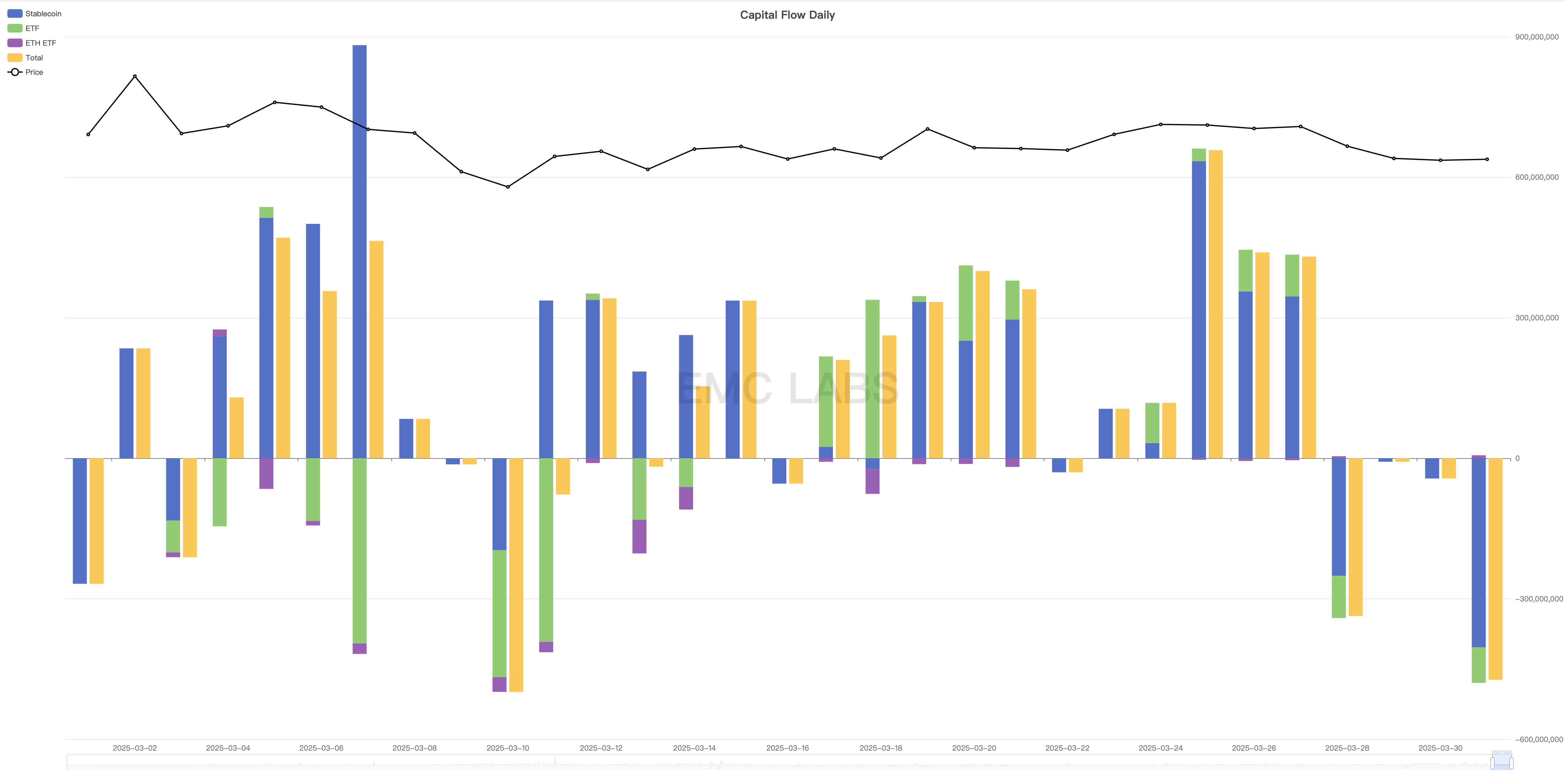

In the February report , we mentioned that the selling force of this round of adjustments came from the BTC Spot ETF. Its selling last month reached 3.249 billion, setting the largest monthly outflow record since its inception. This month, ETF channel funds continued to flow out of the situation overall, but the scale significantly reduced to US$634 million. Among them, outflows mainly came from early March, and after mid-month, the inflows were at most for 10 consecutive trading days.

Statistics of inflows and

outflows of funds in crypto market (month)

Statistics of inflows and

outflows of funds in crypto market (month)

Stablecoins continued to inflow $4.893 billion this month, slightly lower than last month's 5.3 billion.

The inflow and outflow of funds in ETF channel are completely synchronized with the rise and fall of BTC prices, which can be used as evidence that this round of adjustment comes from the joint effects of US stock adjustments.

On-site funds did not act independently, but followed the market to react, both during the decline from late February to early March and in the subsequent rebound.

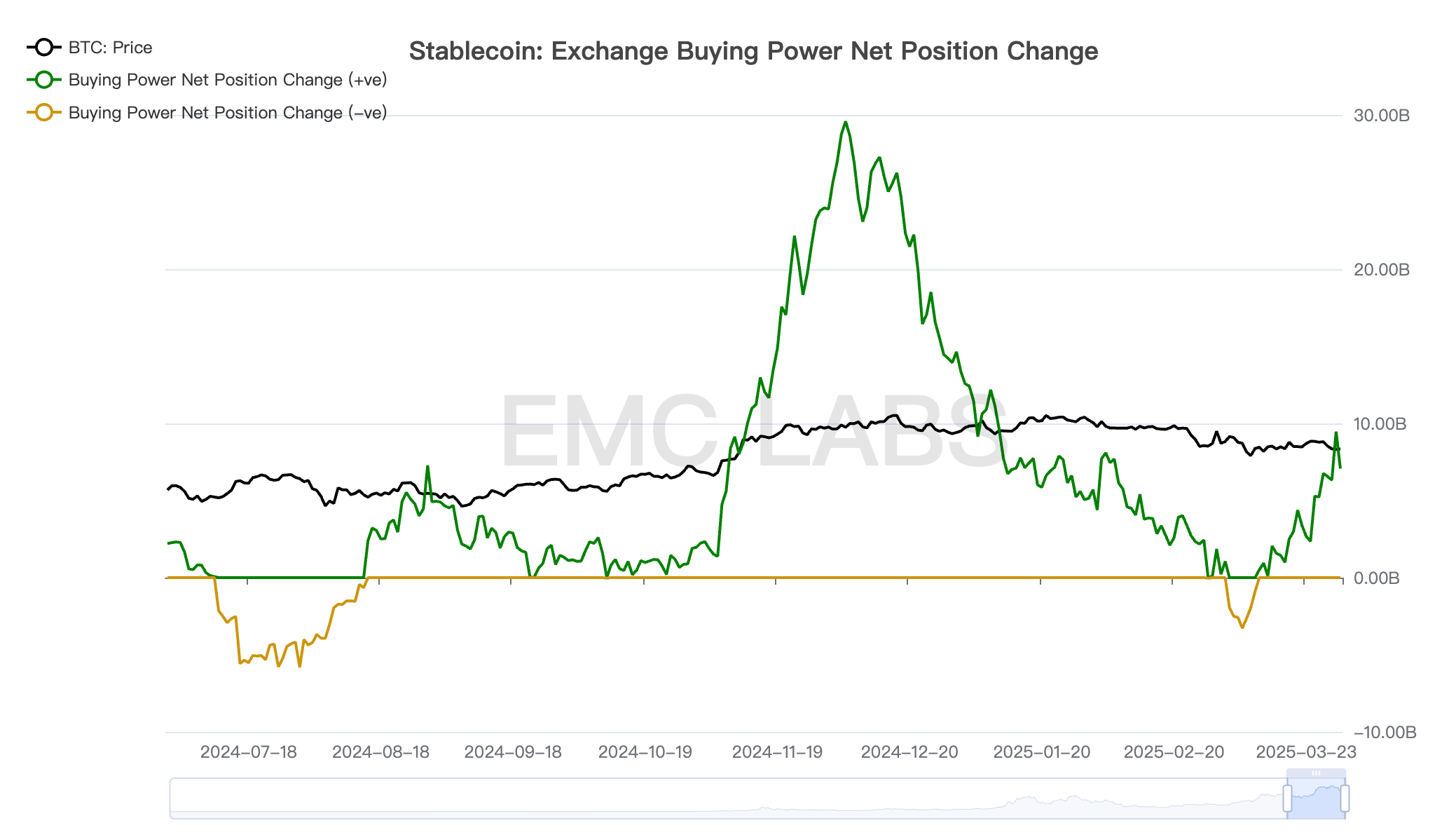

Changes in buying power of BTC

on centralized exchanges

Changes in buying power of BTC

on centralized exchanges

BTC prices will continue to link US stocks, especially the Nasdaq, so the US tariff war and the Federal Reserve 's decision to cut interest rates will continue to affect the medium- and long-term trend. The scale and sustainability of funds inflows in ETF channel have become an observation tool for judging medium and short-term trends.

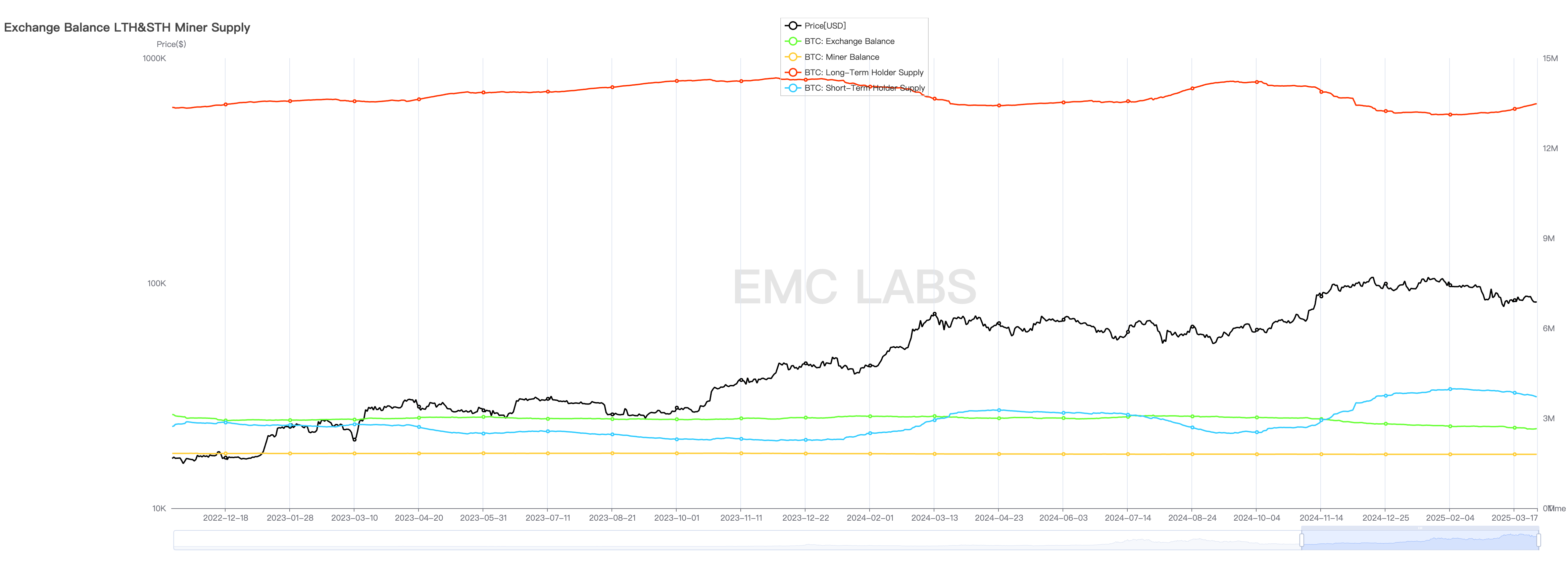

Secondary selling pause: chips return to long-handed cooling, short-handed continued to bear pressure

Before the adjustment in February, the main event that occurred within the crypto market was the second selling group of long-term players. This selling is not only a reaction to the flood of liquidity, but also objectively "suppresses" the rise in BTC prices. Since then, with the changes in the trading theme of US stocks, both US stocks and BTC valuations are facing downward pressure, and short-handed groups have begun to sell and avoid risks.

With the sharp drop in US stocks, the internal structure of the crypto market has suffered a huge impact and made corresponding adjustments. When the short-hand sell-in increased and the price fell rapidly, the long-hand group stopped selling around mid-February and instead "increased holdings" the chips, which greatly reduced the downward pressure on the market and reduced the chip heat to help the market cope with the decay of liquidity, so that the price can reach a new balance after the decline.

Statistics of long-term and

short-term positions and miner groups

Statistics of long-term and

short-term positions and miner groups

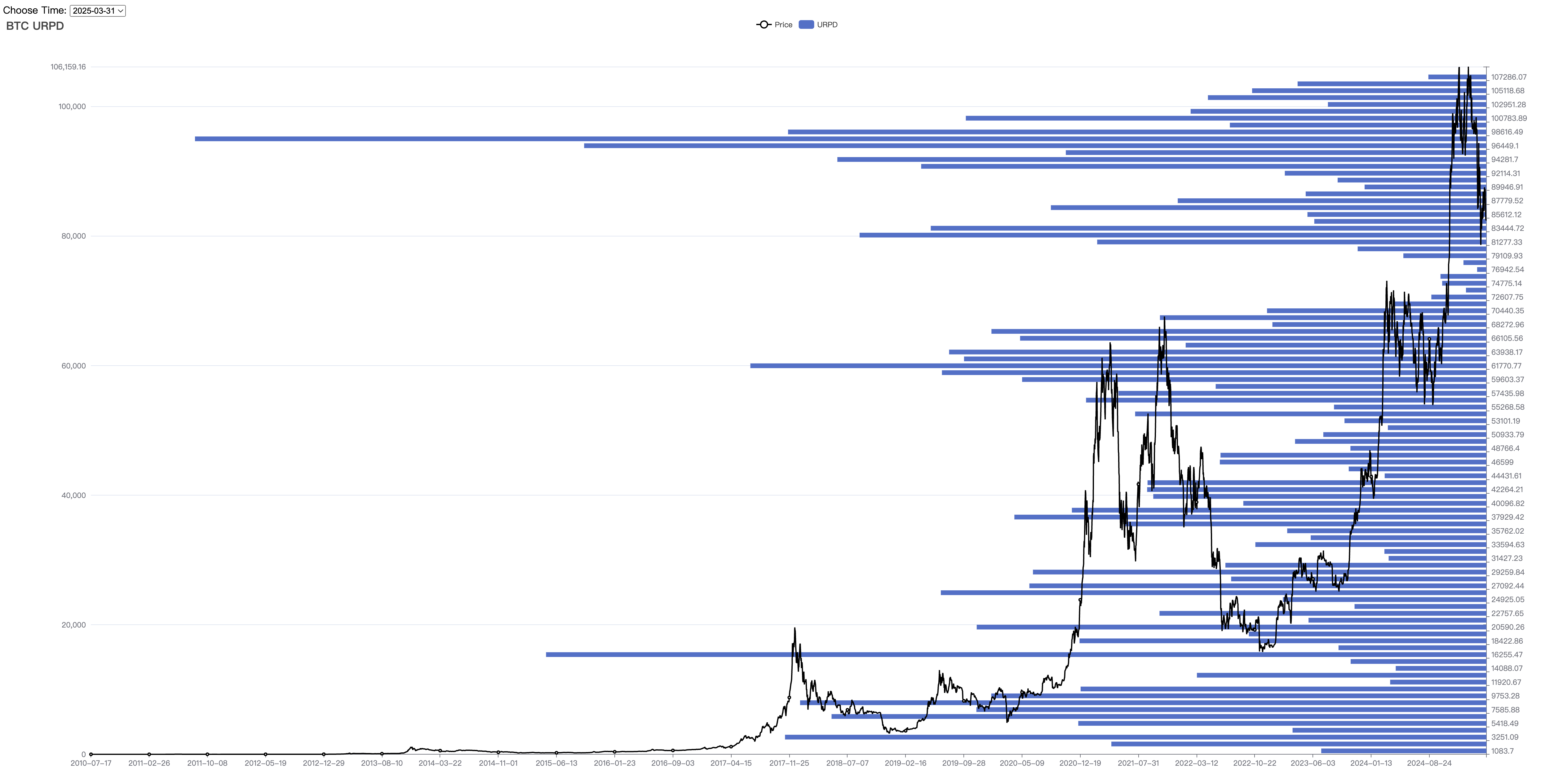

According to eMerge Engine data, the extent of losses caused by this round of decline has exceeded the losses formed in the Carry Trade storm in 2024, becoming the largest loss range in the new cycle since January 2023. On the chain, it is manifested as a large amount of BTC, which was originally priced in the range of 90,000 to 110,000 US dollars, entering the range of 76,000 to 90,000 US dollars, partially solving the problem of insufficient allocation of 73,000 to 90,000 chips.

Distribution of BTC chips on

chain

Distribution of BTC chips on

chain

This round of rapid declines. Although long-term hands also have a take-profit operation, the scale is not large. The chips that changed hands in the panic mainly come from BTC that traded in the range of US$90,000 to US$110,000 after November last year.

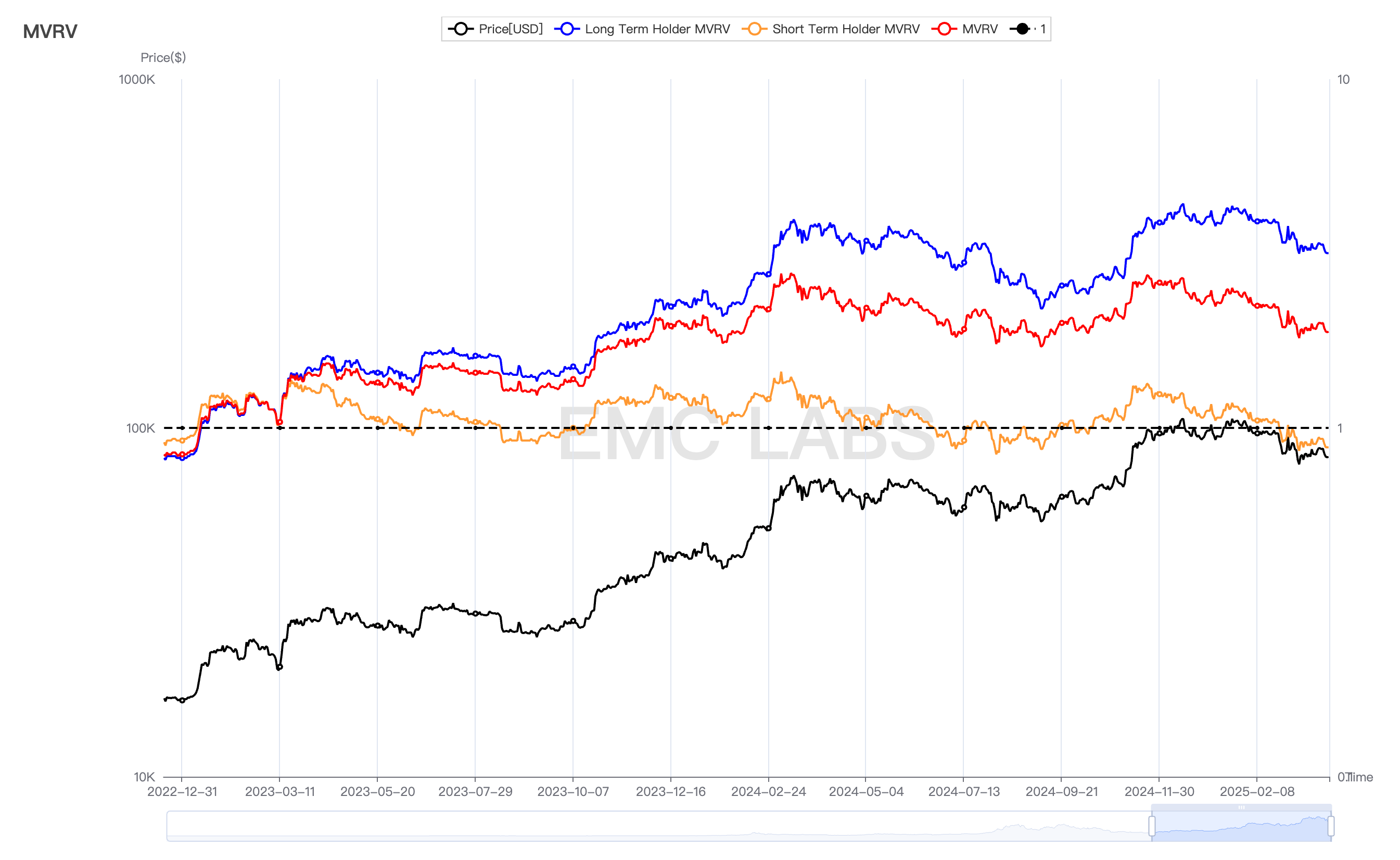

Although the short-hand group has completed a considerable selling, the current situation of floating profits and losses in the entire chain is still not optimistic. The largest floating loss for short-handed groups in this round of decline reached 14%, close to 16% on August 5, 2024. As of March 31, the short-hand group still had a floating loss of 12%, and the patience and tolerance of this group are still facing major challenges.

Statistics on floating profits

and losses of different BTC holders

Statistics on floating profits

and losses of different BTC holders

If this pressure is converted into selling pressure, it may push BTC to $73,000, which is the upper edge of the new high and the price before Trump was elected.

Conclusion

Judging from external factors, BTC prices are currently completely restrained by the game between the expectation of economic "stagflation" and even "recession" due to the chaos in tariffs and inflation stickiness and whether the Federal Reserve compromises interest rate cuts.

From the perspective of internal factors, short sellers have experienced the largest selling loss this cycle in more than a month. The selling pressure has shrunk, but the pressure is still high due to floating losses. It is not ruled out that they will continue to sell to alleviate the pain, but the probability is relatively small. Long-term hands "from selling to increasing" play a great role in stabilizing the market.

Stablecoins continue to flow in, and there are also signs of inflow of funds on the BTC ETF channel. However, if the US stock market falls, the ETF channel funds may be sold again, which will become the active force driving the price downturn.

On April 2, Trump 's tariff war will usher in a temporary high, and US stocks may usher in a medium- and short-term bottom. The opposite is the way. If the tariff policy does not deteriorate too much, the US economy will show signs of recession but not serious. If the Federal Reserve cuts interest rates again in June, BTC, which has experienced a huge valuation, will be a high probability that it will turn around in Q2.

After experiencing the storm in the first quarter, the outlook for the second quarter is still not clear enough, but the most painful moment may have passed. When Washington and the Federal Reserve return to a rational game state, the market should be able to return to its own operating rules.

chaincatcher

chaincatcher