Crypto Investment Institutional Watch in 2025: Star Projects and the Promise of Decentralization

Reprinted from jinse

01/04/2025·5MIn 2025, the cryptocurrency industry will enter a stage of in-depth development. Top crypto investment institutions have a profound impact on the entire industry by injecting capital, guiding market trends, and shaping the direction of technological development. These institutions promote project success on different tracks and face challenges at the same time. The process reveals their strategic vision and practical attitude towards decentralization commitment. This article will explore the areas of focus of leading investment institutions, asset management scale, star project performance, 2025 predictions, and actual efforts to support decentralization.

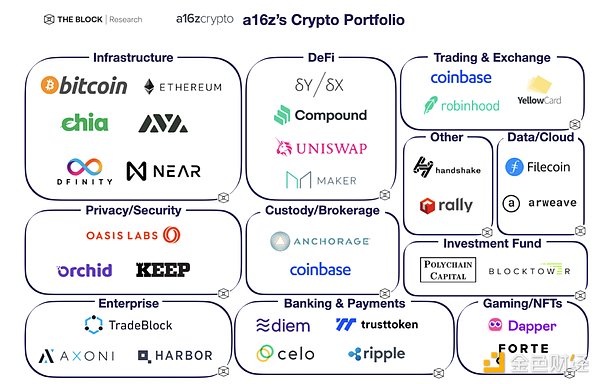

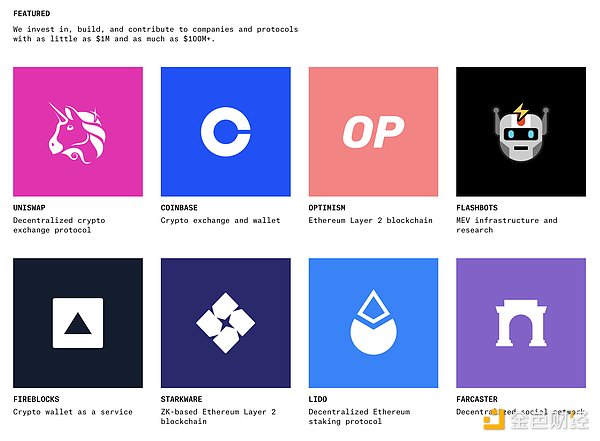

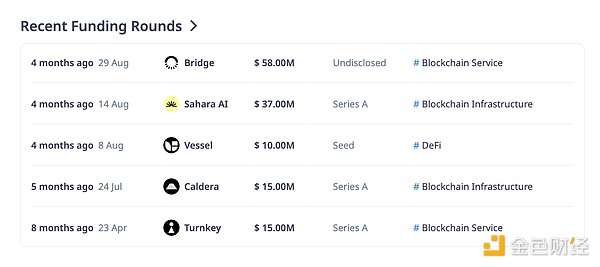

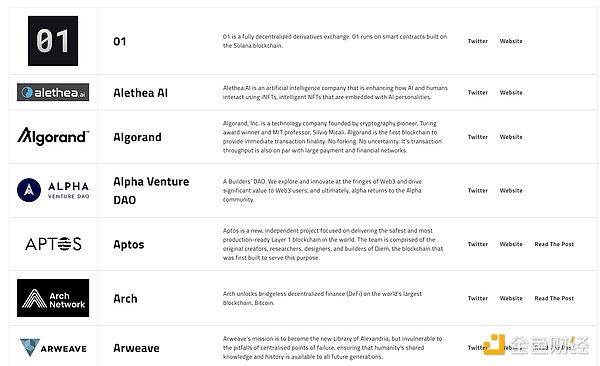

1.Andreessen Horowitz (a16z Crypto)

- Areas of focus: Web3 infrastructure, Layer-2 extensions, decentralized finance (DeFi) and AI blockchain integration.

- AUM: ≈$12 billion.

- Star projects:

- Success stories: Optimism (Layer-2 extension) greatly improves the scalability of Ethereum, and Dapper Labs (NFT ecosystem) expands the field of crypto art and entertainment.

- Challenges faced: Although a16z strongly supports modular architecture, its deep involvement in project governance has triggered centralization disputes.

- 2025 Forecast: Continue to promote the integration of AI and blockchain, invest in independent AI agents and cross-chain infrastructure.

- Decentralization support: Funds are concentrated in decentralized protocols, but governance rights are relatively strong, and decentralization commitments are controversial.

2. Paradigm

- Focus areas: Zero-knowledge proof (ZK), DeFi innovation, decentralized exchanges, cross-chain interoperability.

- AUM: ≈$8 billion.

- Star projects:

- Success stories: Uniswap v4 promotes DEX innovation; StarkWare has made breakthrough progress in the field of zero-knowledge proof technology.

- Challenges faced: StarkWare’s privacy solution has limited application scope, and the community has reservations about its high technical threshold.

- 2025 prediction: zk-SNARKs privacy solutions and dynamic DeFi strategies will become more popular.

- Decentralized support: Committed to community-led governance, but Paradigm’s advisory role raises questions about centralization.

3. Binance Labs

- Focus areas: BSC ecosystem, GameFi, DeFi and real world assets (RWA).

- AUM: ≈$7 billion.

- Star projects:

- Success stories: PancakeSwap became the top DEX on BSC, and Venus Protocol provided decentralized lending solutions.

- Challenges faced: Balancing the relationship between investment and CEX token listing, and evaluating the impact on the decentralized competitive environment of the track.

- 2025 prediction: The GameFi track will continue to expand, and the BSC ecosystem will attract more institutional adoption.

- Decentralization support: Strong reliance on Binance platform, weak decentralization commitment.

4. Sequoia Capital Crypto

- Focus areas: DeFi protocols, Layer-1 public chains, and blockchain SaaS solutions.

- AUM: ≈$5.5 billion.

- Star projects:

- Success Stories: The rapid development of the Solana ecosystem and Chainlink’s oracle network provide strong support for DeFi.

- Challenges faced: Projects on NFT and SaaS solutions are not performing as expected.

- 2025 prediction: Modular blockchain architecture and BaaS model will become popular.

- Decentralization support: It not only supports decentralized projects, but also focuses on the profitability of centralized services.

5. Multicoin Capital

- Focus areas: Layer-1 public chain, decentralized storage, tokenized real- world assets (RWA).

- AUM: ≈$4.2 billion.

- Star projects:

- Success stories: The Graph performs well in the field of data indexing; Render Network provides a solution for decentralized GPU rendering.

- Challenges faced: RWA projects have higher legal and compliance risks and market acceptance is slow to grow.

- 2025 Forecast: The tokenized RWA market may exceed US$300 billion.

- Decentralization support: Strongly advocates decentralized applications and governance models.

6. Coinbase Ventures

- Focus areas: Stablecoins, Layer-2 solutions, DeFi applications.

- AUM: ≈$3 billion.

- Star projects:

- Success stories: The launch of Base Network lowered the entry barrier for developers; Circle promoted the popularity of USDC.

- Challenges faced: The stablecoin space faces tighter regulations that may limit growth.

- 2025 Prediction: Stablecoins will dominate cross-border payments.

- Decentralization support: Focus on practicality and low degree of decentralization.

7. Pantera Capital

- Focus areas: DeFi, Ethereum ecosystem, GameFi and real world asset tokenization (RWA).

- AUM: ≈$5 billion.

- Star projects:

- Success stories: Filecoin promotes the popularity of decentralized storage; Balancer provides innovative solutions for DeFi automated market makers.

- Challenges faced: GameFi-related investment is growing slower than expected and lacks breakthrough user growth.

- 2025 Forecast: The convergence of gaming and the Metaverse will drive a new wave of cryptocurrency adoption, with the tokenized RWA market expanding significantly.

- Decentralization support: Firmly support the construction of a decentralized ecosystem and focus on the long-term value of open networks.

8. Polychain Capital

- Areas of focus: DAO governance, decentralized storage, cross-chain interoperability and modular blockchain.

- AUM: ≈$4 billion.

- Star projects:

- Success stories: Avalanche provides high-performance Layer-1 solutions; Yearn Finance helps improve DeFi’s revenue aggregation efficiency.

- Challenges faced: Investment in cross-chain solutions faces the risk of fierce competition and lagging technological progress.

- 2025 prediction: DAO-driven governance model will become popular, and the application of modular blockchain architecture will be further expanded.

- Decentralization support: Highly supports the development of decentralized governance and infrastructure, and is a staunch advocate of decentralization.

9. Digital Currency Group (DCG)

- Focus areas: Institutional DeFi, cryptocurrency exchanges and tokenized assets.

- AUM: ≈$6 billion.

- Star projects:

- Success stories: Grayscale Bitcoin Trust became an institutional investment vehicle for Bitcoin; Foundry provided leading mining infrastructure support.

- Challenges faced: The centralization of mining and the centralized management of trust products have triggered industry criticism.

- 2025 Forecast: Tokenized securities will attract more institutional investors, driving the mainstreaming of cryptocurrencies as financial instruments.

- Decentralization support: Due to its reliance on centralized investment vehicles, decentralization support is weak.

10. Delphi Digital

- Focus areas: Web3 infrastructure, NFT ecosystem, DeFi innovation and decentralized science (DeSci).

- AUM: ≈$3 billion.

- Star projects:

- Success stories: Axie Infinity promotes the rise of GameFi concept; Aave performs well in the field of DeFi lending.

- Challenges faced: The actual profitability of DeSci-related projects has not yet emerged, and user growth is slow.

- 2025 prediction: Decentralized science will be further integrated into the blockchain, and the application of NFT in identity management and equity distribution will expand.

- Decentralization support: Actively promote decentralized science and community-led governance to provide a more open collaboration platform for the encryption ecosystem.

panewslab

panewslab