Comprehensive interpretation of Fluid: vowing to become the new king of DeFi after rebranding?

Reprinted from panewslab

12/20/2024·5MAuthor: @thedefiedge , crypto KOL

Compiled by: Felix, PANews

On December 4, Fluid Protocol, a DeFi protocol owned by the Instadapp team, released a rebranding and growth plan proposal. It plans to rename the token INST to FLUID and implement a repurchase plan of up to 100% of the revenue. Fluid plans to launch a series of upgrades in the next 12 months, including listing DEX on L2, upgrading ETH Lite Vault, adding more asset support, and launching DEX v2. Crypto KOL @thedefiedge published an article explaining Fluid Protocol. The following are the details.

Project name: Fluid

Token: FLUID (formerly INST)

Market cap: $362.4 million

TVL: $3.47 billion

Number of holders : 5,823

Track: Defi - Lending + Dex

The project has no VC funding, no marketing hype, no points or gamification, pure product domination.

Fluid is the most innovative DeFi protocol this year. Instadapp has just completed the rebranding and rebranding of Fluid, and this article is a brief report on the protocol.

Imagine a platform where your loans not only cost you money, but also make you money. This is what makes Fluid unique. Fluid (formerly Instadapp) has been building since 2018 and is no stranger to DeFi innovation.

During the summer of DeFi, Fluid managed over $15 billion in TVL, solidifying its position as a key infrastructure player and one of the earliest middleware solutions for DeFi.

Middleware can be considered a bridge. It connects users to different DeFi protocols such as Aave, Compound, and Maker, making it easier to access their services from one platform.

Users can manage everything including lending and earning without having to access each protocol individually. All this is done through Instadapp.

Now Instadapp is being reinvented as Fluid, an ecosystem that combines money markets and DEX to make liquidity and debt more efficient. It is the core of four product suites, including:

- Instadapp Pro: Advanced tool for advanced DeFi users.

- Instadapp Lite: Simplified, user-friendly DeFi gateway.

- Avocado Wallet: The next generation of smart wallet, enabling seamless cross-chain interaction.

- Fluid Protocol: Combines currency markets and DEX to achieve unprecedented liquidity efficiency.

Fluid's goal is to make DeFi easier and more efficient by introducing features such as smart collateral and smart debt that can help users make more money and do more with their assets.

Game-changing innovation

Smart Collateral: Most lending protocols allow users to deposit collateral, and Fluid by depositing currency pairs such as ETH<>wstETH, the user's collateral can not only support loans, but also serve as liquidity in DEX to earn transactions fee.

Smart Debt: Debt has always been a cost. Fluid turns debt into assets. The borrowed funds are used as transaction liquidity and earn fees, thereby reducing users’ borrowing costs. In some cases, high transaction volume may even mean that users are actually getting paid for lending.

Let’s understand it through an example:

In the example above, borrowing costs drop to approximately 7.57% (originally 12.44%) as the transaction APR is offset by approximately 5%.

This is a practical application of smart debt, where users can earn transaction fees on their borrowing positions, effectively reducing borrowing APY.

The bigger picture for Fluid

In the next 2-3 years, DeFi lending will grow to a market opportunity of over US$100 billion. Currently, giants like Aave and Compound dominate, but there is room for challengers with new ideas.

Fluid’s role lies in the combination of lending and DEX liquidity. Its liquidity will be enough to challenge Uniswap, with the goal of reaching a market size of US$10 billion by 2025.

Fluid Dex has become the third largest DEX on Ethereum, with a seven-day trading volume of $428 million and a TVL of $1.42 billion one month after launch.

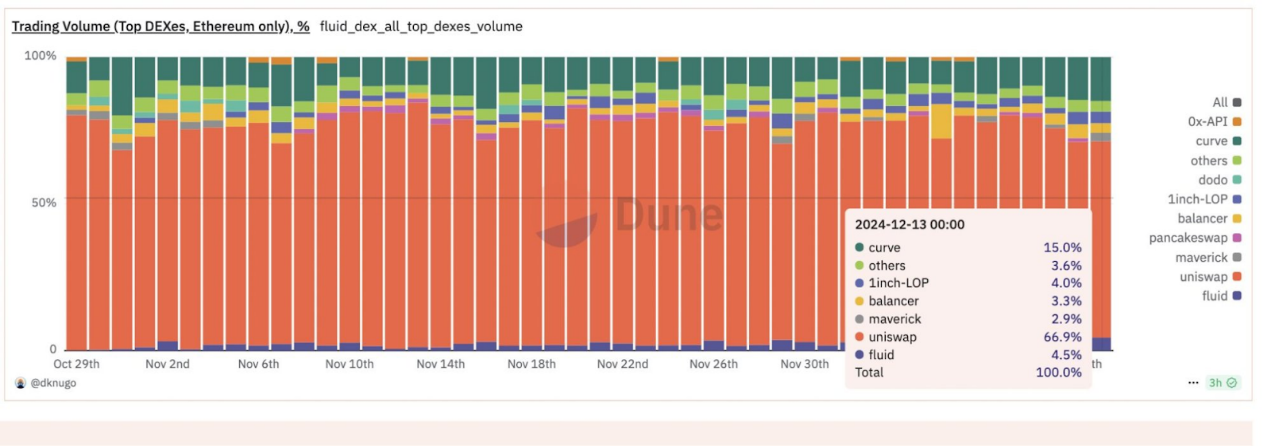

The top three Ethereum DEXs by trading volume market share:

- Uniswap: 66.9%

- Curve Finance: 15.0%

- Fluid Dex: 4.5%

Fluid’s Dex trading volume, [Dune](https://dune.com/dknugo/fluid-dex)

Fluid’s DEX allows users to trade smarter. With features like smart collateral, LPs can use their liquidity positions as collateral to earn trading fees while reducing risk.

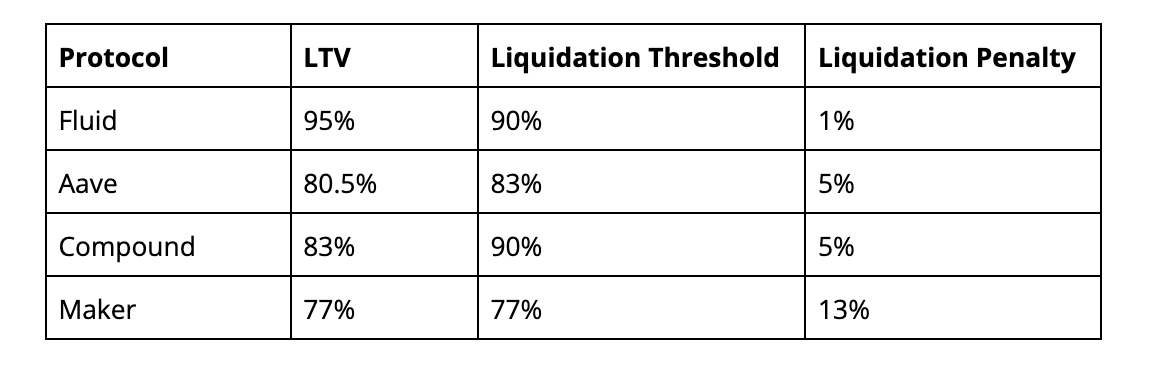

For lenders, Fluid is more efficient than competitors such as Aave, Compound, and MakerDAO.

For example, Fluid’s wstETH <> ETH token pair has a liquidation penalty as low as 0.1%, making it cheaper and safer for users.

Fluid has already processed over $1 billion in trading volume and has plans to expand into derivatives, real-world assets, interest rate swap and foreign exchange markets.

On the Ethereum mainnet, the average return rate of USDC is 15%, and the average return rate of GHO is 14%. The yield on USDC on Base and Arbitrum is around 18%.

With yields like these, it’s no surprise that stablecoins are flocking to them.

The name change to FLUID is in line with Instadapp’s vision of creating a sustainable DeFi ecosystem that brings strong value accumulation to token holders.

Buyback programs and strengthened governance are expected to drive speculative demand and organic growth.

key catalyst

- Rename INST to FLUID and perform 1:1 token migration (no dilution).

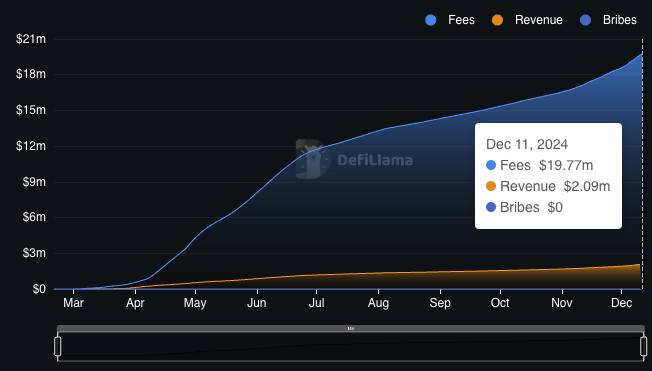

- When the current year's revenue reaches US$10 million per year, the buyback plan is initiated, and up to 100% of the revenue can be used.

- Lido Protocol and Fluid strategic partnership proposal.

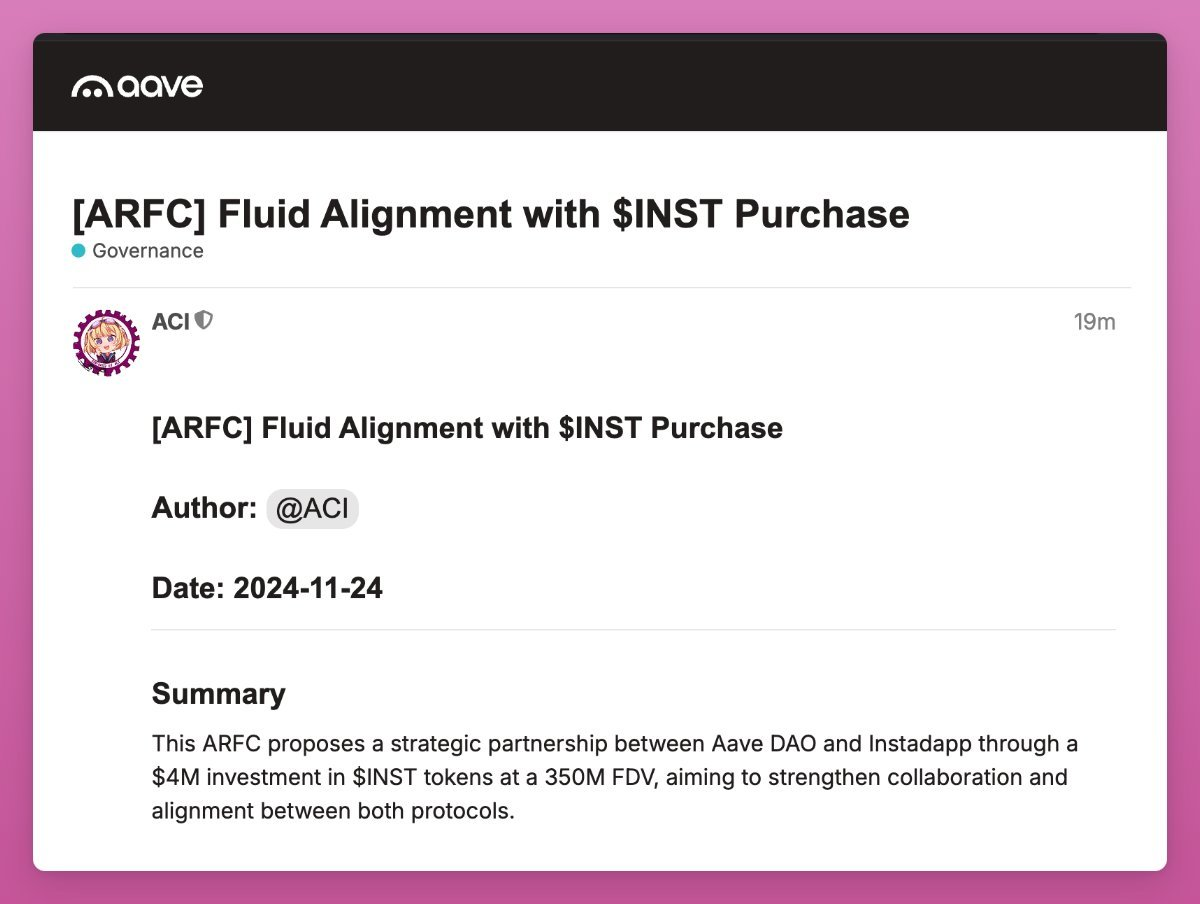

- Aave DAO proposes to acquire 1% of the total supply of INST tokens.

- Extension: Added support for new markets such as derivatives and real-world assets.

- Growth incentives target a market size of $10 billion by 2025.

- 12% of FLUID is allocated for CEX listing, market making and financing.

- Develop protocol-owned FLUID liquidity on FLUID DEX.

- FLUID will be listed on ByBit, and more CEX are expected to be listed.

Instadapp is operated by a team with over 5 years of experience and is backed by the likes of Naval Ravikant, Balaji Srinivasan, Coinbase Ventures, and Pantera Capital.

Team members include @smykjain , @sowmay_jain , @DeFi_Made_Here .

The Fluid difference

- Committed to Security: Instadapp has not been hacked in the past 6 years and has undergone 6 audits to date.

- Revenue Sharing Opportunities: Fluid combines lending and transaction fees to provide users with multiple revenue streams and drive higher TVL.

As the protocol grows, future plans include algorithmic buybacks to reward token holders.

Roadmap: Fluid is expanding into derivatives, real world assets and FX markets. Lending and DEX activities are encouraged, with up to 0.5% of the total supply available per month. New token economics (such as revenue sharing) are designed to attract more users and create value.

Strategic cooperation:

Lido Alliance has proposed a partnership to drive adoption of wstETH on Fluid, targeting billions of dollars in TVL.

- Lido will provide TVL growth incentives, brand support and drive adoption on L2.

- Fluid will share 30% of fees from the Instadapp Lite ETH vault and 50% from the LRT<>wstETH vault.

Wintermute has proposed a 1-year loan of 700,000 INST/FLUID with a $10 strike price repayment option to provide liquidity on major DeFi and CEX platforms.

Aave DAO will use GHO to purchase “$4 million worth of INST tokens (approximately 1% of FDV’s total INST supply of $350 million).”

Aave DAO will allocate up to 1/3 of INST tokens via Merit to support GHO pairs on Fluid.

Use cases for FLUID tokens

The FLUID token is not only used for governance, but also plays a central role in the growth and value accumulation of the protocol:

- Revenue Sharing: Up to 100% of protocol revenue will be used for buybacks to support token value

- Governance: Token holders can influence key decisions such as fee structure, fund usage and future upgrades

- Liquidity Rewards: FLUID will provide incentives for stablecoin lending, DEX activity, and the protocol’s own liquidity for token holders.

There haven’t been a lot of exciting changes in DeFi over the past few years. Most protocols make only minor improvements, nothing truly groundbreaking.

Fluid was the first protocol to truly challenge Uniswap. In just one month, Fluid became the third largest DEX on Ethereum, with a single-week trading volume of $428 million.

This is the key. They did this with just three pools. Imagine what happens when they scale up.

It is not just ordinary users who have noticed this. DeFi institutions including Lido, Aave and other DeFi institutions are lining up to cooperate with Fluid. People who understand this field are betting heavily on Fluid. Fluid is not just another DEX or lending protocol. With smart collateral, users’ assets will not be idle and transaction fees will be earned. With smart debt, users’ loans can generate income, thereby lowering borrowing costs.

Related reading: TVL’s monthly increase is as high as 3 times, will the new DeFi player Fluid subvert Aave and Uniswap?

chaincatcher

chaincatcher