CoinShares: Net outflow of digital asset investment products last week was $415 million

Reprinted from panewslab

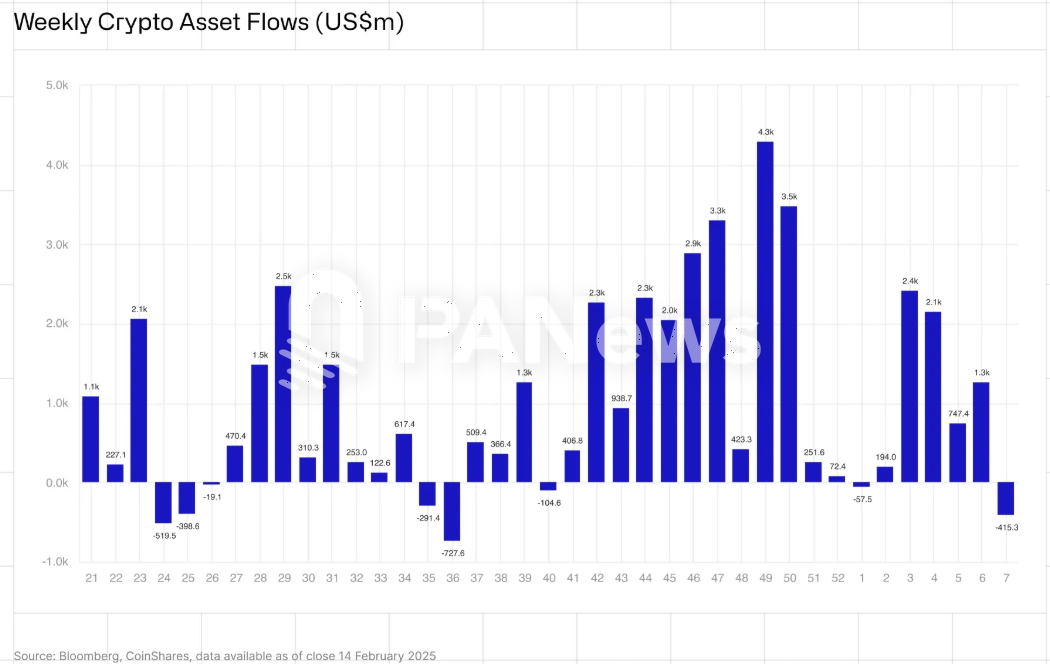

02/17/2025·2MPANews reported on February 17 that digital asset investment products have experienced a significant outflow of $415 million for the first time after a record 19-week continuous capital inflow, with a total of $415 million. The main reason for the outflow is that the hawkish remarks of Federal Reserve Chairman Powell and the U.S. CPI data exceeded expectations, resulting in higher market expectations for interest rates. Bitcoin was most affected by this, with the outflow reaching $430 million.

Most of the outflows came from the United States, reaching $464 million, while markets in other countries were relatively unsignificantly affected. Germany, Switzerland and Canada recorded inflows of $21 million, $12.5 million and $10.2 million respectively.

Solana is the asset with the most inflows, with $8.9 million inflows, followed by XRP ($8.5 million) and Sui ($6 million). In addition, blockchain stocks have also attracted $20.8 million inflows, and have attracted a total of $220 million inflows this year.

chaincatcher

chaincatcher

jinse

jinse