CoinShares 20,000-Word Crypto Outlook for 2025: As regulations become clearer, next year is expected to be the most transformative year for the industry

Reprinted from panewslab

12/17/2024·6MAuthor: CoinShares

Compiled by: Scof, Chaincatcher

summary

As we enter 2025, the cryptocurrency landscape continues to evolve at an alarming rate, influenced by political turmoil, technological innovation, and changing market dynamics. Next year promises to be the most transformative year for the industry, with impacts across regulation, adoption and innovation.

CoinShares is committed to analyzing these key developments, and our 2025 Outlook aims to provide the insight and foresight needed to navigate this rapidly changing space. In this report, we take a deep dive into the major forces reshaping crypto today, such as:

- The far-reaching impact of political changes in the United States

- Significant growth in Bitcoin mining

- The Rise of Companies Focused on Bitcoin Yields

- Issues surrounding Solana development

- Ethereum’s Fragile Growth Trajectory

2025: The year cryptocurrencies push their boundaries

By JEAN-MARIE MOGNETTI, CEO, CoinShares

2024 will undoubtedly be a turning point for the cryptocurrency industry. The field has experienced rapid expansion, building on the solid foundation laid during the previous market downturn. At CoinShares we have seen this growth firsthand, with our assets under management (AUM) approaching the important £10 billion mark.

We believe this is just the beginning. Recent market developments prompt us to think cautiously about future trends. In January, the U.S. approved a Bitcoin spot ETF, followed by an Ethereum-related product, which became a key factor in driving market momentum. We expect more altcoin ETFs to emerge with SEC approval, although progress may be slower than market expectations. Solana appears to be a strong candidate, but established cryptocurrencies like Ripple's XRP and Charlie Lee's Litecoin are also potential contenders.

Regarding Solana, it’s been a big year for the blockchain. After the FTX crash, Solana rebounded quickly and won over retail investors with its user-friendly software, becoming a popular choice for meme coin launches. To compete with Ethereum, Solana will need more than just high throughput. Solana must attract institutional investors and develop a clear strategy to address decentralization and frequent network outages.

Solana's case highlights the important impact of meme coins this year. Although dismissed by some as trivial, meme coins have become an important part of crypto culture. Similar to NFT collections in 2020, some meme coins may gain collectible value or even become "cultural symbols" in the future.

Nonetheless, Bitcoin remains our focus, with analysts predicting significant growth. The adoption strategy pioneered by Michael Saylor's MicroStrategy company is now widely accepted by miners. Many public companies have begun diversifying their financial assets by purchasing Bitcoin, often at the behest of their boards and shareholders, who view Bitcoin as an ideal hedging tool. Governments are also moving to build Bitcoin reserves, with initiatives by U.S. Senator Cynthia Lummis and President-elect Trump leading the trend. The BRICS countries have proposed similar initiatives, signaling Bitcoin’s growing influence at the top levels of government.

Changes in the industry are also reflected in the entry of many traditional financial companies into the cryptocurrency market. For example, Robinhood recently acquired Bitstamp, or BONY finally launched its custody service. As the U.S. regulatory environment becomes clearer, we expect M&A activity to increase, and valuation gaps and the sufficiency of capital will allow traditional U.S. financial institutions to re-enter the cryptocurrency competition. Europe will continue to be the main destination for these deals.

In technology, the development of AI Agents will redefine the industry. These agents, operating autonomously on the blockchain, are beginning to conduct efficient transactions among themselves, bypassing human intervention. Coinbase has already deployed its AI-based on-chain trading solution, a move that is likely to be followed.

The Bitcoin Trio: Balancing Economic Uncertainty, Geopolitics and

Technological Evolution

By JAMES BUTTERFILL, Head of Research, CoinShares

In recent years, CoinShares has focused on monetary policy, particularly its role in shaping Bitcoin as an emerging store of value, and the historic inverse correlation between Bitcoin and the U.S. dollar. However, focusing solely on these aspects misses Bitcoin’s broader potential. We believe that Bitcoin will eventually play a significant role in global trade, driven by its strong connection to the growth of the Internet and digital infrastructure. Treating Bitcoin as a mere store of value underestimates its potential.

Economic factors remain important, and the Federal Reserve recently cut interest rates by 50 basis points. Although jobless claims continue to be stable and market valuations are higher, this move reflects its shift to supportive monetary policy, thus increasing investor confidence in Bitcoin. . This move shows that the Federal Reserve has begun to cut interest rates when the economy is stable and is ready to support the market through the economic downturn through monetary policy, creating a "golden middle ground" scenario. However, this optimism has led to a crowded market, with 80% of investors expecting a "soft landing" for the economy. However, this consensus may overlook potential risks.

There are many directions for the future economic direction. In an optimistic scenario, continued growth in government spending could stimulate economic growth and potentially increase inflation, especially if import tariffs are raised, although specific policies remain uncertain. Instead, President-elect Trump has proposed including Elon Musk in a plan to cut government spending and tackle the national debt. During the campaign, Trump suggested appointing Musk to lead a new "Department of Government Efficiency" with the goal of cutting federal spending by about $2 trillion. Musk has acknowledged that these measures may cause "short-term distress," but he believes they are critical to "long-term prosperity." The partnership underscores Trump's determination to push for major fiscal reforms, leveraging Musk's reputation for improving efficiency and cutting costs. In this new political landscape, the delicate balance between economic growth and low inflation remains critical, but fiscal conservatism could lead to looser monetary policy.

Fed policy is likely to stimulate demand through gradual interest rate cuts, possibly to around 2.6%, especially if inflation remains low. However, the lag effect of monetary policy means that such easing may only affect the real economy slowly. Households, especially in the lower-income bracket, face liquidity constraints, limiting potential consumption growth, while the housing market remains sluggish despite interest rate adjustments.

Restrictions on trade and labor supply, as well as increasingly tight lending standards, continue to pose challenges. The slowdown in corporate capital expenditures suggests that businesses, especially smaller companies, are spending more prudently amid financial pressure. Despite gains in productivity, weakness in capital spending is seen as a potential threat to future economic growth.

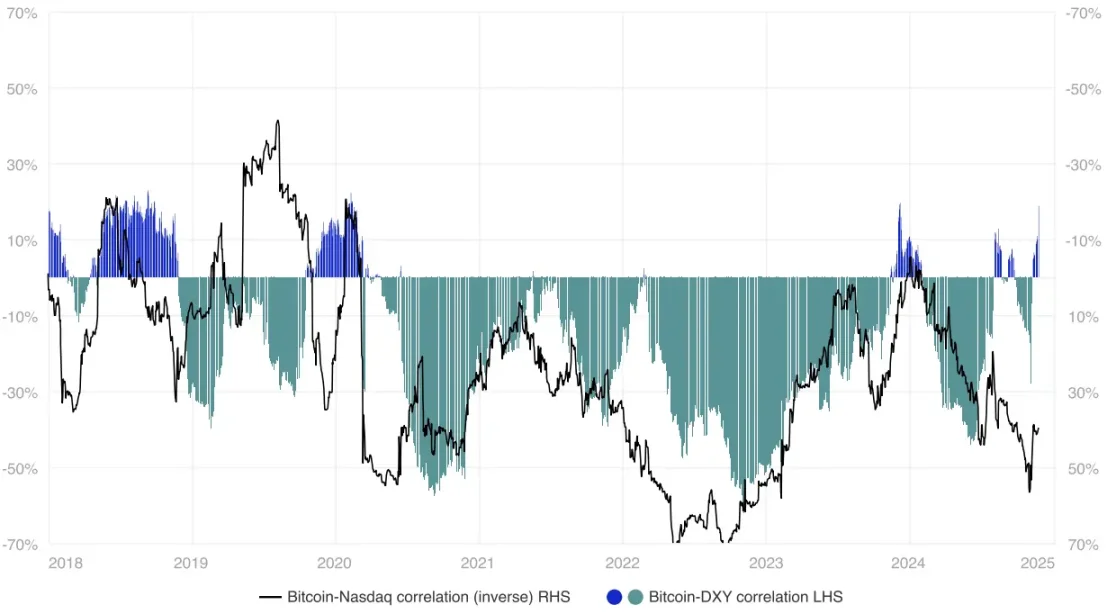

While the Fed has some room to maneuver in a low-inflation environment, weak job growth and conservative consumer spending suggest any economic recovery is likely to be slower, so patience may be required and the Fed may ease more than expected. measure. Historically, Bitcoin has had a strong inverse correlation with the U.S. dollar, with the correlation coefficient averaging around -20% based on daily data and -0.70 based on weekly data since 2018, although this Correlation sometimes fluctuates, as shown in the chart below.

Bitcoin vs USD vs Nasdaq. Source: Bloomberg, CoinShares, data available as of close 23 November 2024

This inverse correlation makes sense: Bitcoin is a limited-supply asset best classified as an emerging store of value that competes with traditional assets like gold and U.S. Treasuries. Additionally, the correlation between Bitcoin and the Nasdaq suggests an interaction between Bitcoin’s properties as a store of value and its link to risk assets.

Bitcoin’s multidimensional nature stems from its unique role as both a hedge against the U.S. dollar and broader economic uncertainty, and as a technology asset with growth potential. Therefore, we believe that Bitcoin may respond differently to changes in monetary policy in 2025 than stocks, which are more directly affected by corporate earnings and macroeconomic trends. When the U.S. dollar strengthens, both stocks and Bitcoin may experience varying degrees of outflows, depending on the scenario and current economic conditions.

Key Factors Affecting Bitcoin, USD, and Stocks’ Interrelationship

Dollar strength vs risk appetite

When the U.S. dollar strengthens, typically driven by economic uncertainty or “risk-off sentiment,” demand for risk assets such as Bitcoin and stocks tends to fall. This could explain why the correlation between Bitcoin and stocks typically rises during such times.

Conversely, a weaker dollar typically means higher risk tolerance and potential lower interest rates, which can lure investors into growth or alternative assets, including stocks and Bitcoin.

Bitcoin’s hedging role:

We view Bitcoin as a hedge against inflation and currency devaluation, similar to gold. When the U.S. dollar weakens, demand for alternative stores of value, such as Bitcoin and gold, tends to rise. However, over-reliance on the U.S. dollar as a reserve currency and safe haven (as viewed by “dollar maximalists”) may be just as risky as the view of Bitcoin maximalists.

Unlike Bitcoin, stocks are closely tied to economic performance and company earnings. When the U.S. dollar weakens, multinational companies' profits typically rise (in U.S. dollar terms), boosting stock performance. However, when the U.S. dollar strengthens, stocks can struggle as foreign currency revenues shrink, while Bitcoin typically experiences outflows due to the U.S. dollar's appeal.

Liquidity and Macro Trends:

Bitcoin and stocks generally perform well in an environment of easy monetary policy and high liquidity. However, during periods of inflation or interest rate hikes, liquidity constraints could have a negative impact on equities, while also putting pressure on Bitcoin, as seen in the 2022/23 period.

Stocks react more directly to changes in interest rates and economic policy, while Bitcoin has a more indirect, but still relevant, relationship with these factors. Bitcoin has occasionally seen divergences during market sell-offs triggered by liquidity constraints or economic concerns, especially when it is viewed as a hedge against traditional markets.

The impact of geopolitics on Bitcoin:

Escalating tensions in the Middle East, such as the conflict between Israel and Iran, could disrupt Middle Eastern oil production and send global energy prices soaring. As a "digital energy storage", Bitcoin may appreciate in value under the inflationary pressure caused by rising energy prices.

Historical precedents (such as the 1973 oil embargo) show that hard assets like gold – and potentially Bitcoin – can retain their value during an energy crisis. Additionally, U.S. financial support for Israel could lead to increased debt and monetary expansion, which could drive Bitcoin’s value against fiat currencies. Bitcoin’s decentralized nature also makes it resistant to disruptions at specific mining sites.

In the current economic climate, weak growth may cause Bitcoin to gradually lose its correlation with stocks, and Bitcoin may also gradually decouple from the US dollar in 2025.

Will the US dollar lose its reserve currency status in 2025?

The short answer is: not in 2025, but the U.S. dollar’s dominance as the world’s main reserve currency is facing growing challenges stemming from economic, geopolitical and technological factors. Central banks are diversifying their reserves, with the dollar’s share falling from 71% in 2000 to 59% in 2022 (according to the International Monetary Fund), as a way of hedging against the impact of U.S. policy and dollar volatility . Countries like China and Russia are bypassing the U.S. dollar for trade to avoid U.S. sanctions, and the BRICS are exploring a new currency to conduct trade within the bloc, which some believe could be Bitcoin. China’s Cross-Border Payments System (CIPS) offers an alternative to the SWIFT system, while digital currency and blockchain technology offer more ways to further reduce reliance on the U.S. dollar.

In addition, the United States is facing increasing fiscal pressure, with the federal budget deficit reaching $1.833 trillion in 2024. Concerns about a possible post-election debt ceiling crisis have led credit rating agencies to issue warnings about U.S. fiscal stability. That, combined with declining foreign demand for U.S. Treasuries, could undermine global confidence in the U.S. dollar. As the United States faces difficulties in resolving its debt problem, emerging financial infrastructure such as China's CIPS, Russia's SPFS, and Bitcoin provide alternatives to reduce reliance on the U.S. dollar's centralized system, implying a gradual shift in the dominance of the U.S. dollar.

Bitcoin is more than just a store of value

We often talk about U.S. monetary policy, but that’s not the whole story, as Bitcoin’s growth potential is often overshadowed by its properties as a store of value. Bitcoin’s success story is more than a cyclical game of buy and sell; it is an evolution in finance that has attracted individuals, companies, and even governments to its decentralized, verifiable nature. Far from being a "fragile illusion," Bitcoin's resilience through multiple economic cycles, as well as continued attention from high-end businesses and investors, reflect what many see as its inherent value as a hedge against traditional financial risks.

Bitcoin's utility goes beyond speculation; it provides a globally verifiable and secure network that requires no central authority. This is not just code, but a network governed by consensus, ensuring transparency and security of transactions. This decentralized model is particularly valuable for individuals and countries seeking financial autonomy, especially in regions with high economic volatility.

While Bitcoin has yet to match the economic productivity of traditional assets, its continued adoption and development (such as the implementation of the Lightning Network) has begun to demonstrate practical applications in remittances, micro-transactions, and financial inclusion. Viewing Bitcoin as merely a speculative asset ignores its potential for future applications in digital finance and technology.

Bitcoin's record inflows signal shift, but price surge remains elusive

amid policy and political headwinds

By JAMES BUTTERFILL, Head of Research, CoinShares

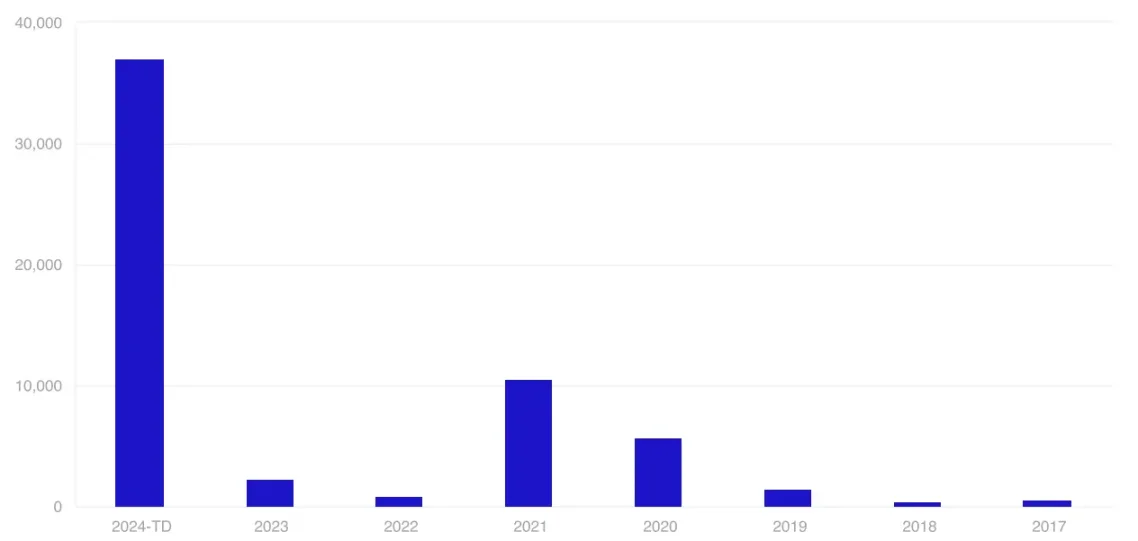

As of the end of November, inflows this year had reached $37 billion. This inflow would have been nearly triple the record of $10 billion set in 2021, had there not been a significant market decline in December. The surge was largely attributed to the launch of the U.S. Spot Bitcoin ETF, which attracted $32.6 billion in inflows. After adjusting to account for outflows from Grayscale, the newly launched ETF has seen record inflows of $50.6 billion so far.

Total global digital asset fund inflows (USD million). Source: Bloomberg, CoinShares, data available as of close 23 November 2024

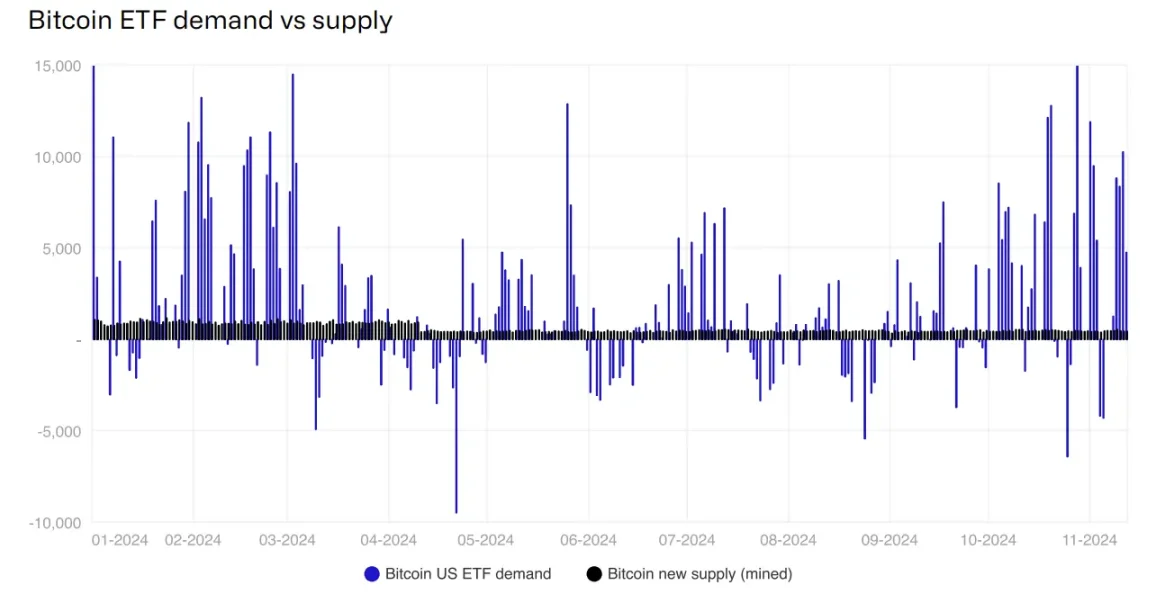

Assuming total U.S. investable assets are $14.4 trillion, if 10% of investors decided to allocate $37 billion of funds to Bitcoin, this would reflect an average portfolio allocation of 2.6%. This is double our 1% forecast at this time last year, which predicted inflows of $14.4 billion. The U.S.-based ETF provider is now the second-largest Bitcoin holder in the world, holding 1.08 million BTC, a level of demand that is more than double the 191,000 newly minted BTC from the mining industry. Globally, ETP holders currently hold 1.3 million Bitcoins in custody.

Bitcoin ETF demand and supply. Source: Bloomberg, CoinShares, data available as of close 23 November 2024

This marks an extremely positive event in Bitcoin's history, although we have yet to see the price surge that many (including ourselves) expected. Based on the relationship between inflows and price (detailed here), our model shows that at this level of inflows, Bitcoin should have passed the $100,000 mark; however, the price is still hovering at all-time highs Around $70,000. We attribute this to several factors, notably monetary policy and the political climate, which we believe have been the main drivers of Bitcoin price recently.

The U.S. Federal Reserve's monetary policy shift took longer than expected, not arriving until September, although a December 2023 poll expected the shift to occur in March this year. The delay is likely due to a combination of excess household savings, higher-than-expected economic growth and persistently high inflation. Political developments have also created headwinds, with polls suggesting Democrats may dominate this year, undermining expectations for a looser regulatory stance on digital assets. In addition, investment platforms have also spent time supporting Bitcoin ETF trading, and Grayscale’s closed-end Bitcoin funds have brought huge selling pressure, with $18.3 billion worth of funds being sold by originally closed holders this year.

Ethereum funds have underperformed Bitcoin this year. Before Ethereum was launched, Ethereum’s total ETP assets under management (AuM) accounted for 20% of Bitcoin. At this ratio, an inflow of $3.2 billion is expected. However, actual inflows were only $1.11 billion, taking into account $3.3 billion of outflows from Grayscale's existing positions. This gap may stem from concerns about Ethereum’s Layer 1 revenue, especially after its Dencun upgrade in June, which we will discuss further here.

We are optimistic about the prospects for capital inflows in 2025. As political transparency increases, especially discussions about the potential impact of the Trump administration, there is a possibility that Bitcoin will be viewed as a strategic reserve asset, driving prices higher similar to what happened after the 2020 election. Monetary policy also seems poised for continued easing, not only in the United States but also in many major central banks around the world. If the U.S. government acquired 5% of the total supply of Bitcoin, it would represent an inflow of approximately $67 billion. That, coupled with clear support from the U.S. government, could encourage hesitant investors to increase their holdings.

Under Trump, the U.S. Prepares for Major Cryptocurrency Reform

By MAX SHANNON, CoinShares Research Analyst

With Donald Trump's victory in the 2024 presidential election, the United States is poised to make major changes in cryptocurrency regulation as it seeks to become a global leader in digital assets. Along with Vice President-elect J.D. Vance, Trump pledged to promote a pro-crypto environment focused on innovation, investment and financial sovereignty.

regulatory reform

Trump has been publicly critical of the U.S. Securities and Exchange Commission (SEC) and its chairman Gary Gensler’s stance, particularly regarding the agency’s approach to regulating digital assets. Gensler has announced that he will resign on the day Trump takes office (January 20). More pro-cryptocurrency SEC commissioners could lead to friendlier cryptocurrency regulation, laying the groundwork for a cryptocurrency resurgence.

Fortunately for the cryptocurrency industry, Trump’s Vice President Vance has previously been committed to pushing for regulatory clarity. Vance has drafted proposals aimed at reforming the way Washington's two major regulators regulate cryptocurrencies.

Coinbase, A16Z, and Ripple are the 9th, 10th, and 11th largest donors to the Trump campaign: lower than Citadel or Susquehanna, but higher than companies like Bloomberg and Blackstone. Cryptocurrency-only Super Political Action Committees (SuperPACs) such as Fairshake, Defend American Jobs, and Protect Progress are the 8th, 13th, and 17th largest fundraising organizations respectively. This will help push pro-crypto legislation in the red-majority House and Senate.

Both Trump and Vans support FIT21's reform of the market structure and are willing to end "Operation Chokepoint 2.0" and accept stablecoins to strengthen the U.S. dollar's international dominance. This should have a positive impact on altcoins and mergers and acquisitions (M&A) activity, as traditional financial firms will gain more clarity and confidence in the crypto-asset space.

Support Bitcoin mining

The Trump administration plans to turn the United States into a global Bitcoin mining center. Throughout the campaign, Trump met with miners and pledged to protect their operations, emphasizing that Bitcoin mining was critical to financial independence and national security. He sees Bitcoin miners as defenders against central bank digital currencies (CBDCs), which his government opposes. At the Bitcoin 2024 conference, Trump pledged to “keep 100% of the Bitcoin currently held by the U.S. government or acquired in the future... which will effectively form the core of the national strategic Bitcoin reserve.”

Trump’s newly appointed pro-cryptocurrency Treasury Secretary Scott Bessent and successful hedge fund manager and CEO of pro-cryptocurrency financial services company Cantor Fitzgerald Howard Lutnick ), has been nominated to lead the government's trade and tariffs strategy as Secretary of Commerce. These appointees may support Trump’s ambitious goals for Bitcoin as a fiscal reserve asset. While Trump's comments need to be taken with a grain of salt, they are undoubtedly positive.

In the short term, miners who focus solely on Bitcoin mining are likely to outpace those who have diversified their revenue streams, such as dabbling in artificial intelligence or machine manufacturing.

Autonomous governance and financial sovereignty

Trump is also a strong supporter of self-government. At the same meeting, Trump noted that he believes individuals should be able to control their own digital assets without government interference. However, Trump's stance on issues such as sanctions and bank secrecy laws has tended to be more neutral or conservative. As a result, his ambitions for autonomous regulation may face challenges, particularly on issues such as financing illegal activities or money laundering. While this policy will not directly affect the price of Bitcoin or individuals, it is a positive step toward private property protection for the United States.

The Economic Prospects of Cryptocurrencies

Trump's economic policy leans toward expansionary fiscal and monetary policy, and he supports further tax cuts and wants the Federal Reserve chairman to take a dovish stance, lower interest rates, increase the debt burden, and drive cheap capital into risky assets such as cryptocurrencies.

All in all, Trump’s victory means a pro-cryptocurrency government with policies that support Bitcoin mining, autonomous regulation, banking and market structure regulation, and the legalization of stablecoins, creating a favorable environment for the innovation and growth of digital assets. As the U.S. shifts toward these policies, while Bitcoin may still be one of the best-performing assets in 2025, other altcoins may become more prominent.

The Bitcoin Mining and AI Boom: Debt, M&A, and Clean Energy

By MAX SHANNON, CoinShares Research Analyst

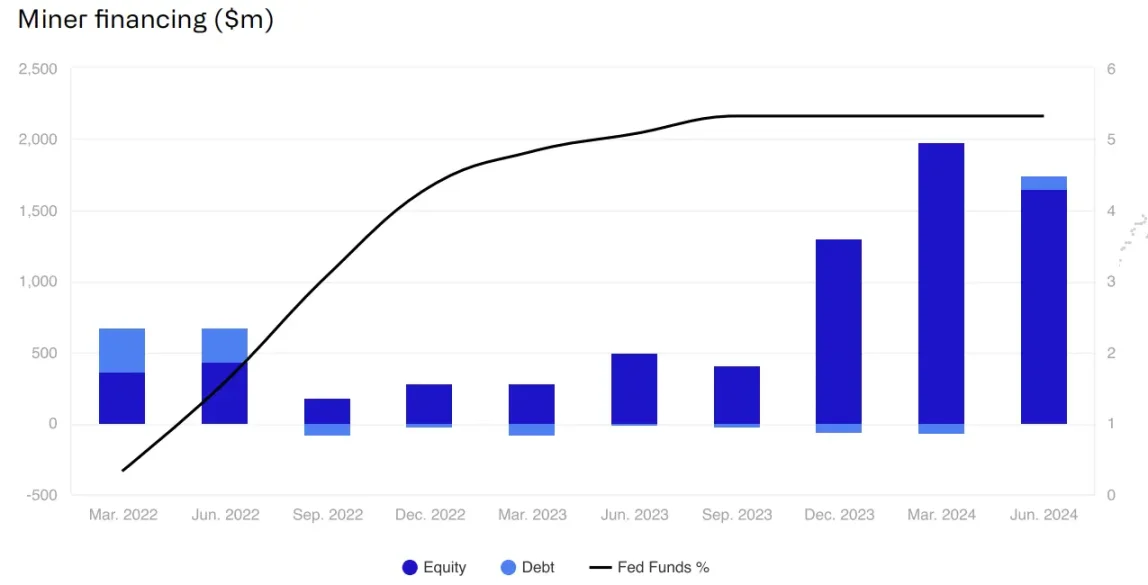

Miners increase use of debt markets as rates fall

As interest rates gradually return to normal levels, Bitcoin miners are expected to return to the debt market. Companies like TeraWulf, Core Scientific, Marathon Digital and Bitdeer Technologies have raised more than $2.5 billion through convertible debt offerings. In the future, this trend is likely to continue, with miners leveraging these tools to reduce capital costs, fund strategic growth, and manage existing debt more effectively. This financing method is particularly attractive given that traditional debt markets are constrained by the high volatility of the industry.

As high interest rates and industry volatility make access to traditional debt markets more difficult, convertible bonds offer a more balanced approach to capital structure management with less dilution. By reducing their reliance on equity financing, these companies are able to pursue diversified strategies, as reflected in differences in the pricing of their convertible debt.

Another form of debt financing also shows some potential. Bitcoin-based financing is expected to grow as miners accumulate more Bitcoin on their balance sheets. We've seen this with Marathon's $200 million credit line, followed by Canaan's $22.3 million loan, which was secured by 530 Bitcoins. This trend coincides with the rise in the value of Bitcoin, making it a more valuable collateral. As a result, miners can issue more devalued fiat debt against their growing Bitcoin holdings, thereby increasing their financial leverage.

Miner financing ($ million). Source: Bloomberg, CoinShares, data available as of close 01 October 2024

Further mergers and acquisitions among miners

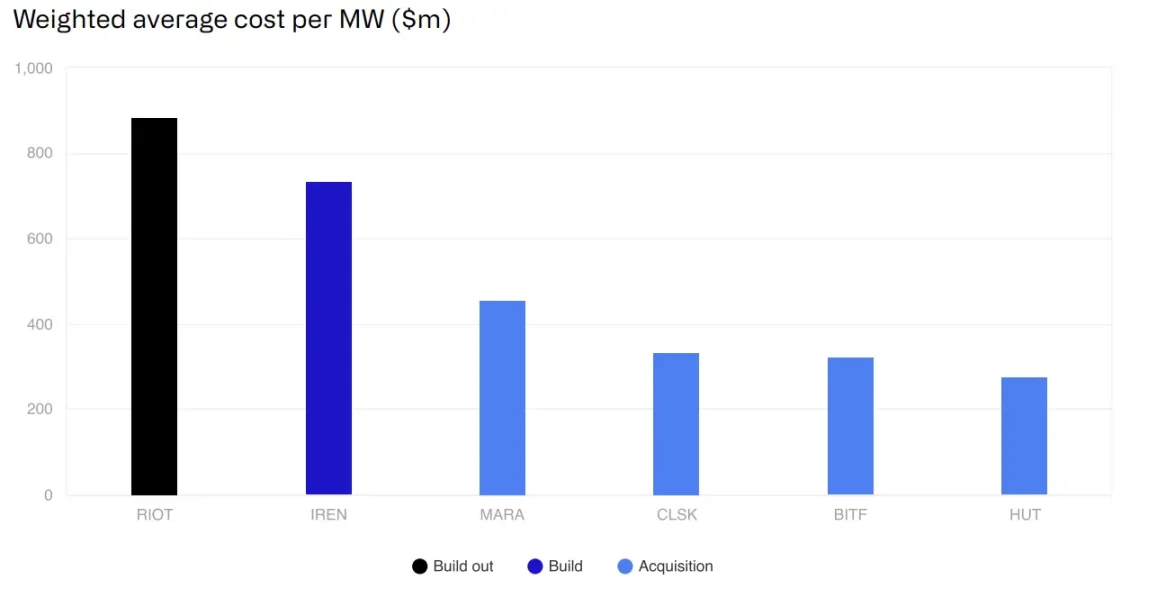

Acquisitions among miners, such as Cleanspark's acquisition of Griid, Riot's deal with Block Mining, and Bitfarms' acquisition of Stronghold (both focused on operating facilities), are expected to increase. Acquiring distressed or turnkey mines is more cost-effective than building new facilities from scratch. While greenfield projects often take years to develop, acquiring and upgrading existing infrastructure can be completed in just a few months. This greatly shortens the time to market and accelerates the realization of returns, thus becoming a strategic focus for miners.

Weighted average cost per megawatt ($ million). Source: Industry Sources, CoinShares, data available as of close 17 October 2024

**AI hyperscale computing company focuses on clean energy triple

redundancy**

Miners will likely continue to enter into land acquisition option agreements to expand their energy portfolios in response to upcoming hash rate and/or GPU computing power. In our opinion, the most desirable site features are Tier 3 clean energy redundancy and gigawatt power supply pipelines. For example, TeraWulf's Lake Mariner site relies entirely on hydroelectric power and, according to management, has a power usage effectiveness (PUE) of 1.2. The site is located in New York, which has a cooler climate than Texas, and by diverting water directly from the lake, they can lower the PUE even further.

Once these high-quality clean energy sites are fully utilized, focus may turn to areas with strong renewable energy mixes, such as the PJM Electricity Interconnection Market (~60-65% renewables). Based on this, Bitdeer's Ohio sites (791 MW by fiscal 2027) and TeraWulf's Nautilus sites (2.5 GW) may gain a competitive advantage.

As a result, we expect that companies with clean energy capabilities or located in attractive locations will be more likely to attract AI partnerships than those that rely heavily on less desirable locations like Texas.

Bitcoin Mining ASICs: The End of the Big Three

By ALEXANDRE SCHMIDT, CoinSharesCFA - Index Fund Manager

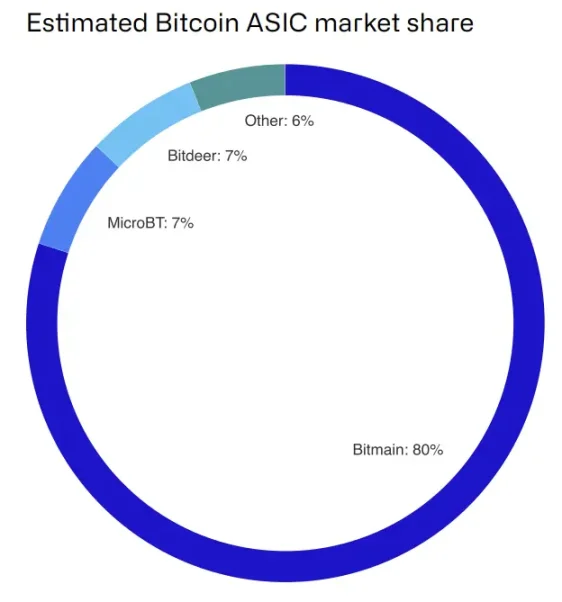

Since the release of the first Canaan Avalon chip in 2013, the ASIC manufacturing industry has been dominated by a handful of key players. China has always been at the heart of the industry, with the vast majority of ASIC designers and manufacturers based there, even after the government imposed a mining ban in 2021. Today, the market actually presents a monopoly situation of three giants, of which Bitmain dominates, followed by Canaan and MicroBT (collectively referred to as the "Big Three"), although they are all headquartered in China, but also has manufacturing facilities abroad.

Estimated Bitcoin ASIC market share. Source: Estimated by CoinShares

As Bitcoin has grown in adoption and price, mining has evolved into a more specialized industry. Since the introduction of the first ASIC chip, the Bitcoin network's hash rate has grown from approximately 1 PH/s to over 600 EH/s today, a 600,000-fold increase. Following Moore's Law, each new generation of mining rigs has significantly improved performance and efficiency, driving down manufacturing costs and price per hash.

The Bitcoin ASIC market has become quite large. Canaan Technology's 2019 IPO documents indicate that the Bitcoin mining machine market grew from US$166 million in 2014 to US$3.2 billion in 2018. Over the past three years, the Bitcoin network's computing power has increased by 100 EH/s per year to 200 EH/s. While not all growth will come from newly purchased equipment, given current mining economics, only the latest generation of highly efficient mining rigs will be profitable, so we believe almost all growth will come from newly purchased rigs. Based on the current mining machine price of about $15 per TH/s, we estimate that the size of the Bitcoin ASIC market in 2024 will be between $15 billion and $30 billion, a figure confirmed by industry insiders.

New entrants challenge traditional giants

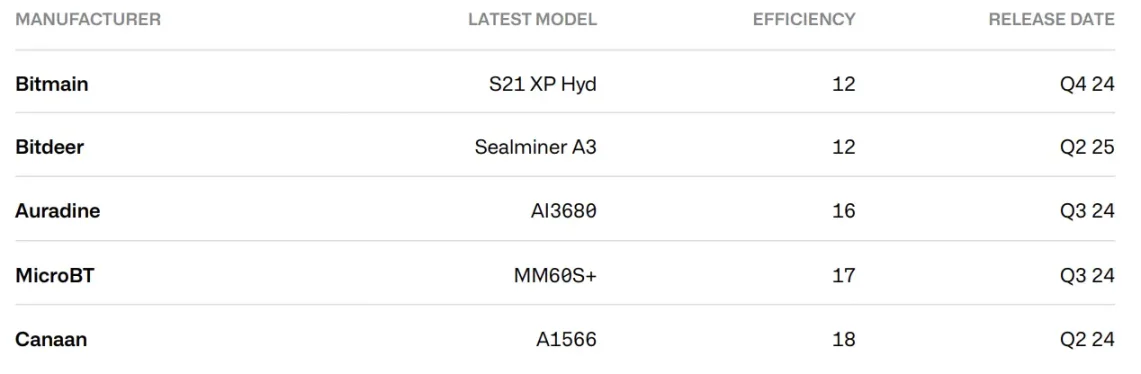

As the market regained momentum in the second half of 2023, new projects began to emerge, especially those of Auradine, Bitdeer, and Block Inc. For the first time since the advent of ASICs, several competitors are simultaneously accelerating the launch of new, high-performance mining machines that may eventually challenge existing industry giants, especially Bitmain.

The abscissas are: manufacturer, latest model, efficiency, release date. Source: CoinShares, ASIM Miner Value, company data (as of 16 October 2024)

The big question is whether these new projects will be successful or whether we will once again see the short-lived glory of mining startups. Auradine is a U.S.-based Bitcoin ASIC design company that has received $49 million in investment from Marathon. Marathon CEO Fred Thiel also serves on the company's board of directors. Auradine’s first Teraflux miner was released in the fourth quarter of 2023. Its latest miner has an efficiency ratio of 15 to 16 Joules per terahash (J/TH), which is almost the same as Bitmain’s latest Antminer S21 XP Pro ( The efficiency is 13.5 J/TH). According to CEO Sanjay Gupta, the company has more than 30 customers, although Marathon appears to be the largest, having made $44.1 million in upfront payments over the past year.

Bitdeer is a publicly traded company that was spun off from Bitmain in April 2023 and initially operated solely as a Bitcoin mining company. In March 2024, the company announced the launch of its own Bitcoin mining machine, powered by the SEAL01 chip. By September 2024, Bitdeer completed testing of its SEAL02 chip, which achieved an efficiency of 13.5 J/TH at underclocking settings. These chips have been integrated into Bitdeer's SEALMINER A2 mining machine and mass production will begin in October 2024. Bitdeer's competitive advantage lies in hiring ex-Bitmain engineers who have successful experience launching Bitcoin mining rigs at scale and have industry connections that can secure supply chain protocols.

The last entrant is Block Inc., which is developing Bitcoin mining chips using a 3-nanometer process. Led by Twitter founder and Bitcoin advocate Jack Dorsey, Block’s goal is to “democratize Bitcoin mining.” While Block is primarily seen as a fintech company, it has extensive ASIC experience by developing chips for Square's point-of-sale systems. In July 2024, Block and Core Scientific announced a cooperation to develop and deploy a 15 EH/s mining machine using Block's new chips. The project is jointly participated by Block's Proto team, ePIC Blockchain Technologies and Core Scientific. However, unlike Auradine and Bitdeer, Block's collaboration with Core Scientific has yet to release a working prototype, and it remains unannounced whether Block's chips or jointly developed mining rigs will be widely commercialized.

Success of new competitors depends on reliability and scale

Whether these emerging competitors can challenge the dominance of the "top three" manufacturers depends largely on their ability to successfully launch usable products and quickly scale up production. And all of this relies on ensuring production capacity at semiconductor manufacturing plants. In addition, mining operators' skepticism about new products, particularly concerns about their reliability, also poses a challenge. However, the emergence of new competitors is welcome because it has the potential to weaken the pricing power of the top three players, thereby forcing mining machines to become more efficient and ultimately achieve higher profitability.

Bitcoin heads to the U.S. financial industry

Author: MATTHEW KIMMELL, Digital Asset Analyst at CoinShares

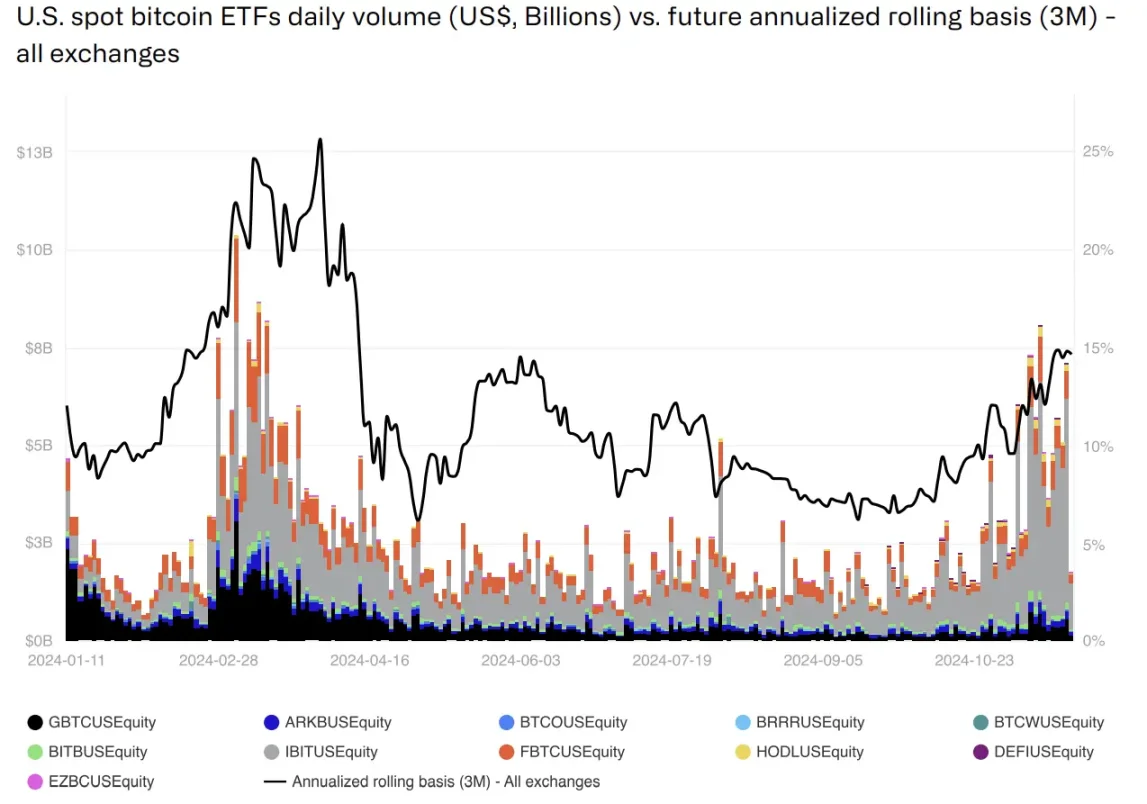

The U.S. Bitcoin ETF has been a huge success since its launch in February. Among the 575 ETFs launched in the United States in 2024, the top four in terms of capital inflows are all spot Bitcoin products: IBIT, FBTC, ARKB and BITB. Positive inflows have been seen in nine of the ten months since launch. In less than a year, the total holdings of these spot Bitcoin products has reached nearly 1 million, which is almost as large as any known holding entity

- which is very large, although still slightly less than the estimated holdings of Satoshi Nakamoto. Some 1.1 million Bitcoins. For comparison, the Bitcoin ETF saw inflows in its first year, while the gold ETF took five years to reach this level since its launch in 2004. Such strong demand raises an important question: Who is buying these ETFs? Can their capital inflows be sustained?

Professional investors account for 20% of U.S. Bitcoin ETF holdings

Through 13-F filings, we can understand the sources of investors who purchase these ETFs. These documents were submitted by investment managers with more than $100 million in assets under management. The content shows that approximately 20% of the assets in U.S. spot Bitcoin ETFs are held by professional institutions and fund managers, which also means that the remaining 80% mainly comes from Retail investors or smaller financial professionals.

According to the Form 13-F, there are more than 1,200 holders of these ETFs. 984 of these holders are investment advisors, accounting for 78% of all submitters, but they only account for 41% of total assets under management (AUM). Understanding the background of these investment advisers can help put the situation into a fuller picture. For example, Goldman Sachs' holding of $741 million may be more of a general liquidity provider, while firms like Ark Investment Management and VanEck hold $206 million each. US dollars and $80 million in funding, and launched its own spot Bitcoin product.

Hedge funds also hold a significant share, with larger average position sizes and larger portfolio weights. A total of 138 hedge funds hold these ETFs, which together account for 38% of the 13-F reporter's total assets. Notable holders include Millennium Management, Schonfeld Strategic Advisors and Aristeia Capital. We suspect these inflows are less stable as hedge funds tend to be more opportunistic in their allocations. Additionally, basis trading has been attractive this year and may be a significant source of hedge fund demand.

U.S. Spot Bitcoin ETF Daily Volume (USD Billions) vs. Futures Annualized Rolling Benchmark (3 Months) - All Exchanges. Source: Bloomberg, Glassnode, CoinShares, data available as of 22 November 2024

Bitcoin ETF has a high probability of continued success

The future path of Bitcoin ETFs depends on several factors. Encouragingly, the number of 13-F report submissions from March to September 2024 increased by 20%. This growth comes primarily from institutions classified as investment advisors, showing that adoption of Bitcoin ETFs is growing. However, while hedge funds still account for a large portion of assets under management (AUM), they tend to trade rather than hold these ETFs for the long term. If market sentiment changes, or certain trades reverse, these funds may exit positions quickly, leading to outflows.

Another factor to consider is the relatively small allocation to Bitcoin ETFs in your portfolio. Bitcoin is still widely viewed as a high-risk asset, with many managers considering it an “alternative investment” category—what we also call digital gold. Alternative investments are typically smaller in size than stocks and bonds, which limits their allocation potential in a portfolio. Still, the Bitcoin ETF has been on the market for less than a year, and many professional investors may still be obtaining internal approval or conducting due diligence through investment committees.

Given the size of the market among U.S. financial professionals, even a smaller portfolio allocation could result in significant inflows, assuming Bitcoin becomes a standard part of modern investment portfolios. However, the inclusion of Bitcoin is not yet widespread, but its clear advantages as a risk diversification tool are recognized and there are already several encouraging examples. For example, Fidelity included its FBTC product in its all-in-one conservative ETF; Michigan and Wisconsin have included Bitcoin ETFs in state pension funds; and more recently, Emory University also held some in its endowment portfolio Bitcoin ETF.

From a retail perspective, this appears to remain the dominant source of Bitcoin ETF demand, with room to grow. Some brokers, such as Vanguard, have not yet opened access to Bitcoin ETFs. Once they open these services and companies like Fidelity, Robinhood, and Interactive Brokers continue to provide access, the number of retail players is likely to grow further.

The outlook looks positive for U.S. Bitcoin ETFs

The launch of the Bitcoin ETF clearly demonstrates the demand among U.S. investors looking to gain exposure to Bitcoin through familiar financial products. These ETFs have not necessarily triggered an eager assessment of Bitcoin’s investment potential among professional financial managers, but given market demand, the smooth progress of the internal approval process, and pressure from peers to gradually recognize Bitcoin as a viable asset, we expect there will be More evaluations followed.

Gaining access is the first step, and assessment is the next—a process that will likely unfold over time. Bitcoin enthusiasts should be wary of claiming that "institutional money has arrived," given the relatively small proportion of allocations in the portfolio and only 20% of total assets under management reported by 13-F institutions. Still, there's plenty to be excited about.

The rapid success of these products speaks volumes about the strength of demand for Bitcoin and could drive greater adoption if professional investors begin to consider Bitcoin as part of a standard investment portfolio. The journey of Bitcoin ETF has just begun, and the future is full of bright prospects.

The Rise of Bitcoin Yield Companies

BY SATISH PATEL, CoinShares CFA - Investment Analyst

Bitcoin income companies are reshaping the landscape of corporate finance, with more and more businesses turning to Bitcoin as a reserve asset, a trend that reflects Bitcoin’s potential not only as a store of value, but also as a means of generating income. The benefits mentioned here include:

- The growth of Bitcoin holdings relative to company stocks;

- Yield farming, which generates returns by lending Bitcoin;

- Alternative strategies for generating income using derivatives in order to benefit from Bitcoin reserves.

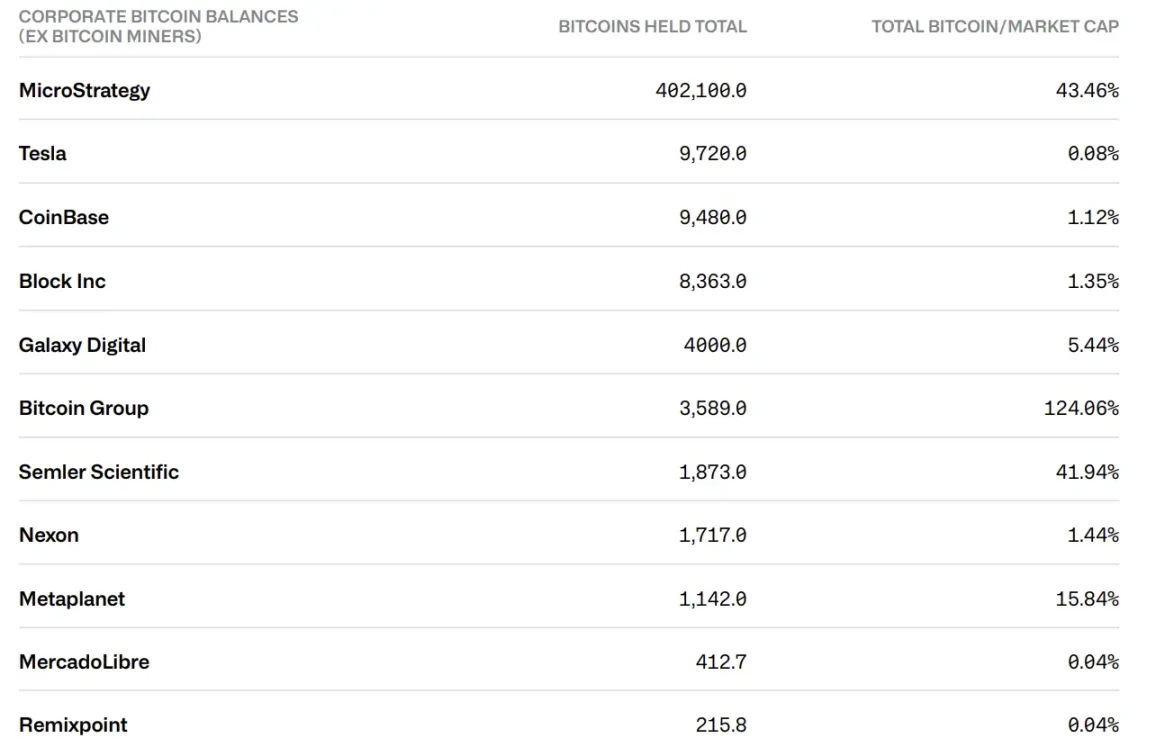

MicroStrategy has become synonymous with corporate Bitcoin investment, and as of December 5, 2024, the company held 402,100 Bitcoins with a market capitalization of approximately $39.8 billion. The company has introduced its own “BTC Returns” metric to measure the effectiveness of its strategy and help investors understand how Bitcoin acquisitions create value for shareholders. For a detailed analysis of the MicroStrategy investment case, see our in-depth analysis.

Similarly, Block Company promised to use 10% of its Bitcoin product profits to acquire Bitcoin, in fact adopting a dollar-cost averaging strategy to strengthen its capital reserves. Bitcoin mining company Marathon Digital has also adopted a similar approach to MicroStrategy, using low-interest debt to acquire Bitcoin. In August 2024, the company issued convertible bonds worth $300 million with an annual interest rate of 2.125%, followed by financing of $1 billion and $850 million in November and December 2024, respectively, with an annual interest rate of 0% . This approach allows Marathon to take advantage of favorable borrowing conditions to grow its Bitcoin reserves.

The abscissas are: corporate Bitcoin balance (excluding Bitcoin miners), total Bitcoin held, and total Bitcoin/market value. Source: BitcoinTreasuries.net, Bloomberg, CoinShares, data as of 5th December 2024

A notable development this year was the U.S. Securities and Exchange Commission (SEC) allowing BNY Mellon to treat Bitcoin and other cryptocurrency securities as assets rather than liabilities, allowing the bank to provide custody services for cryptocurrency exchange-traded products. This classification is consistent with MicroStrategy's efforts to improve the accounting for its Bitcoin holdings, which previously faced impairment losses under current GAAP guidelines. By treating Bitcoin as an asset, companies like MicroStrategy can present a more favorable financial picture, potentially mitigating the negative impact of Bitcoin price fluctuations on reported earnings. Additionally, the change could also increase MicroStrategy's ability to lend Bitcoin at typical market rates (4-6%), offsetting its interest payments.

Semler Scientific is a medical technology company. As of December 5, 2024, the company uses Bitcoin as its main financial reserve, holding 1,873 Bitcoins, with a market value of approximately US$185 million. In addition, Metaplanet, a traditional Japanese hotel company, also began to accumulate Bitcoin and implemented MicroStrategy's BTC revenue indicator. As of December 5, 2024, the company held 1,142 Bitcoins and is actively generating income through the use of Bitcoin options, with plans to become profitable this year. The moves underscore a widespread shift toward Bitcoin revenue strategies among traditional and technology-oriented companies, a trend expected to accelerate in 2025.

In 2024, more and more large companies will begin to accept cryptocurrencies as a means of payment, suggesting that more companies may include Bitcoin in their financial reserves in 2025. For example, luxury carmaker Ferrari has started accepting cryptocurrency payments in the United States and plans to expand to Europe. In addition, Microsoft is evaluating shareholder proposals to consider incorporating Bitcoin into its investment strategy, and a decision is expected to be made at a meeting on December 10, 2024. Retailers such as AT&T, Whole Foods, Home Depot and AMC Theaters also accept Bitcoin payments through platforms such as BitPay, Flexa and Spedn, and acceptance is growing across industries. Currently, e-commerce giants like Amazon, Shopify, Nike, Expedia and PayPal are already involved in the cryptocurrency field, whether through payments or investments, and may also consider adding Bitcoin to their financial reserves in 2025.

According to data from BitcoinTreasuries.net, as of December 5, 2024, the total number of Bitcoins held by enterprises reached approximately 939,190, a significant increase from 80,000 in December 2020. Public companies exclusively held 528,772 Bitcoins, and the total Bitcoin supply About 2.5% of the amount. This strong accumulation trend is expected to continue and may intensify further in 2025, especially in the context of regulatory clarity and political developments that create a more stable framework for corporate investment in digital assets.

Follow the latest news on Lightning Network

By CHRIS BENDIKSEN, Director of Bitcoin Research at CoinShares

Due to its focus on security and simplicity, Bitcoin sacrifices scalability at a fundamental level to maximize decentralization and censorship resistance. As a result, its data processing capabilities are severely limited, resulting in slower processing speeds and higher transaction fees during peak demand periods.

To alleviate these issues, various Layer 2 (L2) solutions have been proposed to move small transactions away from L1 and provide dedicated space for higher capacity and fast processing.

One of the most successful solutions is the Lightning Network (LN). Designed to complement Bitcoin’s base layer, the Lightning Network enables low-cost, instant payments through pre-funded channels that operate outside of the main Bitcoin network but still leverage the security of the main chain when needed.

In 2024, the Lightning Network has solidified its role in the Bitcoin ecosystem, with adoption and development continuing to rise. Next, we’ll briefly explore the current state of Lightning Network, focusing on its adoption, challenges, and future trends.

Most publicly visible network metrics remain flat in 2024

Looking at some standard network metrics, the size and capacity of the Lightning Network will remain essentially flat through 2024. In fact, many of these indicators have remained flat or even declined since 2022. According to data from Bitcoinvisuals, the current number of nodes is about the same as at the end of 2021, and the total capacity of the network is about 5,300 BTC, which is basically the same as at the beginning of 2023. The total number of channels peaked at about 84,000 in early 2022 and has since decreased by about 35% to currently stand at 55,000. This doesn't look too promising. So, what exactly happened?

In last year’s annual flagship report on the Lightning Network, River Financial laid out some reasons why simply using and tracking simple public data points can be problematic when analyzing the Lightning Network:

- Unlike Bitcoin's L1, transaction information on the Lightning Network is not public - only the parties directly involved (sender, routing node or receiver) may know any information about the Lightning Network transaction.

- An increase in the number of nodes does not mean more usage - many Lightning Network users prefer to use Lightning Service Providers (LSPs), which can serve an unlimited number of users through a single node, rather than managing their own channels.

- Due to its privacy properties, Lightning Network usage growth cannot be accurately assessed by simple network metrics alone and is best assessed by traditional metrics such as funds raised by the industry.

We should briefly cover why Lightning Service Providers (LSPs) have become so common recently.

Lightning Service Providers (LSPs) offer several advantages to those who run their own nodes, as well as those who wish to access the Lightning Network through a fully managed service provider.

For example, those running their own nodes can use LSP to access the channel's incoming liquidity and pay a fee. In this way, users leverage the LSP's balance sheet, leveraging its relationships and capital to provide users with more choices and more efficient payment paths. But even so, running a dedicated Lightning node still comes at a cost, and the need to run a Bitcoin node, manage liquidity (even if mitigated by connecting to LSPs), monitor online time, perform software updates, and ensure node security may all Is time intensive and requires expertise.

For those looking to outsource everything, using a fully managed service has many advantages over running a Lightning node yourself, such as lower costs and less technical complexity. Wallet providers and LSPs can work together to handle all technical and liquidity-related tasks for users, providing an easy and efficient way to access the Lightning Network without the need for hardware or ongoing maintenance. For the average user, the fees may be more cost-effective than managing the node themselves, and completely eliminates the concept of channel management and liquidity.

Either method of outsourcing typically results in faster onboarding, more reliable online times, and better routing efficiency, making it more attractive to those who value convenience and speed. For those who occasionally run nodes and use the network, LSP also avoids cumbersome setup and caters specifically to those who prefer simplicity. This is likely to be the main group of people who want to use Bitcoin for small daily payments, and who don’t have high requirements for resistance to censorship or asset seizure.

**VC funding in the Lightning Network space is healthy, but highly

concentrated**

Since 2021, some Lightning Network companies have received considerable venture capital funding for business expansion, but the field is mainly dominated by two companies, namely Strike and River. Strike raised $80 million in Series B funding in September 2022, led by Ten31, to enhance its retail and global payments solutions. After closing a $12 million Series A round in 2021, River Financial secured an additional $35 million in Series B funding in January 2022, solidifying its position as another major Lightning Service Provider (LSP).

Some smaller companies, such as Amboss Technologies, which focuses on data analysis of lightning payments, successfully raised $4 million for artificial intelligence research and routing optimization. These funding rounds reflect growing investor confidence in the potential of the Lightning Network.

Lightning Network user growth comes from multiple user groups

The River Lightning Report 2023 provides a detailed overview of user growth, stating that they observed a 1,212% increase in payment volume over the past two years, an increase that reflects adoption by individuals and businesses alike. Key drivers include low fees, fast settlement and the ability to process micro-transactions, which play a particularly important role in industries such as gaming and cross-border payments. The report also highlights increased node participation (not just node presence), which improves the overall efficiency and liquidity of the network. Additionally, the development of more user-friendly wallets and platforms has made the Lightning Network easier to use, further driving adoption, especially in areas with limited traditional banking infrastructure.

Businesses, especially in industries like gaming and cross-border remittances, are taking advantage of the Lightning Network’s low transaction fees and fast payment capabilities. Individuals also began to use the Lightning Network for daily transactions and micro-transactions because of its ease of use and scalability. Additionally, users in areas with limited traditional banking infrastructure find the Lightning Network particularly valuable as it provides a fast and cost-effective alternative that enhances financial inclusion.

The report notes that Lightning Network integration, such as its use in social media platforms such as Nostr, has further fueled growth, making it easier for users to send and receive Bitcoin around the world. This combination of business use cases and personal accessibility makes the Lightning Network a practical solution for the growing number of people looking for more efficient, low-cost digital payments.

We believe the Lightning Network is “finding itself”

The current state of the Lightning Network is not what many enthusiasts envisioned when the original paper was published in 2016. After eight years of development, it’s now clear that most users – and we see this in the wider crypto space as well – don’t believe that features like censorship resistance and seizure protection are very important for small amounts of money. . A stronger adoption driver appears to be the unparalleled availability of payment applications, which are based on cryptography and have clear advantages over the traditional banking system – not just the Lightning Network, but most importantly stablecoins.

This puts the future of the Lightning Network in an interesting position. At present, it is entirely possible that the Lightning Network will evolve into a network primarily for B2B, where large Lightning Service Providers (LSPs) act as custodians for customers, and customers use the Lightning Network for instant settlement through payment applications.

At the same time, the permissionless nature of the Lightning Network at least allows anyone to participate in the network, even if some custodians restrict access to their applications. We believe that this in itself is an important safeguard against bad behavior. Censorship from a business perspective is ultimately pointless if it cannot completely prevent users from using the payment system.

Finally, we should consider that many Bitcoin owners are unwilling to spend their Bitcoins. Why spend your most valuable asset when there is no lack of opportunities to earn and spend fiat currency? The ability to make small payments is not lacking almost anywhere in the world, but the ability to protect savings from inflation is. Perhaps small daily Bitcoin payments won’t become popular until Bitcoin reaches some level of adoption plateau, meaning the Lightning Network may still be ahead of its time.

Why Bitcoin needs Covenants to enable scalable independent custody and

transactions

Author: MATTHEW KIMMELL, Digital Asset Analyst at CoinShares

Bitcoin was created to allow individuals to hold and transfer value independently, without relying on a third party. Unlike previous digital cash projects, Bitcoin successfully solves the double-spend problem without the need for a centralized coordinator. However, as Bitcoin adoption increases, it becomes increasingly difficult to maintain these core principles, especially in terms of cost-effectiveness, user-friendliness, and system scalability.

We believe that the next step is to introduce "covenants" - that is, modifications to the Bitcoin scripting language to stipulate the rules for the use of Bitcoin. Specifically, the contract allows Bitcoin holders to restrict recipients from spending Bitcoin to certain specific destinations.

While this may seem like a small change, enabling contracts could have a transformative impact on Bitcoin, especially when combined with existing Bitcoin scripting functionality. Contracts can enable new incentives, enhance high-level technologies, and expand the possibilities for Bitcoin governance.

In our view, Covenant is a step toward enabling scalable peer-to-peer electronic cash by reducing the cost of independent custody and transactions. If this change fails to materialize, Bitcoin could deviate from its original purpose.

**Lightning Network solves some problems, but contracts push Bitcoin’s

scalability further**

Bitcoin’s scalability issues have been well documented. As the number of users increases, conducting transactions within limited block space results in longer wait times and makes daily use impractical and costly.

Lightning Network (LN) alleviates this problem by allowing users to open off-chain payment channels and provide fast and low-cost transfer services. Users only need to settle on the chain when the channel is opened and closed. However, the Lightning Network also has its limitations. Certain on-chain operations will still be required, which may come with higher fees, especially as transaction fees rise.

The Lightning Network has increased transaction speeds, but has not yet fully achieved Bitcoin’s goal of transferring value decentrally—that is, without relying on a third party. Due to cost and inconvenience, holding and transferring Bitcoin still typically involves third parties such as exchanges, wallet providers, and financial products.

Covenants may change this. Contracts can allow multiple users to share the same unspent transaction output (UTXO) without losing unilateral control of the funds, thereby enabling new forms of custody, cost sharing, and reducing problems that arise in high-fee environments.

From a broader perspective, the contract is a step toward making Bitcoin more suitable for everyday use while maintaining personal freedom.

**Contracts unlock new possibilities for Bitcoin’s second-layer

network**

Many of the advantages of contracts can be realized through higher-level technologies like the Lightning Network. Although the Lightning Network improves transfer speeds and reduces costs, it still requires on-chain transactions, mainly used for channel opening/closing and liquidity management.

Contracts can further extend the benefits of the Lightning Network by amortizing the costs of these on-chain operations, benefiting more users. For example, Channel Factory allows multiple users to open Lightning channels from a single unspent transaction output (UTXO), thereby reducing the transaction burden and cost for each user.

In addition to channel factories, proposed virtual UTXO (V-UTXO) schemes like Ark can also benefit from contracts. Although these protocols can theoretically run without contracts, the interactivity of these protocols is greatly enhanced through the introduction of certain contracts, and contracts are critical to the actual operation of these systems.

Contracts key to Bitcoin’s self-sovereign adoption

"Not your keys, not your coins" is a common Bitcoin slogan, conveying the importance of self-custody, which means users control their own funds without an intermediary. However, complexity and increasing costs have driven users toward hosted solutions.

In order for Bitcoin to achieve global adoption and maintain self-sovereignty as an option, change is necessary. The Lightning Network helps, but in its current form, it’s almost certainly not enough to solve the problem. Without changes, Bitcoin will eventually become too expensive for the average user.

Contracts solves scalability issues by introducing more advanced trading features, making money management more sophisticated. Which contract you choose and how you activate it is very important, but we think the need is pretty clear. Each contract proposal is relatively simple and backwards compatible, yet has strong potential for practical applications in Bitcoin transactions. Some contracts are reactivations of existing but deactivated opcodes in Bitcoin, while others introduce new opcodes or more flexible ways of constructing transactions.

This is a fitting continuation of the large-scale Taproot and SegWit upgrades carried out in 2021 and 2017, and the research behind them has been carried out for many years.

The concept of acceptance contracts can help individuals affordably and securely self-custody and trade Bitcoin on their own terms. Without the backing of a contract, Bitcoin adoption will continue along the custody path. We expect compact discussions to intensify by 2025, with possible activation in 2026.

Ethereum Layer 2 usage will continue to grow and trend upward

Author: LUKE NOLAN, Ethereum Research Assistant at CoinShares

In March this year, Ethereum implemented the Dencun upgrade, which significantly reduced the transaction costs of Layer 2 and increased the number of transactions per second (TPS) for Layer 2 transactions back to Layer

- The details are complex and will not be explored in this article, but you can find a detailed overview here.

The upgrade had a significant impact on the use of the second floor. On the one hand, we can call it a huge success, as the brief analysis in this article shows; on the other hand, as we observe the Ethereum ecosystem, there are also some indirect effects that influence the The value of the Ethereum (ETH) token. So, what is the future of Layer 2 in the Ethereum ecosystem over the next year?

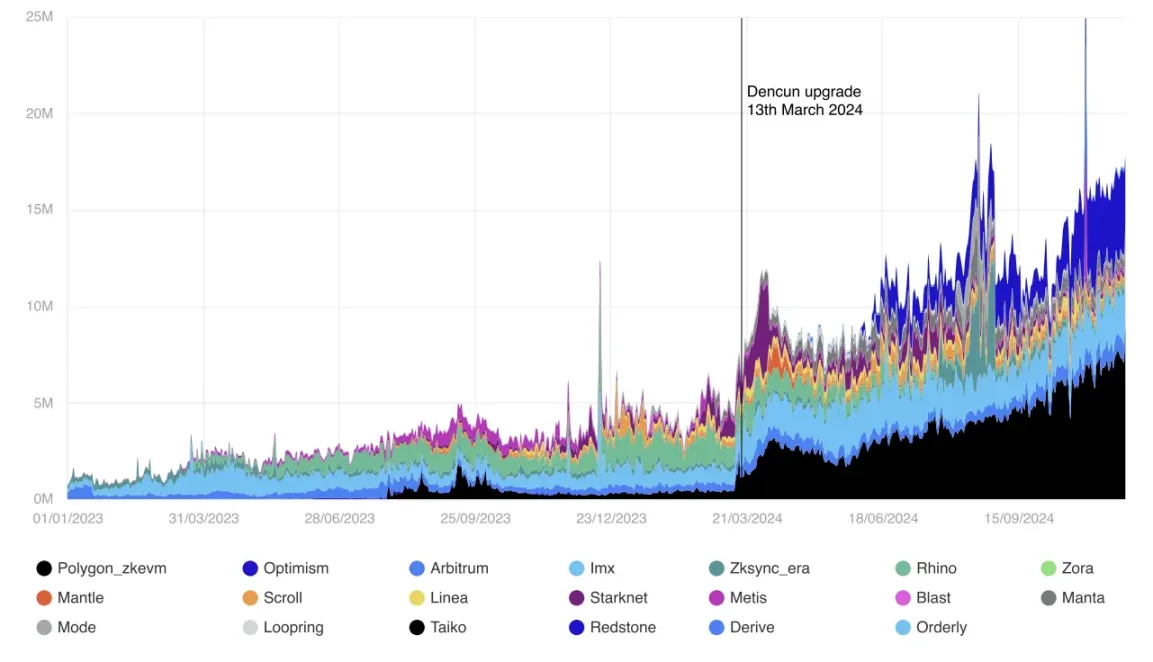

Daily transaction volume on Ethereum Layer 2 (excluding Ethereum main chain). Source: GrowThePie, CoinShares, data available as of close 17 September 2024

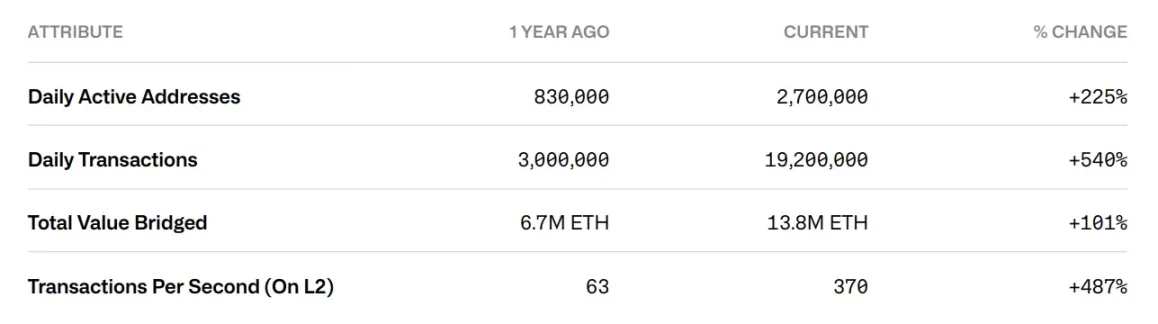

Across the board, Layer 2 adoption has changed significantly over the past year, especially after the Dencun upgrade, as shown on I2beat:

The abscissas are: token usage, one year ago, now, percentage change

Even well beyond the current trend of growing Layer 2 adoption, development of new Layers 2 by large organizations continues to advance. Earlier this year, Sony announced their second-layer network "Soneium" and more recently, Kraken launched their "Ink" blockchain. Institutionalization of the second tier will further drive adoption, bringing on board users who are already customers of these enterprises over the next year.

Blob market dynamics

Even as usage has increased significantly, the blob market—the independent fee market used by the second layer to post transactions to Ethereum—has remained largely “free.” The actual cost of publishing a blob, separate from the transaction data itself, is affected by a mechanism similar to that introduced in EIP-1559. Simply put, each Ethereum block can publish up to 6 blobs; when the number of blobs published exceeds 3, the fees for publishing these blobs increase, and when the number of blobs published is less than 3, the fees decrease , until the cost is reduced to the lowest possible cost.

Most recently, at the end of October, we saw a period of more than 3 blob releases in a row, albeit for a shorter period of time, which brought the blob market into a price discovery phase.

chaincatcher

chaincatcher