Coingecko: Who influenced the crypto market in April? How will BTC go?

Reprinted from jinse

05/14/2025·27DAuthor: Bobby Ong, Coingecko; Translated by: Tao Zhu, Golden Finance

I hope you buy on dips when your panic reaches its peak!

Every time the stock market falls sharply this year, it is due to President Trump's trade policy. On April 2, the "Liberation Day", Trump put pressure on global trade and imposed jaw-dropping tariffs on every US trading partner, the most severe of which was China.

The move immediately hit the financial market hard, and the cryptocurrency market was also hit. It was not until serious problems occurred in the bond market that Trump was forced to take back his position on April 9 (less than 24 hours after the original tariffs came into effect), and instead imposed a 10% tariff on all countries around the world, and suspended the "Liberation Day" tariff for 90 days. As expected, this brought a "finger effect" to the market, and after a relatively calm period, the market returned to a "waiting" state.

At present, the most active trading is undoubtedly gold, which is a long- standing volatility hedging tool and safe-haven asset. Gold is the best performing asset in 2025, continuing its strong momentum since 2024.

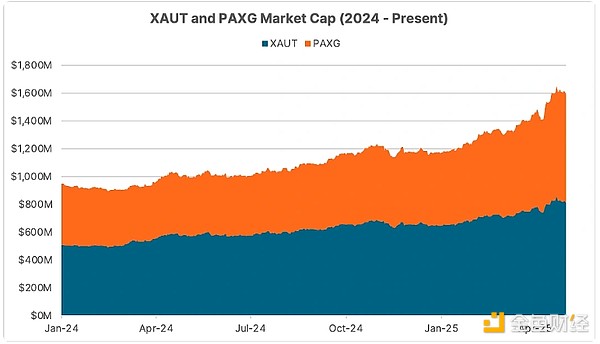

Cryptocurrencies also benefit from this trend, as tokenized gold has long existed in our market, with the most important being Tether Gold (XAUT) and PAX Gold (PAXG). While XAUT and PAXG each have only slightly increased in circulation, their market caps have increased by 59% and 78% respectively since the beginning of 2024, with a total market cap reaching $1.6 billion as of the end of April.

Where will cryptocurrency go? If you buy when Bitcoin (BTC) is down, then congratulations, your earnings may be as high as 25% now! BTC has performed far better than other risky assets such as U.S. stocks, and many are now speculating whether this is the turning point in which Bitcoin ultimately proves its strength as a store of value asset.

The cryptocurrency industry has long advocated the saying that “bitcoin is digital gold” and said it has a unique advantage – ease of transfer and storage. With the rise in demand for gold and Trump's tariffs, it has been reported that the Bank of England has extended the withdrawal of gold bars. If demand for physical gold continues to rise with market uncertainty, this problem will only intensify.

It is very clear that the market will be influenced by Trump 's sudden whims for a considerable period of time. Although we have a 90-day suspension period now, it is certain that there will be some twists and turns in the process, which means that market volatility will be more intense.

Even if Trump eventually lifts most of the tariffs, the current uncertainty is likely to have had a costly impact on U.S. businesses. Decisions to relocate production facilities or reorganize supply chains take months to implement, while costs may take years to recover. Without seeing clear progress, the management team is in a dilemma on how to plan the future, especially given that some of these policies may be overturned in the hands of the next U.S. president in the remainder of Trump’s term, or four years later.

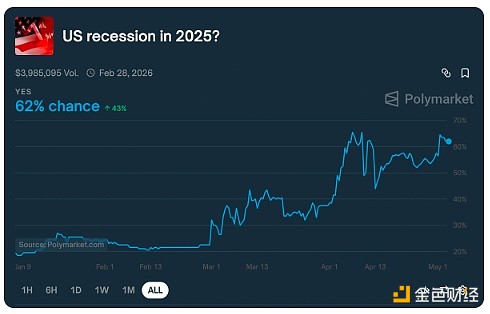

Entering May, the old saying “sell in May, then leave” is particularly important because this month has always been a poor month for the cryptocurrency market. We just released the first quarter of 2025 U.S. GDP data, which showed it shrinks by 0.3%, which is not a good sign for the U.S. economy, as the full impact of tariffs has not yet emerged. Rumors about "recession" and even worrying "stagflation" are everywhere.

However, given Trump's many weaknesses, there may be opportunities for traders seeking to "buy on dips". An important milestone worth noting is July, when the U.S. economy will feel the impact of tariffs on prices and employment until the end of the 90-day "Liberation Day" tariff suspension period and the upcoming second-quarter GDP data to be released at the end of the month.

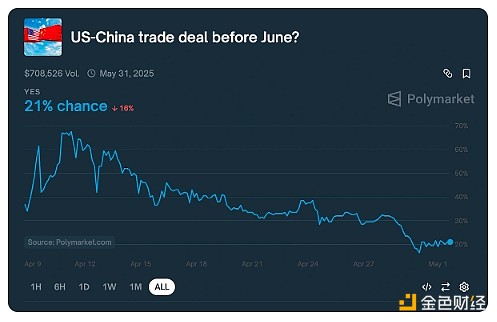

Will the United States reach an active trade agreement with its allies and trading partners by then? Will China surrender as Trump hopes to eventually reach a major deal? Or will the US economic situation be so bad that Trump has to change his mind? All of these are possible, and if you are a gambler, then all of these results are available in Polymarkets (multi-market) options.

At present, long gold seems to be the only trade in the market that can make a profit without losing money. As for other aspects, if you are still investing in the stock market, then tighten your seat belts because we will be more experiencing the volatility brought by Trump.

panewslab

panewslab

chaincatcher

chaincatcher