Coinbase Research Report: Three major themes of the crypto market in the second half of 2025

Reprinted from jinse

06/13/2025·2DSource: Coinbase Author: David Duong, CFA, Global Research Director Compilation and Compilation: BitpushNews

Summary of main points:

-

The trend of enterprises using leveraged financing to purchase crypto assets may trigger systemic risks in the medium and long term, such as forced sell-offs or motivation-driven sell-offs, but we believe that risks are still controllable in the short term.

-

The regulatory environment in the United States is undergoing positive changes, stablecoin legislation is advancing, and the crypto market structure bill is also under discussion.

Our constructive outlook for the crypto market in the second half of 2025 is based on the following core factors: the prospect of US economic growth is more optimistic, the Federal Reserve may cut interest rates, the growth of corporate financial adoption of cryptocurrencies, and the clearer U.S. regulation.

While there are still some potential risks, such as the steeper U.S. Treasury yield curve and the selling pressure caused by listed crypto tools, we believe these risks are controllable in the short term.

We believe that there are three key themes in the crypto market in the second half of the year:

-

Improved macro prospects : The risk of US recession has dropped significantly, and the overall growth momentum has increased;

-

Enterprises use encryption as a means of asset allocation : although it may bring systemic risks in the long run, it will form a strong demand side in the short term;

-

The regulatory path is becoming clearer : especially the legislative progress of stablecoins and crypto market structure will profoundly affect the development of the crypto ecosystem.

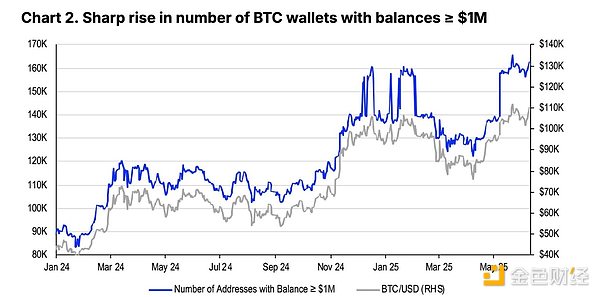

Despite the risks, we expect Bitcoin to maintain an uptrend. The performance

of altcoins may rely more on individual factors.

For example, the SEC is reviewing multiple ETF applications involving

"physical subscription and redemption", pledge, portfolio funds and single

altcoin ETFs, all of which are expected to make rulings by the end of 2025,

and these decisions may reshape the market structure.

Market Outlook: Second Half of 2025

We maintain our previous forecast - that the first half of 2025 is the bottom

of the crypto market and may hit a record high in the second half of the year.

Despite Bitcoin’s rebound at the end of May, we still believe there may be

further room for upside in the next 3-6 months.

In our opinion, the macro disturbance caused by trade tariffs is coming to an

end. Looking ahead, risk appetite is expected to recover as the government

advances its more market-friendly fiscal legislation plan (expected to be

completed by the end of summer).

However, one risk worth noting is that the fiscal spending bill may cause the

U.S. Treasury yield curve to steeper, especially in the 10-30-year period.

In fact, the yield on the 30-year U.S. Treasury bonds rose to 5.15% in May, a

20-year high. This could exacerbate financial tightening, increase financing

costs for businesses and consumers, thereby weakening the growth base and thus

affecting market confidence.

If long-term yields rise too quickly, it may cause fluctuations in the stock market and credit markets, especially when investors begin to doubt whether the United States has the ability to continue high deficits without causing systemic risks.

This development path will challenge the current main narrative of "pre-fiscal fiscal stimulus" and may force the market to reevaluate risky assets in advance, especially if economic data or Fed policies fail to meet expectations.

But at the same time, we think this may also benefit store-of-value assets such as gold and Bitcoin, especially in the context of a weakening dollar dominance.

Three major themes

Topic 1: The shadow of recession has weakened significantly

Trade disturbances at the beginning of the year once caused concerns that the

United States would fall into a technical recession, especially after GDP fell

by 0.2% year-on-month in the first quarter of 2025.

At that time, mainstream media, including the Economist and the Wall Street

Journal, issued warnings, such as "Trump's tariff war may trigger a global

recession" and "Trump's reciprocal tariffs may ignite the US recession."

But we have always maintained relatively optimistic expectations for the

second half of the year. We believe that the "degree" of the recession is

the key , and the impact of a technical recession on the market may not be

far-reaching unless the macro momentum continues to deteriorate.

For example, U.S. stocks plummeted 53% during the 2008 financial crisis, while

the "recession" in 2015 and 2022 was much milder (see the table below for

details). In addition, the Atlanta Fed's GDPNow estimate model has been

significantly revised from 1.0% month-on-month growth rate in early May to

3.8% on June 5, reflecting the improvement in economic data.

We therefore judge that even if there is a slowdown in 2025, it is more likely

to be a moderate recession or a "soft landing" rather than a severe

recession or stagflation situation.

Even so, the market impact may be limited to specific sectors rather than a

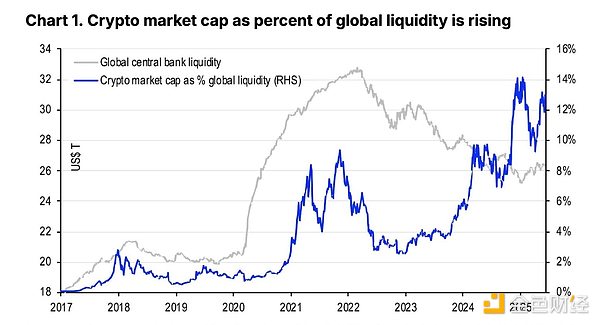

full sale. In addition to the expansion of the US M2 money supply and the

global central bank balance sheet, we believe that the probability of asset

prices returning to the 2024 level is relatively low. Bitcoin’s upward trend

is expected to continue. Furthermore, most of the "tariff shocks" have been

absorbed by the market. Although some policies (such as the end of the

reciprocal tariff suspension period on July 9) are still pending, the overall

risk margin is weakening.

Topic 2: The wave of enterprises adopting crypto assets is coming - is

the "replica Strategy" coming?

Currently, there are about 228 listed companies around the world holding a total of 820,000 BTC . Among them, about 20 (and the other 8 ETH, SOL, and XRP holders) adopt a leveraged financing method similar to "Strategy (former MicroStrategy).

The new version of FASB accounting standards, which will take effect from

December 15, 2024, has greatly promoted companies to include crypto assets on

their balance sheets.

Previously, the US General Accounting Standards (GAAP) only allowed companies

to impair crypto assets on their books, and the increase could only be

reflected at the time of sale.

The new regulations allow disclosure at fair value, making financial

statements more comparable and bringing greater transparency to CFOs and

auditors.

But we have observed that a new trend is taking shape - more and more listed companies are themselves "coin holding machines" , and their business core is to buy crypto assets.

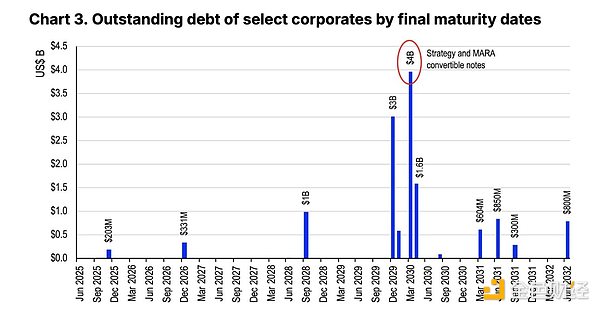

They purchase coins through the issuance of stocks or convertible bonds, and their market value far exceeds their net assets. Representatives are like Strategy, but now more imitators have emerged.

Two potential systemic risks:

-

Forced selling :

Many PTCVs (listed crypto asset carriers) rely on convertible bond financing. If the underlying currency price falls, or the market environment deteriorates or the refinancing fails, these companies may have to sell their crypto assets to repay their debts. -

Motivated selling :

If a PTCV suddenly sells assets out of operation or cash flow management, it may trigger a chain reaction, market panic spreads, and price collapses.

Nevertheless, we believe that such risks are not enough to have a huge impact on the market in the short term . First, most debts will not expire in 2029-2030 (such as Strategy's first redeemable period for the $3 billion convertible bond is at the end of 2026 and officially matures at the end of 2029), so the risk of short-term sell-off is low . Secondly, the current loan-to-value ratio (LTV) is still healthy overall, and some large companies have the ability to avoid forced sales through refinancing.

Of course, as more companies adopt this strategy and debts mature in a concentrated manner, systemic risks are still worth monitoring for a long time. Strategy's "enterprise currency holding model" is also attracting more and more "curious" executive teams to join, indicating that the trend of corporate currency storage will continue in the second half of 2025 .

Topic 3: Opening a new era of supervision

In the first half of 2025, the US crypto policy experienced unprecedented upheaval . The White House abandoned the old path of "using law enforcement instead of supervision" and turned to supporting the development of the crypto industry.

We believe that stablecoin legislation is most likely to be the first to

be implemented. Currently the House of Representatives is advancing STABLE Act

and the Senate is advancing GENIUS Act, both of which have received cross-

party support.

On June 11, the Senate passed the GENIUS Act and submitted it to the House for

consideration. Both set reserve requirements, anti-money laundering

compliance, bankruptcy protection and consumer rights clauses.

The main differences are:

-

How to deal with non-US stablecoin issuers

-

How to set regulatory thresholds

The White House is expected to complete the unified version of the bill before Congress recession on August 4 , submitting it to the president for signature, which may lay the foundation for subsequent market structure bills.

CLARITY Act

On May 29, 2025, the U.S. House Financial Services Committee formally proposed the draft "CLARITY Act", which is considered the most transformative legislation of the year .

The bill aims to clarify the respective regulatory boundaries of the SEC and CFTC for crypto assets and to regulate the division of asset attributes such as “digital goods” or “investment contracts”. The bill is based on the FIT21 Act passed last year, and requires the SEC and CFTC to jointly define key terms and continue to formulate rules , meaning that there is still room for evolution in the regulatory division of labor.

We believe this will become the basis for future negotiations between the two houses , but its complexity and uncertainty will be higher than stablecoin legislation.

ETF progress schedule

The SEC is facing approximately 80 crypto ETF proposals in 2025, covering:

-

Multi-asset crypto index funds (Bitwise, Franklin, Grayscale, etc.): Decided as early as July 2;

-

In-kind mechanism: the results may appear in July, and the latest delay is October;

-

Staking inclusion: Due to the transparency of the 6c-11 clause, the SEC may make decisions in advance;

-

Single altcoin ETF: Most applications are closed for October and the SEC is expected to use the entire review period.

in conclusion

We are optimistic about the outlook for the cryptocurrency market in the third quarter of 2025, thanks to a relatively optimistic outlook for U.S. economic growth, a Fed rate cut, an increase in corporate adoption of cryptocurrencies and an increase in U.S. regulatory transparency.

Although there are risks such as the steepening U.S. Treasury yield curve and the potential selling pressure of PTCVs, it is still within the controllable range in the short term. We believe that the upward trend of Bitcoin will continue, although the altcoin market needs to be judged based on the performance of individual projects.

chaincatcher

chaincatcher