Can Trump’s 100-day speech end the Bitcoin consolidation trend?

Reprinted from jinse

04/30/2025·1MAuthor: Nancy Lubale, CoinTelegraph; Translated by: Deng Tong, Golden Finance

summary

-

The market has been waiting for President Trump's 100-day speech recently, and the price of Bitcoin has been consolidating.

-

More than $4.7 billion in Bitcoin has been withdrawn from exchanges since April 22, resulting in a decrease in supply and an increase in price sensitivity to demand.

-

Trump's clarification of cryptocurrency policies may trigger a surge in Bitcoin prices, but tariffs may limit gains.

-

Traders say Bitcoin prices must break above the key resistance level above $95,000 to continue to rise to $100,000 or even higher.

On the eve of Trump’s 100-day memorial rally, BTC prices consolidated narrowly between $91,700 and $95,850.

BTC/USD daily chart. Source: Cointelegraph/TradingView

The market is waiting for Trump's 100-day speech

US President Donald Trump delivered a 100-day speech today. Bitcoin investors took a wait-and-see attitude ahead of Trump’s speech.

To date, cryptocurrency-related policies have been prominent in Trump's second term, but the market is still awaiting specific regulatory updates on cryptocurrencies in his economic policies.

The Trump administration's clarity on strategic Bitcoin reserve plans may prompt the price of Bitcoin to rise to $100,000. However, a renewed focus on tariffs or a substantial budget cut could put pressure on the broader market and limit Bitcoin’s upside potential in the near term.

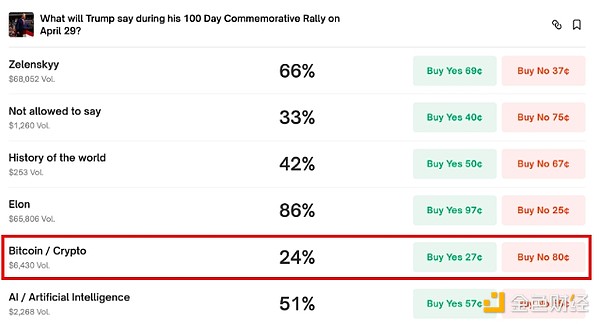

Previously, cryptocurrency gambling platform Polymarket predicted that Trump's chances of mentioning "cryptocurrency" or "bitcoin" in his 100-day speech were 24%. Data from the platform shows that users have invested more than $1 million in bets for the speech.

Polymarket predicts the odds of Trump's 100-day speech. Source: Polymarket

Trump's remarks may trigger short-term price surges, as they did in the past. For example, Bitcoin has recently rebounded from $74,400 to $94,000, partly because Trump said tariffs on Chinese goods “will be significantly lowered.”

While Trump’s speech may spark optimism and drive up prices, broader market dynamics, including tariffs and global trade tensions, may curb the rally, as recent cryptocurrency market volatility shows.

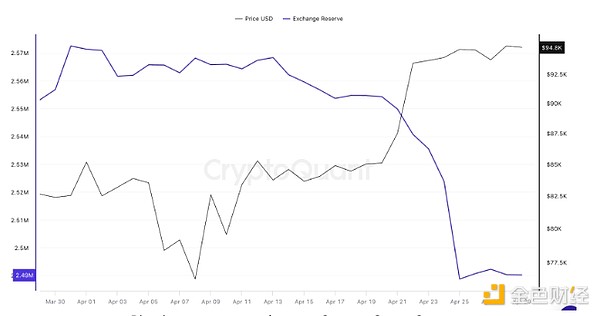

More than $4.7 billion in Bitcoin leaves the exchange

In addition to Trump's factors, the decline in Bitcoin's supply on exchanges also supported the bullish expectation of Bitcoin's price to rise to $100,000.

Investors have withdrawn more than 50,500 bitcoins (worth $4.7 billion) from exchanges since the easing of macroeconomic tensions triggered a full rebound in the market.

Bitcoin reserves on exchanges. Source: CryptoQuant

Reduced exchange supply leads to a decrease in BTC available for sale, thereby increasing price sensitivity to demand that could rise after Trump’s speech.

When will the price of BTC exceed $100,000?

Data from Cointelegraph Markets Pro and TradingView show that Bitcoin prices have been consolidating below $96,000 in the past seven days.

"BTC is slowly compressing and hitting a new low below the $96,000 resistance," said AlphaBTC, a well-known Bitcoin analyst, in a post on April 29 X.

As Cointelegraph reported, the $95,000 level is a key resistance that bulls need to break through to ensure a price rebound.

AlphaBTC asserted: “The more times you try to break through $95,000, the more likely you are to break through.” He added that the squeeze is likely to push Bitcoin to the highly sought-after $100,000 level.

“I expect a bigger pullback, but it may not appear until it breaks through $100,000.”

BTC/USD 30 minutes picture. Source: AlphaBTC

Another analyst, Daan Crypto Trades, made a similar observation, saying: “BTC prices have been squeezed again in the past few days after they have fallen back to the previous range.”

Daan Crypto Trades believes that a key level to focus on downside is the 200-day simple moving average (SMA) in the $89,500 to $91,000 range.

The analyst explained that the main resistance level was a local high of $99,500 and a "psychological mark of $100,000", adding: "In the medium term, these are levels worth watching. For the moment, we just need to watch its trend in the short term."

BTC/USD daily chart. Source: Daan Crypto Trades

Healthy market fundamentals are reportedly likely to push Bitcoin prices to break $100,000, a record high.

Meanwhile, Peter Chung, research director at quantitative trading firm Presto, reiterated his forecast that Bitcoin prices will reach $210,000 in 2025.

panewslab

panewslab