Bulls are back: BTC derivatives data suggests rise to $105,000

Reprinted from jinse

12/26/2024·4MAuthor: Marcel Pechman, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Bitcoin has gained 6.5% since its December 23 low of $92,458, but failed to break the $98,000 resistance. After hitting an all-time high of $108,275 on December 17 last year, the stock market pulled back sharply by 14.5% as traders regained confidence.

Bitcoin derivatives maintained a neutral to bullish stance, indicating that sharp price swings did not significantly affect market sentiment. This position supports the possibility that gold prices will continue to rise above $105,000.

Bitcoin 2-month futures annualized premium. Source: Laevitas.ch

Bitcoin futures monthly contracts trade at a 12% premium to the regular spot market. This indicates strong demand for leveraged long (buy) positions. Typically, a 5% to 10% premium is considered neutral as the seller factors in the extended settlement period when pricing.

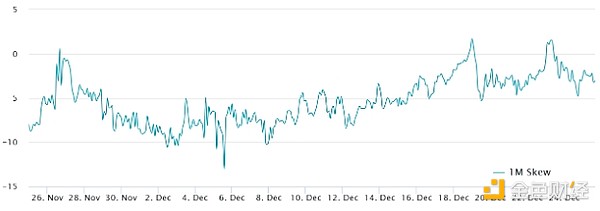

Bitcoin 1-month options 25% delta bias (put options). Source: Laevitas.ch

Bitcoin put (sell) options are trading at a 2% discount compared to equivalent call (buy) options, consistent with trends over the past two weeks. When whales and market makers anticipate a potential pullback, this indicator typically exceeds 6%, reflecting put premium.

The recent recovery in traditional financial markets also pushed Bitcoin above $98,000 as the S&P 500 erased its monthly losses on December 24. In addition, the yield on the 10-year U.S. Treasury note climbed to 4.59% from 4.23% two weeks ago, indicating that investors are demanding higher returns from holding government debt.

Recent increases in U.S. Treasury yields typically reflect expectations of higher inflation or higher government debt, which can dilute the value of current bond holdings. In contrast, when central banks are forced to stimulate the economy by injecting liquidity, scarce assets such as stocks and Bitcoin tend to perform well.

Bitcoin faces stagnation fears amid economic uncertainty

Bitcoin’s upside remains capped as investors worry about the risk of a global economic shutdown. In this case, predicting the full impact on stock markets and real estate assets is challenging. Currently, Bitcoin’s correlation with the S&P 500 is relatively high at 64%.

The Fed has scaled back its expectations for rate cuts and now says it will cut rates only twice in 2025, compared with four previously expected. This adjustment reduces the short-term risk of declining corporate profits and potential problems with real estate financing.

In order to assess market sentiment, it is crucial to analyze Bitcoin’s margin market. Unlike derivatives contracts, which require buyers and sellers, margin markets allow traders to borrow stablecoins to buy spot Bitcoin or borrow Bitcoin to establish short positions, betting that the price will fall.

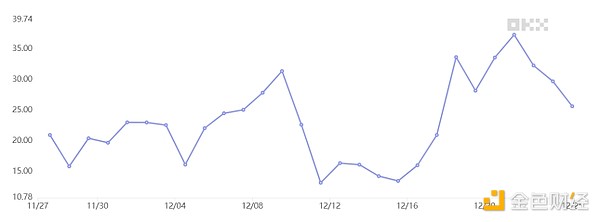

OKX’s Bitcoin margin long-short ratio. Source: OKX

OKX’s Bitcoin long to short margin ratio is currently 25x, favoring long (buy) positions. Historically, excessive confidence has pushed this ratio above 40x, while levels below 5x are generally considered bearish.

Both the Bitcoin derivatives and margin markets are showing bullish momentum, despite record outflows from BlackRock’s iShares Bitcoin Trust ETF (IBIT) on December 24. Additionally, the resilience shown in the retest of $92,458 levels on December 23 has bolstered optimism that Bitcoin has the potential to reach $105,000 and beyond.

panewslab

panewslab