BTC returns to 94,000, but VC is not happy

Reprinted from panewslab

04/23/2025·24DOn April 23, the news rekindled market sentiment as Trump announced the reduction of tariffs on China.

Investor confidence in risky assets quickly rebounded, with BTC rising 7% quietly, and the price returned to $94,000.

Everything seemed to be back all night.

BTC is one step closer to breaking the all-time high of $100,000 at the beginning of the year. Twitter is full of expectations for a new bull market. Traders in the secondary market are busy chasing the rise and fall, and the market seems to have returned to the fanatical spring of 2021.

However, this emotional return does not belong to everyone.

Their lively is theirs. First-level investors may be silent when facing signs of bull recovery.

Niu Hui died of locking his position

The good news of BTC returning to $94,000 made secondary market investors cheer, but for primary market investors, this carnival is like a distant dream.

Most of their tokens are locked and cannot be traded freely, and the market performance in the past year has caused them to suffer heavy losses.

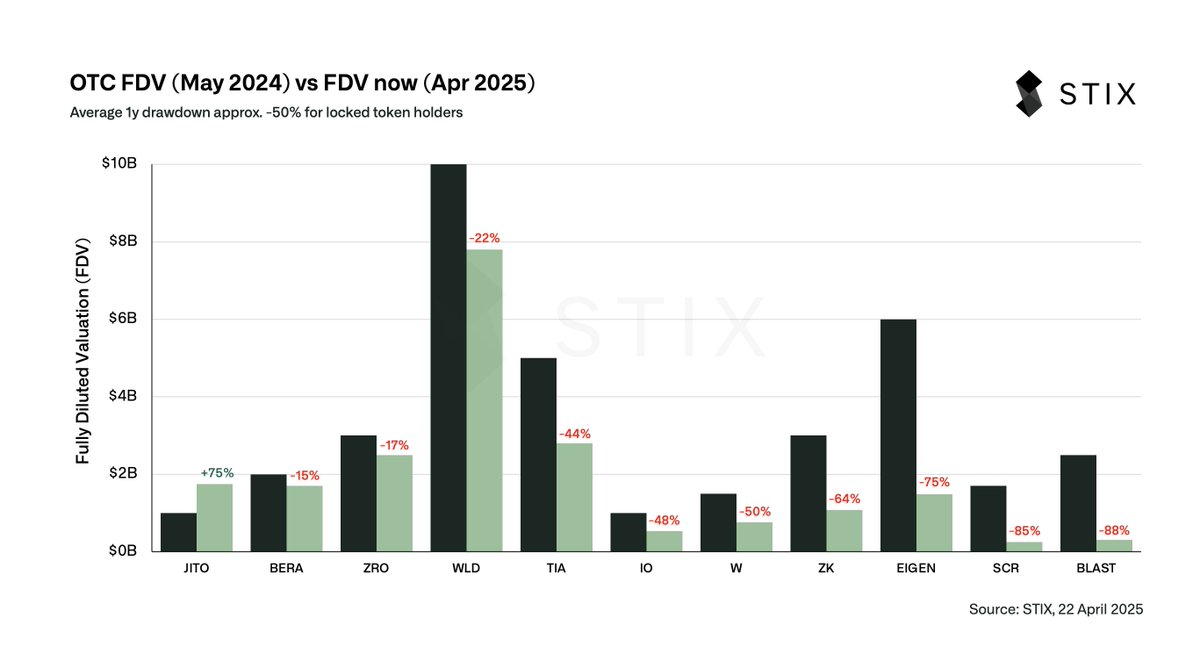

A chart from STIX (@stix_co) reveals this cruel reality.

@stix_co is a platform focusing on cryptocurrency OTC (OTC) trading, providing liquidity support for locked tokens.

The figure above compares the valuation changes of multiple tokens in May 2024 and April 2025: May 2024 is the valuation of these tokens when trading over the counter (that is, the price that first-tier investors can sell when locked), while April 2025 is the actual valuation of these tokens in the open market (that is, the current market price).

The results show that on average, the valuation of these tokens fell by 50% in a year.

Let’s look at a few specific examples.

BLAST's off-market valuation last year was US$250 million, and the current market valuation is only US$30 million, down 88%; EIGEN fell from US$600 million to US$150 million, down 75%; SCR was even worse, down from US$170 million to US$255 million, down 85%.

Almost all tokens fell sharply, with JTO being the exception, rising from $100 million to $175 million, up 75%.

But this is just an exception and cannot cover up the overall bleak situation.

Simply put, if the tokens in the hands of these first-tier investors were not sold through OTC over-the-counter trading last year, the average value of the holdings was cut in half, and some of them were even only 10% or 20%.

Add some background knowledge. OTC trading means that before the token is unlocked, first-tier investors can sell in advance through private transactions, and usually get some discounts.

Taran mentioned in the post above that the price of these tokens was about 100% off the valuation when they were traded over the market last year.

In other words, if they sold last year, they might only lose 10%-20%, or even not. However, some investors chose to hold it for one year and waited for unlocking, but the token value fell by an average of 50%, and some even fell by 70% to 80%, and their wealth shrank significantly.

You might say that their investment cost is low, and even if it falls so much, there is still a profit.

But the problem is that there is something called opportunity cost in economics. As an investor, what is more uncomfortable than making less money (maybe even losing money) is the theoretical loss of opportunity cost.

In the theoretically optimal case, Bitcoin (BTC) has risen 45% in the past 12 months.

If first-tier investors sold their tokens last year and exchanged them for BTC, their money may have risen to 1.45 times the original.

But now, their tokens are only 0.5 times worth, and they may even have to be sold at a 50% discount after being unlocked in the future, and may be worth only 0.25 times in the end.

In other words, compared with the increase in BTC, their actual losses were as high as 82.8%; even in the US dollar, they lost 75%.

It's like watching others make a lot of money, while their assets are shrinking and smaller.

"Niu Hui" may have died of locking up the position for them.

The most annoying thing about locking a position for a year is that it loses half of the loss.

Research, compare, identify and invest in projects, it is more affordable to just take BTC.

In the classic investment book "Strive on Wall Street", there is a famous "orangutan darts theory".

Author Burton Markill proposed that if an orangutan was allowed to throw a dart with his eyes blindfolded and choose a stock portfolio, its long-term returns may not be worse than the careful selection of professional investors.

This theory was originally used to satirize the ineffectiveness of over-analytics in the stock market, but now it is particularly ironic when it is placed in the cryptocurrency market.

First-level investors spend a lot of time and energy studying white papers, analyzing project prospects, and even locking in positions for a year to gain high returns, but the result may be: it is better to throw the darts on Bitcoin casually.

BTC has risen 45% over the past year, while their locked tokens have dropped by 50% on average, or more.

The valuation and investment logic of the entire altcoin may need to be reshaped urgently.

Spring won't come back

Is the next wave of crypto altcoins still locking the position like this?

VC entered the market at a low price. The lock-up mechanism was originally intended to protect the early stages of the project and prevent the large-scale selling of early investors, causing price collapse. But judging from the data from the past year, this mechanism has also caused first-tier investors to bear huge risks.

The original post of the chart above also mentioned that more than US$40 billion of locked tokens will be unlocked one after another in the future, which means that the market may face greater selling pressure. If the new tokens continue to lock their positions at high valuations, investors may fall into a vicious cycle of "locking their positions for a year and losing half of their losses".

Obviously, the gameplay of locking up positions is no longer suitable for the current market environment.

Will primary investment in the crypto market still be hot? Can the spring of first-level investment come back? Judging from the current situation, the answer may not be optimistic.

In the past few years, the high valuation of altcoins has often been based on market fanaticism and liquidity premiums, but as the market gradually matures, investors have begun to pay more attention to the actual value and liquidity of the project.

The high risk of locking up tokens has discouraged first-tier investors, and more people may choose more transparent and liquid projects.

Some emerging trends have emerged: such as shorter lock-up cycles, lower valuation multiples, and even directly reducing the bubble of primary investment by directly issuing Memes;

Of course, it is also possible that old wine is still in new bottles. Under the fairer appearance of Meme coins, the first-level logic still exists. The system will build plates so that you can't see that there is a first-level existence.

More transparent mechanisms have become particularly important for the entire crypto market. The lock-up mechanism also needs to find a better balance point, which can not only protect the early stage of the project, but also prevent investors from taking too high risks.

But the problem is, if you don’t lose at level one, if you don’t lose at level two, if you don’t lose at level two, if you don’t lose at level one, who will lose?

Cryptokens do not produce value, but transfer value; if someone makes money, someone will definitely lose.

One wave of people's spring will inevitably be another wave of cold winter.

jinse

jinse