BTC hits a new high, ETH follows suit, is the Christmas market coming?

Reprinted from panewslab

12/17/2024·6MBitTweet data shows that Bitcoin hit a record high of $107,822 at around 13:30 ET on Monday, up about 5.5% from late last Friday. Meanwhile, Ethereum briefly rose to $4,081, the highest price recorded since December 2021 and slightly higher than the peaks in March and early December this year.

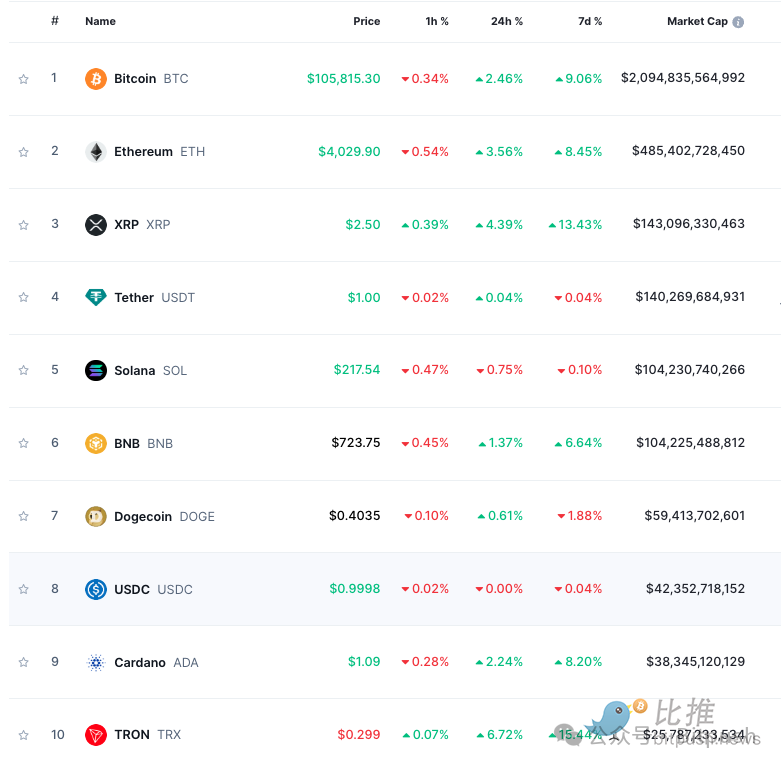

As of press time, Bitcoin's gains have fallen slightly, with the current price at $105,815, up nearly 3% on the day and 9% on the week.

ETH is at $4,029, up more than 3% on the day but still 16% below its all-time high of $4,878 set in November 2021. The total cryptocurrency market capitalization is $3.7 trillion, up 2.97% in the past 24 hours.

According to CoinGlass data, in the past 24 hours, the total liquidation of the crypto market was US$489 million, of which Bitcoin liquidation was US$177 million, while Ethereum (including long positions) was US$97 million.

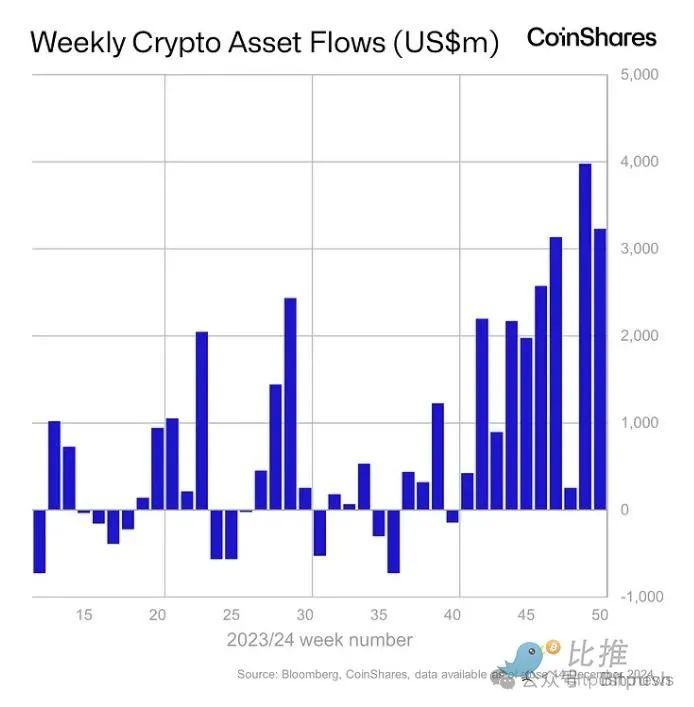

Crypto fund inflows hit record high

Global cryptocurrency funds continue to gain traction among institutional investors, with inflows hitting record highs. According to data from CoinShares, global cryptocurrency funds have continued to record net inflows over the past four weeks, totaling $3.2 billion. The positive trend brings total inflows so far this year to $44.5 billion, more than four times the amount in any previous year.

Among them, the performance of U.S.-listed Bitcoin exchange-traded funds (ETFs) is particularly outstanding. The ETFs attracted $2.17 billion in net inflows over the past week, bringing total inflows to more than $5.3 billion since their launch in January.

In addition to Bitcoin, Ethereum funds have also recorded net inflows for seven consecutive weeks, totaling US$1 billion. The market's optimism about Ethereum continues to heat up, driving the continued inflow of funds. "Ethereum ETF inflows have exceeded $800 million per week since the past two weeks, reflecting an accelerating trend," Bernstein analyst Gautam Chhugani said.

In addition, other altcoin funds also recorded varying degrees of net inflows. XRP investment products saw net inflows of $145 million last week, with funds based on Polkadot and Litecoin seeing inflows of $3.7 million and $2.2 million respectively.

"Christmas Quote" starts

Investor sentiment was boosted by the inclusion of MicroStrategy (MSTR.O) in the technology-heavy Nasdaq 100 index. MicroStrategy's stock price has soared more than sixfold this year, with a market value of nearly $94 billion.

Matthew Dibb, chief investment officer of crypto asset management company Astronaut Capital, believes that inclusion in the Nasdaq 100 will form a virtuous cycle: funds tracking the index passively buy MicroStrategy shares, pushing up the stock price; MicroStrategy can continue to increase its holdings by issuing bonds or stocks. BTC, thereby further consolidating its position advantage, thereby attracting more investor attention and driving the stock price to rise further.

“The inclusion seemed a bit unexpected, but that didn’t stop the excitement, with many believing it was the start of a capital cycle that could push Bitcoin spot prices higher,” he said.

Data from the past eight years shows that since 2015, Bitcoin has closed higher in December six times, with gains of at least 8% and as high as 46% (except in 2020).

This year's Christmas market seems to have started early. The Christmas market refers to the phenomenon that U.S. stocks often rise in the last week of December and the first few days of January. Such increases tend to be driven by holiday optimism, increased holiday spending and investors making year-end trades.

IG analyst Tony Sycamore told CNBC: "We are now in an uncertain range. The next number the market is expecting is $110,000. The pullback that many people speculated did not happen."

Coinstash co-founder Mena Theodorou believes: “With BTC firmly above $100,000, ETH’s growth momentum and huge ETF inflows may herald the beginning of a broader altcoin Christmas rally. Coupled with the Trump administration’s support for cryptocurrencies, With inflation easing and the Federal Reserve potentially cutting interest rates, conditions are well placed to support potential cryptocurrency market growth.”

Meanwhile, some traders are targeting BTC reaching $120,000 and above in the next year.

Jeff Mei, chief operating officer of cryptocurrency exchange BTSE, said on Telegram: “We believe that Bitcoin still has huge upside potential, and the price can easily reach $125,000 by the end of 2025. Although some people have said that in the past month or so, Bitcoin has The upside potential of the coin has been priced in, but we believe the rally is just beginning as it takes time for institutions, family offices, and high net worth individuals to accept moving 1%-3% of their portfolios. Allocate to Bitcoin and Cryptocurrencies. Once that happens, crypto inflows are likely to surge. There are plenty of reasons to be bullish, given Trump’s pro-crypto appointments, continued interest rate cuts, and more.”

jinse

jinse