Bloomberg: TRUMP coins are led by foreign buyers, and dinner promotions have caused regulatory doubts

Reprinted from panewslab

05/09/2025·15DAuthor: Leonardo Nicoletti, Anthony Cormier, David Kocieniewski

Compiled by: Luffy, Foresight News

More than half of Trump's Meme currency Trump's major shareholders come from foreign trading platforms that claim to be banned from U.S. users, indicating that many buyers are from outside the United States.

Trump is a cryptocurrency that President Trump began promoting a few days before his inauguration. Trump token sales have surged in the past two weeks following an unprecedented promotion: More than 200 largest token holders will be invited to a dinner party held at Trump Virginia Golf Club on May 22, while the top 25 holders will be eligible for exclusive receptions before the dinner and the "VIP" visits described by the Trump token website.

Today, Bloomberg News analysis shows that the top 25 holders registered on the website rankings, except for six, use foreign trading platforms that claim to not accept U.S. residents. Among the top 220 holders on the ranking, at least 56% use similar offshore trading platforms. The prevalence of these potential foreign buyers echoes the moral concerns of Congress Democrats about promoting tokens with the promise of engagement with the president. This also raises questions about how promotion dinner participants will be reviewed, whose public identities can be linked to a username composed of several letters.

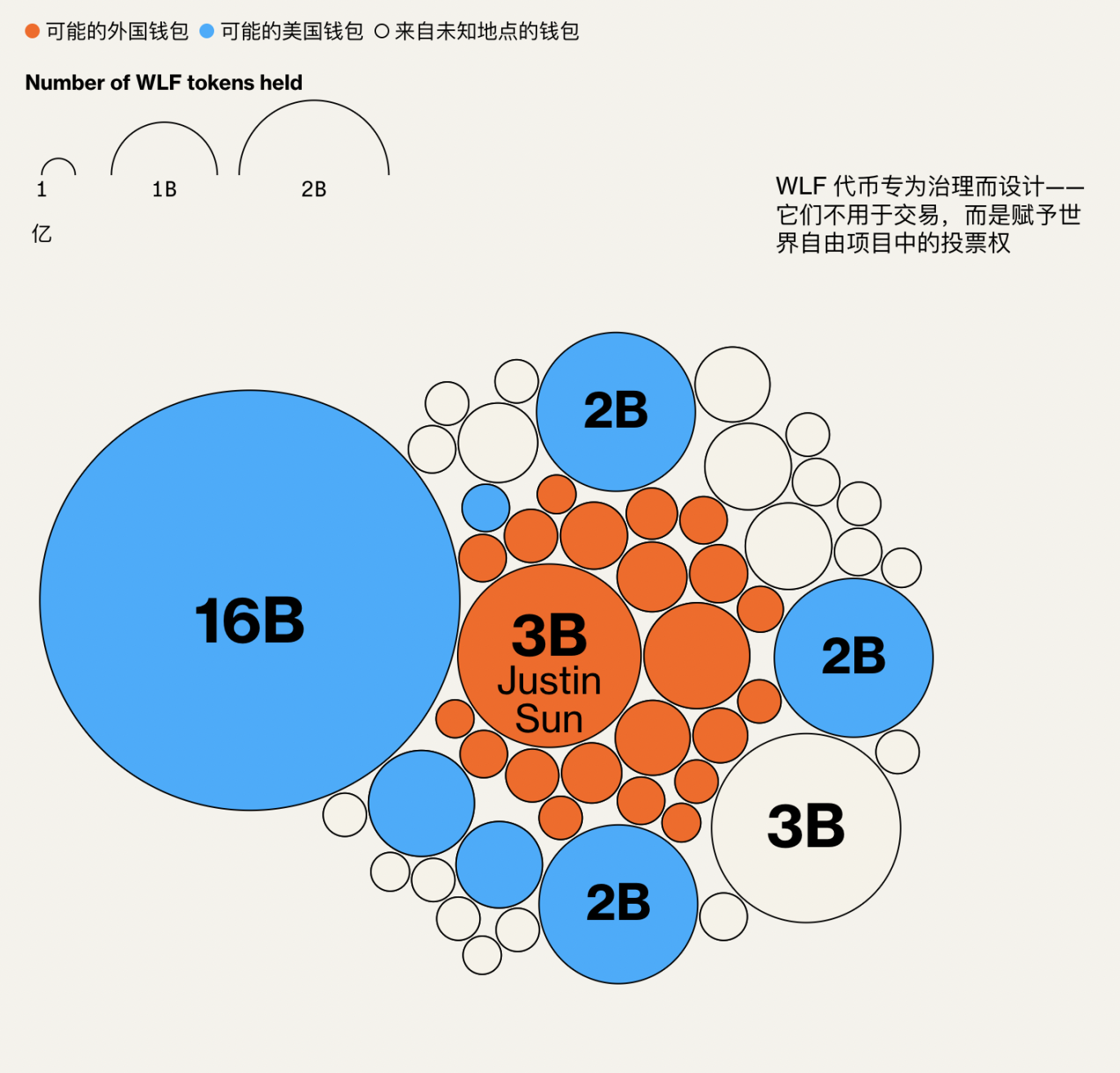

Most of the big holders of Trump tokens may be outside the United States

The value of the current tokens held by the 220 cryptocurrency wallets registered on the TRUMP rankings (by where the wallet holder may be). The value of tokens held in the top 220 wallets may be 76% of the foreign owners because these wallets use trading platforms that are unavailable to U.S. residents. Data Source: Bloomberg's analysis of SolScan data. (Note: The data is as of 10 a.m. ET, May 5. The username is listed on the TRUMP token website and is set by wallet holders when registering for dinner promotions. There is a wallet still on the top 25 of the ranking websites not listed here because it sold almost all tokens held on May 3)

In the website’s details, organizers say that participants must pass a background review. "We will also review your wallet for KYC and compliance purposes. You will have dinner with the President of the United States!" The website reads, but the website does not specify how such review will be conducted.

Promoters of TRUMP tokens did not respond to requests for comment, nor did White House officials respond.

In order to appear on the dinner rankings, people who purchased TRUMP coins must register on their website, which says they will rank them based on the number of tokens they hold and the time they hold, and many large holders have not yet registered. But another Bloomberg analysis of all the largest buyers, whether on the rankings or not, shows that more than half of the wider buyer group also comes from foreign trading platforms.

It is possible that some American buyers have found ways to bypass the ban on using foreign trading platforms, such as using a virtual private network (VPN) to hide the U.S. IP address. Most trading platforms say they have taken measures such as collecting user personal information to try to prevent such evasion. The three foreign trading platforms that TRUMP token holders most commonly use to inject capital into accounts or purchase TRUMP coins are Binance, Bybit and Ouyi, all of which impose restrictions on US users. Bloomberg's analysis found that before Euyi launched the trading platform in the United States on April 15, six holders on the TRUMP token rankings made purchases on the platform. A spokesman for Ouyi said the company would not allow U.S. residents to make purchases before that. Representatives for Binance and Bybit did not respond to requests for comment.

Two of the three trading platforms have previously violated U.S. law. In November 2023, Binance pleaded guilty to ineffective internal controls and violated the federal anti-money laundering and sanctions law and paid more than $4 billion to the United States. Ouyi admitted to violating anti-money laundering regulations in February and paid more than $420 million.

This is not the first time that Trump-related cryptocurrency projects have attracted a large number of foreign investors.

Hong Kong-based cryptocurrency entrepreneur Justin Sun became an advisor to the project after announcing his purchase of the tokens (WLF) of World Liberty Financial, another cryptocurrency project promoted by the Trump family, worth tens of millions of dollars. Justin Sun said at the time that he did not expect any benefit from Trump because of the investment. According to Bloomberg's analysis of cryptocurrency wallet transactions, Justin Sun may also be a major holder of TRUMP tokens.

On May 8, 2020, Justin Sun, the founder of the blockchain platform Tron, was in Hong Kong. Source: Bloomberg

World Liberty is promoting a stablecoin. Zach Witkoff, one of the founders of the company and son of Trump's Middle East envoy, announced at a meeting Thursday that the stablecoin would be used to facilitate transactions between Binance and an investment company founded by the Abu Dhabi government. World Liberty executives did not respond to requests for comment.

"Congress should ask the president to disclose those who secretly pay him tribute to him to assess whether the public interest has been damaged," said Tony Carrk, executive director of the nonprofit Accountable.US. The group has set up a "Trump Accountability War Room" online. Accountable.US found that at least 14 of the top 50 holders of the World Liberty token also used cryptocurrency services that Americans cannot access. Bloomberg analyzed that it found another 8 such wallets. World Liberty disclosed in November that its initial $300 million offering was mainly sold overseas.

Many of the major holders of WLF tokens are located abroad

Holding of 50 wallets holding up to WLF tokens (by where the wallet holder may be located). Data source: Accountable.US, Bloomberg\'s analysis of Etherscan data. Note: Data as of April 30 at 6:45 pm ET.

Trump, who once called Bitcoin a "scam against the dollar", has begun to dissolve regulatory and law enforcement teams that were originally responsible for regulating these digital assets while experiencing deep into the cryptocurrency field. For example, shortly after he took office, the SEC staff investigating cryptocurrencies were reassigned, and many of their cases were put on hold. In April, the U.S. Department of Justice dissolved its cryptocurrency task force.

Last month, Democratic Senators Adam Schiff and Elizabeth Warren called on the U.S. government’s Office of Ethics to investigate Trump’s token dinner promotions. They said the May 22 event had “serious risks” that President Trump and other officials could engage in corruption by selling opportunities to individuals or entities to engage in the president while making personal profits for the president and his family.”

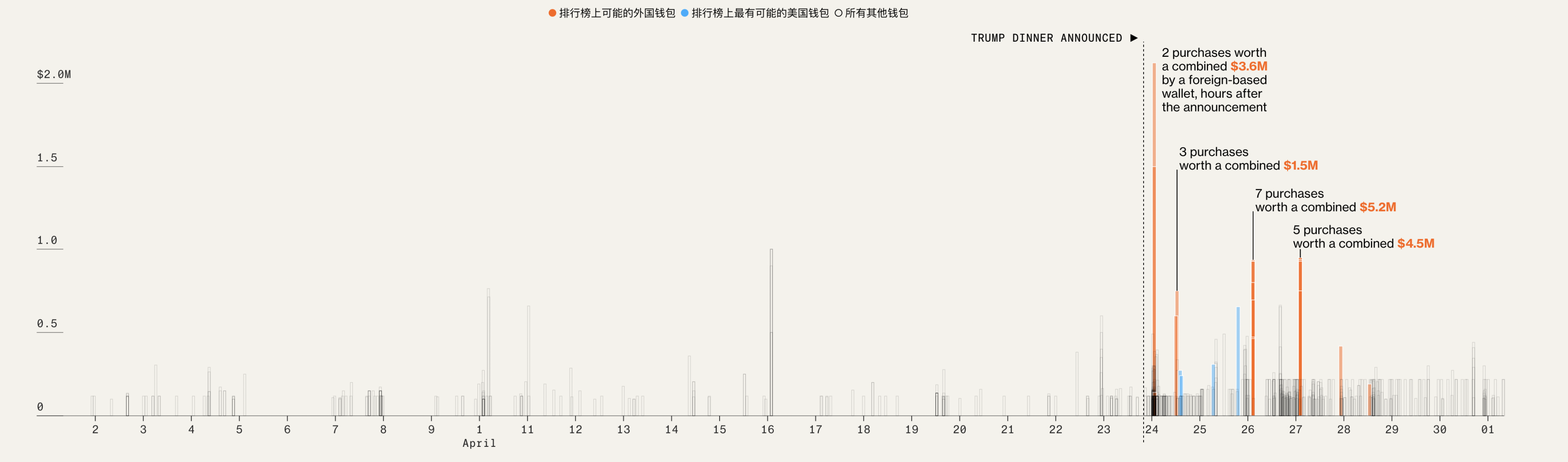

The Trump family benefited from the rise in TRUMP token prices because a company they controlled held a large number of the tokens. Although the Trump family cannot sell any tokens for a period of time under the terms of the token issuance, any fluctuations in the price will change their wealth status on the books. The announcement of the April 23 dinner brought the token price to about $14, with 436 new deals over the next five days involving more than $100,000, including the largest of which involved accounts interacting with trading platforms that do not operate in the U.S.

A large number of overseas purchases appeared after the dinner was

announced

Purchase of TRUMP tokens in April exceeds $100,000. Data source: Dune; Bloomberg's analysis of SolScan data. Note: The data is as of May 1.

To be eligible for dinner with Trump, token holders must register for a "self-custodial" wallet, i.e., wallets controlled by the holder, not by a third-party trading platform.

Bloomberg analyzed transactions in the top 220 wallets on the dinner rankings as of May 5 to determine whether their holders may be from abroad. Another separate analysis examines all self-custodial wallets holding enough Trump tokens to qualify for the top 220 as of April 30. Many of the largest holding wallets are not listed on the dinner rankings, indicating that they are not registered yet, or that their time-weighted holdings may differ significantly from the current holdings. Some may be strategically waiting for registration.

While it is difficult to identify the people behind these accounts, there are already public clues for some of them. For the past few days, entities on the ranking have been swapping positions, with at least one of them boasting about the incident online. The wallet named "MeCo" belongs to an entity named "Memecore" that claims to be a "L1 multi-chain cross-staked mainnet compatible with Ethereum virtual machine (EVM), protected by the Meme proof mechanism."

"We not only want to be at the top of the TRUMP rankings, we also need to conquer the entire Meme currency field," the company said on the X platform. Memecore requires users to send their TRUMP tokens to it in order to improve their rankings. The company said the tokens will be returned to users later, with rewards included.

"The Meme currency field is currently considered to be stagnant, and we want to challenge this statement. By participating in this event, we want to show that the Meme currency field is rising again."

According to Bloomberg's analysis of blockchain data, the leader Memecore is chasing on the rankings chose the username "Sun" and used a wallet belonging to HTX, which is associated with Justin Sun. Justin Sun himself has publicly admitted to buying World Liberty Financial tokens, but so far, he has not stated whether he is the owner of the top wallet. He did not respond to a request for comment.

The wallet marked "Sun" began to accumulate tokens worth a total of $17.9 million when Trump tokens were initially launched in January. It has purchased another $4.5 million worth of tokens since the announcement of the Trump dinner promotion.

In 2023, the Securities and Exchange Commission sued Justin Sun, accusing him of working with a company he owned and controlled to plan the issuance and sale of unregistered securities. Sun's lawyer denied the allegations and said the regulator's claims were "too far-fetched and should be dismissed." In February, the Securities and Exchange Commission suspended its lawsuit against Justin Sun after spending at least $75 million on World Liberty Financial tokens, saying it was in the interest of both parties to consider a potential solution.

chaincatcher

chaincatcher