Blockworks’ 27 predictions for 2025: The United States will become the center of encryption, and Base will be Solana’s main competitor

Reprinted from chaincatcher

12/23/2024·5MAuthor: Mippo, Co-Founder of Blockworks

Compiled by: Deep Wave TechFlow

- The United States will re-emerge as the core center of global cryptocurrency.

More and more entrepreneurs will return to the United States and set up offices in New York.

The U.S. cryptocurrency conference will also be larger than similar events in Asia.

-

More than 10 DeFi protocols will officially launch fee switches, including Uniswap.

-

DeFi protocols will gradually adopt rehypothecation of customer assets as a new business model .

This trend will involve areas such as cross-chain bridges and liquid pledged tokens (LSTs).

- The Ethereum community’s debate on the “North Star” route will come to a conclusion:

Attempts at scaling up the L1 mainnet will remain low (such as increasing the Gas target to 50M gwei, while discussions about reducing block times will heat up).

Ultimately, the roadmap with Rollup at its core will be reconfirmed.

-

Max’s expansion proposal would not gain enough support and ultimately failed.

-

This outcome will bring much-needed cohesion to the Ethereum community and improve overall market sentiment.

Nonetheless, some developers and users with different opinions may exit the ecosystem as a result.

ETH token price is expected to perform strongly.

- Rollup-based solutions will still be difficult to achieve major breakthroughs in 2025.

However, through protocols like Across, good enough interoperability can be achieved.

There is still no clear direction to achieve universal synchronous composability.

-

Trusted Execution Environments (TEEs) will gradually become an important part of L2 infrastructure and eventually become its permanent feature.

-

Solana 's momentum will continue this cycle, but by 2025 problems will gradually emerge:

Due to the decentralization of memecoins) and the challenges posed by MEV (Maximum Extractable Value), Solana’s REV will have difficulty reaching new highs. In response to these issues, there will be a rise in extremism (Maximalism) in the Solana community.

-

The Firedancer client will be officially launched in the fourth quarter, when Solana 's network will achieve a processing capacity of 100,000 TPS .

-

Solana may adjust its token issuance policy to reduce inflation, while Ethereum will not make similar changes.

-

Base will become a dark horse in the Rollup ecosystem and become Solana 's main competitor.

Total assets on Base are expected to exceed $40 billion.

-

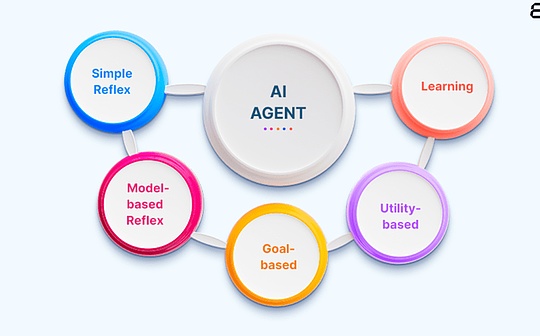

Base will also become an AI **** The preferred chain for AI agents and other AI applications.

-

Stablecoins will gradually become the dominant asset on the L2 network, and their number is expected to be more than twice that of ETH.

-

The stablecoin market will usher in breakthrough growth in the next year:

The market capitalization is expected to exceed $450 billion. Stablecoins will become one of the top three investment areas that venture capital (VCs) will focus on.

- More than 5 large financial technology companies or traditional financial institutions will launch their own stablecoins in 2025.

This will put competitive pressure on existing stablecoins, causing their growth to slow.

- More than 10 enterprises (including banks and Web2 giants) will launch their own L2 networks in 2025.

However, most of these networks will have difficulty gaining market recognition and achieving practical results.

The only possible exceptions are fintech companies such as Robinhood.

- With its large user base and strong brand influence, Robinhood will become one of the dominant forces in the industry by 2025.

By the end of the year, Robinhood will be considered the two leading crypto exchanges in the United States, along with Coinbase.

- Investment opportunities in L1 blockchain still exist and won’t disappear anytime soon.

The most eye-catching projects will be Sui and HyperLiquid.

- The ICO model will return, but it won’t be as dominant as it was in 2017.

Investor protection will be better, and ICOs will become more like crowdfunding campaigns.

Five blue-chip protocols are expected to raise funds through ICOs.

- Venture capital will flow back into the crypto industry, but the scale of financing will not reach 2021 levels.

Total venture capital investment in crypto in 2021 is $30 billion. It is expected to be between US$20 billion and US$25 billion in 2025. The market will welcome more financing rounds of $50 million to $100 million.

- Crypto companies will usher in a window period for IPOs , but there will not be a large-scale listing wave.

More than four companies are expected to IPO, but as the valuation bubble in 2021 has not yet been fully digested, more companies may delay their listing plans.

Growth equity investing is still not going into crypto.

- The main trend in 2025 will be the combination of AI and encryption.

The continued progress of the basic model will attract more attention and promote the craze of AI-related tokens.

- The application scenarios of AI will be more diverse and not limited to agents .

Different types of agents will be tried, such as content creators, hedge fund traders, artists, etc.

But the vast majority of attempts will be in their early stages and likely to be unsuccessful.

- TikTok’s influence in the crypto space will reach unprecedented heights.

Crypto Twitter (CT) may become the primary exit channel for certain TikTok tokens.

- The United States will pass important encryption legislation in 2025.

An updated Market Structure Bill or Stablecoin Bill may be signed into law.

- Bitcoin 's L2 solution will still be difficult to achieve a breakthrough in 2025.

Bitcoin L2, which is truly based on zero-knowledge proofs (ZK), will still take longer to achieve.

- Cryptocurrencies will be widely seen as a long-term force in American politics.

The attitude of the mainstream media (MSM) will gradually change and begin to admit that cryptocurrencies will not easily withdraw from the stage of history.

panewslab

panewslab

jinse

jinse