BlackRock CEO: Inflation concerns will boost BTC to $700,000

Reprinted from jinse

01/23/2025·3MAuthor: Mark Mason, Bitcoin Magazine; Compiler: Wu Baht, Golden Finance

BlackRock CEO Larry Fink recently speculated that Bitcoin could be valued at as much as $700,000 per BTC. The prediction comes amid growing concerns about currency devaluation and global economic instability, positioning Bitcoin as a hedge against the vulnerabilities of the traditional financial system. Fink's comments were not a complete endorsement, but reflected his thoughts during a recent meeting with a sovereign wealth fund. The fund seeks advice on whether to allocate 2% or 5% of its portfolio to Bitcoin. According to Fink, if institutional adoption continues to grow and similar allocation strategies gain widespread acceptance, market dynamics could push Bitcoin to such staggering heights.

Fink made this startling statement in a recent interview, explaining that Bitcoin’s exponential growth potential is closely tied to concerns about economic recession and fiat currency devaluation. Fink described Bitcoin as an “international tool” that could alleviate local economic fears.

information to the market

Given that BlackRock manages $11.5 trillion in assets, Fink's comments are significant and send a clear message to both retail and institutional investors. His support goes beyond personal opinion and becomes a market signal for Bitcoin’s potential direction. Long hailed as “digital gold,” Bitcoin is viewed as a store of value that protects wealth from inflation and government fiscal mismanagement. Fink’s endorsement of this statement may further accelerate the acceptance of Bitcoin by traditional investors.

timely forecast

Fink 's forecast comes as the global economy faces soaring inflation, rising national debt and geopolitical tensions that threaten currency stability. With a fixed supply of 21 million coins and a decentralized structure, Bitcoin is an alternative asset class that is not subject to the inflationary pressures inherent in fiat currencies. In this environment, its value proposition becomes increasingly compelling.

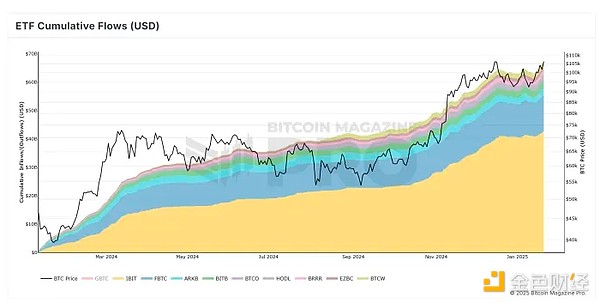

BlackRock’s Bitcoin ETF: A Signal of Institutional Interest

BlackRock’s deep involvement in Bitcoin reached a milestone on January 21, 2025, when the firm purchased $662 million worth of Bitcoin for its exchange- traded fund (ETF), their largest purchase so far this year of single-day purchases.

In October 2024, the net assets of BlackRock's iShares Bitcoin Trust (IBIT) surpassed that of the company's iShares Gold Trust (IAU). This milestone, achieved just months after IBIT launched in January 2024, highlights the rapid growth of Bitcoin-focused exchange-traded funds and increasing investor interest.

balanced view

While Fink 's forecast is undoubtedly optimistic, it still depends on the continuation of current economic trends. If global economic stability improves or innovative financial systems emerge to alleviate currency devaluation concerns, Bitcoin's price trajectory may stabilize at lower levels. Still, Fink’s high-profile comments underscore its growing role as a legal asset class.

The future of Bitcoin

Bitcoin’s evolution from niche digital experiment to mainstream financial instrument is accelerating. Fink’s comments could herald a pivotal moment not just for Bitcoin, but also for its broader acceptance in traditional finance. For investors and enthusiasts, this is more than a vote of confidence—it’s a sign that Bitcoin’s integration into the global financial landscape is not only imminent, but is already underway.

As the world watches, Bitcoin’s role in redefining finance continues to grow. Fink’s prediction reminds us that Bitcoin is no longer a fringe concept but a key player in the future of currency.

chaincatcher

chaincatcher

panewslab

panewslab