Bitwise: Should ETH rise sharply and allocate other crypto assets outside of BTC

Reprinted from jinse

05/15/2025·26DAuthor: Matt Hougan, Chief Investment Officer of Bitwise; Translated by: AIMan@Golden Finance

One big thing happened last week: Ethereum began to recover.

The world's second-largest crypto asset has rebounded sharply after several months of plunge (down nearly 60%). Its price has risen 53% since its April 12 low and has soared 37% in the past week alone.

There are multiple reasons behind this trend, including the successful implementation of the major upgrade of Ethereum and the overall market shift to risk appetite.

This rise has caused many investors to think: Should crypto asset holdings be diversified outside of Bitcoin?

This is a good question.

Bitcoin is the king of crypto assets - the largest, most liquid and most mature. In my opinion, it is similar to "digital gold" and is also the only crypto asset with a chance to become a major currency in the world.

But I think most investors should still allocate other crypto assets.

how so? History can give us inspiration.

Internet Investment in 2004

Suppose you want to invest in the Internet field in 2004. At that time, search was the dominant business and Google was the leader in the industry.

You may think: The Internet will usher in huge development in the future, and I want to buy the leading companies in its dominant market.

This would have been a good strategy. Google's stock price has risen 6309% over the past 20 years.

But the Internet is a general technology that can not only be used for search, but also in other fields: retail, social media, video, business-to-business (B2B) software, etc.

This means that in 2004, in addition to Google, you can also buy leading companies in various vertical fields: Amazon, Netflix, Salesforce, etc.

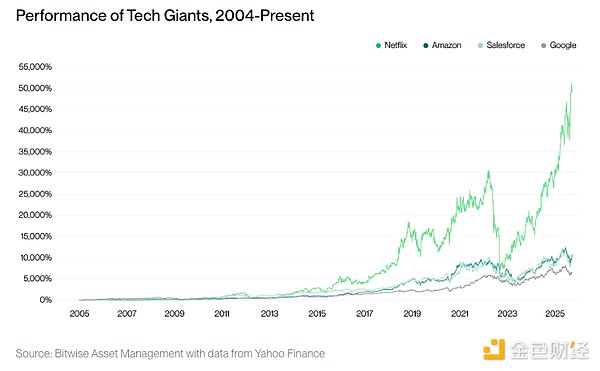

Here are the effects of this investment strategy:

Performance of tech giants (2004-present)

Google has performed extremely well and is now one of the most valuable assets in the world. But companies in other fields are not inferior - in fact, Netflix performs best, which was unforeseen in 2004.

Blockchain is a general technology

Like the Internet, blockchain is also a general technology.

You can use blockchain to create a better form of currency (such as Bitcoin), or build a programmable network for transferring "realistic assets" (such as Ethereum, Solana, Avalanche); you can develop new applications (such as decentralized finance DeFi, decentralized physical infrastructure DePin), or middleware to provide services to other blockchains (such as Chainlink); you can also create traditional enterprises that support the crypto economy (such as Coinbase, Circle, Marathon Digital).

I guess we can still use blockchain to accomplish many things that we have not yet thought of today.

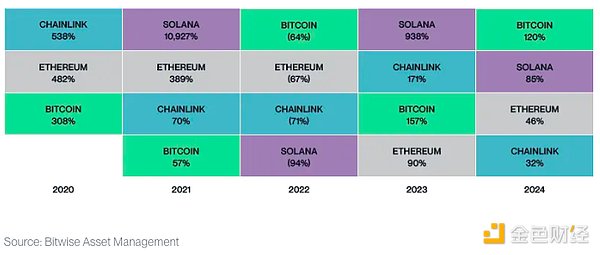

The functional diversity of blockchain means that although there may be different perspectives, the returns of different blockchain assets over time will be very significant. Here are the annual returns for Bitcoin, Ethereum, Solana and Chainlink over the past five years:

Crypto Asset Performance (2020-2024)

Which asset will perform best from now until 2030? This is a question worth thinking about!

Inspiration for investors

This does not mean that everyone should invest outside of Bitcoin.

If you think the only purpose of blockchain is to defend against the abuse of fiat currency, my advice is to buy only Bitcoin. Bitcoin is the only crypto asset with a clear opportunity to become a "currency", and it will be extremely difficult for other competitors to surpass it, if not completely impossible.

But if you agree with my point of view that blockchain is a universal technology—for example, you are interested in the idea that "almost all assets in the world will be chained"—then historical experience shows that you need to hold a basket of crypto assets: Bitcoin, Ethereum, Solana, Chainlink, etc.

Finally, I want to share a data that, despite my extensive experience in exchange-traded funds (ETFs) and crypto industries, still surprised me: Over the past 20 years, US active-managed equity funds have performed less than the benchmark index.

In a rapidly changing, huge and unpredictable field like the crypto field, this data is worthy of our repeated consideration.

My advice is: don’t worry about choosing winners, but invest at the macro level.

panewslab

panewslab