BitMart Research Institute丨WLFI In-depth Analysis: The Trump Family’s Political Empowerment and Financial Ambitions

Reprinted from panewslab

02/14/2025·3M1. Project background

1. Project introduction

WLFI is a DeFi project supported by the family of US President Trump, and was officially launched in September 2024. Its core goal is to promote the widespread use of stablecoins, strengthen the dominance of the US dollar in the global financial system, and use cryptocurrency technology to implement the vision of "making America great again." WLFI is positioned as a lending platform for DeFi. It was initially operated based on the Ethereum network and used mature DeFi protocols (such as Aave v3) to optimize the user experience rather than launching new financial tools.

On December 13, 2024, the World Liberty Financial community successfully deployed Aave v3 instances through its first proposal. Although WLFI has made initial progress, the project team is mostly new, and its long-term feasibility and innovation potential still need to be verified.

On February 12, 2025, WLFI announced the launch of "Macro Strategy", aiming to establish strategic token reserves and support leading cryptocurrency projects such as Bitcoin and Ethereum. The strategy will help WLFI enhance stability, boost growth and build trust while working with traditional financial institutions to promote asset tokenization. WLFI is working with several financial institutions to incorporate their tokenized assets into their reserves and provide transparency through an open blockchain wallet. In addition, WLFI will jointly conduct marketing and brand promotion activities with partner organizations to demonstrate its leadership in the field of financial innovation.

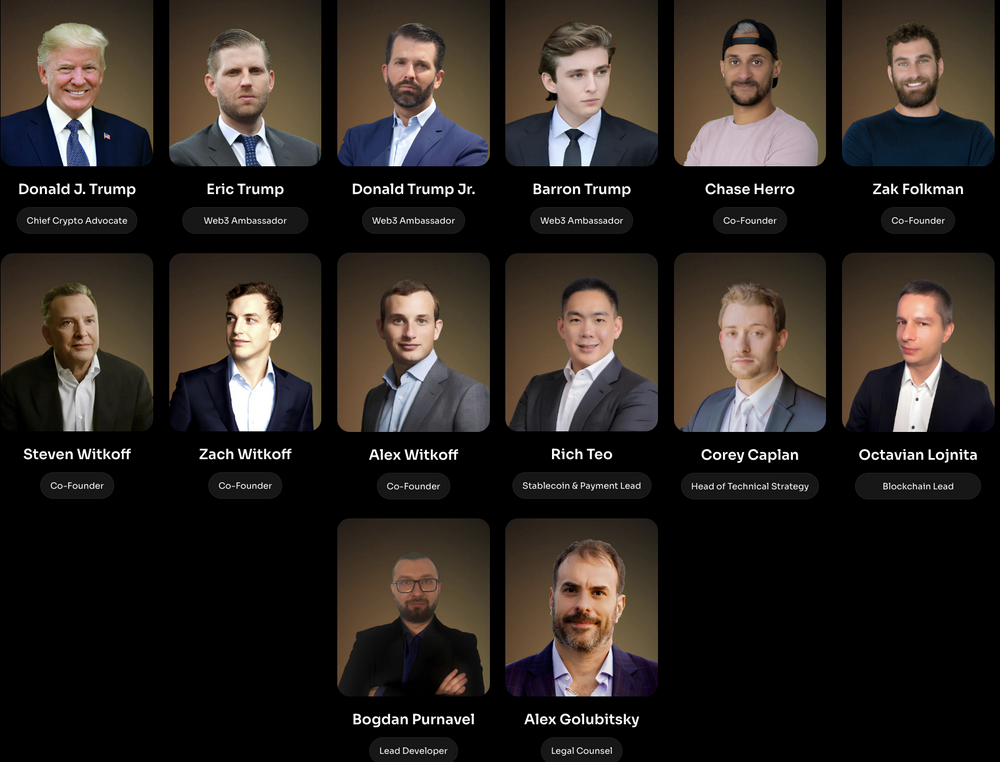

2. Team information

Trump family roles

-

Donald J. Trump: Listed as "Chief Cryptocurrency Advocate", responsible for supporting the project, but not deeply involved in technology or operations.

-

Eric Trump & Donald Trump Jr. & Barron Trump: He serves as the "Web3 Ambassador", mainly responsible for project promotion and promotion.

Core Co-founder

-

Chase Herro and Zak Folkman: The two jointly led the operation, but their background was controversial due to lack of experience in the crypto industry. Chase Herro has been involved in cannabis sales and promotion of controversial tokens; Zak Folkman has founded a men’s dating teaching company.

-

Witkoff Family: Real estate developer Steven Witkoff and his sons Zach and Alex are close to the Trump family, who donated $2 million to the Trump campaign. After Trump won the election, he appointed him as the Middle East envoy.

Core technicians

-

Rich Teo: Head of Stablecoins and Payments, previously founded the exchange itBit and stablecoin company Paxos, and is currently CEO of Paxos Asia. In addition, Rich is also a consultant to the SocialFi project RepublicK.

-

Corey Caplan: Head of Technology Strategy, co-founder of DeFi platform Dolomite, responsible for integrating lending and trading functions.

-

Bogdan Purnavel: Chief developer, formerly a developer of Dough Finance.

Advisory team

-

Alexei Dulub: Founder of Web3 Antivirus, blockchain security expert, has participated in L1/L2 development since 2013.

-

Sandy Peng: Co-founder of Ethereum Layer 2 Network Scroll, providing technical support for capacity expansion.

-

Justin Sun: As a strategic consultant and largest investor (injected US$75 million), he promotes ecological cooperation with Tron TRON.

Source of information: [WLFI official website](https://www.worldlibertyfinancial.com/us/token-sale)

2. Source of funds and usage of tokens

The source of WLFI's funding is obtained through WLFI token fundraising, and as of February 9, a total of US$455 million was raised (data source: WLFI official website ). Among them, the 21.3 billion tokens sold in the first round were sold out at a unit price of US$0.015, and the total amount of funds raised was US$319 million. The second round of public sales raised the unit price to US$0.05, and raised a total of US$136 million as of February 9. Currently, the total value of crypto assets purchased by WLFI is roughly estimated to be approximately US$325.8 million, which includes important projects such as ETH, WBTC, DeFi, and RWA. But one thing to note is that the operation of this project is not a fund-style issuance of WLFI tokens to raise funds, purchase tokens for mainstream project with growth potential, and WLFI token holders share the share gains of asset portfolio appreciation. The project white paper clearly states that the WLFI purchased by users is only for governance tokens and has no right to allocate investment and other benefits. Although WLFI defines itself as a DeFi lending platform, it has not yet started operating or providing DeFi services, so WLFI tokens currently have no value or use them.

3. Total holdings

As of February 2025, the total value of WLFI's assets is roughly estimated to be approximately US$327 million, the value of on-chain assets is approximately US$37.79 million, and the value of centralized exchange assets (if not sold) is approximately US$289 million (deposited into CoinbasePrime as part of fund management and business operations).

WLFI on-chain assets (data source: ARKM )

No

|

Asset

|

Holding

|

Price(USD)

|

Value(USD)

---|---|---|---|---

1

|

USDC

|

9,683,000

|

1

|

9,683,000

2

|

TRX

|

40,718,000

|

0.24

|

9,772,320

3

|

STETH

|

2,743

|

2,664

|

7,172,127

4

|

USDT

|

4,373,000

|

1

|

4,373,000

5

|

ETH

|

2,084

|

2,663

|

5,451,704

6

|

ONDO

|

342,002

|

1.34

|

458,283

7

|

MOVE

|

1,634,000

|

0.54

|

882,360

TOTAL

| | | |

37,792,794

WLFI CoinbasePrime Assets (Data Source: SpotonChain )

No

|

Asset

|

Amount To Coinbase Prime

|

Price (USD)

|

Value (USD)

---|---|---|---|---

1

|

ETH

|

73,783

|

2,663

|

196,484,129

2

|

WBTC

|

553

|

97,027

|

53,648,169

3

|

AAVE

|

16,585

|

246.7

|

4,091,520

4

|

LINK

|

219,149

|

18.79

|

4,117,810

5

|

ENA

|

4,941,034

|

0.5

|

2,470,517

6

|

MOVE

|

2,050,010

|

0.54

|

1,107,005

7

|

ONDO

|

114,754

|

1.34

|

153,770

8

|

USDC

|

27,859,000

|

1

|

27,859,000

TOTAL

| | | |

289,931,920

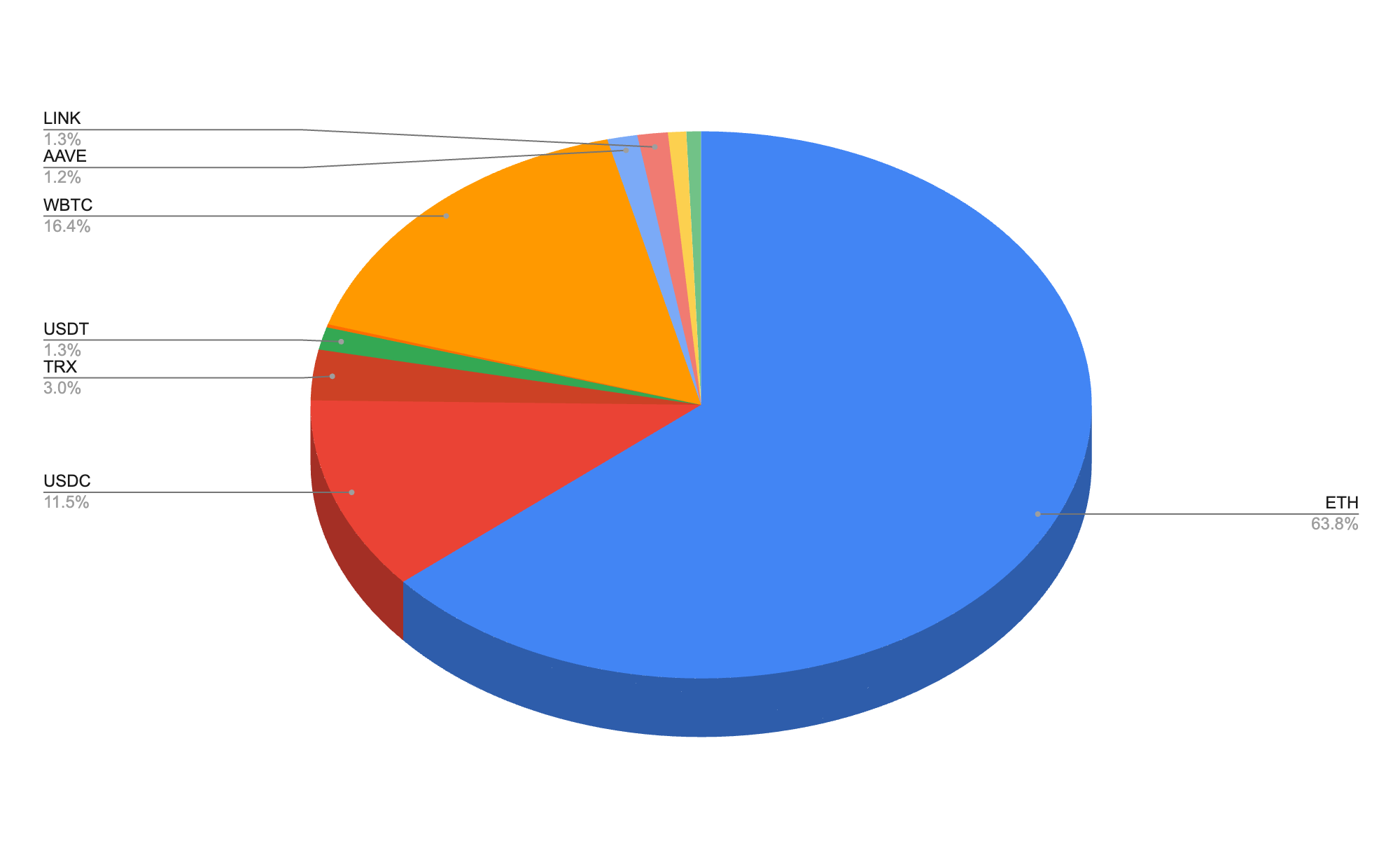

4. Analysis of the holding structure

As a crypto project with strong connections to the Trump family, WLFI's asset allocation strategy has attracted market attention and derived the concept of presidential selection. As of February 2025, ETH occupied a core position in WLFI's crypto holdings (63.8%), followed by WBTC (16.4%), and the remaining funds were placed in the DeFi and RWA tracks. It is worth noting that although the ETH/BTC exchange rate has continued to decline since December 2024, WLFI still chose to increase its position in ETH against the trend, which highlights its bet on the underlying infrastructure value of the Ethereum ecosystem. In terms of selection of sub-tracks, WLFI focuses on top projects: DeFi field has the leading oracle configuration Chainlink (LINK) and lending protocol Aave (AAVE); RWA track has a heavy holding of tokenized US debt agreement Ondo Finance (ONDO) and synthesis The US dollar agreement Ethena (ENA), forms a combination of "old agreement + emerging agreement".

In terms of foreign cooperation, WLFI has formed a deep binding with Tron founder Justin Sun, who invested a total of US$75 million through HTX-related addresses, becoming the largest institutional investor. This also explains the logic of WLFI holding TRX and WBTC.

In terms of fund management, WLFI will transfer US$307.4 million in assets to Coinbase Prime custody in the near future and unstaked 19,400 stETH for liquidity management. Currently, the project still holds US$47.49 million in stablecoin reserves, and the future investment may focus on three major directions: 1) supplement core asset holdings; 2) lay out emerging RWA agreements; 3) pay for ecological cooperation fees.

1. Ethereum (ETH)

ETH: 78,610 pieces (US$209 million, accounting for 63.8%).

2. DeFi

AAVE: 16,585 pieces (USD 4.091 million, accounting for 1.2%)

LINK: 219,000 pieces (USD 4.117 million, accounting for 1.3%)

3.RWA

ENA: 4.941 million pieces (US$2.47 million, accounting for 0.8%)

ONDO: 456,000 pieces (US$612,000, accounting for 0.001%)

4. Justin Sun 's assets

WBTC: 553 pieces (US$53.648 million, accounting for 16.4%)

TRX: 40.71 million pieces (US$9.772 million, accounting for 3%)

5. Other assets

USDC: 37.54 million pieces (US$37.54 million, accounting for 11.5%)

USDT: 4.37 million pieces (USD 4.14 million, accounting for 1.3%)

MOVE: 3.68 million pieces (US$1.989 million, accounting for 0.3%)

5. Logical analysis of WLFI project: political empowerment and financial

ambitions

**1. Financialization of political resources: The Trump family’s

fundraising tools**

Judging from WLFI's token economic model, up to 75% of sales revenue is directly owned by the Trump family, while the legal structure of the project deliberately avoids direct connection with Trump himself, but through family members (such as Eric Trump) Open endorsement to strengthen its political binding attributes. This design essentially transforms Trump's political influence into quantifiable financial assets, making it a political fundraising tool rather than a truly decentralized financial product. The market generally sees WLFI as a "bet on the prospect of Trump's crypto policy support." Previously, investors' purchase of the token was essentially equivalent to indirectly supporting Trump's campaign. This model is similar to Trump MEME tokens previously launched by Trump, both of which are alternative financing channels other than traditional political donations.

**2. Market sentiment manipulation: the dual operation of capital and

narrative**

Projects can use Trump's political influence to create market sentiment for themselves and related projects. For example, after obtaining investment from Justin Sun, WLFI bought a large amount of TRX and WBTC, and its current holdings are worth about US$63.41 million. As of February 9, Justin Sun invested a total of US$75 million, of which 84.5% of the funds were used to purchase his associated tokens. In addition, recently, WLFI co-founder Chase Herro said that he planned to use the tokens purchased by WLFI to build a "strategic reserve". Although there is no specific explanation of the goal and reason for establishing a token reserve, since Trump promised to establish a token reserve during his campaign last year, This topic has always attracted much attention. Last month, Trump signed an executive order to evaluate the feasibility of creating a digital asset reserve. Against this backdrop, the WLFI plan to establish strategic reserves will undoubtedly strengthen market expectations for the concept of "President Selection". Through deep binding with Trump's encryption policy, WLFI can not only create market expectations and attract more capital inflows, but may also promote off-site cooperation between project parties and political capital, thereby further expanding its market influence.

jinse

jinse