Bitcoin hits another 80,000 mark, it’s time to prepare for the “bear market”

Reprinted from panewslab

03/12/2025·1MAuthor: Babywhale, Techub News

Bitcoin once again hit the $80,000 mark this morning, and has rebounded above $82,500 at the time of writing. The weekend's decline also left a huge gap on CME's Bitcoin futures chart like last week.

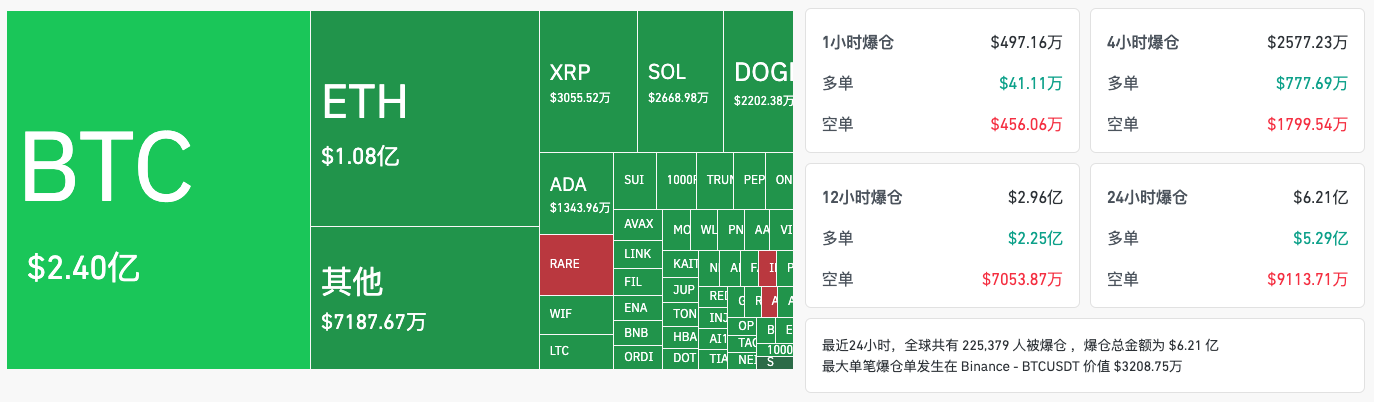

According to Coinglass data, as of the time of writing, the entire network has been liquidated by about US$621 million in the past 24 hours. Among them, the Bitcoin contract was liquidated by about US$240 million, the Ethereum contract was liquidated by US$108 million, the XRP contract was liquidated by about US$30 million, and the SOL contract was liquidated by more than US$26 million. The largest single liquidation occurred at Binance, with more than $30 million being liquidated.

**Reserve policies are less than expected, macro uncertainty rises

rapidly**

The Bitcoin reserve plan, which was previously given high expectations, has brought hardly any good news in the near future.

On the one hand, the Bitcoin Reserve Act signed by Trump clearly states that the bulk of the reserve comes from about 200,000 Bitcoins held by the US policy. Additional purchases of Bitcoin require a "budget neutral" method, that is, even if additional purchases of Bitcoin, the fiscal burden cannot be increased. There are speculations that the government may choose to sell some assets to purchase additional Bitcoin.

Standard Chartered Bank said the U.S. government could choose to sell gold to buy bitcoin, but then "crypto czar" David Sacks denied it. In my opinion, purchasing additional Bitcoin is a very difficult operation for the United States. For governments that cut off a large number of useless budgets in the opening ceremony as a savior, it is difficult to convince people to purchase risky assets that can fluctuate more than 10% in one day. Bitcoin is well known to us in the industry, but not everyone recognizes crypto assets for the general public.

In addition to the fact that the national level of Bitcoin reserves did not buy as crazy as Strategy as many optimistic people predicted, the advancement of the state government's Bitcoin reserve bill has also changed frequently.

So far, several states, including Montana, North Dakota and Wyoming, have rejected the Bitcoin Reserves Act. Although Utah passed the HB230 bill called the "Blockchain and Digital Innovation Amendment", it deleted the clause that authorized the state Treasury Secretary to invest in Bitcoin.

Of course, there are many states' relevant bills that have reached a final stage, but we can also draw some conclusions from the existing situation: the "glorious situation of buying coins from all over the country" that many practitioners expect may not happen, and lawmakers have also kept a clear mind and using real money to buy high-risk assets is indeed difficult to convince the public in the short term.

On the macro side, Morgan Stanley and Goldman Sachs lowered their growth rate expectations for the 2025 U.S. GDP growth rate, the former lowered the growth forecast from the previous 1.9% to 1.5%, while the latter lowered the data from 2.2% to 1.7%, and raised the probability of a recession from 15% to 20%.

In fact, Trump's efforts, including raising tariffs and reducing unnecessary expenses, must essentially contribute to the sustainable development of the United States in the long run, but in the short term, the impact of rising inflation, rising unemployment rate, and weakening of the dollar hegemony will inevitably be avoided. In my opinion, the current financial market is facing an extremely subtle situation: on the one hand, the increase in inflation caused by tariffs will further affect the US economy and have to force the Federal Reserve to cut interest rates at some point; but on the other hand, if the economy is resilient enough, a rash interest rate cut may further push up inflation.

In this way, Trump’s proud “open conspiracy” may bring about an unsolvable vicious cycle, which may be the main reason why analysts predict a recession in the United States. The author has an unfounded speculation, that is, many rich classes in the world are actually seriously derailed from the lives of ordinary people, and their short-term "pain" may destroy the lives of a considerable number of people at the bottom, and this mentality of "why not eat meat" is also an important source of many uncertainties.

For risky assets, the bad news of certainty is even better than uncertainty. The flying of gold, US stocks and US dollar in the past year is the most obvious sign that funds are looking for certainty. The recent decline in US stocks and US dollar means that the last safe haven for the risk market in the United States no longer has certainty, and the rise of Hong Kong stocks and A-shares also follows the same logic. But given that Bitcoin has become a part of the US stock market to some extent after the launch of spot ETFs, the author still needs to remind investors to prevent the tsunami caused by the flapping of the wings of butterflies at any time in the first half of this year.

chaincatcher

chaincatcher