Bitcoin Half a Year: Why does this cycle look very different?

Reprinted from panewslab

04/22/2025·29DAuthor: beincrypto

Compiled by: Blockchain Knight

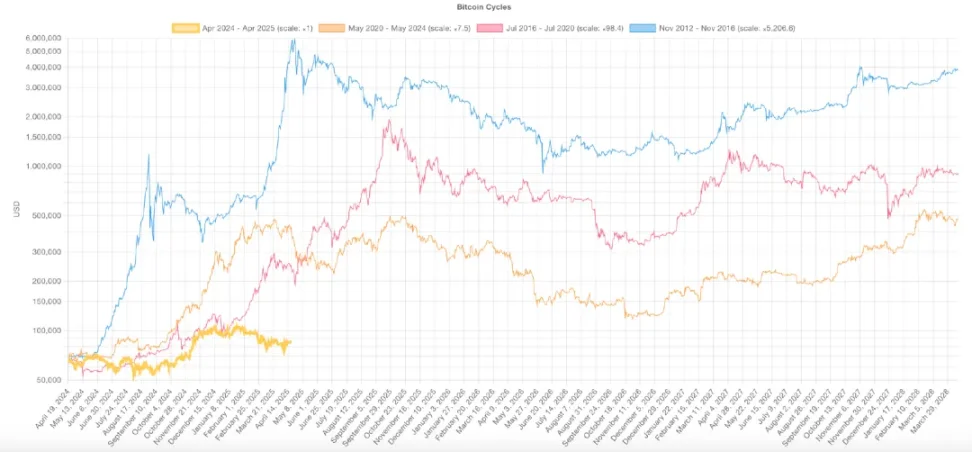

It has been a year since BTC's last halving, and this cycle is showing a completely different trend from the past. Unlike previous cycles where there was an explosive rise after the halving, BTC's gains in this round were relatively mild, only up 31%, while the previous cycle rose by as much as 436% in the same period.

Meanwhile, long-term holder indicators such as MVRV ratios show a sharp decline in unrealized profits, indicating that the market is maturing and the upside space is compressed. Taken together, these changes suggest that BTC may be entering a new era characterized by no longer parabolic peaks but rather a progressive growth driven more by institutions.

BTC Half a Year After: A Different Cycle

The development of this BTC cycle is significantly different from previous cycles, which may indicate a change in the way the market responds to the halving event.

In early cycles (especially from 2012 to 2016, and from 2016 to 2020), BTC tends to see strong gains at this stage. The period after the halving is usually accompanied by a strong upward momentum and parabolic price trend, which is mainly due to the enthusiasm and speculative demand of retail investors.

However, the current cycle has embarked on a different path. Instead of accelerating the rise after the halving, the price began to soar early as October and December 2024, followed by consolidation in January 2025 and a correction in late February.

This behavior of the previous rise is completely different from the historical model. In previous models, halving usually acts as a catalyst for a sharp rise.

There are many factors that cause this change. BTC is no longer just a retail-driven speculative asset, it is increasingly being seen as a mature financial instrument. The increasing participation of institutional investors, coupled with macroeconomic pressure and changes in market structure, has led to more cautious and complex market responses.

BTC cycle comparison. Source: Bitcoin Cycles Comparison

Another obvious sign of this evolution is that the intensity of each cycle is weakening. With the growth of BTC's market value, the explosive growth in the early years has become increasingly difficult to replicate. For example, in the 2020-2024 cycle, BTC rose 436% after a year of halving.

By comparison, this cycle has only increased by 31% over the same period, which is much more modest.

This shift could mean BTC is entering a new chapter, characterized by reduced volatility and more stable long-term growth. Half may no longer be the main driver, and other factors such as interest rates, liquidity and institutional funding are playing a bigger role.

The rules of the game are changing, and so are the trends of BTC.

Despite this, it is worth noting that in previous cycles, there were stages of consolidation and callbacks before returning to the upward trend. While this stage may feel slow or lack of stimulation, it may still represent a healthy adjustment before the next round of rally.

In other words, this cycle may continue to deviate from the historical model. It may not have a dramatic top bubble burst, but rather a longer-lasting, more solid-structured uptrend that is driven more by fundamentals than hype.

Long-term holders MVRV ratio reveals mature BTC market

The market value to MVRV ratio of long-term holders (LTH) has always been a reliable measure of unrealized profits. It shows the profits long-term investors make before they start selling. But over time, this number is declining.

During the 2016-2020 cycle, the LTH MVRV ratio peaked at 35.8, indicating a huge book profit and a significant top being formed. By the 2020-2024 cycle, this peak dropped sharply to 12.2, although BTC prices hit record highs at that time.

In this cycle, the highest LTH MVRV ratio so far is only 4.35, a huge drop. This suggests that long-term holders have gained much lower than in previous cycles, despite a sharp rise in BTC prices. This trend is obvious: the multiples of returns are declining in each cycle.

BTC's explosive upside space is being compressed and the market is maturing.

Now, the highest reading of the LTH MVRV ratio to date is 4.35 in this cycle. This significant decline suggests that long-term holders have much lower earnings than previous cycles, even as BTC prices have seen a sharp rise. This pattern points to a conclusion: BTC's upstream space is being compressed.

BTC long-term holder MVRV. Source: Glassnode

This is not accidental. As the market matures, explosive returns are naturally more difficult to obtain. The era of extreme, cyclical-driven profit multiples may be fading, replaced by more moderate or more stable growth.

The growing market size means that exponentially more capital is needed to significantly drive price increases.

However, this is not sure that this cycle has peaked. Previous cycles usually included a long period of consolidation or a minor pullback before reaching a new high.

As institutional investors play an increasingly important role, the accumulation phase may last longer. Therefore, the sell-off of peak profits may not be as sudden as early cycles.

However, if the trend of peak MVRV ratio declines continues, this may reinforce the idea that BTC is moving from a crazy, cyclical soar to a more mode of milder but structured growth.

The most dramatic gains may have passed, especially for investors entering the market late in the cycle.