Bitcoin fluctuated past $87,000. How do various institutions and KOLs view the future market?

Reprinted from panewslab

04/21/2025·1MAuthor: 1912212.eth, Foresight News

On April 21, Bitcoin broke through $87,000, Ethereum rebounded above $1,600, SOL also rose above $140, and altcoins rose slightly. According to Coinglass data, the 24-hour open contracts on the entire network reached US$220 million, and the short position was US$142 million.

Under the dual influence of the Federal Reserve's policies and Trump administration's tariff measures, the global macroeconomic has shown a complex pattern, with both the US stock market and the crypto market under pressure. Fed Powell recently said that the market's expectation that the Fed will take action to calm the volatility may be wrong. When asked whether the Fed would intervene in response to the sharp decline in the stock market, Fed Chairman Powell said: "My answer is no, but I will give an explanation." Under the hawkish speech of the Federal Reserve Powell, Trump continued to put pressure on it, and the time for the interest rate cut is still unknown.

In terms of tariffs, Wall Street News reported that Trump hinted in an interview last week that the tit-for-tat tariff hike between the United States and China may be about to end. "I don't want tariffs to continue to rise, because when it reaches a certain level, people don't buy it."

However, given the uncertainty of its final results, macro-market sentiment has not been significantly repaired. Today, spot gold has now hit a record high of US$3,364/ounce, and the crypto market has repeatedly fluctuated and entered a boredom period.

How will the market be interpreted in the future? Some institutional celebrities have given their own views.

Placeholder Partner: Bitcoin will hit a new high this year

Placeholder partner Chris Burniske tweeted that his forecast market may experience a few more quarters of gains, and then everyone will be bearish again, reminding investors to take appropriate profits when market sentiment is high. Chris Burniske said in response to comments that Bitcoin will hit a new high this year.

Matrixport: Bitcoin needs multiple catalysts to achieve sustained rise

Matrixport recently released a summary report that possible catalysts to achieve continued rise in Bitcoin include:

(1) The Federal Reserve sends dovish signals or cuts interest rates;

(2) Liquidity growth at the micro level, such as stablecoin growth and futures leverage increase;

(3) Liquidity growth at the macro level, such as money supply growth or government stimulus measures.

A significant upward trend of altcoins requires seeing actual application scenarios driving demand growth, or liquidity surge. However, according to tracking indicators, there is little possibility of a significant influx of liquidity in the crypto market.

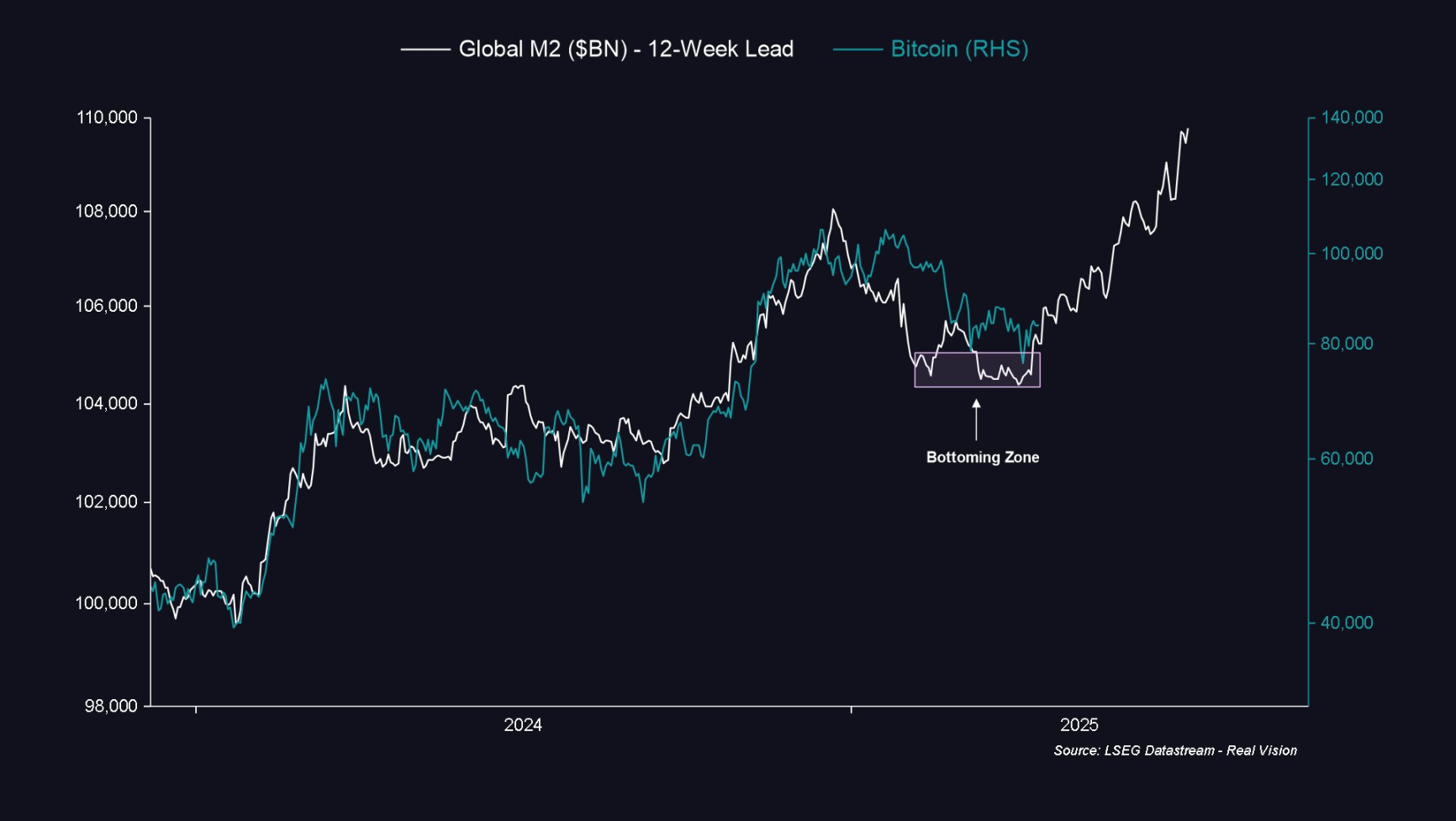

Real Vision Founder: Bitcoin Will Follow M2 to Rise

The founder of Real Vision recently released a schematic diagram of Bitcoin price and global M2 liquidity, and said that Bitcoin will also rise with the M2 trend.

Trader: Pay attention to the 88,000 USD mark

Trader Saint Pump tweeted that Bitcoin shorts were squeezed in this upside and now focus is $88,000.

10x Research Head: Bitcoin may enter a long-term integration period

Markus Thielen, research director at 10x Research, believes that Bitcoin may be entering a long-term consolidation period. In a recent market report, Markus warned that while many analysts predicted record highs in the middle of the year, short-term technical signals painted a more cautious picture. Markus noted that Bitcoin stochastic oscillator—a technical indicator for measuring momentum—indicates that market characteristics are more in line with the top of the late cycle than the beginning of a new bull market.

Santiment: Bitcoin giant whale is still increasing

Data graphs released by Santiment show that wallets holding 10 to 10,000 bitcoins, as key stakeholders of Bitcoin, currently hold 67.77% of this asset with a market value in the cryptocurrency market. During the market volatility in April, these wallets continued to increase their holdings, and have accumulated more than 53,600 Bitcoins since March 22.

Coinbase Research Director: Markets may bottom out in the mid-to-late second quarter of 2025

David Duong, head of research at Coinbase, predicted in recent monthly reports that the market may bottom out in the mid-to-late second quarter of 2025, creating conditions for a third-quarter recovery. Investors are currently advised to maintain a defensive stance on risky assets.

Bitwise Chief Investment Officer: Optimistic Market Q2 rebound

Matt Hougan, chief investment officer at Bitwise, called Q1 "the worst quarter in crypto history" and pointed out several factors that could drive the Q2 market rebound: increased global money supply, improved U.S. regulatory environment and record-high asset management scale

jinse

jinse