Bitcoin fell to $91,000, and KOLs showed their magical powers. What do you think about the future market?

Reprinted from panewslab

02/26/2025·2Mintroduction

Today, Bitcoin fell below $89,000 in a short time, and fell to $88,200 at the lowest point. Ethereum and SOL also fell below $2,400 and $135 respectively. Even within one hour of the plunge, the amount of liquidated the entire network reached $454 million.

In such extreme market conditions, investor sentiment and decision-making become crucial. The words and deeds of those KOLs (key opinion leaders) on social media often invisibly affect the market trend. These KOLs have different reactions during today's plunge. Some released in-depth analysis of the market at this time and put forward bearish views; some expressed patience; and some chose to protect funds through decisive stop-loss strategies. These different voices and strategies reflect the different ideas of KOLs in the face of violent market fluctuations, and also provide investors with different references.

Escape type

At the high point of the market, being able to accurately judge the peak and sell it in time to avoid subsequent losses is almost every investor's dream. Through keen observation and in-depth analysis of market data, some KOLs have successfully achieved this, accurately identifying signs of overheating in the market and making corresponding decisions.

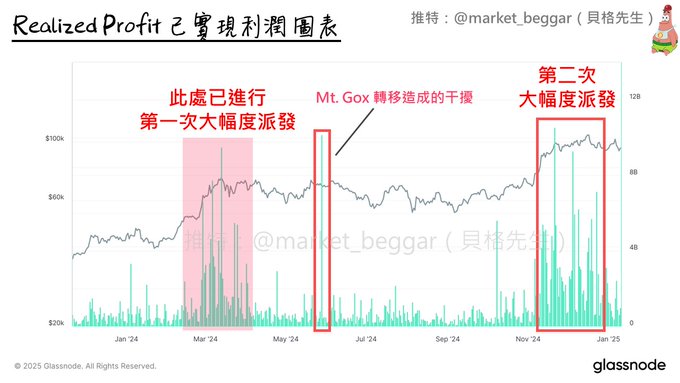

For example, Mr. Berg (@market_beggar) issued a warning to indicate that the market is overheating as early as January 13, such as "Realized Profit", AVIV heat map, Cointime price deviation and other indicators state. His core point is that the top of the market usually goes through two obvious "distribution" stages. In every bull market, a large number of investors will quietly accumulate chips at low levels, and the distribution of these chips is a signal that the bull market is gradually coming to an end. When market sentiment reaches its peak and participants generally hold high-cost chips, once the price cannot continue to rise, the selling will gradually emerge, eventually causing a price to fall and form the beginning of a bear market.

Two rounds of "distribution" signals

Mr. Berger pointed out through the on-chain data model that before each bull market peaks, there will be two rounds of distribution signals. The first round of distribution occurred in the early stages of the market. When prices rose, a large number of low-cost chips began to flock to the market. With the price pullback, market sentiment gradually recovered, and the bottom-buying funds entered, pushing the market into the second round of distribution stage. At this time, a large number of "high-price takeovers" began to be under pressure. If the price fails to continue to rise or begins to fluctuate, these high-cost holders will intensify the selling pressure and further trigger a decline.

How to identify top signals?

Mr. Berger's top judgment model is dynamically corrected through multiple on-chain data, including indicators such as Realized Profit, AVIV Heatmap and Cointime Price Deviation.

- Realized Profit: When the market price exceeded 70k, there was a clear profit-taking signal, which marked the beginning of the first round of distribution. As the price exceeded US$100,000, the second round of distribution appeared again, and the market began to experience more selling pressure.

- AVIV Heatmap: This heat map can help us see if the market is in an overheating stage. As the market rose to its peak, the AVIV indicator showed signs of overheating, and this phenomenon reappeared when it exceeded $100,000, meaning that the pressure on the second round of distribution has accumulated.

- Cointime Price Deviation: Mr. Berg tracks the tops in history through this model and finds that each periodic top is accompanied by two obvious peaks, and the current market is also in the second peak stage, and there has been a turnaround. signs.

Similarly, Calm Calm Calm Calm Calm (@hexiecs) also made a similar judgment on January 20. He pointed out that Trump's wife's issuance of cryptocurrencies was a clear local top signal in the market, so he decisively cleared his position, sold 90% of BTC, and exited his TRUMP position. Looking back at the decision, he said that without the emergence of this signal, he might not have made decisions so decisively. He also mentioned that despite attempts to obtain higher returns through on-chain operations, in a market environment where liquidity is exhausted, fast PVP (player-to-player) transactions leave old players with almost no way out.

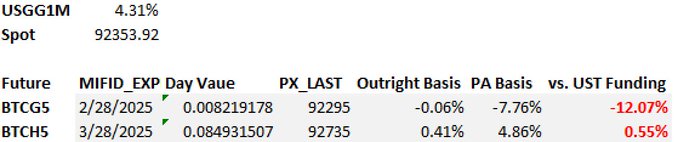

Arthur Hayes has expressed similar views in recent articles and tweets. He believes that cryptocurrency prices may pull back to the fourth quarter of 2024 levels as the US political environment has not fundamentally changed due to Trump's election. He pointed out that many IBIT holders are actually arbitrage funds, and they make profits by long ETFs and short CME futures, but once the BTC price falls, they will sell IBIT and buy back CME futures, which may drive BTC Prices fell further, even falling to $70,000. Arthur Hayes believes that only by the Federal Reserve, the U.S. Treasury Department, or other countries through some form of monetary easing policies can the current market conditions be effectively improved.

Through profound analysis of the market and keen insight into the macro environment, these KOLs have successfully avoided the top risks of the market and provided investors with important signals about market changes.

Cutting shape

When the market falls, timely stop loss is a key strategy to protect the principal. Although stop loss often means short-term losses, being able to perform this operation decisively to avoid greater risks often effectively reduce losses, showing investors' ability to remain calm in the midst of turmoil.

Setting 10 major goals first is a typical example. When the market fell, he quickly closed his long positions, although he lost hundreds of millions of funds. It is worth noting that he had set a clear stop loss line a few days ago, and once the market touched the line, he would immediately close the position. This strict risk management method reflects his high attention to trading discipline. He mentioned on social media that although stop loss brings immediate losses, he believes that admitting failure and stopping losses in time is the only way to protect capital and avoid greater losses. The most dangerous thing in the market is not failure, but ignoring the signal of failure and engaging in a lucky mentality, which ultimately leads to more serious losses.

In his analysis, he emphasized a core principle in trading: quick response, decisiveness and decisiveness. In the face of violent market fluctuations, only by responding calmly and adjusting strategies quickly can we avoid risks to the greatest extent. This calm decision-making ability also comes from a deep understanding of market trends and self-awareness.

Unpredictable

During the violent market fluctuations, some KOLs choose to stay calm. They usually look at the long term and believe that short-term fluctuations are just normal phenomena in the market cycle and do not need to overreact. For these KOLs, patience and firmness are the key to success, and they are often able to keep a clear judgment in the noise of the market.

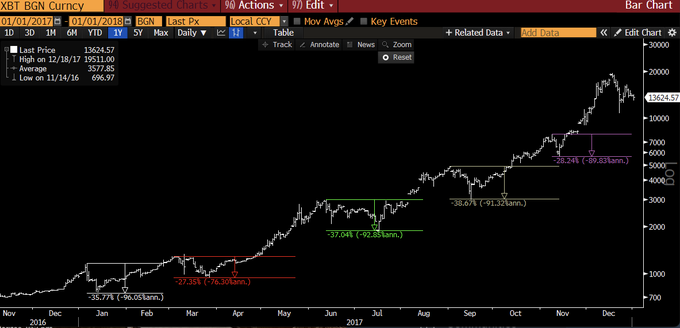

Raoul Pal reminded everyone in a recent tweet: "You need to learn patience... It's like in 2017, Bitcoin experienced five callbacks, each with more than 28%, and most callbacks lasted 2 to 3 The market hits a new high after that. What many people are worried about is just noise. "He reviewed historical trends and told investors that the market pullback is the norm, and there is no need to panic excessively, and waiting patiently is wise.

Kevin Svenson shared a similar view. He pointed out that although current market sentiment is biased towards panic, Bitcoin trading volume has continued to decline since November last year, which he believes indicates that the market may be close to bottoming out and the next volume breakthrough is likely to occur during the rebound. "The current panic has caused people to ignore an important signal that trading volume has not increased with the price drop, which means that the market's selling pressure may have peaked."

Ansem also believes that although Bitcoin has fallen below the stop-fall support level and has broken through the trading range of the high time frame, there is still no obvious bearish range breakthrough, so he believes that this round of decline may only be part of the market adjustment. , the overall trend has not changed. His analysis is more cautious, but also mentioned that if the stock market also falls in the next few weeks, it is likely to mean that the market's risk aversion is spreading, which may lead to a larger market downturn.

Finally, CZ (Zhao Changpeng) retweeted a tweet, emphasizing the need for long-term investment. The tweet mentioned: "On the same day last year, Bitcoin price was $54,000, Ethereum was $3,178, BNB was $401, and SOL was $109. Now, all of these currencies have risen, and three of them are Recently, they have all hit record highs. Short-term vision often allows us to only see price fluctuations, but if we extend the perspective, we can see more opportunities." CZ uses this to remind investors not to be troubled by short-term price fluctuations. Instead, we must look at the market from a broader perspective and seize long-term investment opportunities.

summary

In extreme market conditions, KOLs have different reactions, but whether it is successful in escaping the top, decisively cutting their losses, or maintaining calmness, their decisions reflect a deep understanding and unique judgment of the market. The top-escape KOL avoids market risks through accurate data analysis, and the decisive cut-off KOL protects its principal through stop loss, while the unstable KOL stabilizes its investment rhythm with patience and long-term perspective.

For ordinary investors, the most important thing is to be vigilant at all times and avoid blindly following the trend due to short-term fluctuations. Severe fluctuations in the market may cause us to make emotional decisions, but in any case, staying calm and rational, setting a stop loss line and strictly implementing it is the key to avoiding greater losses. If you encounter extreme situations such as liquidation, you should stop trading immediately to avoid further expanding losses due to momentary impulse. The future market is full of uncertainty, and any investment decisions need to be more cautious and do not overreact due to short-term ups and downs. Only by being calm can you make decisions that truly fit your risk tolerance.

chaincatcher

chaincatcher