Binance has once again banned illegal market makers. How many "borers" in the Crypto industry still exist?

Reprinted from panewslab

03/27/2025·1MAuthor: Yangz, Techub News

When you see a cockroach at home, there is actually a litter of cockroaches.

Following the ban on market makers who violated the GoPlus Security and MyShell projects earlier this month, Binance issued another statement yesterday, saying that the investigation found that a market maker in the Movement project was related to the market makers mentioned above and decided to freeze its related income to compensate users. Binance said that on December 10 last year, the day after the MOVE token was launched, the market maker sold about 66 million MOVEs, and before it was removed from the platform on March 18 this year, the market maker's final profit reached USDT 38 million.

As soon as the news came out, the industry was in an uproar, and the Movement Foundation responded immediately, saying that it had cut off all relations with the market maker and promised to use the 38 million USDT recovered from the market maker to repurchase MOVE on Binance. In addition, it said the Movement Foundation and Movement Labs were "unaware" of the market maker's bad behavior.

Due to the huge amount of profit, in addition to denounced this "borer" behavior, an action to investigate this evil market makers immediately broke out in the industry. Based on the various information on the current CT, the biggest suspicion of this market maker falls on Web3port, the same as the evil market makers of the GoPlus Security and MyShell projects disclosed by the community. (CZ once forwarded a disclosure tweet to market maker Web3Port).

Chen Jian shared that "through the summary of information from multiple parties, we can basically confirm that the market makers of Goplus, Myshell, and Movement that were recently investigated and dealt with by Binance are all the same Web3port." In addition, he also revealed that the market maker had asked him through an intermediary whether he could delete the post.

Zachxbt also said that an investor revealed to it that the market maker is Web3port and suggested that users check out the market maker's recent retweets to learn about other projects they may be working on.

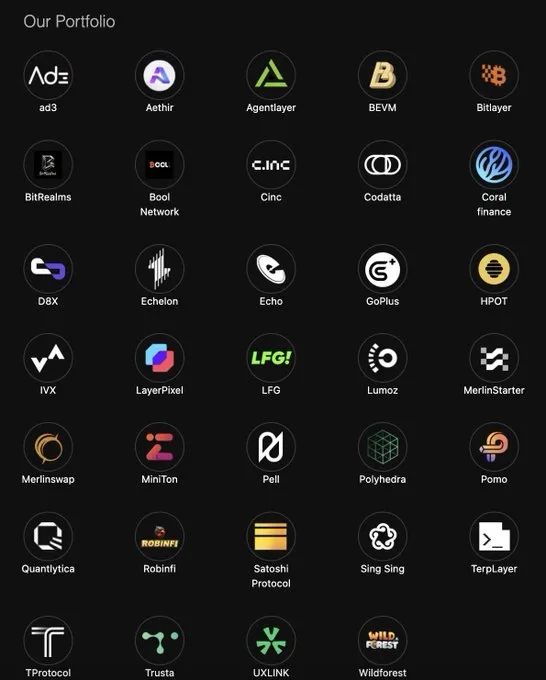

Of course, some netizens have posted the projects handled by Web3port (as shown in the figure below). According to Web3port's 2024 annual summary report, the Web3port Foundation invested 46 projects last year, with a total investment of approximately US$35 million, covering multiple tracks such as Infra, DeFi, and AI. Web3Port Labs helped accelerate 78 projects last year and assisted 83 projects in financing, with a total financing amount of approximately US$120 million.

After basically locking the suspect market maker as Web3port, netizens also deeply understood the background and "bad records" of this market maker.

The disclosure tweet about Web3Port that was previously forwarded by CZ shows that Web3Port's predecessor was Spark Digital Capital, and the core character was May Liu (Piaopiao). Initially, Spark Digital Capital operated in the name of VC, but actually relied on market outsourcing and FA business to allow VCs to invest in projects and obtain free tokens on their own. After the industry inversion caused the project party to be unwilling to give tokens free of charge in 2021 and 2022, Spark Digital Capital turned to the incubator model and established Web3Port, which mainly provided project packaging and VC docking services, and charged 1-3% tokens. Since it is impossible to cash out by incubators alone, Spark Digital Capital also established a market maker Whisper, which actually creates a shipping window for the free tokens in its hands in the name of market maker.

@agintender said that the rumor it heard was that "Web3port was the predecessor of Icport, which was an accelerator that previously focused on the Dfinity (ICP) ecosystem, and then replaced the mountain for some well-known reasons." In 2022, Web3port helped the project party obtain VC investment through the "bootcamp" model and the hackathon participating in the big ecosystem, and then changed the track according to the market rhythm, and finally helped the project go to the institute. In addition, it also revealed that the Particle network launched by Binance last night was also incubated by Web3port in the early days.

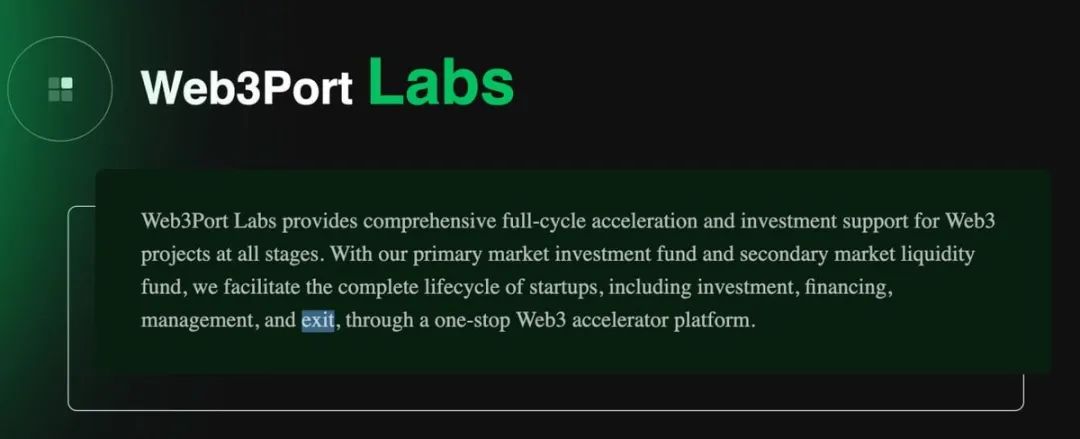

In addition to the investigation of the background of Web3port, netizens also discovered the glaring term "exit" in the introduction of Web3port Labs' official website, which reads, "Web3port Labs provides comprehensive full-cycle acceleration and investment support for Web3 projects at all stages. Through our major market investment funds and secondary market liquidity funds, we use a one-stop Web3 accelerator platform to facilitate the entire life cycle of startups, including investment, financing, management and "exit."

In addition, @0xVeryBigOrange uses the experience of his friend's project party to illustrate the "eating appearance" of Web3port. He said that in January this year, Web3port's BD took the initiative to contact the project and emphasized that they only want to be "active market makers" rather than "passive market makers." @0xVeryBigOrange explained, "The so-called 'active market maker' is actually to use the project party's coins to smash the market, then repurchase it at a low level, and then return it to the project party. Their logic is that the market maker's coins must fall first!"

It should be noted that the above information about Web3port and its predecessor background is currently only speculation. Putting aside this topic, many community users have expressed doubts about the rationality of pushing the responsibility entirely to market makers, believing that this is actually a "collusion" between the project party and the market makers.

@0xcryptowizard bluntly stated that the market maker directly earned $38 million, "it was illogical, it must have been shipped for the Move team." @cryptobraveHQ said, "The information I obtained from Sifang (exchange, actual market maker, market maker, multiple project parties) is indeed the blame." He said that market maker is the top predator in the industry. Standing at the top of the pyramid, it is very easy to make money. Web3Port broke into the market maker track last year, and moved the cake, and was targeted by other market makers. "The exchange and project parties also need to take the blame."

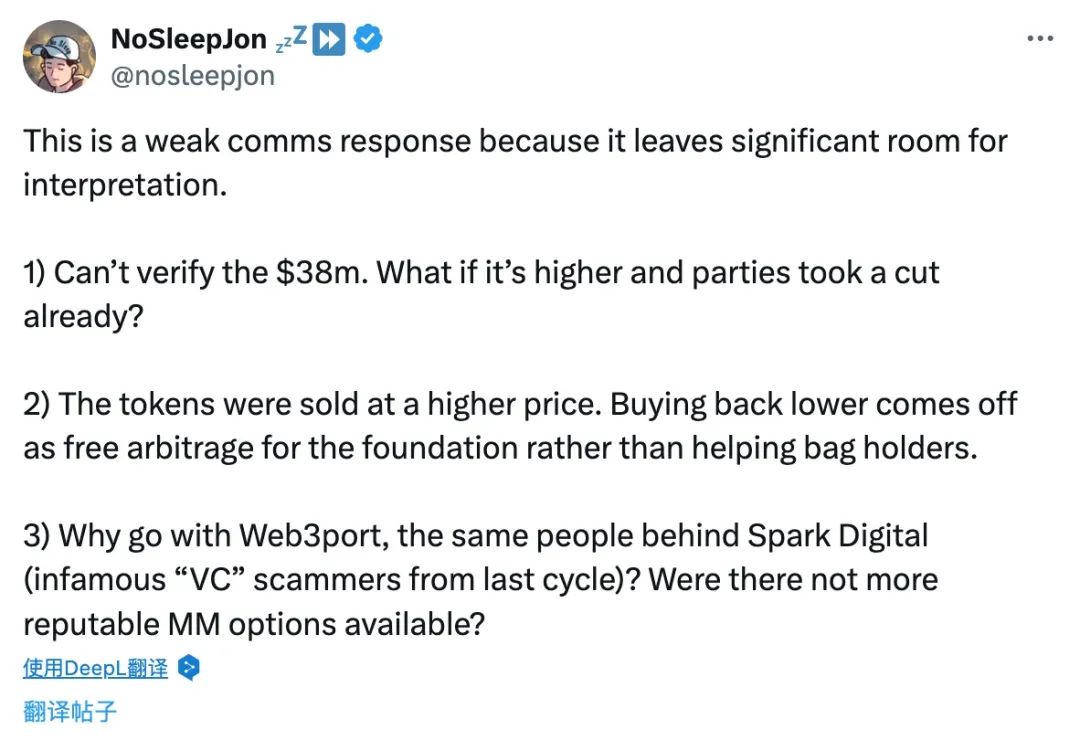

In addition, Zachxbt said that Movement's statement "If it is for transparency, why not name the market makers?" @nosleepjon also believes that Movement's response is "too weak and there are still many things that are not explained clearly." He said that the profit amount of $38 million has not been confirmed, "If the amount is higher and the parties have already paid dividends, what should we do?" In addition, he mentioned that "the tokens are sold at high prices, but repurchasing at low prices is actually free arbitrage for the foundation, not helping holders." Of course, he also pointed out the connection between Web3port and Spark Digital and questioned why he chose the infamous "VC" scammers as market makers.

At the same time, a screenshot of @YunkaizZ's circle of friends revealed the connection between Movement and Primitive Ventures founding partner Dovey Wan. The institution shared an article in December last year that "the Primitive Ventures team initially decided to give up investing in Movement in 2023, but this decision was eventually denied by Dovey Wan and prompted the team to revisit the plan." Given Dovey Wan's reputation in the circle, many users began to question the truth behind this investment.

When you see a cockroach at home, there is actually a litter of cockroaches. The question now is, how many shameful transactions are hidden under the table in the industry? Perhaps, there is not a lot of funds in the circle, but if this kind of industry that cannibalism does not spit out bones continues to exist, who dares to invest in altcoins? How to start and continue the all-round counterfeit bull market?

chaincatcher

chaincatcher