Behind Farcaster's transformation: Web3 social narratives reach a "dead end"

Reprinted from panewslab

04/22/2025·28DAuthor: Kaori

ABCDE's announcement to stop investment in new projects and suspend fundraising for the second phase of funds triggered another round of "VCs are dead" on Crypto Twitter, but the VCs were very glorious in the last cycle, relying on narratives to raise valuations, packaging PPTs into the future of the Internet.

As the leader of decentralized social networking that raised a total of US$180 million in two bull markets, Farcaster is undoubtedly the best representative of VC narrative, but Farcaster's answer is gradually becoming clear - no longer betting on "decentralized imagination", but betting on "assetized execution". Farcaster is not a failed product, but another narrative collapse in the crypto world. VCs find that they do not have the ability to reconstruct the world, but just cash out and exit in a story of pre-valuation.

Farcaster to Warpcast, and then to Farcaster

Recently, Farcaster Agreement Lianchuang Dan announced that the team is considering renaming the official client application currently called Warpcast to Farcaster, and simultaneously adjusting its web-side domain name to farcaster.xyz, in order to simplify the brand system and solve the problem of confusion between the protocol and the application of new users.

In 2021, Farcaster was launched as a desktop product, and in 2023 it will transform into mobile and web applications and renamed Warpcast. Although the initial name change was that if the name of the client (Warpcast) and the protocol itself (Farcaster) was different, it would be more convenient for other developers to build their own clients based on the protocol, thereby driving the growth of protocol users. But in the end, this idea was not really implemented. According to the team's feedback, in reality, most users still register accounts and access protocols through Warpcast.

In May last year, BlockBeats wrote an article to analyze the Farcaster ecosystem. At that time, the front-end application Warpcast mastered the core functions of the Farcaster protocol, such as private messages, Channel, etc. The Matthew effect of the entire ecosystem is very obvious. Unofficial clients can only survive in the cracks and find the pain points of Warpcast for functional development. Despite this, applications such as Supercast and Tako have adopted differentiated strategies to develop their own social platforms.

Now that the Farcaster team officially announced the rename of the front-end Warpcast to Farcaster, it undoubtedly backs the front-end application developers who chose the Farcaster protocol.

In fact, this name change operation is just a small microcosm of Farcaster's transformation. Since October last year, the Farcaster agreement has made adjustments in product updates, strategic layouts, personnel changes and other aspects.

One detail is that in the subsequent development meeting discussions, the "Farcaster issue" and "Warpcast update" parts will no longer be distinguished, but will focus on overall specific issues, such as Growth, Direct Cast, reducing registration costs, Hubs stability, FIP governance, and identity systems.

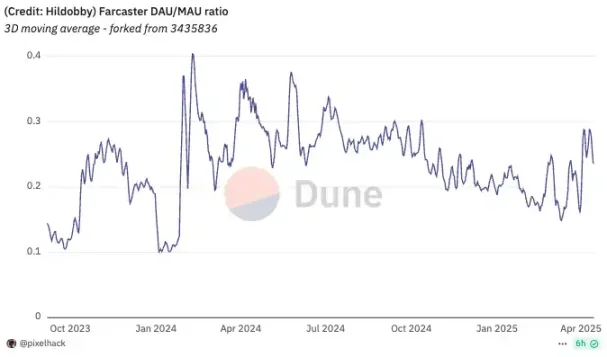

But from the perspective of user stickiness, Farcaster has not yet been able to get out of the typical dilemma of a cold start platform. According to Dune data, since the registration was opened in the second half of 2023, its DAU/MAU ratio has been hovering around 0.2 for a long time, and only briefly hit 0.4 due to DEGEN's popularity in early 2024, and then quickly fell back.

The DAU/MAU ratio refers to the ratio of daily active users to monthly active users. It is used to measure the number of days a user interacts with the application every month. The closer the ratio to 1 indicates the higher the user's activity. When the ratio is below 0.2, the dissemination and interaction of the application will be very weak.

In contrast, DAU/MAU stabilized in the range of 0.25~0.3 for early Web2 community products such as Reddit or Mastodon. Even social applications with smaller user size and more vertical topics, such as Discord small servers, can often maintain an active ratio of more than 0.3. Farcaster's data shows that although it maintains a high level of topic in the Crypto community, user usage habits have not been truly established. Active users are mainly concentrated in a few heavy creators and on-chain natives, and a sustainable closed loop of content consumption and social interaction has not yet been formed.

Make content? Make assets? Farcaster No answer

In the initial product logic, Farcaster tried to build a decentralized social graph through content tools, such as the channel that was once highly anticipated (Single Groups) that is the core unit that carries community and traffic in this graph. But soon the incentive effect of assets far exceeds the self-organization ability of content, and product logic deviates accordingly.

Abandoned channel

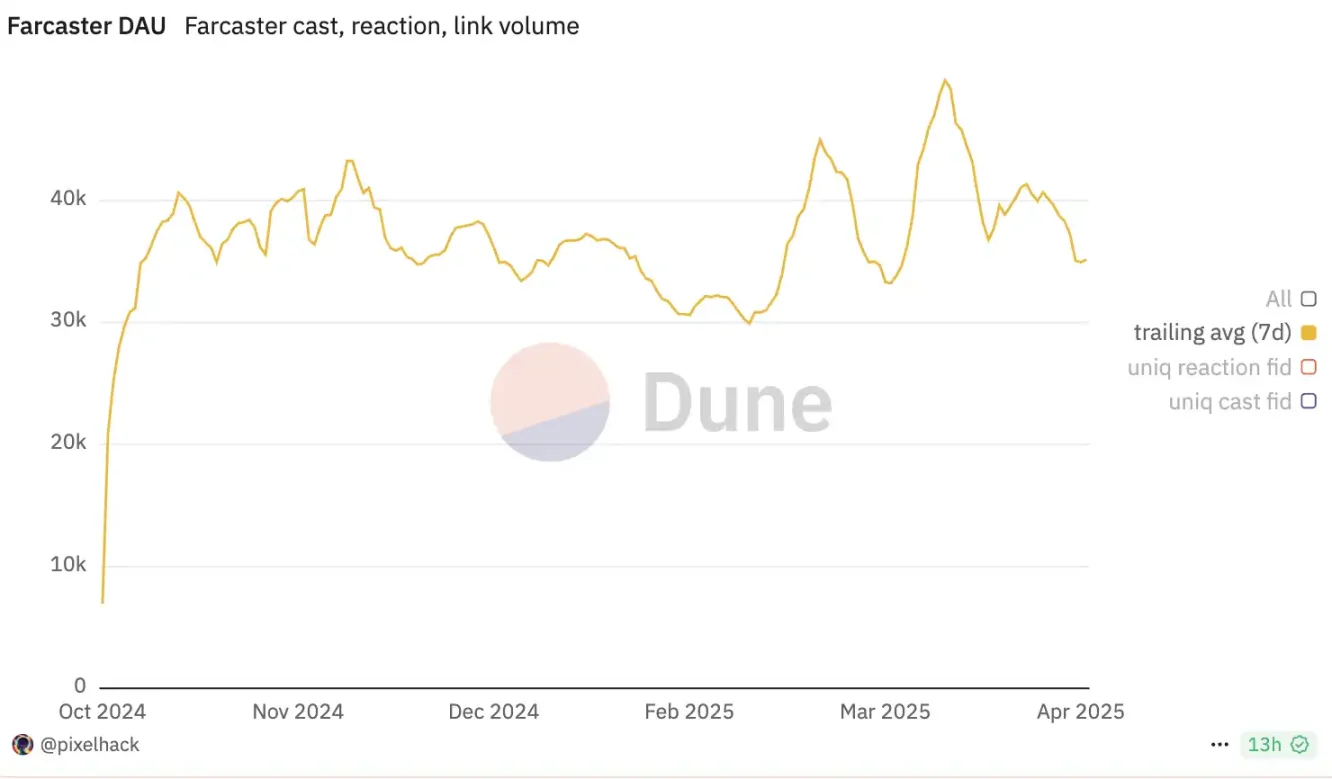

In February 2024, the social token $DEGEN became popular on the channel called Degen in Warpcast, becoming the main driving force for Farcaster to break the circle. At that time, Farcaster had only been relaxing online registration for only four months, with more than 30,000 active users per day. With the fermentation of $DEGEN tokens and the emergence of popular channel tokens of similar types such as Higher, Farcaster's daily active users reached 70,000 people.

The Farcaster team realized that the channel was a vehicle that brings people, attention, and mobility together, and Farcaster founder Dan believed that this was an important difference from centralized social media such as Twitter, allowing small communities to appear in a larger social graph. Although only one feature of Warpcast, the plan is completely decentralized, and by fostering these small, centralized communities, channels can enhance user engagement and create a more intimate social experience.

The team thus established the core development positioning of the channel, created many concepts around it, including various interests of the channel owner and channel ownership, and also derived projects and clients with the channel as the core operation. Dan even called on users not to snatch the channel name so that they could sell it to brands in the future, because it had caused a story about podcast show Bankless and users competing for channel names.

But this approach has not lasted for a long time. In July 2024, the network expansion bottleneck of the Farcaster protocol emerged. At the developer meeting, the team said that it would suspend the decentralization of the channel and rethink the implementation path.

When responding to users' comments on why they cannot speak on certain topic channels, Dan said that the channel will not bring any additional distribution bonuses. It has been in the past, but it has not worked well. He said, "Channels are suitable for operating the community, but not for discussing a topic. We will not recommend them to new users." Judging from historical data, the channel's driving user growth has limited power, and given limited resources, the Farcaster team will not have plans to add new features to the channel in the short term.

Replaced with Mini App and Wallet in product priorities, Farcaster has transformed from a social protocol that is biased towards content and social graphs to a transaction-focused protocol, which can attract more native users in Crypto.

Built-in wallets exacerbate monopoly

In a podcast, Farcaster co-founder Dan shared his latest understanding of the concept of "users": users who only register accounts and engage in mild interactions increase their activity on the surface, but what really brings value to the network are those wallet users who hold crypto assets and are willing to interact on-chain. This user-refined cognition directly affects the team's product strategy on the wallet system.

At the end of November 2024, Farcaster began exploring the integration of tradable wallets in-app to facilitate on-chain transactions. The goal is to enhance ecological stickiness and monetization potential by increasing the frequency of on-chain interactions. In fact, each Warpcast user has created a "Farcaster Wallet" by default when registering. It binds the user's identity and is used to log in to Warpcast and Frames, but because it is only saved locally on the phone, it still prefers authentication and signature rather than capital flow.

In contrast, the newly launched "Warpcast Wallet" is a wallet that can send and receive assets. Users can automatically generate it when registering, and use the wallet to recharge, exchange, transfer and on-chain interaction.

Farcaster has started to build a time node for tradable wallets, and it is hard not to remind people of the emergence of Clanker.

Clanker is a token issuing AI Agent on Warpcast. Users can post and issue tradable tokens on Uniswap. Its official token $CLANKER soared 20 times in November last year, making Base and Warpcast a competitor to Solana in the AI concept track. Also due to the wealth-making effect of $CLANKER, Farcaster's daily active users broke the highest since last summer.

Unlike $DEGEN's fate, as a broken circle target that also ran out of Warpcast, $CLANKER has received attention and support from the team and the core circle from the beginning. However, in this process, Agent, DEX, C-side wallets, etc. all benefited from this asset issuance carnival, and Warpcast did not receive any financial returns.

Clanker's success made the team realize that if more on-chain interactions are needed in the Farcaster ecosystem, it is not enough to rely on open protocols and third-party integration. It is necessary to master a native tradable wallet system, so Warpcast Wallet came into being.

From the perspective of product design, the role played by Warpcast Wallet is to open up users' social networking and on-chain behavior - users do not need to jump or connect to external wallets, click on the Frame to complete transactions, rewards or receive airdrops. This product logic of "social is finance" makes Farcaster more like "Singapore" in an encrypted world - the user base is not large, but the wallet activity and per capita fund size are high.

According to the official documentation, users are required to pay a 0.85% handling fee when using Warpcast Wallet, of which 0.15% belongs to the 0x protocol that provides transaction routing, and 0.70% is directly included in Warpcast revenue. Dune data shows that since its launch, the revenue curve of the Farcaster protocol has continued to grow, initially verifying the feasibility of embedded wallets as a commercialization path.

But it is worth noting that Warpcast built-in wallet does not write to the protocol layer. In addition, it is necessary to rename the Warpcast client to Farcaster, BlockBeats learned that some Farcaster developers believe that protocols are becoming increasingly centralized and monopolized.

The biggest innovation is just the "WeChat Mini Program"

After the introduction of the built-in wallet, Farcaster has made a smoother move towards asset-oriented social applications. The official said that one of the purposes of the wallet launch is to attract developers to build applications based on the Frame framework, and thus promote the combination of transaction behavior and content distribution.

First launched in early 2024, Frame is a set of lightweight application standards running on the Farcaster protocol, allowing developers to embed small programs into social clients. After a user clicks on the Frame, the developer can identify his wallet address, push content to it or trigger interactions. However, with the overall popularity of Farcaster, Frame usage also showed a significant decline.

To cope with this situation, Farcaster launched Frame v2 at the end of 2024. The new version supports the use of HTML, CSS and JavaScript to build applications with near-native experiences. Developers can also quickly deploy products with the Mini App SDK without going through the app store review process. Frame v2 not only improves the complexity of interaction, but also deeply integrates with the built-in wallet, further enhances transaction attributes, and the overall experience is closer to WeChat mini-programs.

In March 2025, Linda Xie, co-founder of Scalar Capital and Bountycaster, joined the Farcaster team to be responsible for developer relationships and focus on promoting the development and promotion of Frame. At the same time, Farcaster launched the "Airdrop Program", encouraging developers to build applications with Frame v2 and reach users through asset airdrops. Although this mechanism is not an official token airdrop, it effectively activates user growth. In mid-March, Farcaster's daily active users briefly exceeded 40,000, setting a temporary high.

In early April 2025, Farcaster officially renamed Frame to Mini App and was sided with Wallet in the navigation bar at the bottom of the Warpcast client.

Currently, a number of lightweight applications that support on-chain interaction have been integrated into Warpcast, and Mini App has officially become an important part of the ecosystem. However, judging from user growth data, Mini App's ability to attract new products has not been significantly released, and its long-term role remains to be seen.

"Web3" disappears, Silicon Valley legends fail

In fact, Farcaster's changes are not special. It just took the lead in exposing the structural dilemma of the entire Web3 social track - open protocols cannot construct user scale, content distribution cannot drive transactions, and ultimately can only return to the only realistic road of asset-driven.

Do we really need a "decentralized social platform"?

From $DEGEN to $CLANKER, Farcaster is almost linked to assets every time he goes out of the circle. What really drives the surge in daily active users is not the evolution of protocols or the innovation of clients, but the wealth effect driven by tokens again and again. This recurring pattern reveals a core fact: Farcaster is not "no one to use", but "only someone to use it when you can make money." Such platforms do meet a certain market demand, but their role is not a social network, but an asset distributor.

This is not accidental, but the inevitable result of the long-term misalignment between encrypted narrative and the use of reality.

In 2020, BlockBeats wrote in an article titled "The World Hates Current Social Media" that decentralization and protocolization may be the only way for social products to get out of the "platform dilemma" - in the increasingly stringent content censorship and platform monopoly, open agreements carry people's hope for a "new social order."

Twitter at that time was called a typical loser of attempted agreements: it once briefly opened up APIs and encouraged developers to build an ecosystem, but in the end it was still back to the old path of advertising platforms and data monopoly. Farcaster's initial ambition was to "not become the second Twitter", which claimed to use open agreements as the core to connect developers, users and assets, and achieve a win-win decentralized social network.

But three years later, what Farcaster replicated is not Twitter's original protocol ideal, but its later platform logic. Dan, who once called on everyone to "build their own client based on protocols", now personally announced that he would call the client Farcaster, so that the "protocol" and "products" are highly bound.

This shift is rational at the level of product search for PMF, and can even be said to be a realistic compromise, but it also shows that the so-called "open ecology" has been quietly misappropriated as a narrative tool for user growth during its implementation. The role of a developer is not to be truly supported, but to tell stories. Just like when Twitter closed its API, the developer ecosystem is just a temporary fuel to the platform's closed loop.

Farcaster has proved one thing in three years: social protocols in the context of Crypto cannot form the ecosystem we expect in 2020. It's not because no one develops a client, but because no one uses it. It’s not because it’s not decentralized enough, but because decentralization is not something that users care about at all.

Nowadays, SocialFi is also known as the death track, and to some extent, a KOL was criticizing the founder of decentralized social applications. Some time ago, a KOL was criticizing the founder of a decentralized social application. "It has been so traffic for so long, and its fans are not as high as me. What are your abilities? What did your company do to raise 2M? It is not as profitable as my SOL wallet." It makes people laugh bitterly, and they can't help but sigh that the era of relying on narrative to do infrastructure has ended, and the valuation system of all VC projects is being reconstructed.

Crypto is not the "next internet"

But a16z is the biggest preacher of this narrative. He has invested in social media such as Twitter and Facebook for a long time. When the investment overlord encounters decentralized social products, it is naturally impossible to ignore its existence. As Google executives said, “They are like crazy people, domineeringly punching in every deal.”

The full name of a16z is Andreessen Horowitz, taken from the last names of the two founders. It was founded in 2009 by Marc Andreessen and Ben Horowitz. As a famous software catcher, almost all the most dazzling companies in the Internet field have been taken into custody: Facebook, Twitter, Airbnb, Okta, Github, Stripe, etc., and their investment strategies have early sensitivity and decisive growth stages. They can not only invest in Instagram in seed rounds, grab Github in the A round competition, but also lead Roblox to $150 million in the G round.

Its keen forward-looking and aggressive and bold investment style are fully reflected in the layout of the encryption field. In 2013, Coinbase, invested in 2013, had a market value of up to US$85.8 billion, making it one of the largest listed companies in the history of technology. a16z still holds a 7% stake in the company after cashing out $4.4 billion. Well-known encryption projects such as OpenSea, Uniswap, and dYdX are also representative works of a16z.

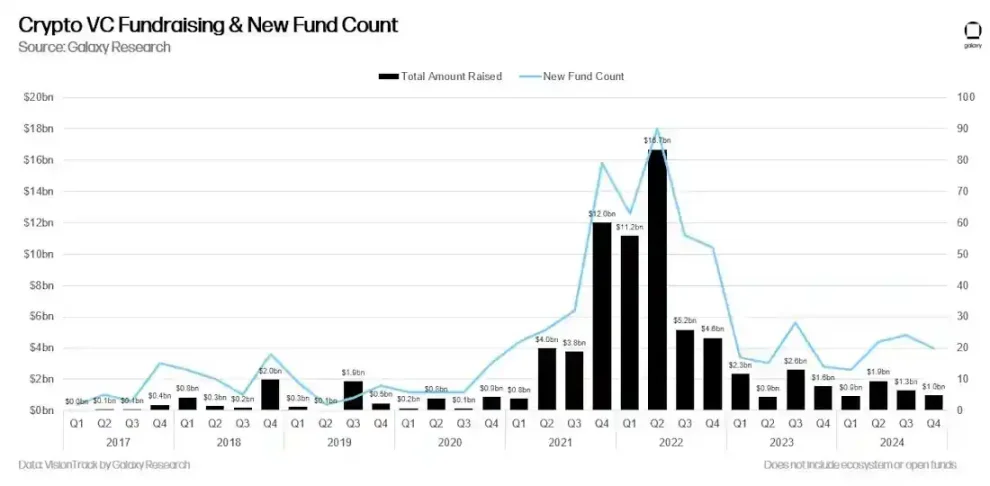

The crypto bull market since 2021 has soared the book value of major venture capital portfolios, with funds returns reaching 20 times or even 100 times, and cryptocurrency venture capital suddenly looks like a money printing machine. LPs flocked in, eager to catch up and down waves. The new funds raised by venture capital companies are 10 times or even 100 times the size of the previous ones, and they are firmly convinced that they can replicate those excess returns.

Farcaster is undoubtedly the product of the peak of this liquidity boom, and in July 2022, Farcaster announced the completion of a $30 million financing led by a16z. Two years later, Farcaster completed a US$150 million financing with a valuation of US$1 billion, led by Paradigm, and big-name VCs such as a16z crypto, Haun, USV, Variant, and Standard Crypto participated in the investment. The valuation is as high as US$1 billion, becoming the largest financing in the history of the Web3 social track. At that time, Fortune magazine commented that this valuation was more of the result of the internal circular game of funds than a real mapping of market demand.

Crypto investor Liron Shapira said: "If venture capital still has LP capital available, they choose to invest $150 million instead of return, and they can charge an additional $20 million to $30 million in administrative expenses." This is not the market's recognition of Web3 social networking, but a self-consistent closed loop of capital operation. Fortune magazine article also said a source who asked to be anonymous due to business constraints said that like most protocols, he expects Farcaster to launch tokens and investors will be eager to capture its fully diluted value.

a16z partner once proposed that "technology waves often appear in combination" to endorse the intersection of Web3, AI, and hardware. But they avoided the basic fact that every leap in the mobile Internet, whether it is a smartphone or a search engine, is based on real user pain points and technological breakthroughs, rather than structural bubbles under capital narratives.

"Technology eats up the world" was once a radical and accurate judgment, but its applicable premise is that technology has a crushing advantage at the basic level. The reason why AI exploded is because it challenges individual intelligence - a structural capability difference that cannot be resisted; while blockchain challenges "sovereign currency", a credit system that has not changed for two thousand years. It will not subvert social structures explosively like the Internet or AI, but will only evolve slowly over a long period of time, be absorbed and recruited by vested interest systems, and eventually rewritten as part of the original order.

Therefore, reality is an encryption system that is truly accepted by users and creates value, almost without exception, it is "mechanism-driven + liquidity first". From Uniswap to Lido, from GMX to friend.tech, they rely on funding gravity, not idealism. VC's model of "investors drives world change" is not applicable in this world.

Crypto has never lacked social tools. The so-called protocol ideal is just an illusion projection of this industry's Internet platform era. It tries to replace the business model with a consensus mechanism, but in the end it only postponed the structural problem to the asset monetization process.

The biggest crisis in the crypto industry at present is not supervision, not technology, but strategic confusion and demand vacuum. Apart from "casino logic" and cross-border payments, almost no field has demonstrated the ability to continuously create user value. The failure of VC is essentially a directional aphasia under the absence of value: if the industry itself has no real value, then value discovery cannot be discussed from the beginning.

jinse

jinse