BB Research holding the currency stock industry depth: DEEP time, currency stocks take the wind

Reprinted from panewslab

01/28/2025·3M| Coin stock rating: optimistic

Analyst: bread

Investment points

- In the Bitcoin investment boom, the development of the currency stock industry has attracted much attention. This article will answer two main questions: 1) What is the competitive pattern of the Bitcoin asset management industry, is it concentrated or differentiated in the future? 2) How does listed companies in the currency stock industry become an important force in the financial field and what is the difficulty of active asset management?

Note: The discussion focuses on listed companies in the industry as the mainstream of the industry.

- Imagine the competition pattern of Bitcoin asset management industry: quantity and scene competition

The global Bitcoin asset management industry competition will show differentiation, but the concentration will be higher. The head company maintains an advantage, and emerging companies also participate in competition with unique advantages. The main reason is:

1) Why is there a high concentration? The asset management industry requires a large amount of funds and professional teams, but the cost of use is low and faster, resulting in leading companies to lead the advantages of funds and resources, and it is difficult for small and medium companies to participate.

- How to achieve differentiated competition? The competition of Bitcoin listed companies is divided into three dimensions: quantity, scene, and function. The giants are similar in scenes and functions, and there are differences in quantity. The key to the number of competition is speed and scene. Enterprises that quickly accumulate Bitcoin can optimize the model, and the company's strategy with suitable scene support is stronger. The first advantage is also important. Early companies can get more experience and resources.

- The development space of the currency stock industry: future change of the currency stock industry

Bitcoin investment brings development opportunities and changes to listed companies. Its low correlation helps decentralized risks and optimizes the asset portfolio. At the same time, Bitcoin helps enterprises to explore new technologies and business models. It is expected that in the next three years, more than 200 companies in the world will hold more than 1,000 Bitcoin. By 2025, the ETF index of the currency shares will be released, and the investment of currency shares will become the mainstream and inject new vitality into the industry.

- Investment advice

We believe that Bitcoin Investment is expected to bring new growth momentum to listed companies, and the development potential of the currency stock industry is huge. We pay close attention to the subversive opportunities brought by the combination of the currency stock industry and the Bitcoin investment.

-

Industry pioneer opportunities: Audit investors can pay attention to companies such as MicroslateGy. At the time of adjustment of the Bitcoin market, we will share the growth potential when you build a diversity. At the same time, pay attention to the layout of emerging technology and financial companies Bitcoin to capture early opportunities, but the risk of stop loss should be set up.

-

Mature enterprise opportunities: Stable investors should pay attention to Bitcoin positions such as Tesla and other large mature companies. After the market trend is clear and the policy is stable, combined with technical and fundamental research, when the price of Bitcoin is reasonable, it is appropriately participated, pays attention to long -term holding, and uses corporate management and diversified business buffer price fluctuations to achieve value -added assets. , To optimize investment portfolios such as high -quality bonds.

-

Indirect investment opportunities: Conservative investors can pay attention to Bitcoin related financial products, such as compliant Bitcoin ETFs. When market sentiment is optimistic, capital inflows, and technical indicators are good, small tentative investment, control investment exposure, ensure the safety of principal, and share the growth bonus in the industry.

- Risk reminder

-

Bitcoin price fluctuations: Bitcoin prices fluctuate violently, such as 2017-2018, 2021-2022, which has risen sharply, which leads to fluctuations in asset value of listed companies, affect financial statements and market value management, investor confidence is frustrated, investment income uncertain.

-

Regulatory policy risks: Global has different attitudes towards cryptocurrency supervision and dynamic changes. For example, some US states recognize but federal institutions are strictly supervised, China prohibits relevant businesses, and the EU continues to improve the regulatory framework. Regulatory tightening may lead to the impairment and selling of Bitcoin assets of listed companies. The business is blocked, affecting the normal operation and investment value of the enterprise.

-

Market acceptance and application risk: Bitcoin has long -term transaction confirmation time and large price fluctuations as a payment method. Cross -border transactions are restricted by policies and regulation. This limits the application and market popularization of Bitcoin in the business of listed companies, hindering the full play of its market value, and the development process of the industry may be affected.

The text directory

1 Industry overview

1.1 Bitcoin development history review

1.2 Listed companies are involved in Bitcoin background

2 Typical case depth analysis

2.1 Microstrategy: Bitcoin investment pioneer

2.2 Tesla: Cross -border disruption

2.3 Meitu: Emerging forces representatives

3 Investment motivation insight

3.1 Diverse asset demand

3.2 Circation of inflation considerations

3.3 Strategic layout intention

4 Outlook for the development trend of the coin stock industry

4.1 Market size prediction

4.2 Industry pattern evolution

4.3 Prospects with the integration of ecological integration with blockchain

5 holding the development trend of the currency stock industry

5.1 We answered two key issues of this round of the revolution in the coin stock industry: pattern and space

5.1.1 Competition pattern of listed companies: In the future, high -fixed, low -margin cost structure -oriented high concentration

5.1.2 Industry space aspect

5.2 Financial performance holding Bitcoin listed companies

5.3 Listed Company Valuation Model

5.3.1 market value premium rate

5.3.2 Witnesses (NAV) premium model

5.3.3 Bitcoin price sensitivity model

6 Conclusion and suggestions

6.1 Research Summary

6.2 Investment recommendations

6.3 Dating risk factors

6.4 Industry Outlook

Chart directory

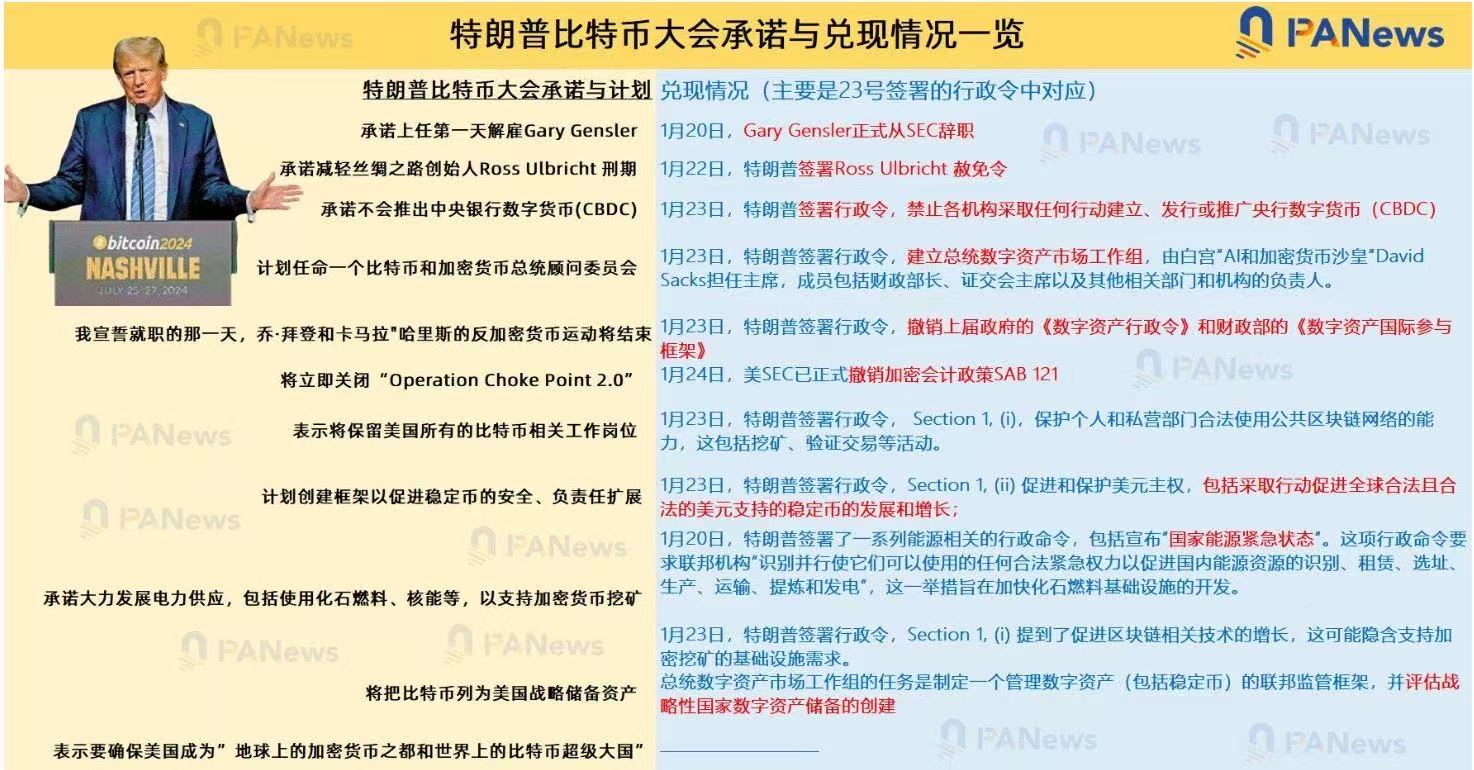

Figure 1 List of promise and cash in Trump Bitcoin Conference

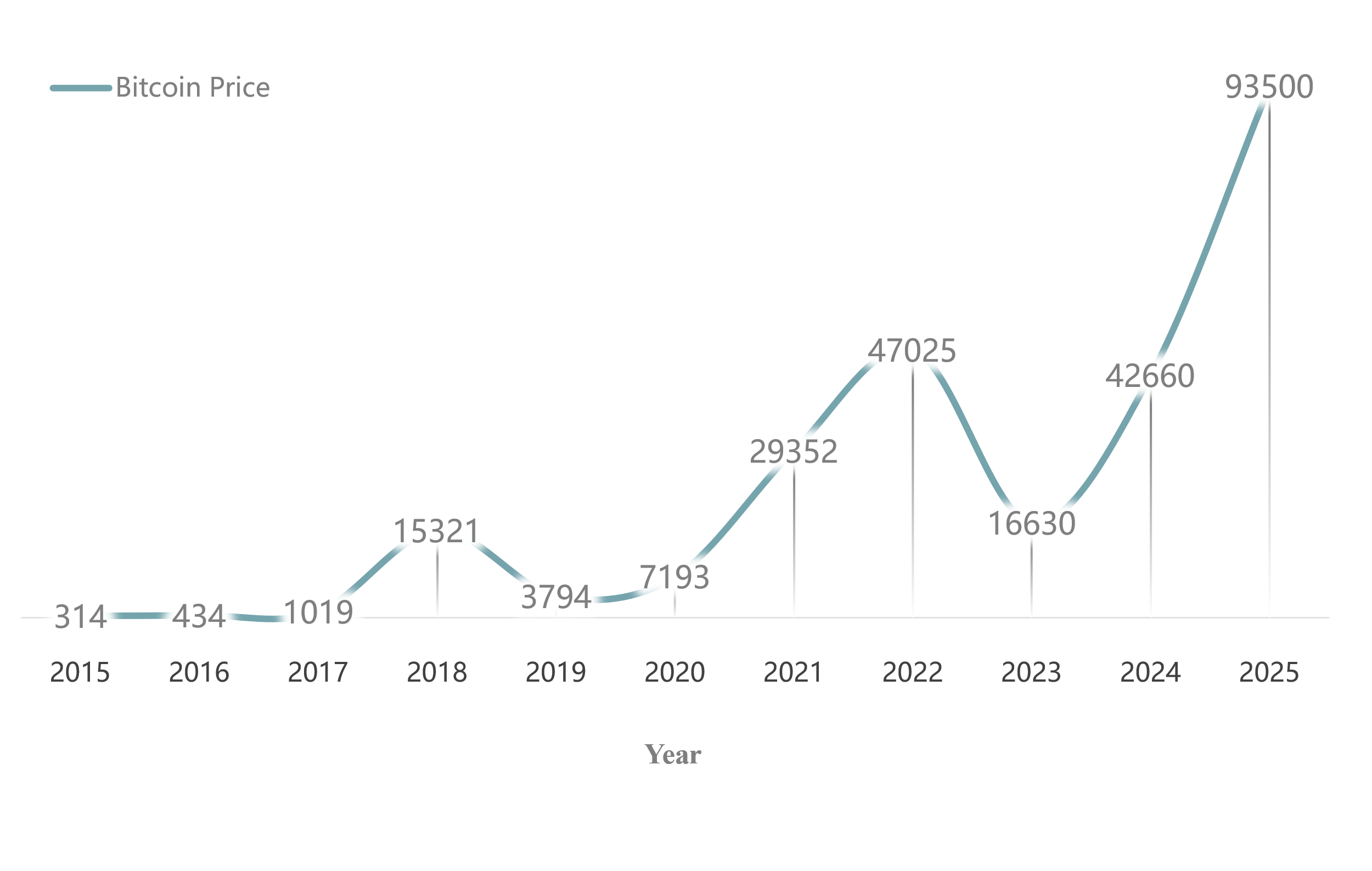

Figure 2 trend chart

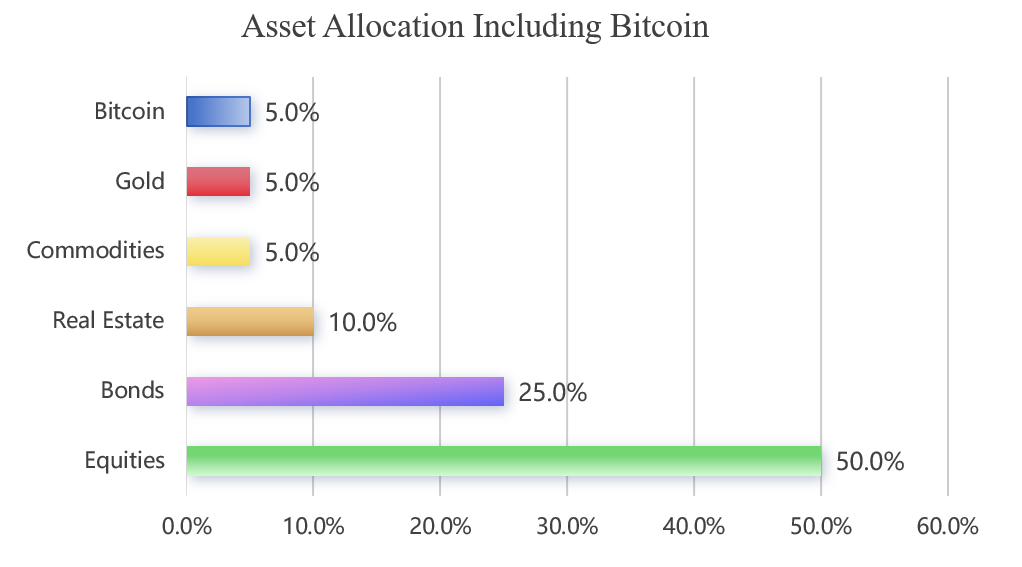

Figure 3 Asset allocation diagram

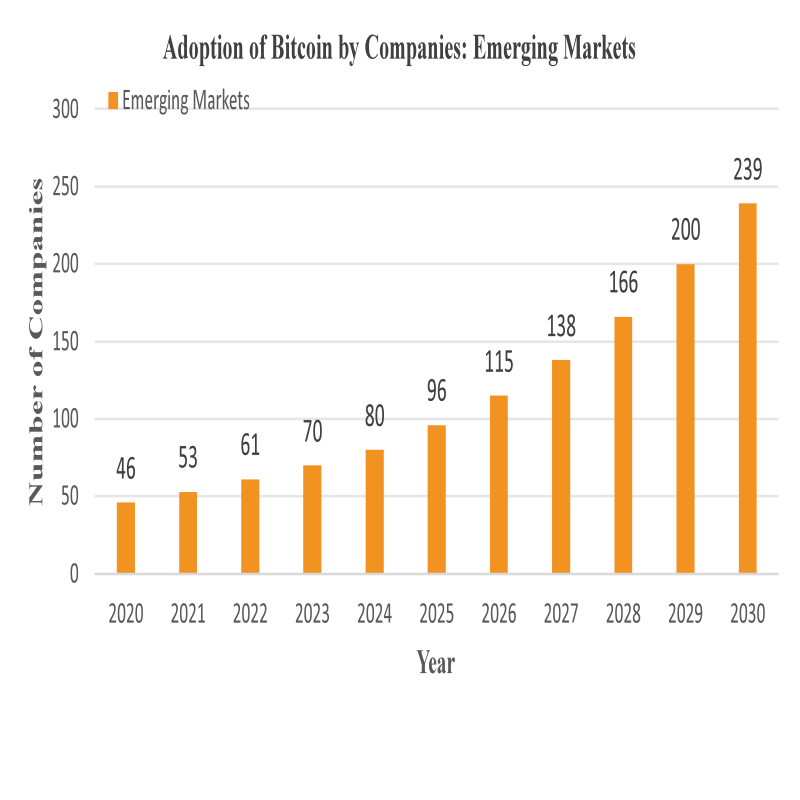

Figure 4 coin stock company listing forecast map

Figure 5 Asset allocation diagram

Figure 6 Asset allocation diagram

Figure 7 MSTR, NANO, MARA, and Boya Interactive market premium rate

Figure 8 MSTR, NANO, MARA, and Boya Interaction 's company value

Table 1 List of promise and cash in Trump Bitcoin Conference

Table 2 Main categories holding Bitcoin listed companies

Table 3 The Competition Law of Listed Companies of the Coin Industry (List of Currency Corporation)

Table 4 NB coin stock ETF index

Table 5 market premium rate

Table 6 Industry market value premium rate median number

Table 7 company value

Table 8 Company value

Table 9 increases market value

Table 10 increases market value

1 Industry overview

1.1 Bitcoin development history review

Bitcoin was born under the background of the 2008 global financial crisis. It was instructed by Satoshi Nakamoto and dug out the creation block on January 3, 2009, marking that it was officially launched. At first, Bitcoin only circulated in the small circle of cryptographic geeks and technical enthusiasts, and the value was almost zero. In May 2010, American programmer Laszlo Hanyecz purchased two pizza with 10,000 Bitcoin. This was the first commercial transaction of Bitcoin. At that time, Bitcoin price was about $ 0.003. Since then, with the rise of the Bitcoin trading platform, such as the establishment of MT. GOX, its price has gradually been priced by the market. In 2013, the price of Bitcoin exceeded $ 1,000, causing global attention; in December 2017, it soared to a historical high of nearly 20,000 US dollars. A large number of investors and media were focused on. Although it has experienced a sharp recovery and volatility period, the market value and influence of Bitcoin continued to rise, and gradually incorporated into the mainstream investment vision, becoming the financial sector that cannot be ignored, and also prompted more listed companies to think about its strategic significance and potential value.

The development of Bitcoin is accompanied by many key nodes and important events, which deeply affects its price trend and market awareness. 2009-2010 is the starting stage of Bitcoin's budding. The birth of the creation of the creation block has opened a new era of decentralized cryptocurrency. At this time, the transaction is extremely niche and has no clear market price. And more concept verification. From 2011 to 2013, the early growth fluctuations were ushered in. Bitcoin prices exceeded key psychological prices such as $ 1, $ 10, and $ 100 for the first time. Price discoveries and market transactions provide places. In 2013, Cyprus's debt crisis broke out, which triggered the European people to seek Bitcoin risk aversion and pushed the currency price to exceed $ 1,000. Mainstream media began to pay attention to reports.

From 2014-2016, it was trapped in the bear market. MT. GOX was stolen 850,000 Bitcoin incidents to hit the market confidence. Bitcoin prices have been greatly retracted from high levels, and regulatory uncertainty has increased. The degree of activity has fallen sharply, investors have a strong mood, and the mining industry is also facing reshuffle due to the low price of currency prices and rising difficulties. From 2017-2018, the crazy bull market and in -depth callback, ICO (Initial Coin Offering) has emerged, a large amount of funds have poured into the crypto market. Bitcoin is a "digital gold" benchmark. With the rupture of the ICO bubble and the strong suppression of the supervision of various countries, the avalanche of the currency price fell back to 3,000-4000 US dollars within a few months.

From 2019-2021, entering the restoration and recovery and new prosperity stage, Bitcoin opened a new round of rising after the bottom of the 3000-10,000 US dollars was shocked. Institutional investors ran into the market. Large allocation, Bitcoin as an emerging alternative assets has gradually stabilized. In April 2021, Bitcoin prices exceeded $ 60,000, and the market's popularity was high. Ecological applications such as payment, lending, and derivatives accelerated. From 2022 to 2024, the fluctuation integration situation has been shown to the present. In the early stage, the bull market accumulated a bubble breakdown. The coin price was affected by factors such as the Federal Reserve's interest rate hikes and the global macroeconomic recession. Clear and technological innovation promotion, such as the optimization of capacity expansion schemes such as Bitcoin spot ETF approved, and lightning network expansion schemes. The currency price gradually stabilized and rebounded. In 2024, it exceeded 100,000 US dollars in the range of $ 30-70,000. The price increased by 120.88%throughout the year. One month after Trump's victory, it exceeded 80,000, 90,000, and 100,000 US dollars, and then gradually fell after touching the peak of US $ 109,000, and now hovering around $ 105,000. Market participants are more rational, and the industry is developing in compliance and diversified directions.

Figure 1 List of promise and cash in Trump Bitcoin Conference

Source: PA News

As shown in Table 1, 93,500 US dollars were touched on January 1, 2025, which was about 297 times on January 1, 2015.

Figure 2 trend chart

Data source: BB Research

From the perspective of price characteristics, Bitcoin was affected by small participants, shallow market depth in the early days, shallow market depth, and vulnerable to minor supply and demand, and the technical community dynamics. The diverse factors such as innovation iterative iteration are driven, showing a sharp rise and fall, the bull market has increased faster and the increase is amazing, and the bear market has retracted rapidly. In recent years, with the maturity of the market and the participation of the institutions. Long -term factors such as fundamentals, monetary policies, and industry supply and demand have gradually become, and the linkage with the traditional financial market has increased. However, the unique halving mechanism still brings special variables to its price cycle. The supply of currency provides momentum for the rise in currency prices from the underlying logic of supply and demand, stimulating market expectations and high cycle of investment enthusiasm.

Recently, many key figures in the American politics and business circles have expressed their positions on Bitcoin, affecting market trends and investor emotions. After Trump was elected as the President of the United States in November 2024, he promised to make the United States a "global cryptocurrency capital" and consider incorporating Bitcoin into national reserves. On January 21, 2025, he was sworn in, and Bitcoin exceeded $ 1090 million a record high. "Trump Meme" has a market value of $ 20 billion a day. Musk has always been an active supporter of cryptocurrencies and supports Trump's cryptocurrency friendly policy, arguing that this will promote technological innovation and economic growth. The Federal Reserve President Powell recently made it clear at a press conference that the Fed did not intend to hold Bitcoin and emphasized that the Federal Reserve was banned from holding such assets according to the Federal Reserve Law. He also pointed out that the Fed will not seek to change this law, and Powell's position in monetary policy is considered to have an indirect impact on the Bitcoin market.

Gold is a mature reserve asset, with a long history and stable price, but there is physical limitations. Bitcoin is an emerging reserve value tool with scarcity, convenience and technical potential, but has high volatility and uncertainty. In the future, Bitcoin and gold may coexist: Gold continues to be a traditional reserve asset, while Bitcoin occupies a place in the digital economy and young investors. The specific choice depends on the balance of investors' demand for stability and growth potential. If more central banks and institutions around the world start to adopt Bitcoin, the status of its reserve assets may be significantly improved in the next decade.

1.2 Listed companies are involved in Bitcoin background

From a macroeconomic perspective, global economic growth is unstable, traditional monetary policy fluctuations and inflation concerns are the main causes. For example, after the financial crisis in 2008, the long -term quantitative easing in Europe and the United States, and the currency excessive issuance caused the market to question the value storage function of fiat currency. Because of the characteristics of 21 million pieces and decentralization, Bitcoin has been regarded by some listed companies as new choices for hedge inflation and asset preservation. Like MicroslateGy, it publicly stated that the purchase of Bitcoin against the US dollar depreciation risk.

At the financial market, on the one hand, the traditional investment fields such as the stock market and the bond market have fluctuated in recent years. In the low interest rate environment, bond returns are small, and the stock market has frequently shocked the impact of trade frictions and geopolitics; on the other hand, the diversified demand for investment portfolios is urgent. According to statistics, from 2015-2020 Bitcoin, asset income from Bitcoin, and bonds such as stocks, bonds, etc., average is only 0.11. In order to pursue a stable return and optimize the asset allocation structure, listed companies have begun to involve new opportunities in the Bitcoin field.

2 Typical case depth analysis

2.1 Microstrategy: Bitcoin investment pioneer

As one of the most listed companies in Bitcoin in the world, MicroslateGy opened a Bitcoin investment journey in August 2020. At that time, the global economy was impacted by the epidemic, the traditional financial market was turbulent, and the depreciation of the US dollar was expected to rise. The company purchased Bitcoin as inventory assets with $ 250 million, and accurately captured the macroeconomic change node. Since then, its coin -holding strategy has continued to aggressive. For example, in September 2020 and the first quarter of 2021, a large increase in holdings. In the process, the company's stock price and Bitcoin prices were significantly linked. It is expected to attract a large number of investors to influx, the stock price has soared, and the increase in 2024 increased by more than 500%; and Bitcoin prices have a deep adjustment period, and the stock price also fluctuates significantly. The characteristics of high risk and high return, which profoundly affects the emotional and capital flow of investors of encryption and traditional financial market investors.

2.2 Tesla: Cross -border disruption

At the beginning of 2021, Tesla brought a huge sum of $ 1.5 billion to Bitcoin, which instantly ignited the enthusiasm for the market. The price of Bitcoin was impacted by this huge amount of funds. The short -term increased in the short term. On the one hand, investing in Bitcoin for the company's idle funds to find value -added exports to alleviate the dilemma of low interest rates and environmental funds; on the other hand, in March of the same year, it was announced to accept Bitcoin car purchases, trying to connect encrypted payment and closed car sales. The dispute and price fluctuations are canceled, but successfully shaping the Tesla technology pioneer and dare to innovate the brand image. The popularity in the encryption field spills to the car business, attracts young and technological enthusiasts, stimulates vehicle orders to grow, and the peak Bitcoin business adds financial reports to the financial report. Highlights, although the strategy turns cautiously, still rely on the remaining positions of the remaining positions in the encryption field.

2.3 Meitu: Emerging forces representatives

From March to April 2021, Meitu threw 100 million US dollars in three times, purchased more than 940 bitcoins and 31,000 Ethereum, and cut into the encrypted track strongly. From a business perspective, Meitu, as a imaging technology company, is facing the Red Sea in traditional business, trying to use encrypted investment to embrace new technological trends, explore digital content and blockchain binding points, such as launching blockchain -based creative works copyright protection applications; finance At the level, the increase in asset value -added in the early stage helps the asset liabilities optimization, the floating profit is considerable, and the stock price rises in the short term. However, in 2022, the bear market was coming, and the asset impairment caused the performance to be under pressure, and the net loss soared. After the cold winter, the market recovered in 2023-2024 to grasp the timing of the sale, the profit was about 79.63 million US dollars, and successfully returned the capital to the core image business. Expand the new path.

3 Investment motivation insight

3.1 Divergent needs of assets

Under the theoretical framework of traditional investment portfolios, asset diversification is the key to reducing non -systemic risks. The asset allocation of listed companies is mostly concentrated in the fields of stocks, bonds, cash and other fields. For example, in the 2008 financial crisis, the stock market plummeted, the bond market fluctuated, and a large number of corporate assets were shrinking. Bitcoin has become a "new favorite" due to unique attributes. According to Bloomberg data, the average correlation between the Bitcoin and the S & P 500 index in 2010-2020 is only 0.08, which is almost zero with bonds. Before the admission of MicroStrategy, the asset allocation relies on the business software business associated assets, facing the risk of industry cyclicality and market competition; after the introduction of Bitcoin, the asset portfolio is scattered and the income flow is diverse. Software, ironing a single business fluctuations, without sacrificing too much expected income, reduce overall risk exposure, and build a solid foundation for corporate financial stability.

Figure 3 Asset allocation diagram

Source: Open AI official website, BB Research

3.2 Circulation of inflation considerations

In the global economic cycle fluctuations, inflation is the "Sword of Damocles". Especially after 2020, the quantitative easing of countries under the new crown epidemic, superb currency, and high inflation. The US CPI once exceeded 9%in 2022. Traditional anti -inflation assets such as gold and real estate are limited, gold is affected by geopolitics and central banks, and real estate is facing bottlenecks in regulation and liquidity. Bitcoin has a constant 21 million and decentralized total, and theoretically, it has strong anti -inflation. From the evidence of data, the long -term dimension in 2009-2023, with the comparison of American inflation data, the price increase of Bitcoin is far exceeding the inflation rate. In some periods, such as 2013-2017, the inflation period is milded, and the annual increase of Bitcoin has increased by more than 200%. Entry Bitcoin can hedge the erosion of prices at a certain extent at the level of the balance sheet, maintain purchasing power, and protect shareholders' rights. Many resource -based and consumer -type enterprises are affected by the inflation affected by upstream costs. Explore new roads.

3.3 Strategic layout intention

Under the wave of emerging technology, the blockchain and encrypted economy are considered the forefront of future changes. Some listed companies have a forward -looking layout of Bitcoin to seize the opportunity. Technology enterprise Reddit purchase Bitcoin to strengthen community encrypted ecology, explore new models, use "community points+ Bitcoin" to attract users to participate, inject vitality into the development of the platform; , Accumulate experience and shape standards, realize the transformation from traditional asset management to digital asset management; traditional enterprise Tesla invested in Bitcoin, associated encrypted payment, integrated in many fields, integrated in many fields Brand image. Pioneers in various industries borrowed Bitcoin as related strategies to "investigate the road" and open up new "colonies".

4 Outlook for the development trend of the coin stock industry

4.1 Market size forecast

Based on the rapid growth of global holding Bitcoin listed companies in recent years, the future expansion power is strong. From the perspective of the market value of the currency holding, although only a few companies are holding a large amount of positions, with the price center of Bitcoin, and more companies enter the venue, it is expected to rise in index levels. According to OKG Research estimates, if about 2.28 trillion US dollars of funds in the Bitcoin market in the next year, the price of currency prices will rise to $ 200,000. The market value of listed companies will increase simultaneously. $ 100 million. In the dimension of the number of companies in the company, the penetration of emerging markets and traditional industries has accelerated. The growth rate in the past five years will be about 15%. It is expected that it will increase at a rate of 20% in the next five years. In particular, new companies in the finance and technology fields will be attracted by encrypted culture and investment returns. , I will run into the market. From the current more than 80 companies to the 200, it will completely rewrite the industry territory. Bitcoin moves from "niche embellishment" to "mainstream weight" in the corporate balance sheet.

Figure 4 coin stock company listing forecast map

Source: Open AI official website, BB Research

4.2 Evolution of the industry structure

The competition of new and old players will be fierce. Old giants such as MicroslateGy and Tesla continue to consolidate their status with the advantages of their first issues, funds, and brand advantages. Main business cash flow, waiting for opportunities to increase their holdings, strengthen encryption-car ecological linkage. Emerging forces should not be underestimated. Financial technology startups compete for shares with innovative products and flexible strategies, such as the launch of Bitcoin's income optimization financial management to attract retail investors to indirectly enter the market; traditional industry giants cross -border disruption, energy and retail companies enter the market. Utilize the industry's upstream and downstream resources, explore Bitcoin payment and supply chain financial innovation. The industry concentration is short -term due to the dilution of new players. In the long run, comprehensive resources of resources, technology, and brand will stand out, reshape the industry's head echelon, forming multi -pole competition, forming multi -pole competition New pattern.

4.3 **Prospects with the integration of ecological integration with

the blockchain**

Listed companies have deeply participated in the construction of blockchain infrastructure to build a general trend. Technology companies are invested in research and development, optimizing the performance of Bitcoin as the core blockchain, reducing transaction costs, shortening confirmation time, such as exploring the commercialization of Lightning Networks, making small high -frequency payments norm, expanding the daily consumption scenarios of Bitcoin; financial institutions; financial institutions; financial institutions; financial institutions; financial institutions; financial institutions; financial institutions; financial institutions; financial institutions; financial institutions; financial institutions; Based on the blockchain to build a compliance Bitcoin custody and liquidation platform, it is a "clearance to the platform" for the institution to enter the market to promote Bitcoin from "wild" to "domestication". At the level of application development, enterprises excavate the value other than Bitcoin's "currency", such as traceability and copyright fields, combined with NFT, anchor the value of Bitcoin as the value of digital assets, and empowerment of digital assets. Virtualized two -way go to the two -way, borrowing the east wind of the blockchain, Bitcoin jumps out of the category of pure investment, integrates into the core area of global commercial value creation, and empowers the digitalization of thousands of industries.

5 holding the development trend of the currency stock industry

5.1 **We answered two key issues of this round of the currency stock

industry revolution** : pattern and space

5.1.1 Competition pattern of listed companies: In the future, high -fixed, low -margin cost structure -oriented high concentration

Listed companies holding Bitcoin refers to companies that include Bitcoin into the balance sheet and disclosed in the capital market. They may regard Bitcoin as part of reserve assets, investment portfolios, or strategic technical assets. Bitcoin's National Reserve Strategy Act Series such as the predictable policy of the Cryptocurrency industry such as the foreseeable policy of the United States is becoming the starting point of the next technological revolution, changing the financial pattern, and a breakthrough in the military reserve competition.

The asset management industry of listed companies is high, but the cost of fixed costs in the asset management industry is relatively low, but the cost of marginal use is relatively low and shows a rapid decline. This means that high -level industry concentration will gradually develop into a pattern of head competition in the future.

We believe that the global competition pattern will tend to compete. On the one hand, due to Bitcoin transactions, the market concentration is high, and there is a certain industry barriers. On the other hand, the initial basis of Bitcoin asset management means is basically homogeneous, but there are certain differences in industry experience accumulated in the past. Bitcoin Asset management capabilities will become the core competitiveness of the enterprise, and the head players who have mastered Bitcoin's enhanced income strategy will gain this advantage.

(1) Competitive elements of listed companies: The value of the value of currency holding the value is homogeneous, and the number of Bitcoin has become the company 's core competitiveness

We divide the competition of Bitcoin listed companies into three dimensions: quantity, scene, and functions. Then we can see that for giants, scenes and functions are highly homogeneous, and there are only significant differentiated competition in the quantity dimension. We believe that the quantity in the ultimate competition is king, and further is the first advantage and unique scene as the king.

Figure 5 Asset allocation diagram

Source: Open AI official website, BB Research

(2) Competition of homogeneous competition in the value storage value of currency storage

a. Scene level: The core reason is that the Bitcoin blockchain cannot support new financial application deployment like Ethereum, and it is difficult to become the ideal financial infrastructure.

b. Functional level: Early Bitcoin large households tended to be risk -disliked in the concept of investment. They lacked the complex structure and risk hedging strategy of verified verifications, and it was difficult to meet investors' demand for diversified income and risks.

(3) Quantity competition: First of the first advantage and scene advantage

The quantity is significantly differentiated, and it will become the core competition elements of the victory between the heroes. We believe that the essence of quantitative competition lies in the competition between speed and scene. First, whether you can quickly hold the scale of Bitcoin and enjoy the model optimization brought by the number of flywheels; second, whether there is a suitable scenario and support the accumulation of sufficient number of Bitcoin strategy to enhance the strategy application.

a. The number of flywheels holding the number of currencies: the number of Bitcoin quantity and the positive cycle of the asset management model

The more currency holdings, the more interactive feedback from investors and asset management models, the better the model can be optimized. Theoretically, the larger the data magnitude, the richer the investment level and the more comprehensive and comprehensive involved, the more timely update, the more superior the investment model performance; Reinforcement learning) is the core link of model tuning. It can be considered that the number of coins affects the actual use scenario of the asset management model, and the scale of currency holding is essential to the optimization of asset management models.

b. The uniqueness of data and scenes has a differentiated opportunity

Bitcoin enhanced strategy application scenario: 1) The adaptive ability of the AI optimization model to improve the robustness of the strategy under extreme market conditions; 2) use of the tools provided by decentralized finance (such as AMM, decentralization) Borrowing) design innovation and enhancement strategies; 3) The large -scale development of the safety use scenarios, and the source of new ecological income. For a long time, Bitcoin applications and income have become scarce, which has led to the head listed companies that can only use Bitcoin as a value storage tool.

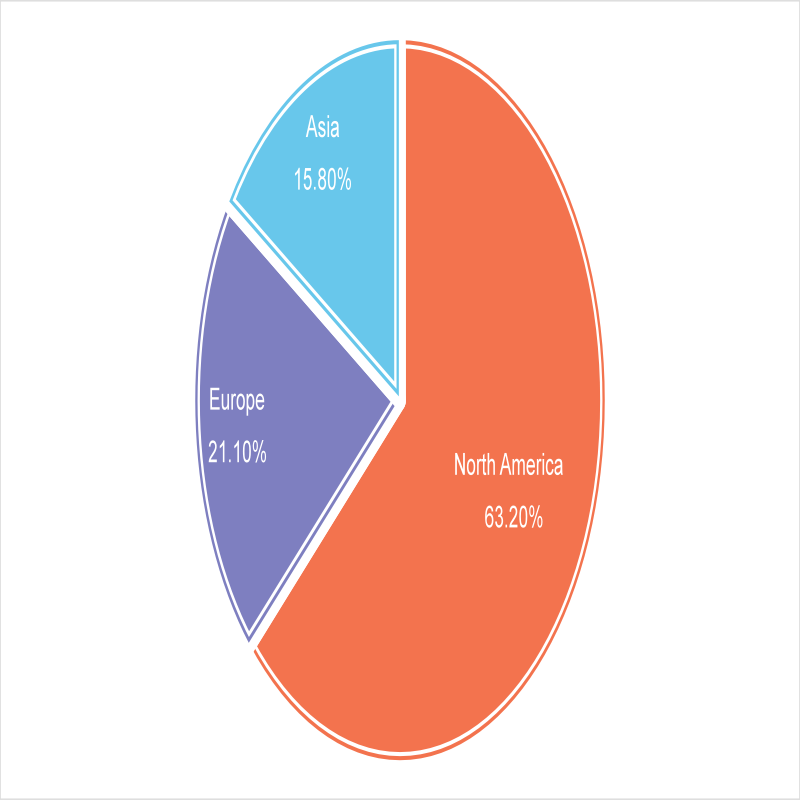

(4) The number of companies and regional distribution

According to data such as Coingecko and OKG Research, as of 2024, about 80 listed companies in the world hold Bitcoin. North America dominates, with more than 60% of related companies, and the United States leads more than 50 companies, including well -known companies such as Microslate and Tesla. Europe followed closely, accounting for about 20%, and companies in countries such as Britain and Germany participated in the environmental regulatory environment. About 15%in Asia, Japan and South Korea are representatives. Driven by the legalization of cryptocurrency transactions, Japan has invested in Bitcoin. Korean companies purchased Bitcoin for the development of the Internet and the game industry to expand payment and assets. Value -added channel. The participation of listed companies on other continents is low, and it is mainly limited by financial infrastructure and uncertainty.

Figure 6 Asset allocation diagram

Source: Open AI official website, BB Research

(5) Industry category differences

Many listed companies have invested in Bitcoin, and technology companies are leading, accounting for more than 40%. Software giant MicroslateGy optimizes the asset structure through Bitcoin and has continued to purchase since 2020. It will hold over 400,000 in 2024. It is regarded as a tool for Bitcoin as a tool against inflation and digital wealth. Payment companies such as Square and PayPal to pay ecological construction through Bitcoin to explore new settlement methods. Internet and e -commerce companies, such as Lotte and Meitu, seek new business opportunities and traffic monetization by buying cryptocurrencies.

The financial industry accounts for 30%. Asset management institutions hold Bitcoin on a large scale through GBTC trusts, encrypted hedge funds and quantitative investment companies use algorithms to arbitrage in price fluctuations. Essence

Mining companies account for 20%. For example, Marathon and Riot Platforms use the advantages of computing power. In addition to operating and repaying debts, a large number of reserves of Bitcoin are affected by various factors, and the Bitcoin supply is jointly affected by mining machine manufacturers and mining pools.

Traditional industries such as manufacturing and consumer industry account for less than 10%. For example, although Tesla is mainly based on automobile manufacturing, Musk's forward -looking vision allows it to invest $ 1.5 billion to purchase Bitcoin, which aims to diversify assets and brand marketing. Although the strategy has been adjusted, there are still over 10,000 people still holding more than 10,000 pieces. Bitcoin provides examples for the integration of new manufacturing companies into the encryption economy. Bitcoin investment in various industries reflects different views on industry changes, asset value -added, and user needs.

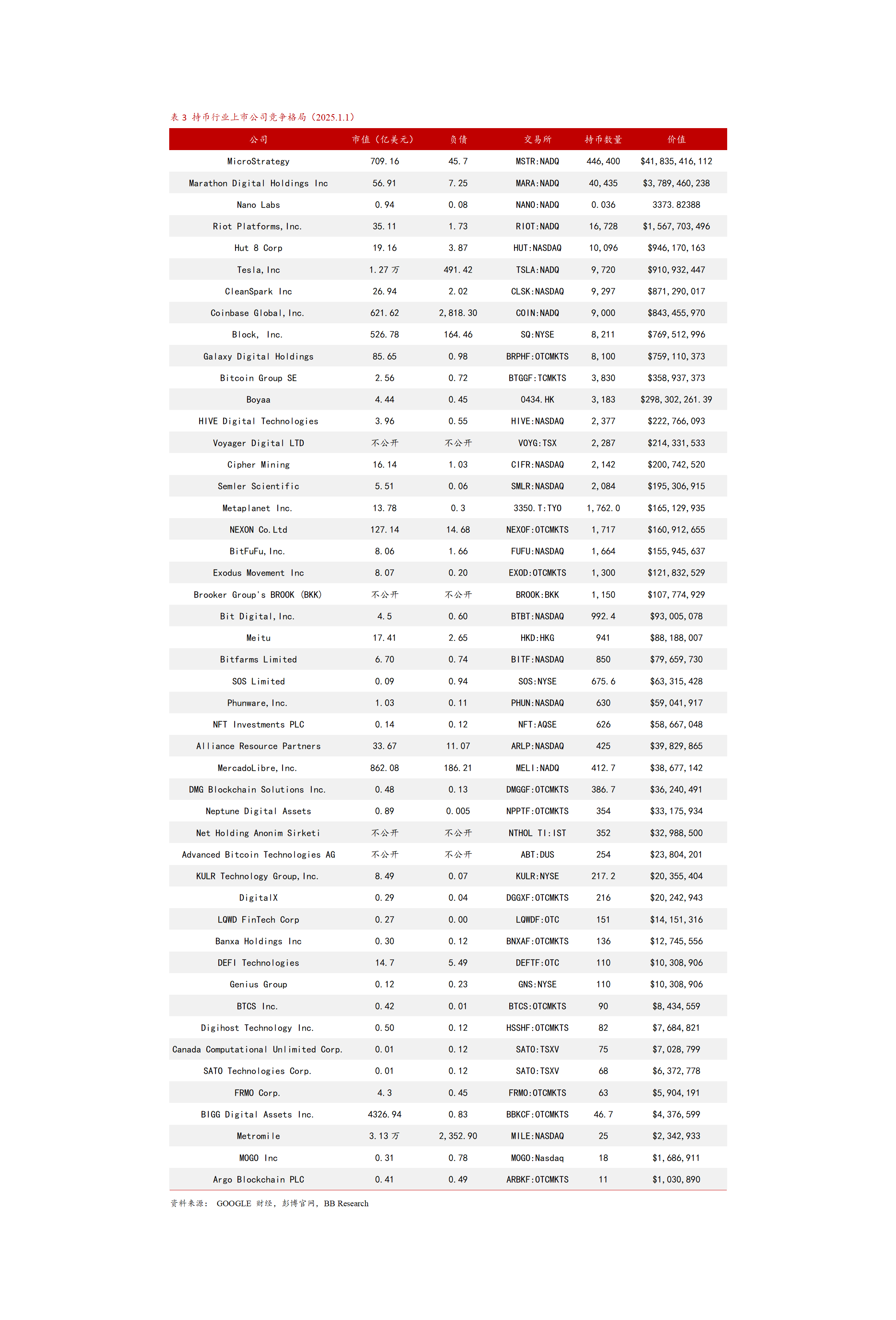

(6) The scale of currency holding to asset allocation

The scale of listed companies has a large scale. MicroStrategy holds 446,400 Bitcoin with a market value of over 50 billion US dollars, far exceeding other companies; Tesla, Galaxy Digital, HUT 8 and other coins hold tens of thousands to tens of thousands of dollars, with a market value of hundreds of millions to billions; The amount of currency is below a thousand.

In terms of asset allocation, the proportion of MicrosRategy exceeds 70%is Bitcoin, and the strategic depth is tilted to the encrypted ecology; medium -sized companies, such as Meitu, Bitcoin accounts for about 10% -20%assets, supplementary as emerging investment; small or cautious companies Bitcoin Bitcoin The configuration is less than 5%, only test water. The size of the currency holding and the asset allocation shows that the company's different attitudes to crypto assets also indicate the diversity of Bitcoin's future role in the company.

5.1.2 Industry space aspect

(1) Bitcoin ETF and Bitcoin active management cover Staking, CEDEFI rate arbitrage and DEFI or other recommendations to maximize the inherent value of Bitcoin. Here, we will include all entrances based on Bitcoin passive ETF and active asset management, including Coinbase (ETF), MARA (miner), MSTR (coins listed company). Replaced;

(2) Some old Bitcoin households generally conservative risks and dislikes in investment concepts are high;

(3) Although Bitcoin is a powerful value storage method, at the financial management level, it is difficult to meet investors' diversified demand for income and risks.

5.2 Financial performance holding Bitcoin listed companies

5.2.1 Impact of asset -liabilities: Bitcoin is usually included in the financial statements based on "intangible assets", and its value is limited by accounting standards. In the bear market, the company may face impairment of assets; the increase in asset value in Niu City is difficult to fully reflect in the financial report.

5.2.2 Stocking of the stock price and Bitcoin price: Holding Bitcoin's stock price fluctuations are usually highly related to Bitcoin prices. For example, Micros''s stock price rose sharply in the Bitcoin bull market, and the bear market fell.

5.2.3 Investor emotional and market value: Bitcoin companies have attracted specific investors because of their opening to digital assets, but they also bear more market volatility.

5. 3 Currency Listed Companies Valuation Model

Based on the global currency company data as of December 31, 2024, the four listed companies have selected four listed companies to build a company valuation model.

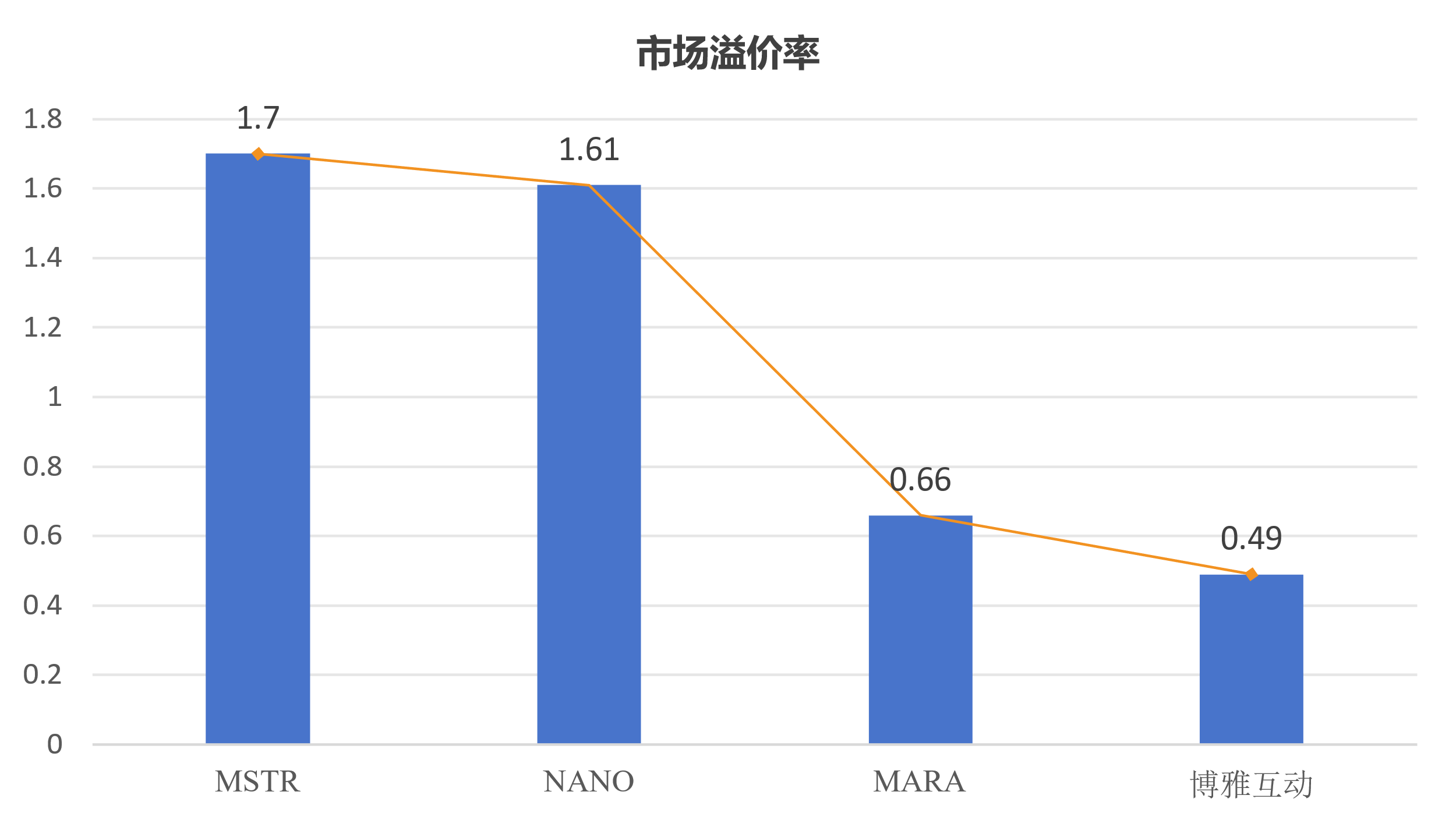

5.3.1 market value premium rate

This model depends on the market value premium rate. Through the diluted financing of the equity, the amount of Bitcoin positioning is thickened, the BTC positioning per share is increased, and the company's market value is pushed up.

Market value premium rate model = (market price-internal value) / internal value × 100%

According to the formula (1) formula, calculate the market premium rate of MSTR, Nano, Mara, and Boya interactive.

Figure 7 MSTR, NANO, MARA, and Boya Interactive market premium rate

Data source: BB Research

As shown in Table 4, in 2024, MSTR's Bitcoin holding was 402,100, each Bitcoin price was US $ 82,100, and its Bitcoin's internal value was US $ 33 billion, and its company's market value was US $ 89 billion. According to Formula 1, the market premium rate is 1.70;

In 2024, NANO's bitcoin holding was 0.03 million pieces, each Bitcoin price was US $ 99,700, and its inherent value was US $ 36 million, and its company's market value was US $ 94 million. The premium rate is 1.61;

In 2024, Mara's bitcoin holding was 40,400 pieces, each bitcoin price was US $ 87.205 million, and its internal value was US $ 3.526 billion, and its company's market value was US $ 5.866 billion. According to the formula 1, the market The premium rate is 0.66;

In 2024, the Bitcoin held by Boya interacted was 0.31.83 million, each Bitcoin price was US $ 577.24 million, and its Bitcoin's internal value was US $ 298 million, and its company's market value was US $ 444 million. The market premium rate is 0.49.

Imagination of the competition pattern of the currency stock industry: the contest of speed and premium rate: the premium rate of the head MSTR market reached 1.70;

The premium rate of the emerging NANO market is 1.61.

The median market premium rate is 1.82, as the central valuation of the coin index center.

It can be seen that the fluctuations of the company's shareholding industry can be seen that when the marginal net purchase increases, the premium rate can remain high; when the marginal net purchase is weakened, the premium rate begins to fall; burden.

How high the premium rate of currency companies represented by MSTR can remain high, depending on: 1) BTC bull market height and length; 2) marginal BTC net purchase continuity; 3) the company's founder's continuous marketing capabilities

5.3.2 Witnesses (NAV) premium model

Based on the company's net value of Bitcoin assets, the company's value is estimated in combination with the premium multiples given by the market.

Company value = premium multiple*Bitcoin net asset

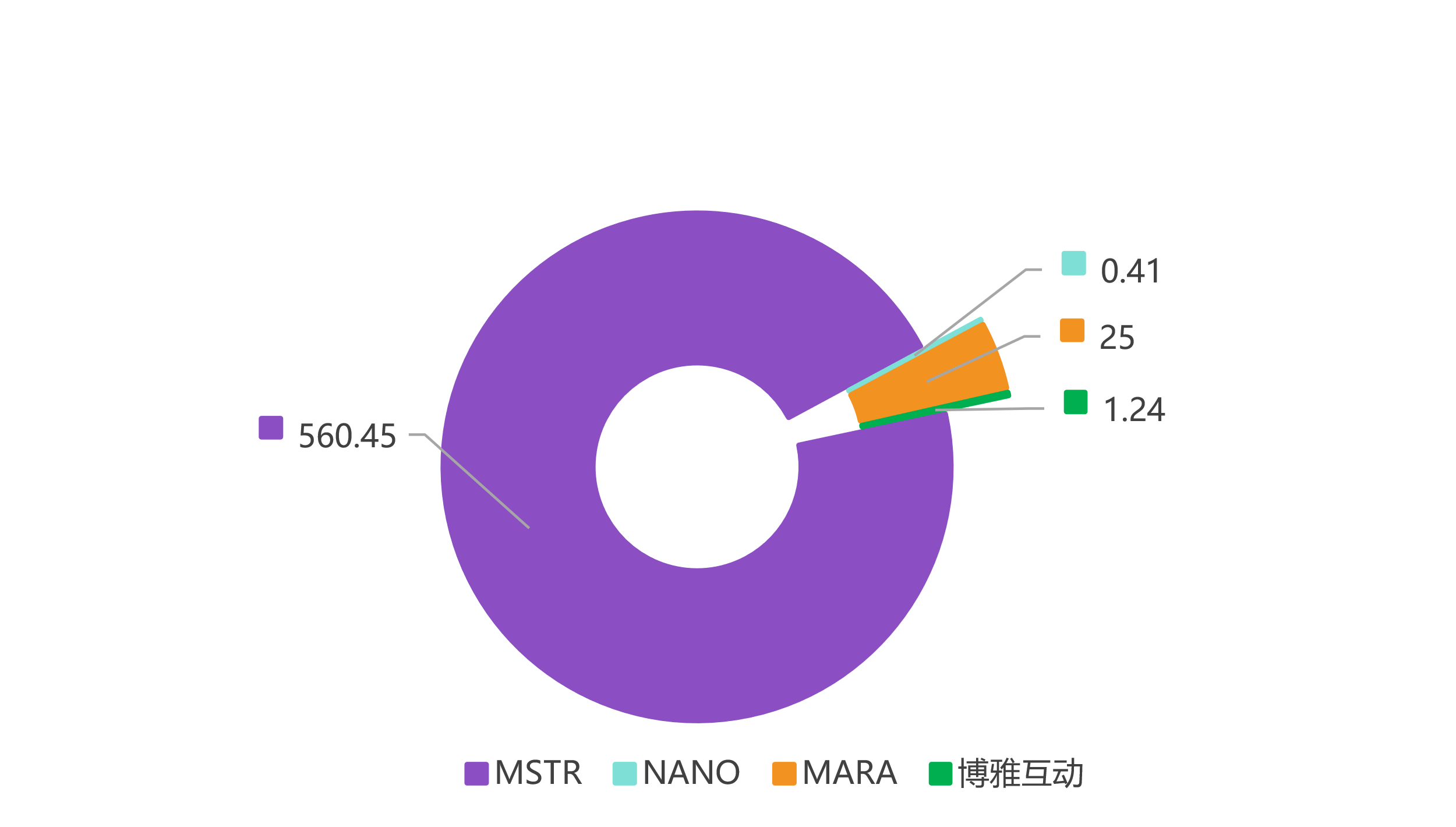

Figure 8 MSTR, NANO, MARA, and Boya Interaction's company value

Data source: BB Research

As shown in Table 5, in 2024, MSTR's Bitcoin value was US $ 37.59635 billion, debt was $ 4.57 billion, and Bitcoin's net assets were US $ 33.026 billion, with a premium multiples of 1.70, and the company value was 560.45;

In 2024, NANO's Bitcoin value was US $ 30336.6 million, liabilities were US $ 08 million, Bitcoin net assets were US $ 26 million, premium multiple was 1.61, and the company value was 0.41;

In 2024, Mara's Bitcoin value was US $ 3.7815 billion, liabilities were $ 1.13 million, Bitcoin net assets were US $ 3.768 billion, premium multiple was 0.66, and the company value was 25.00;

In 2024, Boya interacted Bitcoin value of US $ 298 million, debt was $ 46 million, Bitcoin net assets were US $ 252 million, premium multiple was 0.49, and the company value was 1.24.

The median value of the company is 0.27, as the center of the industry valuation.

5.3.3 Bitcoin price sensitivity model

Based on the impact of the company's market value based on the price of Bitcoin, the valuation

Change market value change = sensitive degree coefficient*Bitcoin price

As shown in Table 6, in 2024, the price sensitivity coefficient of MSTR was 1.51%, the price of Bitcoin increased by 1%, and the company's market value increased by 861 million US dollars;

In 2024, the price sensitivity coefficient of NANO was 2.96%, and the price of Bitcoin increased by 1%, and the company's market value increased by US $ 01 million;

In 2024, the price sensitivity coefficient of MARA was -0.53%, and the price of Bitcoin increased by 1%, and the company's market value decreased by $ 113 million;

In 2024, the price sensitivity coefficient of Boya interacted was 1.04%, and the price of Bitcoin increased by 1%, and the company's market value increased by US $ 0.01 million.

The median increase in market value is 0.01, as the center of the industry valuation.

Buying currency stocks is equivalent to obtaining the expected increase of Bitcoin and the number of listed companies' performance. The first is that currency stock companies can borrow debt and leverage, and the second is that it can be taken by PE RATIO. Learning left and right.

At present, the MSTR's BTC positioning is not existed. After the amount of BTC holding the MSTR reaches a certain limit (the grayscale is 200,000), the premium rate will definitely decline, and the reasonable allocation of currency stock ETFs will be more conducive to obtaining long -term stable income.

Finally, the study found that when the historic MSTR transition rate exceeded 30%, a phased signal appeared.

6 Conclusion and suggestions

6.1 Research summary

Although the global holding of Bitcoin listed companies is still developing, it has shown vigorous vitality and huge potential.

From the characteristics of development, regions are concentrated in North America, and the industry spans into diversified areas such as technology, finance, and mining. The scale of currency holding is diversified and the asset allocation strategies are diversified.

At the level of opportunity, Bitcoin brings a diversified asset and hedging of new tools for listed companies. It meets the needs of strategic transformation and is expected to seize the opportunity in the wave of emerging technology; challenges cannot be underestimated. Limited degree, all bring variables to the company's finance, operation, and strategic landing.

In 2025, the release of the ETF index of the currency shares will be formed. The mainstream institutions will cover currency stock investment. All currency shares will issue coins, and all currency will issue shares. After the combination of the listed company and the Bitcoin enhancement strategy, it brings disruptive investment opportunities.

In general, Bitcoin Investment has become a key path for listed companies to explore new growth and cope with the complex economic environment, but it is necessary to carefully weigh the advantages and disadvantages and fine management risks.

6.2 Investment recommendations

For radical investors, you can pay attention to industry pioneers such as MicroStrategy, the industry's emerging NANO, etc., especially when the Bitcoin market adjustment, panic spread, or the price of key support positions, sharing its high growth potential in batches; At the same time, closely tracking emerging technology, financial companies Bitcoin derivative products, and the ETF layout of the coin holding index ETF, capture early admission opportunities, and use the industry to grow bonus to achieve asset value -added, but be sure to set strict stop loss to prevent the impact of black swan.

Stable investors should give priority to focusing on large -scale mature listed companies Bitcoin positions, such as Tesla, etc., when the market trend is clear and the policy environment is stable, combined with technical analysis and fundamental research, the price of Bitcoin is adjusted to a reasonable valuation range. Participate in a small proportion of funds, focus on long -term holding, and use corporate professional management and diversified business buffer prices to fluctuate to achieve steadily value -added assets. At the same time, with traditional risk -free assets such as gold and high -quality bonds to optimize investment portfolio risk income ratios.

Conservative investors can participate indirectly and pay attention to related financial products of Bitcoin, such as compliant Bitcoin ETFs (if they are approved), track the movement of professional asset management institutions. Tentile investment, strictly adhere to the discipline of asset allocation, and control the opening of Bitcoin investment at a very low level, ensuring that the principal security premise, gently share the industry's growth dividends.

6.3 Dating risk factors

Bitcoin has been fluctuated and fooled since the birth of Bitcoin, which has caused a serious impact on listed companies holding Bitcoin. Taking MicroStrategy as an example, when Bitcoin prices fell in 2022, the company's asset impairment loss increased significantly, the net loss of financial reports expanded, and the market value and stock price plummeted. The sharp change in prices has made listed companies full of uncertainty in financial and market value management, and investors' confidence is also affected.

The global regulatory attitude towards Bitcoin is very different and has been in dynamic changes. Some states in the United States have recognized Bitcoin legal, but federal institutions are strictly supervised, Bitcoin ETF has been approved difficulties, and listed companies are facing strict compliance review and information disclosure requirements. China has banned virtual currency -related businesses since 2017. Monthful investment is limited; the European Union is constantly improving the framework of crypto asset supervision. The trend of regulatory policies affects the legality and operation model of listed companies. Once the supervision is tightened, the Bitcoin assets of listed companies may be impaired, facing the pressure of selling, and the business and strategic layout will also be blocked.

In daily business scenarios, there are many problems with Bitcoin as a payment method. Its transaction confirmation time is up to 10 to 60 minutes, and it is difficult to meet the real -time transaction needs of retail fast -moving consumer. The large price fluctuation also allows merchants to face high exchange risks. In terms of cross -border transactions, although theoretically Bitcoin can bypass foreign exchange control and reduce the cost of remittances, the actual operation is limited by the exchange policies of various countries and anti -money laundering supervision. It has the role of its cross -border business expansion and capital circulation in listed companies, which hinders Bitcoin's popularity in the market.

6. 4 industry outlook

Looking forward to the future, the global holding of Bitcoin listed companies is expected to continue to expand the border of financial innovation. On the one hand, the diversification of Bitcoin financial products, from simple holding to Bitcoin futures, options, structured notes and other complex derivatives innovation to meet the needs of different risk preferences; on the other hand, deepen the integration with the blockchain to help help Bitcoin underlying technology upgrades, accelerated applications such as lightning networks, improve transaction efficiency, and expand commercial scenarios. In terms of market leadership, the head company has become a standard for industry standards with resources, technology, and brand accumulation to guide the improvement of regulatory policies. Emerging companies stimulate the effect of catfish with innovative vitality, promote the multi -competition and healthy development of the industry, and jointly promote the Bitcoin from the edge of the edge Towards the mainstream, integrate into the core of the global financial ecology, reshape asset allocation, payment liquidation, and value storage layout, and inject persistence into the digital transformation of economic digitalization.

In the future, "all currency shares will issue coins and all currency will issue stocks." The stock holding shares will form a new industry -the capital market Web 3.0 carnival, take the wind up, and help the future.

Coin stock investment rating description

Within 6 months in the future, the rising and falling declines of the ETF index of the currency stocks are the standard, and the definition is as follows:

1. Buy: relative to the ETF index performance of the currency stocks more than 20 %;

2. Increasing holdings: relative to the ETF index performance of the coin stock + 10 % ~ + 20 %;

3. Neutral: relative to the performance of the ETF index of the currency stocks -10 % ~ + 10 % fluctuations;

4. Reduction: Compared to the ETF index of the currency stocks below -10 %.

Investment rating in the industry:

Within 6 months in the future, the industry index relative to the currency stock index's rise and fall as the standard, and the definition is as follows:

1. Optimistic: the industry index is more than 10%compared to the currency stock index performance;

2. Neutral: Industry indexes relative to the currency stock index performance -10%~ + 10%;

3. Facing: The industry index is less than 10%compared to the currency stock index.

We will remind you that different securities research institutions adopt different rating terms and rating standards. We adopt a relative rating system, indicating the relative proportion of investment.

Suggestions: The decision of investors to buy or sell currency stocks depends on the actual situation of individuals, such as the current position structure and other factors that need to be considered. Investors should not rely on investment rating to infer conclusions.