Base's L2 capital game: "Pilgrimage" Ethereum liquidity, triple increase in resources, technology and ecology

Reprinted from panewslab

03/15/2025·3MAuthor: Nancy, PANews

L2 has shifted from early technological narratives to the game between ecology and capital. Compared with most L2 projects, which are gradually approaching the end of narrative dividends, Base has recently achieved a double increase in capital inflows and attention. Behind Base's growth is inseparable from the resource advantages of American crypto giant Coinbase, the continuous promotion of technological breakthroughs, and the hot promotion of ecology such as MEME and RWA.

Lead the market by capturing US$2.8 billion, **Ethereum is sucked by

blood from Base**

With strong capital inflows, Base is leading the L2 market, especially the Ethereum ecosystem is moving to the network on a large scale.

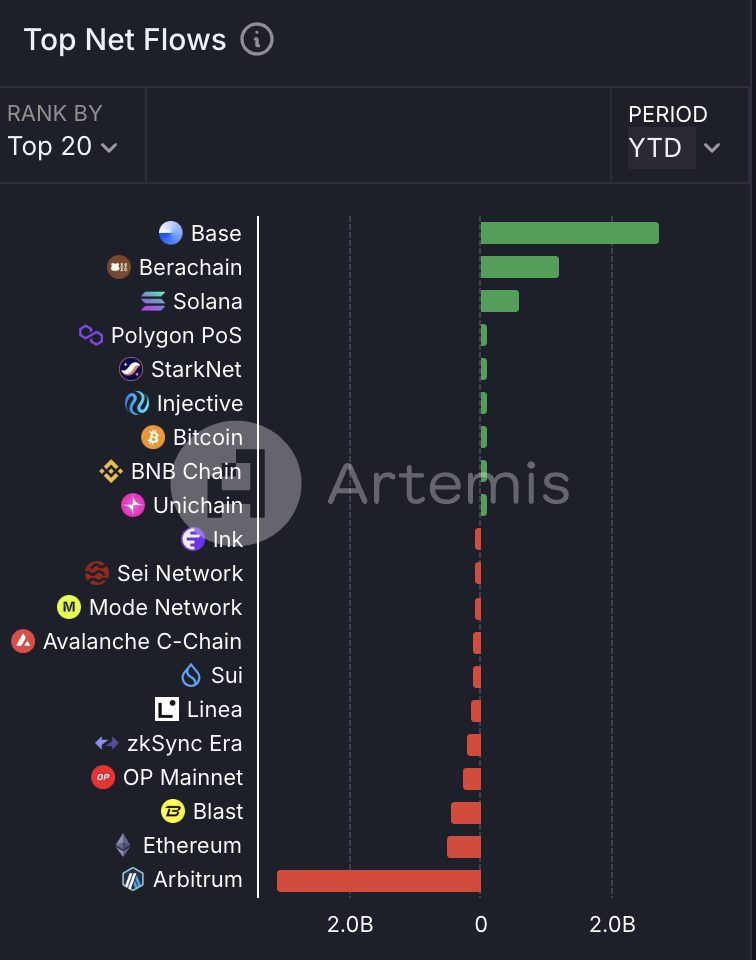

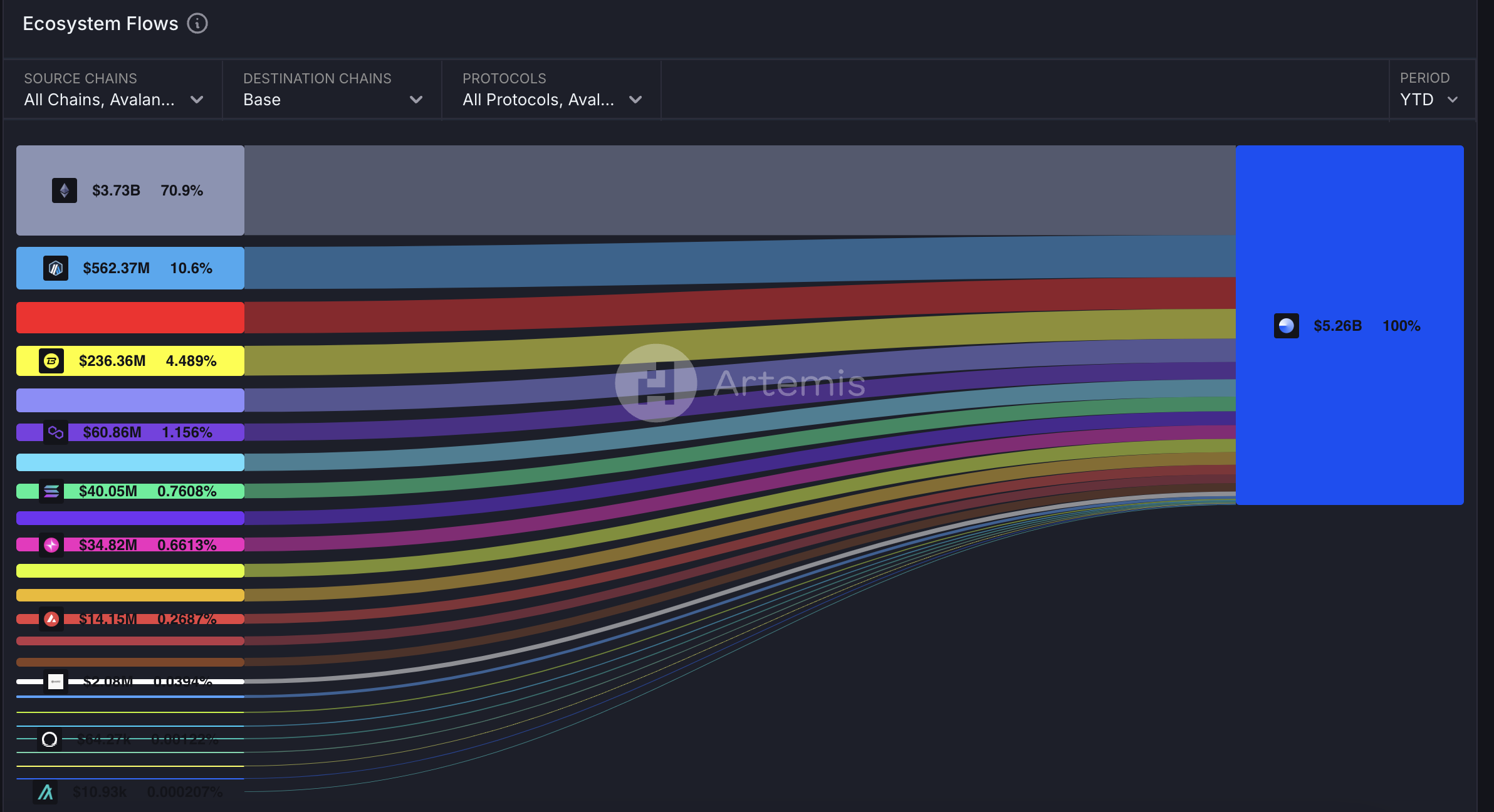

According to Artemis data, the Base network has attracted a large amount of funds since this year, ranking first with a net inflow of about US$2.8 billion, far exceeding other blockchains, and also demonstrates the market's favor for its ecosystem. Specifically, Ethereum is the largest source of Base capital inflows, contributing 70.9% of the inflows, about US$3.73 billion. This reflects the trend of Ethereum users and funds moving to the Base network. Other L2 networks such as Arbitrum, OP Mainnet and Blast also contributed inflows to Base.

From the perspective of capital favor, Base has already gained a significant advantage in L2 competition. In particular, Base is in sharp contrast with Arbitrum, which ranks first in L2. The latter has net outflows of $3.1 billion so far this year, while other L2s such as zkSync Era, OP Mainnet and Linea have also experienced capital outflows of varying degrees.

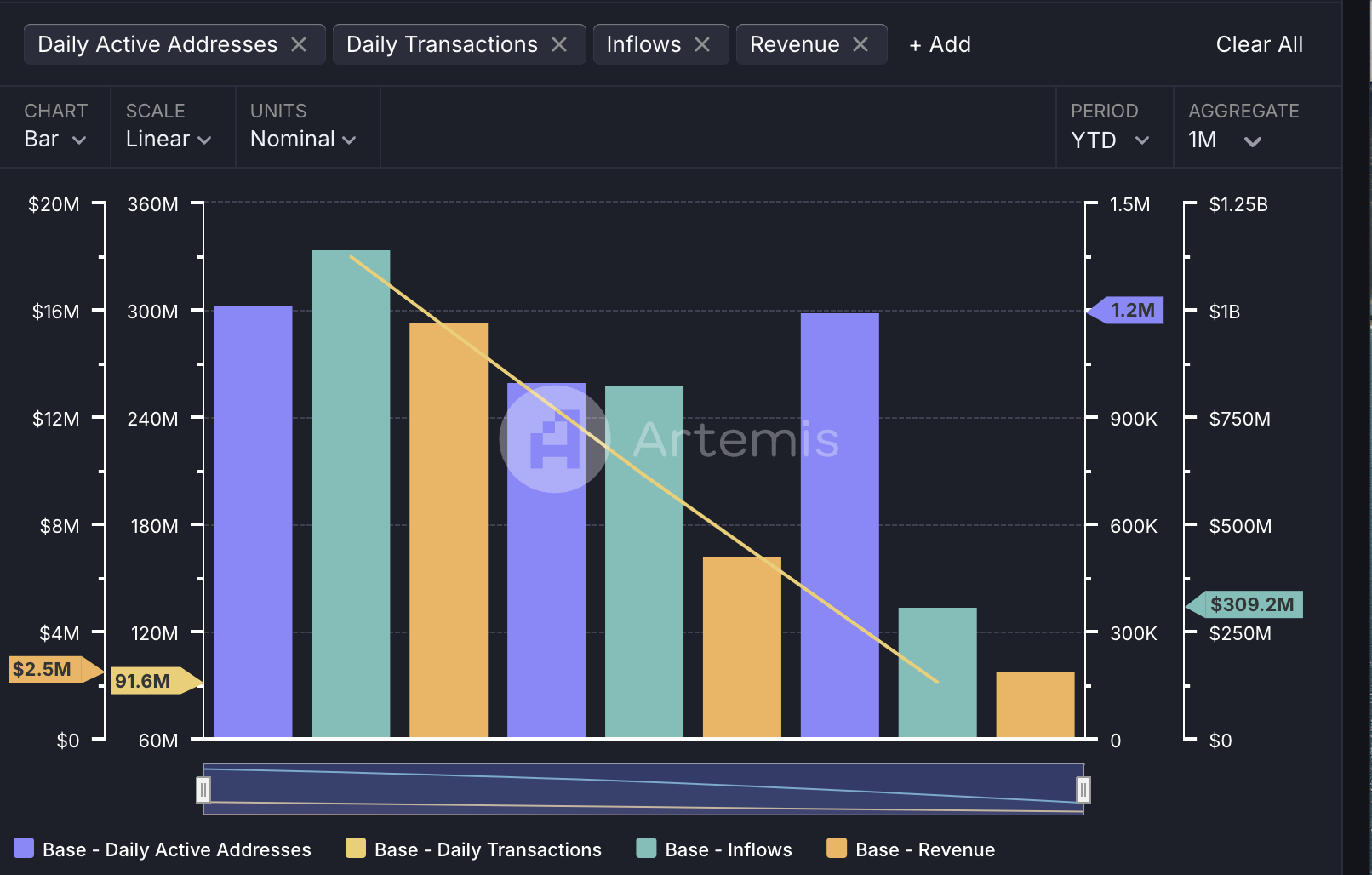

However, Base's on-chain activity has also slowed down this year, but this has important relationship with the overall crypto market's cold. Artemis data shows that Base's capital inflows gradually declined from the peak of $1.1 billion in January, to $830 million in February, and further reduced to $310 million in mid-March. At the same time, the number of on-chain transactions dropped sharply from 330 million in January to 91.6 million in March, a drop of more than 70%. Despite the decline in transactions, Base's active address count rebounded this month. In the past half month, the number of active addresses has reached 1.2 million, equivalent to the level of the whole month in January. Affected by this, Base's revenue also declined, from a maximum of $15.5 million in January to $2.5 million in March.

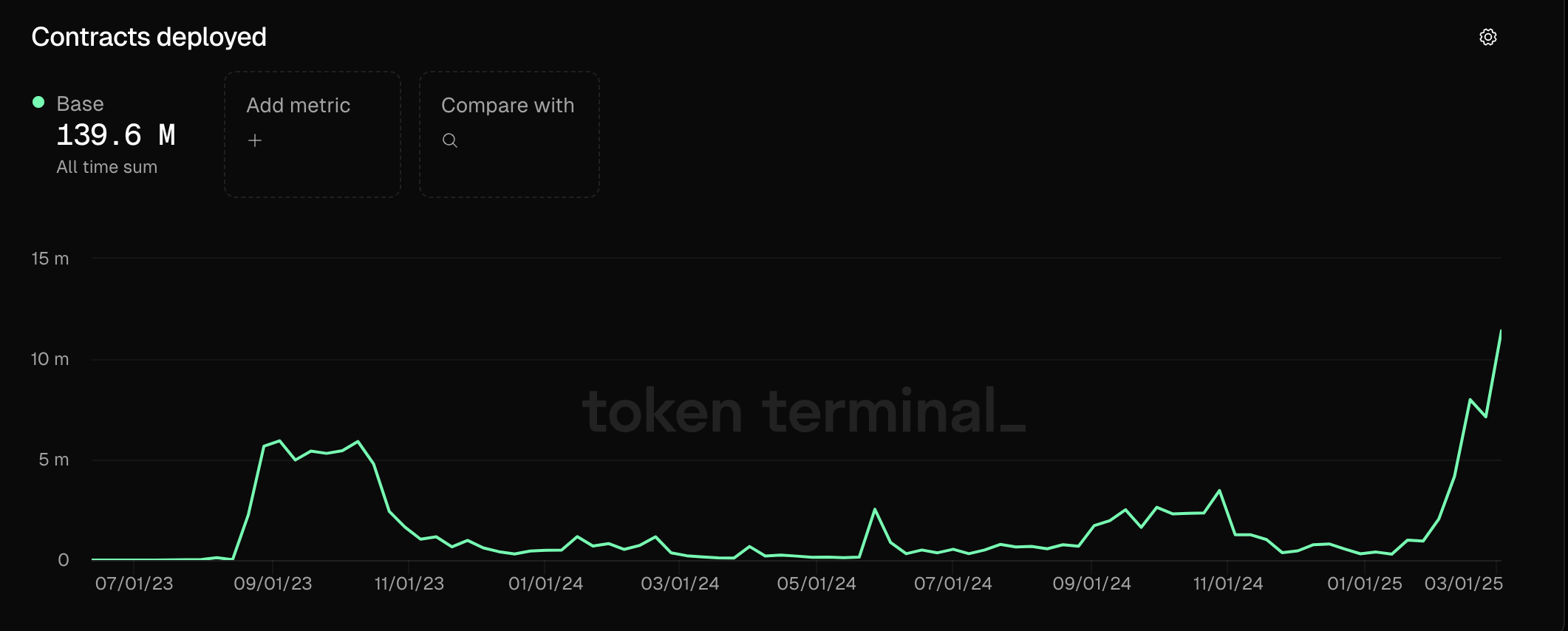

It is worth noting that the current surge in smart contract deployments indicates that Base is attracting a large number of projects and developers to build applications on the chain. According to Token Terminal data, the number of smart contracts deployed on the Base chain has reached an all-time high. Last week, a total of 11.4 million smart contracts were deployed on the L2 network.

Taking advantage of **Coinbase 's east wind, technological

breakthroughs and ecological explosions will strengthen competitiveness**

At present, Base is backing Coinbase, a giant American crypto tree, and the triple east wind of technological innovation and ecological popularity is accelerating its rise.

Taking advantage of the trend of US crypto policy, Coinbase, the creator behind Base, is ushering in more development opportunities. In recent months, Coinbase has reported multiple positive benefits, including receiving "VIP" treatment at the White House summit, revoking lawsuits from the SEC, restarting the tokenized stock COIN plan, revoking pledge services, and even rumored that Coinbase has become a traditional exchange merger and acquisition target. Base may benefit from the improvement of Coinbase's brand and resources. (Related reading: Coinbase takes advantage of US regulation "hitchhiking": White House summit enjoys VIP treatment, tokenized stocks, expansion of enrollment, and mergers and acquisitions rumors )

At the same time, Base's recent frequent actions at the technical level are laying a solid foundation for its move towards large-scale applications. In February this year, Base announced the launch of a number of new technologies, focusing on the improvement of on-chain transaction speed, scalability and user experience, and creating an important weight to attract developers and users. Among them, Flashblocks technology has been launched on the Base Sepolia test network, shortening the block confirmation time from 2 seconds to 200 milliseconds, becoming the fastest EVM chain; Base Appchains (L3 chain) can provide exclusive block space for high-traffic applications and improve scalability. At the same time, Base also introduced Smart Wallet Sub Accounts to optimize user experience, reduce transaction signatures, and provide a safer account management method. Base plans to push Flashblocks and Sub Accounts to the mainnet in Q2. The following month, Base announced the acquisition of the Iron Fish team to accelerate the development of privacy protection technology on Base.

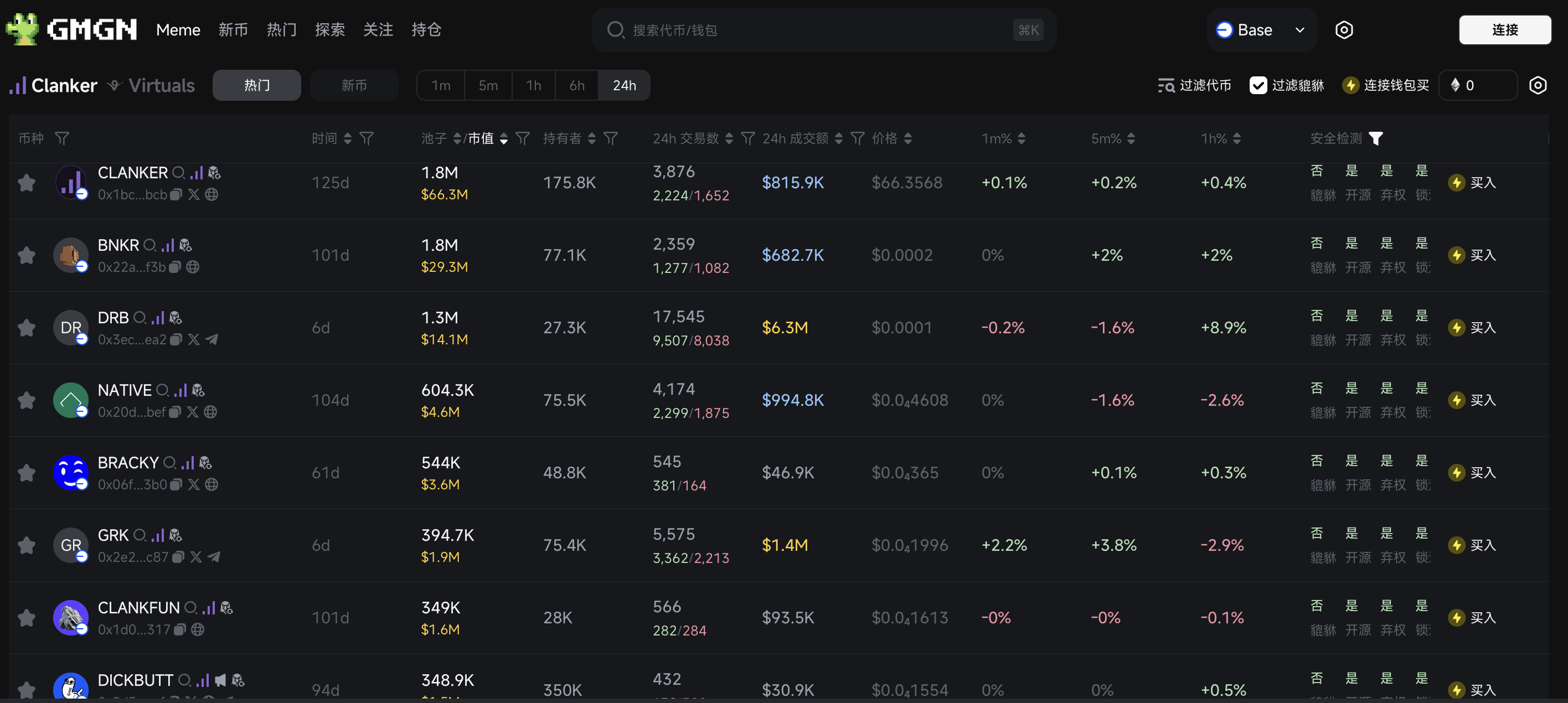

Head MEME on Base Source: GMGN

Compared with the steady advancement at the technical level, ecological popularity is the core driving force for the recent surge in Base inflows. As the MEME market on Solana is weak, the recent boom of $Cocoro and $DRB has driven activity on the Base chain. Cocoro is the prototype of DOGE Shiba Inu KABOSU owner adopts a new rescue dog and joins hands with Own The Doge to launch the token of the same name on Base. Cocoro quickly became popular with the orthodox IP and community sentiment. GMGN data shows that the market value of the MEME coin also exceeded US$100 million at one time, with a turnover of US$130 million on the first day; DRB (DebtReliefBot) is an AI MEME coin proposed by Grok launched by xAI and issued by Bankr on AI. GMGN data shows that its market value is close to US$42 million, and the coin holding addresses are still up to 27,000. The rapid rise in these MEME coins has amplified the appeal of the Base network. It is worth mentioning that the high increase brought by Coinbase's recent launch of MEME coins on DOGINME, TOSHI, etc. has also increased the attractiveness of the network.

At the same time, the U.S. stock market is also one of the hot narratives nowadays. Base developer Jesse Pollak recently revealed that he is considering providing a tokenized version of Coinbase (COIN) stock for US users on Base. Although the plan is still in the exploratory stage, real asset tokenization issuer Backed has taken the lead in launching the tokenized version of wbCOIN, which tracks the share price of Coinbase Global and is fully secured by its stock. In addition to broadening the application scenarios of Base, the exploration of this scenario also expands the investor group.

In order to further consolidate the ecological development, Coinbase Ventures joined hands with Echo, a private equity investment platform on March 13 to launch the Base Ecosystem Group, which will provide three aspects of support for the Base ecosystem: provide developers with broader funds and professional knowledge; provide Base community members with opportunities to participate in early-stage venture capital; accelerate funds flow through the on-chain track and promote the construction of an open financial system. Before this, Base Eco Fund had invested in more than 40 Base projects.

Overall, if Base wants to maintain its competitiveness in the L2 liquidity game for a long time, it needs to continue to make efforts in multiple dimensions such as ecological sustainability, continuous iteration of technology, market adaptability, and user stickiness improvement.