Bankless: Rebuilding Ethereum's product and currency circulation mechanism

Reprinted from jinse

05/15/2025·24DAuthor: David Hoffman Source: Bankless Translation: Shan Oppa, Golden Finance

Overview

Since 2023, Ethereum has lost its distribution advantage that once turned ETH into a “currency” – it has actively restricted the availability of L1, urging developers to “leave the mainnet” and conduct ethical review of certain product categories. These choices result in the dispersion of users, mobility and attention onto L2 and other faster L1 chains. The result is that the original positive feedback loop of "product-currency" was interrupted - the application can no longer attract users, users can no longer bring developers and funds, ETH is no longer the anchor of growth, and can only trade like discounted technology stocks, and capital begins to flow to other places.

Solution? Return to product orientation and main network priority strategy: improve underlying capacity, treat every chain (including Rollup) as a competitor, and reposition the Ethereum main network as a decentralized economic center for future tokenized assets. The two-year roadmap after Ethereum’s restructuring is aimed at 10 times the Gas cap, native zkEVM, and closer L1-L2 integration. It is expected to rekindle that positive feedback loop, bring developers and traders back to the main network, and make Ethereum the "second largest global currency" in the crypto world again.

Broken cycle

ETH's rise in 2021 is because the market begins to price it as the second "currency" in the crypto world.

Against the backdrop of global currency outflows after the COVID-19 pandemic, people have gradually realized that "money" is essentially a belief myth, and the market has also begun to look for a new belief system. Bitcoin is obviously an answer, but in 2021, people realized that there are more than one way to create "currency" with blockchain, and fixed supply caps are not the only option.

At that time, Ethereum showed a positive feedback loop, and its final results were concentrated in the value capture of ETH:

Application → User → Developer → Investor → Liquidity → Agreement Revenue → ETH Value Improvement.

The positive feedback loop is an extremely powerful force. It makes you hear a harsh scream as the microphone is aimed at the speaker; it is the out-of- control energy when the nuclear explosion; it is the exponential increase in the virus during the epidemic lockdown. The powerful positive feedback loop cannot even ignore people who are indifferent.

The market saw such strong positive feedback from Ethereum, so it labeled ETH as a "new currency". Everything worked very well.

what happened?

What should you do when you hear the speaker screaming due to the microphone feedback? Simply disconnect the speaker and the microphone. Cut off the feedback and the sound stops.

This is exactly what Ethereum does when putting Rollup onto the premature roadmap.

Ethereum’s initial advantage lies in L1, which is the only entrance for builders to reach the first batch of users, the central place for users to access applications, and a natural platform for speculators and traders to optimize market efficiency. If you want to do something, you can only come to the Ethereum main network.

There is no second choice.

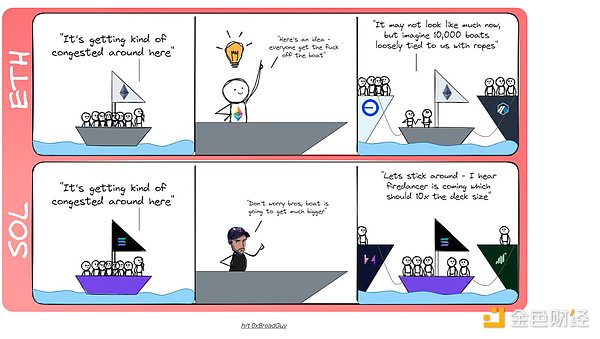

But when the "Rollup-centered roadmap" became mainstream, both Ethereum's official leadership and its community voice pushed L2 as the core of the future. The slogan of "Ethereum relies on L2 to expand capacity" has resounded throughout the ecosystem.

At that time, people did not fully recognize the price. The builders suddenly had to pick a winner from a dozen rollups; users were worried about where their friends (and liquidity) would migrate; exchanges and wallets were scrambling to follow. The originally envisioned competitive cooperation between Ethereum Layer-2 eventually turned into a zero-sum game and ineffective infighting.

Before Rollup came out, investing in Ethereum was easy: just buy ETH. However, since Ethereum's next phase of growth depends on rollup, to achieve this growth, you need to hold a basket of rollup tokens and make subjective guesses about the winner or loser. In this case, how could ETH become a currency?

Once the main network as the coordination center disappears, the signal strength of Ethereum will also collapse. Ethereum's cosmos real existence.

What happened next?

Instead of treating ETH as a “cryptocurrency”, the market began to price it like tech stocks using a discounted cash flow (DCF) model. The problem is that no L1 asset can appear "cheap" under this model.

ETH is no longer cost-effective than BTC, but instead seems to be "expensive" than smart contract platforms that are faster to grow (such as Solana).

Ethereum, which once dominated the country, is now included in the general basket of "many high-performance centralized chains". From 90% dominance to 60%, this is not only a data change. A 90% share means it is a global currency; a 60% share means it is just a technology platform.

This trend is lagging in ETH price, but we all see long-term weak trends in ETHBTC.

Although ETH soared $700 in 3 days from May 8-10, it still fell 72% compared to BTC and 84% compared to Solana (within nearly 900 days).

Some people may think that ETH's performance is weak because of some external factors and has nothing to do with the Ethereum strategy.

But look at the reality:

-

Michael Saylor invested $35 billion in Bitcoin in three years;

-

Solana's memecoin locks in liquidity of over 100 million US dollars;

These two parts of the funds could have flowed into the Ethereum ecosystem , but were taken away by competitors.

Ethereum does not have its own Saylor, and cannot own it because the feedback loop between its assets and ecosystem has been broken.

Solana's memecoin craze is a complex phenomenon. Although Ethereum cannot achieve a block production speed of 400ms and cannot replicate the gameplay of memecoin on Solana, the active development ecosystem and product-friendly attitude have attracted the developers who should have belonged to Ethereum - those developers who were pushed away after 2022.

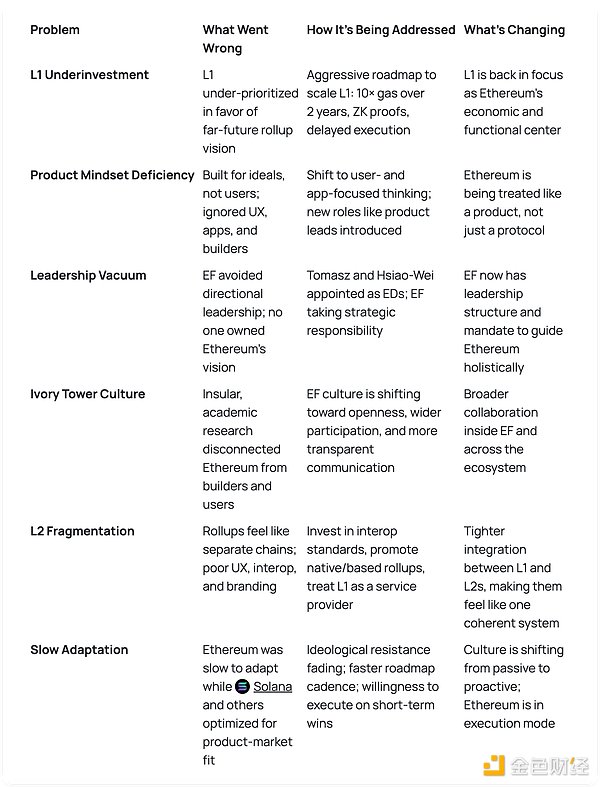

The turn of Ethereum

Ethereum is a decentralized ecosystem, which has no centralized command center—the signals come from the edge, and the truly correct signals will continue to increase over time. By 2024, these correct signals finally reached the right audience and change began to happen.

My podcast conversation with Ansgar of the Ethereum Foundation and Dankrad revolves around this process—we discussed the reasons behind Ethereum’s strategic mistakes between 2021 and 2024, and the specific adjustments made by the ecosystem in leadership.

I have also compiled a list of the categories of various "soft" performance in the Ethereum ecosystem, as well as ongoing solutions.

In the Ethereum community, some people think it is a "strategic shift", while others say it is just a "priority adjustment". But I don't think it actually matters—. This is just a semantic problem. What really matters is: what is Ethereum’s priority for the various components of the ecosystem.

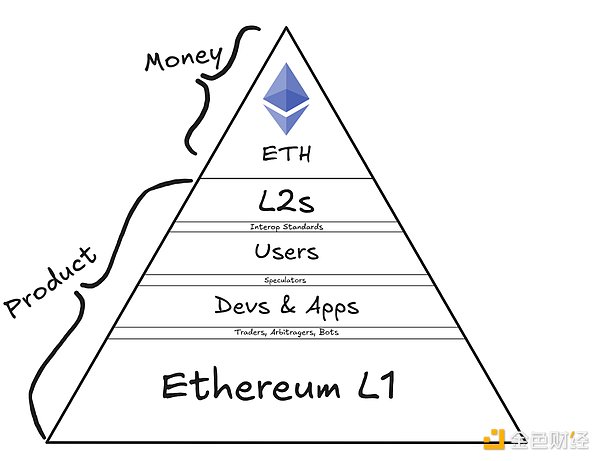

The most important point is: Ethereum must prioritize itself (L1) and then consider L2.

The Ethereum main network (L1) must always be the primary priority of the ecosystem - L2 should not dominate the development roadmap of Ethereum, especially not override the core needs of the main network. Otherwise it will become "putting the cart before the horse".

The priority of Ethereum should be:

-

L1 's technical capabilities and safety

-

L1 's application ecosystem and user base

-

Interoperability standards for L2

A weak L1 is a disaster for the entire Ethereum ecosystem. It will be detrimental to users, applications, traders, and L2. On the contrary, if the focus is re-focused on the strength of the main network, everything in the ecosystem will benefit from it.

For the healthy development of the entire ecosystem, L1 must maintain its top strength in the competition.

If Ethereum wants to serve its users, applications and Rollup best, it must serve itself first.

Ethereum mainnet is the economic center of cryptocurrencies

L1 should be the default platform for anyone to build, use, or trade assets on the chain.

It is the only truly decentralized, multi-client, always online network. It is here that the ideal of password punk can truly reach ordinary users. Our mission is to extend this foundation of excellence to the widest possible range.

We must restore the status of the Ethereum mainnet as a "Shering Point".

This means that we want to expand L1 to become a " big tent" with the widest user base , allowing ordinary users to trade freely like giant whales, while maintaining the anti-censorship core on which Ethereum relies.

Those claims that "the mainnet belongs to only the top 0.1% of users" will only seriously weaken the attractiveness of Ethereum.

The correct signal is: Ethereum is our home - it is the home of developers, the home of users, and the home of assets.

Distribution as king

Every explosive growth in the crypto space—the ICO boom in 2017, the DeFi Summer in 2020, the NFT wave in 2021—has happened on Ethereum because users are already gathering here .

But in 2024, Solana seized the dominance of the memecoin craze, relying on faster and cheaper block space, winning the distribution advantage. Ethereum can no longer lose this position.

Expanding the capacity of L1 is to restore the network effect that attracts applications and Rollup regression . In essence, blockchain is an asset ledger. And Ethereum is the best ledger. It should be the home court with the deepest liquidity, the highest trading volume, and the smallest spread .

Expanding the main network capacity is to expand execution, thereby attracting traders, market makers, and token issuers - they are all looking for the largest and most liquid market.

Traditional finance is now "shopping around" and considering which platform to deploy their real-world assets (RWA) to. Ethereum’s goal should be clear: there should not be a “second choice”.

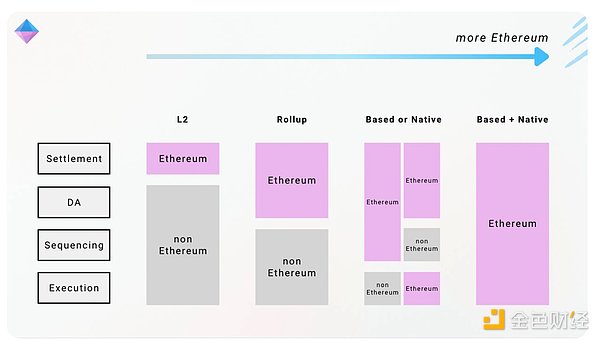

L2 is an Ethereum customer

L2 should be understood as a paid customer of Ethereum. Each L2 controls its own governance, can fork at any time, or choose to settle on other chains. Ethereum needs to treat them as potentially lost customers, not part of the Ethereum technology stack.

The confusion about whether these Rollups "belong to Ethereum" depends on what perspective you look at: if you strictly define Ethereum as an L1 blockchain, then Base, Arbitrum, etc. are obviously independent chains; but if you define Ethereum as a broader security ecosystem, they do count as "family" because they anchor the proof of data on the main network. When we talk about Ethereum, it is necessary to clarify which perspective we are using, because the grand “ecosystem” narrative only resonates with those who already agree with Ethereum’s long-term vision, while others only see competitive settlement platforms.

A more integrated Ethereum

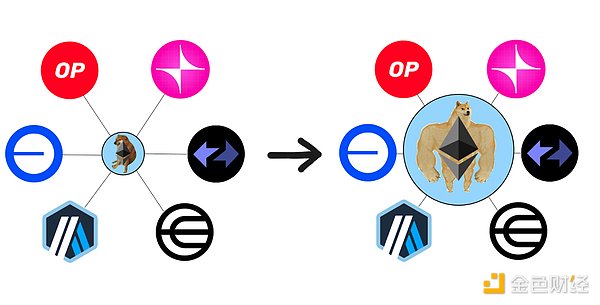

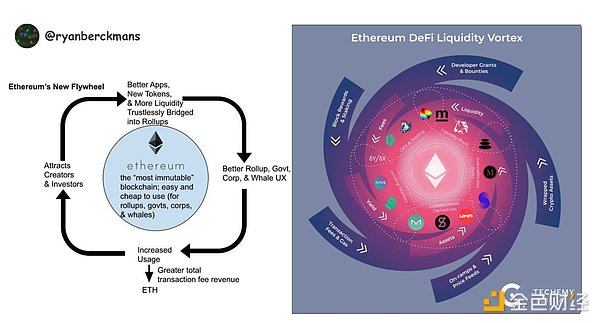

The positive feedback loop in the Ethereum ecosystem (super excess value flows into ETH) is not a new concept. As early as 3 years ago, a chart illustrates this model.

The key mistake we make is not realizing that every L2 must establish the same network effect feedback loop for itself, and Ethereum cannot recapture the network effect from L2 without the technical ability to strongly integrate L2.

Ethereum built L2 before it built interoperability technology. Base, Native Rollups, and interoperability standards didn’t appear until 2024, when Ethereum’s original L2 had split the network effect for a full three years.

In the future, we should prioritize the development of highly integrated Based and Native Rollups over independent L2s.

The Ethereum community is part of the product

Ethereum is not only software, but also the person behind it. While core developers promote a product-driven roadmap, the community also has an equally important position - builders choose chains and culture.

This means that we are co-creators, not critics who stand idly by, and we must jointly promote Ethereum's popularity and application expansion.

We, the Ethereum community, should admit: we are not an attractive community. We have become a “self-pretentious” ecosystem, creating unnecessary barriers between us and many other members of the ecosystem.

Many Ethereum people devalue Meme coins, partly because they don’t like speculation, partly to avoid endorse Solana, partly because Meme coins are often pegged to scams and are seen as interference from the crypto mission.

That's what I did. Bankless is a pioneer in setting this tone and message. We drew the line, and those lines eventually turned into the split we see today – and I’m working to fix them now.

If Ethereum just rejects Meme coins, that's fine. But over time, this "rejection" has become a part of Ethereum culture. At first it was to resist fraud, but later it became a threshold to determine what is "justified".

This mentality mostly stems from collective trauma (Terra, 3AC, FTX) from 2021 to 2022, when fraud was rampant, and Ethereum was relatively safe in this crypto disaster. The "Qingluo factions" proved that they were right, but those injured did not join an ecosystem that kicked them again when they fell. They feel rejected.

Traders and speculators remain when many think Solana is dead. Partly because Solana is indeed technically more suitable for their needs, and partly because the Ethereum community is always biased against trades and speculators.

If Ethereum chooses to prioritize expanding L1 and recognizes the value of traders and speculators more when FTX crashes, then Ethereum could have won the market cycle for the third time in a row.

To this day, the "self-proclaimed aloof" Ethereum culture still exists. We are now licking ourselves to reject the wounds of those participants who are crucial to the ecosystem.

Ethereum cannot artificially define the support scope

Traders and speculators are the most important user groups in the crypto space. They are the first to deposit funds, take risks that others do not want to touch, and send clear market signals to attract developers and users to enter. When Ethereum conducts a moral trial of “legal” use cases, those users who remain ideologically neutral will take liquidity elsewhere.

You may think that developers are the most important user group in the crypto field, but if traders don’t like the content built by developers, then developers will “get out of food.”

The Ethereum community needs to see itself as part of the Ethereum product suite. When choosing a chain, the application team is also choosing the culture behind it. If they feel they are facing a community that despises "speculative behavior", they are likely to choose a more friendly ecological environment.

The Ethereum community cannot support only those use cases that we consider “ethical and noble” and exclude those uses that we find “offensive”. We need to start with the founder's mentality and optimize the largest total addressable market (TAM) as possible.

If Ethereum wants to continue as a hub for asset issuance and innovation incubation, its culture must be as open as its code.

The Ethereum community has always emphasized the importance of its "social layer" and believes that this is one of the keys to Ethereum's unique and valuable value. However, this obsession with the "social layer" creates a gap between project concept consenters and ordinary users who only want to operate on the link.

Those economically rational but ideologically neutral users are blamed for lack of sufficient agreement.

Ultimately, the real responsibility of the “social layer” is to choose the right fork when the consensus layer code fails. In addition to this, social behaviors are all additional functions and should be performed with caution. On the permissionless chain, restricting permissionless behavior runs contrary to "trustworthy neutrality". Ethereum must truly practice the principles it advocates.

Fix feedback loop

Ethereum is undergoing a major refactoring. The "Maslow demand hierarchy" of blockchain development is being rebuilt in the right order. Ethereum has some amazing core assets - now (in my opinion), it is Tomasz's turn to take over the task, reconnecting the feedback loop, allowing Ethereum's assets - developers, applications, users and the Rollup ecosystem - to form a joint force again, and ultimately reflect it through the rise in ETH prices.

Once this process is done, those determined ETH maximalists will have a solid product base enough to compete with Bitcoin extremes like Michael Saylor.

ETH's role as a "currency" must be built on powerful Ethereum products. The path to ETH becoming a currency has always been based on Ethereum's "social- technical product stack". With the successful reconstruction of product strategy, ETH's target price will no longer be $10,000, but a higher distance.

There is still a lot of work to be done to achieve this goal and we cannot be complacent. We are just starting out, and there is still a lot of reconstruction work to be completed in the Ethereum ecosystem.

chaincatcher

chaincatcher

panewslab

panewslab