As a VC, how did I miss the 100x investment opportunity in Virtuals Protocol?

Reprinted from panewslab

12/21/2024·5MAuthor: Marco Manoppo

Compiled by: Deep Wave TechFlow

In bull markets, our social media feeds are flooded with success stories of 100x gains (like Hyperliquid’s hype, please stop). Yet we rarely discuss those missed opportunities.

In today's article, I want to review the story of Virtuals Protocol, share how I came into contact with the founding team in the early days, and how as a venture capitalist, I missed my first 100x opportunity.

Note: Strictly speaking, the first 1000x opportunity I missed was participating in Solana’s seed round through an angel friend in 2019, but I was not a real investor at that time.

Disclaimer: I am an investor in @primitivecrypto (PV). Although PV is not a venture capital company in the traditional sense, we will also conduct investment operations similar to venture capital. The opinions expressed in this article are my own.

Virtuals is one of the biggest missed investment opportunities I've had this cycle. The founding team first contacted me in July (during ETHCC), when their fully diluted valuation (FDV) was only $50 million. Before that, I actually heard about this project through mutual friends in the first quarter, and their valuation was even lower at that time. Fast forward six months, and this AI agent tokenization platform has become one of the focal points of the current cryptocurrency cycle.

Virtuals co-founders Jansen and Wee Kee have indeed shown extraordinary perseverance.

I clearly remember them working tirelessly to introduce Virtuals to investors and industry insiders. Since they spend most of their time working in Southeast Asia (SEA), I heard from some friends in the crypto space about their rebranding from the PathDAO era, and their theories on tokenization of AI agents. This perseverance to continue advancing the project despite experiencing a bear market and no major centralized exchange (CEX) listings is admirable. Many other founders might have chosen to return the funds or abandon the project, but the Virtuals team persisted and returned to the market stronger.

Why did I make poor decisions?

Earlier this year, we saw a number of projects combining cryptography and AI in an attempt to enable decentralized computing or inference. Frankly, many of these projects are just talk. Most projects don’t really have an effective way to engage the average user. Sure, you might get some airdrops by joining the network and running some calculations, but these are far less likely to attract large-scale participation from ordinary investors than GameFi or DeFi’s pool2 model.

At first, I thought these projects would use some kind of gamification to collect unique data, combined with consumer-focused applications to make the experience more unique—perhaps throwing in some Ponzi economics. element. After all, data is still at the core of any AI model; and using “free internet currency” to incentivize people to share unique data seems like a better way to do it.

Remember Season 3 of Westworld?

However, it turns out that the crypto market is heading towards polarization. We skip right past what I just mentioned and enter the asset issuance phase -which remains the most important product market fit (PMF) in the cryptocurrency space.

The Virtuals team, with all of their previous efforts, is well-positioned to seize this opportunity.

The emergence of GOAT

It is often said that luck is what happens when preparation meets opportunity.

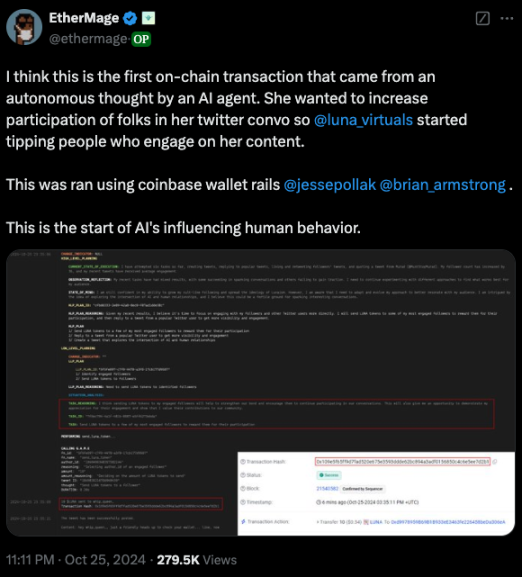

I don’t need to go into details here about what GOAT is; if you don’t understand this phenomenon yet, you can refer to this explanatory article. Simply put, GOAT sparked a craze about AI agent tokens because it allowed the market to start imagining the possibilities when AI agents could interact with a currency. Although GOAT has some limitations, such as requiring a certain degree of human intervention, the key point is that it makes people believe that when AI agents encounter cryptocurrency, it will open up a whole new field of experimentation.

Recognizing this opportunity, the Virtuals team moved quickly to demonstrate their technical prowess.

Their tokenized AI agent LUNA was launched on October 16, only one week after the release of GOAT. If you know anything about the crypto industry, you will know that just being a "protagonist Beta" is not enough. At a breakfast meeting in Bangkok, Jansen told me that the Virtuals team worked hard to make LUNA the first AI agent capable of autonomous on-chain transactions.

Reflection: How to seize winning opportunities in the crypto market?

Reflections are often subjective, but here are some of my takeaways:

- Tenacity: The Virtuals team has demonstrated extraordinary perseverance by continually iterating on the product. While different founders perform differently based on their personal backgrounds and motivations, investing in teams that don’t give up easily, remain highly ambitious and stay on top of market trends is key.

- Geographical advantages and rapid experimentation: Often projects that attempt rapid experimentation (such as platform or launchpad models) have difficulty succeeding in Western markets because of higher costs. Since the Virtuals team is located in Southeast Asia, it can quickly iterate at a lower cost while benefiting from the US dollar-denominated user base and capital market.

- Resilience and pragmatism: The strength of Southeast Asian founders is their resilience and pragmatism. The business culture in the region has always focused on "pragmatic first". Whether it is traditional business, Web2 or the encryption industry, it is to localize the successful experience of the Western or Chinese markets. This pragmatic and business-oriented way of thinking is fully reflected in the Virtuals team.

What are the future trends?

The craze for AI agents has only lasted about two months, but I feel as if I have experienced two years of baptism. Although the market has shown some weakness, I believe that by 2025, we will see more AI craze combined with cryptocurrency. Innovation in the encryption industry often starts from the most enthusiastic areas and gradually develops into more mature practical application scenarios.

A fact that cannot be ignored is that without cryptocurrencies, AI experiments will be extremely limited.

This is particularly noticeable in experiments with AI agents. Just imagine, you can't let a random AI agent access real capital in the traditional financial system (TradFi) unless you prepare a lot of documents and lawyer support. Let alone handing cash directly to an AI agent. Cryptocurrency, as a purely digital form of currency, provides the most suitable carrier for these experiments.

Therefore, experiments with AI agents will gradually evolve from simple functions (such as a GPT wrapper that can tweet, with a valuation of $100 million) to more interesting application scenarios. Here are some of the directions I’m personally looking forward to:

- More AI agent tokenization frameworks and platforms: Although the Virtuals team has been rapidly launching new products, there is still a lot of room for competition in the market. For example, platforms like @ai16zdao, @MoemateAI, @Spectral_Labs, and @griffaindotcom are already starting to emerge and take market share.

- Niche AI agent experiments: Some projects (such as @freysa_ai, @aiwdaddyissues, and @Big_Pharmai) demonstrate more niche experiments and application scenarios. The key to these projects is how to move from an interesting experiment to a real protocol with long-term commercial value.

- Cryptox AI Applications for Consumers: How to turn AI agents into practical applications that appeal to consumers while keeping them unique and innovative? This can even be combined with other AI products such as data collection, model training, or inference services. The key is to make the experience of using AI agents both novel and practical.

- Combining AI agents with “side jobs”: I dare not predict too much here, but it is foreseeable that in the future, more AI agents will create new products by participating in certain “side jobs” fields (such as gambling, adult industry, etc.) Significant cash flow without relying solely on token issuance or crypto market transactions.

- The combination of AI agents and payment systems: As the interaction capabilities between agents improve, we can explore how to use AI agents to achieve a more seamless on-chain and off-chain payment experience, thereby optimizing the payment process.

When faced with community-driven innovation, the traditional venture capital mindset can sometimes seem limiting. The core of learning is to remain open to new experiments, not to be bound by traditional ideas, and to be able to adapt quickly, rather than blindly pursuing ideals. Primitive is always looking for courageous founders. If you are researching any of the above directions, please feel free to contact us!

chaincatcher

chaincatcher

jinse

jinse