Arthur Hayes new article: Bitcoin will collapse before Trump’s inauguration, which will be a good time to buy dips

Reprinted from panewslab

12/19/2024·6MAuthor | Arthur Hayes

Compilation | Wu Shuo Blockchain

Please note that this article has a biased view and is only used to share his personal views and does not constitute any investment advice. Arthur Hayes also laughs at himself for the low accuracy of his short-term judgments. Readers are asked to focus on his non-price-related reasoning logic and analyze.

Original link:

https://cryptohayes.substack.com/p/trump-truth?utm_campaign=post&utm_medium=web&triedRedirect=true

The views expressed here are solely those of the author and should not be relied upon as a basis for making investment decisions, nor should they be construed as a recommendation or recommendation to engage in investment transactions.

Step 4: This is the fixed distance between a vertical plank and the movable bracket. My yoga teacher instructed me to place the heels of my hands where the board meets the brace. I bent my body like a cat, making sure the back of my head was pressed against the board. If the distance is right, I can put my feet up against the wall and turn my body into an "L" shape with the back of my head, back, and sacrum in contact with the board. I have to resist the tendency of my ribs to flare out by activating my abdominal muscles and tightening my tailbone. Phew - I'm sweating profusely just by maintaining the correct posture. But the real challenge has yet to begin. The difficulty lies in kicking up with one leg and maintaining a completely vertical position while maintaining body alignment.

The stick is like a truth serum, revealing incorrect posture. It will be obvious quickly if your body is out of alignment and you will feel some parts of your back and hips pulling away from the stick. All my musculoskeletal issues were exposed when I brought my left foot up while my right foot was still pressed against the wall. My left lat is abducted and my left shoulder is rolled in, looking like a skewed rubber band. But I've known this for a long time because my athletic trainer and chiropractor both discovered that my left side back muscles are weaker than the right, causing my left shoulder to lift up and roll forward. Practicing handstands with a stick only made the imbalance in my body more apparent. There were no quick fixes to my problems, just a long road filled with sometimes painful exercises to slowly correct my imbalances.

If the vertical planks of wood were my body-aligned truth serum, then U.S. President-elect Donald Trump, the “Mr. Orange,” serves a similar purpose on various geopolitical and economic issues facing the world today. Why do global elites hate Trump? Because he tells the truth. What I call the truth about Trump is limited to a narrow realm. I don’t mean whether Trump will tell you the size of his genitals, his net worth, or his golf handicap. Rather, the truth about Trump is about actual relationships between different countries and what ordinary American voters think when they are in their safe space, away from the politically correct “Nazis.”

As a macroeconomic forecaster, I try to make predictions based on publicly available information and current events in order to make decisions for my portfolio. I love Trump Truth because it serves as a catalyst that forces other heads of state to face up to the problems facing their countries and take action. It's these actions that ultimately shape the future state of the world, and Maelstrom hopes to profit from them. Even though Trump has not yet returned to the throne, countries are already taking the actions I predicted, which further strengthens my confidence in how currency printing and financial repression will be implemented. This year-end summary aims to review the major changes among the four largest economies and countries (the United States, the European Union, China and Japan). Crucial to my investment decisions in the short term is whether I believe money printing will continue and accelerate after Trump's coronation on January 20, 2025. Because I think crypto investors have too high expectations for how quickly Trump can change the status quo, when the reality is that Trump doesn't have any politically acceptable solutions to bring about those changes quickly. The market will soon realize that Trump only has a year at most to implement any policy changes, which will be around January 20th. This realization will lead to a violent sell-off in cryptocurrencies and other Trump 2.0 stock trades.

Trump has only a year to act, as most elected U.S. lawmakers will begin campaigning for the November 2026 midterm elections in late 2025. All members of the U.S. House of Representatives and a large number of senators must run for re-election. The Republicans' majorities in the House of Representatives and the Senate are very slim, and they are likely to lose power after November 2026. The American people are rightly outraged. However, solving the domestic and international problems that negatively affect them will take even the most astute and powerful politicians more than a decade, not just a year. As a result, investors are bracing themselves for severe buying regret. But can printing money and a raft of new regulations overcome the “buy expectations, sell facts” phenomenon and keep the crypto bull market alive deep into 2025 and beyond? I think so, but let this post be an outlet for my self-persuasion in trying to convince myself of this final conclusion.

currency stage changes

I will quote Russell Napier on a very simplified timeline of post-WWII monetary structures.

1944 – 1971 Bretton Woods System

Countries peg their currency rates to the U.S. dollar, which is pegged to gold at an exchange rate of $35 per ounce of gold.

1971 – 1994 Petrodollars

President Richard Nixon abandoned the gold standard and allowed the dollar to float against all currencies because the United States could not maintain the dollar's peg to gold while needing to fund an increasingly large welfare state and the Vietnam War. He struck deals with oil-exporting countries, notably Saudi Arabia, requiring them to price oil in dollars, produce oil on demand, and reinvest their trade surpluses in U.S. financial assets. If some reports are to be believed, the United States has also manipulated certain Gulf countries to increase oil prices to provide support for this new monetary system.

1994 – 2024 Petro Yuan

China has sharply devalued its yuan to combat inflation, collapse its banking system and reignite its export industry. China and other Asian Tigers (such as Taiwan, South Korea, Malaysia, etc.) have implemented mercantilist policies to provide cheap exports to the United States, resulting in the accumulation of U.S. dollars overseas as currency reserves, allowing them to pay for energy and high-end products priced in U.S. dollars. Quality manufactured goods eventually brought more than a billion low-wage workers into the global economy, which drove down inflation in the developed West, allowing their central banks to keep interest rates extremely low because they mistakenly believed that endogenous inflation Expansion has been declining for a long time.

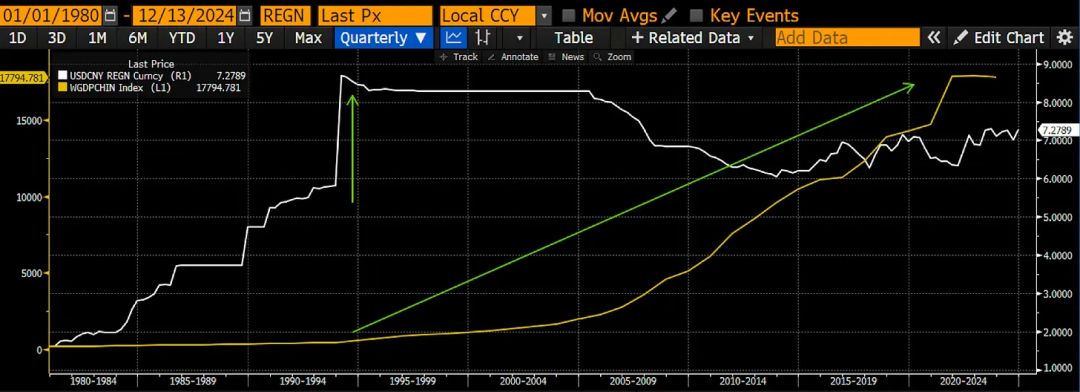

USDCNY is shown in white and Chinese GDP (in constant dollars) is shown in yellow.

2024 – now?

I have no name for the system currently under development. However, Trump’s election is the catalyst that will change the global monetary system. To be clear, Trump is not the root cause of the realignment; rather, he is outspoken about the imbalances he believes must change and is willing to pursue highly destructive policies to quickly bring about what he believes will benefit Americans first changes. These changes will end the petro-yuan. Ultimately, as I argue in this article, these changes will increase the supply of fiat currencies and financial repression around the world. Both of these things must happen because leaders in the United States, the European Union, China or Japan are unwilling to deleverage and push the system into a new sustainable equilibrium. Instead, they will print money, destroying the real purchasing power of long-term government bonds and bank savings deposits so that the elite can continue to control everything in the new system going forward.

I will begin with a brief overview of Trump’s goals and then assess each economic region or country’s response.

Trump truth

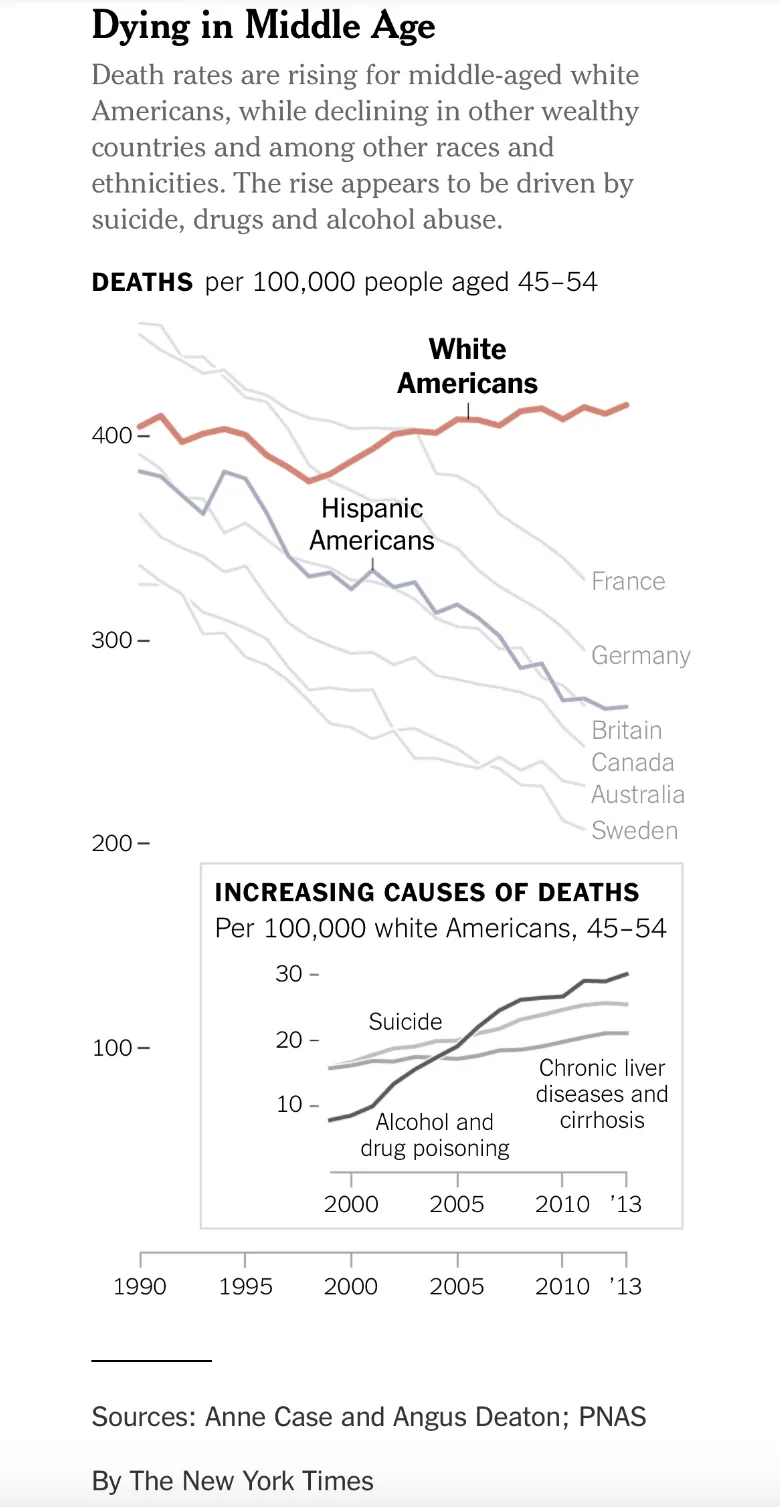

In order to function, the United States must maintain current and trade account surpluses for the petro-yuan system. The result was the deindustrialization and financialization of the American economy. If you want to understand the mechanics, I recommend reading all of Michael Pettis' works. While I don’t think this is a reason why the world should change its economic system, since the 1970s, the people that so-called “American hegemony” serves—the average white American male—have lost the advantage they once had. The key here is the word "ordinary"; I'm not talking about towering figures like Jamie Dimon (JP Morgan) and David Solomon (Goldman Sachs), nor the wage slaves who toil for them. I'm talking about the brother who worked for Bethel Steel and had a house and a wife, and now the only women he sees are nurses at the methadone clinic. Apparently, the phenomenon is unfolding as this group of people destroy themselves through alcohol and prescription drugs in the United States. Everything is relative, and compared to the higher standard of living and job satisfaction they enjoyed after World War II compared with the rest of the United States and the world, this is clearly not a good situation. As everyone knows, this is Trump's base, and he communicates with them in a way that no other politician can. Trump promised to bring industry back to America to bring meaning to their dull lives.

To those bloodthirsty Americans who like to play video game war, a very powerful political group, the current state of the U.S. military is a joke. The myth of U.S. military superiority against near or equal competitors (currently only Russia and China meet this criterion) began with the U.S. military saving the world from Hitler's attack. This is not accurate; the Soviet Union sacrificed tens of millions of lives to defeat the Germans, and the United States only handled the finishing touches. Stalin was frustrated by the United States' long delay in confronting Hitler's offensive on the Western European front. President Franklin Delano Roosevelt bled the Soviet Union so that fewer American servicemen would die. In the Pacific Theater, although the United States defeated Japan, the United States never faced a full-scale offensive by the Japanese army because Japan devoted most of its combat forces to mainland China. Instead of glorifying the D-Day invasion, Hollywood should show the Battle of Stalingrad and the heroism of General Zhukov and the millions of Russian soldiers who died defending their homeland.

After World War II, U.S. troops stalemate North Korea in the Korean War, lost to the North Vietnamese in the Vietnam War, made a chaotic retreat after a decade in Afghanistan in 2021, and are now on the losing end of a losing battle against Russia in Ukraine. The only achievement the U.S. military can be proud of is its use of highly sophisticated and overly expensive weapons to defeat third world countries such as Iraq in the two Gulf Wars.

Crucially, victory in the war was a reflection of the resilience of the industrial economy. If you care about war, the U.S. economy is simply not good at it. Yes, Americans can do leveraged buyouts like no other. And Russia, even though its economy is on paper less than one-tenth that of the United States, has produced unstoppable hypersonic missiles at far less than the cost of conventional U.S. weapons.

Trump is not a peace-loving "Christian hippie". He fully believes in American military supremacy and exceptionalism and is happy to use this military power to commit mass murder. Remember, during his first term, he assassinated Iranian General Qassem Soleimani on Iraqi soil, much to the delight of many in the United States. Trump was unfazed by his violation of Iraqi airspace and his unilateral decision to murder a general in a country against which the United States had not officially declared war. Therefore, he hopes to rearm the United States so that its capabilities match its propaganda.

Trump advocates for the reindustrialization of America, helping people who want good manufacturing jobs and those who want a strong military. In order to do this, the imbalances created under the petro-yuan system need to be reversed. This would be accomplished by weakening the dollar, providing tax subsidies and incentives to boost domestic production, and deregulating. All these measures combined will give companies a greater financial incentive to move production back to the United States, as China is now the most competitive place in the world to produce goods, stemming from three decades of policies aimed at promoting growth.

In my article “Black and White? ”, I talked about “Quantitative Easing (QE) for the Poor” and how this could be used to finance the reindustrialization of the United States. I believe that the incoming US Treasury Secretary Bessent will pursue such an industrial policy. However, this will take time, and Trump will need to demonstrate immediate results that can sell to voters within the first year of his term. Therefore, I think Trump and Bessant must devalue the dollar immediately. I want to discuss why this is possible and why this must happen in the first half of 2025.

Strategic Bitcoin Reserve

"Gold is currency, everything else is credit"

——JP Morgan

Trump and Bessant have repeatedly discussed weakening the dollar to achieve their economic goals. The question is, what should the dollar depreciate against and when?

In addition to the United States, the world's largest exporting countries in order of export size are: China (currency: RMB), the European Union (currency: euro), the United Kingdom (currency: pound) and Japan (currency: yen). To encourage companies to move production back to the United States, the dollar must weaken against these currencies. Businesses do not necessarily need to be headquartered in the United States; Trump has allowed Chinese manufacturers to set up factories in the United States and sell their goods there. But Americans must buy goods made in American factories.

Coordinated currency agreements are a thing of the 1980s. Today, the relative economic or military power of the United States is no longer what it was back then. Therefore, Bessent cannot unilaterally ask other countries to adjust the exchange rate of the US dollar. Of course, Bessant could use some "carrot and stick" policies to force other countries to agree to devalue their currencies against the dollar through tariffs or the threat of tariffs. However, this will take time and a lot of diplomacy. Actually, there is a simpler way.

The United States has the largest gold reserves in the world, at 8,133.46 tons, at least on paper. As we all know, gold is the real currency of global trade. Since the United States left the gold standard 50 years ago, the gold standard has been the mainstream of history, while the current fiat currency system is the exception. The simplest path to achieving Bessant's goal is to devalue the dollar against gold.

Currently, gold is worth $42.22 an ounce on the U.S. balance sheet. Technically, the Treasury Department issues gold certificates to the Federal Reserve (Fed), and these certificates are priced at $42.22 per ounce. Suppose Bessent is able to convince the U.S. Congress to change the legal price of gold, thereby devaluing the dollar relative to gold. The Treasury General Account (TGA) will then receive a dollar credit and can invest it into the economy. The greater the depreciation, the greater the immediate increase in the TGA balance. This is because, in essence, the dollar is created out of thin air by valuing gold at a specific price. Each increase in the legal gold price of $3,824 per ounce generates $1 trillion in TGA growth. For example, adjusting the book value of gold to the current spot price would result in $695 billion in TGA credits.

Through government fiat, dollars can be created and then spent by changing the book value of gold. This is the definition of fiat currency devaluation. Because the value of all other fiat currencies is also implicitly tied to gold, these currencies will automatically appreciate relative to the U.S. dollar based on the amount of gold held by governments. The United States could quickly devalue the dollar against all its major trading partners without consulting any other country's finance ministry.

The most important counterargument is, will the largest exporters try to regain their currency weakness by depreciating relative to gold? Of course, they can try, but none of these currencies are global reserve currencies and lack endogenous demand based on trade and financial flows. Therefore, they were unable to match the depreciation of gold in the United States, which would quickly lead to hyperinflation in their economies. Hyperinflation is almost a given because none of these countries/economies are as self-sufficient in energy or food as the United States is. This is politically unacceptable because social unrest caused by inflation would dispossess the existing ruling elite.

I will tell you the new price of gold by how much devaluation of the dollar it would take to reindustrialize the U.S. economy. If I were Bessent, I would make a big move. A big move would mean a $10,000 to $20,000 per ounce gold revaluation. Luke Gromen estimates that a return to the ratio of gold to the Fed's dollar liabilities in the 1980s would result in a 14-fold increase in gold prices from current levels, with a revalued gold price approaching $40,000 an ounce. This wasn't what I expected, but it goes to show how overvalued the dollar actually is relative to gold at current spot prices (around $2,700 an ounce).

As many of you know, I am a mini gold lover. I own physical gold and small gold mining ETFs stored in vaults because the easiest way to devalue the dollar is through gold. Politicians always push the easy button first. But this is Crypto Trader’s Digest, so how does a $20,000/oz gold price drive Bitcoin and cryptocurrency prices?

Many cryptocurrency hopefuls focus first on discussions of the Bitcoin Strategic Reserve (BSR). U.S. Senator Lummis has introduced legislation that would require the Treasury Department to purchase 200,000 Bitcoins per year for five years. Interestingly, if you read the bill, she proposes to fund these purchases by raising the price of gold on the government's balance sheet, as I've described before.

The arguments in favor of BSR are similar to the reasons why the United States has the largest gold reserves in the world; this allows the United States to claim its financial dominance in both the digital and physical realms. If Bitcoin is the hardest currency known, then the strongest government fiat currency is the one whose central bank owns the most Bitcoin. Additionally, a government whose fiscal position fluctuates with the price of Bitcoin will enact policies that are conducive to expanding the Bitcoin and cryptocurrency ecosystem. This is similar to governments encouraging domestic gold mining and establishing sound gold trading markets. Looking at how China is encouraging domestic gold holdings through the Shanghai Gold Futures Exchange is an example of a pro-gold national policy aimed at increasing the financial strength of the country and its citizens in real money.

If the U.S. government creates more dollars through the devaluation of gold and uses some of those dollars to buy Bitcoin, the fiat price of Bitcoin will rise. This will prompt competitive purchases by other countries as they must catch up with the United States. The price of Bitcoin will therefore increase incrementally, because why would someone sell Bitcoin and receive USD when the USD is being actively devalued by the government? Of course, there is a fiat price and long-term holders may sell their Bitcoin, but it will never be $100,000. This argument is logically sound, but I still don't think BSR will happen. I think politicians would rather spend their newly created dollars on benefits to the people to ensure they win in the upcoming elections. However, it does not matter whether a BSR occurs in the United States, as the threat alone is enough to generate buying pressure.

Although I do not believe that the US government will buy Bitcoin, this does not affect my optimistic view on Bitcoin prices. The bottom line is that gold's depreciation creates dollars that must flow into real goods/services and financial assets. We know from experience that because the supply of Bitcoin is limited and the amount in circulation decreases, fiat Bitcoin prices rise faster than the global dollar supply grows.

The Fed's balance sheet is shown in white, and Bitcoin is shown in yellow. Both have been indexed to 100 since January 1, 2011. The Fed’s balance sheet grew 2.83 times, while Bitcoin grew 317,500 times.

In short, weakening the dollar quickly and dramatically is the first step for Trump and Bessent to achieve their economic goals. It's also something they can do overnight, without consulting domestic lawmakers or foreign finance chiefs. Given that Trump has a year to show voters progress on his goals to help Republicans retain control of the House and Senate, my base case scenario is that a depreciation of the dollar against gold will occur in the first half of 2025.

Japan

Although Japan's elite politicians are proud of their culture and history, they remain America's "towel men." Japan endured a nuclear attack after World War II and, with the help of dollar loans and tariff-free access to U.S. consumers, rebuilt itself into the world's second-largest economy by the early 1990s. The most important thing for my personal lifestyle is that Japan has become the country with the most ski resorts in the world. In the 1980s, as today, trade and financial imbalances also caused turmoil within American political and financial elite circles, forcing the United States to rebalance. Some argue that the currency accords of the 1980s weakened the dollar and strengthened the yen, which ultimately led to the bursting of Japan's stock and real estate market bubbles in 1989. The logic was that in order to strengthen the yen, the Bank of Japan (BOJ) had to tighten monetary policy, which caused the bubble to burst. As usual, housing and stock bubbles are inflated by printing money and burst when easy monetary policy slows or stops. The point is, Japanese politicians will be willing to engage in financial hara-kiri to please their American daimyo.

Today, as in the 1980s, financial imbalances between Japan and the United States are extremely high. Japan is the world's largest holder of U.S. Treasury bonds. Japan has also implemented aggressive quantitative easing (QE) and moved to yield curve control (YCC), which has led to extreme weakness in the USD/JPY exchange rate. I wrote about the importance of the USD/JPY exchange rate in two of my articles, Shikata Ga Nai and Spirited Away.

Trump's "truth" is that the dollar should appreciate against the yen. Trump and Bessant have made it very clear that this has to happen. Unlike China, in Japan there will be no hostile currency realignment and Bessent will dictate the USD-JPY trend and Japan will follow.

A stronger yen means the Bank of Japan (BOJ) must raise interest rates. Here's what might happen without government intervention:

1. Rising interest rates: Japanese government bonds (JGB) become more attractive, and Japanese companies, households, and pension funds will sell foreign stocks and bonds (mainly U.S. Treasury bonds and U.S. stocks) and convert the foreign currency proceeds into Japanese yen, and buy Japanese government bonds.

2. Higher JGB yield: means falling prices, which will have a huge negative impact on Japanese banks' balance sheets. In addition, Japanese banks hold large amounts of U.S. Treasuries and U.S. stocks, which will also lose value as Japanese investors sell to repatriate capital. In addition, Japanese banks must pay higher interest on yen bank reserves. Ultimately, as this process unfolds, this will be bad news for the solvency of Japanese banks.

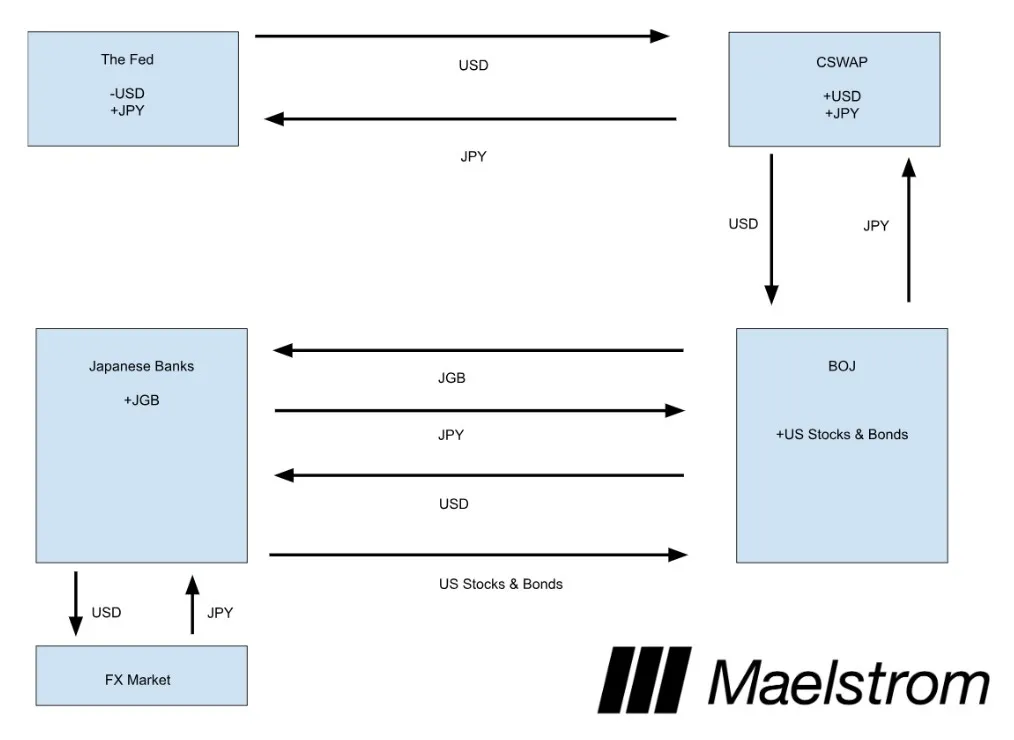

Trump is interested in ensuring that Japan's financial system avoids collapse. The U.S. naval base in Japan helps restrict China's maritime power, and Japan's semiconductor production also ensures that the United States has access to friendly key components. Therefore, Trump will instruct Bessent to take necessary measures to ensure that Japan can survive financially as the yen appreciates. There are a number of ways to do this; one is that Bessent could use the power of the U.S. Treasury Department to offer a U.S. dollar-yen central bank currency swap to the Bank of Japan for any sales of U.S. Treasuries and U.S. equities It can all be absorbed off the court. Here is the flow diagram from my Spirited Away article.

Fed - The Fed increases the supply of dollars, in other words they receive yen created by the growth of carry trades in Japan.

CSWAP - The Federal Reserve provides U.S. dollars to the Bank of Japan (BOJ), and the Bank of Japan provides Japanese yen to the Federal Reserve.

Bank of Japan - They now hold more U.S. stocks and bonds, and the prices of these assets will rise because as the CSWAP balance grows, so does the amount of dollars.

Bank of Japan - They now hold additional Japanese Government Bonds (JGBs).

The impact of this on cryptocurrencies is that the supply of USD will increase to support the unwinding of the massive Japanese USD-JPY carry trade. The unwinding process will be slow, but trillions of dollars will be printed to maintain the financial stability of Japan's financial system.

Correcting the Japan-U.S. trade and financial imbalances is fairly easy because Japan ultimately has no say and is currently too weak politically to mount substantive opposition to Trump’s “truth.” The ruling Liberal Democratic Party (LDP) has lost its parliamentary majority, throwing Japan's governance into chaos. Japan’s elite are currently politically unable to oppose Trump’s “truth,” even though they are privately disgusted with America’s “barbaric” behavior.

The last will be the last

While many Europeans, at least those whose first name is not Muhammad, can be considered Christians to some extent, the biblical statement that "the last will be first" clearly does not apply to the EU's economic situation. The last is still the last. For some reason, European elite politicians continue to silently accept the "relentless onslaught" from the United States. Europe should make every effort to integrate with Russia and China. Russia offers the cheapest energy delivered through pipelines and is a large producer of food to feed its people. China offered cheap, high-quality manufactured goods and was willing to buy European luxury goods in quantities that would put Marie Antoinette to shame. However, Europe has not made such efforts. Instead, it has always been constrained by two island countries-the United Kingdom and the United States.

Because Europe is unwilling to buy cheap Russian gas, abandon the green energy transition scam, or enter into mutually beneficial trade with China, the economic situation of Germany and France is very bad. Germany and France are the economic engines of Europe - while the rest of the continent is simply a resort for Arabs, Russians (well, maybe not anymore) and Americans. It's very ironic that the European elites dislike people in these areas very much, but money talks and crap rides motorcycles.

This year, key speeches in Europe were delivered by Mario Draghi (September 2024, "The Future of European Competitiveness") and Emmanuel Macron (April 2024, "European Speech") . The most frustrating thing for Europeans is that while both politicians correctly identified the problems facing Europe—namely, expensive energy and a lack of domestic investment—the solutions they proposed ended up being It boils down to "we need to print more money to fund the green energy transition and impose more financial repression." The correct solution should be: abandon unconditional support for the adventurous actions of American elites, reach a truce with Russia, obtain cheap natural gas, embrace nuclear energy, strengthen trade with China, and completely deregulate financial markets. Another depressing fact is that many European voters (I am one of them) believe that the current policy mix is not in their interests and they vote for parties that want to change the status quo. However, the elites in power are doing their best to prevent the realization of the majority public opinion. Political unrest is ongoing, as France and Germany effectively do not have an effective governing government.

I'm going to quote a few passages from Macron, lay out Europe's future financial policy, and explain why you should be worried if you hold capital in Europe. You should be worried that your ability to escape the "dungeon" of European capital will be shut down and you will end up buying shitty long-term EU government bonds in your retirement account or bank savings.

Before quoting Macron, here’s a quote from Enrico Letta, former Italian prime minister and current president of the Jacques Delors Institute:

“The EU has a staggering €33 trillion of private savings, the majority of which is held in current accounts (34.1%). However, this wealth is not fully exploited to meet the EU’s strategic needs; a worrying trend , Europe's resources are diverted annually to the U.S. economy and U.S. asset managers, a phenomenon that reveals major questions about the efficiency of the EU's savings if they could be effectively reinvested in the EU's internal economy in achieving its strategic goals. play a huge role.”

This passage highlights the huge potential for savings within the EU, which is not being used effectively and is instead flowing to the US economy and asset management companies. This phenomenon further illustrates that the EU's current economic strategy has serious efficiency problems, and that if the use of these savings can be re-examined and adjusted, it may bring huge economic strategic benefits to Europe.

much more than a market

Letta did not hesitate to express what he saw as the problems, and Macron reiterated these views in his subsequent remarks. European capital should not be funded by American companies, but by European companies. There are many ways that European authorities can force you to own underperforming European assets, whether you want to or not. For example, for investors who hold money through pension funds or retirement accounts, EU financial regulators can define suitable investment horizons so that your investment manager can only legally buy EU stocks and bonds. For people who park their money in bank accounts, regulators could ban banks from offering investments in non-EU stocks and bonds because they are "unsuitable" for savers. Whenever your funds are held by an EU-regulated fiduciary, you are under the control of someone like Christine Lagarde and her team. Maybe you like her, but make no mistake, her job is to financially ensure the survival of EU projects, not to help your savings grow faster than the inflation her banks need to keep the system solvent.

If you think only people at the World Economic Forum in Davos are advocating these things, you're wrong. Here’s a quote from the infamous racist, fascist (or whatever word you can put in)… as they say, Marine Le Pen:

"Europe must wake up... because the United States will defend its interests more aggressively."

Trump’s “truth” triggered a backlash across the EU’s left- and right-wing political spectrum.

Returning to the refusal of EU politicians to adopt simple and less fiscally devastating solutions to their problems, Macron clearly told the people here:

“Yes, the days of Europe buying Russian energy and fertilizer, outsourcing to China, and relying on the United States for security are over.”

Macron went on to emphasize, and further reinforce, that capital should not be directed towards the best-performing financial products, but should instead be wasted on the barren wasteland of Europe:

"The third disadvantage: every year our savings, about 300 billion euros, are used to finance the United States, whether it is buying Treasury bonds or capital risks. This is ridiculous."

Finally, in a coup de grace, Macron talked about suspending Basel III banking regulations. Essentially, this would allow banks to buy unlimited amounts of high-priced, low-yielding EU government bonds. The losers will be those who hold euro-denominated assets, as this effectively allows the supply of euros to increase indefinitely.

"Second, we need to re-examine the way Basel and solvency are applied. We cannot be the only economic region in the world to enforce these rules. The United States was the source of the 2008-2010 financial crisis, but they chose not to enforce these rules."

Macron rightly pointed out that the United States did not follow these global banking rules, concluding that Europe did not need to follow them either. Hello, fiat financial collapse versus Bitcoin and gold.

Draghi further noted in his recent report that in addition to funding a massive welfare state - France, for example, has the world's highest government spending as a share of GDP at 57% - the EU needs to invest €800 billion a year. Where should that money come from? The money would be printed by the ECB and EU savers would be forced through financial repression to buy low-yielding, long-term EU government bonds.

I'm not talking nonsense. These are direct quotes from both the left and right sides of the EU political spectrum. They tell you they know how best to invest EU savings. They tell you that banks should be able to use unlimited leverage to buy the bonds of EU member states, and that eventually, the ECB will issue pan-euro bonds after they are created. The reason for all this is Trump’s “truth.” If Trump's America intends to weaken the dollar, suspend prudential banking regulations, and force Europe to cut ties with Russia and China, then EU savers must accept low returns and financial repression. EU "fools" should sacrifice their capital and real living standards to preserve the EU project. I bet a lot of people enjoy waving flags in public, but then rush to their computers when they get home and figure out how to escape as quickly as possible. I knew the way to escape was to buy Bitcoin and keep it for myself while it wasn't banned yet. But EU readers, this is your choice.

Globally, as the circulation of the euro increases and the suppression of local capital in the EU becomes more and more stringent, Bitcoin will skyrocket. This is precisely the professed policy of the elites. However, I think this will be a "do what I say, don't do what I do" situation. Those in power will quietly move assets to Switzerland and Liechtenstein and buy cryptocurrencies like crazy. And ordinary people who are unwilling to listen and protect their savings will struggle under state-sanctioned inflation. Such is the fragility of French pastry.

truth terminal

Our terminal of truth is the 24/7 crypto free market. Bitcoin’s rise following Trump’s victory in early November was a leading indicator of accelerating growth in the fiat currency supply. Faced with Trump’s “truth,” every major economic region and country must react immediately. The response was to devalue the currency and increase financial repression.

Bitcoin (yellow) is leading the growth of U.S. bank credit (white).

Does this mean Bitcoin will go straight to $1 million without any major pullback? Absolutely not.

I don’t think the market realizes how limited time Trump actually has. The market believes Trump and his team can achieve an immediate economic and political miracle. However, the problems that contributed to Trump’s popularity are actually the result of decades of accumulation. So, no matter what Elon Musk tells you on Platform X, there are no quick fixes. Therefore, it will be nearly impossible for Trump to appease his base enough to prevent Democrats from retaking both chambers in 2026. The people are desperate because they are desperate. Trump is a savvy politician and knows his voters. To me, this means he has to make big moves early on, which is why I expect a massive dollar and gold devaluation to occur within his first 100 days. It's a simple way to quickly make U.S. production costs globally competitive. It will result in an immediate reshoring of production capacity and an immediate increase in hiring, rather than something that happens five years later.

Before we enter the “crash phase” of this crypto bull market, I think crypto markets will experience a thrilling decline ahead of Trump’s inauguration on January 20, 2025. Maelstrom will unwind certain positions early, hoping to repurchase some core positions at lower prices in the first half of 2025. Apparently every trader says this and believes in their ability to time the market. Most of the time, they sell too early and then lack the confidence to buy back at a higher price than before. As a result, these traders missed out on profit opportunities throughout the bull market. If that were the case, we would admit defeat, lick our wounds, and get back into the bull market. Trump’s “truth” opened my eyes to the structural flaws in the global order. Trump’s “truth” tells me that the best way to maximize returns is to own Bitcoin and cryptocurrencies. Therefore, I would buy the dip.

Yahtzee! ! !

jinse

jinse