ARK Research Report: Oversold, Currency Circulation—A Study on the Crypto Market in February

Reprinted from jinse

03/12/2025·1MSource: ARK; Translated by: Baishui, Golden Finance

Bitcoin is a relatively new asset class, and the Bitcoin market is changing rapidly and full of uncertainty. Bitcoin is largely unregulated, and Bitcoin investments may be more susceptible to fraud and manipulation than regulated investments. Bitcoin faces unique and enormous risks, including large price fluctuations, lack of liquidity, and theft. Bitcoin prices fluctuate dramatically, including actions and remarks by influential people and the media, changes in supply and demand of Bitcoin, and other factors. There is no guarantee that Bitcoin will maintain its value for the long term.

Market Overview

Bitcoin reacts to geopolitical turmoil

Bitcoin oversold

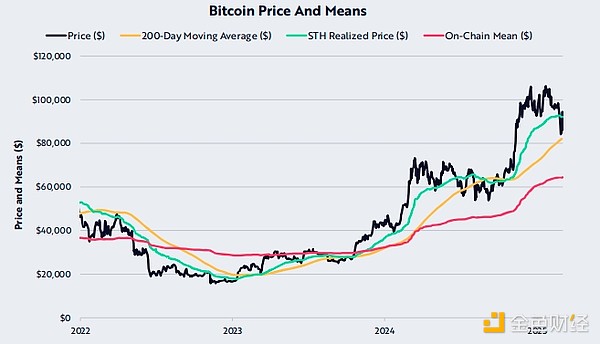

In February, the price of Bitcoin fell 17.6% and closed at $86,391 that month.

• As of March 3, the price of Bitcoin is between its Short-term Holder (STH) cost base and the 200-day moving average—$92,020 and $82,005, respectively.

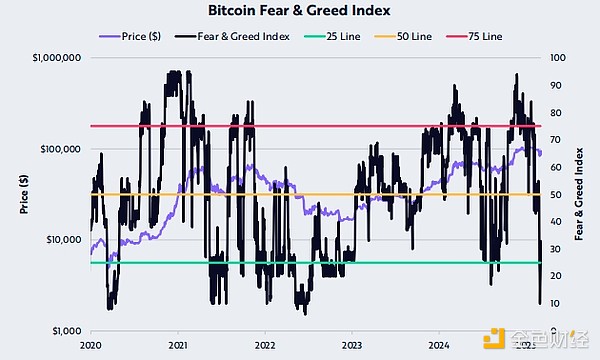

• The Fear and Greed Index has reached a level of “extreme fear” that has never been seen since mid-2022.

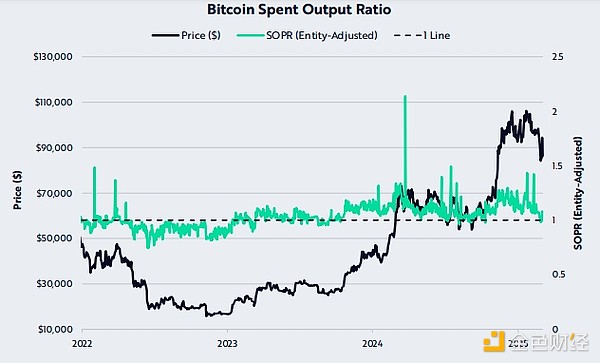

• Bitcoin’s Expenditure Output Rate (SOPR) has been completely reset.

Currency circulation speed, uncertainty, future growth

Economic indicators, including slowing growth in the speed of currency circulation and a decline in consumer confidence, indicate that businesses and households are more cautious during the political transition.

• Despite the short-term uncertainty, ARK’s long-term outlook remains optimistic as we believe policy changes and technological breakthroughs in areas such as artificial intelligence and robotics will reignite consumption and increase productivity.

ARK Key Points

• In February, the price of Bitcoin fell 17.6% to close at $86,391 that month.

• Bitcoin price is between its Short-term Holder (STH) cost base and the 200-day moving average.

• According to the Fear and Greed Index, Bitcoin is oversold.

• The rate of contraction and consumer sentiment signal a weak future economy.

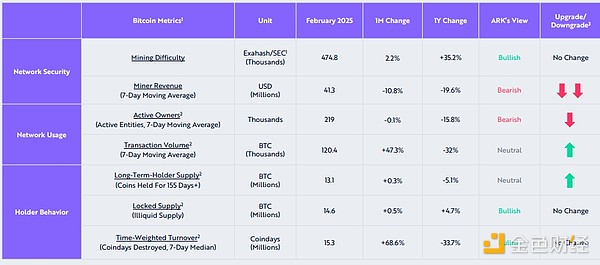

On-chain activities are neutral to positive

The potential bull market is still healthy

Bitcoin oversold

Bitcoin price fluctuates between the 200-day moving average and the

short-term holder cost basis

ARK 's point of view: Neutral

• In February, the price of Bitcoin fell 17.6% to close at $86,391.

• Bitcoin closed below its Short-term Holder (STH) cost base of $92,020, above its 200-day moving average and on-chain average of $82,005 and $64,265, respectively.

• While the main trend remains bullish, recovery of the short-term holder cost base is necessary for recovery momentum.

Bitcoin’s Fear and Greed Index hits a new low in two years

ARK 's opinion: Optimistic

• The Fear and Greed Index reaches a level of “extreme fear” that has never been seen since mid-2022.

• The index has not reached its current fear level since the start of the current bull market.

• We believe that the market's response to current macroeconomic and geopolitical sentiment is too pessimistic.

• Fear and Greed Index from 1 to 100 A comprehensive indicator of Bitcoin’s relative volatility, momentum, transaction volume, social media sentiment and Google trends, as well as Bitcoin’s market share in the crypto industry.

Bitcoin 's SOPR has been reset

ARK 's opinion: Optimistic

Bitcoin’s Expenditure Output Rate (SOPR) has been completely reset to 1.

• In a bull market, the SOPR is 1, indicating that the market is generally reaching a breakeven level, which usually coincides with the local bottom.

• SOPR tracks the transaction prices realized or losses associated with these profits and losses.

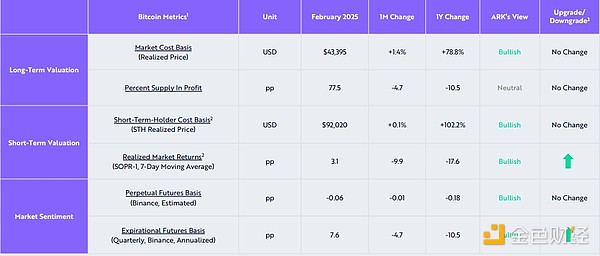

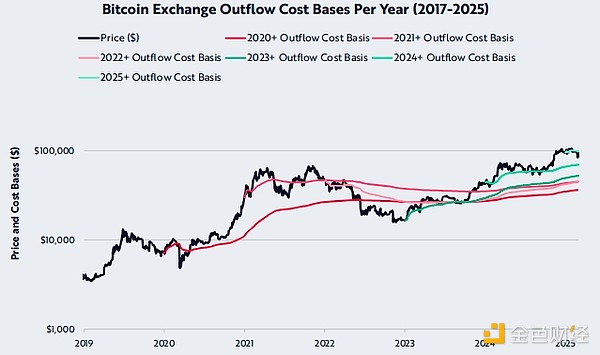

Bitcoin’s exchange outflow cost basis indicates overall profitability

ARK 's opinion: Optimistic

Except for 2025, all Bitcoin annual exchange outflow cost bases have been below the price since 2020, indicating strong support.

• From 2020 to 2024, the cost base of Bitcoin fluctuates between $36,280 and $69,494, indicating that profits are not realized, with little motivation for panic and sell-offs.

• Exchange outflow cost basis tracks the on-chain volume-weighted average price (VWAP) of outflow exchanges, indicating that these funds may be held for a long time.

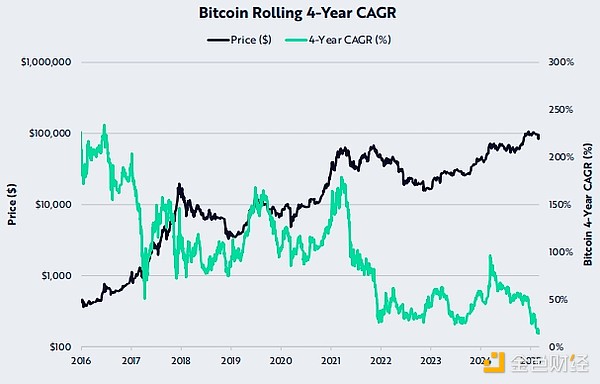

Bitcoin’s 4-year compound annual growth rate hits a record low

ARK 's view: Bearish

• Bitcoin’s four-year compound annual growth rate (CAGR) hit a record low of 14%.

• While this has an impact on Bitcoin’s long-term holdings, its relatively low CAGR may also be a signal that Bitcoin is oversold.

Currency circulation speed, uncertainty and future growth

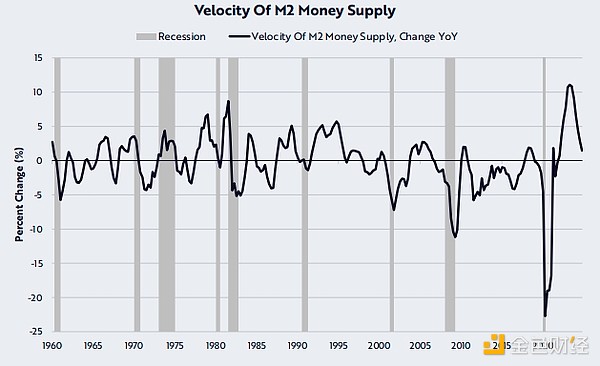

Uncertainty is increasing, M2 money supply growth slows down

ARK 's view: Bearish

• The speed at which currency changes hands (also known as the “speed of currency circulation”) is slowing.

• Amid the uncertainty brought about by American political transformation, consumers and businesses seem to be more cautious.

• Nearly one-third of the workforce (federal, state, local and quasi- governmental positions in the education and health care sectors) may be concerned about government spending cuts.

• Despite short-term challenges, potential incentives for innovative in areas such as deregulation, tax cuts, and artificial intelligence and robotics may boost growth and productivity over time.

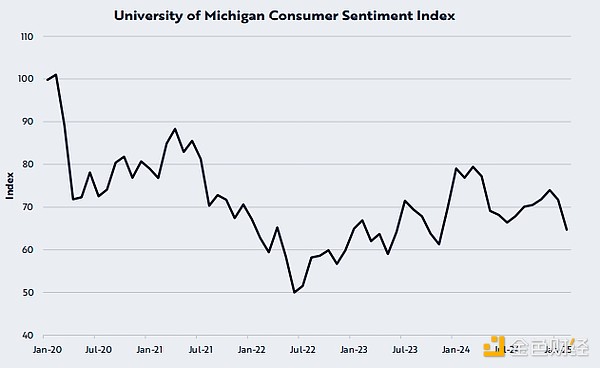

Consumer confidence falls below pre-election levels

ARK 's view: Bearish

According to the University of Michigan Consumer Confidence Survey, consumer confidence is lower than pre-election levels.

• Families appear to be cautious and delay purchases until the impact of the new policy becomes clear.

• This cautionary evidence is a decline in real consumer spending in January and companies such as Walmart and Target lowered expectations.

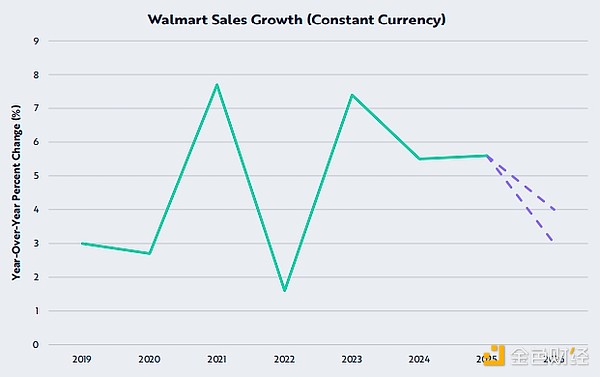

Walmart lowers its performance expectations, suggests consumers are more

cautious

ARK 's view: Bearish

Walmart may benefit from a fourth-quarter pre-order purchase as consumers scramble to avoid tariff hikes.

• The retailer recently lowered its fiscal 2026 fixed-rate sales growth forecast to 3-4% from 5% last year (the purple line on the chart), with growth slowing by 30%.

• The shift in guidelines highlights the growing caution of consumers and heralds a continued slowdown in retail spending.

panewslab

panewslab