Analysts: Key indicators show Bitcoin has not peaked and is bullish in the coming year

Reprinted from jinse

02/27/2025·2MAuthor: Ciaran Lyons, CoinTelegraph; Translated by: Deng Tong, Golden Finance

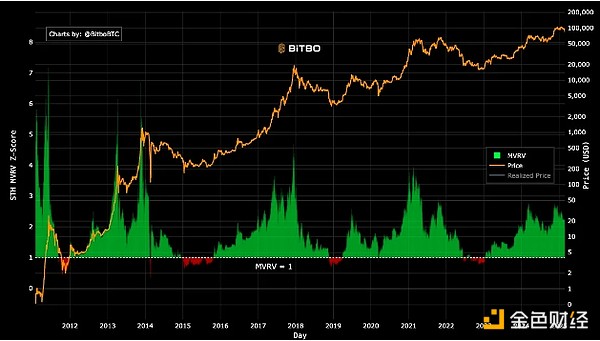

A cryptocurrency analyst said Bitcoin’s market value to actual value ratio (MVRV) is an indicator of whether an asset is overvalued, indicating that cryptocurrencies still have room to peak this cycle.

“I predict the MVRV peak this cycle is around 3.2, which means there is another bullish year in 2025 before we reach the peak of this cycle,” Chapo, CEO and cryptocurrency analyst at Assure DeFi, said in a February 26 X post.

Bitcoin’s MVRV last reached this level in April 2021, when Bitcoin hit $58,253 — about 101% higher than the $28,994 price in early 2021.

MVRV will "sky vertically" at the top of the market

“We’re not at that point yet,” Chapo said. MVRV indicates whether Bitcoin is overvalued or undervalued based on the ratio between its market capitalization and its actual market capitalization.

As of the time of publication, Bitcoin’s MVRV is 1.95, according to Bitbo data.

As of the time of this article, Bitcoin’s MVRV was 1.95. Source: Bitbo

On February 25, U.S. President Donald Trump announced that he planned to impose a 25% tariff on Canada and Mexico "will proceed on time and on schedule" and the price of Bitcoin fell below $90,000.

Chapo said historically, MVRV surged sharply when Bitcoin prices approached its cyclical peak.

“If history tells us anything, it is that MVRV will soar vertically at the top of the market, reaching the point where profit-taking is taken out of interest in new buying, and the risks/rewards of new entrants no longer exist,” he said.

MVRV rises heralds potential increase in Bitcoin earners

When Bitcoin hit an all-time high of $109,000 on January 20, MVRV soared to 2.44.

Similarly, when Bitcoin hit an all-time high of $73,679 in March, the MVRV was 2.67.

As MVRV rises, this suggests that more Bitcoin holders are profitable and may cash in on some of the gains. Chapo said the cost base drops when profiters sell to new buyers, resulting in a drop in MVRV.

For example, when Bitcoin fell to $53,949 on September 7, 2024, the MVRV fell to 1.71.

“It’s healthy because new buyers are not expected to sell until they make a profit, which requires a higher price,” Chapo said.

However, Julio Moreno, head of research at CryptoQuant, said the MVRV indicator suggests that Bitcoin may fall further before it resumes its uptrend.

"All valuation metrics are in the correction zone. This may take more time. For example, the MVRV is below its 365-day moving average. It's a simple but powerful metric," Moreno said in a February 26 X post.

panewslab

panewslab

chaincatcher

chaincatcher