Analysts: Fed's "no rate cut" in 2025 may trigger a bear market

Reprinted from jinse

03/10/2025·2MAuthor: Ciaran Lyons, CoinTelegraph; Translated by: Deng Tong, Golden Finance

Internet economist Timothy Peterson warned that if the Fed delays interest rate cuts in 2025, it could lead to a wider market downturn and could drag bitcoin back to $70,000.

"It needs a trigger. I think that trigger might be simple, like the Fed is not cutting interest rates at all this year," Peterson said in a March 8 X post. Just the day before Peterson commented, Fed Chairman Jerome Powell reiterated that he was not in a hurry to adjust interest rates.

Delay in Fed rate cuts could trigger bear market

“We don’t need to be in a hurry, we have the ability to wait for clearer information,” Powell said in a March 7 speech in New York.

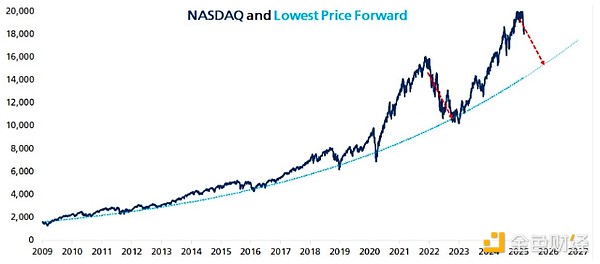

Peterson, author of the paper Metcalfe's Law as Bitcoin Value Model, estimates how low the Nasdaq index may fall to in order to predict the potential bottom of Bitcoin in the "next bear market."

Using Peterson's Nasdaq's lowest price forward model, he estimates that once the bear market begins, the Nasdaq will fall 17% in about seven months before bottoming out.

According to CoinMarketCap, he multiplied the “1.9” times of Bitcoin’s decline by that amount, and estimated that Bitcoin fell 33%, from its current price at the time of release of $86,199 to $57,000.

However, he said Bitcoin may not fall that low, with the expected bottom price approaching the $70,000 low range based on historical trends in 2022.

“Traders and opportunists hover over Bitcoin like vultures,” he said, explaining that once the market expects Bitcoin to reach $57,000, “it won’t get there because there are always some investors who step in because the price is ‘low enough’.”

Bitcoin’s 2022 lows did not fall as expected

"I remember in 2022, everyone said the bottom was $12,000. It only went up to $16,000, 25% higher than expected," he said, noting that the 25% increase from $57,000 was $71,000.

Bitcoin last traded close to $71,000 on November 6, when Donald Trump won the U.S. election, then rose for a month and reached $100,000 on December 5.

In January 2025, BitMEX co-founder Arthur Hayes made a similar price forecast.

“I expect BTC to pull back to $70,000 to $75,000, which is a small financial crisis and the printing of money will resume and will bring our price to $250,000 by the end of the year,” Hayes said in a post on X on January 27.

In December 2024, cryptocurrency mining company Blockware Solutions said that assuming the Fed reverses the direction of interest rate cuts, Bitcoin’s “bear market situation” in 2025 will be $150,000.

chaincatcher

chaincatcher

panewslab

panewslab