Altcoin recovery in April: More than 70% rise, small-cap tokens occupy the increase list

Reprinted from panewslab

04/30/2025·1MAuthor: Frank, PANews

After experiencing a drastic market adjustment in the early stage, the cryptocurrency market in April seemed to have a warm wind. Although mainstream assets such as Bitcoin are still seeking direction within the range, the altcoin field has shown certain signs of recovery, and market sentiment has eased compared to before. How did various tokens perform during the market rebound in this month (April 1 to April 28, 2025)? Which tracks and ecology are more resilient? PANews attempts to reveal the real picture of the recent market by analyzing data from mainstream USDT spot trading pairs on Binance.

Data description: This study is based on the USDT spot trading pair of Binance Exchange and combined with the basic information such as token classification and market value provided by CoinGecko, a total of 397 valid tokens were included for analysis. The time range is from April 1 to April 28, 2025. The increase or decrease is calculated based on the starting price (opening price on April 1) and the end price (closing price on April 28) of the period.

More than 70% of tokens rose, but the overall rise was moderate

Judging from the overall data, the market did show a certain general increase pattern in April. Of the 397 tokens we analyzed:

The average increase was 13.11%, and the median was 7.73%. This shows that although the rise is the main theme, the overall increase is not strong, and most tokens have limited growth.

The rise tokens accounted for 74.1%, and nearly three-quarters of the tokens achieved an upward rebound in April. The declined tokens account for 25.7%.

However, judging from the overall increase, in this rebound market, there are still a few tokens that have risen sharply, and most of the tokens have rebounded below 50%. Tokens with an increase of more than 100% account for only 3.0%, with only 12, and 6 of them were launched in April Binance, so the increase is calculated based on the opening, and the increase seems to be higher than the actual situation. Tokens with an increase of between 50% and 100% account for 3.3%. Tokens with an increase of between 0% and 50% accounted for the highest proportion, reaching 67.8%.

This set of data reflects that although market sentiment has recovered, it is still far from the comprehensive "copy season" fanaticism. The rise of most tokens is relatively restrained, and the structural opportunities in the market seem to be greater than the general market.

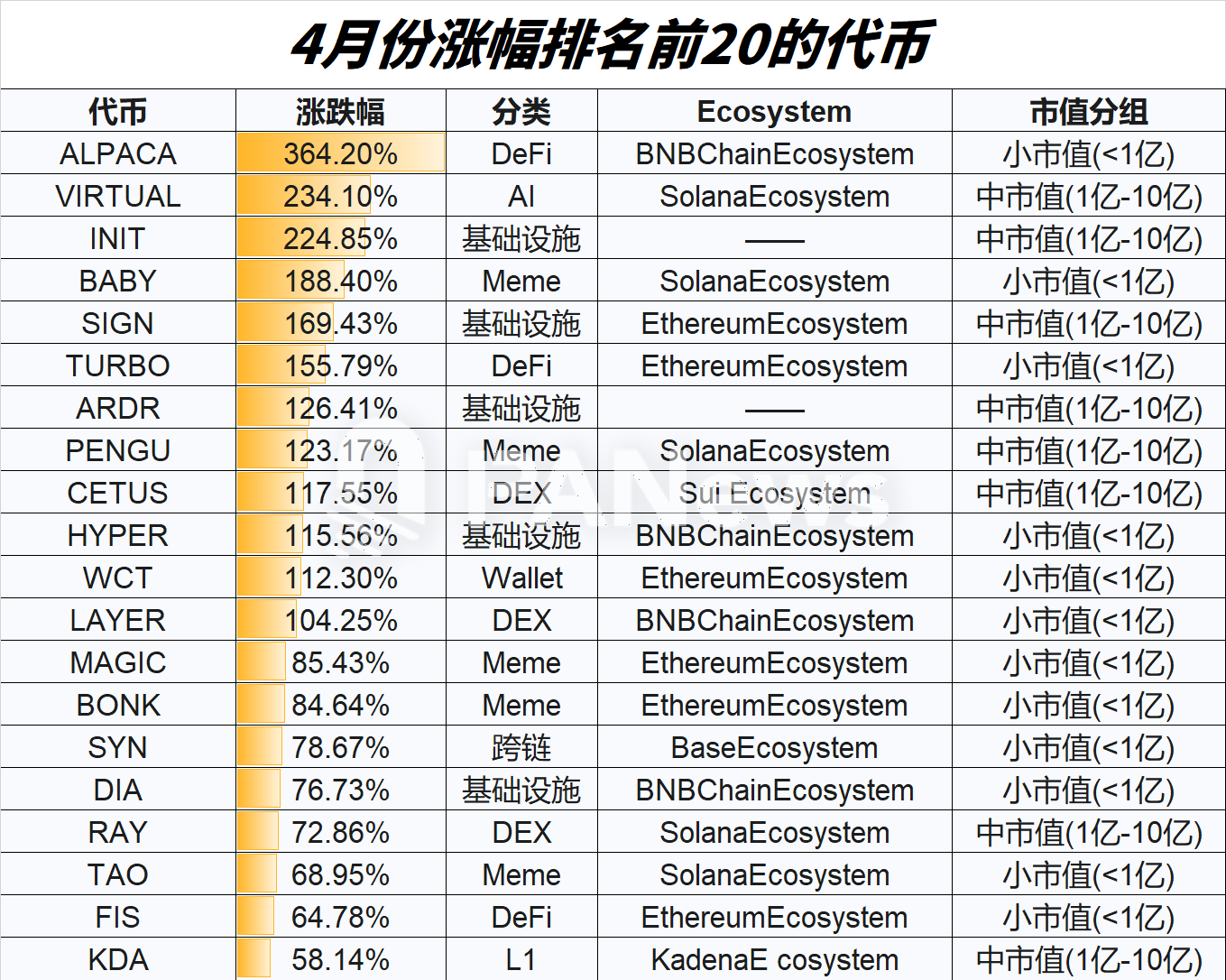

Observe the increase list and you can find several characteristics:

Small-cap tokens dominate: a large number of tokens in the top 20 are in the category of small-cap (<100 million) or medium-cap (100 million-1 billion), indicating that funds are seeking higher flexibility.

Signs of DeFi recovery: DeFi projects such as ALPACA, TURBO, and FIS appear at the top of the list.

The popularity of AI and Meme remains unabated: VIRTUAL (AI), BABYUSDT (Meme), PENGUUSDT (Meme) and other performances are eye-catching, continuing the previous market popularity.

Infrastructure and DEX: Infrastructure and DEX track also have multiple tokens on the list.

Specific Ecosystem: Solana Ecosystem and BNBChain Ecosystem contributed more tokens with the highest growth this month.

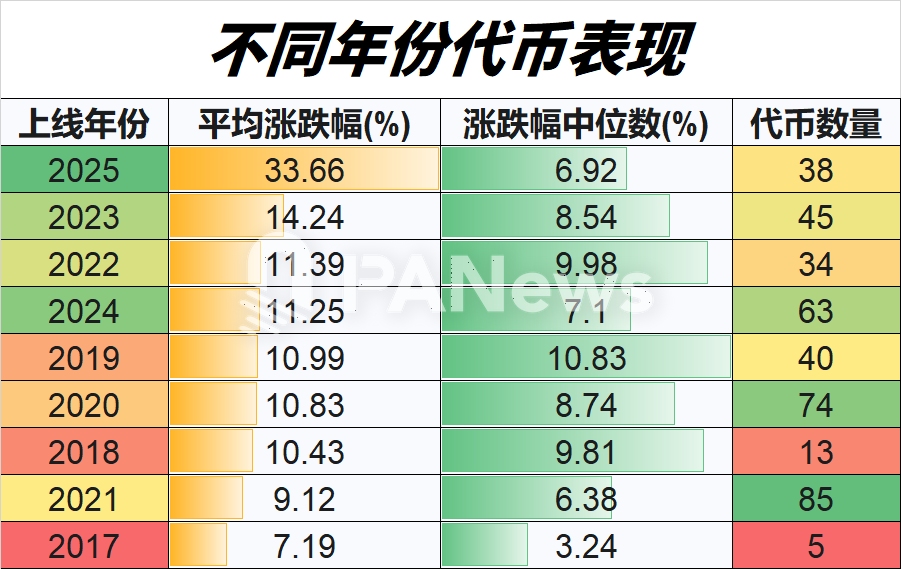

Year differences: New tokens have increased more, old projects have

performed the worst

In addition, during this round of rebound, there is also a trend, that is, the market is still "buy new but not old". Data shows that the average performance of the new currency launched in 2025 is still the best, with an average increase of 33.66%, significantly higher than that of other years. This shows that the market's preference for new assets remains. The tokens launched in 2023 and 2022 are second. Interestingly, although the number of tokens launched in 2024 is the largest, with 63, the average increase is only 11.25%, which performed mediocrely this month, with an average increase even slightly higher than the old currency in 2019 and 2020. For older projects, the average token increase in 2017 was the lowest. As the previous bull market in 2021, I don’t know if it was because of the bigger bubble of the bull market or other reasons, but the increase ranks second to last.

Judging from this data distribution, the tokens that are launched in the bear market from 2022 to 2023 are more proactive, while the tokens in the bull market seem to lack long-term vitality.

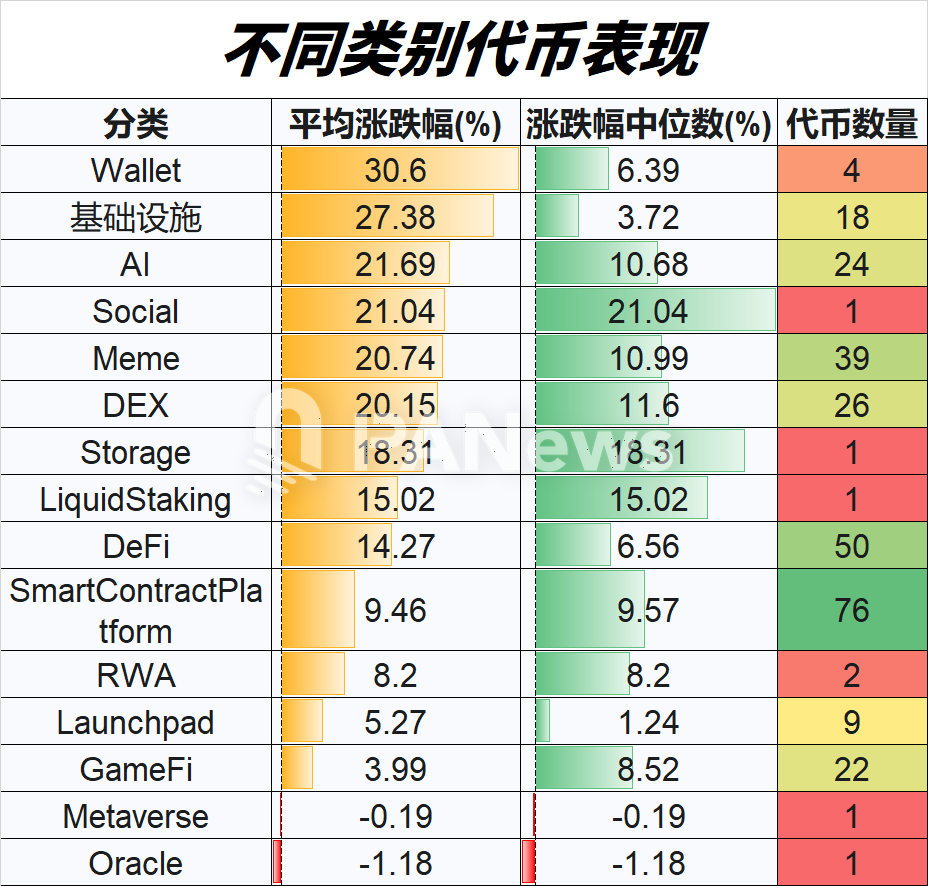

Infrastructure and AI performance is eye-catching

From the perspective of track classification, wallets, infrastructure (average increase of 27.38%) and AI (average increase of 21%) became the three tracks with the highest average increase this month. However, there are only 4 token samples in the wallet track, and mainly because WCT is a newly launched project that has raised the overall level. Overall, the real increase of the wallet track may be only about 5%. Meme and DEX are followed closely. This is related to the distribution of tokens in the top rise list.

As one of the largest sectors, DeFi has a fair average performance. Although the Smart Contract Platform category has many tokens, its overall growth is relatively backward. The RWA track, which has attracted much attention recently, performed mediocrely this month. The worst performers are Metaverse and Oracle, but these two tracks have fewer valid samples in this statistics.

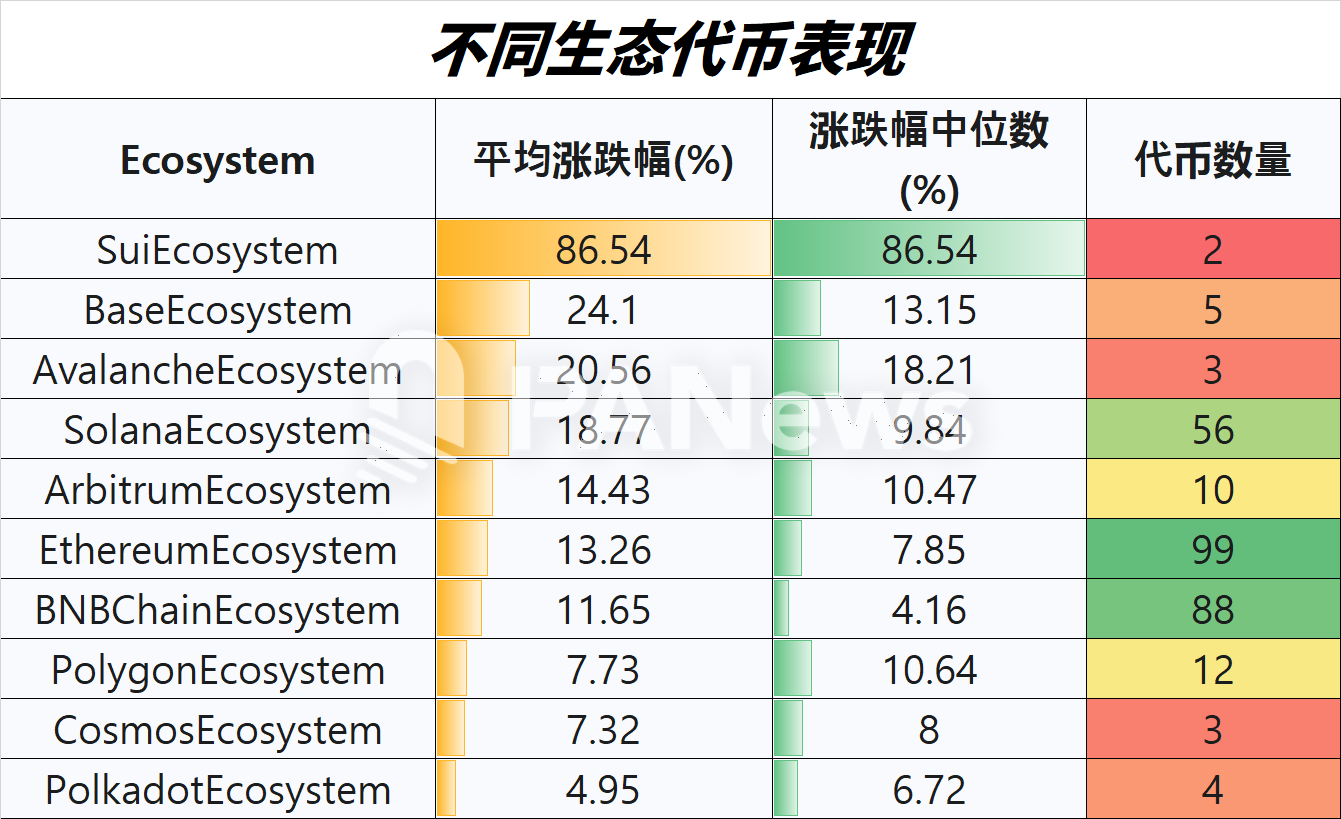

Sui, Base and Solana have a larger average ecology increase

Among different blockchain ecosystems, Sui Eco has the largest increase. Although Binance has launched a small number of Sui Eco tokens, based on the overall market data, Sui is indeed the best performing ecosystem in this round of rebound. Secondly, Base Ecology, Avalanche Ecology and Solana Ecology showed relatively stronger average growth data in April. However, since there are fewer data from Base and Avalanche, based on the actual overall data, Base Ecology has indeed ushered in a major rebound, and Avalanche's real performance may be far lower than this data. The Arbitrum ecosystem follows closely behind. Although the two major ecosystems, Ethereum and BNBChain, have the largest number of tokens, their overall performance is close to or slightly lower than the market average. Polygon, Cosmos and Polkadot ecosystems performed relatively low this month. However, because this part of the data is only Binance's tokens online, there is still a big gap with the overall data of various ecological tokens.

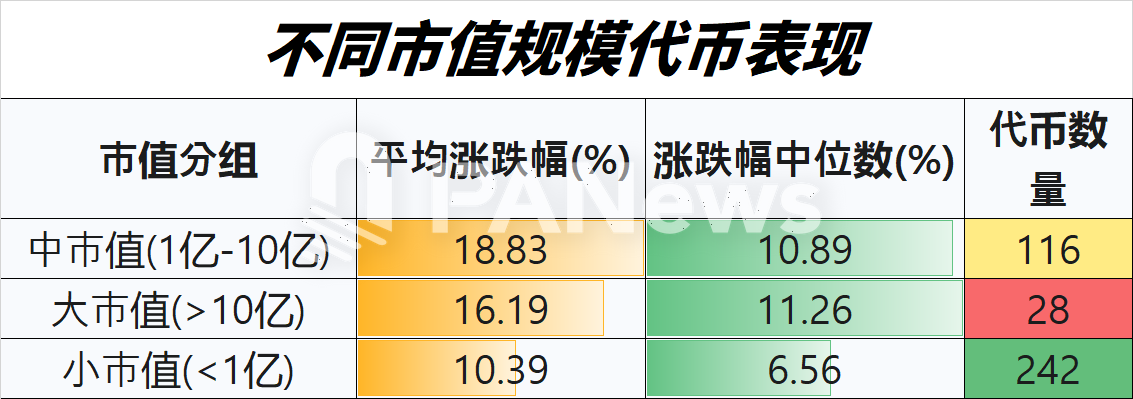

The average performance of the tokens in mid-large market capitalization

is better

In this analysis, PANews also added a dimension, which is the performance of tokens of different market capitalization scales in this round of rise. Interestingly, unlike the commonly believed small-cap resilience, in April data, the average increase in medium-cap (100 million-1 billion) and large-cap (>1 billion) tokens was slightly higher than that of small-cap (<100 million) tokens. This may imply that in this round of rebound, funds tend to flow to assets with a certain foundation and consensus rather than to pursue small currencies that are purely high-risk and high-elastic. In terms of quantity, Binance currently accounts for the largest proportion of small-cap tokens with a market value of less than 100 million, with a market value of 242, accounting for 60%. The second is 116 tokens with market value. There are only 28 tokens with a market value of more than US$1 billion. From this point of view, the overall token market is still relatively scattered.

Overall, in this round of rebound in April, at least in terms of overall increase and the number of tokens with high growth, it may not have ushered in a major reversal as people hoped. Other interesting phenomena are that new tokens seem to be more favorable to the market, while the tokens launched in the last bull market are not very marketable. In addition, the tokens with medium and large market capitalizations generally have a larger increase, but small market capitalizations seem to be more likely to create high-multiple increases (of which 12 tokens have a market value of less than 100 million in the top 20 tokens). For investors, the current market may be more suitable for selecting individual coins and tracks, rather than expecting a comprehensive "copy season" to rise.

(The content of this article is based on historical data analysis and does not constitute any investment advice. The crypto market fluctuates violently, so investment should be cautious.)