AI and tokenization will lead the “new long tail capital market” in 2025

Reprinted from jinse

01/06/2025·5MAuthor: Martin Young, CoinTelegraph; Compiler: Wu Baht, Golden Finance

Bitwise CEO Hunter Horsley says 2025 could see a boom in small, niche businesses with the help of artificial intelligence and tokenization, more corporate adoption of Bitcoin, and mergers and acquisitions that could benefit the cryptocurrency "recovery".

In a series of X posts on January 5, Horsley said he believed the world of 2025 was "on the verge of change."

Tokenization empowers small businesses

Horsley also made some predictions about tokenization in an It lies on the supply side.

He said the transformative power of tokenization could come from giving a slew of untapped small businesses access to capital markets.

Brickken founder and CEO Edwin Mata says the real- world asset (RWA) tokenization industry could be the next key narrative in crypto in 2025. “Tokenization of real-world assets is transforming traditional markets by enabling assets such as real estate, debt and equity to be digitized and traded on the blockchain,” he noted.

Artificial intelligence will drive a surge in the number of micro-

companies

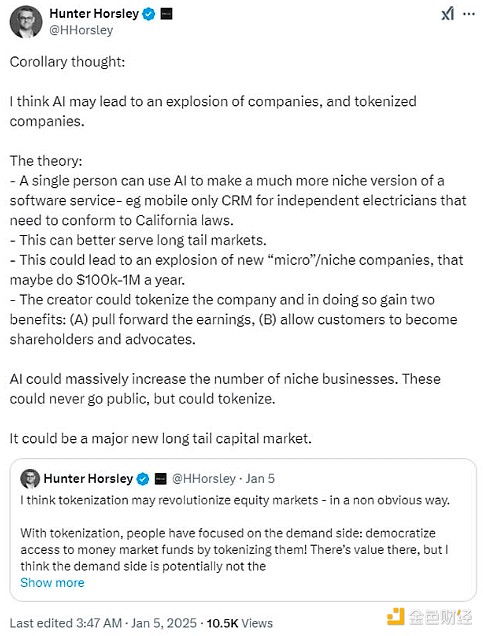

“I think AI is likely to drive a surge in companies and tokenized companies,” Horsley said in a separate post, sharing his thoughts on AI developments in the year ahead.

" AI can dramatically increase the number of niche businesses. These businesses can never go public but can be tokenized. It could be an important new long-tail capital market."

An example of how artificial intelligence can facilitate tokenization. Source: Hunter Horsley

"Bitcoin Standard" Inc.

Horsley also predicted that a major theme in 2025 will be the emergence of “Bitcoin standard companies” that hold BTC on their balance sheets. “There will be many companies joining the Bitcoin standard in 2025,” Horsley said.

MicroStrategy, which hinted at another purchase on Monday, is the largest corporate holder of BTC with 446,400 coins, worth about $43.7 billion at current market prices.

In late 2024, several smaller companies announced that they had begun developing strategies to invest in and hold Bitcoin as part of their treasury.

Removing controls on mergers and acquisitions

Horsley said the Trump administration may “unlock” controls on mergers and acquisitions by major companies, which would be a boon for cryptocurrencies.

Horsley predicted in a Jan. 6 article in maximize its market value. "

“The big companies may get bigger, and the mid-sized companies may shrink,” he said, adding that “if that happens, I think it will accelerate the development of cryptocurrencies” if the big companies are based on their own Operated by interests rather than user interests.

“The concept of cryptocurrencies is premised on not trusting large institutions to do what is in your best interest. This is underscored by the fact that large companies are getting bigger.”

chaincatcher

chaincatcher

panewslab

panewslab