After the US stock market plummeted continuously, the reversal signal gradually appeared

Reprinted from panewslab

03/21/2025·2MSummary of one sentence: short squeeze, seasonal factors, bottoming out of sentiment, pension rebalancing, retail investors' continued buying, monetary and cash ready to be released may drive a rebound

Data from Goldman Sachs Trading Station as of March 20:

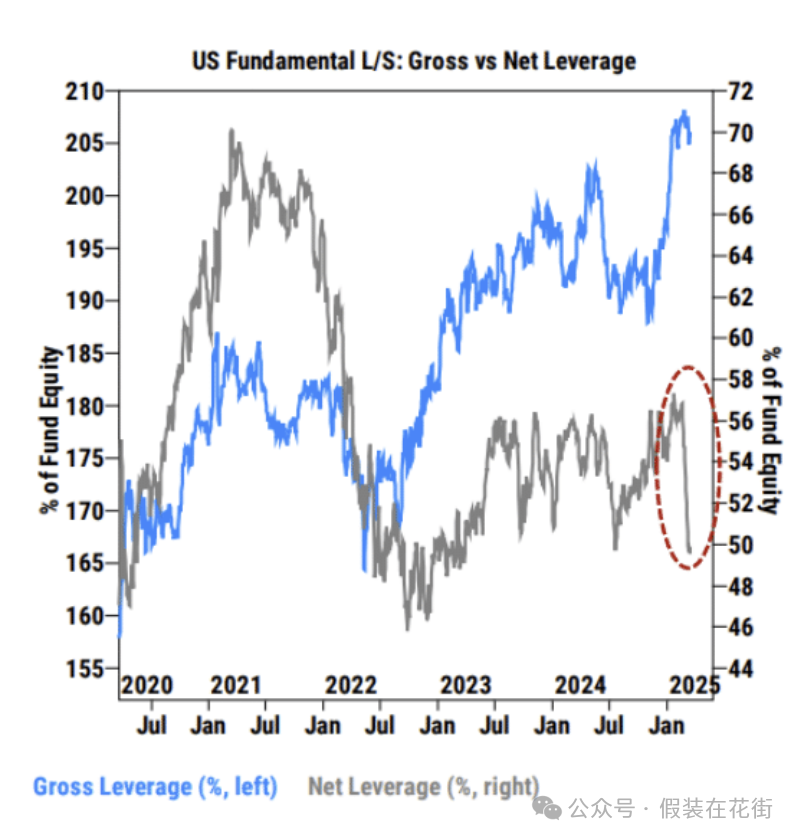

The U.S. fundamentals faced the net leverage ratio of hedge funds (gray line above) fell sharply to a two-year low of 75.8%;

But the total leverage ratio (blue line above) is still as high as 289.4% at its highest level in five years, which is obviously due to the rise in short positions;

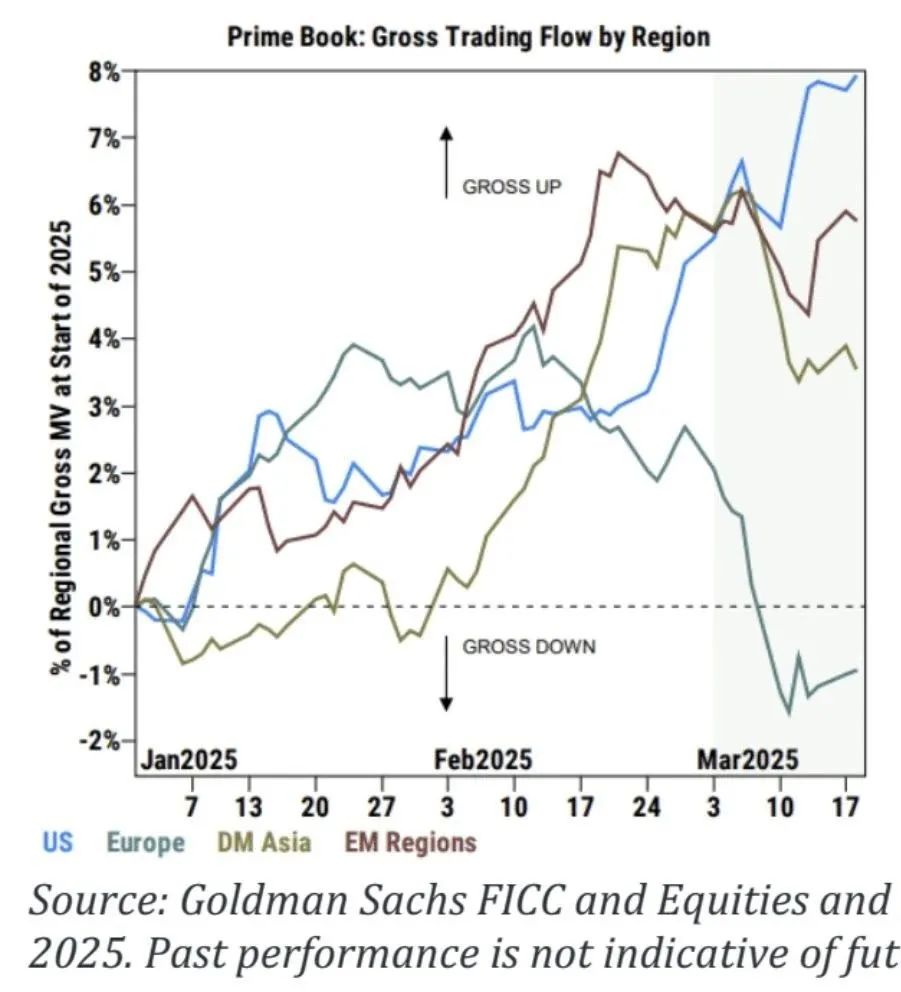

The figure above shows that the total leverage ratio of funds rose sharply by 2.5% in the United States in March, deleveraging elsewhere in the world;

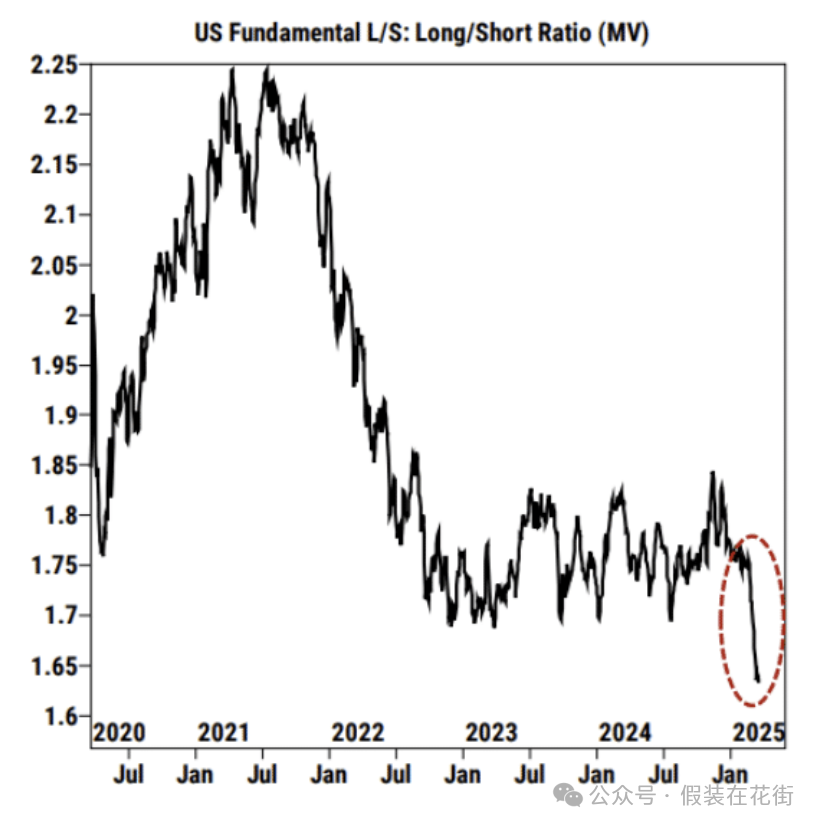

The long/short (market cap) ratio fell to its lowest level in more than five years of 1.64;

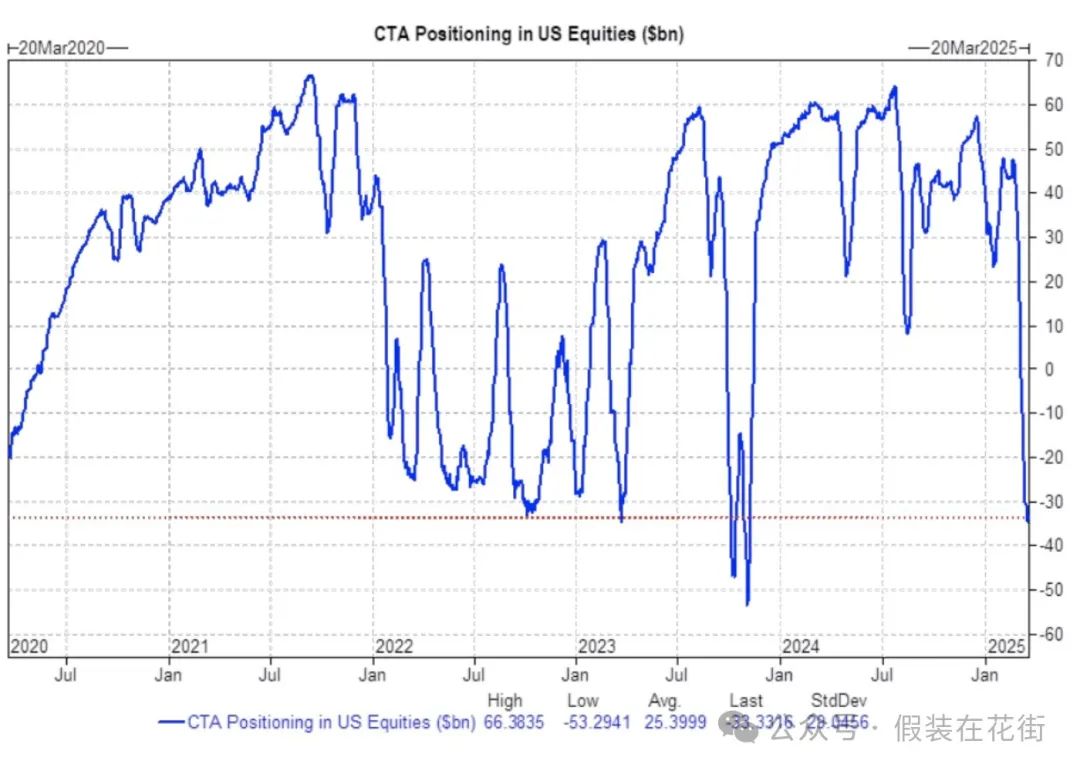

CTA funds have net shorted US stocks for the first time after a year and a

half;

CTA funds have net shorted US stocks for the first time after a year and a

half;

The above shows that high leverage has gone a little, but for there is still room for deleveraging before the tariff is implemented, we are very close to the reversal.

The total leverage ratio increases because of the increase in leveraged short positions, which may be a good thing. The data shows that hedge funds are unwilling to cut long positions too much, but rely on leveraged short hedging of external financing. When the market fluctuates abnormally, the financing party may issue a margin call, causing the shorts to be forced to close positions or sell other assets to supplement margin, that is, the probability of short squeeze is greatly increased. If the funds choose the latter, that is, sell other assets, it may amplify abnormal fluctuations in the market.

But note that this does not mean an inevitable rise but that if it rises, it will be short squeeze boosted.

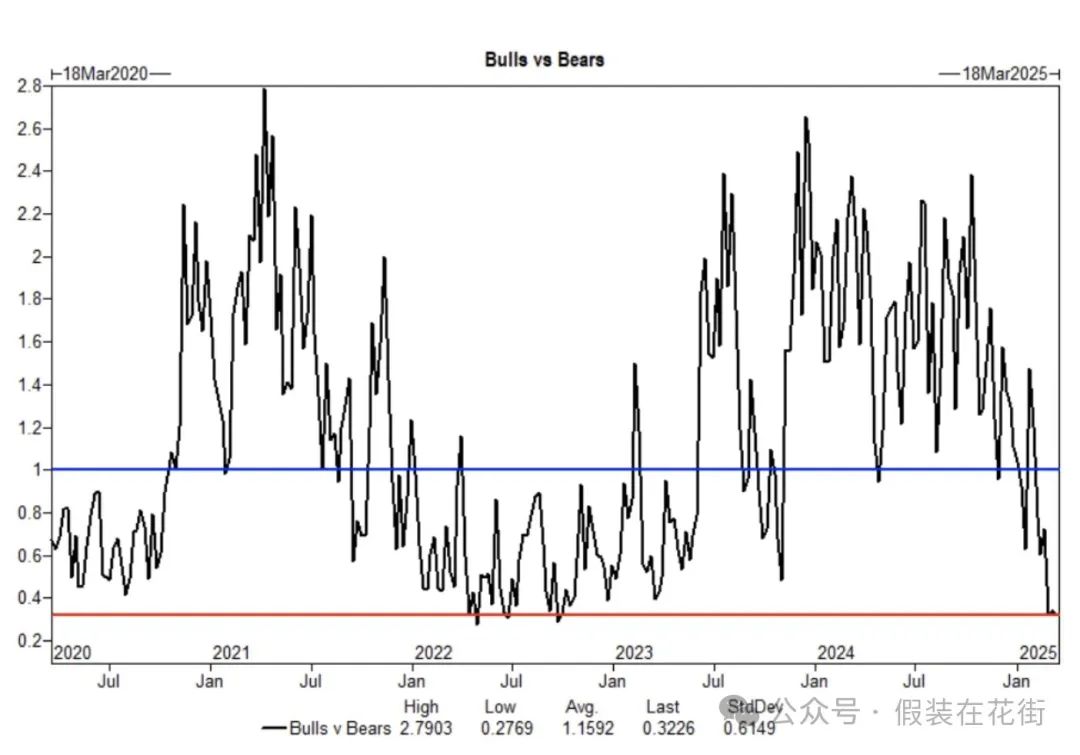

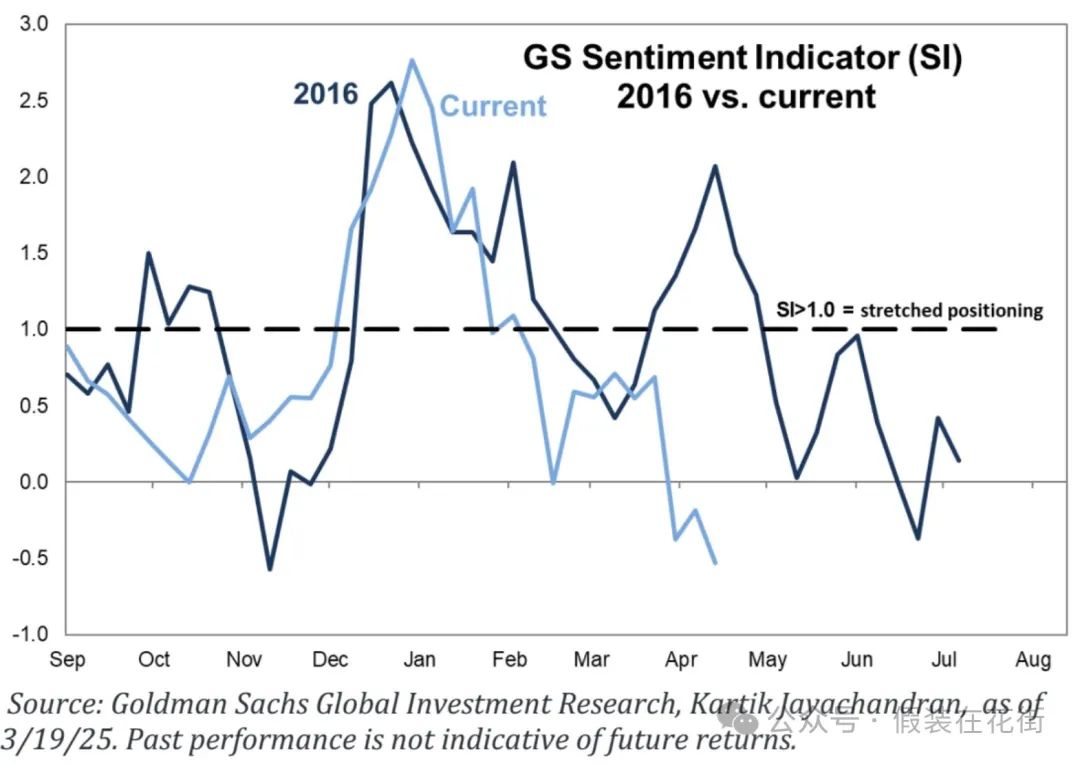

Market sentiment has fallen to the bottom, and the market has returned to the environment of "good news is good news", and sentiment may recover:

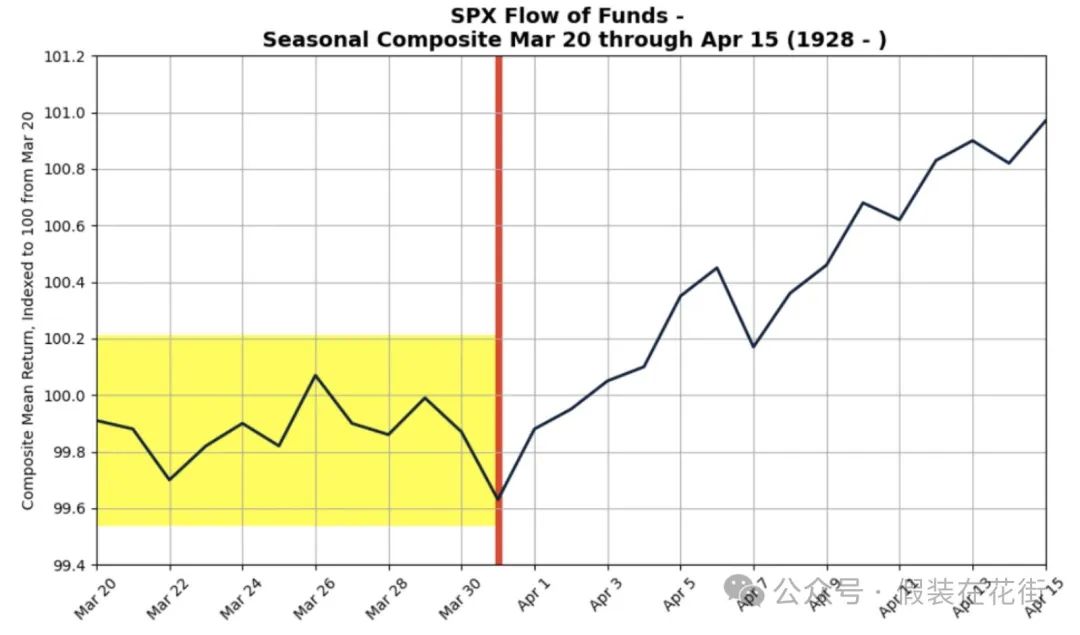

Seasonal negative trends end:

According to data since 1928, the second half of March usually fluctuates significantly, and this year is no exception.

But the S&P 500 rose an average of 0.92% between March 20 and April 15, and an average of 1.1% between the end of March and April 15.

This suggests that there may be a seasonal rebound potential in April, but the magnitude is limited. After April 2, the market may stabilize if there are no major accidents.

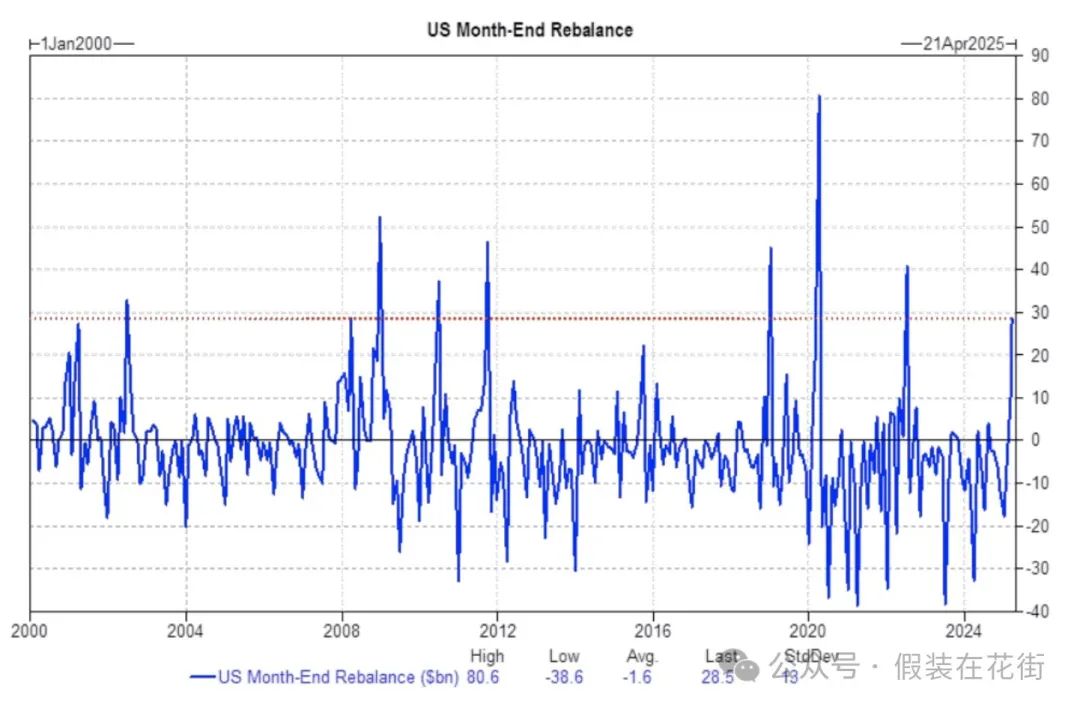

U.S. pensions are expected to buy US$29 billion in U.S. stocks at the end of the quarter, ranking 89% of the estimation of absolute value in the past three years and 91% of the 91% of the estimation since January 2000. This move may provide some support to the market:

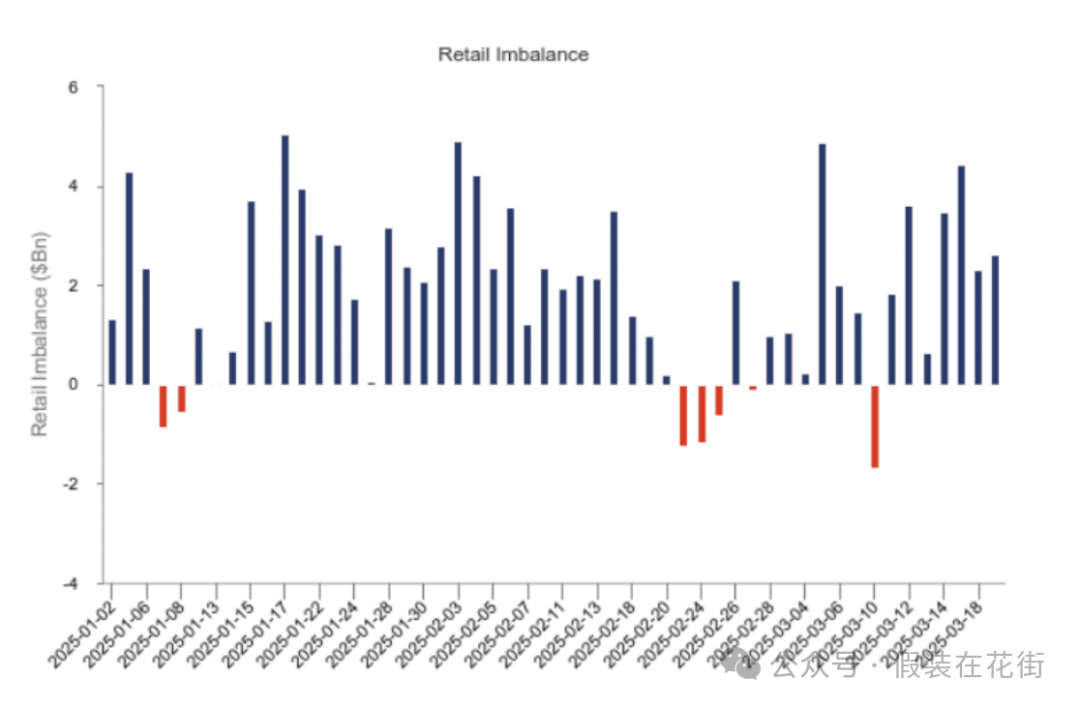

Despite the market fluctuations, the participation rate of retail investors remains stable. Since 2025, retail investors have only net selling in 7 trading days, and the cumulative net buying volume has reached US$1.56 trillion.

In addition, the asset size of money market funds (MMFs) continues to grow to US$8.4 trillion. These funds represent the cash reserves of retail investors and other investors. Once market sentiment improves or investment opportunities appear, these funds may quickly convert into stock market buying power.

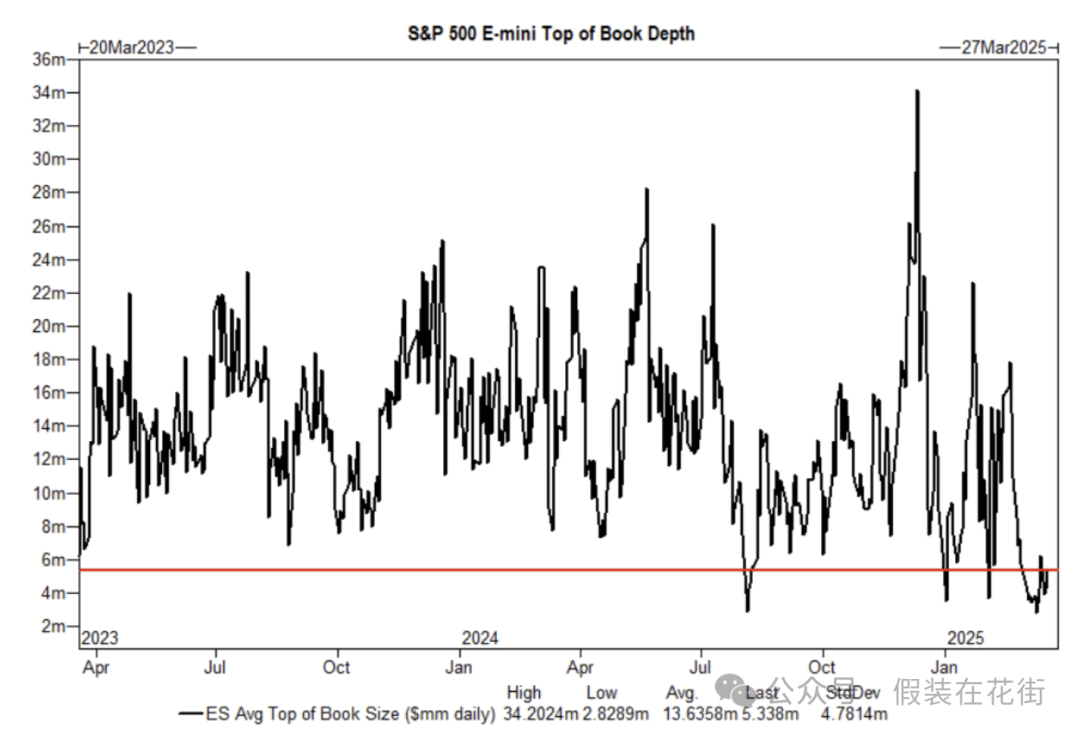

The market liquidity is still thin, which is also the reason why it often fluctuates greatly during the session. Pay attention to risks:

chaincatcher

chaincatcher