After the name change of Gorgeous, one article will show you the latest status of Sonic ecosystem

Reprinted from panewslab

02/17/2025·2MAuthor: Magpie Protocol

Compiled by: TechFlow

DeFi (decentralized finance) is developing rapidly, and Sonic's speed is equally impressive. Sonic has become a breeding ground for innovation and provides opportunities for protocols like Magpie to spread their wings by building an ecosystem that benefits the community and supports developers.

Sonic has all the elements of success: high speed, efficiency, strong throughput, security, scalability, and an ecosystem of potential. Not only that, it also provides an attractive incentive mechanism for the community and developers.

Next, let's elaborate on why Sonic is the ideal place for the growth and development of the Magpie project.

First, let me briefly introduce Sonic, its main website was officially launched in mid-December last year and has quickly become popular since then. Its locked position (TVL, Total Value Locked) grew by more than 700% month-on-month, and the trading volume also showed a continuous upward trend. In such an environment, protocols such as Magpie naturally hope to join this vibrant ecosystem and grow together.

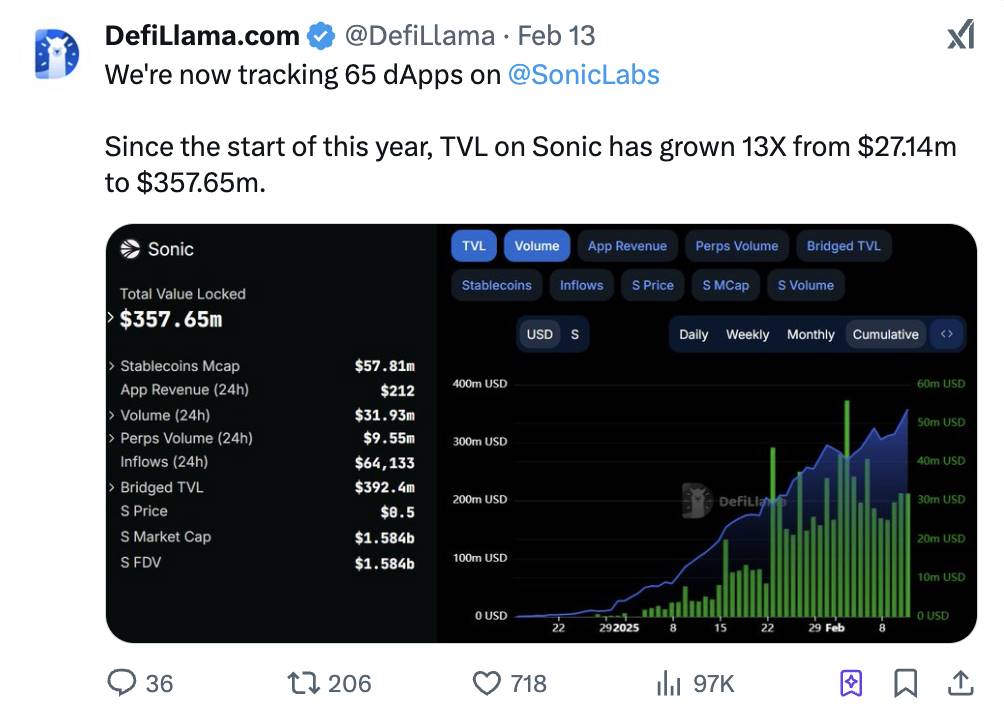

@DefiLlama: “We are currently tracking 65 decentralized applications (dApps) on the SonicLabs platform.

Since the beginning of this year, Sonic's TVL, Total Value Locked has achieved a 13-fold increase, soaring from $27.14 million to $357.65 million. This significant growth demonstrates the rapid expansion and strong development potential of the platform's ecosystem. ”

Let's quickly disassemble Sonic's technical specifications:

-

< 1 second confirmation time : Instant transaction confirmation can be achieved almost, and the speed is close to the limit.

-

10,000 TPS (10,000 transactions per second) : Shows strong scalability and has huge room for growth in the future.

-

Gas fees below USD 0.01 (blockchain transaction fee) : Very low cost and very affordable.

Sonic has reached a leading level in terms of speed and efficiency. Next, let’s explore why building a project on Sonic is exciting.

Advantages for developers

Sonic's FeeM profitability program is a highlight and an unprecedented innovation. The program allows projects built on Sonic, such as Magpie, to receive up to 90% of the on-chain application Gas fee share.

We plan to use this mechanism to reduce transaction costs and improve user experience by allocating some of the recycled Gas fees to users. In this way, we want to create a more efficient and attractive platform for traders on Sonic.

Inspiration for the community

Sonic designed a simple and efficient incentive mechanism for $S tokens:

Users earn points by participating in the ecosystem, which can be converted into $S tokens.

- Hodlers.

If you are a coin holder, you can earn passive points by holding whitelisted assets directly in a Web3 wallet (such as Rabby or MetaMask).

- Farmers

If you prefer liquidity mining, you can deploy whitelisted assets to participating apps to earn active points. The income from these active points is twice as good as the passive points.

- Agreement Reward

Sonic Points is a community-centric reward system that allows dApps and protocols to design unique points distribution mechanisms for their users, encouraging users to use their protocols or participate in community activities. These points can be later redeemed as $S tokens, directly rewarding users' participation.

If you are looking for passive gains, you can get $scUSD, $scETH or $stS from partners @Rings_Protocol and @beets_fi to hold it. If you need to borrow, @SiloFinance provides related services and can also earn points through borrowing.

Whether it’s hoarding coins or trading, participating in the Sonic ecosystem can be rewarded. Moreover, to make this process more convenient, when using Magpie, you can directly exchange assets for these tokens, or even mint them, while earning points and superimposing rewards through Sonic, Rings, Magpie and other participants.

Although the reward may require a certain lock-up period, this incentive mechanism is very attractive. And don’t forget that the greater the transaction volume, the more “gems” we get, and these gems can be used to provide more incentives for our community and promote a virtuous cycle of the ecosystem.

Core team

@AndreCronjeTech is the founder of Sonic, which is one of the reasons why Sonic is worthy of optimism. Not only is he the founder of @yearfi , he has also jointly developed the innovative ve(3,3) token economic model. Therefore, when he focuses on a project, it always attracts our attention.

His team members include @michaelfkong , @_lfausto , @AVKhatibi and @MainnetMari . They are innovative, generous and open, and fully promote the growth and cooperation of the DeFi ecosystem, bringing more possibilities to the industry.

Our Favorite Eco Project

We are confident in Sonic’s technology, team and ecosystem. Now, we want to share with you some of our favorite protocols and community updates.

Metropolis

Metropolis is a rapidly rising decentralized exchange (DEX). Their liquidity and trading volume continue to grow and recently launched their own token $METRO (available on Magpie). One of the highlights of Metropolis is its dynamic liquidity market maker (DLMM), a tool that allows users to customize liquidity distribution strategies, whether it is bell curve, spot strategy, buying and selling order style, or fixed investment strategy (DCA). Flexible configuration. If you are an art lover, their social media posts often come with beautiful artwork. Whether out of love for art or the need for liquidity control, Metropolis is an excellent platform to watch out for.

Rings

If you have $USDC, $ETH or $USDT in your hands, you might as well try the income stablecoins and ETH derivatives provided by Rings. These tools not only help your assets no longer stay idle, but also help you increase your assets through pledge or other means.

SwapX

SwapX is the leading decentralized exchange (DEX) in the Sonic ecosystem. The key to its success is the first to adopt V4 technology. This technology significantly improves capital efficiency and enables traders to obtain higher returns, while helping liquidity providers (LPs) effectively reduce impermanent losses (ILs) through centralized liquidity and automated position management.

Additionally, SwapX has developed and audited a highly anticipated DeFi plug-in dedicated to managing liquidity in liquidity staking tokens (LSTs), which will be released exclusively on Sonic. With its huge community and ve(3,3) token economic model, SwapX is gradually becoming an important role in the Sonic ecosystem.

Beets

Beets is the flagship LST center on Sonic. Users can convert $S to $stS to earn profits in a pool of automatic compounding while maintaining liquidity of assets. What is more convenient is that the Magpie platform supports direct casting or redemption to $stS, making the operation simpler and more efficient.

**WAGMI & [Hey

Anon](https://x.com/HeyAnonai)**

Next comes WAGMI and HeyAnon, two projects carefully crafted by @danielesesta .

-

WAGMI : Known for its innovative GMI pool, a multi-layer pool structure that contains multiple subpools. The WAGMI ecosystem has a multi-layer cost structure through this "pool in pool" design. If you are pursuing diversification of your portfolio and maximizing your returns, WAGMI is an option to watch out for.

-

HeyAnon : This is an upcoming AI agent, where users can complete DeFi operations through conversations. For example, you can ask HeyAnon to help you swap ETH from Arbitrum to $scUSD on Sonic. As its developers said, "Agencies are the new wallets. In beta testing, you'll see that it provides security through keys, integrates all wallet information, and performs tasks and provides a conversational user interface. This It is the future trend, a tool that never rests and completes tasks for you anytime, anywhere.”

Equalizer

Equalizer focuses on providing “real benefits” to token holders. Its unique perpetual model balances rewards from token holders and liquidity providers while focusing on low slippage trading. In addition, they direct liquidity to the trading pairs with the largest trading volume through community voting, ensuring that the most popular trading pairs enjoy better spreads and higher liquidity efficiency.

SpookySwap

SpookySwap is a decentralized exchange (DEX) known for its low transaction fees, which is powerful and easy to use. Their native token $BOO also provides users with rich entitlements, including voting rights to participate in platform governance proposals, and opportunities to share exchange fee benefits.

Shadow

Shadow is a protocol layer and trading platform based on centralized liquidity. Users can earn fee sharing and additional rewards (i.e. bribery rewards) by voting token emissions. The platform supports flexible fee allocation, dual emission mechanism and other functions, and is a representative of the next generation of DeFi innovation. If you are looking for a trading platform based on the x(3,3) model, Shadow is worth a try.

Silo

Silo provides an isolated lending market where users can earn real income and market revenue by pledging $SILO or holding $spSILO. In addition, every $1 deposit used to borrow can earn Sonic points, and the borrower can also receive half the reward, and the specific reward multiple depends on the type of token borrowed.

The Sonic platform is as fast and efficient as its name, while committed to creating more value for users.

chaincatcher

chaincatcher