After a sharp drop in venture capital by 70%, the crypto industry has entered the merger and acquisition season: buy ready-made or build it yourself?

Reprinted from panewslab

05/11/2025·28DWritten by: Saurabh Deshpande

Compiled by: Luffy, Foresight News

Coinbase acquired Deribit for $2.9 billion, the largest merger and acquisition event in cryptocurrency history.

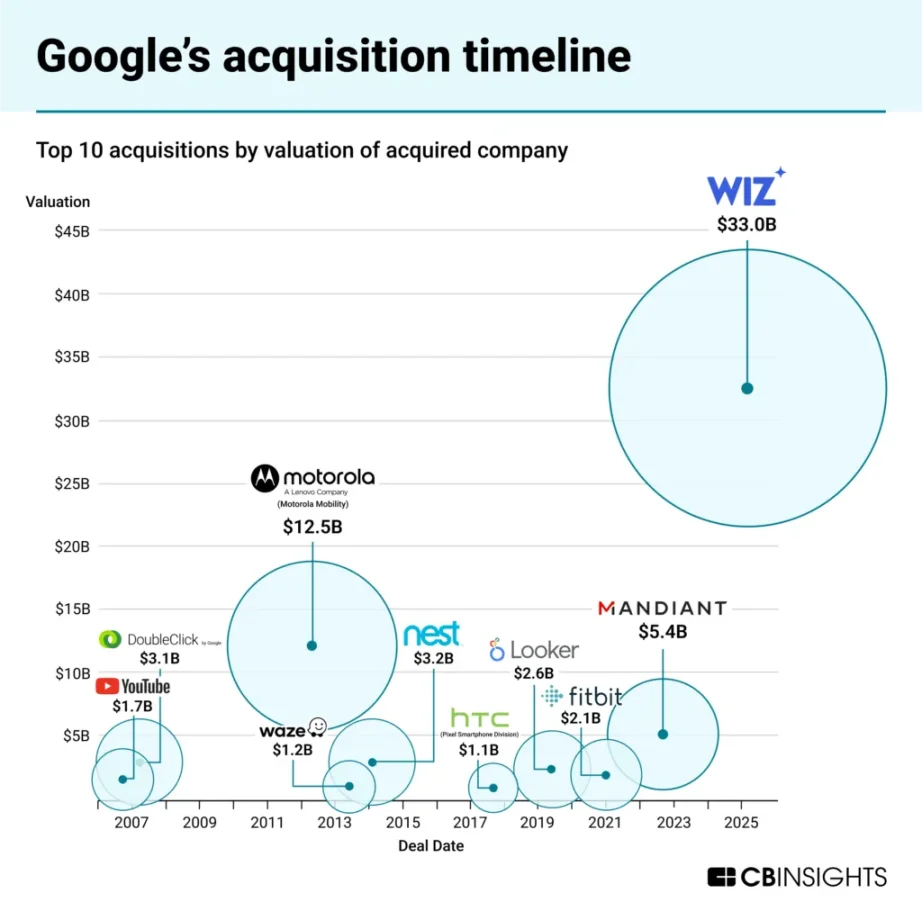

The same is true for the history of science and technology. So far, Google has acquired 261 companies. These acquisitions have created products such as Google Maps, Google Advertising Alliance and Google Analytics. Perhaps the most significant of these is that Google acquired YouTube for $1.65 billion in 2020. In the first quarter of 2025, YouTube generated $8.9 billion in revenue, accounting for 10% of Alphabet's (Google parent company). Similar to Google, Meta has made 101 acquisitions so far. Instagram, WhatsApp and Oculus are prominent examples. Instagram generated more than $65 billion in annual revenue in 2024, accounting for more than 40% of all Meta's business revenue.

Buy ready-made or build it yourself?

The cryptocurrency industry is no longer a new industry. It is estimated that the number of cryptocurrency users reaches 659 million, Coinbase has more than 105 million users, while the global Internet users are about 5.5 billion. Therefore, cryptocurrency users have reached 10% of the total number of Internet users. These numbers are important because they help us identify the source of growth for the next phase.

The increase in the number of users is an obvious way to grow. At present, we have only developed applications of cryptocurrencies in the financial field. If other applications use blockchain technology as infrastructure, the entire market size will expand significantly. Acquisition of existing users, cross-selling, and increasing single user revenue are some ways for existing companies to achieve growth.

When the pendulum swings towards the purchase

The acquisition solves three key problems that cannot be solved by simple financing. First, acquisitions help talent acquisition in a highly specialized field where experienced developers are scarce. Second, in an environment where natural growth costs are increasingly expensive, acquisitions help users acquire. Third, acquisitions can facilitate technological integration and enable agreements to transcend their original use cases. These issues will be further discussed later in combination with industry cases.

We are in a new wave of mergers and acquisitions in cryptocurrencies. Coinbase acquired Deribit for a record $2.9 billion; Kraken acquired NinjaTrader, a retail futures trading platform regulated by the U.S. Commodity Futures Trading Commission (CFTC) for $1.5 billion; Ripple acquired Hidden Road, a multi-asset main broker, for $1.25 billion, and it also offered to acquire Circle but was rejected.

These transactions reflect changing priorities in the field. Ripple wants distribution and regulatory channels, Coinbase pursues option trading volume, and Kraken is filling the product gap. These acquisitions are all derived from strategy, survival and competitive positioning.

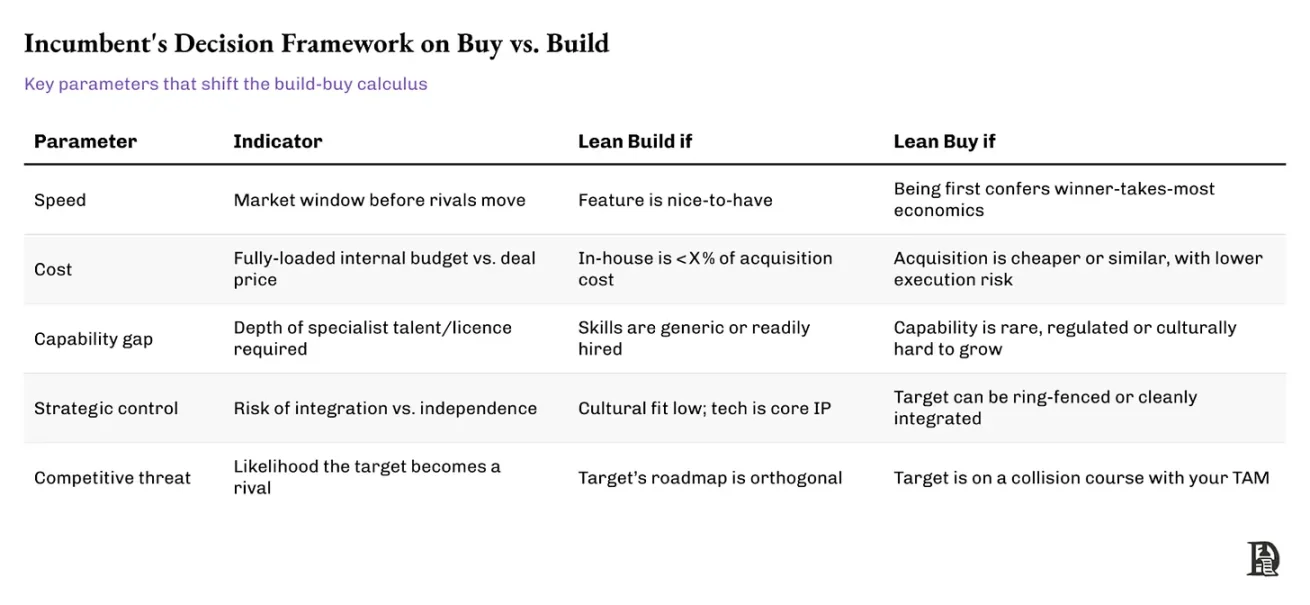

The following table can help you understand what existing companies think when considering self-built or acquisition.

While the table summarizes the key trade-offs in self-built and acquisition decisions, incumbent companies tend to rely on unique signals when acting decisively. A good example is Stripe's acquisition of Paystack in Nigeria in 2020. Build self-construction infrastructure in Africa means facing a steep learning curve in regulatory details, local integration and business entry.

Stripe chose to acquire. Paystack has addressed local compliance issues, established a merchant base, and demonstrated its distribution capabilities. Stripe's acquisition meets several criteria such as speed (gaining a first-mover advantage in a growing market), capability gap (local expertise), and competitive threats (Paystack becomes a regional competitor). This move accelerated Stripe's global expansion without distracting its core business.

Before we explore the reasons for the transaction in depth, there are two questions worth thinking about: one is why the founder should consider being acquired; the other is why now is an important moment to consider this issue.

Successful acquisitions can be a booster

Why is the current macro environment now conducive to acquisitions?

For some, it's about liquidity when exiting. For others, this is to access more lasting distribution channels, ensure long-term development, or be part of a platform that can amplify its influence. And for many, it is a way to avoid the increasingly narrow path to venture capital, which is now scarce than ever, with investors expecting more and time tight.

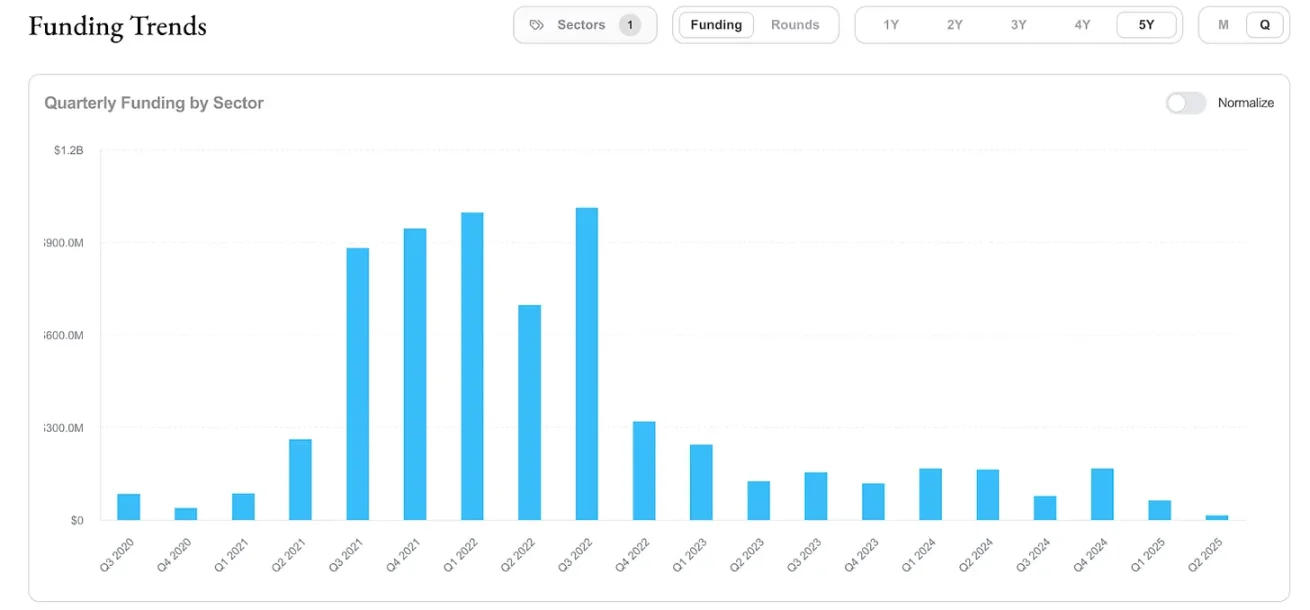

High tide does not allow all ships to rise

The venture capital market lags behind the liquidity market for several quarters. Typically, whenever Bitcoin price peaks, it takes months or quarters to cool down. Venture capital in the cryptocurrency sector has dropped by more than 70% since its peak in 2021, with median valuations returning to 2019-2020 levels. I don't think this is a temporary callback.

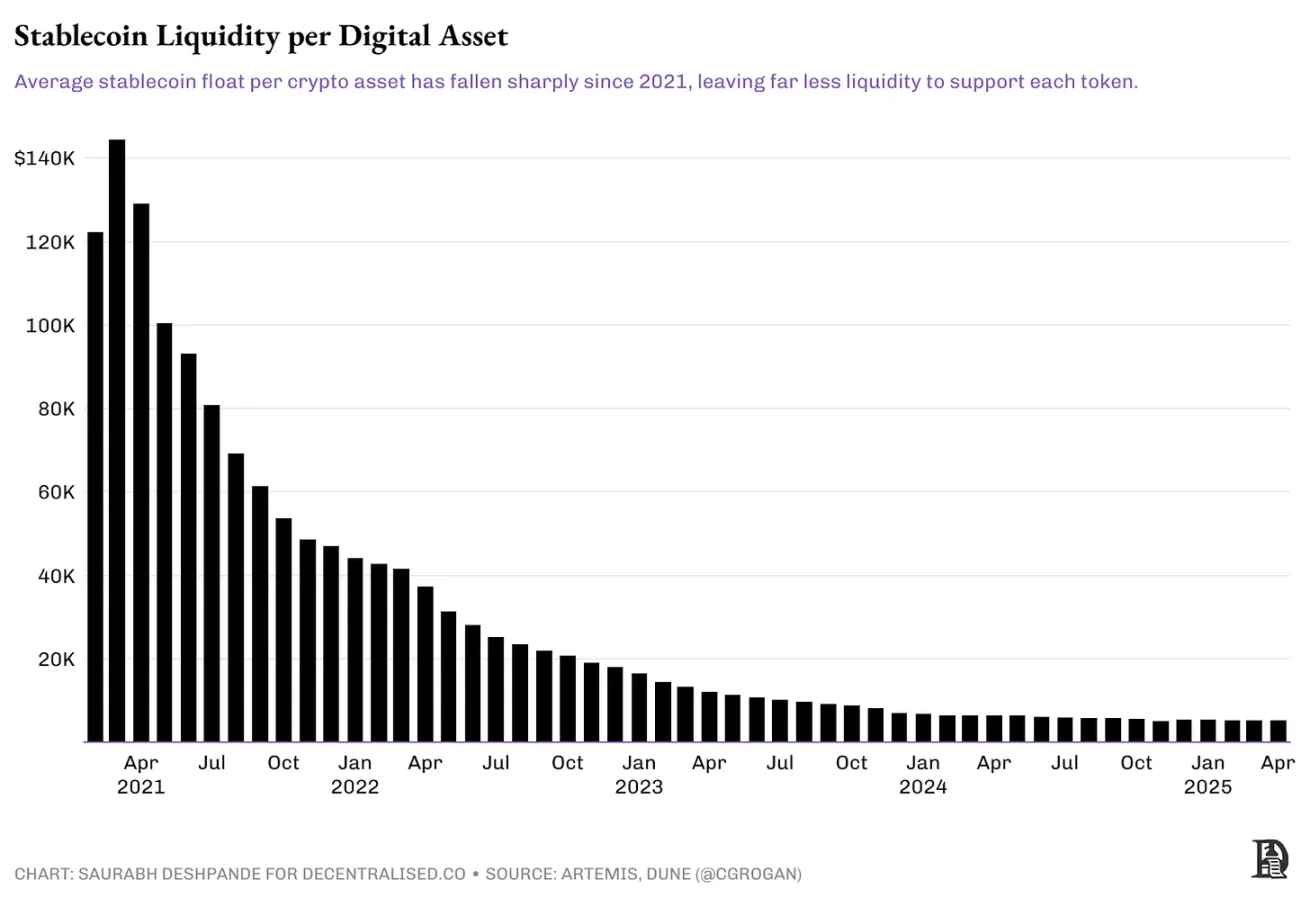

Let me explain why. In short, the returns on venture capital declined while the cost of capital rose. Therefore, due to the high opportunity cost, the venture capital funds chasing transactions have been reduced. But from the perspective of reasons unique to the cryptocurrency field, the market structure has been affected by the significant increase in the number of assets. I've been following this chart and most token businesses should be aware of it. Just because creating a new token is easy to issue, it may not be a wise move. Capital on the Internet is limited. As each new asset is issued, the liquidity chasing it will decrease, as shown in the figure below.

Every venture-backed token launched at a high complete dilution valuation (FDV) requires a lot of liquidity to reach a multi-billion dollar market cap. For example, EigenLayer’s EIGEN token was launched at $3.9, with a full dilution valuation of $6.5 billion. The circulation volume at the time of launch was about 11%, and the market value was about $720 million. The current circulation is about 15%, and the full dilution valuation is about $1.4 billion. After multiple rounds of unlocking, 4% of the supply has entered circulation since the token was first issued. The token price has fallen by about 80% since its launch. To return to the issuance valuation, the price needs to rise by 400% in the case of increased supply.

Unless tokens do accumulate value, there is no reason for market participants to chase these tokens, especially in a market with a large number of investment options. Most of these tokens are likely to never reach their original valuation. I looked at the 30-day revenues for all the projects on Token Terminal, and only three projects (Tether, Tron and Circle) had more than $1 million in monthly revenue. There are only 14 projects with monthly income of more than $100,000. Among these 14 projects, 8 have tokens, which means they have investment value.

This means that individual investors are either unable to exit or must exit at a certain discount. The overall poor performance of secondary markets puts pressure on the return on investment of venture capital. This will lead to more cautious investment strategies. So, a product either has to find a product market fit (PMF) or it has to be something new that we haven't tried yet in order to attract investors and get a valuation premium. It is difficult to find investors for a product with only a minimum viable product (MVP) and without users. So, if you are building another "blockchain expansion layer", then the chances of your favor from outstanding investors are very low.

We have seen this happen. As we mentioned in the VC Tracking article, monthly risk capital inflows entering the cryptocurrency sector fell from a peak of $23 billion in 2022 to $6 billion in 2024. The total financing rounds fell from 941 in the first quarter of 2022 to 182 in the first quarter of 2025, indicating the caution of venture capital funds.

Why now?

So what happens next? Acquisitions may make more sense than a new round of financing. Those agreements that already have a certain income or businesses will chase niches that can make up for their own blind spots. The current environment is driving teams toward integration. Higher interest rates make capital expensive; user adoption rates tend to stabilize, so natural growth becomes more difficult; token incentives are less effective than before; at the same time, regulation is forcing teams to specialize faster. All of these factors have prompted the cryptocurrency sector to use acquisitions as a means of growth. This time, M&A activities in the cryptocurrency sector seem to be more thoughtful and focused than previous cycles. We will discuss the reasons later.

Merger and Acquisition Cycle

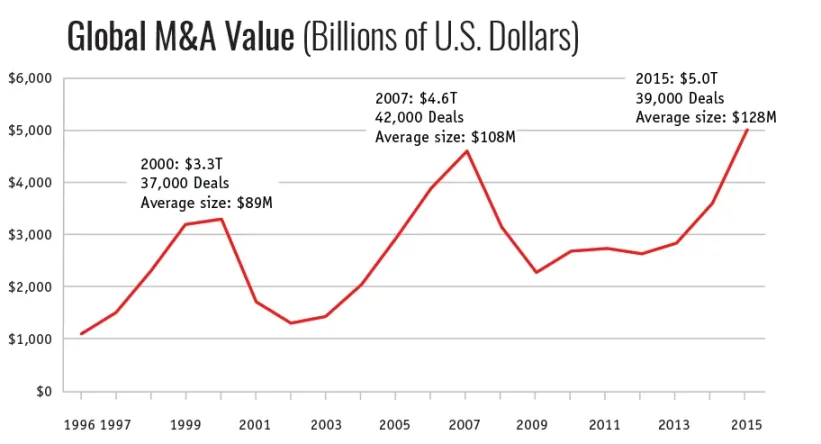

Historically, the traditional financial sector has experienced five to six major mergers and acquisitions, triggered by factors such as relaxed regulation, economic expansion, cheap capital or technological changes. The early waves were driven by vertical integration and monopoly ambitions; the later waves emphasized synergy, diversity or global influence. We don’t need to look at the century-long history of mergers and acquisitions in detail, simply put: when growth slows down and capital is abundant, integration accelerates.

Source: Harvard Law School Corporate Governance Theory Forum

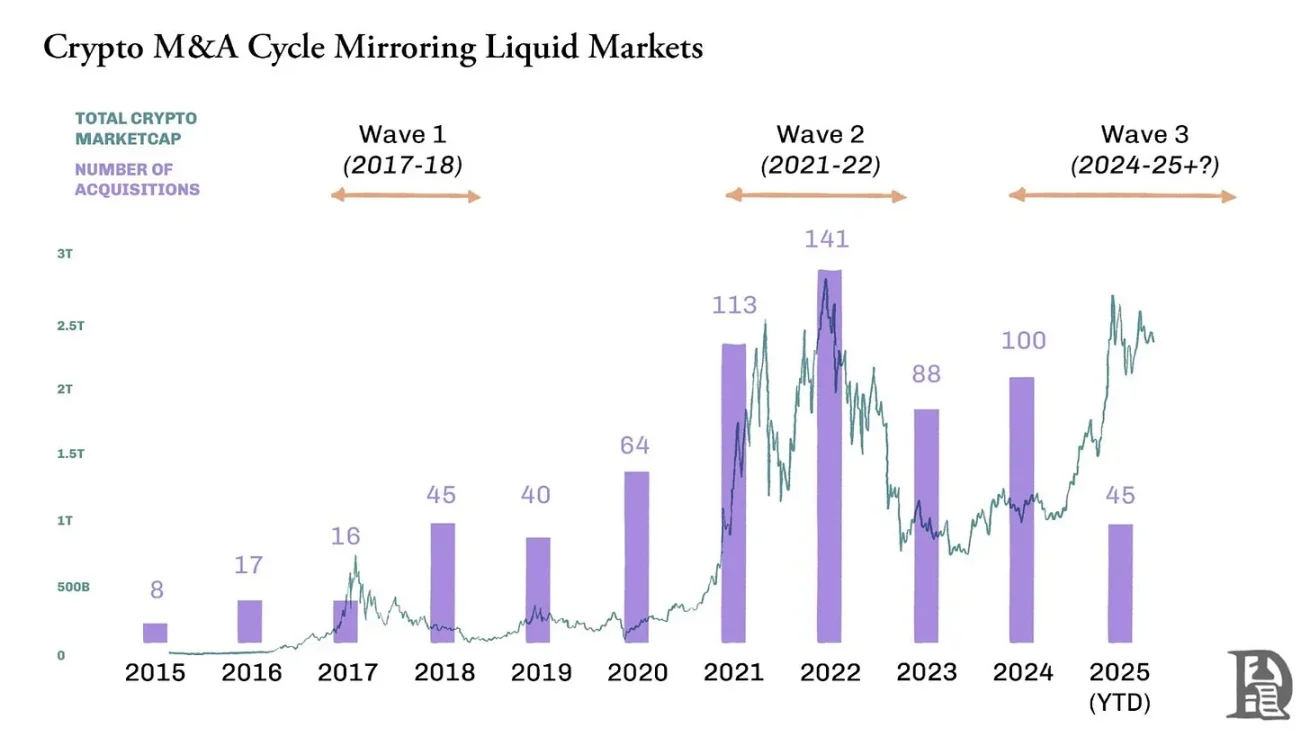

How to explain the different stages of mergers and acquisitions in the cryptocurrency field? This is similar to what we have seen in traditional markets for decades. Growth in emerging industries is often wave-like, rather than straight-up. Each wave of mergers and acquisitions reflects different needs in the industry's maturity curve: from building products, to finding product market fit, to acquiring users, and locking in distribution channels, compliance or defense capabilities.

Source: CBInsights

We have seen this in the early Internet era and in the mobile Internet era. Recall that in mid-2005, Google acquired Android. This is a strategic bet that mobile devices will become the dominant computing platform. According to the book "Androids: Teams Building Android Operating Systems" written by Chet Haase, a veteran engineer of Android and Google employee:

In 2004, global personal computer shipments were 178 million units. During the same period, mobile phone shipments were 675 million, almost four times the number of personal computers, but their processor and memory performance was comparable to that of personal computers in 1998.

The mobile operating system market was once fragmented and constrained. Microsoft charges licensing fees for Windows Mobile, the Symbian system is mainly used on Nokia devices, and the BlackBerry's operating system only runs on its own devices. This creates strategic opportunities for the development of open platforms.

Google seized the opportunity to acquire a free open source operating system that manufacturers can adopt without paying expensive licensing fees or building their own operating system from scratch. This democratization approach allows hardware manufacturers to focus on their own strengths while accessing a complex platform that can compete with the iOS ecosystem that Apple strictly controls. Google could have built an operating system from scratch, but the acquisition of Android gave it the lead and helped to combat Apple's growing dominance. Twenty years later, 63% of the network traffic comes from mobile devices, and 70% of the mobile network traffic is generated through Android. Google foresaw the transition from personal computers to mobile devices, and the acquisition of Android also helped Google dominate the mobile search field.

The 2010s was an era when cloud infrastructure-related transactions dominated. Microsoft acquired LinkedIn for $26 billion in 2016, a move aimed at integrating identity information and professional data from Office, Azure and Dynamics. Amazon acquired Annapurna Labs in 2015 to build its own custom chips and provide edge computing power for AWS, suggesting that vertical integration of infrastructure is becoming crucial.

These cycles emerge because each stage of industry development brings different limiting factors. In the early stages, the key lies in the speed of product launch. Later, the focus is on acquiring users. Ultimately, regulatory clarity, scalability and endurance become key. Acquisitions are the way industry winners compress time, they buy licenses instead of applying, acquire teams instead of hiring, buy infrastructure instead of building from scratch.

Therefore, the pace of mergers and acquisitions in the cryptocurrency field echoes the situation in the traditional market. The technology is different, but the common sense is the same.

Three waves of mergers and acquisitions in cryptocurrencies

If you think about it carefully, mergers and acquisitions in the cryptocurrency field have gone through three different stages. Each stage is determined by the market demand and technical conditions at that time.

The first wave (2017-2018) - ICO Inspur: Smart contract platforms have just emerged. There was no decentralized finance (DeFi) at that time. People only hope to build on-chain applications that can attract users. Exchanges and wallets acquire smaller front-end platforms to attract new token holders. Famous deals in this era include Binance’s acquisition of Trust Wallet and Coinbase’s acquisition of Earn.com.

The second wave (2020-2022) - Fund-driven acquisitions: Some agreements such as Uniswap, Matic (now Polygon) and Yearn Finance, as well as companies such as Binance, FTX and Coinbase, have found a product market fit (PMF). During the 2021 bull market, their market value soared, with the tokens they hold too high to be valued and available for expenditure. The protocol’s decentralized autonomous organization (DAO) uses governance tokens to acquire related teams and technologies. Yearn's M&A season, OpenSea's acquisition of Dharma and crazy acquisitions before FTX's collapse (such as the acquisition of LedgerX and Liquid) defined this era. Polygon also undertook an ambitious acquisition, acquiring teams such as Hermez (zero-knowledge proof expansion solution) and Mir (zero-knowledge technology) to establish its leadership in the field of zero-knowledge expansion.

The third wave (2024-present) – Compliance and Scalability Phase: With tightening venture capital and clearer regulation, well-funded businesses are rushing to buy teams that can bring regulated places, payment infrastructure, zero-knowledge technical talents and account abstract primitives. Recent examples include Coinbase’s acquisition of BRD Wallet to strengthen its mobile wallet strategy and user guidance, and it also acquires FairX to accelerate its advancement into the derivatives sector.

Robinhood's acquisition of Bitstamp is aimed at expanding its business to other regions. Bitstamp has over 50 valid licenses and registration qualifications worldwide, which will bring Robinhood customers from the EU, the UK, the US and Asia. Stripe acquires OpenNode to deepen the cryptocurrency payment infrastructure.

Why did the acquirer acquire?

Some startups have been acquired for strategic motivation. When a acquirer initiates a transaction, they usually want to accelerate their own development roadmap, eliminate competitive threats, or expand to new user groups, technology areas or regions.

For the founders, becoming an acquisition target is not just to get returns, but more importantly, to achieve scale expansion and business continuity. A well-planned acquisition can bring teams greater distribution channels, long-term resource support, and the ability to integrate products into the wider ecosystem they are trying to improve. Rather than working on the next round of financing or transforming your business to seize the next wave, becoming the acquisition goal may be the most effective way to achieve the original mission of a startup.

Here is a framework that helps you evaluate how far your startup is from being a “suitable acquisition target.” Whether you are actively considering the acquisition path or just considering the possibility of being acquired when building your business, performing well on these parameters will significantly increase the likelihood that you are noticed by the right acquirer.

Four modes of cryptocurrency acquisition

While studying the major deals over the past few years, we found that these acquisitions have shown some obvious patterns in structure and execution. Each model represents a different strategic focus:

1. Talent acquisition

Vibe coding has emerged, but the team needs skilled coding people who can build products without relying on artificial intelligence. We are not yet at the point where we can let AI write code and use millions of dollars of funds with confidence. So, acquiring small startups to gain talent before they become a threat is indeed a reasonable reason for incumbent companies to acquire startups.

But from an economic perspective, why is talent acquisition reasonable? First, the acquirer will usually obtain relevant intellectual property rights, an ongoing product line, and existing user base and distribution channels. For example, when ConsenSys acquired Truffle Suite in 2020, it not only absorbed a development tool team, but also acquired key intellectual property rights such as Truffle’s development tool suite, including Truffle Boxes, Ganache and Drizzle.

Second, talent acquisition enables existing companies to quickly integrate professional teams, and the cost is often lower than the cost of building teams from scratch in a highly competitive talent market. As far as I know, there are only about 500 engineers who truly understand zero-knowledge technology in 2021. That's why it makes sense for Polygon to acquire Mir Protocol for $400 million and Hermez Network for $250 million. Assuming these talents are available, it may take years to hire these zero-knowledge cryptologists individually.

Instead, these acquisitions brought elite zero-knowledge researchers and engineers into Polygon’s team overnight, simplifying the recruitment and onboarding process at scale. The total cost of such acquisitions is economically efficient compared to recruitment, training and staffing time, especially when the acquired team is already launching the product.

When Coinbase acquired Agara for $40-50 million at the end of 2021, the deal was more about gaining engineering talent than customer service automation. Agara’s India-based team has deep expertise in artificial intelligence and natural language processing. After the acquisition was completed, many of these engineers were integrated into Coinbase’s product and machine learning teams to support its wider AI business.

While these acquisitions are based on technology, the real assets are talent: engineers, cryptologists and protocol designers who are able to realize Polygon’s vision for a zero-knowledge future. While the full integration and productization of these teams takes longer than expected, these acquisitions give Polygon a deep reserve of zero-knowledge technology talent, a resource advantage that still shapes its competitive strategy today.

2. Capacity/Ecosystem Expansion

Some strategic acquisitions focus on expanding ecosystem coverage or internal team capabilities. The positioning and market awareness of the acquisition company often help achieve this.

Coinbase is a great example of scaling capabilities through acquisitions. It acquired Xapo in 2019 to expand its hosting business. This sets the stage for Coinbase Custody to provide a secure, compliant storage solution for digital assets. The acquisition of Tagomi in 2020 prompted Coinbase to launch Coinbase Prime, a comprehensive suite of institutional transactions and custodial services. The acquisition of FairX in 2022 and the acquisition of Deribit in 2025 will help Coinbase consolidate its position in the U.S. and global derivatives markets respectively.

Take Jupiter's acquisition of Drip Haus in early 2025 as an example. Jupiter is the leading decentralized transaction aggregator on Solana, with the goal of expanding from the decentralized finance (DeFi) to the non-fungible token (NFT). Drip Haus has built a highly active on-chain audience by providing creators with free NFT collection distribution services on Solana.

Because Jupiter is closely linked to Solana’s infrastructure and developer ecosystem, it has unique insights into which cultural products are gaining attention. It sees Drip Haus as a key focus center, especially in the creator community.

Through the acquisition of Drip Haus, Jupiter gained a foothold in the creator economy and community-driven NFT distribution. This move enables it to extend NFT capabilities to a wider audience and to provide NFT as an incentive to traders and liquidity providers. It's not just about collectibles, it also involves the NFT channel that controls Solana's native attention. The expansion of this ecosystem marks Jupiter's first foray into the cultural and content sector, where it had no business yet. This is very similar to how Coinbase systematically establishes custodial, master brokerage, derivatives and asset management capabilities through acquisitions.

Source: Bloomberg

Another example is FalconX's acquisition of Arbelos Markets in April 2025. Arbelos is a professional trading company known for its expertise in structured derivatives and risk storage. These capabilities are crucial to serving agency customers. FalconX, a leading broker for institutional cryptocurrency funds, understands the volume of derivatives trading through Arbelos. This may lead it to believe that Arbelos is a high-value acquisition target.

By incorporating Arbelos into its portfolio, FalconX has enhanced its ability to price, hedge and risk management of complex encryption tools. The acquisition will help them upgrade their core infrastructure to attract and retain mature institutional funding flows.

3. Infrastructure Distribution

In addition to talent, ecosystem or users, some acquisitions revolve around infrastructure distribution. They embed a product into a wider stack to improve defense capabilities and market coverage. An obvious example is the acquisition of MyCrypto in 2021. While MetaMask is already the leading Ethereum wallet, MyCrypto brings user experience experiments, security tools, and a diverse group of users focused on advanced users and long-tail assets.

This acquisition is not a comprehensive rebranding or merger, and the two teams continue to develop in parallel. Ultimately, they incorporated the feature set of MyCrypto into the MetaMask code base. This strengthens MetaMask's market position and resists competition from more agile wallets by directly absorbing innovation.

These infrastructure-driven acquisitions aim to lock users at a critical level by improving the tool stack and protecting distribution channels.

4. User basic acquisition

Finally, there is the most direct strategy: to buy users. This is particularly evident in the competition in the NFT market, and the competition for collectors has become very fierce.

OpenSea acquired Gem in April 2022. At that time, Gem had about 15,000 active wallets per week. For OpenSea, the deal was a preemptive defense: locking in a high-value "professional" user base and accelerating the development of an advanced aggregator interface, which was later launched in the form of OpenSea Pro. In a highly competitive market, acquisitions are more cost-effective when speed is critical. The life cycle value of these users (LTV), especially the "professional" users who often spend huge amounts of money in the NFT field, are likely to justify the acquisition cost.

It makes sense when acquisitions are economically reasonable. According to industry benchmarks, the average revenue per NFT user in 2024 is $162. But Gem's core user group - "professional" users, may contribute several orders of magnitude higher. If the life cycle value of each user is conservatively estimated to be $10,000, then the value of these users means $150 million in value. If OpenSea acquires Gem for less than $150 million, the acquisition may have repaid from a user economy perspective alone, not to mention the savings in development time.

While user-centric acquisitions are not as compelling as talent- or technology-driven deals, they are still one of the fastest ways to consolidate network effects.

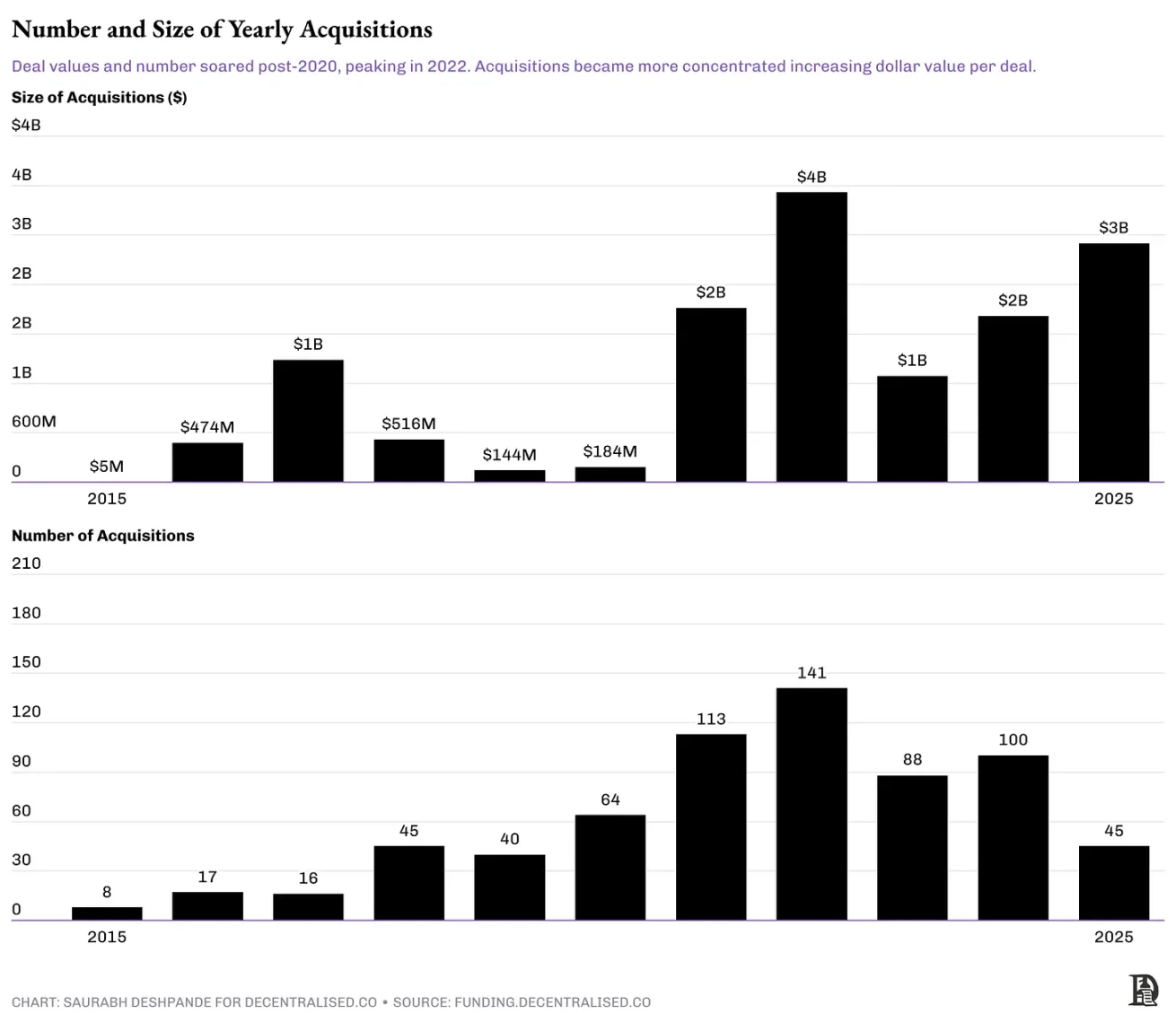

What does this data mean?

Here is a macro perspective of the evolution of cryptocurrency acquisitions over the past decade - divided by transaction volume, acquirer and target category.

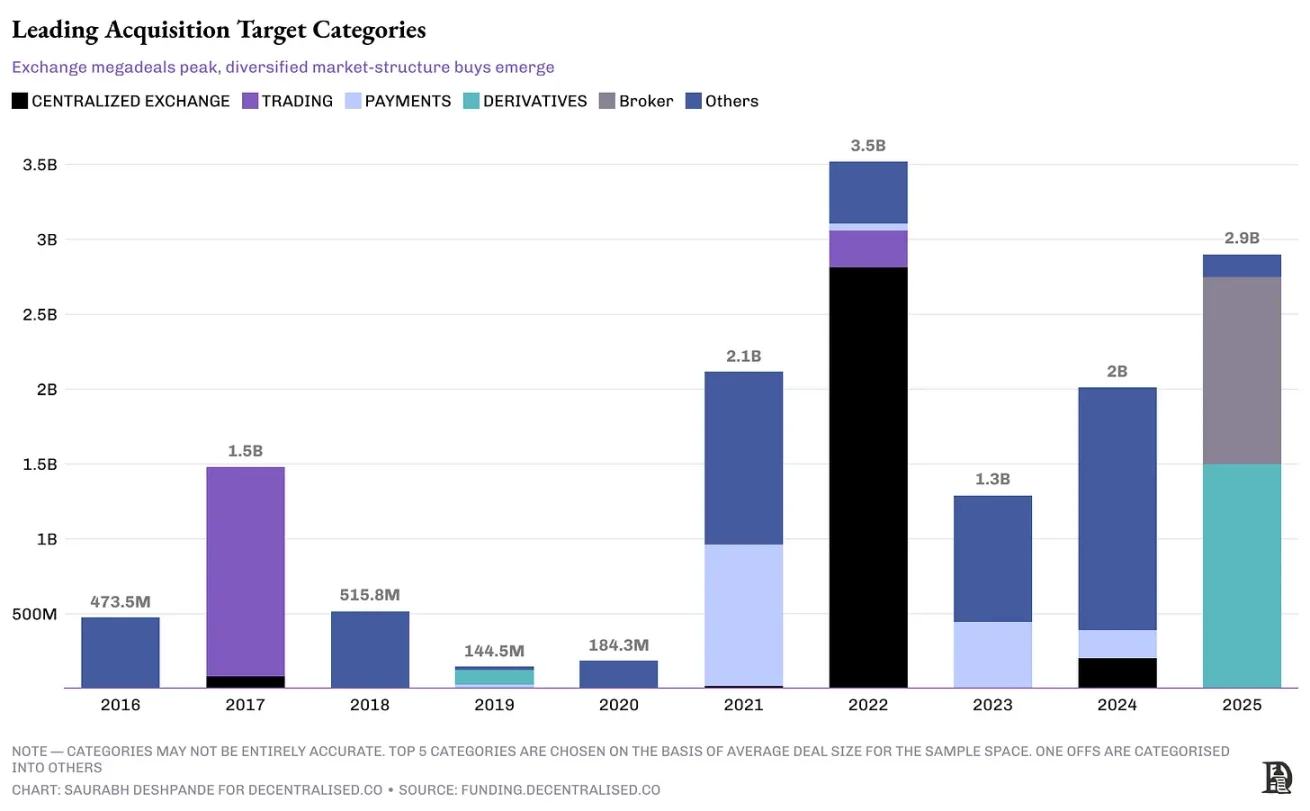

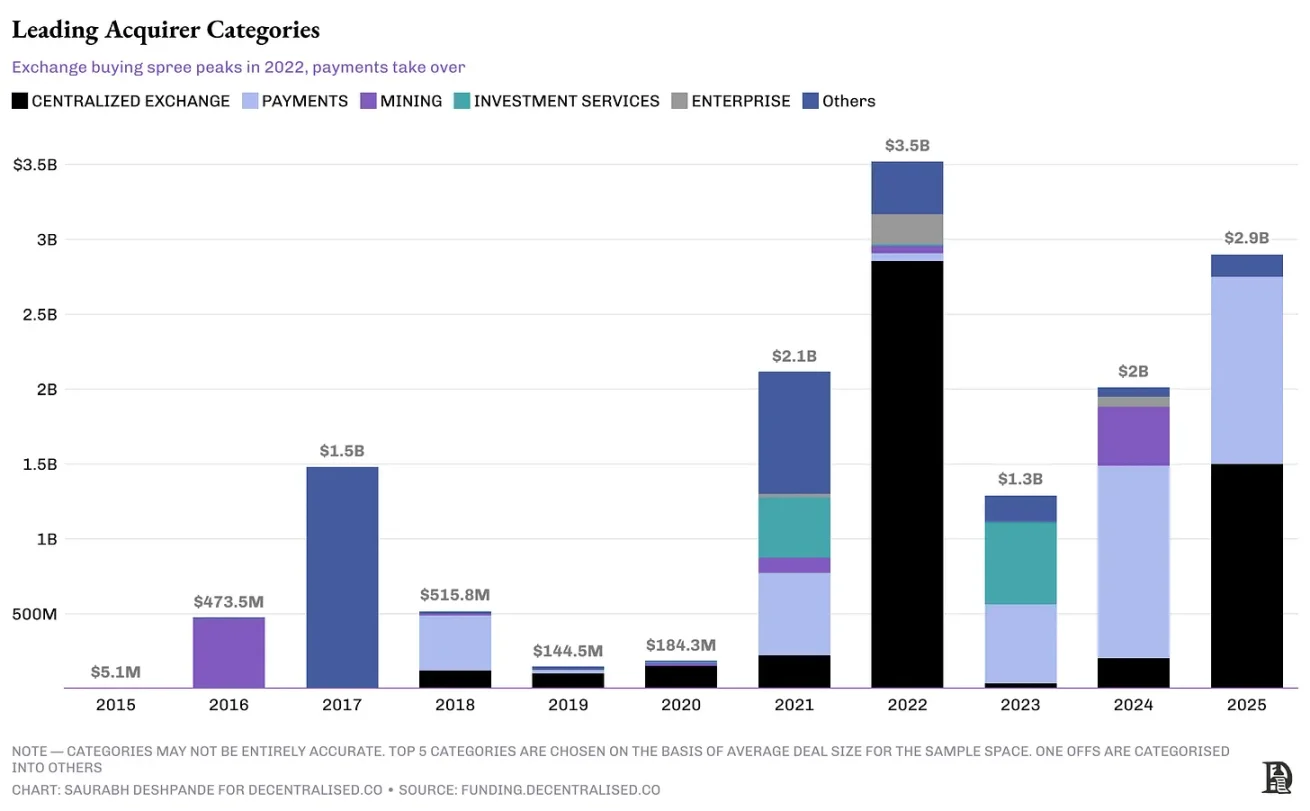

As mentioned earlier, the number of transactions is not exactly synchronized with the price trends in the open market. Bitcoin peaked in December during the 2017 cycle, but the merger wave continued in 2018. This time there was a similar lag. Bitcoin peaked in November 2021, but mergers and acquisitions in the cryptocurrency sector didn’t peak until 2022. Private markets respond slowly than liquid markets and usually delay digestion of market trends.

After 2020, M&A activity increased significantly, and peaked in 2022 in both quantity and cumulative value. But the trading volume does not tell the whole story. Although M&A activities cooled down in 2023, the scale and nature of M&A have changed. The widespread defensive acquisition boom is over, replaced by more cautious investments in categories. Interestingly, despite the decline in the number of mergers and acquisitions after 2022, the total transaction value in 2025 rebounded. This shows that the market is not shrinking, but that mature acquirers are conducting fewer, larger and more targeted transactions. The average transaction size increased from $25 million in 2022 to $64 million in 2025.

Coinbase transactions to Deribit are not counted on this chart

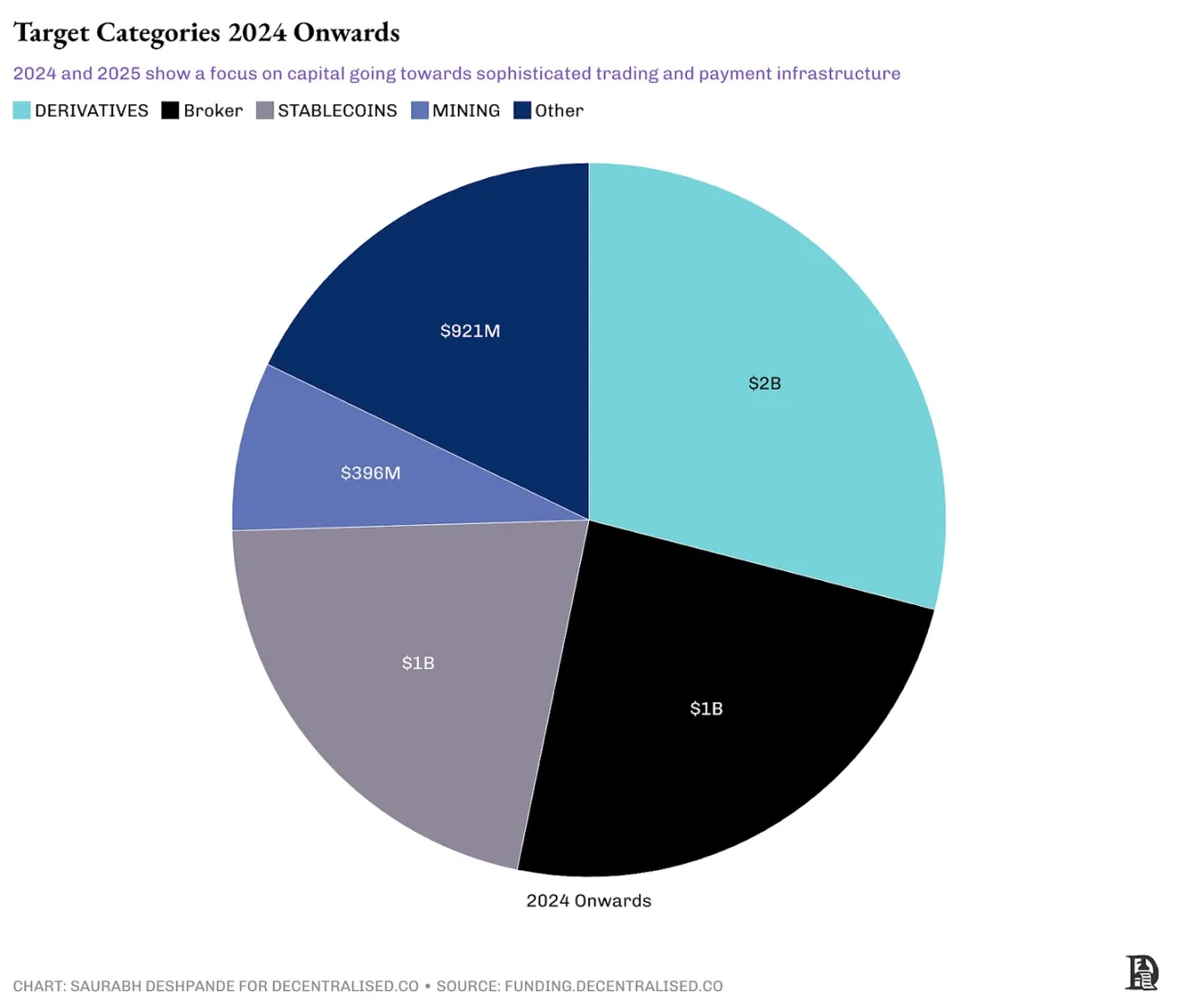

From the perspective of target categories, the early merger and acquisition targets were relatively scattered. The Marketing Platform acquires gaming assets, Rollup infrastructure, and a range of ecosystem investments covering early gaming, Layer 2 infrastructure and wallet integration. But over time, the target categories have become more concentrated. During the peak period of M&A in 2022, transactions focus on acquisitions of transaction infrastructure such as matching engines, custody systems and the front-end interface required to enhance the trading platform. Recently, mergers and acquisitions have focused on derivatives and user-oriented brokerage channels.

Coinbase transactions to Deribit are not counted on this chart

In-depth research on transactions from 2024 to 2025 can reveal that the concentration of mergers and acquisitions continues to increase. Derivative trading venues, brokerage channels and stablecoin issuers absorb more than 75% of disclosed transaction value. The U.S. Commodity Futures Trading Commission (CFTC) has made more clear on cryptocurrency futures rules, with MiCA providing passes for stablecoins, and Basel's guidance on reserve assets, reducing risks in these areas. The solution for giants such as Coinbase is to buy regulatory strongholds rather than build them on their own. NinjaTrader provides Kraken with the necessary licenses, as well as 2 million customers in the United States. Bitstamp provides MiCA-compliant transaction coverage, while OpenNode connects the US dollar stablecoin channel directly to Stripe's merchant network.

Coinbase transactions to Deribit are not counted on this chart

The acquirer is also constantly evolving. In 2021-2022, the exchange led the M&A trend by defending market share by acquiring infrastructure, wallets and liquidity layers. By 2023-2024, the baton will be passed on to payment companies and financial instrument platforms, targeting downstream products such as NFT channels, brokers and structured product infrastructure. But with the changes in regulation and insufficient services in the derivatives market, exchanges such as Coinbase and Robinhood have become acquirers again, acquiring derivatives and brokerage infrastructure.

One common feature of these acquirers is their abundant capital. By the end of 2024, Coinbase has over $9 billion in cash and cash equivalents. Kraken achieved operating profit of $454 million in 2024. Stripe has over $2 billion in free cash flow in 2024. By transaction value, most acquirers are profitable companies. Kraken acquired NinjaTrader to control the entire futures trading stack from the user interface to settlement, an example of a vertical acquisition with the aim of controlling more value chains. In contrast, horizontal acquisitions are designed to expand market coverage at the same level, and Robinhood’s acquisition of Bitstamp for expanded geographical coverage is an example. Stripe's acquisition of OpenNode combines vertical integration and horizontal expansion.

Coinbase transactions to Deribit are not counted on this chart

Remember the story of Google's acquisition of Android? Rather than focusing on short-term revenue, Google prioritized two things that simplified the entire mobile experience for hardware manufacturers and software creators. First, provide hardware manufacturers with a unified system for their adoption. This will eliminate the fragmentation problem that plagues mobile ecosystems. Second, a consistent software programming model is provided so that developers can create applications that run on all Android devices.

In the cryptocurrency space, you can see similar patterns. Incumbent companies that are well-funded are not just filling business gaps, but aim to strengthen their market position. As you dig into the latest acquisition cases, you will see a gradual strategic shift in the acquisition target and every aspect of acquisition. The point is that we see signs of maturity throughout the industry. Exchanges are consolidating their moats, payment companies are racing to control channels, miners are building their strength before the halving incident, and verticals like games, driven by hype have quietly disappeared from M&A records. The industry is beginning to understand which integrations actually produce a compound effect and which ones will only consume capital.

The gaming field is a good example. In 2021-2022, investors invested a total of billions of dollars to support game-related startups. But since then, the pace of investment has slowed significantly. As Arthur mentioned in our podcast, investors have lost interest in the gaming space unless there is a clear product market fit.

Source: funding.decentralised.co

This background makes it easier for us to understand why so many mergers and acquisitions have failed to achieve the expected results despite strategic intentions. It's not just about what was acquired, it also involves the quality of integration. While cryptocurrencies are unique in many ways, these problems cannot be avoided.

Why do mergers and acquisitions often fail

In the book "M&A Failure Trap", Baruch Lev and Feng Gu studied 40,000 M&A cases around the world and concluded that 70%-75% of M&A ended in failure. They attribute the failure to factors such as the target company being too large, the target valuation is too high, the core business-related acquisitions, weak target operations, and inconsistent executive incentives.

There have also been some failed mergers and acquisitions in the cryptocurrency field, and the above factors also apply here. Take FTX's $150 million acquisition of portfolio tracking application Blockfolio in 2020. At the time, the deal was advertised as a strategic move to convert Blockfolio's 6 million retail investors into FTX's trading users. Although the app was renamed to FTX App and briefly gained some attention, it failed to significantly increase retail trading volume.

Worse, when FTX collapsed in late 2022, the partnership with Blockfolio almost completely disappeared. The brand assets accumulated over the years have gone into nothing. This reminds us that even acquisitions with a strong user base may become silly due to the overall failure of the platform.

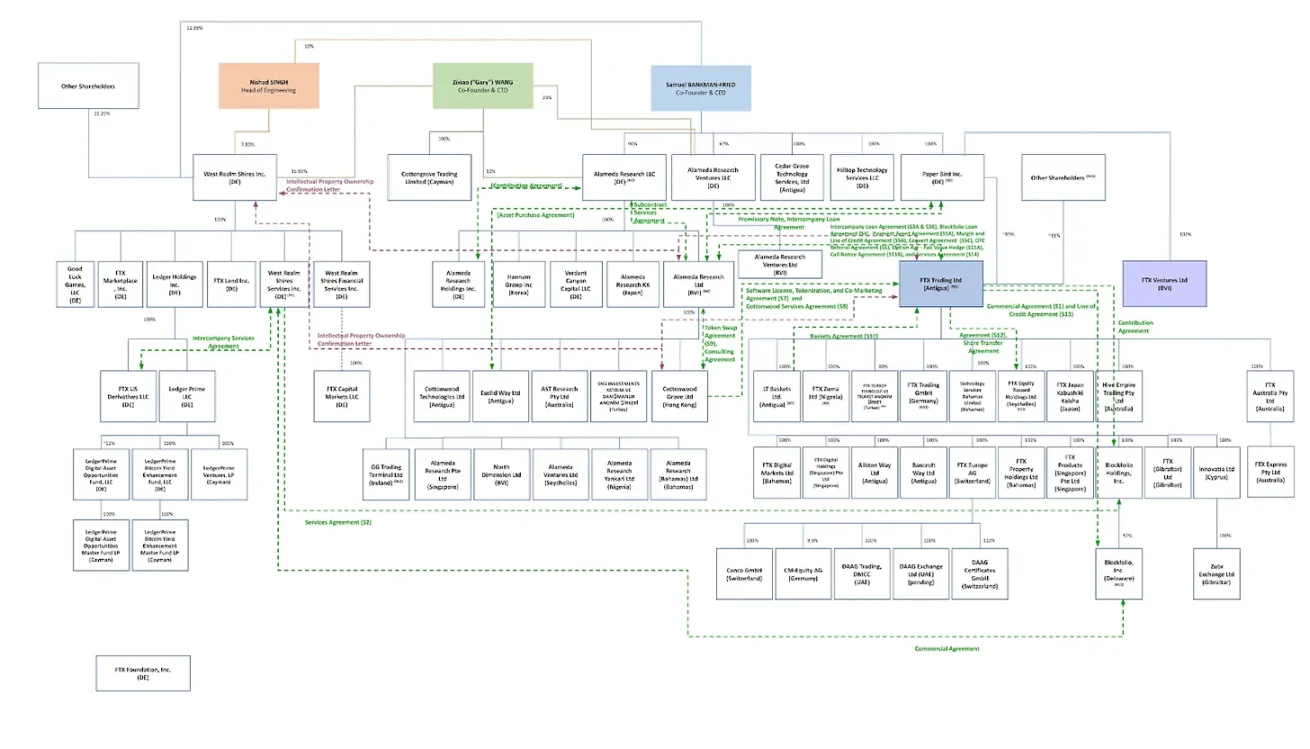

Many companies act too quickly and make mistakes when they acquire. The picture below shows how fast FTX is when it acquires, perhaps this speed is unnecessary. It obtains a license through acquisitions, and the following figure shows its after-acquisition company structure.

Source: Financial Times

Polygon is a prominent example of the risks of radical acquisition strategies. Between 2021 and 2022, it spent nearly $1 billion to acquire projects related to zero-knowledge proofs, such as Hermez and Mir Protocol. These moves were praised as visionary at the time. But two years later, these investments have not yet translated into meaningful user adoption or market dominance. Miden, one of its key zero-knowledge proof projects, eventually split into an independent company in 2024. Polygon, once at the center of cryptocurrency topics, has seen a significant decline in strategic relevance. Of course, these things often take time, but as of now, there is no substantial evidence of the return on investment for these acquisitions. Polygon’s acquisition boom reminds us that talent-driven acquisitions can fail even if they are well-funded, without the right timing, integration and clear downstream uses.

There are also failed acquisitions in the on-chain native DeFi field. In 2021, the merger and token swap between Fei Protocol and Rari Capital will be carried out and jointly governed under the newly formed Tribe DAO. In theory, the merger promises deeper liquidity, lending integration and collaboration between DAOs. But the combined entity soon fell into a governance dispute and encountered a costly Fuse market loophole, and eventually the DAO voted to return the funds to token holders.

Nevertheless, the cryptocurrency sector has more advantages than traditional industries in successful mergers and acquisitions for three reasons:

- Open source foundation means that technology integration is usually easier. When most of your code is already public, due diligence becomes more direct and there are fewer issues with merging codebases than merging proprietary systems.

- Token economics can create incentive alignment mechanisms that are incomparable to traditional equity, but only if the token has real utility and value capture capabilities. When the teams of the acquirer hold tokens for the merged entity, their incentives remain consistent for a long time after the transaction is completed.

- Community governance introduces a rare accountability mechanism in traditional mergers and acquisitions. When major changes must be approved by token holders, it becomes even more difficult to drive transactions based solely on executive arrogance.

So, where should we go next?

Built for acquisition

Today’s financing environment requires a pragmatic attitude. If you are a founder, your publicity should be not only "why should we raise funds" but also "why somebody might acquire us". Here are the three major drivers of the current cryptocurrency M&A field.

First of all, venture capital will be more accurate

The financing environment has changed. Venture capital has plummeted by more than 70% since its peak in 2021. Monad’s $225 million Series A financing and Babylon’s $70 million seed financing are individual cases and are not evidence of a market rebound. Most venture capital firms focus on companies that have momentum and clear business models. Investors become extremely selective as interest rates raise capital costs and most tokens fail to demonstrate sustainable value accumulation mechanisms.对于创始人来说,这意味着在考虑日益艰难的融资路径的同时,也必须考虑收购要约。

第二,战略杠杆

资金充裕的现有企业正在购买时间、分销渠道和防御能力。随着监管清晰度的提高,获得许可的实体成为明显的收购目标。但这种收购欲望不止于此。像Coinbase、Robinhood、Kraken 和Stripe 这样的公司正在进行收购,以便在新地区更快地进入市场,获得稳定的用户基础,或者将数年的基础设施建设压缩到一笔交易中。如果你构建的东西能够降低法律风险、加速合规进程,或者为收购方提供更清晰的盈利或声誉提升途径,那么你已经进入了收购方的考虑范围。

第三,分销和接口

基础设施中缺失的环节是将产品快速可靠地送达用户手中。关键在于收购那些能够解锁分销渠道、简化复杂性并缩短产品与市场契合时间的部分。Stripe 收购OpenNode 以简化加密货币支付流程。Jupiter 收购DRiP Haus,将NFT 分发功能添加到其流动性堆栈中。FalconX 收购Arbelos 以添加机构级结构化产品,这可能使其更容易服务于不同的客户群体。这些都是旨在扩大覆盖范围并减少运营阻力的基础设施战略。如果你构建的东西能够让其他公司发展得更快、覆盖范围更广或服务更好,那么你就在收购方的候选名单上。

This is an era of strategic withdrawal.打造你的公司时,要考虑到你的未来取决于别人是否想拥有你所创造的东西。

jinse

jinse