Abandon the fantasy, the full copycat season will not come again

Reprinted from panewslab

04/08/2025·1MIn 2025, the crypto market is like a deserted morning after a feast. Altcoins

- tokens that once ignited the wealth dreams of countless investors, are quietly losing their former halo. The ICO boom in 2017, the DeFi and NFT fanatics in 2021, the altcoin once wrote the glory of the "Proverb Season" with the legend of a hundred-fold increase. However, today's market is beyond recognition, with narrative exhaustion, value collapse and liquidity crisis completely overturning the bull market feast of altcoins. Will the copycat season come again? The answer may be no. So in the next cycle, how can we grasp the possible local market conditions?

The Dream of the Copyright Season: From Fever to Cold Reality

Altcoin was once the most dazzling star in the crypto market. In 2017, the ICO boom swept the world, and countless projects made money through token issuance. Investors flocked to the market like gold diggers, eager to seize the "next Bitcoin". Tokens such as Ethereum and EOS soared overnight, and their market value increased dozens of times. By 2021, DeFi and NFT have become new trends, with DeFi tokens such as Uniswap and Aave, which have seen amazing increases. The token AXS of the NFT project Axie Infinity soaring from US$1 to US$160, and the total market value of altcoins once exceeded US$1 trillion. It was a fanatical era, and retail investors were intoxicated by the dream of "100 times of coins", and the copycat season seemed to be endless.

However, the altcoin market in 2025 is already deserted. The Altcoin Season Index fell to a new low of 16, indicating that the overall performance of the altcoin has fallen to the bottom. Market analysts pointed out that according to the logic of end acceleration, the next quarter may be a critical period for altcoins to find the bottom. The former fanaticism has faded, and investors' confidence in altcoins has almost collapsed, and even leading altcoins like Ethereum have not been spared. The fantasy of the copycat season is shattering in the cold reality.

Why is the copycat season unsustainable? The answer lies in the essential dilemma of altcoins. Many tokens lack actual value and contribute little to the real society compared to Web2 companies with the same market capitalization. For example, some Meme coins have market capitalizations of up to billions of dollars, but their technical value is almost zero; while SaaS companies with the same market capitalization often have a stable income and user base, creating actual value for society. Blockchain technology has been born for more than ten years, but altcoins have rarely been applied. Metaverse projects such as Decentraland were once highly expected, but their virtual world users were few and difficult to convert into sustainable value. Altcoins with collapsed value are the first to be hit in the bear market, and investors are gradually turning to Bitcoin and a few leading projects, leaving the altcoins with increasingly narrow living space.

Narrative exhaustion and incremental shrinkage: from national fanaticism

to deserted stock

The fuel of the copycat season is inseparable from the injection of new narratives and new funds. In 2017, the narrative of the "blockchain revolution" made the ICO craze swept the world; in 2021, the hot words of DeFi and NFT ignited market enthusiasm, retail investors flocked to the market, and funds pushed up the token price like a flood. However, the altcoin market in 2025 has lost the magic of narrative and the torrent of funds has dried up.

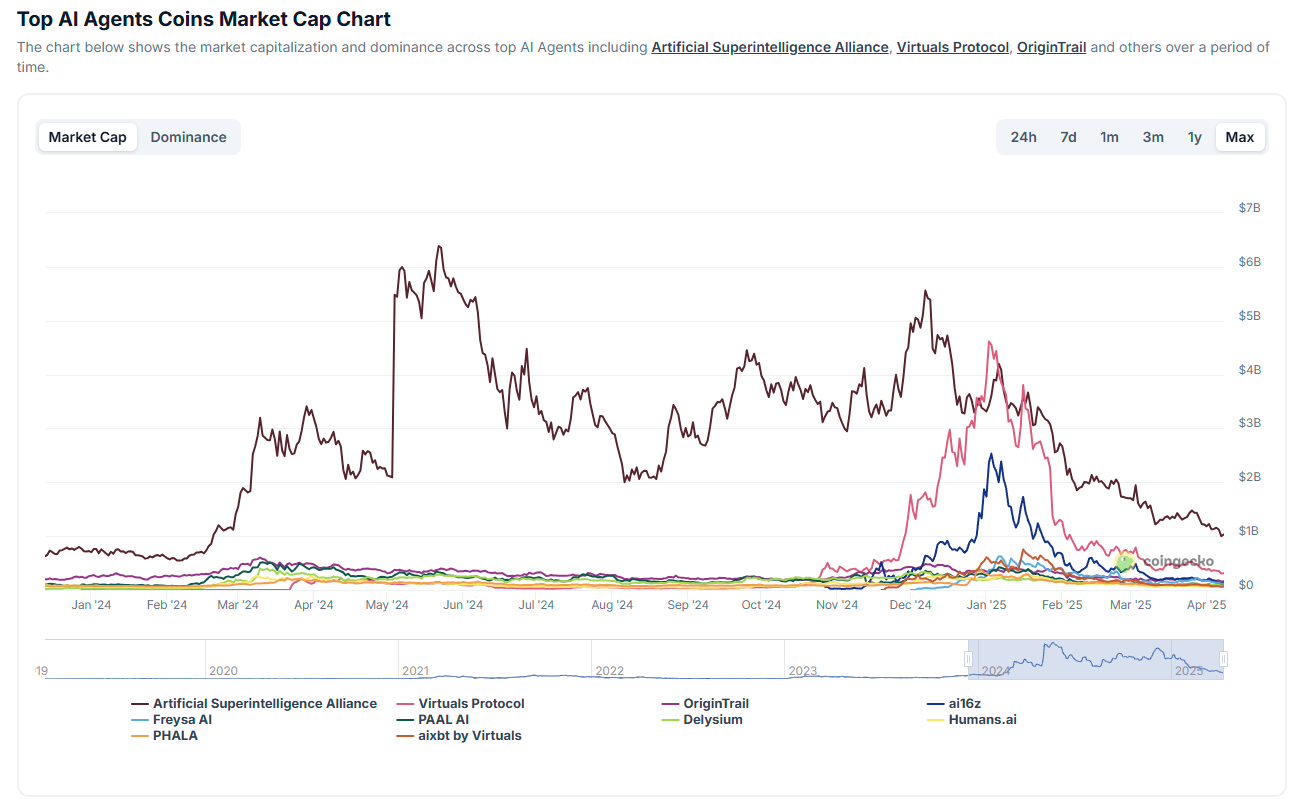

First, narrative exhaustion has left the altcoin attractiveness. The DeFi boom has long cooled down, and many projects have lost trust due to high returns and frequent hacker attacks (such as cross-chain bridge vulnerabilities). The NFT market has also cooled down, with trading volume falling from billions of dollars in 2021 to the bottom. The once-popular NFT tokens such as AXS are now falling back below $5. Although new narratives such as the metaverse and AI tokens have been tried, it is difficult to form a market consensus, which is far from enough to ignite a full-scale bull market. What’s even more fatal is that blockchain technology has not yet created killer applications. After losing the halo of “subverting traditions”, it is difficult for altcoins to attract new players to enter the market.

Secondly, the market has shifted from "incremental" to "inventory". The early crypto market was like an uncultivated wasteland, with few projects and concentrated funds, and retail investors flocked to push up market value. Today, the number of crypto projects has surged to tens of thousands, but the total market value and retail investors' attention are seriously divided. The deterioration of the global economic environment further worsens: high interest rate policies compress the valuation of risky assets, geopolitical risks intensify, investors tend to hold cash or gold, and speculative demand for altcoins shrinks significantly. Losing the injection of new funds, the engine of the copycat season has been shut down.

The divergence of the original intention of decentralization: Bitcoin is

the leader

The original intention of blockchain is decentralization, but many altcoin projects go against each other. Some public chains sacrifice decentralization in pursuit of performance, and centralized exchange tokens rely more on platform policies rather than community consensus. This divergence makes the consensus on altcoins look like a flash in the pan, and investor confidence is difficult to last. For example, in the 2022 LUNA/UST crash, the centralized algorithmic stablecoin returned to zero overnight, and investors lost tens of billions of dollars. Similar events are common among small altcoins, seriously damaging market trust.

In contrast, Bitcoin, as the source of blockchain, is highly decentralized (without a single control point, miners distributed around the world) making it an irreplaceable existence. In 2025, Bitcoin's market share has reached nearly 60% (historical trend speculation). BitMEX founder Arthur Hayes bluntly stated on social media: "Shitcoins are getting in our strike zone, but I think #bitcoin dominance keeps zooming towards 70%. Institutional investors also prefer Bitcoin, which is regarded as "digital gold" and has become the first choice for safe-haven assets. If Bitcoin's market share soars to 70%, the living space of altcoins will be further compressed, and the possibility of a return of the copycat season is slim.

Liquidity Crisis and Public Chain Decline: Survival Dilemma in the Shadow

of Ghost Town

Another fatal injury to altcoins is the severance of liquidity. In 2025, the liquidity of the crypto market was concentrated in a few public chains, such as Ethereum, Solana, and BNB Chain. The transaction volume and developer activity of small public chains have dropped significantly. For example, EOS once reached billions of dollars in TVL in 2018, but now it is less than $100 million, almost becoming a "ghost chain". The reason for the decline of public chains is: lack of ecological appeal and it is difficult to attract DApp developers; slow integration of cross-chain technology; Layer 2 diverts the main chain transaction volume. In the future, more than 90% of public chains may become "ghost cities", and the living environment of altcoins will become increasingly harsh.

What’s even more dangerous is that altcoins that lose liquidity should not be bought at the bottom. There is a saying in the market: "A 90% drop can be another 90%. Take LUNA as an example, it fell from its peak of US$120 in 2022 to US$0.0001, a drop of more than 99.9%. Similar fates abound among small altcoins. If investors blindly buy at the bottom, they may lose all their money. The liquidity crisis is like an invisible shackle, trapping altcoins firmly in the abyss.

The glimmer of light breaking through the darkness

The full return of the copycat season may have become history, but in the next cycle, altcoins are not without opportunities. Even if the market is generally sluggish, some tracks and projects may still stand out with unique narratives, practical applications or strong community support, becoming the highlight of local breakthroughs. The following are three types of altcoins that may maintain high market capitalization in the next cycle, which are worthy of investors' attention.

1. New project of strong narrative: the ignition point of igniting market enthusiasm

The explosion of altcoins is often inseparable from a narrative that can "become out of the circle". This narrative can quickly attract new funds and new users to enter the market and ignite market enthusiasm. The NFT craze and meta-universe concept in 2021 are typical cases: NFT project Axie Infinity has attracted millions of players through the "playing while earning" model, and its token AXS soared from $1 to $160; meta-universe projects such as Decentraland have once become the focus of the concept of "virtual real estate".

During this cycle, AI Agent tokens and Meme coins showed similar potential. AI Agent tokens (such as AI16Z, Fetch.AI) benefited from the artificial intelligence boom and attracted a lot of attention; Meme coins are spread through social media, which is in line with the logic of "attention economy". However, it is difficult to escape the end of most tokens returning to zero. What we can learn is that if a similar strong narrative track appears, it may still become the trigger point of the next cycle, driving capital inflows, but please remember to escape.

2. Practical application projects: the stable cornerstone of DeFi, RWA, and stablecoins

After the speculation craze fades, projects that have real practical applications and revenue will become the mainstay of the altcoin market. The DeFi track is still the core. For example, Uniswap and Aave continue to attract users and funds with stable transaction volume and fee income; RWA (real world asset) tokens have opened up the connection channel between blockchain and traditional finance by putting real estate, bonds and other assets on the chain, and projects such as Ondo Finance have begun to take shape. The stablecoin track has unlimited potential, and the payment demand for USDT and USDC continues to grow. The stablecoin bill that may be passed in 2025 (requiring full mortgage of US dollars or US bonds) will further consolidate the hegemony of the US dollar and promote the expansion of the stablecoin ecosystem. Projects such as Circle (USDC issuer) may become new hot topics due to favorable policies. These tracks are expected to grow steadily in the next cycle due to their real demand and revenue sources.

3. Strongzhuang or ground promotion project: a community-driven traffic engine

Projects with strong community strength and ground promotion capabilities often maintain high market value when the market is sluggish. Through large-scale ground promotion in South Korea and other places, XRP has accumulated a huge user base, and its market value has been at the forefront for a long time; Pi Network has attracted tens of millions of users to participate in mining through social fission mode, forming a strong community consensus; Cardano (ADA) has established extensive grassroots support through educational projects in Africa. Although these projects may not be outstanding in technical value, with their strong community drive and traffic engine, they have the opportunity to attract financial attention in the next cycle and become the highlight of local market conditions.

Next cycle operation guide

The glory of the copycat season has passed, but the next cycle is not without opportunities.

Source: @CryptoPainter_X

Even if the exchange rate of altcoin market value against BTC is still in a short trend, with only 23% of the space left before the lower edge of the range, the next quarter may be a key window for bottoming out. Through long-term observation, senior traders have summarized a set of strategies to capture the glimmer of altcoins. Investors may wish to try:

Step 1: Analyze the general trend and grasp the macro trend

The rebound of altcoins is inseparable from the cooperation of the macro environment. The first task is to observe global liquidity and the trend of the US dollar: if the US dollar enters a weak cycle, global liquidity is loose, risky assets may rebound, and altcoins may have local opportunities; on the contrary, if the US dollar continues to be strong and liquidity tightens, the pressure on altcoins will be further intensified. In 2025, the global economy will still be affected by high interest rates and geopolitical risks, and investors need to pay close attention to the Fed's policy trends.

Step 2: Select carefully and lock in potential new stars

In the altcoin market, optimizing items is key. Focus on new projects that have been established for about one year and have initially gained a foothold, and avoid the newly launched high-risk tokens. Don't be confused by the token's dollar price, but focus on its exchange rate performance against BTC. At the end of the current decline in the altcoin market value exchange rate, select varieties that are resistant to declines or stable performance. These items are often more resilient and may become dark horses in the next cycle.

Step 3: Dig deep into the track and find the celebrity field

The selected projects are not the end point, and the next step is to analyze the track potential behind them. The explosion of altcoins often relies on track narratives, such as AI, RWA, stablecoins, etc. Find the areas with the most intersection of multiple projects and evaluate whether they have the potential to become the next bull market star track. The key lies in the liquidity sensitivity and actual demand of the track: AI tokens may rise due to technological breakthroughs, RWA tokens are stable due to actual assets being put on the chain, and stablecoins may become the focus due to policy favorable policies (such as the 2025 Stablecoin Act).

Step 4: Make steady progress and build positions patiently

After selecting the track, adopt the strategy of building positions in batches. It takes 6 months to gradually establish spot positions in the target track, accounting for 60% of the total funds. You can choose to invest at a fixed time, or buy in batches when the price falls below the key support, such as investing 10% of the position at each time. The altcoins have high volatility, and patience is the key. After building a position, you can wait for the market to recover.

Step 5: Dynamic optimization, rolling adjustment strategy

The altcoin market is changing rapidly, and the track and project performance need to be re-evaluated every quarter. Continue to screen new projects, analyze track trends, and adjust position configuration until the spot position reaches the target proportion. Rolling adjustments can help investors seize market changes and avoid missing new opportunities.

Step 6: Wait for the flowers to bloom and lock in profits to leave the market

The cyclical fluctuations of altcoins take time, and investors need to learn to be friendly with time. When the altcoin market value exchange rate pair returns to the high range, it may be a bull market signal. At this time, use one quarter to gradually clear the position and lock in profits. Although the copycat season will not come again, the glimmer of local market conditions is still worthy of capturing.

Conclusion: The rules of survival of altcoins

The glory of the Copyright Season has become a past event, and the exhaustion of narratives, collapse of value, and liquidity crisis have made a comprehensive bull market a luxury. Bitcoin's market share may soar to 70%, dominating the stock game market. Investors should give priority to the layout of leading public chain tokens such as Ethereum and Solana, pay attention to the stablecoin track, and be cautious in participating in narrative projects such as AI and Meme. Do not buy the bottom of altcoins that have lost liquidity, a 90% drop may just be the beginning. In the next cycle, the glimmer of altcoins is hidden in practical applications and strong narrative tracks. Only by rational operation can we find vitality in the cold winter.

chaincatcher

chaincatcher