a16z: Recapitating key events of traditional finance embracing stablecoins in recent times

Reprinted from chaincatcher

05/12/2025·26DAuthor: a16zcrypto

Compiled by: TechFlow

We have mentioned many times that stablecoins are gradually disrupting the payment industry. Looking back at the past month, many top payment companies around the world have finally begun to turn their attention to this trend. In just six weeks, we have seen a series of important events: Circle, the issuer of USDC, submitted an application for listing on the New York Stock Exchange; Coinbase launched the stablecoin API payment standard, officially entering the field of proxy payments; Visa and Mastercard further strengthened their support for stablecoins; Stripe released a series of new features, including stablecoin account balance, programmable stablecoins, and payment cards that support stablecoins.

There is a common core behind these events: meeting user needs. It can be considered as the "Skype moment" in the payments space. Looking back in 2003, Skype introduced a disruptive feature that allows users to make landline calls for a lower fee through their computers. However, as more and more people join the digital calling network, people eventually abandoned traditional calls completely and turned to WhatsApp calls based on the internet. This marks a seamless transition from landline telephones to mobile communications to Internet-based voice and data connectivity.

Similarly, connecting stablecoins with traditional payment systems allows more people to reach and use stablecoins, even if they still need to rely on compatible features provided by traditional payment companies. As individuals and enterprises gradually adopt stablecoins through existing products, new opportunities will also emerge - stablecoins will be widely used in self-custody, shopping, remittance, DeFi and other scenarios.

Here are the key event timelines over the past six weeks and their significance in the larger picture:

May 7 and 8: Stripe launches stablecoin financial accounts

Stripe announced the launch of a "stablecoin financial account", allowing corporate users to hold account balances in stablecoins in 101 countries. In addition, they have released USDB, a programmable stablecoin that developers can embed into their applications and receive rewards by building the USDB ecosystem.

Why is it important?

Stripe promotes the popularization of stablecoins by directly building incentive mechanisms at the stablecoin level and tries to control more payment ecosystems. Stablecoin financial accounts allow Stripe to bypass the complex processes and high fees of traditional banks and compete directly with banks and card networks. The number of countries supported also expanded from 46 to 101. USDB may become the default stablecoin for Stripe products, providing it with more ways to monetize payments.

These initiatives allow Stripe to leverage neutral blockchain infrastructure rather than traditional card networks to offer lower-priced, more customized, more coverage and more profitable products.

May 7: MoneyGram launches "MoneyGram Ramps"

MoneyGram has released the “MoneyGram Ramps,” a cash deposit and withdrawal channel that supports stablecoins, covering more than 170 countries.

Why is it important?

Stablecoins have found certain market fits in emerging markets, especially in areas with strong remittance demand. However, it is still very difficult to convert between stablecoins and cash, which remains a widely used payment method in many markets. MoneyGram has a global cash network, providing a new way for stablecoins to interoperate with daily consumption and spending.

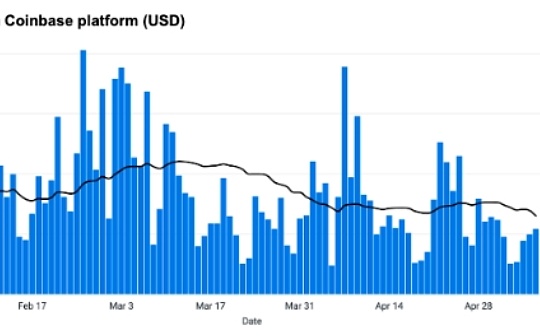

May 6: Coinbase releases x402 payment standard

Coinbase has launched x402, a stablecoin payment standard designed for Internet native payments, designed to enable atomic transactions between APIs, applications and AI agents.

Why is it important?

You may not know that Visa can't handle payments less than 1 cent. The future "agent payment" - that is, transactions executed by independent software agents on behalf of users - require programmable currency to achieve. If we want these agents to be able to buy goods or services for us, stablecoins will be ideal.

Companies such as Stripe and Visa are all exploring their own proxy payment solutions, and stablecoins are favored for their trusted, neutral and decentralized platforms. In contrast, decentralized protocols do not have high fees, and in the long run, stablecoins may be the most economical option. The x402 standard integrates stablecoin settlement, intent-based payments and compliance into one specification, far exceeding Visa and SWIFT in terms of speed, composition and programmability.

May 6: Visa reaches strategic cooperation with BVNK

Visa announces a strategic partnership with BVNK, a stablecoin payment infrastructure company.

Why is it important?

This collaboration by Visa can be seen as a bet on the stablecoin payment infrastructure, directly involved in the payment track that could disrupt its existing business model. By partnering with BVNK, Visa can not only fight Stripe's growing stablecoin payment products, but also gain a place in the future payment ecosystem.

Visa's strategy is very clever: other traditional payment companies are expected to follow suit, otherwise they may be left behind by startups that dominate stablecoin payments.

April 28 and 30: Mastercard and Visa launch stablecoin payment products

On April 28, Mastercard announced that it will cooperate with Circle, OKX, Paxos and other exchanges and wallets to launch a wider integration of stablecoin, allowing consumers to consume stablecoin balances through Mastercard cards. At the same time, merchants can also directly settle fiat card payments to USDC.

Two days later, Visa announced a partnership with Stripe-backed Bridge to allow fintech developers to issue Visa cards pegged to stablecoins, allowing users to pay with stablecoin balances at fiat currency points through the Visa network.

Why is it important?

These products significantly lower the threshold for users to adopt stablecoins through integration with existing payment systems. Users do not need to worry about whether the merchant supports stablecoin payments, they can complete the payment by using the bound Visa or Mastercard card.

Although stablecoin cards achieve compatibility with traditional payment infrastructure, merchants may prefer to accept stablecoin payments directly in the future to avoid high card swipe fees. At the same time, entrepreneurs will also develop more new products to make stablecoins a more preferred payment method.

April 23: PayPal announces 3.7% yield

PayPal announced that from 2025, US users will receive a 3.7% return on PYUSD holdings in PayPal or Venmo balances.

Why is it important?

PayPal wants to attract more deposits, even if these deposits may be in MetaMask. By providing yield, they incentivize users to purchase and hold stablecoins within their platform, while PYUSD’s use outside the platform can also bring more benefits to PayPal. Yield rate is just the first step, and there may be more measures to drive PYUSD transaction volume and integration in the future.

April 21: Circle launches Circle Payments Network

Circle announced a partnership with several global banks and stablecoin startups to launch the Circle Payments Network to improve international payments.

Why is it important?

Circle directly challenges SWIFT and traditional banking networks to try to replace its inefficient messaging services and payment processes. If this move is successful, it will completely change the pattern of international payments.

April 1: Circle applies for listing

Circle filed an application for listing on the New York Stock Exchange, which marked further recognition of the legitimacy of stablecoin payments.

Summarize

Traditional payment companies not only recognize the value of stablecoins, but are also actively building critical infrastructure that enables stablecoins to be compatible with existing payment systems, thereby accelerating their popularity. Although these products look similar to traditional payment methods in the near term, they are actually laying the foundation for a completely new on-chain economy.

In the future, we will see more people using stablecoins through traditional payment methods, and infrastructure improvements launched this year will further promote users to adopt stablecoins directly. As the integration of stablecoins becomes simpler and more intuitive, the network effect will also emerge: more entrepreneurs will develop a series of innovative products based on stablecoins that can only be achieved in an almost instant and almost free programmable currency environment.

panewslab

panewslab

jinse

jinse