A new investment legend, detailed explanation of micro-strategy Bitcoin strategy

Reprinted from panewslab

12/31/2024·4MAuthor: 0xCousin

There is no shortage of legends in the history of Wall Street, but the strategic transformation of MicroStrategy Bitcoin Treasury Company is destined to become a unique new legend.

A Bitcoin strategy that attracted global attention

In 2020, the COVID-19 epidemic triggered a global liquidity crisis, and countries adopted loose monetary policies to stimulate the economy, leading to currency depreciation and increased inflation risks.

Michael Saylor re-evaluates the value of Bitcoin during the coronavirus pandemic. He believes that when the money supply is growing at 15% per year, people need a safe haven asset that is not tied to fiat cash flows. Therefore, he chose a Bitcoin strategy for MicroStrategy.

Compared with the BTC ETF or other Spot Bitcoin ETPs launched by companies such as BlackRock, MicroStrategy's Bitcoin strategy is more aggressive. It purchases Bitcoin through the company's idle funds, issuance of convertible bonds, additional share issuance and other financing methods. The company itself obtains the potential income from the rise of Bitcoin while bearing the potential risk of the fall of Bitcoin, while ETF/ETPs focus more on price tracking. .

MicroStrategy’s Funding Sources and Bitcoin Buying Journey

There are four main ways MicroStrategy raises funds to buy Bitcoin.

1. Use your own funds to purchase

For the first three investments, the micro-strategy is to invest the idle funds in the book into purchases. In August 2020, MicroStrategy spent US$250 million to buy 21,400 Bitcoins; in September, it invested US$175 million to buy 16,796 Bitcoins; in December, it invested US$50 million to buy 2,574 Bitcoins.

2. Issuance of convertible senior notes (Convertible Senior Notes)

In order to purchase more Bitcoins, MicroStrategy began to issue convertible bonds to finance the purchase of coins.

A convertible senior bond is a financial instrument that allows investors to convert the bond into company stock under certain conditions. Such bonds feature low, or even zero, interest rates while setting a conversion price that is higher than the current stock price. Investors are willing to buy such bonds primarily because they offer downside protection (i.e., principal and interest will be collected at maturity) as well as potential gains if stock prices rise. The interest rates of several convertible bonds issued by MicroStrategy are mostly between 0% and 0.75%, which shows that investors are actually confident in the rise of MSTR's stock price and hope to earn more income by converting the bonds into stocks.

3. Issuance of Senior Secured Notes

In addition to the convertible senior bonds, MicroStrategy also issued a US$489 million senior secured bond due in 2028 with an interest rate of 6.125%.

Senior secured bonds are secured bonds with lower risk than convertible senior bonds, but these bonds only have a fixed interest rate. This batch of priority guaranteed bonds issued by MicroStrategy has chosen to be repaid in advance.

4. At-the-Market Equity Offerings

As MicroStrategy's Bitcoin strategy began to bear fruit, MSTR's stock price continued to rise, and MicroStrategy adopted more market-priced stock issuances to raise funds. Funding obtained this way is lower risk because it is not debt, there is no pressure to repay, and there is no foreseeable repayment date.

MicroStrategy has signed open market sales agreements with agency structures such as Jefferies, Cowen and Company LLC and BTIG LLC. Pursuant to these agreements, MicroStrategy may, from time to time, issue and sell Class A common shares through these agents. This is what the industry calls an ATM.

Market-priced stock issuance is more flexible, and micro-strategies can choose the timing of selling new shares based on secondary market conditions. Since the issuance of shares dilutes the equity of existing shareholders, its correlation with the price of Bitcoin and the increase in the currency content of each share of MSTR have led to complex market reactions to this move, and the overall stock price of MSTR has shown high volatility.

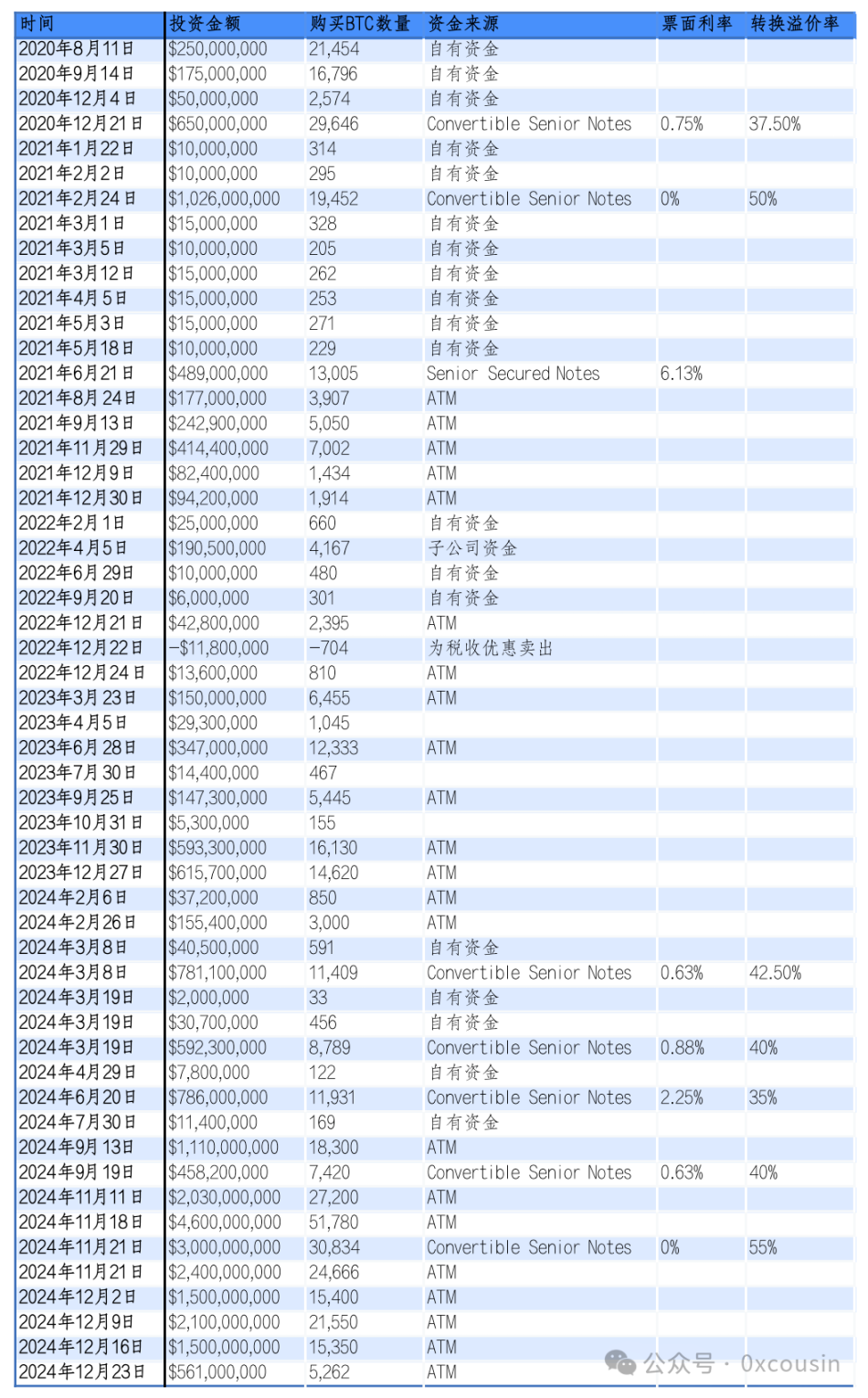

MicroStrategy’s process of purchasing Bitcoin through the above four methods is as follows:

Produced by:IOBC Capital

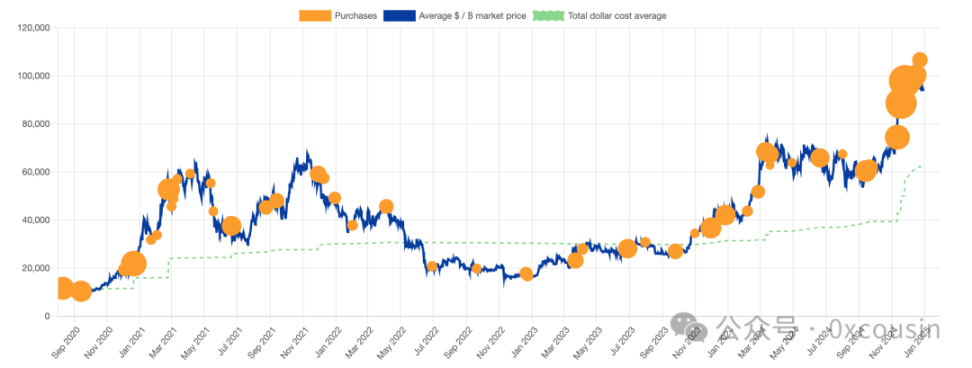

Corresponding to the price chart of BTC, MicroStrategy’s specific purchase history is as follows:

Source: bitcointreasuries.net

As of December 30, 2024, MicroStrategy had invested a total of approximately US$27.7 billion and purchased 444,262 Bitcoins, with an average position price of US$62,257 per coin.

Several key questions about buying Bitcoin with micro-strategy "Smart

Leverage"

There is a lot of controversy in the market about MicroStrategy's "Intelligent Leverage" strategy for buying Bitcoin. Let me share my thoughts on several key issues hotly discussed in the market:

1. Is the leverage risk of MSTR high?

Let me start with the conclusion, which is not too high.

According to the information disclosed by MSTR in the Q3 2024 earnings call, MSTR's total assets at that time were approximately US$8.344 billion, because the carrying value of Bitcoin in this financial report was only US$6.85 billion (there were only 252,220 coins at the time, based on 27,160 Price statistics in U.S. dollars). Total debt is approximately US$4.57 billion, so the corresponding debt-to-equity ratio is 1.21.

We will not discuss this accounting standard, but only consider the data at the time of actual sale, which reflects the latest market price. If calculated based on the latest market price of Bitcoin on September 30, 2024 ($63,560), the actual market value of MSTR's Bitcoin holdings is $16.03 billion, and the corresponding MSTR debt-to-equity ratio is only 0.35.

Let's look at the data as of December 30, 2024.

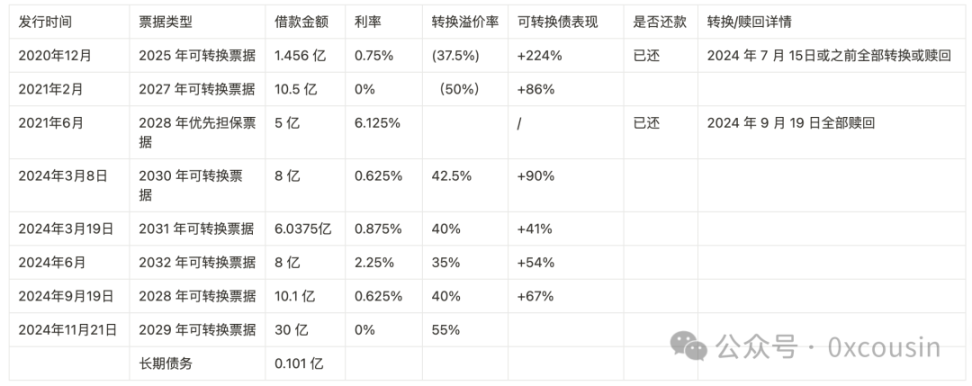

As of December 30, 2024, MicroStrategy's total outstanding liabilities were $7,273.85 million, as follows:

Produced by:IOBC Capital

As of December 30, 2024, MicroStrategy held 444,262 Bitcoins, worth $42.25 billion. Assuming that the assets of other parts of MicroStrategy remain unchanged (ie, $1.49 billion), then MSTR's total assets are $43.74 billion and liabilities are $7,273.85 million. At this time, MSTR's debt-to-equity ratio is only 0.208.

Let’s take a look at the debt-to-equity ratios of the top listed companies in the U.S.—Alphabet 0.05, Titter 0.7, Meta 0.1, The Goldman Sachs Group 2.5, JPMorgan Chase & Co. 1.5.

MicroStrategy is a company that has transitioned from the software industry to the financial industry, and its debt-to-equity ratio is still healthy.

**2. Under what circumstances will these convertible bonds become

unbearable in the future?**

Let’s talk about the conclusion first. If MicroStrategy does not continue to issue convertible bonds later, and Bitcoin falls below $16,364 for a long time, the value of MicroStrategy’s 444,262 Bitcoins will be lower than its total convertible bonds of $7.27 billion. If the micro-strategy only uses ATM financing and idle funds to buy coins, as the number of micro-strategy Bitcoin positions increases, the "insolvent" price line can become even lower.

If the micro-strategy continues to crazily issue convertible bonds to buy Bitcoin when Bitcoin is at a high level, and Bitcoin enters a bear market, the decline in Bitcoin prices will cause the value of the Bitcoin held by the micro-strategy to be lower than the total amount of its convertible bonds, which will also cause the MSTR stock price to fall. A downturn will affect its refinancing ability and debt repayment ability, and then convertible bonds will become unbearable.

For micro-strategy convertible bonds, bondholders have the right to convert their bonds into MSTR stocks, and are divided into 2 stages: 1. Initial stage

- if the bond's trading price drops >2%, creditors can exercise their rights, Convert the bonds into MSTR shares and sell them back; if the trading price of the bonds is normal or even rises, creditors can resell the bonds in the secondary market at any time to get their money back. 2. Later stage - when the bond is about to mature, the 2% rule does not apply, and the bondholder can take back the cash and walk away, or directly convert the bond into MSTR shares.

Since the convertible bonds issued by MicroStrategy are low-interest or even zero-coupon bonds, it is obvious that what creditors want is the conversion premium. If the MSTR stock price rises to a certain extent on the repayment date compared to the original financing price, then the creditor is more likely to consider a debt-for-equity swap. If MSTR's stock price drops to a certain extent compared to the price when it was originally financed, creditors will consider demanding principal and interest.

If the creditor does not choose to convert to MSTR stock and ultimately needs to repay the creditor, MicroStrategy also has several options:

- Continue to issue new shares and obtain repayment of funds;

- Continue to issue new debt and repay old debt with new debt; (This will already be done in September 2024)

- Sell some of your Bitcoins to repay the loan.

Therefore, at present, it is unlikely that MicroStrategy will fall into an "insolvent" situation.

**3. Why do investors start to care about the currency content per

share of MSTR?**

Let's talk about the conclusion first. The currency content per share will determine MSTR's net assets per share.

Whether it is the issuance of convertible bonds or ATM, financing is achieved through dilution of equity capital. The purpose of financing is to increase Bitcoin reserves. For MSTR shareholders, dilution of capital is a negative, and is not a good thing in the traditional sense. The story that MicroStrategy’s management tells MSTR shareholders is – BTC Yield KPI.

Essentially, as long as the market value of MSTR is higher than the total value of BTC held, that is, there is a market value premium rate, then diluting MSTR equity to buy BTC can increase the currency content of each MSTR. The increase in the currency content of MSTR means that the net assets per share of MSTR are increasing. Therefore, it is still worth doing for shareholders to dilute their share capital to raise funds to buy Bitcoin.

Currently, MicroStrategy holds 444,262 BTC, with a total holding value of approximately $42.256 billion. With the current market capitalization of MSTR at $80.37 billion, the market capitalization of MSTR is 1.902 times the value of Bitcoin positions, which is a current premium rate of 90.2%. The current total share capital of MSTR is 244 million shares, and the corresponding BTC holdings per share are approximately 0.0018.

This is the core of the so-called "smart leverage", which turns the difference between the market value of one's own company and the market value of Bitcoin holdings into a capital operation advantage.

**4. Why have micro-strategies been more aggressive in buying Bitcoin

in the past two months?**

Let me talk about the conclusion first. It may be because MSTR's stock price is very high.

MicroStrategy has significantly increased the scale of financing to buy coins in the past two months. In November and December 2024, MicroStrategy invested a total of US$17.69 billion (accounting for 63.8% of the total investment) through ATMs and the issuance of convertible bonds, and purchased 192,042 Bitcoins (accounting for 43.2% of the total purchases). Among them, only US$3 billion is convertible bonds, and the remaining US$14.69 billion is financed through ATM.

Overall, the entire process of micro-strategy strategic allocation of Bitcoin has the characteristics of fixed investment in the time dimension; but in terms of quantity and amount, it seems that buying in a bull market is more aggressive than in a bear market.

I can't understand this feature. I can only hazard a guess that it may be because MSTR's stock price rises higher in the bull market. In August 2024, MSTR's stock price increased threefold after high transfers, and its stock price increased more than fourfold throughout the year, while Bitcoin's increase this year was only 2.2 times.

MicroStrategy's CEO talked about a beautiful "42B Plan" in the Q3 2024 financial report conference call.

British writer Douglas Adams said in "The Hitchhiker's Guide to the Galaxy" that the supercomputer "Deep Thought" gave "the ultimate answer to the questions of life, the universe, and everything" and the result was 42.

MicroStrategy believes that this is a magic number, so it proposed a 42B financing plan. 21 is also a magic number, and the maximum total amount of Bitcoin is 21M. Therefore, MicroStrategy plans to issue 21B ATM + 21B Fixed Income in the next three years to continue to increase its holdings of Bitcoin.

Assuming that MicroStrategy ultimately raises US$42 billion through the issuance of additional shares, and assuming that the additional issuance is carried out at a stock price of US$330, the total equity after the additional issuance will become 371.3 million shares. Assuming MicroStrategy buys Bitcoin at an average price of 10wU, the company can add 420,000 Bitcoins, bringing MicroStrategy's total holdings to 864,262 Bitcoins. At that time, the currency content per share will increase to 0.00233, and the currency content will increase by approximately 29.4%. At this time, the total market value of MSTR is US$122.53 billion, and the total value of BTC positions is 86.4 billion. In this case, the market value premium rate still exists.

**5. After micro-strategy, what other driving force does Bitcoin have

to rise?**

Let’s talk about the conclusion first. Except for the listed companies that are driven by micro-strategies to buy Bitcoin, currently there are only more national strategic reserves that can be thought of, but we don’t have high expectations in this bull market.

The main reasons for Bitcoin’s rise in this cycle are the following:

1. Long Term Holder with strong consensus on Bitcoin

There is no reason for the long-term rise of Bitcoin. For BTCers, this is as natural as a monkey climbing a tree or a mouse digging a hole, because it is digital gold.

After Bitcoin fell below $16,000, the most popular Antminer S17 series of mining machines at the time were close to the shutdown price. Mining machines such as Whatsminer M30S, Hippo H2, and Ant T19 have also fallen into the shutdown price range. In this price range, even if nothing happens, this rebound will happen. The bull-bear transition is like a basketball free-falling from a high place. After hitting the ground, there will be multiple rebounds that weaken in sequence.

Source: glassnode

As can be seen from the chart above, at the end of 2022, Long Term Holder continued to increase its positions.

After more than ten years of development, the Bitcoin consensus has become strong enough. On-market investors and Long Term Holders have a consensus around the shutdown price of mainstream mining machines.

2. ETFs bring incremental funds to traditional financial markets

Since the adoption of the BTC ETF, a total net inflow of 52.86w BTC has occurred. In this bull market, the ETF has brought nearly 36B incremental buying orders to Bitcoin and 2.6B incremental buying orders to ETH.

Source: coinglass.com

In addition, the approval of BTC ETF (and ETH ETF) will also have a driving effect, and more traditional financial institutions will begin to pay attention to and deploy the Crypto field.

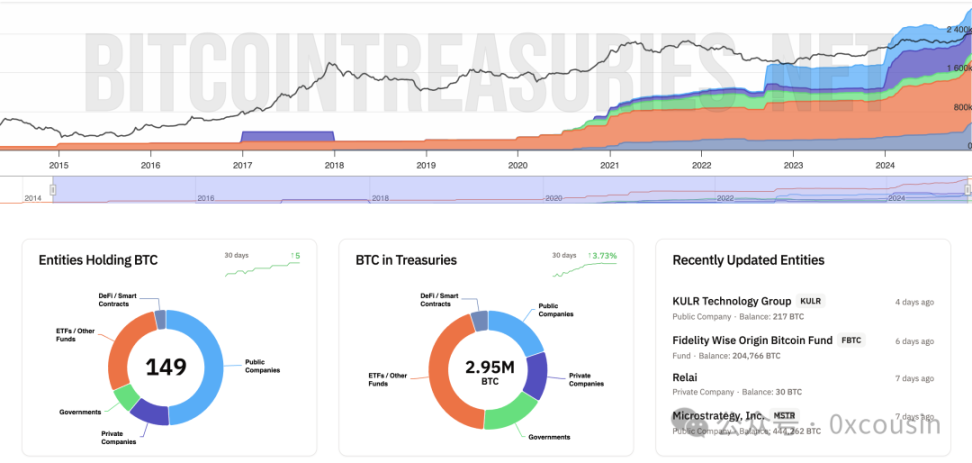

3. Micro-strategy continues to buy, many listed companies follow suit, Davis double-clicks

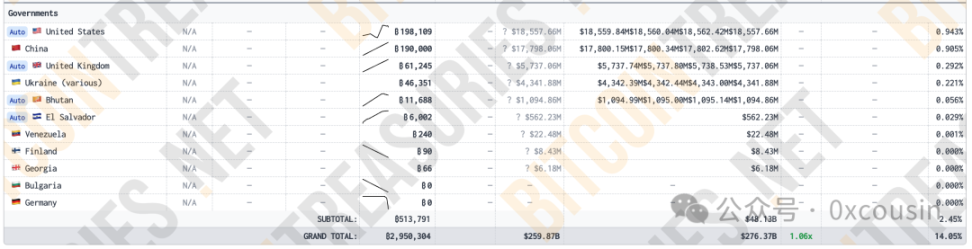

According to Bitcointreasuries data, as of December 30, 2024, 149 entities held a total of more than 295w Bitcoin. And this data is still growing rapidly in the near future.

Source: bitcointreauries.net

Among these entities holding Bitcoin, 73 are listed companies, 18 private companies, 11 countries, 42 ETFs or Funds, and 5 DeFi protocols.

MicroStrategy is the first public company to adopt the “Bitcoin Treasury Company” strategy, but it is not the only one. Listed companies such as Marathon Digital Holdings, Riot Platforms, and Boyaa Interactive International Limited have also implemented this strategy. But micro-strategy still has the greatest impact.

4. National strategic reserves

There are already some governments holding Bitcoin. The specific details are as follows:

Source: bitcointreasuries.net

Although these countries hold Bitcoins, most of them were seized by law enforcement agencies during law enforcement. It's just that there is no selling for the time being, so it is not a stable Holder.

Among these countries, I am afraid that only El Salvador is a real BTC Holder. El Salvador started buying Bitcoins in 2021, buying one every day. So far, it has held 6,002 BTCs, with a market value of over US$560 million.

In addition, Bhutan also holds 11,688 BTC through Bitcoin mining. However, Bhutan is not a BTC Holder and has reduced its holdings in the past two months.

During the campaign, U.S. President Trump stated that if he was elected president, he would establish a Bitcoin strategic reserve.

If there is anything that can drive the rise of Bitcoin after micro-strategy, the first choice is that after Trump came to power, it promoted the US government’s strategic reserve of Bitcoin, which in turn led to more national strategic reserves of Bitcoin.

Summarize

MicroStrategy’s Bitcoin strategy is not only a business experiment in corporate transformation, but also a major innovation in financial history. Through sophisticated capital operations, smart leverage, and deep insights into the value of Bitcoin, it not only won itself a brilliant increase in market value, but also pushed Bitcoin deeper into the perspective of traditional finance, penetratingly breaking the encryption Barriers between assets and mainstream capital markets.

This bold attempt of micro-strategy may be just the prelude to the legend of Bitcoin, or it may be just a small and dispensable step in the real rise of Bitcoin, but it may be a big step in the new era of finance.

References:

jinse

jinse

chaincatcher

chaincatcher