3 Reasons Why Ethereum Still Being Bullish After Slump to 17-Month Low

Reprinted from jinse

03/15/2025·3MAuthor: Marcel Pechman Source: cointelegraph Translation: Shan Oppa, Golden Finance

Ethereum fell 13% between March 8 and March 11 as investors turned to short- term fixed income and cash positions, seeking security amid a global tariff war and concerns about a growing recession.

Ethereum price needs to rise 29% to return to $2,500.

Market concerns escalate after the U.S. took retaliatory measures against Canadian electricity surcharges.

S&P 500 futures (left, magenta) with Ether/USD (blue). Source: TradingView/Cointelegraph

Typically, traders tend to overreact, which increases the likelihood that Ethereum will rebound faster than other assets after market sentiment improves. While some believe risky assets are driven by inflation and economic growth data, others believe that earnings depend on stimulus measures and monetary expansion.

Regardless of the catalyst for the next bull market, Ethereum price must rise 29% from the current $1,940 level to return to $2,500. This move may require an increase in demand for leveraged buyers, whose activity is currently at its lowest point in five months.

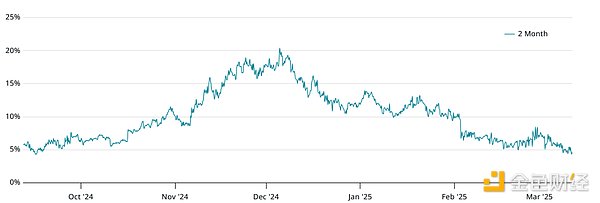

ETH 2-month futures annualized premium. Source: Laevitas.ch/Cointelegraph

Traders want higher prices to cover longer settlement cycles, so in neutral markets, an annualized premium (basis rate) is expected to be 5% to 10%. This indicates weak bullish belief when interest rates fall below this range (such as the current 4.5%).

Excessive optimism played a role in Ethereum’s recent pullback as $235 million of leveraged long positions were liquidated between March 10 and March 11.

A panic sell-off pushed Ethereum to a low of $1,744, its lowest level since October 2023. However, some metrics indicate a possible recovery as Ethereum derivatives and on-chain metrics show resilience.

Ethereum Layer-2 Network Growth

Ethereum is trading at 60% below its all-time high of $4,868 in November 2021. This decline is mainly due to intensified competition in the smart contract sector and weaker demand for applications such as flying homogeneous tokens (NFTs), games, collectibles, metaverse projects, social networks and Web3 infrastructure.

However, this view ignores a key factor. At the end of 2021, the average transaction fee exceeded $50, while activity on the Ethereum Layer-2 ecosystem is 97% lower than today.

For reference, despite the increasing daily operands per second, on March 11, the cost of token exchange on the Ethereum base layer was $1.70, highlighting a significant improvement in network efficiency.

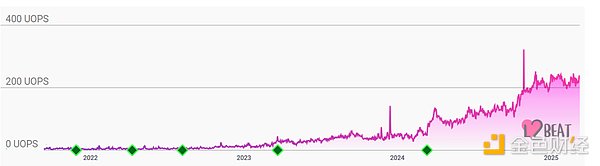

Ethereum Tier 2 average daily operands per second. Source: L2beat

Even if the robot generates 80% of Layer-2 transactions, the remaining 20% on Base, Arbitrum, Optimism, ZKsync and Blast are still about three times as active as the Ethereum base layer. However, critics have a reasonable argument: despite the surge in network activity, validators’ benefits are significantly reduced compared to the end of 2021.

Ethereum regains DEX leading position, TVL grows

Ethereum has consolidated its position as the second most popular choice for investors in traditional financial institutions and has been backed by a $8.9 billion spot exchange-traded fund (ETF).

Meanwhile, competitors such as Solana are still awaiting regulatory approval for similar ETF products. Even if they were approved, they could not match the first-mover advantage of Grayscale Ethereum Trust, which began trading publicly in the OTC market in June 2019.

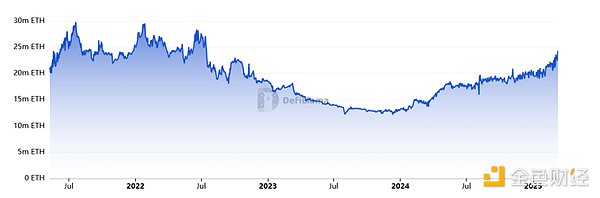

Additionally, Ethereum smart contract deposits (measured in total locked value (TVL)) reached their highest level since July 2022 on March 11, up 10% in the past two weeks.

Ethereum network TVL, ETH. Source: DefiLlama

Ethereum's TVL reached 24 million ETH, driven by liquid staking, lending, earnings farming and real-world asset tokenization growth. According to DefiLlama data, the network recently regained its lead in decentralized exchange trading volume (DEX), reaching $20.5 billion in seven days, surpassing Solana's $13.9 billion.

This provides a bullish outlook for Ethereum prices, driven by factors such as Layer-2 trading volume approaching record highs, regaining the leading position in DEX trading volume, and the growth of TVL deposits.

Ultimately, Ethereum’s trend reversal remains highly dependent on macroeconomic improvements, but once stabilized, Ethereum is fully capable of returning to $2,500 in the coming weeks and using it as a key support level.