2025 Cryptocurrency Holders Survey Report: Digital Asset Map of 55 million Americans, Who is using cryptocurrency?

Reprinted from panewslab

04/03/2025·1M

Original text: National Cryptocurrency Association

Compiled by: Yuliya, PANews

In the tide of the digital age, cryptocurrencies are being integrated into our daily lives at an amazing speed. Once regarded as the exclusive area of speculators and technical geeks, the mysterious field has now become an important part of the ordinary people's investment portfolio. What exactly drove this change? Who is using cryptocurrency? Why did they choose this path?

Breaking stereotypes: Digital assets of ordinary people

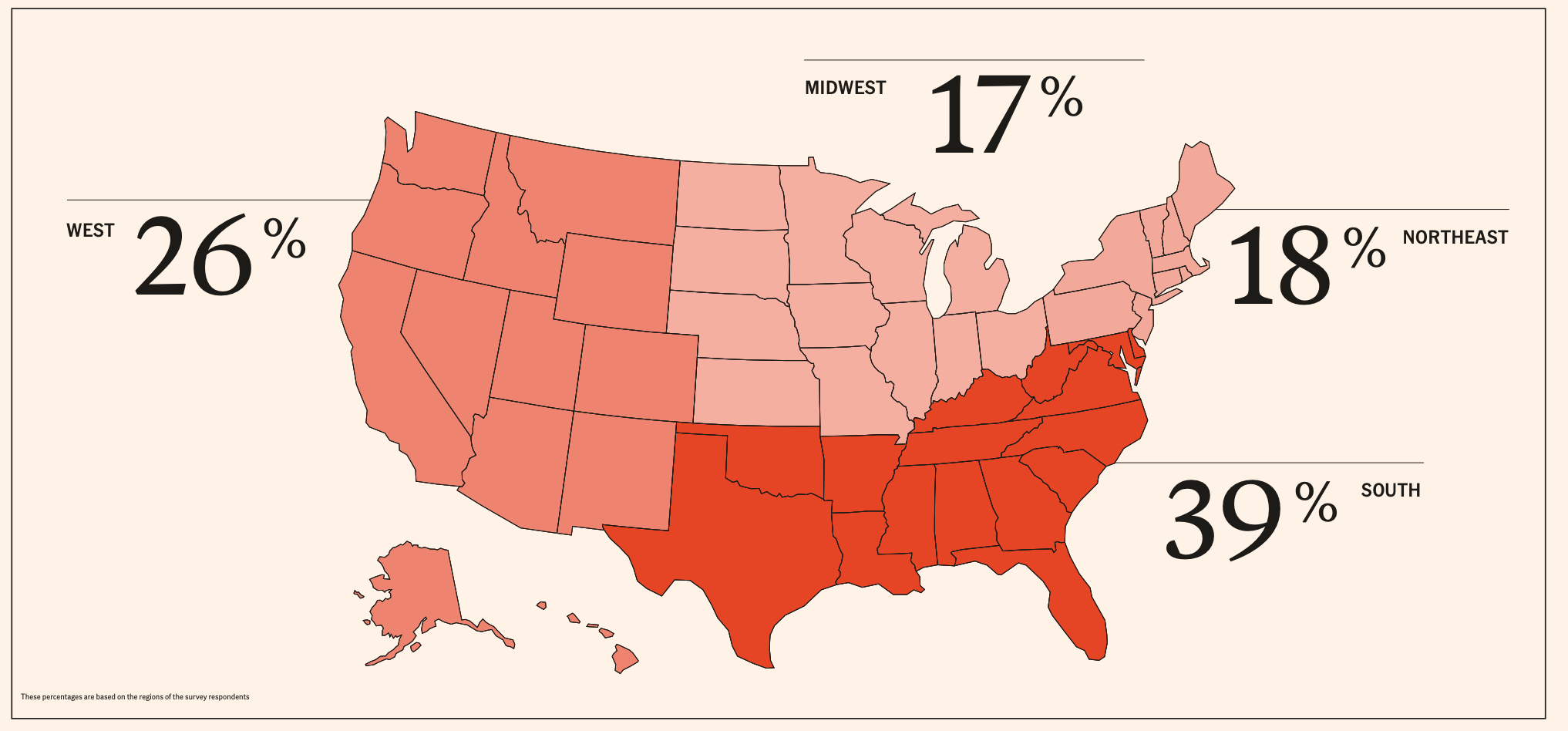

The National Cryptocurrency Association commissioned a large-scale survey of 54,000 Americans in early 2025, from which 10,000 cryptocurrency holders were identified, the largest cryptocurrency user survey to date. The result is surprising - cryptocurrencies have stepped out of the niche circle and entered mainstream society.

The survey shows that about 21% of U.S. adults — the equivalent of 55 million — own some form of cryptocurrency. These holders are not stereotyped "crypto brothers" or risk-taking speculators, but ordinary people from all walks of life. Some of them use cryptocurrencies as investment tools, some use them in the art and gaming sectors, and many try this new technology out of curiosity. In addition, many people are already using cryptocurrencies for daily shopping.

- 1/5 of Americans own cryptocurrency

- 39% of holders pay for goods and services in cryptocurrency

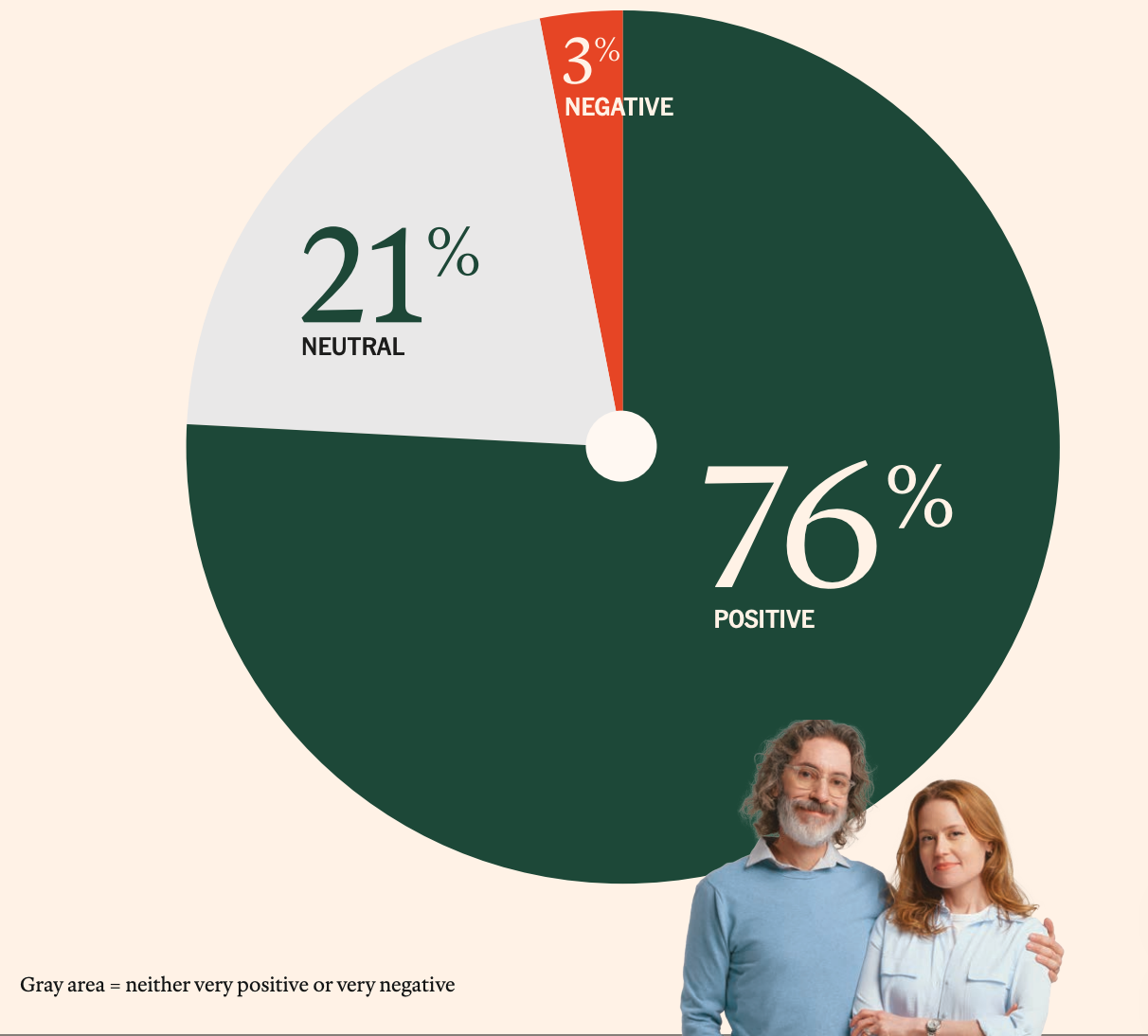

- 76% say cryptocurrencies have a positive impact on their lives

Regional distribution of cryptocurrency holders

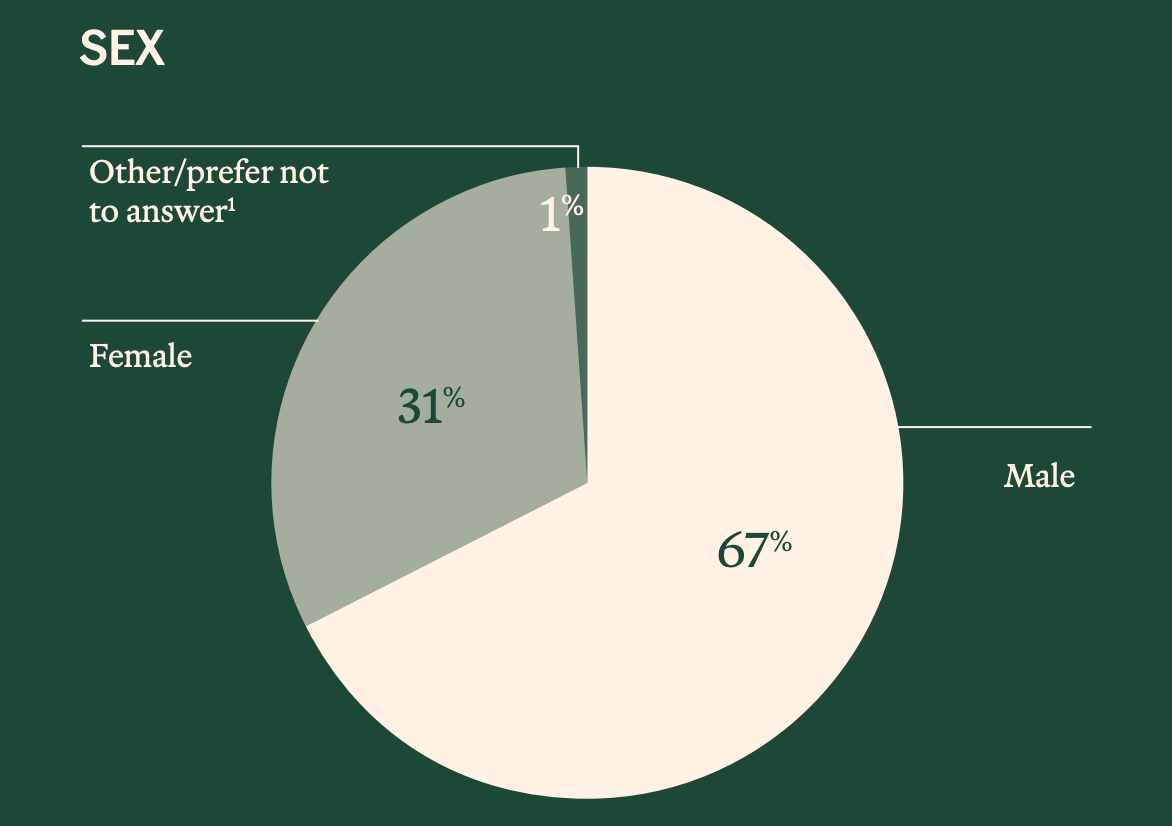

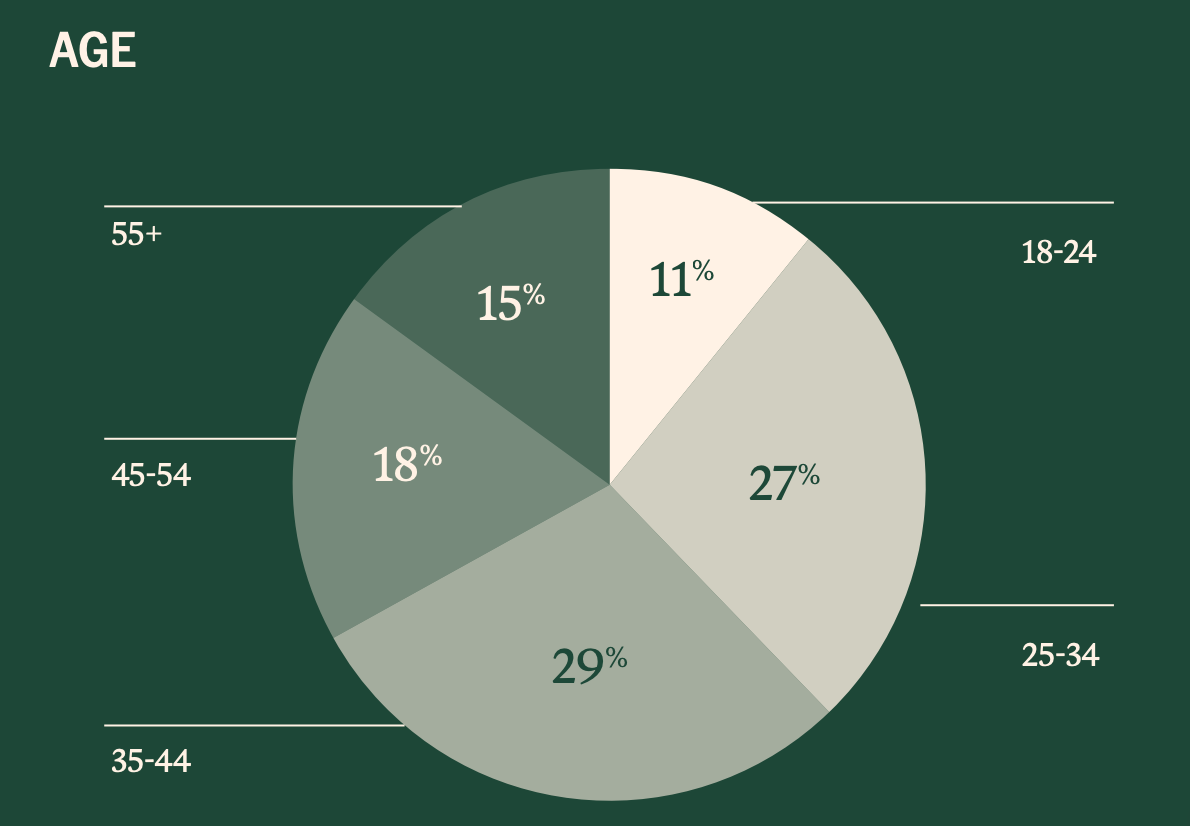

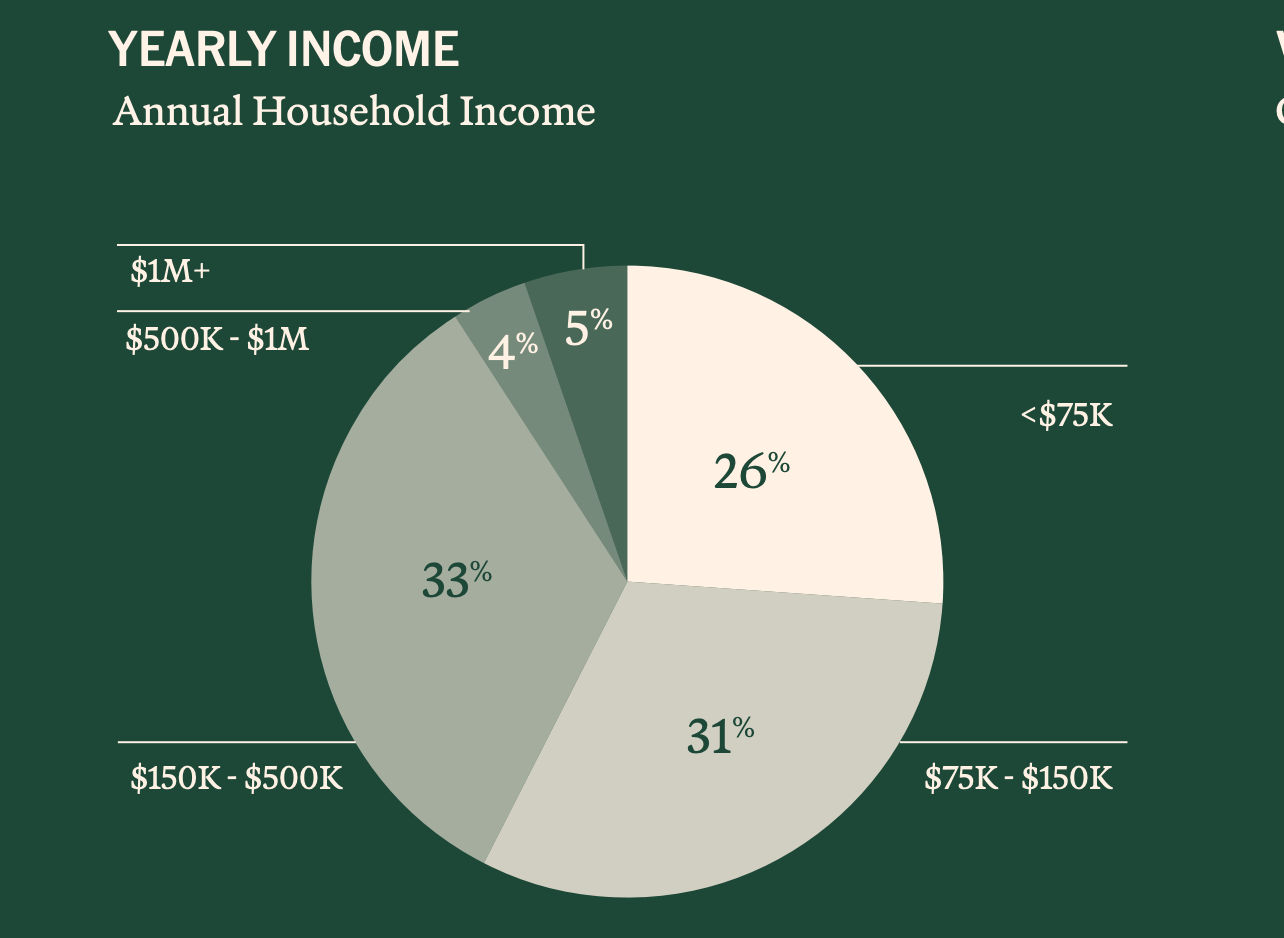

Diversified group of holders

The survey shows that cryptocurrency holders are a diversified group. People of different ages and income levels are holding and using cryptocurrencies. Among them, although there are more male holders (67%), there are also many female holders (31%).

As expected, the holders' age structure is relatively young, with 67% of cryptocurrency holders under the age of 45. However, 15% of holders—nearly 9 million—are over 55 years old.

They are engaged in a variety of careers, 14% from the technology industry, 12% from the construction industry, far exceeding the financial industry and manufacturing industry, while 6% from the healthcare/health industry.

In terms of income levels, 26% of cryptocurrency holders earn less than $75,000 per year, indicating that this is not a exclusive game for the rich.

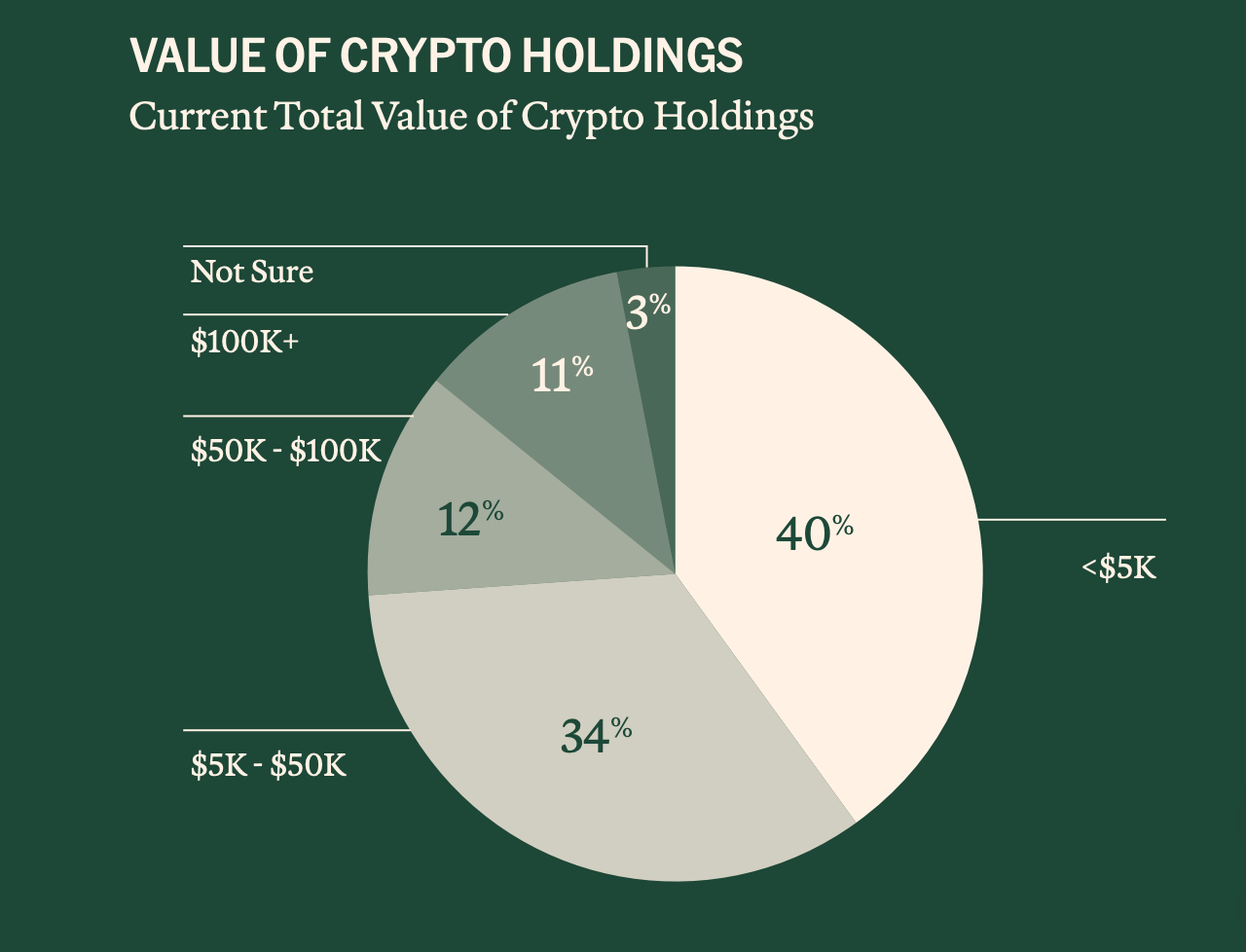

The low threshold nature of cryptocurrencies is a key factor in attracting a wide range of people. While 11% of holders have over $100,000 in crypto assets, most hold relatively modest amounts—55% hold less than $10,000, and 15% hold less than $500. This diversified holder composition clearly shows that cryptocurrencies have become financial instruments that all kinds of people can participate.

Use cryptocurrencies in daily life

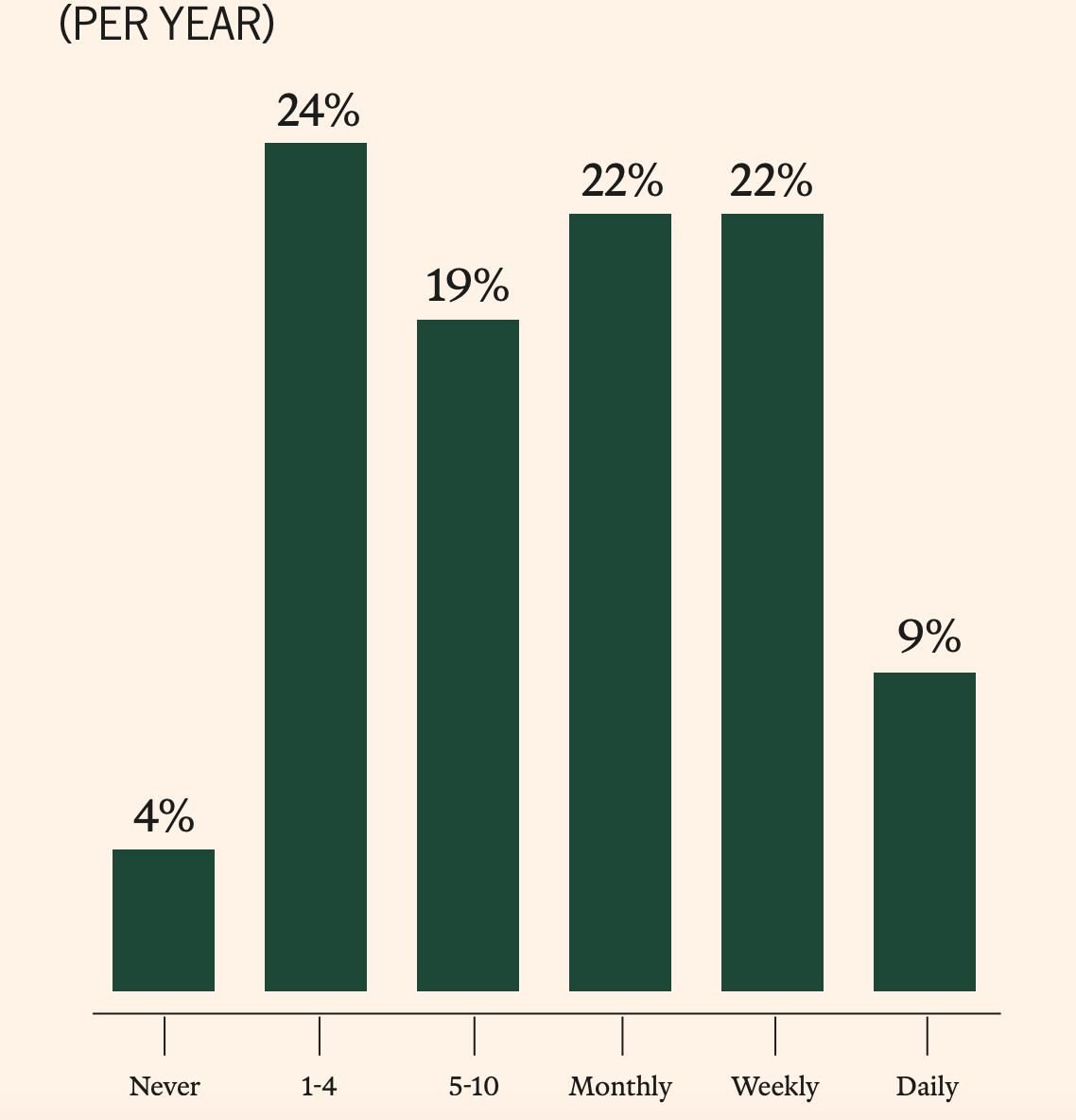

Surprisingly, many people are using cryptocurrencies as currency, the survey shows. In fact, 39% of cryptocurrency holders report using it to purchase goods and services, 96% of which use it at least once a year. This everyday application is also the driving force behind many people’s first exposure to cryptocurrencies, with 27% saying they initially acquired cryptocurrencies for online transactions.

Frequency of using cryptocurrencies

In addition to shopping, cryptocurrencies can also be used in the following scenarios:

- Purchase, sell or use blockchain NFT: 32%

- Send cryptocurrency to family: 31%

- Accept cryptocurrency commercial payments: 31%

- Develop a system or product, such as new cryptocurrency: 22%

- Acquire or trade digital collections and artworks: 21%

- Participate in decentralized games: 20%

- Buy or sell artwork: 17%

- Purchase real estate or real estate through blockchain tokenization: 15%

Looking ahead, cryptocurrency holders say that the way they are most interested in (52%) will remain investing in the financial future in the next 2 to 3 years. But some people plan to use cryptocurrency to transfer money to friends and family, participate in decentralized online games, accept payments for commercial transactions, and even improve the speed and accuracy of business (i.e., large-scale and complex businesses). These diverse application scenarios show that cryptocurrencies are transforming from pure investment assets to practical financial instruments.

As one interviewee said, "I didn't realize that you can do so many things with cryptocurrencies." This shift in perception is driving more people to explore the potential of cryptocurrencies.

Multiple Benefits of Cryptocurrencies

The survey results show that cryptocurrency holders are generally optimistic about the technology. As many as 76% of respondents said cryptocurrencies had a positive impact on their lives, with 46% of whom felt the impact was “very positive”.

The survey results show that cryptocurrency holders are generally optimistic about the technology. As many as 76% of respondents said cryptocurrencies had a positive impact on their lives, with 46% of whom felt the impact was “very positive”.

These positive effects are mainly reflected in several aspects: increasing financial independence (49%), providing learning and personal growth opportunities (45%), bringing investment diversification (42%), feeling of accomplishment from investment returns (44%), and feeling of excitement from participation in innovation (45%). For artist Autumn, blockchain technology allows her to record ownership of the work, automatically distribute the proceeds, and ensure that every creator is fairly recognized, "even after I left the planet, my artwork is still making an impact."

In addition to personal benefits, respondents also believed that cryptocurrencies have positive contributions to society as a whole, including promoting financial inclusion (45%), enhancing digital transactions (45%), promoting technological innovation (38%), supporting sustainable economic practices (38%), and promoting international trade and cooperation (33%). These perceptions show that cryptocurrencies have surpassed pure investment tools and become a potential force in promoting social progress.

Improve the global financial system

Cryptocurrency holders generally believe that this technology can complement traditional financial systems. 76% of respondents said their trust in cryptocurrencies is equal to or exceeding traditional banking institutions. They see the potential of cryptocurrencies in reducing transaction costs (45%), increasing transaction speed (44%) and enhancing transparency (44%).

How can cryptocurrencies better support traditional financial systems?

- Reduce transaction costs and fees: 45%

- Enhanced transparency and security: 44%

- Improve transaction speed and efficiency: 44%

- Offer alternatives in times of economic instability: 39%

- Diversified financial products and services: 39%

- Provides wider financial inclusion: 34%

- Promote global financial connectivity and collaboration: 33%

Respondents showed strong support and expectations for the future development of cryptocurrencies in the United States. 73% want the United States to be a global leader in cryptocurrency, while 64% believe government regulation is important. However, 67% are also worried that overregulation may kill innovation. This balanced view suggests that cryptocurrency holders want to see a regulatory framework that protects consumers and promotes innovation.

As one interviewee said: "Regulation gives the industry an opportunity to show its credibility...but it must be intelligent regulation and cannot kill innovation."

The starting point of the cryptocurrency journey

Every cryptocurrency holder has his own unique entry story. The survey shows that 56% of people acquired cryptocurrencies between 2020 and 2025, and investment purposes (60%) and curiosity about technology (50%) are the main motivations for people to consider cryptocurrencies. But the factors that really drive people to buy cryptocurrencies for the first time are often more personal—recommendations from friends and family (43%) are the biggest triggers, followed by interest in blockchain technology (38%) and financial news or market trends (36%).

What triggered the decision to get cryptocurrency for the first time?

- Family or friends discuss or use cryptocurrency: 43%

- Technological interest or development in blockchain and cryptocurrencies: 38%

- Financial news or market trends: 36%

- Economic events (such as inflation, financial crisis): 27%

- Peer influence or social norms (cultural transformation to digital currency): 23%

- Suggestions or recommendations from financial advisors or experts: 23%

- Cryptocurrency company marketing activities or promotions: 22%

- Educational content (article, tutorial, course): 20%

- Internet celebrity endorsements or celebrities invest in cryptocurrencies: 20%

- Political events or changes (such as elections, regulatory changes): 15%

It is worth noting that although celebrity endorsements and internet celebrity promotions have attracted much attention in the media, their influence on ordinary people seems to be limited, with only 20% of respondents saying that these factors have an impact on their decisions. This suggests that the actual influence of celebrity effect in the cryptocurrency space may be overestimated compared to professional opinions and personal recommendations.

The main reasons for getting cryptocurrencies:

- Investment Purpose: 60%

- Curiosity about technology: 50%

- Recommended from family and friends: 36%

- Conduct online transactions: 27%

- Impact of social media or celebrities/influencers: 21%

Max, a nonprofit worker, found that cryptocurrencies bring new opportunities to the public welfare cause: "There is only the benefit—more transparency, more access—but most importantly, the ability to access this new blockchain campaign for crypto donors."

The gap between safety concerns and actual experience

Although 75% of respondents expressed concern about scams and security in the cryptocurrency industry, the proportion of actually experiencing negative experiences was surprisingly low—only 3% of holders reported negative effects, and less than one-third had personally experienced fraud or security breaches. This gap between perception and reality suggests that media coverage of cryptocurrency security risks may have a certain amplification effect.

There are many factors that prevent people from participating in more cryptocurrencies, including concerns about volatility (15%), underfunded funds (15%), security concerns (13%), tax impact (10%), underrepresented acceptance (9%) and underperformed public understanding (8%). These barriers suggest that the cryptocurrency industry still needs to make more efforts in user education, risk management and market popularity.

Main concerns:

(In the 3% of the population reporting at least some negative effects)

- Financial losses caused by market volatility: 48%

- Difficulties in understanding cryptocurrency technology and markets: 35%

- Stress or anxiety associated with managing or tracking investment: 32%

- Negative experience of fraud or security breaches: 32%

- Regulatory or legal challenges related to the use or possession of cryptocurrencies: 29%

Content creator Hunter discovered that cryptocurrency solves his international payment puzzle: "I want to work with people, no matter where they are. If you have something good for my project, I want to work with you. I want to pay you." cryptocurrency allows him to pay editors around the world immediately, keeping the production process running seamlessly.

The desire for knowledge

Although cryptocurrency holders are passionate about the technology, they also admit that there is a lack of knowledge. 81% of respondents said they were interested in learning more about cryptocurrencies, and 40% followed the relevant news every day.

This passion for learning covers multiple areas, with nearly half (47%) seeking information on investment strategy, but they also want to learn more about basic issues such as legal and regulatory topics (34%), security measures (38%), blockchain technology (38%) and the tax impact of owning cryptocurrencies (39%).

Practicality also plays a big role, and cryptocurrency holders believe that the industry does not communicate everyday uses well, and they want to learn more about what can be done with cryptocurrencies. For example, 1/4 people still want to gain a basic understanding of cryptocurrency, while 1/3 want to learn how to use it in daily trading, and another 1/3 want to understand use cases other than financial trading.

Therefore, they learn from multiple channels. 60% of them visited YouTube to enhance their knowledge, while 40% turned to traditional media such as the New York Times and the Wall Street Journal. Of all of this, cryptocurrency holders prefer expert comments over peer insights, and discussion posts on sites like Discord (22%) and Reddit (33%) are less popular. This shows that in terms of information acquisition, professional and authoritative voices are more valued than peer experience. As one interviewee said, "I don't think there are many educational tools on cryptocurrencies, and you really need to do research."

What are the areas of cryptocurrency knowledge that require more information?

- Cryptocurrency investment strategy: 47%

- Tax Impact of Cryptocurrency Investment: 39%

- Understanding blockchain technology: 38%

- Security measures to protect cryptocurrency investment: 38%

- Risks and benefits of cryptocurrency investment: 37%

- Prevent fraud and master cryptocurrency security practices: 36%

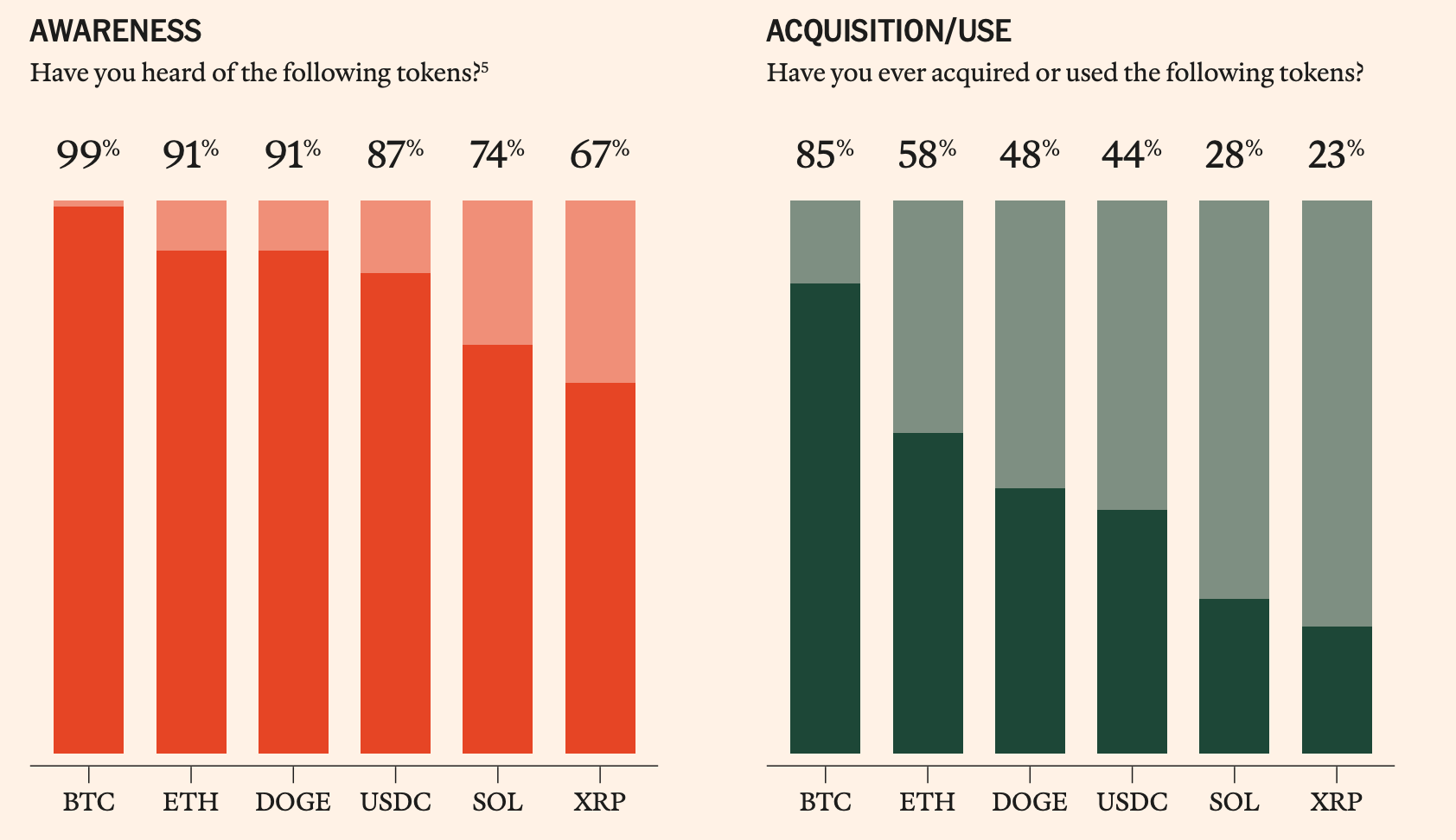

Popularity and awareness of major tokens

Today, thousands of cryptocurrencies have been launched on blockchains around the world. In addition to household names such as Bitcoin, cryptocurrencies also include various types ranging from tokens for smart contracts (ETH), tokens for instant payments (XRP), stablecoins (USDC), Meme coins (DOGE) to decentralized financial platforms (SOL). The survey shows that cryptocurrency holders have extensive familiarity with these tokens.

- BTC (Bitcoin) : The first and most well-known cryptocurrency.

- ETH : used for transactions and payment fees on the Ethereum network, supporting smart contracts and decentralized applications.

- DOGE : A cryptocurrency that is based on the basics was just a light joke at first, but later gained active community support.

- USDC : A stablecoin pegged to the US dollar: its value remains at $1.

- SOL (Solana) : A blockchain platform that is widely popular in the fields of decentralized finance, non-fungible tokens and payments.

- XRP (Ripple) : designed for fast and low-cost cross-border payments and is used by financial institutions.

Looking to the future: The road to popularization of cryptocurrencies

As cryptocurrencies continue to integrate into mainstream society, we see a more inclusive and diverse group of holders forming. They are no longer marginalized tech enthusiasts or speculators, but ordinary people from all walks of life who see cryptocurrencies as tools to improve their lives and participate in the future economy.

The value of cryptocurrencies is not only reflected in their investment potential, but also in the innovation and improvement it brings to the financial system. Improved transparency, enhanced transaction efficiency and expanded financial inclusion are all characteristics that cryptocurrency holders value.

With the gradual improvement of the regulatory framework and the in-depth development of user education, cryptocurrencies are expected to be further popularized in the next few years and become an indispensable part of the global financial system. As the investigation reveals, cryptocurrency is no longer a concept of the future, but is in progress – it is changing the way we interact with money, art, games and one another.

In this era of evolving digital assets, it is more important than ever to understand the true situation of cryptocurrency holders. They are not the stereotyped "encrypted brothers", but the ordinary people around you and me, who are exploring and shaping a more open and efficient financial future.

chaincatcher

chaincatcher